Heavy Commercial Vehicle EPS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438803 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Heavy Commercial Vehicle EPS Market Size

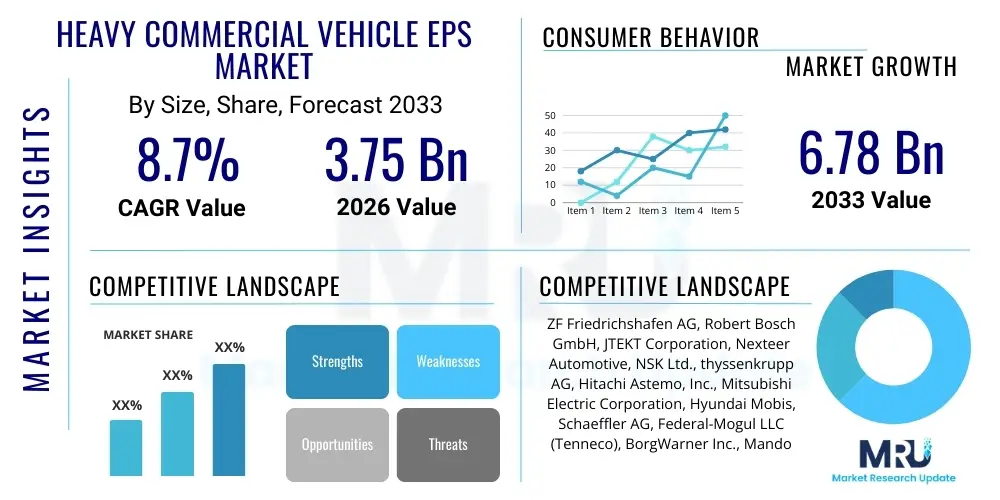

The Heavy Commercial Vehicle EPS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 3.75 Billion in 2026 and is projected to reach USD 6.78 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by rigorous safety regulations mandating advanced driver assistance systems (ADAS) in heavy-duty trucks and buses, coupled with the global push for enhanced fuel efficiency and reduced operational costs across logistics fleets. The adoption rate, while initially slower than in passenger vehicles due to higher load requirements, is accelerating rapidly as technological advancements provide robust and reliable electric steering solutions capable of handling axle loads exceeding 10 tons.

The calculation of the market size reflects the increasing penetration of sophisticated EPS units, moving beyond traditional hydraulic systems. Factors such as the integration of steer-by-wire capabilities and the increasing necessity for seamless interaction with Level 2 and Level 3 autonomous driving features are key valuation determinants. Geographically, emerging economies, particularly in Asia Pacific, are contributing significantly to the volumetric growth as modernization of aging commercial vehicle fleets becomes a priority, necessitating advanced steering mechanisms that offer better driver comfort and operational performance.

Heavy Commercial Vehicle EPS Market introduction

The Heavy Commercial Vehicle (HCV) Electric Power Steering (EPS) Market encompasses the manufacturing, distribution, and integration of electrically assisted steering systems designed for heavy-duty trucks, buses, and specialized commercial vehicles. Unlike conventional hydraulic steering, EPS systems utilize an electric motor to provide steering assistance, leading to reduced engine load, improved fuel economy, and higher packaging flexibility. These systems are crucial components for modernizing commercial vehicles, enhancing maneuverability at low speeds, and ensuring precise handling at highway speeds. The core product includes the electric motor, torque sensor, electronic control unit (ECU), and associated wiring harnesses, all calibrated specifically for the demanding operational environment and load characteristics of HCVs.

Major applications for HCV EPS systems span across line haul trucks (semi-trailers), vocational trucks (dump trucks, cement mixers), and various public and private transit buses. The primary benefits driving adoption include compliance with stringent environmental norms due to lower energy consumption, superior driver ergonomics that reduce fatigue on long hauls, and the foundational requirement for enabling ADAS features such as Lane Keeping Assist (LKA) and Automated Parking. These systems are pivotal in transitioning the commercial transport industry towards greater automation and operational safety.

Key driving factors accelerating market penetration include the aforementioned safety mandates (e.g., European Union’s General Safety Regulation), the rising cost of fuel prompting fleet operators to seek efficiency gains, and continuous technological advancements in motor and sensor components that improve system reliability and load capacity. Furthermore, the global logistics boom, fueled by e-commerce expansion, necessitates more efficient and driver-friendly heavy-duty vehicles, creating a strong market pull for integrated EPS solutions capable of supporting higher degrees of autonomy and connectivity.

Heavy Commercial Vehicle EPS Market Executive Summary

The Heavy Commercial Vehicle EPS Market is characterized by robust technological innovation focusing on high-torque output and fail-operational safety architectures essential for autonomous applications. Business trends indicate consolidation among Tier 1 suppliers who are vertically integrating software and component manufacturing capabilities to offer complete steer-by-wire solutions. Strategic partnerships between traditional steering manufacturers and technology companies specializing in AI and sensor fusion are becoming increasingly common, aiming to accelerate the development of steering systems suitable for Level 4 autonomy in trucking. Furthermore, fleet management companies are increasingly factoring in the total cost of ownership (TCO), where the fuel savings and reduced maintenance offered by EPS systems provide a compelling economic argument for rapid fleet conversion, outpacing initial adoption hurdles related to capital expenditure.

Regionally, the Asia Pacific (APAC) region, spearheaded by China and India, dominates market volume due to massive domestic production and the rapid replacement cycle of older fleets, particularly in the bus segment where maneuvering in congested urban environments is a priority. North America and Europe, while representing lower volumetric growth, lead in value due to the higher integration of advanced features such as redundancy and steer-by-wire systems tailored for long-haul autonomous truck platooning projects. Regulatory stringency regarding vehicle safety and emissions remains the strongest regional divergence factor, with the EU and North America setting the pace for advanced system requirements.

Segment-wise, the adoption of Column Assist EPS (CEPS) remains strong in lighter commercial applications and certain bus platforms, while high-torque Pinion Assist EPS (PEPS) and Rack Assist EPS (REPS) are gaining ground in medium and heavy-duty trucks requiring maximum steering force and precision. The component segment sees the Electronic Control Unit (ECU) and high-performance motors as critical growth areas, driven by the need for increased computational power and thermal efficiency to ensure reliability under heavy load conditions. These trends collectively underscore a market transitioning from optional convenience to mandatory safety and efficiency infrastructure.

AI Impact Analysis on Heavy Commercial Vehicle EPS Market

Users frequently inquire about how AI enhances the safety and functionality of EPS systems, specifically focusing on redundancy, predictive maintenance, and the enabling role of AI in Level 4 autonomous trucking. Common concerns revolve around the cybersecurity implications of highly connected, AI-driven steering controls and the reliability of machine learning algorithms in unpredictable heavy-duty operational scenarios, such as varying load distribution or extreme weather. Users are particularly keen on understanding how AI facilitates real-time torque control, predictive failure analysis, and optimized power consumption based on driving style and road conditions. The analysis reveals a consensus that AI is transformative, moving EPS from a simple assistance mechanism to a complex, adaptive safety critical control system, capable of optimizing performance parameters far beyond traditional, rule-based software.

- AI algorithms enhance real-time torque application optimization based on speed, steering angle, and driver input, improving responsiveness and fuel efficiency.

- Predictive maintenance systems utilizing AI analyze sensor data within the ECU to forecast component degradation (motor, sensor failure), significantly reducing unexpected vehicle downtime.

- AI is essential for validating and executing commands in steer-by-wire systems, ensuring fail-operational performance crucial for Level 4 autonomous driving architectures.

- Machine learning models optimize power consumption by intelligently adjusting assistance levels, extending battery life in electric HCVs.

- AI supports advanced driver assistance features such as active centering and crosswind stabilization, significantly improving vehicle stability and driver comfort.

- Enhanced cybersecurity protocols are being developed using AI to detect and mitigate malicious input attempts directed at the steering ECU.

DRO & Impact Forces Of Heavy Commercial Vehicle EPS Market

The Heavy Commercial Vehicle EPS Market is dynamically shaped by powerful drivers focused on safety and efficiency, counterbalanced by significant technological and economic restraints, leading to compelling long-term opportunities centered around vehicle automation. The primary drivers include global regulatory shifts mandating advanced safety features in commercial vehicles, such as automated emergency steering and lane keeping support, which require precise and rapid control only offered by EPS. Concurrently, the operational imperative for fleet operators to reduce fuel consumption and environmental footprint strongly favors EPS over power-intensive hydraulic alternatives. These drivers create a sustained high demand foundation for system upgrades and new vehicle installations across all major geographical markets.

Restraints largely center on the high initial capital expenditure associated with implementing high-torque EPS units, which are significantly more expensive and technically complex than legacy hydraulic systems. Furthermore, integrating these sophisticated electronic systems into diverse heavy commercial platforms presents complex electromagnetic compatibility (EMC) and durability challenges, given the harsh vibrational and thermal environment in which HCVs operate. Supply chain limitations regarding high-power semiconductors and precision motors, particularly post-2020, also pose periodic constraints on rapid volume scaling, affecting lead times for large fleet orders.

The overarching opportunity lies in the burgeoning market for autonomous trucking, where EPS systems are foundational components enabling steer-by-wire capability necessary for redundancy and remote operation. The continuous development of modular and scalable EPS platforms that can accommodate various axle loads and vehicle types offers significant growth potential, especially as fleets transition to electric powertrains, making the energy efficiency of EPS critical. Impact forces, therefore, lean heavily towards technological acceleration and regulatory mandate fulfillment, ensuring the trajectory of the market remains positive despite cost barriers. The high impact of safety mandates, particularly in developed regions, acts as the strongest determinant of market direction.

Segmentation Analysis

The Heavy Commercial Vehicle EPS Market is segmented based on the type of assistance mechanism, the core components integrated into the system, and the application vehicle class. This segmentation provides a granular view of technological preferences and market adoption rates across different regions and operational requirements. Type segmentation reveals the technical evolution, moving from basic Column Assist Systems (CEPS) suitable for lighter loads, towards robust Pinion Assist (PEPS) and Rack Assist (REPS) systems required for heavy-duty long-haul trucks that demand maximum torque output and precision control, especially for automated features. Component-wise, the sophistication of the Electronic Control Unit (ECU) is increasingly becoming the differentiating factor, driving value growth within the segment.

- By Type:

- Column Assist EPS (CEPS)

- Pinion Assist EPS (PEPS)

- Rack Assist EPS (REPS)

- Hydraulic Power Steering (HPS) Conversion Kits (Hybrid Solutions)

- By Component:

- Electric Motors

- Electronic Control Units (ECU)

- Sensors (Torque, Position, Speed)

- Steering Gears and Columns

- Wiring Harnesses and Connectors

- By Application:

- Trucks (Heavy-Duty, Medium-Duty)

- Buses (Transit, Coach)

- Construction and Mining Vehicles

- Specialty Commercial Vehicles

- By Vehicle Type (Tonnage):

- Class 7 & 8 (Heavy Trucks)

- Class 4-6 (Medium Trucks)

Value Chain Analysis For Heavy Commercial Vehicle EPS Market

The value chain for the Heavy Commercial Vehicle EPS market begins with upstream activities dominated by specialized raw material suppliers and component manufacturers providing critical inputs such as high-grade steel, complex semiconductors, precision sensors, and rare earth magnets essential for high-power electric motors. Upstream complexity is high due to the stringent quality requirements for safety-critical components, demanding specialized expertise in electronics manufacturing and metallurgy. Key suppliers in this stage wield significant influence, particularly those providing customized ECUs and advanced software algorithms for torque control and functional safety features. This phase requires rigorous testing and validation to meet global automotive safety integrity levels (ASIL).

Midstream activities involve Tier 1 suppliers who are the core integrators, assembling motors, sensors, and ECUs into complete EPS systems. Companies like ZF, Bosch, and JTEKT dominate this stage, often engaging in proprietary research and development to optimize system performance, thermal management, and fail-operational redundancy. Distribution channels are highly structured; direct distribution models are prevalent, where Tier 1 suppliers engage in long-term contracts directly with Original Equipment Manufacturers (OEMs) such as Daimler, Volvo, and PACCAR, ensuring timely integration into vehicle assembly lines. Indirect distribution primarily focuses on the aftermarket segment, supplying replacement units and retrofitting kits through specialized commercial vehicle distributors and authorized service centers, though this segment is relatively smaller compared to OEM sales.

Downstream analysis focuses on the OEMs and the end-users (fleet owners, logistics companies, and public transport authorities). The efficiency of the service and maintenance networks—the critical last stage—significantly influences fleet purchasing decisions, as HCV downtime is extremely costly. Effective implementation of telematics and remote diagnostics, often leveraging the EPS ECU’s connectivity, helps streamline maintenance. The continuous feedback loop from end-users regarding durability, performance in varying terrains, and integration with telematics systems drives the iterative improvements in the design and manufacturing phases, making customer feedback a pivotal aspect of value retention and optimization throughout the chain.

Heavy Commercial Vehicle EPS Market Potential Customers

The primary customers and end-users of Heavy Commercial Vehicle EPS products are globally operating commercial vehicle manufacturers (OEMs) and large fleet management companies who purchase the systems either for new vehicle assembly or for modernization/replacement programs. These buyers are highly sophisticated, prioritizing reliability, total cost of ownership (TCO), and compliance with global safety standards (e.g., UNECE regulations, FMVSS). OEMs, being the immediate customers, demand customized solutions that seamlessly integrate with their specific chassis designs, advanced braking systems, and nascent autonomous driving platforms. Their purchasing criteria are heavily skewed towards suppliers offering high-torque capabilities and certified functional safety architectures (ISO 26262).

Fleet operators, particularly those involved in high-mileage, long-haul logistics or intensive urban transit, represent the ultimate demand source. These customers value the operational benefits derived from EPS, primarily the significant reduction in fuel consumption, which directly impacts their profit margins, and the improved driver comfort, which aids in driver retention—a critical challenge in the logistics industry. Furthermore, government agencies and municipalities purchasing bus fleets also represent a substantial customer segment, often driven by public policy mandates regarding urban emissions and passenger safety, thereby favoring modern vehicles equipped with advanced steering and ADAS components.

The growing trend of vehicle electrification in the commercial sector has introduced a new class of potential customers: electric truck and bus startups and established EV manufacturers. For these electric vehicles, the efficiency of EPS is non-negotiable, as it minimizes parasitic electrical load, directly extending range. These buyers seek suppliers who can deliver systems optimized for high voltage architectures and regenerative braking integration. Therefore, the customer base is diversifying, demanding not just a steering mechanism, but an integrated, energy-efficient control unit crucial for the vehicle's entire electronic infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.75 Billion |

| Market Forecast in 2033 | USD 6.78 Billion |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Robert Bosch GmbH, JTEKT Corporation, Nexteer Automotive, NSK Ltd., thyssenkrupp AG, Hitachi Astemo, Inc., Mitsubishi Electric Corporation, Hyundai Mobis, Schaeffler AG, Federal-Mogul LLC (Tenneco), BorgWarner Inc., Mando Corporation, Continental AG, BWI Group, Meritor, Inc., Knorr-Bremse AG, Infineon Technologies AG, Renesas Electronics Corporation, Magna International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Commercial Vehicle EPS Market Key Technology Landscape

The technological landscape of the Heavy Commercial Vehicle EPS market is rapidly evolving, driven primarily by the requirement for extremely high torque capacity, redundancy, and seamless interface with autonomous driving software stacks. The transition from 12V and 24V architectures to higher voltage systems (e.g., 48V or specialized high-voltage EV systems) is a key trend, necessary to handle the peak power demands of steering heavy axles. Steer-by-Wire (SbW) technology represents the forefront of innovation, completely eliminating the mechanical link between the steering wheel and the road wheels, which is essential for achieving higher levels of vehicle autonomy (L4/L5) and improving safety through digital control. SbW systems require sophisticated triple or quadruple redundancy in sensors, ECUs, and power supply to ensure functional safety, pushing the limits of current ASIL D certifications.

Another pivotal technology is the development of advanced motor and gearbox assemblies capable of operating reliably under continuous high-load cycles and harsh environmental conditions typical of heavy commercial use. This includes the use of high-efficiency permanent magnet synchronous motors (PMSM) paired with robust, low-backlash gear reduction systems. Thermal management is critical; innovations in motor cooling and housing design are crucial to prevent performance degradation during prolonged heavy maneuvering. Furthermore, the integration of advanced sensor fusion capabilities, combining data from torque sensors, steering position sensors, and vehicle dynamics sensors, allows the ECU to provide highly tailored and proactive assistance, enhancing stability control systems.

Software and connectivity represent the third major pillar of the technology landscape. The steering ECU must not only execute steering commands reliably but also serve as a node in the vehicle's high-speed communication network (e.g., CAN FD or Automotive Ethernet), facilitating over-the-air (OTA) software updates, remote diagnostics, and data logging for compliance and predictive maintenance. Specialized algorithms are deployed for complex functions like compensating for tire wear, road crown, and wind gusts, functionalities that leverage the inherent precision and speed of electrical control systems. Future advancements are expected to focus heavily on miniaturization of power electronics and further integration of AI-based decision-making within the ECU for enhanced safety and operational efficiency.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing market by volume, fueled by aggressive infrastructural development, large-scale fleet replacement cycles, and increasing domestic manufacturing capacity in countries like China, India, and Japan. Government initiatives pushing for greater vehicle safety standards and the rapid adoption of electric buses and trucks in urban centers are key growth catalysts. The market in this region often focuses on cost-competitive, reliable systems for medium to heavy-duty applications.

- North America: North America represents a high-value market segment, driven primarily by long-haul Class 8 trucks. The demand here is highly concentrated on incorporating advanced EPS systems that support Level 2+ ADAS features (e.g., Highway Pilot) and are future-proofed for autonomous platooning initiatives. Regulatory pressure for improved safety, combined with fleet focus on reducing driver fatigue on vast road networks, ensures premium system adoption.

- Europe: Europe is characterized by stringent environmental and safety regulations, including the widespread adoption of the General Safety Regulation (GSR), which mandates certain driver assistance technologies. This regulatory push forces high adoption rates of advanced EPS with integrated fail-safe redundancy. The region is a leader in technological innovation, particularly concerning steer-by-wire and high-efficiency systems tailored for the diverse European road and urban environments.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions are emerging markets showing steady growth, primarily driven by the modernization of aging commercial vehicle fleets and increased foreign investment in logistics infrastructure. Adoption is currently focused on reliable, durable EPS systems that offer basic safety and efficiency improvements over legacy hydraulic setups, often prioritizing robustness for challenging road conditions over advanced automation features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Commercial Vehicle EPS Market.- ZF Friedrichshafen AG

- Robert Bosch GmbH

- JTEKT Corporation

- Nexteer Automotive

- NSK Ltd.

- thyssenkrupp AG

- Hitachi Astemo, Inc.

- Mitsubishi Electric Corporation

- Hyundai Mobis

- Schaeffler AG

- Federal-Mogul LLC (Tenneco)

- BorgWarner Inc.

- Mando Corporation

- Continental AG

- BWI Group

- Meritor, Inc.

- Knorr-Bremse AG

- Infineon Technologies AG

- Renesas Electronics Corporation

- Magna International Inc.

Frequently Asked Questions

Analyze common user questions about the Heavy Commercial Vehicle EPS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of EPS over traditional hydraulic steering in heavy commercial vehicles?

The primary advantages include significant fuel efficiency gains due to the absence of a continuously running hydraulic pump, reduced maintenance complexity, superior packaging flexibility, and the necessary electronic interface required to support advanced driver assistance systems (ADAS) and autonomous driving features.

How does Steer-by-Wire (SbW) technology influence the future of HCV EPS systems?

Steer-by-Wire technology is foundational for Level 4 and Level 5 autonomous HCV operation as it removes the mechanical link, allowing for complex, redundant, and electronically precise steering control. It enhances safety through software-based fail-operational designs and enables customized steering feedback based on driving mode.

What are the main technical challenges in integrating EPS into high-capacity heavy-duty trucks?

Key challenges include developing systems capable of generating the extremely high torque required for heavy axle loads (often requiring higher voltage architectures), ensuring rigorous functional safety (ASIL D certification) and redundancy, and managing the thermal dissipation of high-power electric motors operating in strenuous commercial environments.

Which geographical region leads the global Heavy Commercial Vehicle EPS Market in terms of value and technological adoption?

While Asia Pacific leads in volume due to fleet size, North America and Europe typically lead in market value and technological adoption, driven by stringent regulatory mandates for safety, early adoption of autonomous technology, and a preference for high-end, redundant Steer-by-Wire systems for premium long-haul trucks.

How do EPS systems contribute to the electrification of commercial vehicle fleets?

EPS systems are critical for electric HCVs because they consume power only when steering assistance is needed, minimizing parasitic electrical load compared to continuously running electro-hydraulic systems. This efficiency directly extends the vehicle’s driving range and optimizes overall battery management and energy conservation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager