Heavy Duty Truck Vehicles Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434335 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Heavy Duty Truck Vehicles Lighting Market Size

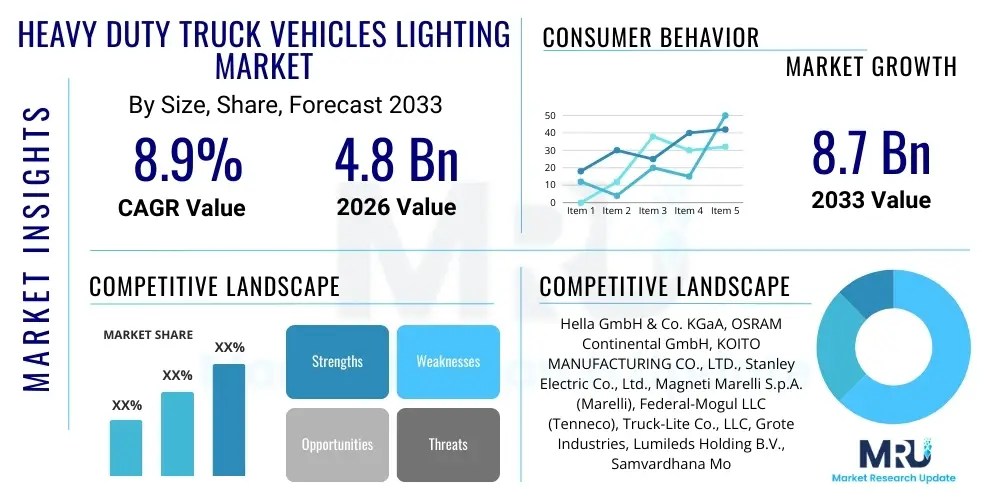

The Heavy Duty Truck Vehicles Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily fueled by stringent governmental regulations concerning vehicle safety and visibility, particularly across North America and Europe. The mandatory adoption of advanced lighting technologies, such as Light Emitting Diodes (LEDs), in newly manufactured heavy-duty trucks, coupled with increased aftermarket demand for durable, energy-efficient replacements, dictates the market's expansion.

The valuation reflects the increasing complexity and technological integration within modern truck lighting systems. Historically, lighting was purely functional; however, contemporary systems integrate features like dynamic signaling, adaptive front-lighting systems (AFS), and sensor integration for advanced driver-assistance systems (ADAS). These sophisticated components inherently possess higher average selling prices compared to traditional halogen bulbs. Furthermore, the robust growth in the global logistics and transportation sectors, particularly in emerging economies in the Asia Pacific region, drives the volume demand for new heavy-duty trucks, consequently expanding the lighting system market significantly.

Market forecasts indicate a continuous shift away from traditional incandescent and halogen systems towards solid-state lighting (SSL) technologies, primarily LEDs, due to their superior longevity, lower power consumption, and enhanced styling potential. This transition is not only driven by manufacturer preference but also by fleet owner demand seeking reduced total cost of ownership (TCO) through minimized maintenance requirements. The regulatory push for better road visibility to decrease nighttime accidents serves as a core, non-cyclical demand driver sustaining the market's robust financial growth through 2033.

Heavy Duty Truck Vehicles Lighting Market introduction

The Heavy Duty Truck Vehicles Lighting Market encompasses all external and internal illumination systems designed for Class 7 and Class 8 commercial vehicles, including long-haul trucks, dump trucks, concrete mixers, and specialized vocational trucks. These systems are critical for ensuring operational safety, regulatory compliance, and vehicle aesthetics. Key products include high-performance headlamps (low beam, high beam), tail lamps, brake lights, turn signals, clearance lights, side marker lights, daytime running lights (DRLs), and interior cabin illumination. Modern lighting solutions are evolving from simple components to integrated safety features, utilizing advanced technologies like LED matrices and adaptive optics to dynamically adjust light distribution based on road conditions, speed, and surrounding traffic, thereby significantly enhancing driver visibility and reducing fatigue.

Major applications of heavy-duty truck lighting span across original equipment manufacturing (OEM) for new vehicle production and the vast global aftermarket segment, which services maintenance, repair, and replacement needs. Benefits derived from advanced lighting systems include drastically improved road safety due to superior luminance and beam pattern control, significant energy savings due to the adoption of low-power LED technology, and extended operational lifecycles, minimizing vehicle downtime associated with bulb failures. These technological advancements are increasingly viewed by fleet managers not as mere components, but as investments contributing directly to operational efficiency and regulatory adherence, especially concerning mandatory photometric performance standards set by agencies like NHTSA (North America) and ECE (Europe).

The primary driving factors sustaining market growth include the global implementation of stricter safety mandates, particularly mandates requiring higher performance and reliability for external lighting systems, such as mandatory DRLs in many jurisdictions. Furthermore, the sustained trend of vehicle electrification indirectly benefits the lighting market, as electric trucks require highly efficient, low-draw components, which LEDs inherently provide, minimizing drain on the battery pack. The continuous innovation in material science, leading to more robust and weather-resistant lamp assemblies capable of enduring harsh operating environments characteristic of heavy-duty transport, also acts as a crucial growth catalyst. Consumer preference for distinctive, aesthetically pleasing light signatures also plays a minor but increasing role, particularly in premium truck segments.

Heavy Duty Truck Vehicles Lighting Market Executive Summary

The Heavy Duty Truck Vehicles Lighting Market is experiencing a paradigm shift characterized by a rapid transition toward sophisticated LED and smart lighting systems, moving away from conventional technologies. Key business trends indicate strong vertical integration among lighting suppliers who are increasingly collaborating directly with major truck OEMs during the design phase to integrate advanced features like Adaptive Driving Beam (ADB) technology and integrated sensing capabilities. This shift is reinforcing the OEM channel while simultaneously challenging traditional aftermarket component suppliers who must rapidly adapt their offerings to match the complexity and digital integration of modern systems. Furthermore, sustainability and material lightweighting are becoming critical competitive differentiators, pushing manufacturers toward optimized plastic components and modular designs to aid recycling and reduce fuel consumption.

Regionally, the market presents varied dynamics. North America and Europe remain the leaders in technological adoption and regulatory stringency, driving premium segment growth focused on safety and technological sophistication. The implementation of specific regulations regarding beam cutoff and luminous intensity in these regions ensures a steady demand for high-quality, certified systems. Conversely, the Asia Pacific (APAC) region, dominated by high-volume manufacturing in China and India, is the largest consumer market driven primarily by new vehicle registrations and infrastructural development. While price sensitivity remains higher in APAC, there is a notable, accelerating trend towards adopting energy-efficient LEDs, particularly in fleet modernization programs, signaling future high-growth potential for mid-range advanced lighting solutions.

Segment trends confirm the dominance of the LED technology segment, which is projected to achieve the highest CAGR over the forecast period, replacing traditional halogen and Xenon High-Intensity Discharge (HID) lights across all truck applications (headlights, signals, work lights). In terms of application, external primary lighting (headlights and tail lamps) commands the largest market share due to their direct impact on safety and regulatory mandates. Looking forward, the segmentation by vehicle class shows Class 8 heavy trucks contributing the most substantial revenue, driven by the requirement for durable, high-performance systems suitable for long-haul operations. Strategic investments are centered on developing standardized, multi-voltage compatible LED modules that simplify global inventory management for OEMs and aftermarket distributors.

AI Impact Analysis on Heavy Duty Truck Vehicles Lighting Market

User queries regarding AI's influence on heavy-duty truck lighting center primarily on three key themes: the role of AI in autonomous trucking safety, the development of predictive maintenance strategies for lighting components, and the integration of AI-powered adaptive and communication lighting systems. Users are concerned about how AI will manage dynamic beam patterns in complex environments, ensuring compliance with diverse international lighting regulations without human intervention. Expectations are high regarding AI's ability to minimize lighting failures, a critical safety concern, through predictive algorithms analyzing vibration data, thermal performance, and electrical load history. The core concern revolves around achieving flawless, instantaneous situational awareness through lighting systems managed entirely by artificial intelligence, ensuring optimum visibility under all operating conditions for Level 4 and Level 5 autonomous vehicles.

- AI algorithms will be essential for managing Adaptive Driving Beam (ADB) systems, optimizing light distribution in real-time based on road curvature, weather, traffic density, and speed, surpassing current sensor-based limitations.

- Predictive maintenance analytics, powered by machine learning, will analyze operational data (temperature, voltage fluctuation) to forecast potential LED module failure, scheduling preemptive replacements and drastically reducing unplanned downtime.

- Integration of V2X (Vehicle-to-Everything) communication lighting, where AI manages Li-Fi (Light Fidelity) broadcasting capabilities to communicate status, intent, and warnings to other vehicles and infrastructure.

- AI will facilitate automated compliance checks, verifying that lighting outputs and beam patterns meet local regulatory standards dynamically as the truck crosses jurisdictional boundaries.

- Enhanced testing and calibration processes during manufacturing will use AI vision systems to ensure perfect photometric accuracy and alignment of complex matrix LED systems, improving initial quality control.

DRO & Impact Forces Of Heavy Duty Truck Vehicles Lighting Market

The Heavy Duty Truck Vehicles Lighting Market is fundamentally shaped by a set of robust drivers (D), persistent restraints (R), emerging opportunities (O), and significant impact forces. The dominant drivers include global regulatory mandates enforcing superior vehicle visibility and the rapid cost reduction and performance enhancement of LED technology, making it the default choice for new installations. However, market expansion is constrained by the relatively high initial capital investment required for high-tech adaptive LED systems compared to older alternatives, coupled with the complexity and specialized knowledge needed for sophisticated electronic system repairs in the aftermarket. Opportunities are flourishing in the realm of smart lighting integration, particularly incorporating sensors for ADAS functions and leveraging distinct light signatures for brand differentiation and enhanced fleet safety features. These factors interact dynamically, forcing market players to balance cost optimization with stringent safety requirements, thereby maintaining high impact forces.

The primary driving force is the regulatory landscape, especially the push towards safer roads through superior illumination. This regulatory impetus drives technological advancement, as manufacturers are compelled to invest in R&D for better beam control and system durability. Furthermore, the total cost of ownership (TCO) argument favors LEDs heavily; while initial outlay is higher, the vastly superior lifespan (up to 50,000 hours) and minimal energy consumption significantly reduce lifetime operating costs for high-mileage heavy-duty fleets, creating a strong pull factor. The integration demands of autonomous and semi-autonomous trucks also act as a crucial driver, as reliable, high-definition lighting is essential for sensor accuracy and vehicle perception systems.

Restraints are primarily economic and structural. The aftermarket segment faces challenges related to counterfeit products and non-compliant replacements, which undermine safety standards and legitimate market revenues. For advanced systems, complex wiring harnesses and integrated cooling systems increase manufacturing complexity, potentially creating supply chain vulnerabilities. The shortage of skilled technicians capable of diagnosing and repairing integrated electronic lighting modules is a structural restraint, particularly in developing markets. The primary opportunities lie in the adoption of standardized, modular lighting platforms (reducing SKU complexity) and the development of intelligent adaptive systems that can communicate maintenance needs directly, improving system reliability and customer satisfaction. The impact forces are high due to the non-negotiable nature of safety compliance and the aggressive pace of technological obsolescence imposed by rapid LED innovation.

Segmentation Analysis

The Heavy Duty Truck Vehicles Lighting Market is systematically segmented based on technology type, application, sales channel, and vehicle type, allowing for precise market analysis and strategic planning. Segmentation by technology highlights the ongoing and definitive shift from legacy systems (Halogen, Xenon HID) toward advanced Solid-State Lighting (SSL), primarily LED, which dominates new OEM installations. Application-based segmentation provides insight into functional demand, distinguishing between mandatory external visibility components (headlights, brake lights) and auxiliary/aesthetic elements (cabin lighting, warning lamps). Understanding these segments is crucial for manufacturers tailoring product lines to meet diverse regulatory standards and end-user performance requirements across various geographical regions.

The segmentation by sales channel differentiates between Original Equipment Manufacturer (OEM) sales, which represent the initial installation during truck production, and the Aftermarket (AM), which encompasses replacement and upgrade components sold through distributors, retailers, and independent service garages. The OEM segment is quality-sensitive, focusing on integration and long-term warranties, whereas the Aftermarket is often more price-competitive but is increasingly demanding high-quality, certified LED retrofit solutions. Vehicle type segmentation clearly delineates the market based on truck classes (e.g., Class 7 and Class 8), recognizing that Class 8 long-haul trucks typically require the most sophisticated, durable, and weather-resistant lighting systems due to their operating hours and exposure to extreme conditions.

- By Technology Type:

- LED (Light Emitting Diode)

- Halogen

- Xenon (High-Intensity Discharge - HID)

- Other Advanced Lighting (Laser, OLED)

- By Application:

- Headlights (High Beam & Low Beam)

- Tail Lights and Brake Lights

- Turn Signals and Hazard Lights

- Fog and Auxiliary Lamps

- Interior Lighting (Cabin, Sleeper, Gauge Cluster)

- Side Marker and Clearance Lights

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

- By Vehicle Type:

- Class 7 Trucks (e.g., Heavy Single-Unit Trucks)

- Class 8 Trucks (e.g., Semi-Tractor Trailers, Dump Trucks)

Value Chain Analysis For Heavy Duty Truck Vehicles Lighting Market

The value chain for the heavy-duty truck lighting market initiates with upstream activities involving the sourcing of specialized raw materials and components, moving through complex manufacturing, and culminating in delivery via both OEM and aftermarket distribution channels. Upstream analysis focuses on suppliers of semiconductor materials for LEDs (e.g., gallium nitride, sapphire), advanced plastics and polycarbonate materials for lens covers and housings (which must withstand UV radiation and impact), and complex electronic control units (ECUs) and thermal management systems. The cost and quality of these raw components heavily influence the final product's performance and cost structure. Efficiency gains at this stage, particularly in LED chip manufacturing yields and thermal management innovation, are crucial for competitive advantage in the finished goods market.

Midstream activities involve sophisticated component assembly and final product manufacturing. Tier 1 and Tier 2 suppliers are critical here, focusing on precision molding, optics design, and quality assurance testing (photometric, vibration, ingress protection ratings like IP67/IP68). Direct and indirect distribution channels define the downstream movement. The direct channel focuses on OEM sales, where major lighting manufacturers supply fully integrated modules directly to truck assembly plants, necessitating long-term contracts and adherence to strict engineering specifications. This channel prioritizes quality, reliability, and integration support. The indirect channel, serving the aftermarket, involves complex networks of national distributors, regional wholesalers, independent truck parts stores, and online platforms, prioritizing inventory availability, competitive pricing, and certified quality for replacement parts.

The complexity of modern lighting, especially adaptive systems, necessitates strong cooperation between upstream semiconductor suppliers and midstream assembly partners. For instance, the transition to matrix LED technology requires advanced communication protocols with the truck’s central electronic architecture, demanding specialized software integration expertise. Downstream success relies heavily on efficient logistics and comprehensive technical support provided to service centers, ensuring that complex LED modules can be correctly diagnosed and replaced. The increasing regulatory pressure for certification means that both OEM and certified aftermarket parts must demonstrate compliance, tightening the control over the entire supply chain and favoring established brands with robust quality control and extensive distribution reach.

Heavy Duty Truck Vehicles Lighting Market Potential Customers

The primary potential customers and buyers in the Heavy Duty Truck Vehicles Lighting Market are segmented into four main categories: Original Equipment Manufacturers (OEMs), large-scale commercial fleet operators, independent owner-operators, and the comprehensive aftermarket service ecosystem. OEMs, such as Daimler Trucks, Volvo Group, and PACCAR, are the largest customers by volume in the initial installation phase, demanding customized, technologically advanced, and highly reliable lighting systems that align with their specific vehicle platforms and brand aesthetics. Their procurement decisions are heavily influenced by Tier 1 supplier capability to integrate complex electronics and ensure long-term, fail-safe operation under warranty conditions. These buyers are the primary drivers for adopting new, high-cost technologies like ADB and smart matrix LED systems, focusing on overall vehicle design integration and compliance.

Commercial fleet operators, ranging from national logistics companies to regional specialized transport firms, represent the largest segment of the aftermarket demand. Their buying behavior is driven predominantly by Total Cost of Ownership (TCO) considerations, prioritizing durability, energy efficiency, and ease of replacement. For these customers, lighting components are viewed as critical safety assets, and failure minimization is paramount; hence, they seek robust LED replacements that offer extended operational life compared to halogen systems, justifying a higher unit cost. They often maintain standardized fleets and prefer purchasing through established distributor networks that offer bulk pricing and rapid fulfillment services, minimizing truck downtime for repairs.

Independent owner-operators and smaller local trucking businesses constitute another crucial customer base. While more price-sensitive than major fleets, this segment also shows interest in quality upgrades, seeking products that offer superior nighttime visibility and reliability for personalized safety assurance. Their purchasing decisions are often made at local parts stores or independent garages, where availability and immediate replacement options are key. Finally, the service and maintenance ecosystem, including authorized dealership service centers and independent repair shops, acts as an indirect buyer, stocking commonly failed components and requiring technical support and training for the increasingly complex electronic modules integrated within modern lighting assemblies. This segment demands reliable supply chains and comprehensive product documentation for effective diagnosis and repair.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hella GmbH & Co. KGaA, OSRAM Continental GmbH, KOITO MANUFACTURING CO., LTD., Stanley Electric Co., Ltd., Magneti Marelli S.p.A. (Marelli), Federal-Mogul LLC (Tenneco), Truck-Lite Co., LLC, Grote Industries, Lumileds Holding B.V., Samvardhana Motherson Group, Valeo SA, ZKW Group GmbH, Ichikoh Industries, Ltd., L.E.D. Automotive Lighting, TYRI, Peterson Manufacturing Co., Optronics International, WABCO (ZF Group), Continental AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Duty Truck Vehicles Lighting Market Key Technology Landscape

The technological landscape in the heavy-duty truck lighting market is defined by advanced digitalization, optical precision, and power efficiency, centered predominantly around Light Emitting Diode (LED) platforms. The most impactful emerging technology is the Adaptive Driving Beam (ADB), often utilizing high-resolution matrix LED arrays. ADB systems leverage integrated sensors and cameras to selectively control individual LED segments, creating complex, non-glaring light patterns that maximize illumination for the driver without blinding oncoming traffic. This transition from traditional static beam patterns to dynamic, digitally controlled light distribution requires sophisticated Electronic Control Units (ECUs) and high-speed data processing capabilities, placing lighting manufacturers squarely within the realm of electronic system providers rather than simple component suppliers. The development of standardized protocols for ADB system communication is crucial for widespread adoption across different OEM platforms.

Another crucial technological development is the implementation of specialized thermal management solutions. While LEDs are highly energy efficient, their performance and longevity are extremely sensitive to heat build-up. Heavy-duty truck environments, often involving extreme operating temperatures and prolonged running hours, necessitate robust passive and active cooling mechanisms, including advanced heat sinks and sometimes active cooling fans, integrated into the lamp assembly. Furthermore, the convergence of lighting with other safety features is accelerating. This includes the integration of heating elements within the lens assembly for de-icing or de-fogging, critical for maintaining visibility in severe weather conditions, and the incorporation of LiDAR or radar sensors directly into the headlight module, enabling cleaner aesthetic design and better sensor placement for ADAS functions and autonomous driving systems.

Future technology focuses on Vehicle-to-Everything (V2X) communication through lighting, utilizing visible light communication (VLC) or Li-Fi. This technology allows the truck's external lights to transmit data, safety warnings, and logistical information to other vehicles or infrastructure elements, transforming the lighting fixture into a communication interface. Standardization and robust testing against severe vibration and extreme voltage fluctuations inherent to heavy-duty vehicle electrical systems remain key focus areas for R&D. Material science innovations are also vital, particularly in developing lightweight, high-performance lens materials (like advanced polycarbonates) that offer superior scratch resistance and UV stability while contributing to overall vehicle weight reduction, thereby improving fuel efficiency or extending electric range.

Regional Highlights

- North America (United States, Canada, Mexico): North America is characterized by high demand for advanced safety features and premium LED systems, largely driven by strict Federal Motor Vehicle Safety Standards (FMVSS) and the intense competition among Class 8 truck manufacturers. The region shows robust aftermarket demand due to the long operational life and severe operational environments of heavy trucks. Recent regulatory changes, particularly concerning dynamic lighting standards and specific photometric performance requirements, compel rapid technological upgrades. The high concentration of large logistics fleets prioritizing operational efficiency and driver retention further solidifies the demand for high-reliability, low-maintenance lighting solutions.

- Europe (Germany, France, UK, Italy, Spain): Europe is a leader in implementing environmental and energy efficiency regulations (e.g., specific CO2 reduction mandates), which strongly favors the low power draw of LED technology. The region exhibits high adoption rates for sophisticated technologies like Adaptive Driving Beam (ADB), supported by ECE regulations that are often quicker to accommodate innovation than those in North America. Germany, being a central hub for commercial vehicle manufacturing, drives both OEM innovation and high-quality Tier 1 component supply. The focus here is on aesthetic integration, advanced signaling, and minimizing light pollution, alongside core safety compliance.

- Asia Pacific (APAC - China, India, Japan, South Korea): APAC represents the fastest-growing market by volume, fueled by rapid industrialization, infrastructure development, and subsequent surge in heavy-duty truck production and sales, particularly in China and India. While the market remains sensitive to pricing, there is an accelerating transition from conventional lighting to entry-level and mid-range LED systems, driven by increasing government mandates for vehicle safety and fuel efficiency in dense urban areas. Japan and South Korea, however, operate at technological parity with Europe and North America, demanding premium, technologically advanced systems for their export-oriented truck manufacturers. The sheer scale of new vehicle registrations makes this region the primary engine for volume market growth.

- Latin America (LATAM - Brazil, Argentina): The LATAM market is defined by fluctuating economic conditions, high price sensitivity, and a high reliance on aftermarket solutions. While regulatory frameworks are slowly tightening, leading to gradual adoption of basic LED systems in new trucks, the dominant market remains replacement parts, often favoring cost-effective solutions. Brazil, as the largest regional economy and manufacturing hub, dictates regional trends, showing moderate demand for durable, multi-voltage lighting assemblies capable of withstanding varied road and climate conditions.

- Middle East and Africa (MEA): This region is characterized by significant variance in market maturity, driven largely by oil and infrastructure projects (Middle East) and economic development efforts (Africa). Demand is highly concentrated in markets like Saudi Arabia and UAE, where imported trucks or locally assembled vehicles require robust lighting systems capable of handling high temperatures and dust/sand ingress. Growth is tied to new infrastructure spending, favoring ruggedized, simple, and high-intensity LED work lights and main illumination systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Duty Truck Vehicles Lighting Market.- Hella GmbH & Co. KGaA

- OSRAM Continental GmbH

- KOITO MANUFACTURING CO., LTD.

- Stanley Electric Co., Ltd.

- Magneti Marelli S.p.A. (Marelli)

- Federal-Mogul LLC (Tenneco)

- Truck-Lite Co., LLC

- Grote Industries

- Lumileds Holding B.V.

- Samvardhana Motherson Group

- Valeo SA

- ZKW Group GmbH

- Ichikoh Industries, Ltd.

- L.E.D. Automotive Lighting

- TYRI

- Peterson Manufacturing Co.

- Optronics International

- WABCO (ZF Group)

- Continental AG

- WIPAC Group

- Narva GmbH

Frequently Asked Questions

Analyze common user questions about the Heavy Duty Truck Vehicles Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift from Halogen to LED lighting in heavy duty trucks?

The primary driver is the superior operational efficiency and longevity of LEDs. LEDs offer significantly lower power consumption, reducing the alternator load and improving fuel economy or extending battery range in electric trucks. Critically, their long lifespan (often matching the vehicle's life) drastically reduces maintenance costs and fleet downtime, satisfying stricter safety and reliability mandates.

How do global safety regulations impact the design and cost of heavy duty truck lighting systems?

Stricter global safety regulations, such as those governing photometric performance (luminous intensity and beam cut-off), necessitate the use of advanced, precision-engineered components, including complex lens optics and integrated cooling systems for high-output LEDs. This regulatory pressure directly increases the complexity and initial manufacturing cost of modern, compliant lighting assemblies compared to basic components.

What is Adaptive Driving Beam (ADB) technology and why is it important for heavy trucks?

Adaptive Driving Beam (ADB) utilizes sensor input and matrix LED arrays to dynamically shape the light beam in real-time. This is crucial for heavy trucks operating in varied environments, as it maximizes the driver's forward visibility without causing glare to other road users, thereby enhancing night-time safety and reducing driver fatigue, a critical factor for long-haul operations.

What are the main challenges facing the aftermarket segment for truck lighting?

The main challenges in the aftermarket segment include the prevalence of non-compliant and counterfeit lighting products, which compromise safety and performance. Furthermore, the complexity of diagnosing and repairing modern integrated electronic LED modules requires specialized training and equipment, posing a barrier for traditional independent repair shops compared to simple bulb replacement.

Which regional market is expected to show the fastest growth in the heavy duty truck lighting sector?

The Asia Pacific (APAC) region, particularly driven by high volume sales in China and India, is projected to exhibit the fastest growth by volume. This growth is sustained by aggressive infrastructural investment, high rates of new vehicle production, and an accelerating trend towards adopting cost-effective, energy-efficient LED technology across major commercial vehicle fleets for modernization purposes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager