Heavy Duty Truck and Bus Seat Damper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437073 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Heavy Duty Truck and Bus Seat Damper Market Size

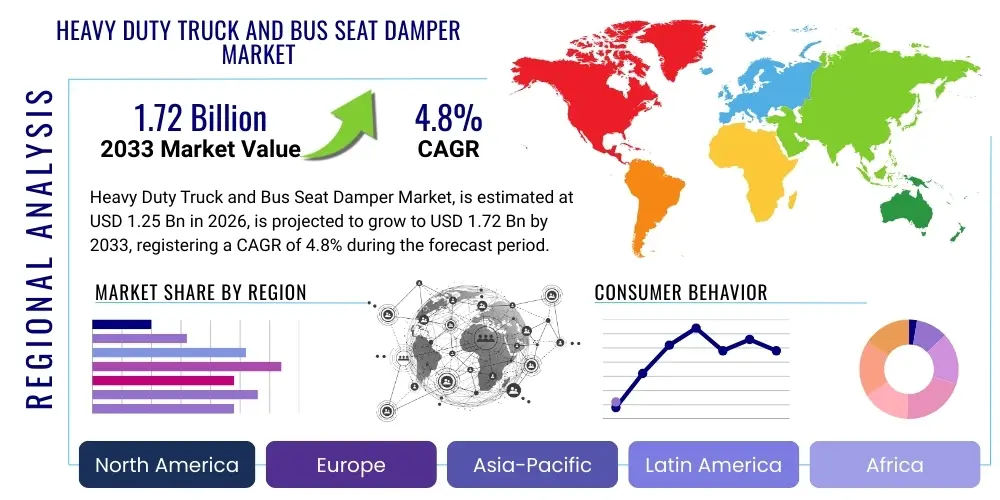

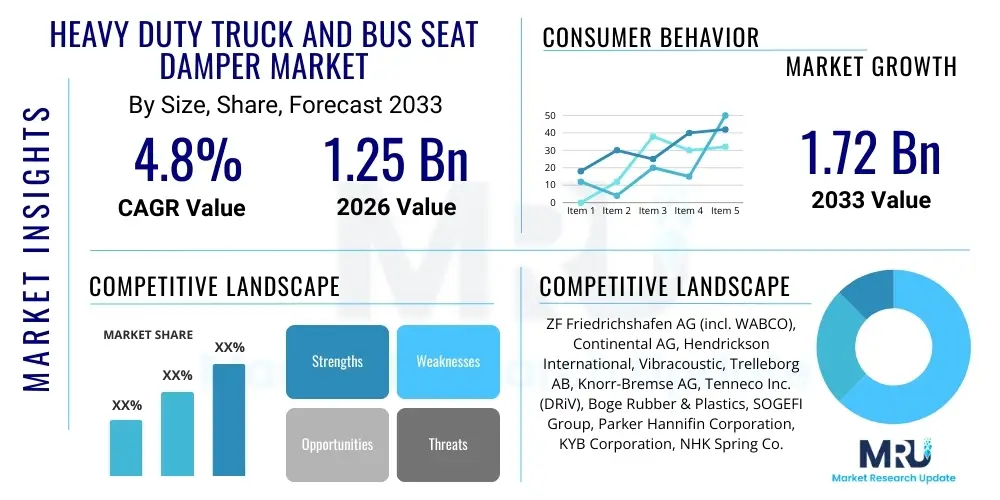

The Heavy Duty Truck and Bus Seat Damper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 1.72 billion by the end of the forecast period in 2033.

Heavy Duty Truck and Bus Seat Damper Market introduction

The Heavy Duty Truck and Bus Seat Damper Market encompasses the production, distribution, and utilization of hydraulic or pneumatic damping systems specifically designed for seating applications in commercial vehicles, including long-haul trucks, city buses, coaches, and specialized heavy machinery. These damping systems, often integrated into suspension seats, are crucial components that mitigate vibrations and shocks transmitted from the vehicle chassis to the driver or passenger. The primary function is to enhance ride comfort, reduce driver fatigue, and improve long-term occupational health, which is increasingly regulated by governmental bodies globally, especially concerning whole-body vibration exposure. Modern seat dampers incorporate advanced technologies such as semi-active control and electronic dampening adjustments to respond dynamically to varying road conditions and load weights, ensuring optimal suspension performance across diverse operating environments. The focus on driver retention and well-being in the logistics and public transit sectors serves as a fundamental catalyst for market expansion, pushing OEMs and aftermarket providers toward higher-quality, more durable, and technologically sophisticated solutions.

Product descriptions typically involve passive hydraulic dampers, adjustable hydraulic dampers, and increasingly, electronically controlled semi-active dampers. Major applications are concentrated in Class 8 trucks (North America), heavy-duty rigid and articulated trucks (Europe/APAC), and urban and intercity buses. The benefits derived from these advanced components are manifold: they significantly reduce the transmissibility of low-frequency vibrations, thereby lowering the risk of musculoskeletal disorders and enhancing concentration levels for safer operation. Driving factors for market growth include stringent safety regulations mandating lower vibration exposure, the continuous expansion of global trade requiring extensive long-haul trucking, the replacement cycle of aging commercial vehicle fleets in developed economies, and rising consumer demand for premium seating solutions in passenger transport buses and coaches. Moreover, the integration of telematics and health monitoring systems within the cabin environment further elevates the necessity for superior damping technologies.

The core objective of heavy-duty seat damper manufacturers is to develop solutions that offer unparalleled durability against constant, high-stress use while providing granular control over suspension characteristics. Key innovations center around reducing weight, improving packaging efficiency, and ensuring compatibility with ergonomic seat designs. The sustained growth in emerging economies, particularly in Asia Pacific, driven by infrastructure investment and rapid urbanization, is creating massive demand for new commercial vehicles, consequently fueling the market for essential safety and comfort components like high-performance seat dampers. The competitive landscape is characterized by a mix of specialized suspension component manufacturers and large tier-one automotive suppliers that leverage global manufacturing footprints to serve major truck and bus original equipment manufacturers (OEMs).

Heavy Duty Truck and Bus Seat Damper Market Executive Summary

The Heavy Duty Truck and Bus Seat Damper Market exhibits robust growth, primarily propelled by global regulatory pressure to mitigate driver health risks associated with whole-body vibration (WBV) and the ongoing technological migration towards smart, adjustable suspension systems. Business trends indicate a heightened focus on modular seat suspension platforms that can be customized for various cabin sizes and operational requirements, shifting investment toward mechatronic integration, where mechanical dampers are complemented by electronic control units (ECUs) for real-time damping adjustments. Key players are also prioritizing lightweight materials, such as aluminum alloys and reinforced polymers, to reduce overall seat mass, contributing to vehicle fuel efficiency goals. Furthermore, the aftermarket segment remains critical, driven by fleet owners seeking cost-effective upgrades to older vehicles to meet enhanced safety standards and improve driver comfort, impacting fleet retention rates positively. Strategic collaborations between damper manufacturers and major seat suppliers are defining the competitive approach to secure long-term OEM contracts for next- generation commercial vehicle platforms.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily due to soaring commercial vehicle production volumes in China and India, coupled with rapid modernization of their logistics infrastructure, which demands vehicles capable of covering long distances under heavy load. North America and Europe, while mature, demonstrate high-value growth, characterized by the swift adoption of advanced active and semi-active suspension seat technologies, driven by stricter labor laws and a highly competitive environment for professional drivers. European markets show a strong inclination toward premium pneumatic and hydraulic damping solutions that meet strict EU standards for driver ergonomics (e.g., EU Directive 2002/44/EC). Conversely, Latin America and MEA are focused on durable, cost-effective hydraulic dampers, although modernization efforts are gradually introducing more sophisticated systems, especially in the premium coach and long-haul truck segments.

Segment trends confirm that Hydraulic Dampers maintain market dominance based on volume due to their proven reliability and low cost of maintenance, especially in entry-level and medium-duty applications. However, the fastest growth is observed in the Semi-Active/Adaptive Damper segment, categorized by technology. By application, the Long-Haul Truck segment commands the largest revenue share, reflecting the continuous need for high-performance seating solutions in vehicles that spend thousands of hours annually on the road, where driver fatigue mitigation is paramount for operational safety. The shift toward electrification in the bus sector is also influencing damper design, requiring solutions that minimize noise and vibration characteristics specific to electric powertrain architectures. This executive overview underscores a market moving towards smart components that integrate seamlessly with advanced vehicle dynamics and telematics systems, emphasizing human factors engineering as a central design criterion.

AI Impact Analysis on Heavy Duty Truck and Bus Seat Damper Market

User queries regarding AI's influence on the seat damper market frequently revolve around predictive maintenance capabilities, the optimization of damping algorithms, and the integration of seating systems into autonomous driving platforms. Common questions include: "How will AI enable predictive failure detection for seat dampers?", "Can machine learning algorithms dynamically adjust seat suspension better than current semi-active systems?", and "What role do intelligent dampers play in ensuring driver alertness during partial automation?" The analysis reveals a clear user expectation that AI should transition the market from reactive components to proactive, adaptive ergonomic systems. Users anticipate that AI-driven analysis of driver biometrics (fatigue, posture) combined with real-time road profile data will lead to highly personalized and optimized damping characteristics, significantly exceeding the performance of current systems. Furthermore, there is strong interest in how AI can optimize the manufacturing process itself, enhancing quality control and reducing variance in damper performance, ensuring consistency across large production batches critical for global commercial vehicle OEMs.

The primary thrust of AI integration in the heavy-duty seat damper market lies in enhancing the responsiveness and intelligence of semi-active and active suspension seats. By utilizing machine learning models trained on vast datasets encompassing road roughness indices, vehicle speed, load distribution, and driver anthropometric data, AI systems can instantly calculate and execute the precise damping force required to neutralize incoming vibrations. This level of predictive control minimizes the lag inherent in purely reactive systems, offering unparalleled comfort and significantly reducing the cumulative impact of whole-body vibration. Moreover, AI algorithms are being employed in diagnostics; by analyzing the performance signature of the damper actuator or valve, the system can predict component degradation, allowing fleet managers to schedule maintenance proactively before total failure occurs, thereby maximizing vehicle uptime and reducing unplanned repair costs—a substantial factor for heavy-duty fleet operations.

The future application of AI extends beyond simple vibration control into creating holistic cabin comfort systems. Integrating data from internal cabin sensors, external cameras, and vehicle motion sensors, AI can manage the entire seating environment, including posture support, microclimate control, and, critically, personalized damping. For autonomous or partially autonomous trucks, intelligent dampers will play a vital safety role by ensuring the driver remains comfortable yet alert. If the AI detects signs of excessive fatigue or poor posture (inferred from force sensors in the seat base), it can subtly adjust the seat’s dynamic behavior to encourage slight movement or re-establish optimal ergonomic alignment. This integration transforms the seat damper from a mechanical component into a sophisticated node within the vehicle's overall cognitive architecture, positioning driver health and safety as a dynamically managed parameter rather than a static design constraint.

- AI-driven Predictive Maintenance: Enabling real-time fault detection and prediction of damper failure, maximizing vehicle operational lifespan.

- Adaptive Damping Algorithms: Machine learning models optimize damping characteristics instantaneously based on road conditions, speed, and load profiles.

- Ergonomics and Alertness Monitoring: AI integration monitors driver fatigue and posture via seat sensors, subtly adjusting suspension stiffness for enhanced safety.

- Personalized Vibration Mitigation: Customizing damping profiles based on individual driver weight, height, and preference history.

- Manufacturing Quality Control: Using computer vision and deep learning to inspect damper components for microscopic defects, ensuring zero-defect quality standards.

- Integration with Vehicle Dynamics: Allowing seat suspension to interact synergistically with vehicle chassis control systems (e.g., stability control) for optimized overall ride quality.

DRO & Impact Forces Of Heavy Duty Truck and Bus Seat Damper Market

The dynamics of the Heavy Duty Truck and Bus Seat Damper Market are shaped by a powerful confluence of drivers, restraints, and opportunities (DRO), which collectively form the impact forces dictating industry trajectory. The primary driver is the pervasive focus on occupational safety and driver well-being, codified through increasingly stringent regional and international regulations governing permissible levels of whole-body vibration exposure (e.g., ISO 2631, EU directives). This regulatory environment forces mandatory adoption of effective damping solutions, especially in long-haul segments where drivers spend extended periods behind the wheel. Concurrent technological advancements, specifically in electronic control units (ECUs) and sensor technology, enable the development of high-performance semi-active and active seat suspensions that offer superior vibration isolation compared to conventional passive systems. Furthermore, the global expansion of logistics fleets, particularly in emerging markets demanding robust infrastructure and transport, provides a sustained volume driver for basic and advanced damper units.

However, the market faces significant restraints, notably the high initial cost associated with premium, electronically controlled seat damper systems. While OEMs are adopting these systems in top-tier models, the cost sensitivity of volume-based commercial vehicle markets, especially in cost-competitive regions like Southeast Asia, often favors cheaper, traditional passive hydraulic units. Another key restraint is the complexity associated with maintaining and repairing advanced mechatronic systems; specialized diagnostic tools and technician training are required, which can increase the total cost of ownership (TCO) for fleet operators, making them hesitant to upgrade. The long life cycles of commercial vehicles mean that the replacement rate, while stable, can sometimes be slower than the innovation curve, creating market saturation challenges in specific mature segments.

Opportunities in this sector are vast, driven by the shift towards electrification and autonomous driving. Electric trucks and buses inherently reduce ambient noise, making vibration and road noise more noticeable, thus demanding superior acoustic and vibration damping solutions. The rise of connectivity in commercial vehicles (IoT and telematics) creates a platform for intelligent damping systems to integrate and optimize performance remotely. Furthermore, diversification into specialized off-highway vehicles (construction, mining, agriculture) presents a lucrative niche opportunity where extreme operating conditions necessitate highly rugged and customized damper solutions that can handle significantly higher load fluctuations and severe shocks. These impact forces—ranging from regulatory mandates to technological convergence—are compelling manufacturers to invest heavily in R&D focusing on durability, intelligence, and lightweight design, ensuring the market's long-term upward trajectory.

Segmentation Analysis

The Heavy Duty Truck and Bus Seat Damper Market is segmented based on product type, technology, application (vehicle type), and distribution channel, providing a granular view of market dynamics and targeted opportunities. Product Type segmentation primarily categorizes dampers based on their physical mechanism, typically Hydraulic (most common), Pneumatic (often integrated into air suspension seats), and Mechanical (spring-based assistance). The Technology segmentation is highly influential, distinguishing between Passive Dampers (fixed rate), Semi-Active Dampers (electronically controlled stiffness/damping based on external inputs), and Active Dampers (utilizing external energy sources for maximum isolation, though less common in mass-produced commercial seats due to complexity). The underlying rationale for this detailed segmentation is to allow suppliers to align their product offerings precisely with the differing demands for comfort, cost-effectiveness, and regulatory compliance across the global commercial vehicle landscape, from basic municipal buses to advanced luxury coaches and premium long-haul trucks.

Analyzing segmentation by Application reveals that the Long-Haul Truck segment consistently generates the highest revenue due to the intense focus on mitigating driver fatigue over extended journeys, justifying the investment in high-end, semi-active systems. The City Bus and Coach segments are also significant, driven by high passenger comfort expectations in coaches and durability requirements in high-cycle, stop-start urban buses. By Distribution Channel, the OEM segment dominates revenue, as seat dampers are integral safety components specified during vehicle design and assembly. However, the Aftermarket segment, consisting of replacement parts and upgrade kits, is crucial for market stability, providing steady demand driven by maintenance cycles and fleet modernization programs. The evolving technological complexity is driving greater standardization in OEM components but is simultaneously creating highly specialized service requirements in the aftermarket, particularly for diagnostic and recalibration services related to electronic damping systems.

The segmentation data highlights a clear trend of premiumization: while volume sales are anchored in standard hydraulic dampers for price-sensitive applications, the value growth is concentrated in the technologically advanced semi-active segment. Geographically, segmentation informs strategic resource allocation; manufacturers target APAC for volume growth of basic and hydraulic units, while focusing R&D and premium sales efforts on North America and Europe, where regulatory incentives and competitive advantage prioritize active vibration control. Understanding these segmented demands is essential for market penetration, enabling companies to develop specific product portfolios, such as heavy-duty, robust hydraulic units for mining trucks (Specialty Vehicles) or finely tuned, electronically controlled dampers for premium intercity coaches, optimizing both cost structure and performance characteristics for each niche.

- By Product Type:

- Hydraulic Dampers

- Pneumatic Dampers

- Mechanical Dampers (Auxiliary)

- By Technology:

- Passive Dampers

- Semi-Active/Adaptive Dampers

- Active Dampers

- By Application (Vehicle Type):

- Heavy Duty Trucks (Long-Haul, Construction, Regional Haul)

- Buses and Coaches (City Bus, Intercity Coach, School Bus)

- Specialty Vehicles (Mining Trucks, Fire Trucks, Utility Vehicles)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and Upgrades)

Value Chain Analysis For Heavy Duty Truck and Bus Seat Damper Market

The Value Chain for the Heavy Duty Truck and Bus Seat Damper Market begins with upstream activities focused on raw material sourcing and component manufacturing, proceeding through core manufacturing and assembly, and concluding with downstream processes involving distribution, sales, and post-sales support. Upstream analysis highlights the procurement of critical materials such as specialized steel alloys for piston rods and cylinder tubes, high-grade hydraulic fluids, elastomeric seals (crucial for durability), and advanced plastics and electronics for semi-active units. Key suppliers include specialized metal processors, chemical companies providing hydraulic fluids, and electronic component manufacturers (sensors, microprocessors) for advanced systems. The challenge upstream is managing the volatility of steel prices and ensuring the consistent quality of materials that must withstand harsh operating temperatures and extreme duty cycles typical of heavy-duty commercial vehicles. Manufacturers must maintain robust relationships with a diversified supplier base to mitigate supply chain disruptions, ensuring high-tolerance component specifications are met consistently.

The midstream focuses on the core manufacturing and assembly processes. Damper manufacturers undertake precision machining, welding, assembly of valve systems, and final charging with hydraulic or pneumatic media. Quality control is paramount here, involving stringent testing for damping characteristics, leakage, and fatigue resistance. After manufacturing, the products move to downstream channels. The distribution channel is bifurcated into direct sales to OEMs and indirect sales via the aftermarket. Direct distribution involves long-term contracts with major truck and bus manufacturers (e.g., Daimler Truck, Volvo Group, PACCAR), often requiring Just-In-Time (JIT) delivery and highly customized product specifications tailored to specific vehicle platforms. These relationships are sticky and capital-intensive, requiring extensive engineering support and validation.

Indirect distribution targets the aftermarket, utilizing a network of authorized distributors, independent wholesalers, and fleet service centers. This channel is crucial for replacement revenue and requires robust inventory management and technical support documentation. The downstream analysis also includes specialized service providers and installers who handle complex installations, especially for integrated seat suspension assemblies. The competitive advantage in the downstream segment is achieved through superior customer service, comprehensive warranty programs, and readily available technical training for maintenance personnel. The shift towards electronically controlled dampers means that the downstream value addition increasingly includes software updates, diagnostics, and electronic component replacement, shifting the focus beyond pure mechanical repair to mechatronic service excellence. Optimization of the value chain is focused on lean manufacturing practices to absorb raw material cost fluctuations and utilizing digital tools to enhance visibility across the entire chain, from sourcing specialized fluids to final delivery to a regional distribution center serving the aftermarket.

Heavy Duty Truck and Bus Seat Damper Market Potential Customers

The primary potential customers and end-users of Heavy Duty Truck and Bus Seat Dampers are segmented into three major categories: Original Equipment Manufacturers (OEMs), large commercial Fleet Operators, and Independent Aftermarket Buyers/Service Garages. OEMs, including global giants such as Volvo, Daimler Truck, PACCAR, MAN, Scania, and major bus manufacturers like BYD and King Long, represent the largest and most critical customer base. These customers require massive volumes of standardized, high-quality dampers, often integrated into proprietary seat suspension systems. OEM procurement decisions are driven by stringent criteria including performance validation, price competitiveness, global supply chain capability, and the manufacturer's ability to co-develop next-generation semi-active systems. Securing an OEM contract typically involves intense technical collaboration and long-term commitment, focusing on weight optimization and seamless electronic integration into the vehicle’s CAN bus system for advanced models.

The second substantial customer group comprises large commercial Fleet Operators, including national and international logistics companies (e.g., FedEx, UPS, Schneider), regional haulers, and major public transit agencies (bus operators). While many fleet operators purchase new vehicles directly from OEMs, they also constitute the major clientele for the aftermarket. These customers prioritize Total Cost of Ownership (TCO), meaning they seek durable, reliable replacement parts that minimize vehicle downtime. Fleet managers are increasingly educated on the long-term cost benefits of superior ergonomic seating, recognizing that reduced driver fatigue translates directly into higher productivity and lower accident rates. Their procurement decisions for replacement parts are heavily influenced by parts availability, ease of installation, and proven longevity under high-mileage conditions, often favoring OEM-equivalent or specified high-performance aftermarket brands.

The final customer category includes independent service garages, parts wholesalers, and smaller trucking companies, which collectively form the broad base of the independent aftermarket. These buyers typically focus on immediate needs, competitive pricing, and broad application coverage. For this segment, damper manufacturers must ensure wide retail distribution and strong brand recognition. The growing market for specialized vehicles, such as heavy construction equipment, mining trucks, and agricultural tractors, also represents a specialized, high-demand customer base requiring bespoke, ultra-durable damper solutions capable of handling extreme environmental stress and shock loading far exceeding standard road applications. Addressing these varied customer needs requires tailored sales strategies, ranging from highly technical, engineering-focused consultations for OEMs to value-based marketing and expansive distribution networks for the aftermarket.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 billion |

| Market Forecast in 2033 | USD 1.72 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG (incl. WABCO), Continental AG, Hendrickson International, Vibracoustic, Trelleborg AB, Knorr-Bremse AG, Tenneco Inc. (DRiV), Boge Rubber & Plastics, SOGEFI Group, Parker Hannifin Corporation, KYB Corporation, NHK Spring Co., Ltd., Grammer AG, Commercial Vehicle Group (CVG), Airo Shock Absorbers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Duty Truck and Bus Seat Damper Market Key Technology Landscape

The technology landscape of the Heavy Duty Truck and Bus Seat Damper Market is rapidly evolving from basic passive hydraulic components to sophisticated, sensor-driven mechatronic systems. Passive hydraulic dampers, utilizing oil flow through fixed orifices, remain the foundational technology, valued for their robustness, simplicity, and low manufacturing cost, dominating the entry-level and high-volume segments. However, the performance limitations of passive systems in handling the wide spectrum of road inputs encountered by heavy-duty vehicles, especially during long-haul trips across varied terrain, are driving innovation. The current R&D focus is squarely on enhancing the capabilities of semi-active and adaptive systems, which utilize electronic sensors (measuring velocity, acceleration, and position) and electronically controlled valves (like Magneto-Rheological or solenoid valves) to modify damping force characteristics in real time, optimizing ride quality instantly based on detected road conditions and vehicle dynamics. These technologies require integration with the vehicle's electronic control architecture, utilizing CAN communication protocols to receive data inputs and execute control commands.

A key technological advancement involves the miniaturization and increased reliability of sophisticated valve systems, allowing for faster response times and more granular control over the damping curve. Manufacturers are also heavily investing in new materials science, focusing on low-friction seals and advanced hydraulic fluids that maintain stable viscosity across extreme temperature ranges, significantly extending the service life of the damper unit and reducing maintenance requirements—critical factors for fleet operators. Pneumatic damping technology, prevalent in air suspension seats, continues to see improvements in air spring design and integration with hydraulic components, creating hybrid systems that leverage the high load-bearing capacity of air with the precise energy dissipation of hydraulics. Furthermore, digitalization is enabling "smart" components; dampers are increasingly equipped with internal sensors that collect operational data, facilitating remote diagnostics and contributing to AI-driven predictive maintenance models, thereby transitioning the damper into a connected device within the vehicle's Internet of Things (IoT) ecosystem.

Looking forward, the development of fully Active Damper systems, although currently niche due to high cost and complexity, represents the pinnacle of vibration isolation technology. These systems utilize external power (e.g., electric actuators) to actively push or pull the seat suspension, effectively neutralizing low-frequency vibrations that conventional systems struggle to manage. Concurrently, lightweighting technologies are essential; the use of high-strength, low-density materials (e.g., specific aluminum alloys and carbon fiber reinforced plastics) is aimed at reducing the unsprung mass of the seat mechanism, contributing to overall vehicle fuel efficiency and dynamic performance. The strategic imperative for technology providers is to achieve a balance between superior, adaptive performance and the commercial viability of these advanced systems, ensuring that the enhanced driver comfort and health benefits justify the premium price point in a highly competitive heavy-duty vehicle manufacturing environment.

Regional Highlights

Asia Pacific (APAC) is the undisputed leader in volume growth within the Heavy Duty Truck and Bus Seat Damper Market, driven by robust infrastructure development, rapid industrialization, and massive commercial vehicle production centered in countries like China, India, and Southeast Asia. The region’s demand is characterized by a strong preference for durable, cost-effective hydraulic dampers, especially in the entry- and mid-range heavy-duty segments. However, with increasing regulatory focus on driver working hours and safety standards (mirroring European directives), premiumization is rapidly gaining traction in high-end coach and long-haul trucking markets, leading to increased demand for locally manufactured semi-active systems. The sheer scale of new vehicle registrations in APAC necessitates large-scale manufacturing capacity, often established through joint ventures between local industrial conglomerates and established global damper technology leaders, making the region a critical hub for both production and consumption.

North America represents a mature yet high-value market, characterized by stringent safety standards and a strong emphasis on driver comfort and retention in the highly competitive long-haul trucking sector. The market shows a high penetration rate of air-suspension seating systems, where advanced pneumatic and hydraulic damping solutions are standard, especially in Class 8 trucks. Demand is heavily skewed towards high-performance, semi-active dampers that integrate seamlessly with sophisticated truck telematics and chassis control systems. Regulatory bodies and fleet safety programs strongly influence purchasing decisions, ensuring continuous demand for replacement and upgrade components that meet or exceed FMCSA standards. The aftermarket is also highly vibrant in North America, driven by the strong culture of customization and long operational life of heavy trucks, providing consistent revenue for replacement high-quality components.

Europe is defined by its leadership in adopting advanced, ergonomically superior damping technology, driven primarily by strict European Union directives concerning whole-body vibration (WBV) exposure. European OEMs, including the major truck and bus manufacturers, are early adopters of mechatronic semi-active suspension seats to comply with labor laws and enhance brand reputation concerning driver welfare. The market favors high-specification, reliable components that contribute to vehicle certification and operational efficiency. Furthermore, the extensive use of coaches for intercity travel necessitates premium damping solutions to ensure superior passenger comfort, pushing manufacturers toward optimized low-frequency isolation capabilities. Standardization across the EU single market allows manufacturers to leverage scale, but product design must meet the highly specific dynamic requirements of diverse road networks, from high-speed motorways to demanding mountainous terrain.

- Asia Pacific (APAC): Volume leader; strong growth fueled by China and India; increasing adoption of safety standards driving premiumization in long-haul segment.

- North America: High-value market; dominant use of air suspension seats; strong demand for semi-active dampers driven by driver retention and safety mandates.

- Europe: Technology leader; adoption driven by strict EU WBV regulations; focus on ergonomic excellence and high integration with vehicle electronics.

- Latin America (LATAM): Emerging modernization; price sensitivity remains high, favoring basic hydraulic systems, but infrastructure projects drive localized heavy-duty vehicle demand.

- Middle East & Africa (MEA): Growth driven by logistics expansion and mining sectors; demand concentrated on ultra-durable, robust damping solutions to withstand harsh desert environments and high temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Duty Truck and Bus Seat Damper Market.- ZF Friedrichshafen AG (incl. WABCO Commercial Vehicle Control Systems)

- Continental AG

- Hendrickson International (A Boler Company)

- Vibracoustic (A Freudenberg Company)

- Trelleborg AB

- Knorr-Bremse AG

- Tenneco Inc. (DRiV Automotive)

- Boge Rubber & Plastics Group

- SOGEFI Group

- Parker Hannifin Corporation

- KYB Corporation

- NHK Spring Co., Ltd.

- Grammer AG (Major Seat System Integrator and Damper User)

- Commercial Vehicle Group (CVG)

- Airo Shock Absorbers

- Monroe (Tenneco/DRiV brand presence)

- Showa Corporation

- Hutchens Industries

- ArvinMeritor

- Sachs (ZF brand presence)

Frequently Asked Questions

Analyze common user questions about the Heavy Duty Truck and Bus Seat Damper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between passive and semi-active seat dampers?

Passive dampers offer fixed resistance based on component design and are suitable for general use. Semi-active (adaptive) dampers use sensors and electronic control units (ECUs) to continuously adjust damping force in real time based on road input and vehicle speed, providing significantly superior vibration isolation and ride comfort.

How do global regulations impact the demand for advanced seat damping systems?

Strict global regulations, particularly EU Directives and ISO standards (e.g., ISO 2631) governing Whole-Body Vibration (WBV) exposure, mandate manufacturers to install effective suspension systems, driving high demand for premium, electronically controlled dampers that meet lower vibration transmissibility thresholds to protect driver health.

Which geographic region dominates the adoption of heavy-duty seat damper technology?

North America and Europe currently lead the market in terms of high-value adoption and technological integration (semi-active systems), primarily due to stringent occupational health mandates and strong market demand for premium driver comfort in long-haul fleets. However, Asia Pacific leads in overall volume growth.

What role does the Aftermarket play in the Heavy Duty Truck and Bus Seat Damper sector?

The Aftermarket is crucial, providing necessary replacement parts for maintenance and allowing fleet operators to upgrade older vehicles to comply with modern safety and comfort standards. It is driven by the long operational lifecycles of commercial vehicles and the need for durable, readily available repair components.

How is the move toward electric commercial vehicles influencing seat damper design?

Electric vehicles (EVs) require seat dampers optimized for new noise and vibration profiles. Since EVs are quieter, minimizing road-induced structure-borne noise and vibrations becomes critical. This drives the use of highly efficient, low-friction materials and advanced isolation technologies to maintain superior cabin acoustics and comfort.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager