Heavy Duty Telehandler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438656 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Heavy Duty Telehandler Market Size

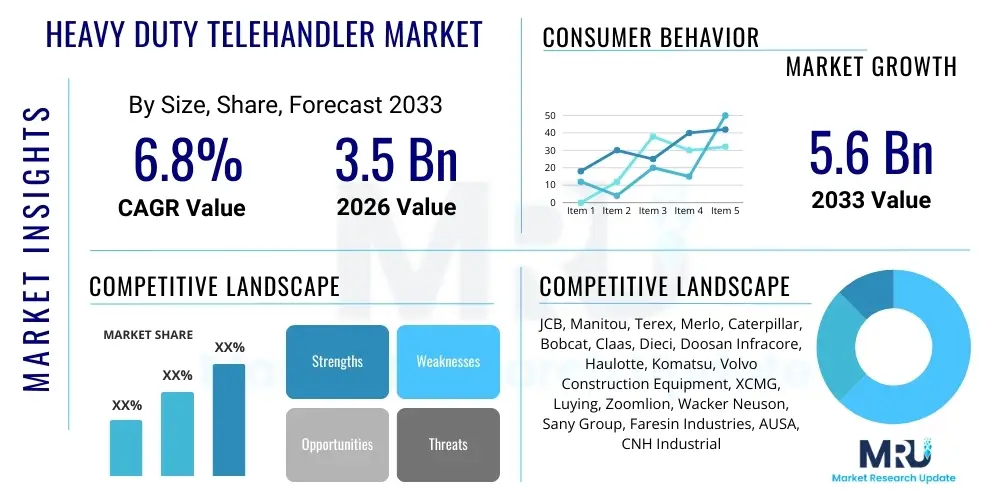

The Heavy Duty Telehandler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing global infrastructure expenditure, especially in emerging economies, alongside the continuous demand for high-capacity, versatile material handling equipment in complex industrial and construction environments. The focus on efficiency and safety in logistics operations further underscores the necessity for advanced heavy-duty telehandlers capable of managing extreme loads and heights.

Heavy Duty Telehandler Market introduction

The Heavy Duty Telehandler Market encompasses specialized industrial machinery designed for lifting, moving, and placing heavy loads, distinguished by its high lifting capacity—typically exceeding 10 tons—and significant reach capabilities. These machines combine the functionality of a conventional forklift with that of a crane, featuring a telescopic boom that can extend forward and upward, making them indispensable in challenging operational settings such as large-scale civil engineering projects, deep mining operations, and expansive port logistics. The primary product differentiation in this segment relates to maximum lifting capacity, operational efficiency in adverse conditions, and integration of sophisticated stability and safety systems mandated by stringent regulatory bodies globally. Furthermore, the inherent versatility of the heavy-duty telehandler, facilitated by a wide array of interchangeable attachments including buckets, forks, winches, and jibs, allows for seamless transition between tasks, thus optimizing equipment utilization rates across various sectors.

Major applications of heavy-duty telehandlers span construction, where they manage structural steel, pre-cast concrete elements, and large equipment rigging; logistics and port management, handling massive containers and bulk materials; and mining and quarrying, moving heavy components and supporting infrastructure development within rugged terrains. The market is benefiting significantly from the global drive toward urbanization and substantial government investments in road, rail, and energy infrastructure, particularly in the Asia Pacific region, which necessitates powerful, robust lifting solutions. The inherent benefits of these machines include enhanced site safety due to superior stability systems, increased operational flexibility compared to fixed cranes, and reduced labor costs through multi-functional capabilities. The technological evolution towards hybrid and electric powertrains, coupled with advanced telematics for real-time monitoring and predictive maintenance, further solidifies their position as essential assets in modern heavy industries.

Key driving factors accelerating market expansion include stringent worker safety regulations compelling businesses to adopt mechanized handling solutions, the increasing average weight and size of construction components necessitating higher lift capacities, and the growing demand for rental equipment models which lowers upfront capital expenditure for end-users. Economic recovery in developed markets, alongside massive infrastructure build-out initiatives in developing nations, provides a substantial demand base. Moreover, continuous innovation by manufacturers focused on improving fuel efficiency, integrating semi-autonomous operation modes, and enhancing cabin ergonomics to reduce operator fatigue and increase productivity is pivotal to maintaining market momentum. The shift towards sustainable operational practices is also influencing design, with manufacturers investing heavily in developing cleaner, quieter, and more environmentally friendly heavy-duty models that comply with evolving global emission standards, thereby future-proofing their product lines and catering to environmentally conscious clients.

Heavy Duty Telehandler Market Executive Summary

The Heavy Duty Telehandler Market is characterized by robust business trends centered on technological integration, fleet optimization, and strategic expansion into high-growth geographical areas. Key manufacturers are focusing their R&D efforts on enhancing machine intelligence through sophisticated telematics, enabling remote diagnostics, geo-fencing, and performance analytics, which significantly improves fleet management for large rental companies and end-users alike. A notable trend involves the development and commercialization of machines compliant with Stage V and Tier 4 Final emission standards, pushing the market towards more sustainable, yet powerful, diesel and alternative fuel options, including hydrogen fuel cells being explored for ultra-heavy models. Competitive dynamics suggest strategic mergers and acquisitions among top-tier players to consolidate market share and leverage specialized regional distribution networks, particularly in niche segments like specialized container handling or extreme-altitude construction. Furthermore, the rental sector is playing an increasingly dominant role, providing flexibility and capital efficiency to construction and industrial firms, leading manufacturers to tailor product specifications and service agreements toward rental fleet requirements, emphasizing durability and ease of maintenance.

Regionally, the market exhibits divergent growth patterns. North America and Europe, characterized by established infrastructure and high labor costs, drive demand for highly automated, premium, and environmentally compliant telehandlers, emphasizing safety and operational sophistication. Conversely, the Asia Pacific (APAC) region, spearheaded by massive infrastructure projects in China, India, and Southeast Asian nations, represents the highest volume growth potential, focusing on robustness, affordability, and sheer lifting capacity. Latin America and the Middle East and Africa (MEA) are emerging as significant growth frontiers, driven by burgeoning oil and gas projects, mining activities, and rapid urbanization, which necessitate specialized, rugged equipment capable of operating in extreme temperatures and remote locations. Regulatory harmonization and trade agreements are facilitating cross-border sales, but manufacturers must still navigate complex local certification and maintenance requirements tailored to specific regional operational standards and climate conditions.

Segmentation trends highlight the increasing specialization within the Heavy Duty Telehandler segment. In terms of capacity, the 15-20 Ton segment is experiencing accelerated adoption due to its versatility in handling mid-to-large civil engineering components, offering an optimal balance between payload and machine maneuverability. Application-wise, the logistics and port management segment is showing exceptional growth, driven by the expansion of global container traffic and the need for efficient stacking and loading operations at major global hubs. The agricultural segment, while traditionally utilizing lighter telehandlers, is now showing interest in heavier variants for handling high-volume silage, large equipment changes, and infrastructure tasks on mega-farms. Manufacturers are responding by offering modular designs that allow end-users to upgrade components, tailoring the machine’s capabilities over its lifecycle, thereby maximizing return on investment and addressing the diverse needs of the global heavy industry clientele who require machines capable of enduring continuous high-load cycles and harsh environments while maintaining precision and operator control.

AI Impact Analysis on Heavy Duty Telehandler Market

User inquiries regarding AI's impact on the Heavy Duty Telehandler Market predominantly revolve around three critical areas: enhancing machine safety through predictive failure analysis, implementing semi-autonomous or fully autonomous operation capabilities to counter skilled labor shortages, and optimizing operational efficiency via advanced real-time data processing. Users are particularly concerned with how AI can mitigate safety risks associated with lifting heavy, unstable loads at extreme heights, focusing on intelligent load sensing and stability control systems that utilize machine learning algorithms to predict and correct potentially hazardous movements faster than human reaction time. Furthermore, the expectation is high for AI-driven maintenance programs that analyze sensor data across thousands of operational parameters (engine health, hydraulic pressure, boom stress) to schedule proactive maintenance, thereby reducing catastrophic breakdowns and maximizing machine uptime, which is crucial for high-capital equipment. This summarization highlights a dual focus: leveraging AI for operational perfection (efficiency and uptime) and significantly improving the inherently high-risk nature of heavy lifting operations.

- AI-Powered Predictive Maintenance: Utilizing deep learning models on telematics data to forecast component failure (e.g., hydraulic leaks, engine anomalies) long before they occur, drastically reducing unscheduled downtime and optimizing inventory management for spare parts.

- Intelligent Load Stabilization: Employing machine vision and AI algorithms to constantly monitor the stability triangle, load moment indicator, and ground conditions, automatically adjusting boom movements and limiting lift envelopes in real time to prevent rollovers or structural damage.

- Semi-Autonomous Operation: Implementing AI for repetitive, high-precision tasks such as container stacking or long-distance material transport on large sites, reducing operator fatigue and increasing task consistency, while retaining human oversight for complex maneuvers.

- Optimized Fleet Management: Using AI to process fleet utilization data, routing optimization, and resource allocation across multiple job sites, leading to improved overall project efficiency and lower fuel consumption per operational hour.

- Enhanced Operator Assistance Systems: Incorporating AI-driven systems for advanced proximity sensing, collision avoidance, and automated calibration checks, significantly improving safety in congested work environments and during operations near overhead lines or complex structures.

- Digital Twin Modeling: Creating high-fidelity virtual replicas of telehandlers and their operating environments, allowing for simulated testing of new operational scenarios, operator training, and AI system refinement before deployment in the field, ensuring robustness and reliability under diverse conditions.

DRO & Impact Forces Of Heavy Duty Telehandler Market

The dynamics of the Heavy Duty Telehandler Market are shaped by a confluence of strong market drivers, persistent infrastructural restraints, significant opportunities arising from technological evolution, and powerful impact forces that influence strategic decision-making. The primary driver is the accelerating pace of global infrastructure development, especially in sectors such as high-speed rail, renewable energy facility construction (wind and solar farms), and massive port expansion projects, all requiring reliable, high-reach, high-capacity material handling. Simultaneously, stringent international safety regulations, particularly in North America and Europe, push construction and industrial firms toward certified, technologically advanced machinery that offers superior load management and stability control systems, making heavy-duty telehandlers a preferred choice over traditional cranes or industrial forklifts for certain tasks. The shift towards mechanized lifting solutions globally, driven by rising labor costs and the necessity for faster project completion times, further reinforces market demand, compelling continuous investment in fleet expansion and modernization by rental companies.

Restraints hindering the market growth include the exceptionally high initial capital investment required for purchasing heavy-duty models, which can be prohibitive for smaller construction firms or operators in less developed regions, although this is partially mitigated by the growth of the equipment rental market. Another significant restraint is the operational complexity and the scarcity of highly trained operators and maintenance technicians capable of handling sophisticated machinery integrated with advanced hydraulics and electronic control units; this knowledge gap poses safety risks and impacts machine uptime. Furthermore, the market faces cyclical demand fluctuations tied directly to global economic health and governmental capital expenditure on infrastructure, making long-term forecasting challenging. Regulatory hurdles pertaining to emissions (e.g., EU Stage V, US Tier 4 Final) impose substantial R&D costs on manufacturers, which are eventually passed on to the consumer, potentially impacting price sensitivity and slowing adoption rates in cost-conscious markets, thereby requiring delicate balance in product pricing strategies.

Significant opportunities lie in the rapid adoption of alternative power sources, specifically hybrid and all-electric heavy-duty telehandlers, driven by green construction mandates and urban area zero-emission targets, opening lucrative avenues for manufacturers specializing in electrification. The integration of advanced Industry 4.0 technologies, including IoT, sophisticated telematics, and AI-driven automation, presents massive opportunities for market differentiation based on offering enhanced fleet management, predictive maintenance, and optimized fuel consumption solutions, adding significant value beyond basic lifting capabilities. Impact forces compelling manufacturers and buyers include rapidly evolving material science that allows for lighter yet stronger boom construction, extending reach without compromising stability, and shifting demographic trends resulting in labor shortages, accelerating the transition towards autonomous or remote-controlled heavy equipment operations. These forces mandate continuous innovation, service optimization, and strategic partnerships with technology providers to maintain a competitive edge and address the dynamic operational requirements of modern heavy industries globally.

Segmentation Analysis

The segmentation analysis of the Heavy Duty Telehandler Market provides a granular view of market dynamics based on key technical specifications and end-user applications, allowing stakeholders to identify niche growth areas and tailored product strategies. Primary segmentation involves classifying telehandlers based on their maximum lifting capacity, which directly correlates with the scale and type of construction or industrial project they can undertake. This capacity-based segmentation (10-15 Tons, 15-20 Tons, Above 20 Tons) is crucial as regulatory standards and operator certifications often align with these classifications, directly influencing market penetration in different geographical zones. Furthermore, the market is dissected by application, encompassing the diverse range of industries reliant on these powerful machines, including the highly cyclical construction sector, the consistently demanding logistics and port operations, the rugged environment of mining and quarrying, and specialized industrial handling tasks. Understanding these segments is paramount for manufacturers to allocate R&D resources efficiently and for investors to assess potential returns based on global infrastructure spending forecasts and commodity price trends, which heavily influence the mining and construction segments' performance and equipment purchasing patterns.

The segmentation by lifting capacity reveals distinct operational preferences. The 10-15 Ton segment often serves high-density urban construction and large-scale agricultural operations, requiring maneuverability coupled with substantial power. The 15-20 Ton capacity segment is highly prevalent in infrastructure projects, managing pre-cast concrete beams and heavy piping, representing a sweet spot for versatility and power, and consequently, often dominating market volume. The Above 20 Tons segment caters specifically to heavy industrial installation, specialized rigging, major port container handling (especially empty container stacking in dedicated terminals), and deep pit mining operations where sheer capacity and exceptional reach are non-negotiable prerequisites. This specialization drives pricing and technological complexity, with the highest capacity machines incorporating advanced stabilization technologies and robust structural engineering to manage extreme load moments safely, justifying their premium positioning in the market and ensuring adherence to stringent international safety standards governing ultra-heavy lifting.

Application-based segmentation is critical for targeted marketing and service provision. The Construction segment remains the largest consumer, driven by continuous global urbanization and civil engineering investments. However, the Logistics & Port Management segment is poised for the fastest growth, propelled by the relentless expansion of global trade and the necessity for high-speed, safe container handling solutions in major global hubs, demanding telehandlers with highly specialized reach and quick cycle times. The Mining & Quarrying application requires machines built for extreme durability, robust chassis, and enhanced filtration systems to cope with abrasive dust and severe temperature variations. Lastly, the Industrial Handling segment includes manufacturing facilities, heavy equipment yards, and utility maintenance, often necessitating custom attachments and precise movement controls within confined spaces. Analyzing these distinct end-user requirements allows manufacturers to customize telehandler features—such as enhanced dust protection for mining or specialized tire configurations for port use—to maximize their machine’s effectiveness and operational lifespan across varied demanding environments, enhancing the overall value proposition.

- By Lifting Capacity:

- 10 Tons to 15 Tons

- 15 Tons to 20 Tons

- Above 20 Tons

- By Application:

- Construction

- Logistics & Port Management

- Mining & Quarrying

- Agriculture

- Industrial Handling

- By Drive Type:

- Diesel

- Hybrid/Electric

- By Operating Height:

- Up to 15 Meters

- 15 Meters to 20 Meters

- Above 20 Meters

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket & Rental Fleet

Value Chain Analysis For Heavy Duty Telehandler Market

The value chain for the Heavy Duty Telehandler Market is characterized by a high degree of integration between specialized component suppliers and major OEMs, followed by complex distribution and robust aftermarket services. Upstream activities involve the sourcing of high-grade raw materials, particularly specialized steels for the telescopic boom and chassis, hydraulic components (pumps, cylinders, valves), high-performance engines (often procured from specialized industrial engine manufacturers like Cummins or Deutz), and advanced electronic control units (ECUs). The profitability and competitive advantage at the upstream level depend heavily on managing global supply chain volatility, ensuring quality control for critical structural components that bear immense stress, and leveraging economies of scale in component purchasing. Component specialization is a key feature; for instance, hydraulic systems must be meticulously engineered for precise, smooth high-pressure operation under varying load conditions, demanding deep technical collaboration between suppliers and the final machine assemblers to meet stringent performance and safety benchmarks.

The manufacturing stage, dominated by major global OEMs, involves sophisticated assembly, welding of structural elements, integration of complex hydraulic and electronic systems, and rigorous quality assurance testing, especially concerning load bearing and stability certification required by international bodies such as ISO and relevant national agencies. Distribution channels are multifaceted, including direct sales for large institutional buyers (like major construction or mining corporations), specialized dealer networks offering localized sales and support, and increasingly, large global equipment rental companies which act as massive indirect buyers, influencing demand trends and maintenance requirements. The direct channel allows for tailored customization and stronger customer relationships, while the indirect dealer/rental channels provide broader market reach and quicker deployment of machines, critical for project-based demand. Effective channel management requires OEMs to provide extensive technical training and parts supply logistics to ensure rapid service response times, which is a major differentiator in the heavy equipment sector where downtime equates to significant financial losses for the end-user.

Downstream activities focus heavily on the aftermarket services, which often represent a major revenue stream and competitive battleground. This includes the supply of genuine spare parts, provision of preventative and corrective maintenance, servicing of complex electronic and telematics systems, and refurbishing or trading used equipment. The life cycle management of a heavy-duty telehandler—which can span 15 to 20 years in operation—necessitates a long-term commitment to servicing, predictive maintenance facilitated by telematics data, and periodic safety re-certification. Direct channels maintain control over this crucial service relationship, ensuring brand loyalty and maximizing parts sales margins. Indirect distribution channels rely on authorized service centers and dealers, who must maintain certified technicians and inventory. The growing trend of equipment rental further emphasizes the role of fleet maintenance and remarketing services, ensuring high residual values and continuous operational readiness for a diverse customer base, solidifying the aftermarket service's position as a primary value driver in the heavy-duty segment.

Heavy Duty Telehandler Market Potential Customers

Potential customers for the Heavy Duty Telehandler Market primarily comprise large entities engaged in capital-intensive projects requiring the safe and efficient movement of exceptionally heavy materials across challenging terrains or significant heights. The dominant buyer segment is large-scale infrastructure and civil engineering contractors who are responsible for building bridges, high-rise commercial and residential structures, industrial parks, and critical national infrastructure projects such as dams and power plants. These customers prioritize machines offering maximum lift capacity, extensive outreach, compliance with strict safety standards, and integration with advanced telematics for site management and operational monitoring. Their purchasing decisions are often guided by fleet standardization, total cost of ownership (TCO), and the ability of the manufacturer or dealer to provide rapid, reliable on-site service support to minimize project delays. Furthermore, specialized rigging and heavy lift companies, acting as subcontractors, constitute another critical customer base, requiring highly adaptable machines for precision placement of specialized equipment.

Another rapidly expanding segment of potential customers includes operators within the logistics, shipping, and port management industries. These buyers, encompassing major container terminal operators, logistics hubs, and intermodal transport centers, utilize heavy-duty telehandlers for high-speed, high-volume container handling, bulk material loading, and equipment maintenance within the terminal environment. Their requirements emphasize rapid cycle times, high maneuverability within confined port spaces, exceptional durability against corrosive environments, and specialized attachments for container stacking and maneuvering. The demand in this sector is intrinsically linked to global trade volumes and the continuous expansion and modernization of global shipping infrastructure, making them stable, long-term buyers focused on equipment uptime and fuel efficiency metrics relevant to continuous 24/7 operations and stringent environmental regulations governing port emissions.

Finally, major players in the energy, mining, and quarrying sectors represent highly valuable potential customers. Mining companies utilize heavy-duty telehandlers for handling massive tire and engine components during maintenance of ultra-class haul trucks, assisting with infrastructure erection in remote mining sites, and managing material stockpiles. Renewable energy construction, particularly the erection and maintenance of large wind turbines and solar farms, mandates the use of these powerful machines for precise lifting and placement of multi-ton components at significant heights, often under highly variable weather and ground conditions. These customers are characterized by their demand for extremely rugged, reliable machinery capable of enduring harsh, isolated operating conditions, often requiring bespoke cold-weather packages or enhanced dust protection systems, making the equipment's robustness, resilience, and remote diagnostic capabilities key purchasing criteria and a significant differentiating factor for OEMs targeting these demanding, high-value segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JCB, Manitou, Terex, Merlo, Caterpillar, Bobcat, Claas, Dieci, Doosan Infracore, Haulotte, Komatsu, Volvo Construction Equipment, XCMG, Luying, Zoomlion, Wacker Neuson, Sany Group, Faresin Industries, AUSA, CNH Industrial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Duty Telehandler Market Key Technology Landscape

The technological landscape of the Heavy Duty Telehandler Market is rapidly evolving, driven primarily by demands for enhanced safety, improved fuel efficiency, and greater integration into digital construction ecosystems. The core technological advancement revolves around sophisticated load management and stability control systems. Modern heavy-duty telehandlers incorporate complex sensor arrays (load cells, inclination sensors, pressure transducers) that feed real-time data into an advanced Electronic Control Unit (ECU). This system constantly calculates the load moment, boom extension, and machine stability angle, utilizing dynamic load charts to prevent overloading or instability events, often automatically intervening to limit dangerous movements. Furthermore, advanced hydraulic systems now feature regenerative capabilities, recovering energy during boom lowering, which substantially enhances fuel efficiency and reduces heat generation, crucial for sustained heavy lifting operations. The integration of CAN bus architecture facilitates seamless communication between engine, transmission, hydraulic, and safety systems, optimizing performance across diverse operational profiles, while electro-hydraulic proportional control valves ensure extremely precise movements and feathering of controls, essential for placing multi-ton components accurately at extreme reach.

Telematics and IoT integration represent another cornerstone of the modern heavy-duty telehandler technology landscape. All major OEMs now offer standard telematics packages that transmit operational data—including GPS location, engine hours, fuel consumption, fault codes, and utilization metrics—to a cloud-based platform. This connectivity facilitates predictive maintenance regimes, allowing rental companies and fleet managers to monitor machine health remotely and schedule service proactively, significantly reducing unplanned downtime, which is a massive operational cost in the heavy equipment sector. Geo-fencing capabilities and remote diagnostics tools are also standard features, enhancing security against theft and allowing technicians to troubleshoot complex issues without physically being on site. Furthermore, operator assistance systems utilizing augmented reality (AR) are beginning to be integrated, overlaying crucial stability or operational information onto the operator's view, improving situational awareness and safety, especially during complex blind lifts or operations near hazardous zones.

Sustainability and powertrain innovation are critical technological frontiers. While high torque demands necessitate powerful diesel engines, manufacturers are heavily investing in developing hybrid and electric variants to meet stringent emission regulations and address the demand for zero-emission equipment in urban and indoor environments. Hybrid models typically pair a smaller diesel engine with electric motors and high-capacity battery packs, capturing braking energy and providing an electric boost during peak demand, enhancing efficiency. All-electric heavy-duty telehandlers, though challenging due to battery weight and required power output for continuous heavy lifting, are being introduced for specialized applications like port and large logistics warehouse use, requiring robust thermal management systems for the battery packs. Beyond power, structural technologies, including the use of high-tensile, lightweight steel alloys, enable the construction of longer, stronger booms without increasing the base machine's weight excessively, thereby maintaining or enhancing stability while pushing the boundaries of maximum lift height and reach capabilities, ensuring that the latest generation of heavy-duty telehandlers can address the increasing structural demands of modern engineering projects efficiently and safely.

Regional Highlights

The market dynamics for Heavy Duty Telehandlers vary significantly across major global regions, influenced by localized infrastructure spending, regulatory environments, and the maturity of the equipment rental market. North America and Europe represent mature markets characterized by high labor costs, stringent safety and emission standards (e.g., EU Stage V, EPA Tier 4 Final), and a high reliance on rental fleets. Demand in these regions is focused on premium, technologically advanced machines featuring telematics, AI-driven safety systems, and, increasingly, hybrid or electric powertrains to comply with urban low-emission zones. The replacement cycle of aging fleets and continuous investment in complex infrastructure repair and upgrades drive consistent, stable demand, with a high willingness among buyers to invest in features that enhance productivity and operator comfort, positioning these regions as leaders in technological adoption and setting global benchmarks for operational excellence and environmental compliance.

The Asia Pacific (APAC) region stands out as the primary engine of global market growth, driven by unprecedented levels of government and private investment in massive infrastructure projects, including high-speed rail networks, new port development, and rapid urbanization across nations like China, India, and Southeast Asia. The demand here is volume-driven, with a primary focus on cost-effectiveness, high durability, and sheer lifting capacity (especially in the Above 20 Tons segment for major construction and mining projects). While price sensitivity is higher compared to Western markets, there is a rapidly emerging segment demanding higher technology integration, particularly in sophisticated port logistics and specialized construction projects in countries like Japan and South Korea. Local manufacturers in APAC are rapidly closing the technological gap with Western competitors, often offering customized solutions tailored to specific regional operational requirements and harsh climate conditions, leveraging scale for competitive advantage.

Latin America and the Middle East and Africa (MEA) constitute burgeoning markets exhibiting high volatility but significant long-term growth potential. In MEA, demand is fueled by large-scale oil and gas infrastructure expansion, significant real estate developments (e.g., in the UAE and Saudi Arabia), and mining activities in sub-Saharan Africa. These regions require extremely robust machines designed to withstand high temperatures, dust, and often poor road infrastructure. Latin America's market growth is tied closely to commodity prices influencing the mining and agricultural sectors, driving demand for heavy-duty machinery. Challenges in these regions include complex import regulations, infrastructure limitations for servicing remote sites, and a greater reliance on imported technology. However, urbanization and government focus on diversification beyond resource extraction are creating substantial opportunities for telehandler deployment in new commercial and residential construction sectors, provided that reliable aftermarket service and parts availability can be consistently guaranteed by the OEMs.

- North America: Focus on premium, high-efficiency, highly regulated machines; strong rental market dominance; high adoption of telematics and safety technology.

- Europe: Driven by Stage V emission mandates; strong demand for electric/hybrid models in urban environments; maturity in specialized agricultural and construction applications.

- Asia Pacific (APAC): Highest volume growth; concentrated demand in the 15-20 Ton and Above 20 Ton segments; major driver is large-scale national infrastructure and port expansion projects in China and India.

- Middle East and Africa (MEA): Growth linked to oil/gas and mega-real estate projects; demand for machines optimized for extreme temperature and dust resistance; developing aftermarket support networks are crucial.

- Latin America: Demand fluctuating with commodity prices; strong use in mining, quarrying, and large agricultural infrastructure; market requires rugged and versatile equipment configurations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Duty Telehandler Market.- JCB

- Manitou

- Terex

- Merlo

- Caterpillar

- Bobcat

- Claas

- Dieci

- Doosan Infracore

- Haulotte

- Komatsu

- Volvo Construction Equipment

- XCMG

- Luying

- Zoomlion

- Wacker Neuson

- Sany Group

- Faresin Industries

- AUSA

- CNH Industrial

Frequently Asked Questions

Analyze common user questions about the Heavy Duty Telehandler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a standard telehandler and a heavy-duty telehandler?

Heavy-duty telehandlers are explicitly engineered for superior lifting capacity, typically exceeding 10 tons, and greater operational reach and height, making them suitable for large-scale construction, port operations, and mining, whereas standard telehandlers generally handle loads under 5-7 tons for light to mid-sized tasks.

How is regulatory compliance, specifically related to emissions, impacting the adoption of new telehandler technology?

Strict global emission standards, such as EU Stage V and US Tier 4 Final, mandate that new heavy-duty telehandlers integrate sophisticated exhaust after-treatment systems or adopt hybrid/electric powertrains. This regulatory push is driving technological innovation and increasing the total cost of ownership (TCO) but ensures cleaner, more efficient operation across construction sites and urban environments.

Which application segment is expected to drive the highest growth in the heavy-duty telehandler market?

The Logistics and Port Management segment is projected to exhibit the fastest growth, fueled by the continuous expansion of global container shipping and the need for high-speed, high-capacity equipment for efficient container stacking, loading, and maintenance activities at major global maritime hubs.

What role does telematics play in the operational efficiency of heavy-duty telehandlers?

Telematics provides real-time data on location, utilization, fuel consumption, and machine health, enabling AI-driven predictive maintenance, theft prevention (via geo-fencing), and optimized fleet management. This significantly reduces unscheduled downtime and maximizes return on investment for high-capital heavy equipment.

Are electric heavy-duty telehandlers currently a viable alternative to diesel models?

Electric heavy-duty telehandlers are increasingly viable for specialized applications in confined spaces, large warehouses, and highly regulated urban/port areas where zero emissions are mandatory. While battery technology poses challenges for continuous, ultra-heavy operations compared to traditional diesel power, continuous advancements are rapidly expanding their operational scope and market penetration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager