Heavy Brick Type Tile Adhesive Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431669 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Heavy Brick Type Tile Adhesive Market Size

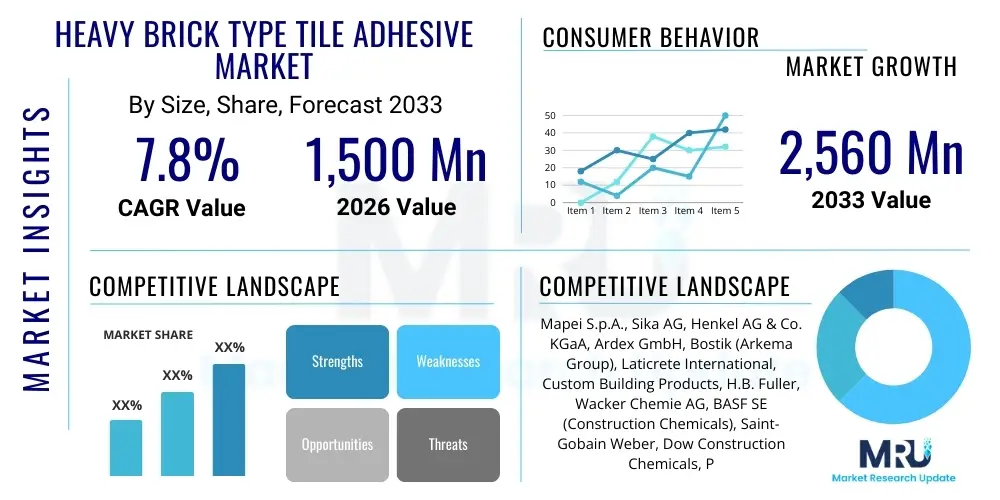

The Heavy Brick Type Tile Adhesive Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1,500 Million in 2026 and is projected to reach USD 2,560 Million by the end of the forecast period in 2033.

Heavy Brick Type Tile Adhesive Market introduction

The Heavy Brick Type Tile Adhesive Market encompasses high-performance polymer-modified cementitious and non-cementitious formulations specifically designed to bond large format, dense, and heavy architectural elements such as engineered stone, porcelain slabs, and specialized heavy facade bricks, often exceeding 60x60 cm or requiring specialized shear strength. These adhesives are critical in modern construction where aesthetic demands favor larger, heavier cladding materials. Traditional mortar systems are inadequate for these applications due to insufficient bond strength, flexibility, and resistance to thermal movement and structural deflection. The introduction of improved polymer additives, such as redispersible polymer powders (RDPs), coupled with optimized grading of mineral fillers, provides the necessary characteristics—low shrinkage, high adhesion, and excellent workability—to handle the immense weight and low porosity typical of heavy brick and large-format tiles.

Product descriptions typically emphasize C2S1 or C2S2 classifications under EN 12004 standards, signifying high tensile adhesion strength and significant deformation capacity, respectively. Major applications span high-rise commercial buildings, exterior cladding systems, heavily trafficked industrial floors, and luxury residential projects requiring premium finishes. The primary benefits derived from using these specialized adhesives include enhanced durability and longevity of installations, superior resistance to freeze-thaw cycles, improved water resistance, and ultimately, ensuring the safety of large vertical installations by preventing slippage or failure. The structural integrity provided by these heavy-duty formulations is non-negotiable in demanding environments and high-stress installations.

The market is primarily driven by global urbanization trends, rapid expansion of infrastructure development in emerging economies, and increasingly stringent building codes mandating higher safety and performance standards for facade systems. Furthermore, shifting architectural preferences towards open-plan designs, large monolithic tile surfaces, and the popularity of heavier, natural stone cladding materials necessitate the adoption of robust adhesive technologies. The increasing focus on green building certifications also plays a role, pushing manufacturers to develop low volatile organic compound (VOC) and sustainable adhesive solutions that maintain superior performance characteristics for heavy-duty applications. Technological advancements focused on accelerating cure times without compromising final bond strength are continually fueling market growth.

Heavy Brick Type Tile Adhesive Market Executive Summary

The Heavy Brick Type Tile Adhesive Market is undergoing robust expansion, fundamentally driven by the architectural shift toward large-format, low-porosity materials, particularly in high-traffic and exterior facade applications across Asia Pacific and the Middle East. Business trends indicate a strong move toward specialized, high-specification products (e.g., C2S2 classifications) that offer superior flexibility and rapid-setting properties, reducing project timelines and catering to the premium segment. Key manufacturers are focusing heavily on product differentiation through sustainable ingredients, such as incorporating recycled content and reducing cement content while enhancing polymer modification levels, thereby aligning with global environmental, social, and governance (ESG) reporting mandates. Strategic mergers and acquisitions are common as large players seek to acquire niche technologies or expand geographical footprint, particularly in developing regions where construction activity is peaking.

Regionally, Asia Pacific maintains market dominance due to massive infrastructure investments in China, India, and Southeast Asian nations, alongside the immense volume of residential and commercial construction utilizing durable exterior cladding. North America and Europe, while characterized by mature markets, exhibit consistent demand driven by refurbishment, renovation activities, and stringent quality regulations that favor high-end, certified adhesives. The Middle East and Africa (MEA) region shows the highest growth potential, largely fueled by mega-projects (e.g., smart city developments) that necessitate materials capable of withstanding extreme temperature fluctuations and high UV exposure, demanding high-performance, heat-resistant heavy tile adhesives.

Segmentation trends highlight the increasing preference for polymer-modified cementitious adhesives, which offer a favorable balance of cost, performance, and versatility, although high-performance epoxy adhesives remain essential for niche applications requiring maximum chemical resistance or zero water absorption. Demand is heavily concentrated within commercial and infrastructure end-use sectors, including airports, metro stations, and large-scale shopping complexes, where the installation of heavy stone cladding or durable brick veneer requires absolute reliability. Moreover, the emergence of hybrid formulations that blend the benefits of polyurethane and cement systems is creating new opportunities by offering superior flexibility and crack bridging capabilities, addressing one of the core challenges associated with heavy installations on flexible substrates.

AI Impact Analysis on Heavy Brick Type Tile Adhesive Market

User queries regarding the integration of Artificial Intelligence (AI) in the Heavy Brick Type Tile Adhesive Market predominantly focus on optimizing material formulation, enhancing supply chain predictability, and automating quality control processes on construction sites. Users are keen to understand how AI-driven predictive modeling can simulate the long-term performance and durability of novel adhesive compositions under various environmental stressors, such as extreme temperature cycles and high moisture exposure, thereby significantly accelerating the research and development lifecycle for next-generation products. Concerns are often raised about the cost of implementing sophisticated sensor technology and AI platforms, particularly among smaller adhesive manufacturers, and how this technology will interface with existing legacy manufacturing infrastructure.

A secondary theme in user questions revolves around utilizing AI for advanced logistics and demand forecasting. Given that tile adhesives are often bulky and sensitive to specific storage conditions, users anticipate AI-powered supply chain management to minimize waste, optimize inventory levels for specific regional demands (e.g., high-heat resistance required in desert climates), and predict material flow to large-scale, time-sensitive construction projects. Furthermore, there is significant user expectation concerning AI’s role in automating on-site application guidance and quality assurance. For heavy brick installation, precise adhesive thickness and coverage are crucial; AI vision systems could potentially monitor and certify the application process in real-time, drastically reducing installation errors and improving project compliance documentation.

- AI-driven optimization of chemical formulations, leading to predictive performance modeling and faster R&D cycles.

- Implementation of AI in manufacturing process control to maintain consistent viscosity and polymerization rates, ensuring batch-to-batch quality.

- Enhanced supply chain logistics using machine learning algorithms for precise demand forecasting and inventory management, minimizing storage costs and material spoilage.

- Development of AI-powered vision systems for automated quality control on construction sites, verifying proper adhesive coverage and trowel patterns for heavy tiles.

- Creation of digital twins for major infrastructure projects, allowing simulation of adhesive stress responses under seismic or thermal loading conditions.

- AI integration into customer support platforms to provide instantaneous, customized advice on product selection based on specific substrate and brick type requirements.

DRO & Impact Forces Of Heavy Brick Type Tile Adhesive Market

The dynamics of the Heavy Brick Type Tile Adhesive Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction. Key drivers include the global mandate for safer, more durable building facades, specifically the requirement for high-performance adhesives to secure increasingly large and heavy cladding materials that are preferred in modern architectural design. Restraints primarily involve the volatility in raw material pricing, particularly for polymers and specialty chemicals derived from petrochemical sources, alongside the challenges associated with standardization and quality control across fragmented construction markets, particularly concerning the inconsistent application skills available globally. Opportunities are vast, focused primarily on developing hybrid adhesive technologies and sustainable, low-carbon formulations that cater to the green building movement, alongside market penetration into rapidly urbanizing regions that are adopting advanced construction methods.

Impact forces heavily influence adoption rates. The shifting architectural trends toward large format, non-porous tiles and engineered heavy stone necessitates adhesives with superior flexibility (S1 and S2 grading) to absorb structural movement and prevent cracking or bond failure, establishing a strong pull factor for premium products. Regulatory impact is high, especially in developed economies where strict safety standards govern the installation of exterior cladding, demanding certified adhesives that meet or exceed specific European (EN) and American Society for Testing and Materials (ASTM) standards for shear and tensile strength. The environmental force is compelling, pushing manufacturers towards low-VOC, dust-reduced formulations to comply with workplace health regulations and consumer preference for ecological solutions, driving product innovation towards sustainable alternatives.

Economic forces, particularly fluctuations in construction spending and lending rates, directly influence market uptake; however, the specialized nature of heavy brick installations often involves high-value, non-discretionary spending, insulating this segment somewhat from broader economic volatility compared to standard construction adhesives. Competitive forces are intensifying, with established chemical companies leveraging their R&D capabilities to launch advanced polymer-enhanced systems, while localized manufacturers compete aggressively on price in the cementitious segment. The cumulative effect of these forces suggests a sustained movement towards high-specification, specialized adhesive products where performance and safety outweigh marginal cost differences, reinforcing the need for continuous material science innovation in this market niche.

Segmentation Analysis

The Heavy Brick Type Tile Adhesive Market is comprehensively segmented based on its composition, application area, end-use sector, and geographical region. Understanding these segments is crucial for strategic planning, as distinct product requirements and regulatory landscapes define demand within each category. Compositional segmentation, ranging from cementitious to epoxy and hybrid systems, dictates performance characteristics such as flexibility, chemical resistance, and setting time, directly impacting suitability for heavy applications. Application-wise, interior versus exterior demands different levels of UV and weather resistance. Furthermore, the commercial and infrastructure segments typically require higher volumes and superior performance specifications compared to residential installations, forming critical differentiators in market strategy.

- By Composition:

- Polymer Modified Cementitious Adhesives (PCC)

- Epoxy Adhesives

- Polyurethane Adhesives

- Hybrid Formulations

- By Tile/Brick Type:

- Porcelain and Vitrified Tiles

- Heavy Natural Stone (Granite, Marble, Slate)

- Engineered Heavy Brick Veneers

- Large Format Slabs (>60x60 cm)

- By Application Area:

- Interior Floors and Walls

- Exterior Facades and Cladding Systems

- Wet Areas (Swimming Pools, Bathrooms)

- By End-Use Sector:

- Commercial (Shopping Centers, Offices, Hotels)

- Residential (High-End Housing, Multi-Family Units)

- Infrastructure (Airports, Railway Stations, Hospitals)

- By Technology Classification (EN 12004 Standard):

- C2E (Cementitious, Improved, Extended Open Time)

- C2S1 (Cementitious, Improved, Flexible)

- C2S2 (Cementitious, Improved, Highly Flexible)

Value Chain Analysis For Heavy Brick Type Tile Adhesive Market

The value chain for Heavy Brick Type Tile Adhesives begins with the upstream procurement of essential raw materials, a phase characterized by high specialization and dependency on global commodity markets. Key raw materials include high-quality Portland cement, various inert mineral fillers (e.g., fine silica sands), and, most critically, specialty performance polymers such as redispersible polymer powders (RDPs), cellulosic ethers (for rheology modification), and chemical accelerators. Manufacturers of RDPs and specialized additives hold significant leverage in the upstream segment, as these components determine the final adhesive classification (e.g., C2S2 flexibility). Price volatility in petrochemicals affects polymer costs, forcing adhesive producers to actively manage hedging strategies and secure long-term supply agreements to ensure stable production costs and consistent product quality, which is paramount for heavy-duty applications.

Midstream activities involve the formulation, blending, and manufacturing processes, where advanced chemical engineering expertise is required to achieve the precise balance of high bond strength, low shrinkage, and extended open time necessary for heavy installations. Manufacturers often invest heavily in dust reduction technologies and automated blending equipment to ensure homogeneity and compliance with environmental standards. Following manufacturing, the distribution channel is highly critical. Direct sales channels are typically utilized for large-scale commercial and infrastructure projects, allowing manufacturers to provide technical support, product training, and customized solutions directly to major contractors and facade specialists. This direct approach ensures quality control and professional application advice, minimizing installation risks associated with heavy materials.

Conversely, indirect distribution utilizes a network of specialized construction material distributors, hardware retailers, and wholesalers to reach smaller contractors and residential installers. This indirect channel is vital for market penetration but requires robust inventory management and logistical support due to the regional variations in required product specifications. Downstream analysis focuses on the end-users—professional tile setters, facade installation contractors, and large construction developers—who drive demand based on project specifications and performance requirements. The successful completion of the value chain is highly dependent on quality assurance checks and comprehensive post-sale technical service, especially considering the severe implications of bond failure in heavy brick type installations, necessitating ongoing training for applicators on proper substrate preparation and installation techniques to maximize product performance.

Heavy Brick Type Tile Adhesive Market Potential Customers

The primary cohort of potential customers for Heavy Brick Type Tile Adhesives consists of large-scale construction developers and general contractors specializing in high-end commercial, industrial, and infrastructure projects. These buyers prioritize product certifications (such as C2S2 ratings), technical support, and proven product performance over cost savings, given the safety and longevity requirements of heavy facade systems and large-format flooring. Specific buyers include companies involved in constructing high-rise office buildings, luxury hotels, major transportation hubs (airports, metros), and specialized industrial facilities, where materials must withstand extreme environmental conditions, seismic activity, or intense mechanical loads. Procurement decisions in this segment are highly technical, driven by consulting engineers and architects who specify the precise adhesive requirements during the design phase.

A secondary, yet rapidly growing, customer segment includes specialized facade and cladding installation sub-contractors. These firms are the direct end-users, responsible for the application and installation of heavy stone, brick, and tile materials. Their purchasing behavior is influenced by product workability, ease of use, curing time (speed of installation), and technical support availability from the manufacturer. They seek adhesives that reduce labor costs while ensuring maximum safety and adherence to strict project timelines. The shift towards proprietary heavy brick and stone systems often ties these sub-contractors into specific manufacturer ecosystems, driven by system compatibility and warranties offered by the adhesive supplier.

Furthermore, the high-end residential renovation and custom home building sector represents a critical segment, particularly in mature markets like North America and Western Europe. Although smaller in volume than commercial projects, these customers demand premium products for luxury finishes, such as large marble slabs in kitchens and bespoke exterior stone veneer installations. While purchasing decisions are often channeled through architects or interior designers, the ultimate buyers are high-net-worth individuals or boutique residential developers seeking uncompromising aesthetic appeal coupled with long-term structural integrity. These buyers are less price-sensitive and prioritize sustainability, low-VOC content, and aesthetic preservation capabilities of the adhesive.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,500 Million |

| Market Forecast in 2033 | USD 2,560 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mapei S.p.A., Sika AG, Henkel AG & Co. KGaA, Ardex GmbH, Bostik (Arkema Group), Laticrete International, Custom Building Products, H.B. Fuller, Wacker Chemie AG, BASF SE (Construction Chemicals), Saint-Gobain Weber, Dow Construction Chemicals, Pidilite Industries, Myk Laticrete, Beiyang Adhesive, Fosroc International, Dryvit Systems, Sakrete, ParexGroup. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Brick Type Tile Adhesive Market Key Technology Landscape

The technology landscape for Heavy Brick Type Tile Adhesives is defined by continuous innovation in polymer chemistry aimed at enhancing flexibility, adhesion, and durability under extreme conditions. A major technological focus is the development of high-performance polymer modification systems, particularly incorporating advanced redispersible polymer powders (RDPs) derived from EVA (Ethylene Vinyl Acetate) or VAE (Vinyl Acetate Ethylene). These RDPs are finely tuned to provide high deformation capacity (S2 classification) necessary for bonding heavy, non-porous materials onto substrates prone to movement (e.g., timber frames or large concrete structures exposed to thermal cycling). Furthermore, the optimization of specialized additives, such as hydrophobic agents and accelerating chemistries, allows manufacturers to produce rapid-setting adhesives that maintain a high degree of flexibility and water resistance, crucial for fast-track construction projects involving external heavy cladding.

Another pivotal technological advancement involves the creation of hybrid adhesive systems, which combine the favorable characteristics of polyurethane or epoxy resins with traditional cementitious binders. These hybrid formulations offer zero-slump properties, essential for vertical installations of heavy bricks, coupled with exceptional chemical resistance and the capability to bond to challenging substrates (e.g., metals or glass) where standard cementitious products fail. The development of lightweight fillers, such as microscopic hollow spheres, is also a growing trend, enabling the production of adhesives that are easier to handle and transport, without compromising the required shear strength or bond performance necessary for securing heavy architectural elements. This focus on reducing density while maintaining performance is a crucial element of modern adhesive engineering, addressing logistical challenges on complex construction sites.

Finally, the integration of dust-reduced or low-dust technology is a mandatory feature in modern formulations, primarily driven by occupational health and safety regulations. Manufacturers employ specialized grinding techniques and chemical agents during the blending process to minimize airborne silica dust, improving applicator safety and complying with stringent environmental standards in markets like Europe and North America. Simultaneously, the push toward sustainability has led to technological research into bio-based polymers and cement alternatives (e.g., geopolymers), aiming to reduce the carbon footprint associated with traditional Portland cement while ensuring the structural performance demanded by heavy brick and large-format tile applications. These technological developments collectively define the competitive edge, enabling products to meet increasingly severe performance specifications mandated by contemporary architectural design and building codes.

Regional Highlights

- Asia Pacific (APAC): Dominates the market share due to unparalleled growth in infrastructure and construction projects, particularly in China, India, and ASEAN nations. Demand is driven by urbanization, increasing adoption of modern building techniques, and a vast pipeline of commercial and high-rise residential construction utilizing heavy facade materials. The competitive landscape is characterized by both global players and strong domestic manufacturers.

- North America: Exhibits stable, high-value demand, primarily driven by renovation projects, stringent safety regulations, and the architectural preference for large format porcelain slabs and natural stone veneers. High penetration of C2S2 and epoxy-based systems due to high performance expectations and comprehensive building codes focusing on earthquake resistance and wind load management.

- Europe: A mature but highly regulated market, leading the adoption of sustainable and low-VOC adhesive technologies. Growth is steady, driven by infrastructure upgrades and renovation of historical structures requiring specialized, high-flexibility (S1/S2) adhesives capable of accommodating thermal movement and diverse substrates. Germany, France, and the UK are key markets focusing on quality certification.

- Middle East and Africa (MEA): Projected to register the highest growth rate, fueled by massive government-backed mega-projects (e.g., in UAE, Saudi Arabia, and Qatar). Demand is concentrated on adhesives formulated specifically to withstand extreme heat, high humidity, and prolonged UV exposure, necessitating specialized polymer chemistries and non-slump properties for vertical heavy installations.

- Latin America: Demonstrates nascent but accelerating demand, tied to local economic stability and foreign investment in commercial real estate and tourism infrastructure. Adoption rates are increasing as local construction firms shift from traditional mortar systems to polymer-modified adhesives for improved long-term reliability and safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Brick Type Tile Adhesive Market.- Mapei S.p.A.

- Sika AG

- Henkel AG & Co. KGaA

- Ardex GmbH

- Bostik (Arkema Group)

- Laticrete International

- Custom Building Products

- H.B. Fuller

- Wacker Chemie AG

- BASF SE (Construction Chemicals)

- Saint-Gobain Weber

- Dow Construction Chemicals

- Pidilite Industries

- Myk Laticrete

- Beiyang Adhesive

- Fosroc International

- Dryvit Systems

- Sakrete

- ParexGroup

- Schönox GmbH

Frequently Asked Questions

Analyze common user questions about the Heavy Brick Type Tile Adhesive market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes heavy brick tile adhesives from standard mortars?

Heavy brick tile adhesives, typically polymer-modified cementitious systems (C2 classified), are formulated with high levels of specialized polymers (RDPs) and additives to provide significantly higher tensile adhesion strength, superior flexibility (S1 or S2 deformation capability), and anti-slip properties (T classification). This ensures reliable, long-term bonding for heavy, low-porosity materials like large porcelain slabs or stone veneers, which standard mortars cannot adequately secure, particularly in external or high-stress environments.

Which performance standards are critical for heavy tile adhesives used on exterior facades?

The most critical performance standards are those outlined in EN 12004/ISO 13007, specifically the C2S1 or C2S2 classifications. C2 denotes improved adhesion strength (>1.0 N/mm²), while S1 (flexible) and S2 (highly flexible) indicate the adhesive's capacity to deform under movement, which is essential for external facades subjected to extreme thermal cycles, wind loads, and structural deflection common in high-rise construction, ensuring bond integrity and safety.

How does raw material price volatility affect the Heavy Brick Type Tile Adhesive Market?

Raw material price volatility significantly impacts the market, primarily through the cost fluctuations of petrochemical-derived polymers (RDPs and latex emulsions). As these polymers are the essential components that impart flexibility and high adhesion required for heavy tiles, increased polymer costs raise the overall manufacturing expense. Manufacturers often absorb some costs or pass them on, leading to price instability for the final specialized adhesive product, necessitating strategic sourcing and hedging practices.

What are the primary applications driving demand for C2S2 classified adhesives?

C2S2 highly flexible adhesives are primarily demanded for high-risk, high-movement applications, including exterior cladding systems on high-rise commercial buildings, installations over complex or deformable substrates (like particle board or young concrete), and high-traffic public areas such as airports and metro stations where structural movement and mechanical loads are severe. Their superior deformation capacity prevents bond failure where substrate movement is anticipated.

What technological trends are promoting sustainability in heavy tile adhesive formulations?

Sustainability is driven by developing low Volatile Organic Compound (VOC) and low-dust formulations to improve indoor air quality and worker safety. Manufacturers are also increasingly researching and incorporating alternative cement binders (such as calcium sulfoaluminate or geopolymer technology) and utilizing bio-based or recycled content in polymer components, aiming to reduce the reliance on high-carbon Portland cement while maintaining the critical performance specifications required for heavy brick and tile installation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager