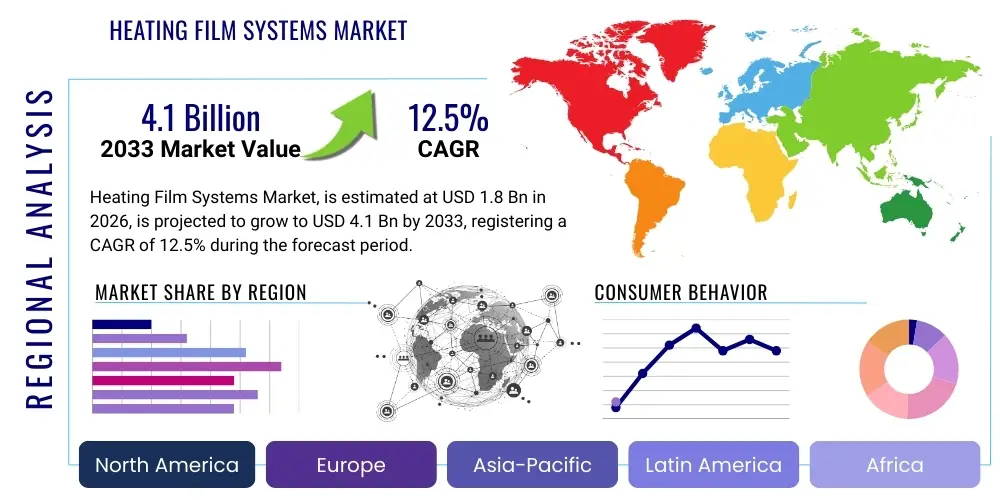

Heating Film Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438619 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Heating Film Systems Market Size

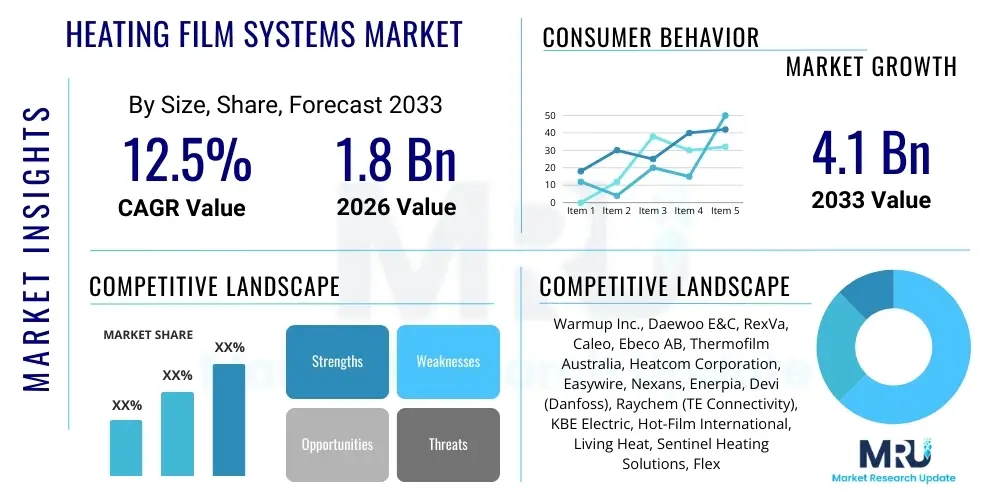

The Heating Film Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global demand for energy-efficient, customizable, and aesthetically pleasing heating solutions in both the residential and commercial construction sectors. The inherent thinness, flexibility, and rapid heating response of these film systems make them highly suitable for modern architectural designs and renovation projects aimed at achieving net-zero energy standards. Furthermore, regulatory mandates promoting sustainable building practices, particularly across Europe and parts of Asia, are accelerating the adoption curve, positioning heating film technology as a critical component of future smart infrastructure development.

The market valuation reflects significant investment in material science and manufacturing processes, specifically targeting enhanced durability, efficiency, and integration capabilities with smart home ecosystems. While initial installation costs for specialized film systems can be higher compared to conventional hydronic or forced-air systems, the long-term operational savings derived from zone heating capabilities and minimal energy waste are justifying this premium, driving the overall market growth trajectory. Key geographical regions, especially the Asia Pacific, are witnessing rapid urbanization and infrastructure development, creating massive opportunities for large-scale deployment of these systems in new housing complexes and commercial spaces, further solidifying the projected growth metrics through 2033.

Heating Film Systems Market introduction

The Heating Film Systems Market encompasses advanced radiant heating technologies utilizing thin, highly flexible polymeric films coated or impregnated with conductive heating elements, such as carbon paste or metallic nanowires, designed to generate heat when electrical current passes through them. These systems function primarily through radiant heat transfer, offering uniform temperature distribution and superior thermal comfort compared to convection-based heating methods. The primary product description highlights their low profile, ease of installation beneath various flooring types (laminate, tile, wood), and compatibility with wall or ceiling installations, making them exceptionally versatile for diverse construction environments. Major applications span residential underfloor heating, primary heating in commercial office spaces, specialized heating in hospitals and educational institutions, and de-icing applications in infrastructure projects.

The core benefits driving market penetration include their high energy efficiency, attributed to precise zone control and rapid thermal response, significantly reducing overall energy consumption. Furthermore, heating film systems offer health advantages by minimizing air circulation and dust movement, which is beneficial for occupants with respiratory sensitivities. The primary driving factors fueling the market expansion are the increasing focus on smart home integration, where these films can be seamlessly controlled via IoT devices and sophisticated algorithms, coupled with a surging global trend towards sustainable and aesthetically non-intrusive building technologies. The demand for renovation and retrofitting projects that require minimal structural alteration further bolsters the appeal and adoption rate of these innovative heating solutions.

Modern heating film systems are also evolving beyond simple floor warming, integrating sensor technology for preemptive fault detection and optimized performance based on occupancy patterns and external climate data. This technological sophistication elevates the product from a basic heating element to a critical component of building management systems (BMS). The market introduction signifies a shift away from bulkier, less efficient traditional heating methods toward modular, highly responsive, and digitally manageable solutions that align with the stringent environmental and energy performance criteria mandated by international regulatory bodies, ensuring their long-term viability and dominance in decentralized heating applications across the globe.

Heating Film Systems Market Executive Summary

The Heating Film Systems Market is currently characterized by robust business trends focusing on technological miniaturization and enhanced material efficiency. Key corporate strategies revolve around securing reliable supply chains for advanced polymers and conductive materials, alongside aggressive expansion into emerging markets, particularly in Asia Pacific, which is experiencing explosive growth in both residential and light commercial construction. The market structure remains highly competitive, with established players focusing on patenting advanced carbon nano-tube (CNT) and graphene-based heating elements to achieve higher efficiency ratings and longer operational lifetimes, thereby mitigating the restraints associated with material costs and maximizing the product value proposition. Furthermore, partnerships between heating system manufacturers and smart home platform developers are becoming crucial business trends, aimed at delivering fully integrated, voice-controlled, and energy-optimized heating environments.

Regional trends indicate that Europe, driven by stringent energy performance directives such as the Energy Performance of Buildings Directive (EPBD), remains a crucial region for high-value system adoption, especially in refurbishment markets where the low profile of heating films is highly advantageous. North America is demonstrating strong growth, largely fueled by consumer preference for comfortable radiant heating and increased investment in high-end residential construction featuring integrated smart technologies. However, the Asia Pacific region, led by China, South Korea, and Japan, holds the highest potential for volume growth, supported by governmental incentives for electric heating systems to combat air pollution and reduce reliance on fossil fuels in urban centers. This regional divergence necessitates customized market strategies concerning product specifications, price points, and distribution network optimization to capture regional specific demand.

Segment trends highlight the significant dominance of the residential application segment due to the widespread adoption of underfloor heating systems in new builds and renovations, primarily utilizing the carbon film type for cost-effectiveness and scalability. However, the commercial segment, particularly offices and hotels, is showing an accelerating CAGR, driven by the shift towards flexible, modular office layouts where integrated ceiling or wall heating films offer superior design flexibility and zoning capabilities. Within the product type segmentation, metallic alloy films are gaining traction in industrial and specialized infrastructure applications requiring higher heating intensity and maximum durability, signaling diversification in product offerings beyond standard floor heating applications to maintain competitive advantage.

AI Impact Analysis on Heating Film Systems Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Heating Film Systems Market reveals a strong focus on predictive maintenance, energy optimization, and enhanced user personalization. Users are keenly interested in how AI algorithms can move beyond simple scheduled heating to create truly proactive systems that learn occupant behavior, anticipate heating needs based on external weather forecasts, and minimize energy waste. Key concerns often revolve around the security and privacy of the behavioral data collected by AI-driven smart thermostats and the complexity of integrating advanced AI modules into existing infrastructure. Expectations are high that AI will significantly reduce operational costs and increase system longevity by identifying potential component failures before they occur, thus establishing a new standard for intelligent climate control in modern buildings.

The deployment of machine learning (ML) models is fundamentally transforming the operational efficiency of heating film systems. These models process vast quantities of environmental data, including ambient temperature, humidity levels, insulation performance, and historical energy usage patterns, to generate highly accurate heating curves. This allows the system to modulate the power output of the heating films in real-time, preventing energy overshoot and ensuring optimal comfort levels with minimal fluctuation. For example, in large commercial buildings, AI systems can dynamically adjust zone heating based on real-time occupancy monitoring via integrated IoT sensors, ensuring energy is only expended in actively utilized spaces, which is a major efficiency improvement over conventional fixed-schedule systems.

Furthermore, AI significantly impacts the service and maintenance ecosystem for heating film systems. By analyzing electrical resistance fluctuations and thermal signatures across the film network, AI can accurately predict the degradation rate of components, scheduling preventative maintenance rather than relying on reactive fixes. This predictive capability minimizes downtime and extends the overall useful life of the installed system, directly enhancing customer satisfaction and reducing lifecycle costs. The integration of Natural Language Processing (NLP) into smart control interfaces also simplifies user interaction, allowing occupants to manage complex heating schedules and preferences through intuitive voice commands, democratizing access to these advanced features and accelerating mass market adoption of intelligent heating solutions.

- AI enables predictive heating schedules based on learned occupant behavior, weather forecasting, and real-time occupancy data.

- Machine Learning algorithms optimize energy consumption by precisely modulating film output power, reducing energy wastage by up to 20%.

- Predictive maintenance analytics detect subtle electrical or thermal anomalies, preventing system failure and extending product lifespan.

- AI integration enhances system self-diagnosis capabilities, streamlining troubleshooting and reducing maintenance labor costs.

- Smart interfaces utilizing NLP allow for intuitive, voice-activated control and personalized comfort settings.

- Data analytics derived from AI usage patterns provide valuable feedback for manufacturers, driving product innovation towards greater efficiency.

DRO & Impact Forces Of Heating Film Systems Market

The dynamics of the Heating Film Systems Market are powerfully shaped by an intersection of regulatory drivers, economic constraints, and burgeoning technological opportunities, summarized by the DRO (Drivers, Restraints, Opportunities) framework. The primary driver is the global emphasis on decarbonization and the stringent regulatory pressure in developed economies to adopt highly efficient electric heating solutions, substituting traditional fossil fuel boilers. This is complemented by the burgeoning consumer preference for minimalist design and radiant comfort, especially within the luxury and smart home segments. Conversely, significant restraints include the relatively high initial capital expenditure compared to basic convection heaters, particularly for large installations, and a persistent lack of awareness among conventional construction professionals regarding installation best practices and long-term performance benefits, necessitating substantial market education efforts.

Opportunities for market expansion are vast, centering on the integration of these films with renewable energy sources, such as photovoltaic (PV) solar panels, enabling truly self-sustaining and zero-emission heating systems in residential settings. Furthermore, expansion into non-traditional applications like outdoor de-icing for walkways, localized heating in industrial warehouses, and specialized applications in the automotive and aerospace industries presents novel revenue streams. The overarching impact forces influencing the market trajectory are primarily technological, driven by advancements in nanotechnology which are yielding more efficient, durable, and cost-effective conductive materials (e.g., graphene and CNTs). Simultaneously, socio-economic forces, such as rising global electricity prices and the increasing focus on indoor air quality post-pandemic, are amplifying the urgency for high-efficiency, non-convective heating methods.

The competitive landscape is strongly influenced by supplier power, particularly concerning the niche materials required for manufacturing high-quality films, which creates moderate input cost volatility. Buyer power is moderate; while consumers have alternative heating options, the unique benefits of heating film (low profile, zone control) provide manufacturers with strong product differentiation. The threat of substitutes, while present from hydronic radiant systems and advanced heat pumps, is mitigated by the film systems' superior installation flexibility and minimal spatial requirements, especially in retrofit scenarios. Thus, market players must continuously innovate in material science and system integration to maintain competitive advantage against both traditional and emerging alternative heating technologies, ensuring the heating film systems remain a highly attractive proposition for sustainable building development.

Segmentation Analysis

The Heating Film Systems Market is comprehensively segmented based on Type, Application, and Conductive Material, providing a granular view of market dynamics and adoption patterns across diverse end-user sectors. This detailed analysis allows stakeholders to identify high-growth niches, tailor product development strategies, and optimize marketing efforts based on specific segmental requirements. The segmentation highlights the predominance of cost-effective carbon films in volume-driven residential markets and the specialized, higher performance requirements met by metallic alloy films in industrial and specialized commercial contexts. Furthermore, the application segmentation clarifies that while residential underfloor heating remains the cornerstone, high growth rates are emerging in non-traditional applications like ceiling and wall heating in commercial and healthcare facilities, driven by architectural design trends prioritizing minimalism and spatial efficiency. Understanding these segments is vital for accurate forecasting and strategic business planning across the entire value chain.

- By Type:

- Standard Heating Film

- Specialized Heating Film (High Wattage/Anti-Fog)

- By Conductive Material:

- Carbon Film (Carbon Paste/Graphite)

- Metallic Film (Nickel-Chrome, Copper, Silver Alloys)

- Advanced Materials (Graphene, Carbon Nanotubes)

- By Application:

- Residential (Underfloor, Wall/Ceiling)

- Commercial (Offices, Retail, Hospitality)

- Industrial (Warehouses, Specialty Facilities)

- Infrastructure (De-icing, Agricultural/Horticultural)

- By Installation Area:

- Floor Heating Systems

- Wall Heating Systems

- Ceiling Heating Systems

Value Chain Analysis For Heating Film Systems Market

The value chain for the Heating Film Systems Market begins with the upstream segment, primarily focused on the procurement and refinement of specialized raw materials. This includes high-grade polymer substrates (e.g., PET films) offering superior thermal stability and electrical insulation, and critical conductive materials such as refined carbon paste, silver alloys, and increasingly, advanced nanomaterials like graphene and carbon nanotubes. Upstream analysis indicates that supplier concentration for high-quality polymer substrates and advanced conductive inks is relatively moderate, yet pricing power is significant due to the stringent quality requirements specific to heating applications, mandating strict control over material purity and consistency to ensure safety and longevity of the final product. Technological advancements at this stage, particularly in coating precision and material formulation, directly influence the manufacturing efficiency and the performance characteristics of the heating films.

The manufacturing stage involves sophisticated processes including printing, lamination, and curing, where the conductive material is precisely applied onto the polymer substrate and subsequently laminated with protective layers. This midstream activity is capital-intensive, requiring specialized machinery for high-volume, high-precision production. After quality control and cutting, the films are bundled with essential components such as wires, connectors, and thermostats. The distribution channel then takes over, utilizing a mix of direct and indirect methods. Direct distribution involves sales to large-scale construction companies, specialized installers, and OEM partners for integration into prefabricated building modules. Indirect distribution relies heavily on established networks of electrical wholesalers, specialized HVAC distributors, and increasingly, e-commerce platforms targeting DIY enthusiasts and smaller renovation contractors, highlighting the need for robust logistics and comprehensive installer training programs.

The downstream analysis focuses on installation and the ultimate end-users. Installation is typically performed by certified electrical contractors or specialized heating system installers, emphasizing the need for robust technical support and adherence to safety standards. Potential customers, spanning residential homeowners to large commercial property developers, evaluate products based on total cost of ownership, energy efficiency ratings, and ease of integration with existing smart infrastructure. Post-sales service, including warranty provisions and long-term maintenance contracts, constitutes a crucial part of the downstream value proposition. Effective management across the value chain, from securing advanced material supply to ensuring high-quality, professional installation, is paramount for market participants seeking to optimize costs, minimize product failure rates, and build strong brand reputation in this rapidly evolving heating technology segment.

Heating Film Systems Market Potential Customers

The primary potential customers and end-users of Heating Film Systems are segmented into several distinct categories, each driven by unique installation requirements and efficiency demands. The largest segment remains the residential sector, comprising new home builders and, significantly, property owners undertaking renovation and remodeling projects. Homeowners are attracted to the low profile, comfort, and zonal efficiency of these systems, often integrating them as luxury amenities or essential components of a high-efficiency smart home upgrade. Within the residential space, high-density apartment complexes and modular home manufacturers represent crucial volume buyers, benefiting from the rapid installation time and scalability of film heating technology across multiple identical units, minimizing construction timelines and labor costs effectively.

The commercial sector forms a rapidly expanding customer base, encompassing developers and operators of commercial offices, retail spaces, hotels, and educational facilities. These entities prioritize systems that offer minimal visual intrusion, precise temperature control across varied zones, and low maintenance requirements, making the thin film system an ideal choice for integrating seamless heating into modern, open-plan architectural designs. Moreover, specialized commercial customers, such as healthcare providers, often choose radiant heating films for their non-convective nature, which helps maintain higher indoor air quality by reducing the circulation of dust and pathogens, aligning with stringent health and safety protocols specific to medical environments.

A third, high-value customer segment includes infrastructure developers and specialized industrial facilities. For infrastructure, customers are focused on heating films applied for de-icing pavements, ramps, and critical exterior surfaces where safety and reliability are paramount, often requiring specialized, high-durability film types. Industrial end-users, such as manufacturers with clean room requirements or specialized agricultural operations (e.g., greenhouses), utilize these systems for localized, precise heating to control environmental variables crucial for their processes, demonstrating the versatility of the technology beyond traditional building climate control. Therefore, successful market penetration requires tailored product offerings and sales strategies addressing the specific regulatory and performance criteria of each distinct customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Warmup Inc., Daewoo E&C, RexVa, Caleo, Ebeco AB, Thermofilm Australia, Heatcom Corporation, Easywire, Nexans, Enerpia, Devi (Danfoss), Raychem (TE Connectivity), KBE Electric, Hot-Film International, Living Heat, Sentinel Heating Solutions, Flexel International, Solfex Energy Systems, ThermoSphere, Heatek. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heating Film Systems Market Key Technology Landscape

The technological landscape of the Heating Film Systems Market is undergoing rapid evolution, primarily driven by breakthroughs in materials science and the pervasive integration of Internet of Things (IoT) capabilities. A core technology advancement is the transition from conventional carbon paste heating elements to advanced conductive materials such as graphene and carbon nanotubes (CNTs). Graphene, known for its exceptional thermal conductivity and mechanical strength, offers the potential for ultra-thin films with superior energy conversion efficiency, allowing systems to heat up faster and operate at lower power requirements. CNTs, utilized in highly engineered inks, ensure greater uniformity in heat distribution across the film surface and enhance the durability and resistance to thermal stress, directly addressing historical concerns regarding potential localized hot spots or premature system degradation.

Beyond material innovation, the second critical technological pillar is smart control and connectivity. Modern heating film systems are moving away from simple mechanical thermostats toward sophisticated, cloud-connected control units. These systems leverage IoT protocols (such as Wi-Fi, Zigbee, and Thread) to communicate with central smart home hubs and Energy Management Systems (EMS). This integration allows for complex zone management, remote control via mobile applications, and highly granular data collection on energy usage. Furthermore, the incorporation of advanced self-regulating polymer technology is crucial; these films inherently adjust their electrical resistance based on temperature, preventing overheating and improving safety without relying solely on external limiting devices, significantly simplifying system design and enhancing overall reliability across diverse installation environments.

Current research and development efforts are also focused on improving the manufacturing techniques for better product scalability and cost-effectiveness. Innovations in roll-to-roll processing and high-precision printing techniques for conductive inks are lowering manufacturing costs, making these systems more competitive against traditional heating methods. Furthermore, integration technologies are enabling seamless installation within pre-fabricated construction elements, such as insulated panels or drywall, streamlining the construction process. The convergence of highly efficient conductive materials, advanced IoT-based predictive controls, and streamlined manufacturing methodologies defines the key technology landscape, positioning heating film systems as a premium, future-proof solution for sustainable building climate control across global markets.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven primarily by massive urbanization, new construction activity in China and India, and the widespread adoption of efficient heating systems in South Korea and Japan. In South Korea, heating film is widely accepted as a standard floor heating solution (Ondol modernization). Government initiatives to reduce reliance on coal-fired heating, particularly in metropolitan areas, are creating substantial market incentives for electric radiant heating systems. The region is also becoming a key manufacturing hub, benefiting from lower production costs and increasing local innovation in material science.

- Europe: Europe represents the largest and most mature market in terms of value, largely due to stringent environmental regulations, high energy costs, and significant consumer preference for radiant comfort. Directives focusing on nearly Zero-Energy Buildings (nZEB) mandate the use of high-efficiency, non-fossil fuel heating solutions. The market growth here is strongly centered on the renovation and retrofit sector, where the low profile of heating films provides a distinct advantage in historic or space-constrained properties. Germany, the UK, and Scandinavian countries are the leading contributors to regional revenue.

- North America (NA): The North American market is characterized by steady, high-value growth, particularly in custom luxury homes and specialized commercial buildings. Demand is driven by increasing consumer awareness regarding energy savings and the superior comfort provided by radiant heating over traditional forced-air systems. Integration with sophisticated home automation systems (e.g., Google Home, Amazon Alexa) is a critical factor influencing purchasing decisions, particularly in the US. Cold climates in Canada and the northern US states ensure continuous demand for effective supplemental and primary heating solutions.

- Middle East & Africa (MEA): This region is an emerging market, with adoption concentrated in high-end commercial and residential developments in the GCC countries (UAE, Saudi Arabia). While cooling demand dominates, localized radiant heating is increasingly used for specific luxury amenities and temperature-sensitive indoor spaces. The reliance on advanced, reliable technology is high, making premium heating film systems attractive for prestigious construction projects aiming for high sustainability ratings.

- Latin America (LATAM): Market penetration is currently lower in LATAM compared to other regions, constrained by variable economic stability and lower average disposable incomes for high-end building technologies. However, countries like Chile and Argentina, with their distinct cold climate zones, show potential for future growth, particularly as regulatory standards for building insulation and energy performance begin to align with international benchmarks, paving the way for efficient electric heating adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heating Film Systems Market.- Warmup Inc.

- RexVa

- Caleo

- Ebeco AB

- Thermoplan AG

- Heatcom Corporation

- Enerpia

- Devi (Danfoss)

- Nexans

- Raychem (TE Connectivity)

- Living Heat

- Solvias AG

- Flexel International

- Easywire

- KBE Electric

- Daewoo E&C

- ThermoSphere

- Solves AG

- Sentinel Heating Solutions

- Warmfloor

Frequently Asked Questions

Analyze common user questions about the Heating Film Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Heating Film Systems Market?

The Heating Film Systems Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033, driven by increasing demand for energy-efficient radiant heating and smart home integration globally, reaching an estimated value of USD 4.1 Billion by 2033.

How do heating film systems compare to traditional heating methods in terms of energy efficiency?

Heating film systems generally offer superior energy efficiency, primarily due to their direct radiant heat transfer, rapid response time, and advanced zonal control capabilities, allowing users to heat only occupied areas and significantly reducing the energy waste common in centralized forced-air or hydronic systems.

Which application segment drives the highest volume of demand in the market?

The residential application segment, specifically underfloor heating systems, currently drives the highest volume of demand for heating film systems, fueled by strong consumer interest in comfort upgrades and renovations across Europe and the Asia Pacific region.

What are the primary technological innovations influencing the future of heating films?

Key technological innovations include the adoption of advanced conductive materials like graphene and carbon nanotubes (CNTs) for enhanced efficiency, and the widespread integration of Artificial Intelligence (AI) and IoT platforms for predictive maintenance and intelligent, real-time energy optimization.

What major restraints are impacting the market adoption of heating film systems?

Major restraints include the relatively high initial capital expenditure required for installation compared to basic heating alternatives, coupled with a persistent need for greater market education to address installer knowledge gaps and ensure high-quality, long-term performance.

Further analysis within the Heating Film Systems Market reveals complex dynamics concerning standardization and regulatory harmonization, crucial factors for long-term global stability. The lack of fully harmonized international standards for electrical compatibility and fire safety in different building types presents a challenge for manufacturers aiming for global scalability. While regional bodies like the European Committee for Electrotechnical Standardization (CENELEC) have established clear guidelines, markets in North America and parts of Asia often operate under differing jurisdictional requirements, necessitating costly product customization and certification processes. This regulatory fragmentation impacts market entry strategies and increases the complexity of quality assurance across borders. Stakeholders are actively engaging in industry consortia to push for unified safety and performance metrics, particularly for high-power specialized films used in industrial or external de-icing applications, thereby reducing barriers to international trade and fostering greater consumer confidence in product safety and reliability.

From an economic standpoint, the volatility of key raw material prices, particularly copper, silver, and specialty polymers, poses an ongoing risk to manufacturer margins. Heating film producers must adopt sophisticated hedging strategies and cultivate diversified supplier relationships to mitigate input cost fluctuations. The shift towards advanced materials such as graphene and CNTs, while offering performance benefits, introduces a new layer of supply chain complexity, given the specialized production methods required for these nanomaterials. Companies that successfully vertically integrate or secure long-term contracts for these advanced components are expected to gain a significant competitive edge, allowing for more stable pricing models and consistent product quality delivery. Furthermore, life-cycle cost analysis strongly favors heating film systems due to their minimal maintenance requirements post-installation, often requiring no maintenance for decades, which serves as a powerful selling point against alternatives that necessitate periodic servicing of pumps, boilers, or ducts. This long-term cost efficiency is increasingly swaying procurement decisions in both the commercial and institutional construction sectors globally.

Considering the competitive environment, differentiation is increasingly centered on service and smart capabilities rather than basic heating function. Leading market players are investing heavily in proprietary control software and developing user-friendly interfaces that offer deep diagnostic features and personalized energy management tools. The emergence of 'Heating-as-a-Service' models, where system performance and maintenance are managed remotely through AI-driven platforms, represents a growing trend, especially in large commercial portfolios. This allows customers to pay for optimized thermal comfort rather than owning and managing the complex technology infrastructure itself. This model appeals strongly to property management firms seeking predictable operational expenses and guaranteed uptime. Additionally, environmental sustainability is now a core marketing pillar; systems certified for low electromagnetic frequency (EMF) emissions and manufactured using recycled or sustainable polymer substrates are gaining significant traction among environmentally conscious developers and consumers, aligning the market with global sustainability benchmarks and demonstrating corporate responsibility.

Geographically, while APAC and Europe maintain primary positions, the emerging potential in the Middle East and Africa (MEA) cannot be overlooked, specifically concerning the application of heating films in high-tech, controlled environment agriculture (CEA). As MEA countries invest heavily in food security and sustainable farming technologies, the precise, uniform heating required for high-yield vertical farms and greenhouses offers a specialized, high-growth niche for heating film manufacturers. These specialized industrial applications often require bespoke film specifications, demanding high resistance to moisture and chemical exposure, thus requiring concentrated R&D investment tailored specifically for these non-building environment uses. This diversification of applications outside the traditional construction sector underscores the fundamental versatility and adaptability of heating film technology to address diverse global infrastructural and economic challenges, securing its role as a versatile component in future technology integration strategies.

Finally, the interplay between construction technology (ConTech) and Heating Film Systems is accelerating installation efficiency. Companies are developing pre-wired panels and standardized installation kits that minimize on-site labor time and reduce the likelihood of installation errors. Building Information Modeling (BIM) platforms now frequently incorporate detailed specifications for heating film layouts, allowing architects and engineers to precisely model thermal performance and energy consumption before construction begins. This digital integration improves project coordination, reduces material waste, and ensures that the installed system performs exactly to specifications. This focus on seamless digital integration is crucial for penetrating large-scale public infrastructure projects and high-volume residential construction where time and precision are critical contractual elements, further solidifying the long-term technological trajectory of the heating film systems market toward greater digitalization and automation within the construction lifecycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager