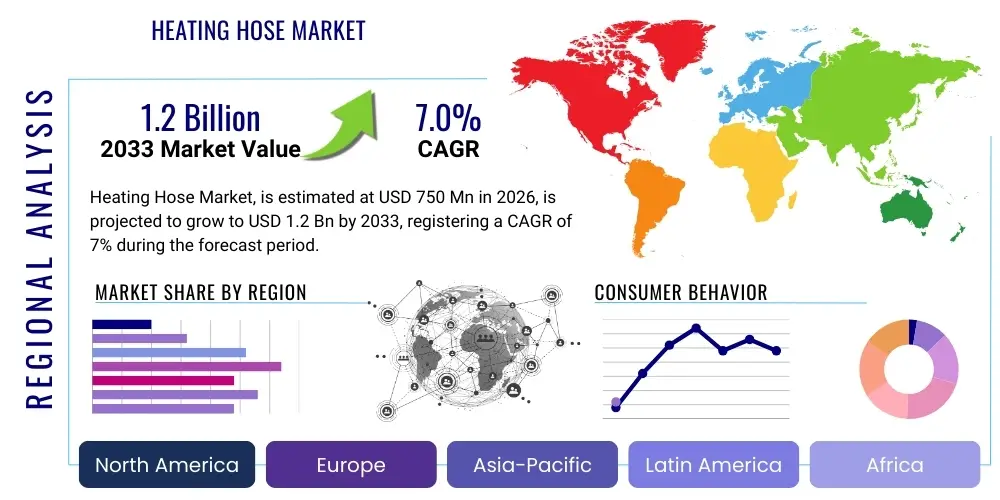

Heating Hose Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438886 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Heating Hose Market Size

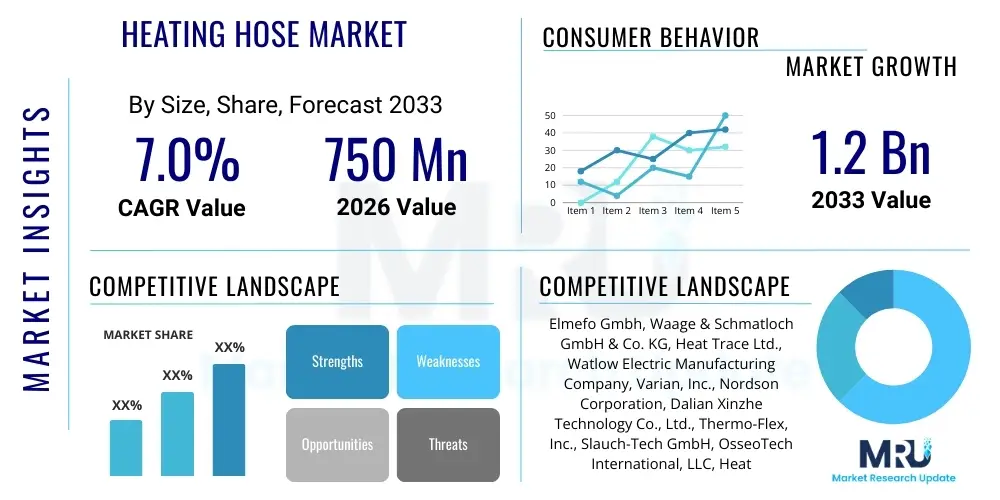

The Heating Hose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.0% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1.2 Billion by the end of the forecast period in 2033.

Heating Hose Market introduction

Heating hoses are specialized flexible conduits engineered to transport viscous materials, gases, or liquids while maintaining a precise, elevated temperature. These systems are crucial in industrial processes where thermal consistency prevents solidification, crystallization, or degradation of the transported medium, ensuring smooth material flow and process efficiency. The product primarily consists of an inner hose, electric heating elements (like resistance wires or heating foils), thermal insulation layers, and a protective outer jacket, typically made from materials such as PTFE, Silicone, or stainless steel braiding, depending on the required chemical resistance and temperature range. Applications span a wide range of sophisticated manufacturing and processing environments, including the precise metering of hot melt adhesives in packaging, the transfer of chemical resins and waxes, and the delivery of paints or coatings in automotive manufacturing lines.

The primary benefits of utilizing heated hose systems include rigorous temperature control, which directly translates to reduced material waste and improved product quality consistency. They offer flexibility in installation, allowing materials to be transported around complex machinery or across large factory floor spaces where fixed, rigid piping would be impractical or excessively costly. Furthermore, modern heating hoses are designed for energy efficiency, often incorporating advanced insulation materials and localized heating controls, minimizing energy consumption compared to conventional jacketing systems. The market is currently driven by the accelerating demand for automation in manufacturing, particularly within the automotive, food & beverage, and pharmaceutical sectors, where precise temperature management is non-negotiable for product integrity.

Key driving factors include the stringent regulatory requirements for consistent quality control in sensitive industries, especially pharmaceuticals and food processing, necessitating reliable temperature maintenance during transport. The rise of sophisticated adhesive and sealant formulations, which require specific activation temperatures, further fuels the adoption of high-performance heating hoses. Technological advancements focusing on integrating smart monitoring systems and enhanced insulation materials are pushing market growth by offering greater reliability, diagnostic capabilities, and overall system longevity, appealing to industries focused on minimizing downtime and maximizing operational output.

Heating Hose Market Executive Summary

The global Heating Hose Market is characterized by steady growth, primarily supported by robust industrialization trends in emerging economies and the continuous push for process optimization and automation across established manufacturing landscapes. Current business trends indicate a strong shift towards modular and highly customized heating hose solutions that can integrate seamlessly with existing PLC and SCADA systems, emphasizing precise digital temperature control and remote monitoring capabilities. Material science innovation is also a significant trend, with manufacturers increasingly adopting high-performance polymers like PFA and specialized silicone compounds to enhance chemical resistance, flexibility, and withstand extreme operating temperatures necessary for advanced chemical and semiconductor processing applications. Sustainability considerations are beginning to influence product development, driving demand for hoses featuring superior insulation to reduce energy consumption and lower operational costs in long-term industrial deployments.

Regionally, the market exhibits strong bifurcation. Asia Pacific (APAC) dominates in terms of consumption volume, propelled by massive expansion in automotive production, electronics assembly, and infrastructure development, particularly in China and India, which drives high demand for specialized adhesive and material transfer systems. North America and Europe, conversely, lead in terms of technological adoption and value, characterized by demand for premium, highly durable, and safety-compliant heating hoses utilized in critical applications such as medical device manufacturing and high-purity chemical transfer. Regulatory frameworks related to worker safety, explosion protection (ATEX compliance), and material purity (FDA/BfR compliance) heavily dictate the product specifications and competitive landscape in these mature regions, driving innovation in protective braiding and integrated safety features.

Segment trends reveal that the PTFE-lined heating hose segment is experiencing rapid growth due to its superior chemical inertness and suitability for harsh environments, especially in chemical and oil & gas refining. The hot melt adhesive application segment remains the largest end-user category, benefiting from the global surge in packaging, assembly, and product labeling activities. Furthermore, the medium-temperature range (100°C to 200°C) products maintain market dominance, but the high-temperature niche (above 200°C) is projected for accelerated growth, driven by the handling of specialized engineering plastics, high-viscosity resins, and complex polymer formulations required in advanced manufacturing sectors like aerospace and electric vehicle battery production.

AI Impact Analysis on Heating Hose Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Heating Hose Market reveals key themes centered around predictive maintenance, optimization of thermal profiles, and autonomous quality control. Users frequently inquire how AI algorithms can monitor operational parameters—such as internal resistance, insulation integrity, and temperature uniformity along the hose length—to predict potential failures before they occur, thereby reducing costly unplanned downtime. Another significant concern relates to using machine learning to dynamically adjust heating output based on ambient conditions, flow rates, and material viscosity changes in real-time, seeking enhanced energy efficiency and more consistent product quality. There is also substantial interest in how AI can integrate sensor data from hoses into larger plant-wide predictive models, optimizing entire fluid handling processes rather than just the individual component.

- AI integration facilitates predictive maintenance schedules by analyzing vibration, resistance, and temperature fluctuation anomalies.

- Machine learning algorithms optimize energy consumption by dynamically adjusting power output based on process variables and external environment.

- AI-powered diagnostic tools enhance system reliability by providing early warnings regarding insulation breakdown or heater element degradation.

- Real-time thermal profiling using AI ensures maximum material consistency and prevents thermal degradation of sensitive substances.

- AI contributes to automated compliance monitoring by recording and verifying temperature logs against regulatory standards (e.g., FDA, ATEX).

- Integration of AI improves supply chain resilience by forecasting demand for specific hose types based on predictive factory production trends.

- Computer vision and AI systems can assist in the automated inspection of hose jacket integrity and connector quality during manufacturing.

DRO & Impact Forces Of Heating Hose Market

The dynamics of the Heating Hose Market are shaped by powerful drivers, significant restraints, and emerging opportunities, all contributing to the overarching impact forces that dictate market direction and competitive intensity. The primary drivers revolve around the global expansion of high-precision manufacturing sectors, necessitating flawless material handling, particularly in industries dealing with highly viscous materials like specialized polymers, hot-melt adhesives, and chocolate/confectionery products. The increasing complexity of industrial automation systems demands components, like heated hoses, that offer sophisticated interfacing capabilities (e.g., integrated sensors and digital communication), pushing manufacturers to invest in R&D to enhance system intelligence and diagnostic features. Furthermore, stricter environmental and occupational safety regulations require hoses with improved thermal efficiency and enhanced external protection against abrasion and chemical spills, serving as a powerful force for material innovation and product refinement.

However, the market faces notable restraints, chiefly the high initial capital investment required for specialized, customized heating hose systems, especially those engineered for high-temperature or explosive (ATEX) environments. These costs can be prohibitive for small and medium enterprises (SMEs), particularly in developing markets. Technical restraints include the challenge of achieving absolute temperature uniformity over long lengths of highly flexible hose, a critical requirement in precision dispensing applications, which requires complex and expensive resistance wiring designs. Furthermore, the lack of standardization across different regional regulatory bodies regarding materials compatibility and safety certification poses a challenge for global players seeking streamlined product deployment and commercialization across diverse geographical markets.

Opportunities for growth are abundant, focusing primarily on the integration of Industry 4.0 technologies and the expansion into niche, high-value applications. The massive global shift towards electric vehicle (EV) manufacturing presents a key opportunity, as EV battery production requires precise application of specialized adhesives and sealants under strict thermal control. Additionally, leveraging material science breakthroughs to develop extremely lightweight, highly flexible, and high-purity hoses for biomedical and pharmaceutical fluid transfer represents a lucrative avenue. The key impact forces driving change include rapid technological obsolescence of older, inefficient heating systems and the increasing pressure from end-users for custom-engineered solutions that minimize energy consumption and offer unparalleled reliability in mission-critical applications.

Segmentation Analysis

The Heating Hose Market is intricately segmented based on core product characteristics, operational parameters, and end-user applications, allowing manufacturers to tailor offerings to specific industrial needs. Primary segmentation includes differentiation by hose type, material of construction, operating temperature range, and the critical application area. This detailed segmentation aids in understanding the varied requirements of end-user industries, from the high-pressure needs of chemical processing to the hygienic requirements of food and beverage production. The continuous growth in complexity across manufacturing—such as the requirement for precise, localized temperature zones within a single production line—demands highly specialized segmented products, driving value in niche segments.

Segmentation by material is crucial, as the inner liner determines chemical compatibility and purity, while the external jacket dictates resistance to abrasion and environmental factors. PTFE (Polytetrafluoroethylene) hoses, for example, command a premium in chemical and pharmaceutical sectors due to their inertness, while silicone rubber hoses are preferred for their flexibility and broader temperature tolerance in general industrial and packaging applications. Further differentiation occurs in heating element technology, contrasting between standard resistance wire heating, which is robust and common, and self-regulating heating cables, which offer built-in safety mechanisms and localized heat output adjustment, appealing to complex fluid dynamics scenarios. These variations directly influence both the cost structure and the suitability of the hose for critical operational tasks.

The functional segmentation by temperature range (low, medium, and high) dictates the complexity of insulation and the choice of internal wiring and jacketing materials. Medium-temperature hoses (up to 200°C) dominate the volume due to their wide use in hot melt adhesives and standard resins, whereas the high-temperature segment (above 200°C) is highly specialized, serving sophisticated processes such as the transfer of high-performance engineering plastics and specialized waxes. Understanding these segmentation nuances is vital for market players to focus their research and development efforts and strategically position their product portfolio to capture high-growth areas within the global industrial manufacturing ecosystem.

- By Type:

- PTFE Lined Hoses

- Silicone Lined Hoses

- Stainless Steel Braided Hoses

- Polymer/PVC Hoses

- High-Pressure Hoses

- By Heating Element:

- Resistance Wire Heating

- Self-Regulating Heating Cables

- Heating Foil Elements

- By Temperature Range:

- Low Temperature (Below 80°C)

- Medium Temperature (80°C - 200°C)

- High Temperature (Above 200°C)

- By Application/End-Use Industry:

- Hot Melt Adhesives and Sealants

- Chemical Processing and Petrochemicals

- Automotive (Paint and Coating Delivery)

- Food and Beverage (Chocolate, Waxes, Fats)

- Pharmaceutical and Medical Devices

- Semiconductor Manufacturing

Value Chain Analysis For Heating Hose Market

The value chain for the Heating Hose Market begins with raw material sourcing and component manufacturing (upstream analysis), progresses through specialized assembly and integration (midstream), and concludes with distribution, installation, and after-sales service (downstream analysis). Upstream activities are dominated by suppliers of critical components, including high-purity polymer resins (PTFE, Silicone), specialized heating resistance wires (e.g., nickel-chromium alloys), high-grade insulation materials (e.g., fiberglass, aerogel), and rugged protective braiding materials (e.g., stainless steel, Kevlar). The quality and consistency of these raw materials directly impact the final product's performance, durability, and compliance with stringent industry standards like FDA or ATEX. Strategic partnerships with reliable material suppliers are paramount to maintaining cost efficiency and ensuring product specification adherence.

The midstream segment involves the core competence of heating hose manufacturers, focusing on the sophisticated process of integrating the heating elements precisely around the inner liner, applying multi-layered thermal insulation, and securely fitting end-fittings and electrical connectors. This stage requires significant technical expertise in electrical engineering, thermal dynamics, and mechanical assembly to ensure homogeneous heating and robust electrical isolation and safety. Value addition at this stage is achieved through customization—designing hoses to specific lengths, temperature tolerances, pressure ratings, and integrating proprietary sensor technologies or diagnostic feedback loops, thereby creating highly differentiated, application-specific products that command higher margins.

Downstream analysis focuses on the efficient delivery and maintenance of the product. Distribution channels for heating hoses are bifurcated into direct sales to large, specialized OEMs (Original Equipment Manufacturers) or high-volume end-users (e.g., major automotive plants) and indirect sales through specialized industrial distributors, automation integrators, and fluid handling equipment suppliers. Indirect channels are crucial for reaching SMEs and providing localized installation support and prompt maintenance services. The successful execution of after-sales support, including calibration, repair, and replacement of connectors or hose sections, is critical, as heating hoses are integral, mission-critical components that impact overall production line uptime, making rapid, expert service a key competitive differentiator.

Heating Hose Market Potential Customers

Potential customers for heating hoses are diverse, spanning virtually every industrial sector where fluids or viscous materials must be maintained at an elevated temperature during transfer to ensure process functionality, consistency, and efficiency. The largest customer base resides within manufacturing operations that rely heavily on adhesives, sealants, and coatings, such as the packaging, assembly, and automotive sectors. These industries require reliable systems to deliver hot melt adhesives at precise temperatures to guarantee bonding strength and rapid curing times, making consistency in fluid handling a top operational priority. Customers in this segment prioritize hose flexibility, durability, and compatibility with proprietary dispensing equipment.

Another major segment consists of high-purity and critical process industries, including pharmaceutical manufacturing, biotechnology, and semiconductor fabrication. These end-users, or buyers, require hoses engineered with inert materials (like PFA or high-purity PTFE) and often mandate specialized certifications (e.g., FDA, USP Class VI) to prevent contamination or leaching. For these customers, the primary purchasing drivers are material cleanliness, the ability to withstand steam sterilization (CIP/SIP capabilities), and rigorous quality control documentation, justifying higher price points for specialized, validated equipment used in cleanroom environments.

Furthermore, industries dealing with bulk material transfer, such as chemical processing, refining, and specialized food production (e.g., handling waxes, fats, or specialized resins), constitute substantial potential customer groups. These buyers often require heavy-duty, high-pressure, and high-temperature rated hoses capable of handling corrosive or hazardous materials over long distances. Their buying decisions are typically driven by factors such as explosion-proof ratings (ATEX compliance), maximum operating pressure, and the longevity of the insulation system to withstand harsh, continuous operational cycles, ensuring worker safety and regulatory adherence are key purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1.2 Billion |

| Growth Rate | 7.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Elmefo Gmbh, Waage & Schmatloch GmbH & Co. KG, Heat Trace Ltd., Watlow Electric Manufacturing Company, Varian, Inc., Nordson Corporation, Dalian Xinzhe Technology Co., Ltd., Thermo-Flex, Inc., Slauch-Tech GmbH, OsseoTech International, LLC, Heatrex, Chromalox, Inc., Spirax Sarco, Inc., Tempco Electric Heater Corporation, BriskHeat, Hotwatt, Inc., Zoppas Industries, OMEGA Engineering Inc., Thermal Systems, Inc., Hi-Tech Heating Hoses. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heating Hose Market Key Technology Landscape

The technological landscape of the Heating Hose Market is rapidly evolving, driven by the necessity for greater energy efficiency, reliability, and digital integration. A primary focus is on advanced thermal management systems, moving beyond simple on/off heating controls to proportional-integral-derivative (PID) controllers that modulate power output with extreme precision. This PID control technology, often coupled with multiple embedded thermocouples or RTD sensors along the hose length, allows for maintaining temperature within a fraction of a degree, which is crucial for thermally sensitive materials used in demanding applications like aerospace bonding agents or high-purity medical resins. The use of proprietary algorithms further enhances this precision by anticipating thermal drift caused by changing ambient conditions or flow rates.

Material innovation represents another cornerstone of the current technology landscape. Manufacturers are leveraging advanced insulation materials, such as flexible ceramic fibers and aerogel-based composites, to achieve superior thermal retention with minimal wall thickness. This improves energy efficiency significantly while maintaining the necessary flexibility and reducing the overall weight and footprint of the hose assembly. Concurrently, the development of specialized inner liners, including highly modified PFA (Perfluoroalkoxy Alkanes) and proprietary cross-linked silicone formulas, ensures enhanced chemical resistance and reduced particulate shedding, directly addressing the stringent contamination concerns of the pharmaceutical and semiconductor industries. These material developments enable the hoses to operate reliably under higher pressures and extreme corrosive environments.

Furthermore, the integration of Industry 4.0 elements is transforming the market. Key technological breakthroughs include the incorporation of integrated digital diagnostic systems and smart monitoring capabilities. These systems allow hoses to communicate their operational status—including component health, current temperature profiles, and energy consumption—back to a centralized plant monitoring network via protocols such as IO-Link or Ethernet/IP. This connectivity supports proactive maintenance strategies, enables remote troubleshooting, and provides historical data logging necessary for process validation and regulatory compliance, thereby positioning the heating hose as a smart, interconnected asset rather than a passive component in the industrial workflow.

Regional Highlights

The global Heating Hose Market exhibits distinct growth patterns and maturity levels across key geographical regions, largely influenced by industrial infrastructure, regulatory environments, and the speed of technological adoption.

- Asia Pacific (APAC): APAC represents the fastest-growing market, primarily fueled by extensive capital investment in manufacturing capacity across China, India, and Southeast Asia. The region is characterized by high-volume demand from the automotive, electronics assembly, and consumer goods packaging sectors, driving rapid adoption of hot melt adhesive dispensing systems. Government initiatives promoting industrial automation and smart factory development further accelerate the integration of high-performance heating hoses, though price sensitivity remains higher compared to Western markets.

- North America: North America is a mature market focused on high-value, specialized applications, particularly in pharmaceutical, biotechnology, aerospace, and high-purity chemical processing. Growth here is driven by stringent quality control standards and the need for ATEX-compliant hoses for hazardous environments. Manufacturers in this region focus heavily on system integration, durability, and incorporating advanced diagnostic features (Industry 4.0 readiness) to minimize process downtime and meet complex regulatory demands.

- Europe: Europe maintains a strong market share, characterized by robust demand from the advanced automotive industry (paints, coatings, sealants), precision mechanical engineering, and specialty chemical production. The region is highly regulated, placing immense emphasis on energy efficiency (driven by EU directives) and worker safety. This necessitates investment in high-quality insulation technology and standardized, safety-certified hose assemblies, leading to a strong competitive focus on reliability and long product lifecycle value.

- Latin America (LATAM): The LATAM market, while smaller, shows steady growth driven by expanding food and beverage processing sectors and localized automotive assembly plants. Market adoption is often tied to macroeconomic stability and foreign direct investment into industrial infrastructure. Demand is typically moderate-temperature range, standard hoses, with increasing interest in imported high-quality systems as manufacturing standards rise.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in petrochemicals, oil & gas downstream processing, and specialized coatings. The demand profile is skewed towards rugged, high-temperature, and corrosion-resistant hoses capable of operating in extreme ambient conditions, often requiring specialized certifications for hazardous area installations. Market dynamics are heavily influenced by large infrastructure projects and fluctuating global commodity prices affecting capital expenditure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heating Hose Market.- Elmefo Gmbh

- Waage & Schmatloch GmbH & Co. KG

- Heat Trace Ltd.

- Watlow Electric Manufacturing Company

- Nordson Corporation

- Dalian Xinzhe Technology Co., Ltd.

- Thermo-Flex, Inc.

- Slauch-Tech GmbH

- OsseoTech International, LLC

- Heatrex

- Chromalox, Inc.

- Spirax Sarco, Inc.

- Tempco Electric Heater Corporation

- BriskHeat

- Hotwatt, Inc.

- Zoppas Industries

- OMEGA Engineering Inc.

- Thermal Systems, Inc.

- Hi-Tech Heating Hoses

- Durex Industries

Frequently Asked Questions

Analyze common user questions about the Heating Hose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for specialized heating hoses in the automotive industry?

The automotive sector drives demand for heated hoses primarily due to the complex application of hot melt adhesives, specialized sealants, and high-viscosity paints/coatings required for modern vehicle assembly, especially in EV battery manufacturing. These processes necessitate precise, stable temperature control during material transfer to ensure bond strength, curing speed, and consistent quality.

How does ATEX certification influence the selection and cost of heating hoses?

ATEX certification is mandatory for heating hoses used in potentially explosive atmospheres (Ex zones), common in chemical, petrochemical, and refining industries. This certification significantly influences selection by requiring specialized explosion-proof components, robust static dissipation layers, and stringent manufacturing processes, consequently increasing the initial cost of the certified hose assemblies.

What role do advanced insulation materials play in modern heating hose technology?

Advanced insulation materials, such as aerogels and high-performance ceramic fibers, are crucial for enhancing energy efficiency and thermal stability. They minimize heat loss to the ambient environment, reduce operational costs, and enable highly uniform temperature profiles along the hose length, which is vital for high-precision dispensing tasks and meeting sustainability goals.

Which segmentation segment, by material, is expected to show the highest growth rate?

The PTFE (Polytetrafluoroethylene) lined heating hose segment is projected to show the highest growth rate. This acceleration is driven by increasing demand from high-purity industries (pharmaceuticals and semiconductors) and chemical processing, owing to PTFE's superior chemical inertness, non-leaching properties, and ability to withstand aggressive corrosive media at elevated temperatures.

How is Industry 4.0 integration changing the heating hose maintenance paradigm?

Industry 4.0 integration, utilizing embedded sensors and digital communication protocols, shifts maintenance from reactive to predictive. Smart hoses provide real-time diagnostic data on thermal performance and component health, enabling AI-driven monitoring that forecasts potential failures, optimizes repair schedules, and maximizes production line uptime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager