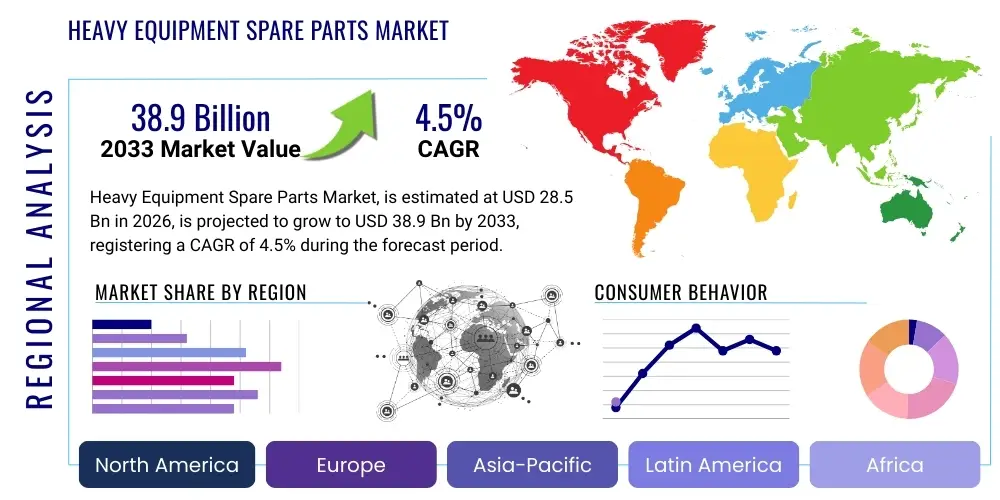

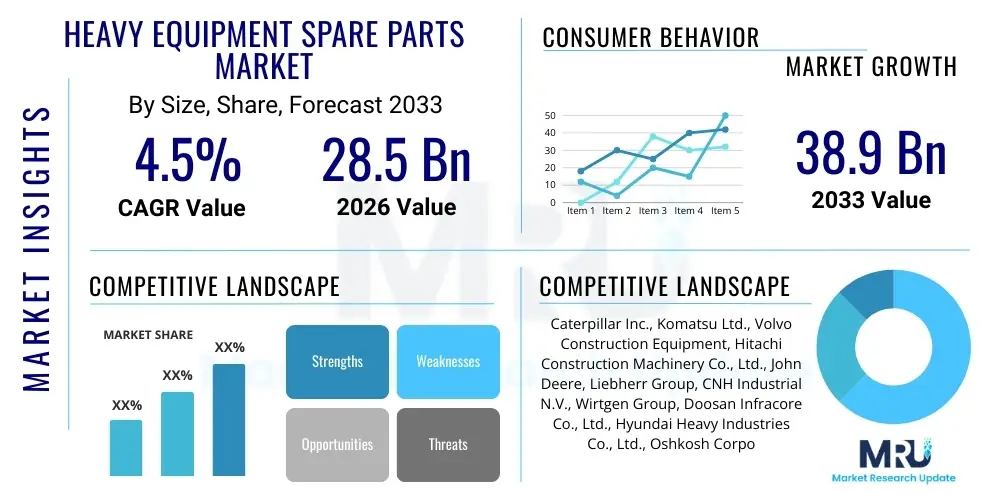

Heavy Equipment Spare Parts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437756 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Heavy Equipment Spare Parts Market Size

The Heavy Equipment Spare Parts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $28.5 Billion in 2026 and is projected to reach $38.9 Billion by the end of the forecast period in 2033.

Heavy Equipment Spare Parts Market introduction

The Heavy Equipment Spare Parts Market encompasses the manufacturing, distribution, and sale of components required for the maintenance, repair, and overhaul (MRO) of large machinery utilized across critical sectors such as construction, mining, agriculture, and material handling. These essential components include engine parts, hydraulic systems, chassis components, electrical parts, and filtration systems, crucial for ensuring operational continuity and optimizing the lifespan of high-value heavy machinery. The market is intrinsically linked to global capital expenditure in infrastructure development and resource extraction, experiencing fluctuating demand cycles correlated with global economic health and government infrastructure spending initiatives. Product performance, durability, and availability are paramount considerations, driving competition between Original Equipment Manufacturers (OEMs) and independent aftermarket suppliers.

Major applications for heavy equipment spare parts center around minimizing downtime and maintaining compliance with stringent operational safety and environmental regulations. In the construction sector, parts for excavators, dozers, and loaders are continuously needed due to high wear rates. Similarly, the mining industry requires robust components for haul trucks and crushing equipment operating under extreme stress. The primary benefits derived from a well-functioning spare parts supply chain include enhanced equipment reliability, optimized fuel efficiency, reduced total cost of ownership (TCO) for fleet operators, and adherence to manufacturer warranty requirements. This necessitates robust inventory management and swift logistical capabilities globally.

The market is primarily driven by accelerating global urbanization, leading to massive government investment in public and commercial infrastructure projects, particularly in emerging economies of Asia Pacific and Latin America. Furthermore, the increasing average age of the existing equipment fleet globally necessitates frequent parts replacement and maintenance activities, substantially boosting aftermarket demand. Technological shifts, such as the integration of telematics and Internet of Things (IoT) sensors into modern machinery, generate demand for specialized electronic components and contribute to optimized maintenance scheduling, further influencing the demand patterns within the spare parts ecosystem. The trend toward remanufacturing and sustainable practices also shapes product offerings and supply chain dynamics.

Heavy Equipment Spare Parts Market Executive Summary

The global Heavy Equipment Spare Parts Market is characterized by robust resilience driven by the foundational needs of infrastructure and resource sectors, exhibiting a structural shift toward digitalization and sustainability. Current business trends indicate a critical focus on strengthening supply chain integrity, mitigating risks associated with geopolitical instability, and addressing the persistent challenge of counterfeit parts, which compromise equipment performance and safety. Major players are investing heavily in predictive maintenance platforms and advanced inventory management systems, leveraging data analytics to forecast demand accurately and minimize inventory carrying costs. The strategic importance of expanding global distribution networks, particularly in underserved regions, remains a key competitive differentiator, alongside the growing emphasis on offering comprehensive service contracts that include guaranteed parts availability and expedited delivery.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China and India, maintains dominance, fueled by unprecedented state-backed investment in large-scale infrastructure and residential development projects. North America and Europe, while mature markets, demonstrate high adoption rates of advanced spare parts technologies, specifically those related to engine efficiency and emission control components, driven by stringent regulatory frameworks. These regions are also leading the transition toward certified remanufactured parts, reflecting a heightened awareness of circular economy principles. Emerging markets in Latin America and the Middle East and Africa (MEA) offer substantial long-term growth potential, contingent upon stabilized commodity prices and sustained investment in mining and oil and gas infrastructure, creating pockets of high demand for heavy-duty components.

Segmentation trends highlight the increasing prominence of hydraulic parts and advanced filtration systems due to the complexity and precision required by modern, sophisticated machinery. The sourcing segment is witnessing intense competition, with the independent aftermarket (IAM) gaining traction by offering cost-competitive solutions, pressuring OEM pricing structures. However, OEMs maintain a strong position in critical components (e.g., electronic control units and proprietary engine parts) due to warranty requirements and perceived quality assurance. Application-wise, the construction sector consistently remains the largest consumer segment, although the mining sector often dictates demand for the largest, highest-stress-tolerance components. This segmented demand profile necessitates tailored distribution strategies and product differentiation across various end-use applications to capture maximum market share.

AI Impact Analysis on Heavy Equipment Spare Parts Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the Heavy Equipment Spare Parts Market, addressing common user questions centered around predictive failure, optimal inventory levels, and automated procurement. Users frequently inquire about the reliability of AI-driven diagnostic tools, the feasibility of reducing unexpected downtime through pattern recognition, and the return on investment (ROI) associated with implementing sophisticated supply chain optimization algorithms. The core expectation is that AI will shift the industry paradigm from reactive maintenance to proactive planning, requiring parts only precisely when and where they are needed. Concerns often revolve around the initial capital expenditure for sensor retrofitting, data security protocols, and the need for a highly skilled workforce capable of managing and interpreting complex machine-generated data streams derived from telematics units integrated into heavy equipment fleets globally.

- AI enables highly accurate Predictive Maintenance (PdM), drastically reducing unplanned equipment downtime by forecasting component failure probabilities based on operational data.

- Optimization of spare parts inventory levels through ML algorithms, leading to reduced warehousing costs and decreased obsolescence risk across global distribution centers.

- Automated spare parts procurement and dynamic pricing models based on real-time fleet utilization and historical failure rates.

- Enhanced quality control during the manufacturing process using computer vision and AI-driven defect detection systems for new and remanufactured components.

- Personalized maintenance schedules and recommended parts lists delivered via AI-powered platforms, improving service efficiency and customer satisfaction.

- Improved supply chain transparency and resilience by analyzing external factors (weather, geopolitical events) to reroute parts shipments proactively.

DRO & Impact Forces Of Heavy Equipment Spare Parts Market

The Heavy Equipment Spare Parts Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its growth trajectory and competitive landscape. Key drivers include aggressive global government spending on critical infrastructure (roads, bridges, energy projects), particularly in developing economies, which directly correlates to increased usage and resultant wear-and-tear of construction and mining machinery. Furthermore, the global trend toward sophisticated, high-performance machinery, requiring specialized and often proprietary replacement components, contributes significantly to market value. The underlying force impacting the market remains the imperative to maximize asset utilization, making the speedy and reliable availability of spare parts a non-negotiable factor for end-users, thereby continuously driving demand for robust supply chain solutions and competitive parts sourcing strategies.

Conversely, significant restraints impede exponential market growth. The proliferation of low-quality, often unsafe counterfeit parts poses a substantial risk to both equipment integrity and worker safety, eroding legitimate manufacturer profitability and complicating warranty claims. Additionally, the inherent volatility in global commodity prices (steel, aluminum, rubber) directly impacts manufacturing costs for spare parts, leading to fluctuating end-user pricing and inventory valuation challenges. Geopolitical tensions and trade barriers further complicate the global logistics of moving large, often heavy components, contributing to supply chain delays. The requirement for specialized expertise in the repair and maintenance of complex electronic components is also a growing bottleneck, particularly in regions facing skilled labor shortages in the heavy equipment repair field.

Opportunities for expansion are abundant, primarily centered around technological adoption and sustainability initiatives. The widespread integration of IoT and telematics provides an immense opportunity for parts manufacturers and distributors to offer subscription-based, predictive parts services, creating steady revenue streams. The growing global emphasis on the circular economy and environmental sustainability is accelerating the acceptance and demand for certified remanufactured and rebuilt components, offering a cost-effective and environmentally conscious alternative to new parts. Furthermore, advancements in additive manufacturing (3D printing) present a disruptive opportunity for localized, on-demand production of specific, high-cost spare parts, particularly in remote mining or construction sites, significantly reducing logistical lead times and dependency on centralized inventory hubs.

Segmentation Analysis

The Heavy Equipment Spare Parts Market is meticulously segmented based on component type, application, and sourcing channel, reflecting the diverse operational environments and procurement strategies of end-users. This granular segmentation allows manufacturers and distributors to tailor their product portfolios and go-to-market strategies effectively. The analysis reveals distinct demand elasticity across segments, with highly critical components, such as engine parts and transmission components, exhibiting inelastic demand regardless of economic cycles, driven by the absolute necessity of maintaining operational status. Conversely, demand for less critical, easily replaceable consumables often demonstrates higher price sensitivity, especially within the independent aftermarket channel.

By component type, the market is categorized into hydraulics, undercarriage, engine, and structural components. Hydraulic systems components—including pumps, valves, and cylinders—are crucial for nearly all modern heavy equipment, driving significant replacement demand due to operational stress. In terms of application, the construction sector consistently holds the largest share due to the sheer volume and diversity of machinery deployed globally, followed closely by the mining and material handling sectors, which demand components designed for extreme durability and load-bearing capacity in harsh environments.

The sourcing segmentation—OEM versus Aftermarket—is fundamental to market dynamics. While OEMs control the initial supply and benefit from warranty requirements, the independent aftermarket (IAM) provides intense price competition, often specializing in high-wear components and offering flexibility in parts specification and brand choice. The growing trend of certified remanufactured parts, offered by both OEMs and large aftermarket firms, creates a profitable middle ground, balancing cost efficiency with quality assurance, thereby complicating the traditional OEM-versus-IAM competitive landscape and demanding sophisticated inventory forecasting models.

- By Component Type

- Engine Components (Filters, Pistons, Cylinders, Turbochargers)

- Hydraulic Components (Pumps, Valves, Hoses, Cylinders)

- Undercarriage Components (Tracks, Rollers, Idlers, Sprockets)

- Transmission and Drive Train Parts

- Chassis and Body Components

- Electrical and Electronic Components (Sensors, ECUs)

- By Sourcing Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Suppliers)

- Remanufactured Parts

- By Equipment Type

- Excavators and Loaders

- Dozers and Graders

- Cranes

- Mining Haul Trucks

- Material Handling Equipment (Forklifts)

- Agricultural Tractors and Harvesters

- By Application

- Construction

- Mining

- Agriculture and Forestry

- Material Handling

Value Chain Analysis For Heavy Equipment Spare Parts Market

The value chain of the Heavy Equipment Spare Parts Market is characterized by high complexity, spanning from raw material extraction to final installation. Upstream activities involve the meticulous sourcing of high-grade raw materials, primarily specialized steel alloys, cast iron, and complex polymers, demanding stringent quality checks and long-term contracts with global metal suppliers. The manufacturing stage is bifurcated, involving both high-volume standardized production by Tier 1 suppliers and specialized, low-volume, high-precision manufacturing conducted by OEMs for proprietary parts. Effective upstream management requires managing price volatility in commodities and ensuring compliance with international material specifications to guarantee the durability required for heavy equipment applications under extreme stress conditions.

Downstream analysis focuses heavily on efficient inventory management and sophisticated logistical networks. The primary distribution channels are multifaceted: direct sales from OEMs to large fleet owners, distribution through authorized dealer networks, and sales through independent aftermarket wholesalers and retailers. Direct sales offer maximum control and service integration but require significant investment in regional parts depots. Authorized dealers manage regional inventory and provide installation and service support, acting as a crucial interface between the manufacturer and the end-user. The indirect distribution channel, comprising independent third-party retailers, focuses on high-turnover, general-purpose components, often leveraging e-commerce platforms for wider geographical reach and price transparency, thereby increasing competitive pressure across the entire downstream network.

The complexity of parts (thousands of SKUs per equipment type) necessitates highly efficient warehousing and logistics. Direct channels allow OEMs to offer integrated, warranty-backed services, positioning them as providers of 'uptime' rather than just components. Indirect channels thrive on speed and cost advantage, especially for older equipment fleets outside warranty periods. The current trend involves utilizing sophisticated supply chain software and integrating blockchain technology to improve traceability and authenticate parts, directly addressing the endemic issue of counterfeit components and safeguarding the integrity of the supply chain, which is critical for maintaining equipment safety and performance standards globally.

Heavy Equipment Spare Parts Market Potential Customers

The potential customers for the Heavy Equipment Spare Parts Market are diverse, ranging from large multinational corporations managing extensive fleets to small, independent contractors and repair shops. The primary end-users are large construction conglomerates engaged in mega-infrastructure projects (e.g., high-speed rail, massive dam construction, or urban development), who prioritize parts availability and quality assurance to minimize costly project delays. These buyers typically enter into long-term service agreements (LSAs) with OEMs, ensuring prompt delivery of proprietary components and certified technical support, often dictating high service level agreements (SLAs) that the supply chain must uphold rigorously.

Another crucial customer segment includes global mining companies and quarry operators. Operating in geographically remote and harsh environments, these entities require highly specialized, heavy-duty components (e.g., massive tires, powerful engine components, robust filtration systems) that can withstand continuous, high-stress operation. For these users, the reliability of the part is paramount, and procurement decisions are often heavily influenced by mean time between failures (MTBF) statistics and the manufacturer's proven track record in extreme operating conditions. Due to the difficulty in logistics to remote sites, these customers often maintain large, decentralized inventories, leading to high-volume purchasing.

Furthermore, equipment rental companies represent a rapidly growing segment. These businesses continuously refresh and maintain a diverse fleet of equipment to be rented out, making them high-volume buyers of replacement parts, focusing primarily on maintenance consumables and components prone to high wear-and-tear (e.g., ground engaging tools, hydraulic hoses). Their buying behavior balances cost-effectiveness with guaranteed operational reliability, driving demand equally for certified remanufactured parts and high-quality, cost-competitive independent aftermarket components. Independent repair garages and small fleet owners constitute the long tail of the market, primarily sourcing through indirect channels based on price sensitivity and immediate availability for routine repairs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $28.5 Billion |

| Market Forecast in 2033 | $38.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., John Deere, Liebherr Group, CNH Industrial N.V., Wirtgen Group, Doosan Infracore Co., Ltd., Hyundai Heavy Industries Co., Ltd., Oshkosh Corporation, Sany Heavy Industry Co., Ltd., Zoomlion Heavy Industry Science and Technology Co., Ltd., Kubota Corporation, FleetPride, Inc., Daimler AG (Truck & Bus Division), ZF Friedrichshafen AG, Eaton Corporation, Cummins Inc., Parker Hannifin Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Equipment Spare Parts Market Key Technology Landscape

The technological landscape of the Heavy Equipment Spare Parts Market is rapidly evolving, driven by the dual needs of efficiency in operations and integrity in the supply chain. Telematics and IoT integration stand at the forefront, providing continuous, real-time data on equipment performance metrics such as temperature, pressure, vibration, and hours of use. This continuous data stream is the bedrock for successful predictive maintenance programs, allowing end-users to transition from scheduled, time-based parts replacement to condition-based replacement, thus maximizing component lifespan and significantly reducing unnecessary inventory holdings. The sophistication of these sensor systems increasingly demands specialized electronic spare parts, creating a new high-value component segment within the market that requires advanced diagnostic tools for servicing.

Additive manufacturing, commonly known as 3D printing, is a transformative technology primarily utilized for small-volume, high-complexity, or highly customized parts. While mass production of structural components remains dominated by traditional casting and machining, 3D printing offers an unparalleled opportunity for on-site or regional production of critical, low-volume plastic or metallic parts, drastically cutting lead times and shipping costs for remote projects. This decentralization of manufacturing capacity acts as a powerful hedge against traditional supply chain disruptions. Furthermore, digital twinning technology, creating virtual replicas of physical assets, allows for simulated wear-and-tear analysis, enabling manufacturers to optimize parts design and improve material performance before physical prototyping, accelerating the new product introduction (NPI) cycle.

The integrity of the supply chain is being fortified through the adoption of secure digital technologies, notably blockchain. Implementing blockchain provides an immutable, transparent ledger for tracking the provenance of spare parts from the raw material supplier through to the end-user, certifying authenticity and mitigating the widespread risk posed by counterfeit components. This technological verification is crucial for high-value components where failure could result in catastrophic consequences. Additionally, advanced robotics and automation are being integrated into warehousing and distribution centers to improve picking accuracy and speed, ensuring that expedited delivery requests for mission-critical parts can be met efficiently across complex global logistics networks, further solidifying the link between technological investment and operational reliability.

Regional Highlights

The geographical distribution of the Heavy Equipment Spare Parts Market reflects the uneven pattern of global infrastructure and resource extraction activities, with each region presenting unique demand characteristics and regulatory pressures. Asia Pacific (APAC) dominates the market share, driven primarily by continuous, large-scale investments in national infrastructure development, urbanization projects in China, India, and Southeast Asia, and robust mining activity in Australia. The region's vast existing fleet of heavy equipment and relatively relaxed environmental standards compared to Western economies mean that maintenance and replacement demand remains consistently high, favoring both low-cost aftermarket solutions and high-volume procurement.

North America (NA) represents a mature, high-value market characterized by high technology adoption and a strong focus on asset efficiency. Demand here is increasingly driven by components compatible with telematics and advanced emissions reduction standards (Tier 4 Final/Stage V compliance), favoring OEMs and certified suppliers capable of delivering technologically advanced and proprietary electronic and engine parts. The widespread use of equipment rental fleets also creates a stable, consistent demand for standardized maintenance components, supported by highly sophisticated just-in-time logistics systems designed to minimize equipment idle time.

Europe, similar to North America, is heavily regulated, leading to intense demand for parts that enhance fuel economy and meet the European Union's stringent environmental mandates. A key characteristic of the European market is the significant adoption of remanufactured components, encouraged by strong sustainability policies and favorable economic structures promoting the circular economy. The competitive landscape in Europe is fierce, focusing on quick service response times and the quality assurance associated with certified parts distribution networks. Meanwhile, Latin America and the Middle East and Africa (MEA) offer high potential, dependent on fluctuating commodity prices driving mining and oil & gas investments. These regions prioritize basic reliability and cost-effectiveness, often relying on multi-brand independent aftermarket suppliers for rapid, cost-optimized repairs.

- Asia Pacific (APAC): Highest growth region fueled by massive government infrastructure expenditure, including China's Belt and Road Initiative and India's urban development programs. Characterized by high volume demand for construction machinery parts and increasingly adopting local manufacturing capabilities.

- North America (NA): Mature market defined by high technology integration (telematics, AI diagnostics) and stringent emissions compliance, driving demand for specialized engine and electronic spare parts. Strong presence of equipment rental companies ensuring steady aftermarket activity.

- Europe: Focus on sustainability, resulting in high uptake of certified remanufactured parts and components designed for optimizing fuel efficiency and meeting EU Stage V emission standards. Highly fragmented market requiring localized distribution expertise.

- Latin America (LATAM): Growth tied heavily to the extractive industries (mining and agriculture). Demand is sensitive to commodity price cycles, focusing on durable, cost-effective replacement components for large-scale earthmoving machinery.

- Middle East and Africa (MEA): Varied market driven by oil & gas projects and infrastructure investment in the Gulf region. Logistical complexity is high, favoring localized inventory and robust, high-temperature-tolerant components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Equipment Spare Parts Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery Co., Ltd.

- John Deere (Deere & Company)

- Liebherr Group

- CNH Industrial N.V.

- Wirtgen Group (John Deere subsidiary)

- Doosan Infracore Co., Ltd. (now Hyundai Doosan Infracore)

- Hyundai Heavy Industries Co., Ltd.

- Sany Heavy Industry Co., Ltd.

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Kubota Corporation

- FleetPride, Inc.

- Daimler AG (Truck & Bus Division components)

- ZF Friedrichshafen AG

- Eaton Corporation

- Cummins Inc.

- Parker Hannifin Corporation

- Dana Incorporated

Frequently Asked Questions

Analyze common user questions about the Heavy Equipment Spare Parts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for heavy equipment spare parts?

The primary factor is aggressive global infrastructure investment, particularly in developing economies, which increases the utilization and operational lifespan of heavy machinery, necessitating frequent maintenance and replacement of high-wear components like hydraulic systems and undercarriage parts. The aging global fleet of heavy equipment also contributes significantly to sustained aftermarket demand.

How is predictive maintenance influencing spare parts inventory management?

Predictive Maintenance (PdM), powered by AI and telematics data, fundamentally shifts inventory from reactive stocking to proactive, condition-based ordering. This allows fleet operators and distributors to significantly reduce inventory carrying costs and minimize the risk of obsolescence by stocking critical parts precisely when failure is anticipated, maximizing asset uptime.

What are the key differences between OEM and Aftermarket parts sourcing?

OEM parts offer guaranteed compatibility, typically come with warranty coverage, and are crucial for proprietary systems (e.g., electronic control units). Aftermarket parts, conversely, are generally more cost-competitive, offer wider availability, and are often preferred for standard high-wear components, especially for equipment outside the manufacturer's warranty period, though quality assurance varies widely.

Which geographical region holds the largest market share for heavy equipment spare parts?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to high population density, rapid urbanization, and sustained, large-scale governmental investment in construction, mining, and transportation infrastructure, particularly in major markets like China and India.

What role does 3D printing play in the heavy equipment spare parts supply chain?

3D printing enables decentralized, on-demand manufacturing of specialized, low-volume, or obsolete components, particularly beneficial for remote operational sites. It reduces dependency on centralized global logistics, cuts down lead times for critical repairs, and offers flexibility in prototyping custom replacement solutions, thereby enhancing supply chain resilience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager