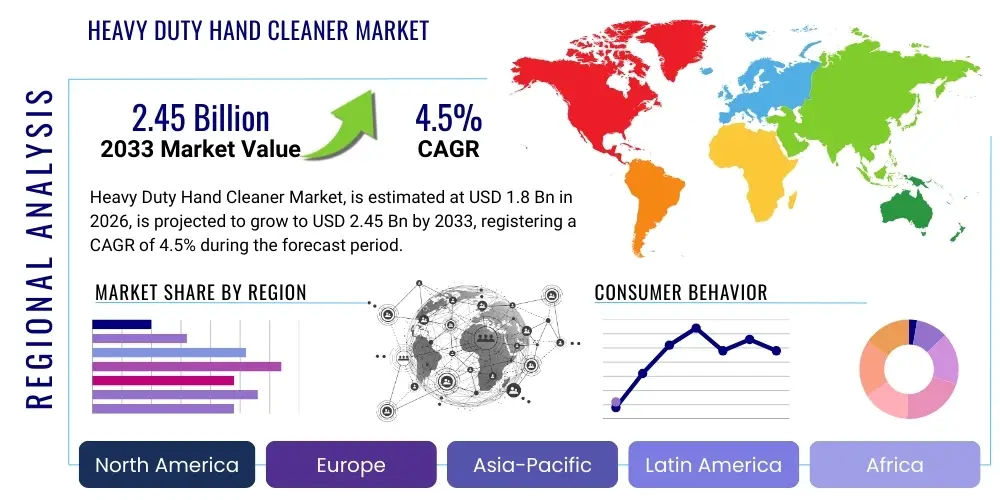

Heavy Duty Hand Cleaner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437327 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Heavy Duty Hand Cleaner Market Size

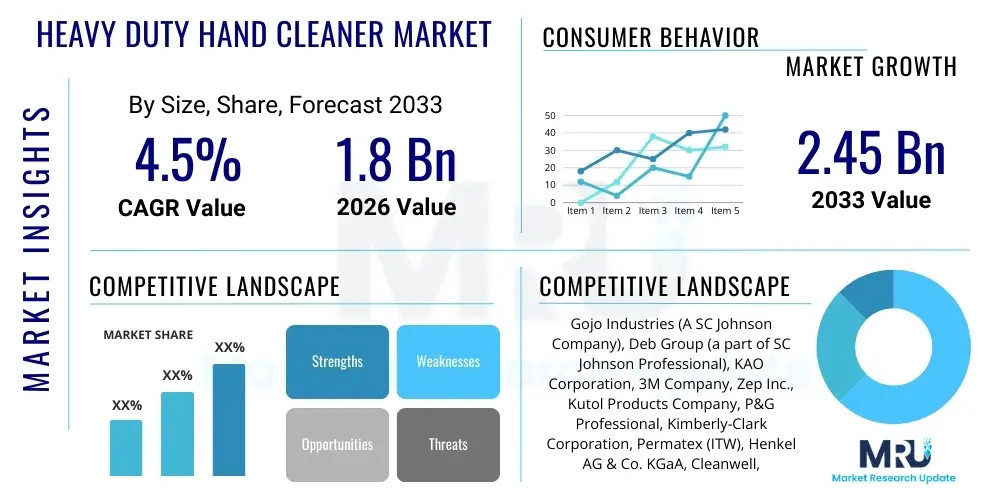

The Heavy Duty Hand Cleaner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $2.45 Billion by the end of the forecast period in 2033.

Heavy Duty Hand Cleaner Market introduction

The Heavy Duty Hand Cleaner Market encompasses specialized cleaning solutions designed to effectively remove stubborn industrial soils, such as grease, oil, paint, resins, and tar, which standard household soaps cannot address. These products are crucial for maintaining hygiene and preventing skin irritation in industrial, automotive, manufacturing, and construction settings where workers are routinely exposed to severe contaminants. The formulations often incorporate powerful solvents, surfactants, and abrasive agents like pumice, walnut shells, or polyethylene beads, balanced with skin conditioners and emollients to mitigate the harsh drying effects of strong cleaning agents. The necessity for these high-performance cleaners is driven directly by occupational safety regulations and the sheer volume of highly soiled hands in heavy industries globally.

Product differentiation within this market centers on efficacy, ingredient composition (e.g., solvent-based vs. solvent-free, bio-based ingredients), and dispensing methods. Modern heavy duty hand cleaners are increasingly focusing on sustainability and skin health, moving away from harsh petroleum-based solvents and non-biodegradable abrasives toward bio-based alternatives and natural exfoliation agents. Major applications span the repair and maintenance (MRO) sector, machinery manufacturing, shipbuilding, mining, and general fabrication. The primary benefit remains the swift and thorough removal of hazardous and deep-seated grime, significantly contributing to a safer and healthier working environment, thereby reducing the risk of dermatitis and associated lost workdays.

Key driving factors accelerating market expansion include stringent workplace hygiene standards mandated by regulatory bodies like OSHA, the rapid growth of the global automotive aftermarket, and increased industrial activity, particularly in developing economies across Asia Pacific. Furthermore, technological advancements leading to the development of highly effective, yet skin-friendly, formulations are expanding product acceptance, pushing industrial facilities to upgrade their hygiene protocols. The continuous influx of workers into heavy industrial sectors necessitates robust sanitation solutions, underpinning stable demand for specialized hand cleaners.

Heavy Duty Hand Cleaner Market Executive Summary

The Heavy Duty Hand Cleaner Market is poised for sustained growth, characterized by a fundamental shift towards environmentally responsible and safety-compliant formulations. Current business trends indicate a strong focus on innovation, particularly in the realm of solvent-free and bio-based cleaners that maintain cleaning efficacy while meeting consumer and regulatory demand for sustainability. The competitive landscape is intensely focused on vertical integration and optimized distribution channels to serve expansive industrial sectors efficiently. Companies are leveraging digital platforms to educate end-users on proper hygiene protocols and the benefits of advanced dispensing systems, driving recurring consumable sales. Strategic partnerships with major industrial suppliers and maintenance organizations are crucial for market penetration and sustaining long-term contracts.

Regionally, North America and Europe remain mature markets dominated by stringent health and safety regulations, fostering high demand for premium, compliant products. However, the Asia Pacific region is expected to exhibit the fastest growth, propelled by massive governmental investments in infrastructure, escalating industrialization, and the consequential expansion of automotive and manufacturing facilities, particularly in China and India. This rapid industrial expansion is creating immense demand for professional-grade cleaning solutions to protect a burgeoning workforce. Manufacturers are keenly establishing production and distribution hubs in APAC to capitalize on localized demand and competitive sourcing advantages.

Segment trends reveal a noticeable migration away from traditional solvent-based cleaners toward advanced waterless, solvent-free, and bio-based products due to health and environmental concerns. The demand for cleaners containing natural abrasives, such as walnut shell or cornmeal, is increasing significantly, displacing synthetic microplastics. Furthermore, the institutional segment (large scale industrial facilities and garages) continues to dominate market share based on volume, but the consumer/DIY segment is showing robust growth driven by the popularity of automotive maintenance hobbies and small repair shops. The preference for gel and liquid formulations, often packaged in controlled-dose dispensing systems, remains high due to their ease of use, waste reduction, and hygienic benefits.

AI Impact Analysis on Heavy Duty Hand Cleaner Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Heavy Duty Hand Cleaner Market typically revolve around optimizing operational efficiency, enhancing product formulation, and predicting industrial demand cycles. Key concerns include how AI can assist in customizing surfactant blends for highly specific industrial contaminants, the role of machine learning in optimizing supply chain logistics for high-volume industrial consumables, and whether AI-driven predictive maintenance scheduling in factories will alter the consumption patterns of specialized cleaning agents. Users are expecting AI to introduce precision manufacturing, leading to cleaners tailored not just for broad industrial categories, but for specific manufacturing waste streams (e.g., aerospace hydraulic fluids vs. automotive machining coolants), thereby enhancing efficacy and reducing environmental impact through precise chemical deployment.

The immediate practical impact of AI lies primarily in the operational and logistical spheres rather than direct product application. AI algorithms are being deployed to analyze real-time data from large industrial facilities concerning worker density, task types, contaminant exposure levels, and inventory depletion rates. This predictive analytics capability allows manufacturers and large distributors to accurately forecast demand fluctuations across diverse geographical zones, ensuring optimal inventory levels and minimizing stockouts, which are detrimental to compliance in industrial settings. Furthermore, generative AI tools are assisting R&D chemists by simulating the performance of novel ingredient combinations, accelerating the discovery of non-toxic, highly effective cleaning agents, particularly in the challenging domain of bio-based substitutes for established petrochemical solvents.

In the long term, the influence of AI will extend to quality control and personalized usage recommendations. Computer vision and sensor technology, combined with AI processing, can monitor hand hygiene compliance rates in automated industrial wash stations, ensuring workers use the correct heavy-duty product post-task, thereby enforcing safety protocols automatically. This integration of smart dispensing systems with centralized data analytics provides facility managers with comprehensive reports on consumption trends, usage effectiveness, and opportunities for cost reduction through optimized product selection, marking a significant advancement over traditional, reactive procurement methods prevalent in the maintenance sector.

- AI-driven Predictive Maintenance: Optimizes product inventory based on forecasted industrial activity and maintenance schedules.

- Generative Chemistry: Accelerates R&D for novel, bio-based surfactant and solvent replacements in formulations.

- Supply Chain Optimization: Machine learning algorithms enhance routing and stock management for high-volume industrial consumables.

- Quality Control Enhancement: AI vision systems monitor the consistency and stability of manufactured batches.

- Smart Dispensing Systems: AI analytics integrate with smart dispensers to track consumption and compliance in real-time.

DRO & Impact Forces Of Heavy Duty Hand Cleaner Market

The Heavy Duty Hand Cleaner Market is significantly shaped by a powerful interplay of regulatory mandates, consumer demands for environmental responsibility, and ongoing industrial expansion, encapsulated by distinct Drivers, Restraints, and Opportunities (DRO). Primary drivers include stringent occupational safety and health regulations worldwide, particularly those relating to the prevention of occupational skin diseases like contact dermatitis, which necessitate the use of specialized cleansing products after handling hazardous materials. The global acceleration of manufacturing and construction activities, coupled with sustained growth in the automotive repair and maintenance (MRO) sector, ensures a consistently high volume of hands requiring heavy-duty cleaning. These positive market forces are amplified by the increasing awareness among employers about the direct costs associated with workplace injuries and inadequate hygiene, pushing voluntary adoption of high-quality products.

Conversely, the market faces considerable restraints, primarily stemming from environmental concerns and the complexity of formulation chemistry. Traditional, highly effective heavy-duty cleaners often contain volatile organic compounds (VOCs) and petrochemical solvents, which are increasingly restricted by environmental agencies such as the EPA and REACH. The resulting move toward eco-friendly formulations presents a technical challenge, as maintaining powerful cleaning efficacy without traditional solvents can increase production costs and potentially reduce performance, thereby acting as a short-term constraint on widespread adoption. Furthermore, the sheer volume of product consumed annually results in a substantial waste stream, demanding innovation in packaging and refill mechanisms to mitigate environmental impact, alongside managing the fluctuating costs of raw materials like natural abrasives and specialized surfactants.

Opportunities for growth are concentrated in sustainable innovation and geographical expansion. The most compelling opportunities lie in the commercialization of fully biodegradable, high-performance solvent-free, and waterless formulations that meet both industrial performance requirements and stringent green certifications. The development of advanced, ergonomically designed dispensing systems that promote portion control and reduce cross-contamination represents a crucial segment for investment. Geographically, untapped potential exists in rapidly industrializing regions of Southeast Asia, Africa, and Latin America, where basic industrial hygiene standards are catching up to global benchmarks. These regions offer large, growing industrial workforces that are prime targets for initial adoption of structured hand cleaning protocols and specialized products, providing long-term market sustainability beyond mature economies.

Segmentation Analysis

The Heavy Duty Hand Cleaner Market is comprehensively segmented based on its core components, target user base, and methods of distribution. Understanding these segments provides critical insights into purchasing behaviors, product development focus, and strategic market entry points. Segmentation by formulation type is crucial, dividing the market into solvent-based, solvent-free, waterless, and bio-based products, reflecting the industry's evolution towards safer and greener alternatives. The end-use application segmentation identifies major demand clusters, primarily dominated by the automotive and manufacturing sectors, but also recognizing emerging opportunities in mining, aerospace, and utilities. Finally, distribution channels, including retail/DIY and institutional/direct industrial supply, determine how products reach their diverse user base.

The solvent-free segment is forecast to experience the fastest growth, largely driven by regulatory pressure and heightened awareness regarding the potential health hazards associated with prolonged solvent exposure. These newer formulations often utilize advanced surfactants, natural oils (like citrus extracts), and specialized polymers to achieve high cleaning power without the drying effects of traditional solvents. Within the end-use market, the automotive repair segment, encompassing independent garages, dealership service centers, and specialized body shops, remains the largest consumer, primarily due to the ubiquitous presence of petroleum-based contaminants and routine maintenance tasks requiring frequent heavy cleaning cycles. This segment prioritizes fast-acting, high-volume products.

- By Formulation:

- Solvent-Based Cleaners

- Solvent-Free Cleaners

- Waterless Cleaners

- Bio-Based Cleaners

- By Abrasion Type:

- Pumice

- Natural Abrasives (e.g., Walnut Shells, Cornmeal)

- Polyethylene Beads (Declining due to bans)

- Micro-Abrasive Technology

- By End-Use Application:

- Automotive Repair and Maintenance (MRO)

- Manufacturing and Heavy Industry

- Construction and Infrastructure

- Mining and Utilities

- Aerospace and Defense

- Printing and Graphics

- By Distribution Channel:

- Institutional/Direct Sales (Industrial Suppliers)

- Retail/DIY Stores

- Online E-commerce Platforms

- By Product Form:

- Gels and Liquids

- Foams

- Wipes

- Bar Soaps

Value Chain Analysis For Heavy Duty Hand Cleaner Market

The value chain for the Heavy Duty Hand Cleaner Market begins with the upstream sourcing of crucial raw materials, which include specialized surfactants, synthetic and natural solvents (or solvent alternatives), abrasive particles (such as pumice, ground walnut shells, or specialized polymers), and various conditioning agents like lanolin and glycerin. Sourcing reliability and cost management in the upstream segment are highly critical, especially for bio-based ingredients where supply can be volatile or subject to agricultural yield variations. Manufacturers must maintain strong relationships with global chemical suppliers and increasingly, specialized botanical extract providers to ensure a steady influx of high-quality components necessary for both traditional and green formulations. Furthermore, the regulatory status of key ingredients, such as certain solvents or microplastics, significantly dictates sourcing strategies and R&D investment decisions, necessitating constant vigilance regarding global chemical inventories and hazard classifications.

The midstream phase involves the manufacturing, blending, and packaging processes. This is where proprietary intellectual property, concerning the optimal mixture ratios and processing techniques to achieve maximum efficacy and stability, is most pronounced. Production facilities must adhere to strict quality control standards, particularly regarding pH levels, viscosity, and microbial load, to ensure product safety and compliance with dermatological standards. Packaging is also a vital manufacturing consideration, moving toward large, robust containers designed for industrial use, coupled with specialized, durable dispensing systems that minimize waste and prevent contamination. Investment in automated blending machinery and high-speed filling lines allows major market players to achieve economies of scale necessary for competitive pricing in high-volume industrial contracts.

The downstream distribution network is bifurcated between institutional and retail channels. Direct distribution (institutional sales) involves supplying products directly to large industrial end-users, maintenance organizations, and Original Equipment Manufacturers (OEMs) through specialized industrial suppliers and distributors. This channel demands customized logistics, bulk packaging, and often involves long-term service contracts that include maintenance of the dispensing equipment. Indirect distribution primarily focuses on the retail channel, serving the DIY, small shop, and consumer segment via physical stores (auto parts stores, hardware chains) and rapidly expanding e-commerce platforms. The success of the downstream phase relies heavily on efficient warehousing, logistics capable of handling large and heavy shipments, and effective brand education to ensure end-users understand the necessity and proper application of specialized heavy-duty products over generic soaps.

Heavy Duty Hand Cleaner Market Potential Customers

The primary customers for Heavy Duty Hand Cleaners are professionals and workers engaged in environments where hands are exposed to contaminants that are insoluble or highly resistant to standard cleansing agents. The largest segment of potential customers resides within the Maintenance, Repair, and Overhaul (MRO) sector, particularly automotive and heavy machinery repair facilities, where mechanics, technicians, and maintenance staff routinely handle thick oil, grease, brake fluid, and specialized lubricants. These industrial end-users prioritize high cleaning power, speed, and packaging convenience, often requiring bulk containers and wall-mounted dispensing systems for easy access across multiple workstations within a large facility. The institutional nature of these buyers means procurement decisions are often driven by safety compliance officers and facility managers focused on cost-in-use and regulatory adherence.

Another significant customer base is the heavy manufacturing and fabrication industries, including metalworking, chemical processing plants, and equipment assembly lines. Workers in these settings deal with solvents, paints, adhesives, resins, and metallic dust. Here, potential customers value products that not only clean effectively but also contain high levels of skin conditioners to counteract the drying and irritating effects of continuous exposure to harsh chemicals. This customer group often requires specialized cleaners targeted at specific contaminants, such as those formulated to remove polyurethane foams or hardened epoxy, differentiating their needs from the general grease removal requirements of the automotive sector. The size and complexity of these operations necessitate comprehensive hygiene solutions, often integrated into facility-wide safety programs.

The third major potential customer segment includes construction sites, utilities (such as power generation and telecommunications infrastructure repair), and printing shops. These customers often require portable or waterless solutions, such as heavy-duty hand cleaning wipes or waterless gel formulations, due to limited access to traditional washing facilities in field environments. While smaller in individual volume compared to large manufacturing plants, the sheer number of distributed units in this segment makes them highly valuable. The retail and DIY consumers also represent a growing segment, including hobbyist mechanics, home renovators, and small independent contractors who purchase smaller, more accessible packaging sizes through automotive parts stores and general retail outlets, driven by brand recognition and perceived product efficacy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $2.45 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gojo Industries (A SC Johnson Company), Deb Group (a part of SC Johnson Professional), KAO Corporation, 3M Company, Zep Inc., Kutol Products Company, P&G Professional, Kimberly-Clark Corporation, Permatex (ITW), Henkel AG & Co. KGaA, Cleanwell, Fast Orange (CRC Industries), Stoko (Evonik Industries), Safetec of America, Stockhausen (a Evonik Company), Swarfega (Deb Group), Mirius, Virox Technologies, Inc., Stepan Company, and Schaeffer Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Duty Hand Cleaner Market Key Technology Landscape

The technological landscape of the Heavy Duty Hand Cleaner Market is currently undergoing a significant transformation driven by the simultaneous demands for enhanced cleaning efficacy and greater environmental responsibility. A primary area of innovation focuses on the reformulation of products to replace traditional petroleum-based solvents with high-performance, non-VOC, bio-based alternatives, often derived from renewable resources like citrus extracts or specialized seed oils. This necessitates advanced surfactant chemistry, utilizing optimized micellar structures that can effectively encapsulate and lift hydrophobic industrial soils (such as heavy grease and cured resins) without requiring harsh chemical solvency. Research and development efforts are centered on achieving a perfect balance: maximum industrial cleaning power coupled with a mild, dermatologically tested formulation that preserves the skin’s natural barrier function, addressing a critical pain point for industrial workers.

Another crucial technological development involves abrasive materials. The widespread regulatory restrictions on polyethylene microbeads have spurred intense innovation in naturally derived, high-performance exfoliating agents. Leading manufacturers are deploying proprietary grinding and processing technologies to refine natural materials such as walnut shell powder, cornmeal, and mineral pumice to ensure consistent particle size, optimal texture, and effective scrubbing action without causing micro-abrasions to the skin. Furthermore, micro-abrasive technologies, which utilize ultra-fine, highly uniform mineral particles, are being integrated into gel formulations to enhance mechanical cleaning action while minimizing environmental impact and ensuring compatibility with drain systems. Packaging technology is also evolving, with new bag-in-box and cartridge systems designed to maximize hygiene, reduce product waste through controlled dosing mechanisms, and integrate smart tracking features.

Finally, the proliferation of specialized hand cleaning wipes represents a key portable technology designed for use where water access is limited, such as construction sites or field service vehicles. These wipes employ specialized saturated fiber substrates and high-efficacy, waterless cleaning formulations that emulsify heavy soils upon contact. Automation in dispensing is also gaining traction; smart dispensers equipped with sensors and networking capabilities provide usage data to facility managers, enabling predictive restocking and compliance monitoring. The convergence of superior, sustainable formulation chemistry with advanced, waste-reducing dispensing hardware defines the current technological trajectory, aiming to elevate industrial hygiene standards through integrated, smart solutions rather than simply standalone chemical products.

Regional Highlights

- North America (NA): Characterized by stringent Occupational Safety and Health Administration (OSHA) regulations and high awareness regarding dermatitis prevention, North America represents a mature, high-value market. The region, particularly the United States, is dominated by large-scale manufacturing, a robust automotive aftermarket, and significant expenditure on compliant industrial consumables. Growth is driven by the adoption of premium, specialized solvent-free products and integrated dispensing systems.

- Europe: This region is highly influenced by the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulations and strong environmental mandates concerning VOCs and ingredient biodegradability. The market focus is heavily skewed toward sustainable, bio-based formulations and closed-loop dispensing systems. Countries like Germany and the UK, with their large industrial bases, are key revenue contributors, prioritizing skin health and eco-certification.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive industrial expansion, rapid urbanization, and rising industrial safety standards in economies like China, India, and Southeast Asian nations. Although price sensitivity remains a factor, the increasing presence of multinational manufacturing firms is driving the adoption of global hygiene benchmarks, leading to robust demand for high-volume, professional-grade cleaners across the automotive and construction sectors.

- Latin America (LATAM): Growth in LATAM is moderate but steady, concentrated in resource extraction (mining) and developing automotive manufacturing clusters (Mexico, Brazil). The market exhibits a mix of basic and advanced products, with increasing interest in affordable, effective heavy-duty solutions as local regulatory frameworks gradually strengthen.

- Middle East & Africa (MEA): Demand is primarily centered around the region's prominent oil & gas, petrochemical, and large infrastructure projects. Specific challenges include adapting formulations for extreme climate conditions and ensuring product stability. Growth potential is significant but concentrated in high-capital industrial zones, with purchasing decisions heavily influenced by global safety specifications mandated by multinational energy companies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Duty Hand Cleaner Market.- Gojo Industries (A SC Johnson Company)

- Deb Group (a part of SC Johnson Professional)

- KAO Corporation

- 3M Company

- Zep Inc.

- Kutol Products Company

- P&G Professional

- Kimberly-Clark Corporation

- Permatex (ITW)

- Henkel AG & Co. KGaA

- Cleanwell

- Fast Orange (CRC Industries)

- Stoko (Evonik Industries)

- Safetec of America

- Stockhausen (a Evonik Company)

- Swarfega (Deb Group)

- Mirius

- Virox Technologies, Inc.

- Stepan Company

- Schaeffer Manufacturing

Frequently Asked Questions

Analyze common user questions about the Heavy Duty Hand Cleaner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Heavy Duty Hand Cleaner Market?

The market is predominantly driven by increasing stringency in occupational health and safety regulations, particularly those aimed at preventing contact dermatitis in industrial settings. Furthermore, continuous expansion in the global automotive maintenance (MRO) and manufacturing sectors creates constant, high-volume demand for specialized industrial cleaning agents.

How is the shift towards sustainable formulations impacting the industry?

The shift is profoundly impacting R&D, leading manufacturers to replace traditional petroleum-based solvents and non-biodegradable abrasives (like polyethylene beads) with advanced bio-based, solvent-free alternatives. This trend meets rising consumer and regulatory demand for eco-friendly products without compromising cleaning performance.

Which product segment is expected to experience the fastest growth rate?

The Solvent-Free and Bio-Based formulation segments are projected to record the highest growth rates, primarily due to heightened health concerns regarding volatile organic compounds (VOCs) and mandatory compliance with environmental protection standards across North America and Europe.

What role does the automotive industry play in the Heavy Duty Hand Cleaner Market?

The Automotive Repair and Maintenance (MRO) sector is the largest single end-use segment. Mechanics and technicians routinely encounter heavy grease, oil, and petroleum derivatives, making the rapid and effective removal of these specific contaminants essential and driving continuous bulk demand for specialized heavy-duty products.

How are advancements in dispensing technology affecting industrial purchasing decisions?

Advanced dispensing technologies, such as controlled-dose systems and touchless dispensers, are highly valued by industrial buyers. These systems reduce product waste, ensure hygienic application, prevent cross-contamination, and often integrate data tracking capabilities, contributing directly to lower long-term operational costs and improved safety compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager