Heavy-Duty Truck Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432090 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Heavy-Duty Truck Market Size

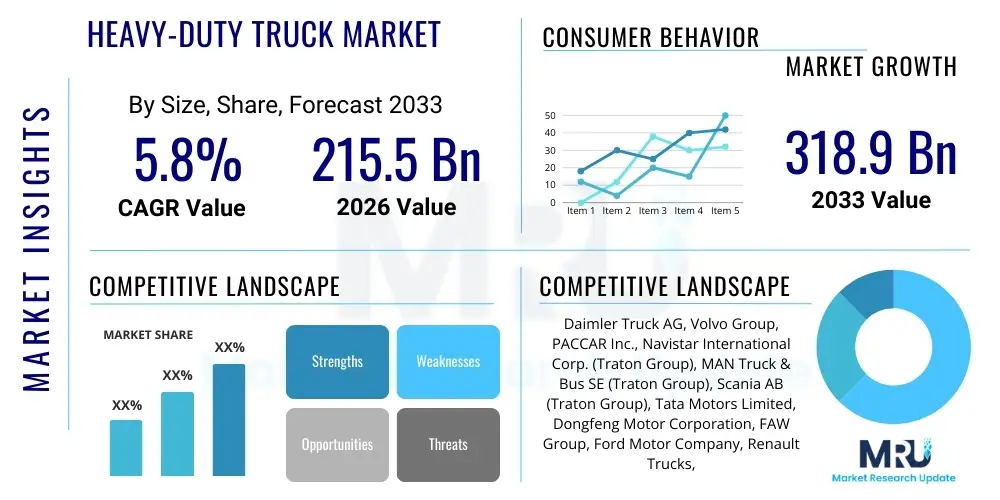

The Heavy-Duty Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 215.5 Billion in 2026 and is projected to reach USD 318.9 Billion by the end of the forecast period in 2033.

Heavy-Duty Truck Market introduction

The Heavy-Duty Truck Market encompasses vehicles classified primarily as Class 8 (in North America) or equivalent global categories, characterized by a Gross Vehicle Weight Rating (GVWR) exceeding 33,000 pounds (15,000 kg). These robust vehicles are the backbone of global supply chains, serving essential functions in long-haul freight transport, construction, waste management, and specialized industrial applications. The core product offering includes tractor units used for pulling semi-trailers, straight trucks designed for heavy lifting, and specialized chassis for vocational purposes. The evolution of the market is currently centered on optimizing fuel efficiency, enhancing driver safety and comfort, and adopting powertrain electrification and alternative fuels to meet increasingly stringent global emissions standards.

Major applications for heavy-duty trucks span across several critical industries, with logistics and transportation holding the largest share due to the rising demand for cross-border and inter-city freight movement driven by e-commerce proliferation and globalization. The construction sector also relies heavily on these trucks for hauling raw materials, heavy equipment, and specialized concrete mixer and dump truck configurations. Furthermore, the increasing complexity of urban and regional distribution networks necessitates reliable, high-capacity vehicles that can perform demanding operational cycles, thereby solidifying the necessity of heavy-duty trucks in modern infrastructure.

The primary driving factors propelling market expansion include robust governmental investment in infrastructure development across emerging economies, which directly stimulates demand for construction and material transport vehicles. Concurrently, technological advancements, particularly in advanced driver-assistance systems (ADAS), powertrain efficiency, and fleet management telematics, are compelling fleet operators to upgrade their existing inventories. The mandatory adoption of cleaner energy sources and the push towards decarbonization mandates are also stimulating significant investments in electric and hydrogen fuel cell heavy-duty truck platforms, signaling a transformative shift in the market landscape.

Heavy-Duty Truck Market Executive Summary

The global Heavy-Duty Truck Market is experiencing dynamic growth driven by the interplay of macroeconomic recovery, structural shifts in logistics, and aggressive regulatory mandates favoring sustainability. Key business trends indicate a strong move toward fleet modernization, with major original equipment manufacturers (OEMs) focusing capital expenditure on modular electric vehicle (EV) platforms and autonomous driving capabilities, particularly for highway platooning applications. Consolidation among smaller logistics providers and increasing partnership activity between technology firms and established truck manufacturers are defining the competitive landscape, prioritizing integrated digital solutions that improve uptime and operational efficiency for end-users.

Regionally, Asia Pacific (APAC) continues to dominate the volume market, spurred by massive infrastructure projects in China and India and expanding trade corridors across Southeast Asia. Conversely, North America and Europe are leading the market in value and technological adoption, primarily due to higher average selling prices (ASPs) for premium, high-efficiency, and electrified vehicles, alongside early compliance with stringent emissions regulations like Euro VI and upcoming zero-emission vehicle mandates. While economic uncertainties and supply chain fluctuations occasionally temper near-term growth, the long-term outlook remains robust, underpinned by essential freight demand that is highly inelastic to short-term economic cycles.

Segment trends reveal a rapid expansion in the adoption of Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs), although the Internal Combustion Engine (ICE) segment, particularly those running on advanced diesel or natural gas, retains dominance due to established refueling infrastructure and lower initial acquisition costs. Within application segments, the logistics and freight transport category is seeing the fastest adoption of advanced telematics and safety features, while the construction and vocational segments are increasingly demanding robust, customized powertrains and chassis designs capable of enduring severe duty cycles. The shift in component sourcing is also notable, with a growing reliance on specialized battery suppliers and software providers, making strategic vertical integration a key competitive differentiator.

AI Impact Analysis on Heavy-Duty Truck Market

Common user inquiries regarding AI in the Heavy-Duty Truck Market typically revolve around the speed of autonomous deployment, the implications for driver employment, the required regulatory framework, and the return on investment (ROI) for advanced predictive maintenance systems. Users are keenly interested in understanding how Level 4 automation will fundamentally change long-haul routes, focusing on 'hub-to-hub' logistics and platooning efficiency. Furthermore, there is significant interest in AI's role in enhancing cybersecurity for connected vehicles and optimizing dynamic route planning to mitigate fuel costs and delivery times. The underlying expectation is that AI will simultaneously solve the persistent driver shortage crisis while drastically lowering total cost of ownership (TCO) through unparalleled operational precision.

AI's influence is profound, transforming operational paradigms from reactive maintenance schedules to proactive, predictive fault avoidance. AI algorithms ingest vast amounts of telematics data—engine performance, brake wear, tire pressure, and environmental conditions—to predict component failure with high accuracy, enabling Just-In-Time maintenance interventions that minimize unplanned downtime. This predictive capability significantly extends the operational lifespan of high-value components and enhances vehicle utilization rates, a critical metric for fleet profitability. Consequently, insurance premiums are expected to decrease for fleets leveraging proven AI-driven safety and maintenance protocols, creating a substantial economic incentive for adoption.

Beyond maintenance, AI is the foundational technology enabling the progressive rollout of autonomous driving systems. While full Level 5 autonomy remains a long-term goal, Level 4 (supervised autonomy in geofenced or specific highway conditions) is already being tested for commercial deployment. AI powers perception systems (Lidar, Radar, cameras), decision-making logic, and sophisticated sensor fusion necessary for safe navigation and interaction with human-driven traffic. Furthermore, AI-driven logistics platforms are optimizing dynamic routing, factoring in real-time traffic, weather delays, and delivery window constraints, resulting in immediate efficiency gains and reduced carbon footprints.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting component failure based on telematics data.

- Enhanced Fuel Efficiency: AI algorithms optimize engine mapping, gear shifting, and platooning sequences.

- Autonomous Driving Systems (Level 4): Facilitates supervised long-haul, hub-to-hub logistics, addressing driver shortages.

- Optimized Fleet Management: Utilizes machine learning for dynamic route planning, load optimization, and delivery scheduling.

- Improved Driver Safety: AI monitors driver fatigue, attention levels, and provides real-time intervention alerts.

- Cybersecurity and Data Protection: AI models detect and respond to unusual network activity or potential cyber threats in connected vehicle systems.

DRO & Impact Forces Of Heavy-Duty Truck Market

The Heavy-Duty Truck Market is heavily influenced by a confluence of accelerating drivers, structural restraints, and compelling strategic opportunities, all converging to create significant market impact forces. Key drivers include the exponential growth of global e-commerce, which necessitates increased last-mile and middle-mile freight capacity, coupled with robust infrastructure investments in rapidly industrializing nations. Simultaneously, stringent regulatory pressures, particularly related to carbon emissions (e.g., EU Green Deal, U.S. EPA standards), are forcing mandatory fleet turnover towards zero-emission technologies. These drivers collectively establish a strong foundational demand for technologically advanced, cleaner, and more efficient vehicles.

However, the market faces significant restraints, most notably the high initial capital expenditure (CapEx) associated with purchasing electric and hydrogen-powered heavy-duty trucks, which remains a barrier for small and medium-sized fleet operators. Compounding this is the critical challenge of inadequate charging and refueling infrastructure, particularly for long-haul routes in vast geographical areas like North America and parts of Asia. Furthermore, the persistent global shortage of skilled truck drivers and ongoing supply chain disruptions affecting semiconductor chips and essential battery components continue to dampen immediate production capacity and delivery timelines, slowing the pace of modernization.

These challenges create substantial opportunities. The transition to alternative powertrains presents a massive opportunity for component suppliers specializing in battery technology, hydrogen fuel cell stacks, and high-voltage power electronics. The driver shortage issue fuels the opportunity for rapid deployment of semi-autonomous (Level 2/3) and fully autonomous (Level 4) systems, dramatically increasing vehicle utilization and potentially reducing labor costs over the long term. The primary impact force on the market is the regulatory push towards decarbonization; this force is non-negotiable and fundamentally reshapes product development cycles, capital allocation, and competitive dynamics, favoring those OEMs and technology providers who can swiftly scale commercially viable zero-emission trucking solutions.

Segmentation Analysis

The segmentation of the Heavy-Duty Truck Market provides a comprehensive framework for understanding diverse demand patterns, technological maturity, and regional differences in purchasing behavior. The market is primarily segmented by Vehicle Type (e.g., Class 8, and equivalent categories), Application (e.g., Logistics, Construction, Mining), Fuel Type (e.g., Diesel, Natural Gas, BEV, FCEV), and Axle Type. Analyzing these segments helps stakeholders identify niche markets and tailor product offerings, such as developing lighter chassis for regional distribution or ruggedized powertrains for off-road mining operations. The growing divergence between traditional diesel and emerging electric powertrains is currently the most impactful segmentation dynamic, reflecting the market’s transitionary phase.

Segmentation by Fuel Type is increasingly pivotal, dictating investment strategies by both OEMs and energy infrastructure providers. While traditional diesel dominates existing fleets, the Battery Electric Vehicle (BEV) segment is gaining rapid traction in regional haul and port operations where range anxiety is mitigated by shorter, predictable routes and established depot charging. The Fuel Cell Electric Vehicle (FCEV) segment, leveraging hydrogen, holds promise for long-haul, high-utilization applications where fast refueling and high energy density are critical, though its commercial scaling depends heavily on the cost and availability of green hydrogen production and distribution networks.

The application segment segmentation confirms the sustained dominance of the Freight and Logistics sector due to the sheer volume of goods moved globally, but also highlights robust growth in specialized vocational segments. For instance, the demand for specialized heavy-duty vehicles in the waste management and municipality sectors is stable and often insulated from macroeconomic volatility, offering reliable revenue streams. Understanding the specific duty cycle requirements—from high torque needs in construction to maximized uptime in long-haul freight—is essential for designing optimized product portfolios and achieving market leadership within specific segments.

- By Vehicle Type

- Class 8 (GVWR > 33,000 lbs)

- Equivalent Global Categories (e.g., 16 tons and above)

- By Application

- Logistics and Freight Transport (Long Haul, Regional Haul)

- Construction and Mining (Dump Trucks, Concrete Mixers)

- Vocational (Waste Management, Fire/Emergency Services, Utility)

- Distribution and Delivery

- By Axle Type

- 3-4 Axles

- 5-6 Axles

- More than 6 Axles (Specialized)

- By Fuel Type/Powertrain

- Internal Combustion Engine (ICE - Diesel, Gasoline)

- Natural Gas (CNG, LNG)

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

Value Chain Analysis For Heavy-Duty Truck Market

The Heavy-Duty Truck market value chain is complex, spanning raw material procurement to final delivery and aftermarket services. Upstream analysis involves the sourcing of critical materials such as specialized steel alloys for chassis construction, lightweight aluminum for optimized body structures, and, increasingly, battery components (lithium, cobalt, nickel) for electric powertrains. Key upstream players include major metal processors, specialized component manufacturers (e.g., axle and transmission providers like ZF and Dana), and now, high-capacity battery cell manufacturers. Efficiency and sustainability in this stage are paramount, as material costs and sourcing transparency directly impact the final TCO of the vehicle.

Midstream activities involve the design, manufacturing, and assembly of the trucks, dominated by global OEMs like Daimler Truck, Volvo Group, and PACCAR. This stage is rapidly evolving with the adoption of modular platforms that allow for flexible integration of different powertrains (ICE, BEV, FCEV) and the incorporation of sophisticated electronics for connectivity and autonomy. The distribution channel analysis reveals a mix of direct sales to large corporate fleets and reliance on an established network of authorized dealers for sales, service, and financing. Dealers play a crucial role in maintaining strong customer relationships, offering regional service expertise, and facilitating the trade-in or disposal of used vehicles.

Downstream analysis focuses on the end-users—large logistics companies, specialized fleet owners, and government entities—and the lucrative aftermarket segment. Aftermarket services, including maintenance, repair, parts replacement, and digital fleet management subscriptions (telematics), often represent a significant and stable revenue stream for both OEMs and independent service providers. The shift towards connected vehicles facilitates remote diagnostics and over-the-air (OTA) updates, blurring the lines between direct and indirect distribution by allowing OEMs to maintain direct communication and service provision to the vehicle, irrespective of the physical dealership network.

Heavy-Duty Truck Market Potential Customers

Potential customers, or end-users, of the Heavy-Duty Truck Market are highly diversified but predominantly belong to sectors engaged in high-volume goods movement or capital-intensive infrastructure development. The largest segment comprises third-party logistics (3PL) providers and large retail chains that operate their private fleets. These buyers prioritize total cost of ownership (TCO), fuel efficiency, driver retention features (comfort and safety), and vehicle reliability, often demanding long-term service contracts and customized telematics solutions to optimize complex global supply chains.

Another major category includes vocational users, such as construction companies, mining operators, and waste management corporations. These customers require highly specialized vehicles built to withstand extreme operating conditions, prioritizing durability, high torque output, and low maintenance requirements. For instance, mining fleets often operate in isolated areas, requiring robust, serviceable designs and increasingly, electric powertrains that offer lower operational noise and heat generation in confined spaces.

Government agencies and municipalities represent a stable customer base, purchasing heavy-duty trucks for public works, emergency services (fire trucks, rescue vehicles), and local utility operations. These buyers are often influenced by public mandates regarding emissions and safety, leading to early adoption of alternative fuels and advanced safety features, even if the initial procurement cost is higher. Across all customer types, purchasing decisions are moving away from simple acquisition price towards holistic lifecycle value, including residual value, fuel savings, and the integration capabilities with existing fleet management software platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 215.5 Billion |

| Market Forecast in 2033 | USD 318.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler Truck AG, Volvo Group, PACCAR Inc., Navistar International Corp. (Traton Group), MAN Truck & Bus SE (Traton Group), Scania AB (Traton Group), Tata Motors Limited, Dongfeng Motor Corporation, FAW Group, Ford Motor Company, Renault Trucks, IVECO Group, Kenworth Truck Company, Peterbilt Motors Company, Hino Motors Ltd., Nikola Corporation, Tesla, BYD Co. Ltd., Oshkosh Corporation, Western Star Trucks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy-Duty Truck Market Key Technology Landscape

The technological landscape of the Heavy-Duty Truck Market is rapidly converging on three core areas: powertrain electrification, autonomous driving capabilities, and advanced connectivity/telematics. Electrification involves not only the development of robust, energy-dense battery packs suitable for heavy loads and long ranges but also the intricate management systems required for thermal control and charging optimization. OEMs are investing heavily in scalable electric vehicle platforms that can support diverse configurations, aiming to overcome the current hurdles of range anxiety and payload limitations compared to traditional diesel vehicles. Hydrogen fuel cell technology is gaining traction as a complementary solution for routes requiring faster refueling and zero tailpipe emissions over very long distances, driving innovation in fuel cell stacks and high-pressure storage tanks.

Autonomous driving technology, progressing through SAE Levels 2 to 4, is fundamentally reshaping the operational safety and efficiency profile of heavy-duty trucks. Current market focus is on advanced driver-assistance systems (ADAS) such as adaptive cruise control, lane-keeping assist, and collision mitigation systems, which enhance driver safety and reduce fatigue. The most significant technological leap is the development of Level 4 autonomy for specific operational domains, utilizing sophisticated sensor suites (LiDAR, high-definition cameras, radar) combined with highly precise mapping and AI-driven decision-making algorithms, setting the stage for driverless platooning and terminal yard operations.

Connectivity and the Internet of Things (IoT) form the third pillar, enabling the transition to smart, digitally managed fleets. Modern heavy-duty trucks are equipped with advanced telematics units that continuously collect performance data, environmental conditions, and GPS location. This data feeds into cloud-based fleet management platforms, facilitating predictive maintenance, dynamic route optimization, and regulatory compliance (e.g., electronic logging devices). Furthermore, connectivity enables Over-the-Air (OTA) updates for vehicle software, allowing manufacturers to improve vehicle performance and fix bugs without requiring a physical visit to the dealership, substantially boosting fleet uptime and customer satisfaction.

Regional Highlights

- North America

North America, particularly the United States and Canada, represents a high-value market characterized by long-haul transportation requirements and early adoption of safety and automation technologies. The region's regulatory environment, particularly California's aggressive push for zero-emission vehicle (ZEV) mandates, is driving substantial investment into electric and hydrogen trucking infrastructure and vehicle production. The market is dominated by Class 8 trucks, and demand is intrinsically linked to cross-border trade and fluctuating energy prices. Major OEMs based here are focused on robust, comfortable designs suitable for lengthy continental hauls and the integration of highly sophisticated ADAS packages.

Fleet operators in North America are increasingly relying on sophisticated telematics and predictive maintenance to combat high operational costs and the persistent scarcity of long-haul drivers. The integration of Level 4 autonomous technology is expected to first take hold in segregated highway stretches and specific regional hub-to-hub operations, offering solutions to operational bottlenecks. High fuel prices and state-level incentives continue to make the ROI calculation for BEVs and FCEVs more attractive for regional and port drayage applications, cementing North America's position as a technological trendsetter in the global heavy-duty market.

- Europe

Europe stands out due to its stringent emissions regulations (Euro VI and subsequent proposed standards) and strong commitment to the Green Deal, driving rapid adoption of alternative powertrains. The European market favors truck designs optimized for varied road conditions and cross-country logistics within the Schengen Area. Government initiatives, including subsidies for zero-emission truck procurement and investments in high-capacity charging corridors (like the proposed charging megahubs), are accelerating the displacement of diesel powertrains, particularly in core logistics routes connecting major economic centers.

The emphasis in Europe is placed heavily on achieving maximum efficiency and compliance, leading to high demand for aerodynamic designs, precise digital tachographs, and advanced safety features mandatory under EU regulations. Leading European OEMs are aggressively commercializing both BEV and FCEV models, often collaborating with energy providers to develop integrated ecosystem solutions that span vehicle supply, maintenance, and energy provision. The focus on reducing CO2 emissions from transport makes Europe a critical testing ground for sustainable heavy logistics solutions.

- Asia Pacific (APAC)

APAC is the largest market globally in terms of volume, characterized by diverse regional requirements, substantial government infrastructure spending, and rapid urbanization, particularly in China and India. Growth in this region is propelled by expanding manufacturing bases and burgeoning cross-regional trade agreements. While price sensitivity remains a major factor, leading to a large volume of diesel vehicle sales, China is simultaneously leading the world in the production and deployment of heavy-duty electric commercial vehicles, often driven by intense governmental policy support and state-owned fleet mandates.

The Indian market is experiencing a significant shift towards higher payload capacity vehicles and enhanced safety standards, driven by updated axle load norms and an increased focus on operational efficiency within fragmented logistics networks. Due to the high utilization rates and often challenging road conditions, demand for robust, easily maintainable vehicles is paramount. As economies mature, there is a gradual migration from basic commercial vehicles toward trucks incorporating more advanced features and compliance with progressively stricter emissions regulations adopted regionally.

- Latin America, Middle East, and Africa (LAMEA)

LAMEA represents a heterogeneous market with growth heavily reliant on commodity cycles (mining, oil and gas) and internal infrastructure development projects. Latin America's market dynamics are complex, influenced by fluctuating currency values and reliance on imported technology, though domestic manufacturing is significant in countries like Brazil. The primary demand driver is the movement of raw materials, requiring highly durable and reliable trucks capable of operating in demanding environments with limited support infrastructure.

The Middle East benefits from high public spending on mega-projects and robust logistics networks supporting global shipping lanes, leading to demand for modern, high-horsepower trucks. Africa, while offering immense long-term potential, generally focuses on lower-cost, durable vehicles, with growth linked to improving road networks and increasing investment in mining and agricultural logistics. Decarbonization efforts are slower here compared to Europe and North America, with the ICE segment expected to maintain dominance for the immediate future, though regional pilots for electric trucks are emerging, particularly in major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy-Duty Truck Market.- Daimler Truck AG

- Volvo Group

- PACCAR Inc.

- Navistar International Corp. (Traton Group)

- MAN Truck & Bus SE (Traton Group)

- Scania AB (Traton Group)

- Tata Motors Limited

- Dongfeng Motor Corporation

- FAW Group

- Ford Motor Company

- Renault Trucks

- IVECO Group

- Kenworth Truck Company

- Peterbilt Motors Company

- Hino Motors Ltd.

- Nikola Corporation

- Tesla

- BYD Co. Ltd.

- Oshkosh Corporation

- Western Star Trucks

Frequently Asked Questions

Analyze common user questions about the Heavy-Duty Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for heavy-duty truck market growth?

The exponential growth of the e-commerce sector globally, coupled with massive governmental investments in infrastructure development (roads, ports, logistics hubs), is the primary driver accelerating demand for new, high-capacity heavy-duty trucks.

When will electric heavy-duty trucks achieve price parity with diesel counterparts?

Price parity, defined by total cost of ownership (TCO), is anticipated to be reached within the next decade (2028-2032). This timeline is dependent on declining battery costs, increased production scale, higher utilization rates, and regulatory incentives compensating for the currently high initial capital expenditure.

Which fuel type is projected to dominate the long-haul heavy-duty segment by 2033?

While advanced diesel engines will remain significant due to their installed base, the Fuel Cell Electric Vehicle (FCEV), powered by hydrogen, is strongly positioned to dominate the zero-emission long-haul segment by 2033 due to its superior energy density, fast refueling times, and suitability for heavy payloads over extensive distances.

What role does Artificial Intelligence (AI) play in modern heavy-duty trucking?

AI is crucial for enabling Level 4 autonomous driving systems, providing highly accurate predictive maintenance capabilities to minimize downtime, and optimizing real-time routing and logistics operations, thereby significantly improving fleet efficiency and safety.

Which region leads in the adoption of zero-emission heavy-duty trucks?

Europe and North America (specifically the US states with ZEV mandates) currently lead the market in value and technological adoption of Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs), primarily driven by stringent regulatory pressures and supportive public policy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager