Heavy Payload Cobots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435690 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Heavy Payload Cobots Market Size

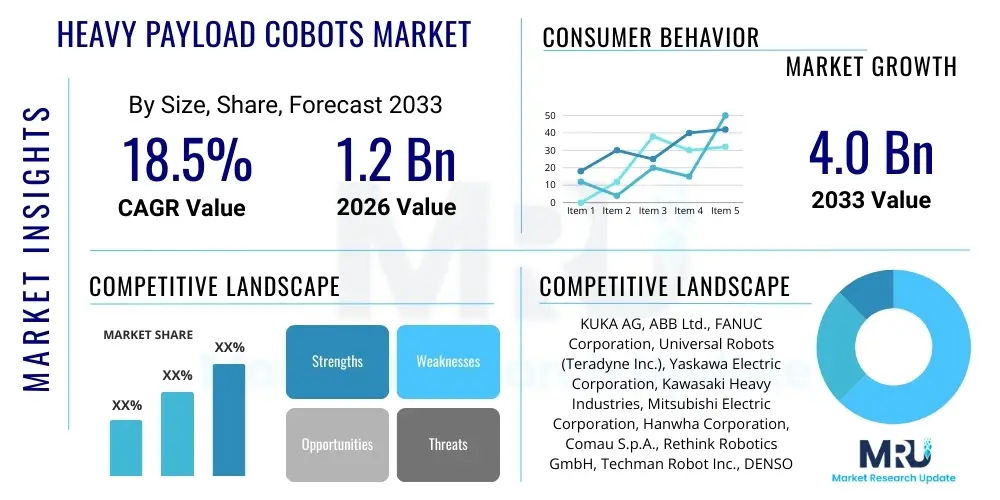

The Heavy Payload Cobots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Heavy Payload Cobots Market introduction

The Heavy Payload Cobots Market encompasses collaborative robotic systems designed specifically to handle substantial weights, generally defined as payloads exceeding 10 kilograms, and extending up to 500 kilograms in advanced industrial applications. These systems retain the core collaborative functionalities—such as integrated safety sensors, speed and force monitoring, and intuitive programming—allowing them to operate alongside human workers without extensive safety caging. The development of heavier payload cobots addresses a critical gap in industrial automation, bridging the flexibility of traditional cobots with the muscle of heavy-duty industrial robots. This technological convergence enables manufacturers, particularly in automotive, aerospace, heavy machinery, and logistics sectors, to automate complex and strenuous tasks previously considered too heavy or hazardous for human workers or too rigid for standard payload cobots.

Product descriptions typically highlight features such as enhanced joint stiffness, higher torque motors, advanced integrated vision systems for precise heavy component handling, and sophisticated safety protocols (e.g., ISO 10218-1 compliance). Major applications for heavy payload cobots include large-scale assembly operations, especially bolting and welding of heavy components in vehicle manufacturing; high-speed palletizing and depalletizing of bulk goods in logistics and warehousing; machine tending for large CNC machinery; and precise material removal in foundry and fabrication shops. These applications often require not only high lifting capacity but also high repeatability and long reach, characteristics increasingly integrated into modern heavy-duty collaborative designs.

The primary benefits driving the market include significant improvements in worker ergonomics by eliminating strenuous manual lifting and repetitive tasks, leading to reduced workplace injuries and associated costs. Furthermore, these cobots enable higher operational throughput and consistency, operating 24/7 with minimal variation, which is crucial for quality control in high-stakes manufacturing environments. Key driving factors accelerating adoption include persistent global labor shortages in manufacturing, the increasing cost of manual labor, stricter safety regulations compelling automation of hazardous tasks, and continuous advancements in sensor technology and robotic materials that enhance both payload capacity and collaborative safety features simultaneously.

Heavy Payload Cobots Market Executive Summary

The Heavy Payload Cobots market is experiencing robust growth driven by the pervasive need for scalable automation solutions that maintain operational flexibility. Business trends indicate a strong move toward hybrid manufacturing ecosystems where traditional high-speed industrial robots and flexible collaborative robots coexist. Major manufacturers are focusing their R&D efforts on developing modular robotic arms, enabling end-users to scale payload capacity based on application needs without complete system overhaul. Furthermore, there is a distinct trend towards subscription-based Robot-as-a-Service (RaaS) models for heavy payload cobots, lowering the substantial initial capital expenditure hurdle for small and medium-sized enterprises (SMEs) looking to automate heavy handling tasks. Partnerships between cobot manufacturers and specialized gripping/end-effector providers are crucial for optimizing performance in specific heavy-duty applications like spot welding or large material handling.

Regional trends demonstrate Asia Pacific (APAC) as the leading growth region, fueled by massive investments in automotive production, electronics assembly, and general manufacturing capacity expansion in countries like China, South Korea, and Japan. North America and Europe, characterized by high labor costs and rigorous safety standards, exhibit strong demand for heavy payload cobots, particularly in aerospace and logistics, where automation provides immediate return on investment through efficiency gains and injury reduction. Regulatory frameworks in these developed regions often mandate the automation of ergonomic risks, accelerating the adoption curve for collaborative solutions capable of handling heavier loads safely alongside humans. The Middle East and Africa (MEA) and Latin America are nascent markets, showing gradual adoption primarily within oil and gas component manufacturing and infrastructure construction sectors, recognizing the long-term benefits of enhanced productivity and safety.

Segmentation trends highlight the increasing demand for cobots categorized in the 20-50 kg payload segment, deemed the "sweet spot" for many assembly, machine tending, and medium-scale palletizing applications. The 50 kg and above segment, though smaller in volume, is growing rapidly due to specialized applications in aerospace component handling and heavy machinery assembly, requiring maximum strength. Furthermore, the segmentation by end-use industry shows that automotive and metals & machinery remain the dominant consumers, but logistics and warehousing are emerging as the fastest-growing segments, driven by the e-commerce boom and the subsequent need for automated heavy pallet handling and sortation systems. Software advancements focused on intuitive, drag-and-drop programming for complex path planning are becoming crucial differentiators for manufacturers in all segments.

AI Impact Analysis on Heavy Payload Cobots Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Heavy Payload Cobots Market often revolve around safety enhancements, adaptability to unstructured environments, and the ability to handle variability in heavy components. Key concerns focus on how AI can ensure collaborative safety when handling loads of 50 kg or more, preventing high-impact collisions, and enabling complex decision-making processes such as optimal path planning under dynamic loads. Users also frequently ask about the role of machine learning (ML) in predictive maintenance for high-stress components, crucial for reducing downtime in heavy-duty applications. The underlying expectation is that AI will transform these powerful systems from pre-programmed tools into highly adaptable, context-aware collaborators, maximizing both efficiency and safety in shared workspaces.

AI's primary influence centers on enhancing the cognitive capabilities of heavy payload cobots. Advanced AI algorithms facilitate real-time safety envelope calculation, adjusting speed and trajectory instantaneously based on human proximity and movement prediction, significantly improving collaborative trust, especially when maneuvering heavy items. Furthermore, deep learning models applied to computer vision allow cobots to identify, locate, and precisely manipulate heavy components that may vary slightly in size, orientation, or presentation (e.g., bins of randomly oriented metal parts), moving beyond rigid pick-and-place tasks into truly flexible assembly operations. This transition minimizes the need for high-precision fixturing, offering unprecedented flexibility in heavy manufacturing environments and making complex, low-volume production economically viable.

- AI-Powered Real-Time Collision Avoidance: Enhancing safety protocols by calculating instantaneous trajectories for heavy loads based on dynamic human presence.

- Predictive Maintenance via Machine Learning: Analyzing sensor data (torque, temperature, vibration) to forecast component failure in high-stress joints and motors, minimizing costly downtime.

- Advanced Vision Systems and Object Recognition: Using Deep Learning to accurately locate and grasp heavy, randomly presented components, crucial for machine tending and bin picking.

- Optimized Heavy Load Path Planning: AI algorithms dynamically calculate the most efficient and safest motion paths, especially important when dealing with varying inertia and weight distribution.

- Cognitive Task Reprogramming: Enabling cobots to learn new handling tasks from human demonstration or simulation, reducing programming time for new heavy-duty applications.

DRO & Impact Forces Of Heavy Payload Cobots Market

The Heavy Payload Cobots market is significantly shaped by a confluence of driving forces, inherent restraints, and burgeoning opportunities, all interacting to define the pace and direction of market growth. Key drivers include the overwhelming economic necessity for automation in high-wage economies to maintain competitive pricing, coupled with the global push towards safer working environments that necessitate the removal of human labor from repetitive, strenuous, and ergonomically challenging heavy lifting tasks. Opportunities are primarily centered around the development of specialized end-effectors for highly specific heavy-duty processes, such as friction stir welding or large part inspection, and the expansion into non-traditional sectors like construction materials handling and specialized agricultural automation. Impact forces dictate that technology standardization (e.g., communication protocols) and continuous improvement in safety sensor reliability are non-negotiable for sustained market adoption.

Major restraints temper the market’s explosive growth potential, predominantly revolving around the high initial capital investment required for these robust systems, which often includes extensive integration costs for heavy-duty tooling and custom fixturing. Furthermore, the inherent trade-off between payload capacity and operational speed often limits throughput compared to traditional high-speed industrial robots operating behind safety fences, requiring careful economic justification by end-users. The scarcity of personnel trained in programming, integrating, and maintaining these specialized heavy-duty collaborative systems also acts as a critical bottleneck, particularly in emerging industrial regions. Addressing these restraints requires manufacturers to develop highly intuitive software interfaces and invest heavily in global technical training programs.

Opportunities for market expansion are abundant, particularly in leveraging the modularity of heavy payload systems to address customized batch production—a rapidly growing manufacturing trend. The development of next-generation tactile and force sensing technologies will further enhance the ability of these cobots to handle fragile, yet heavy, materials with dexterity, unlocking potential in sectors like precision glass manufacturing. The increasing adoption of 5G and industrial IoT (IIoT) infrastructure provides an opportunity for enhanced remote monitoring and predictive maintenance for these critical, high-value assets, ensuring maximum uptime. These impact forces—driven by technological breakthroughs and industrial digitization—are propelling heavy cobots from niche applications into mainstream heavy manufacturing and logistics operations globally.

Segmentation Analysis

The Heavy Payload Cobots Market is segmented based on critical technical specifications such as payload capacity, end-use application, and component type, providing a detailed map of industry dynamics and specialized demand pockets. Payload segmentation is arguably the most defining factor, directly correlating with the complexity and type of task the cobot can perform, ranging from medium-heavy assembly to extremely heavy palletizing and machine tending. Understanding these segments helps manufacturers tailor arm geometry, motor torque, and safety mechanisms to specific industry requirements. This structured analysis reveals that while high-capacity models (over 50 kg) command higher prices and cater to specific high-inertia applications, the mid-range heavy payload models (10 kg to 50 kg) represent the largest volume segment due to their versatility across multiple manufacturing operations.

Segmentation by end-use industry highlights the uneven distribution of demand, with capital-intensive sectors like Automotive and Metals & Machinery being the foundational adopters due to their necessity for handling large components (e.g., engine blocks, chassis components). However, the fastest evolution is observed in the Logistics & Warehousing segment, where heavy payload cobots are essential for automating high-volume, repetitive palletizing and depalletizing tasks in highly constrained environments. Component segmentation provides insight into the technological landscape, indicating high investment in specialized robotic arms capable of supporting the leverage and stress of heavy loads, and advanced control systems required for maintaining precision and safety during high-mass maneuvers.

- By Payload Capacity:

- 10 kg to 20 kg

- 20 kg to 50 kg (Dominant Segment)

- 50 kg to 100 kg

- Above 100 kg

- By Component:

- Robotic Arm/Manipulator (Core Segment)

- End-Effectors/Grippers (Heavy-Duty Tooling)

- Controllers and Software

- Sensors and Vision Systems (Force and Torque Sensors)

- By Application:

- Material Handling and Palletizing

- Machine Tending (Heavy CNC)

- Assembly (Large Components)

- Welding and Fabrication (Heavy Spot Welding)

- Inspection and Quality Control

- By End-Use Industry:

- Automotive

- Metals and Machinery

- Logistics and Warehousing

- Aerospace and Defense

- Electronics and Semiconductor (Specialized Heavy Handling)

- Pharmaceuticals and Chemicals

Value Chain Analysis For Heavy Payload Cobots Market

The value chain for the Heavy Payload Cobots Market begins with upstream activities focused on the procurement and manufacturing of specialized high-strength materials and precision components. This stage involves the sourcing of advanced composite materials for lightweight yet rigid robotic arms, high-torque brushless DC motors, sophisticated servo drives, and high-resolution force/torque sensors critical for safety and precision under heavy load. Key upstream suppliers include component manufacturers specializing in high-load harmonic drive gears, ensuring zero backlash and high repeatability under stress, and advanced semiconductor companies providing the processing power necessary for real-time safety calculations. Quality control and rigorous stress testing are paramount at this stage, as component failure in a heavy payload cobot poses significant safety risks.

The midstream segment involves the core manufacturing and integration process, where Original Equipment Manufacturers (OEMs) design, assemble, and program the collaborative robots. This stage includes complex software development focusing on intuitive user interfaces (UI) and advanced motion planning algorithms optimized for heavy inertia. Distribution channels play a vital role, often utilizing a mix of direct sales teams for large strategic accounts (such as major automotive OEMs) and indirect channels comprising authorized system integrators (SIs) and value-added resellers (VARs). System integrators are crucial in this market because heavy payload applications usually require highly customized end-of-arm tooling (EOAT), dedicated safety assessments, and integration with existing factory machinery (e.g., conveyors, CNC machines).

Downstream activities center on deployment, maintenance, and ongoing support for the end-users. Direct distribution provides manufacturers with immediate feedback on performance and usage patterns, driving future product iterations, while indirect channels leverage localized expertise for swift installation and troubleshooting. The relationship with system integrators is particularly critical for maximizing customer adoption, as they bridge the gap between complex robotic technology and specific factory floor requirements. Successful market penetration relies heavily on the quality and responsiveness of technical support and the availability of specialized training programs for client personnel to operate and maintain these high-value, heavy-duty assets effectively.

Heavy Payload Cobots Market Potential Customers

The primary end-users and buyers of Heavy Payload Cobots are characterized by industrial operations that involve the repetitive lifting, manipulation, or processing of items exceeding the safe or practical limits of human workers or standard light-payload cobots. The quintessential buyer operates within environments requiring high throughput, stringent quality control, and an increasing focus on improving worker ergonomics and minimizing liability related to musculoskeletal injuries. These customers are typically large-scale manufacturers, logistics providers, and heavy engineering firms who possess the capital expenditure capability and infrastructure necessary to support sophisticated robotic deployments, seeking immediate efficiency gains and long-term operating cost reductions through automation.

Major consumers are concentrated in industries where component size and weight are inherent factors of production. Automotive manufacturers utilize these cobots extensively for engine assembly, chassis component handling, tire and wheel mounting, and particularly heavy spot welding operations on vehicle bodies. The Metals and Machinery sector employs them for machine tending of large-scale casting and forging machinery, handling heavy raw materials, and precise component assembly. Furthermore, the burgeoning demand from the Aerospace and Defense industry focuses on utilizing heavy payload cobots for handling large, sensitive composite structures and performing complex, high-force operations like riveting or drilling on fuselages and wing components.

Beyond traditional manufacturing, logistics and warehousing represent a rapidly growing customer base. E-commerce expansion necessitates automated solutions for handling extremely heavy pallets, bulk containers, and specialized freight, tasks for which heavy payload cobots excel in terms of speed, endurance, and safety in mixed human-robot environments. These potential customers prioritize systems with long reach, high payload-to-weight ratios, and easy integration with Warehouse Management Systems (WMS). The decision to purchase often hinges on the total cost of ownership (TCO) calculation, factoring in reduced insurance liabilities, fewer worker compensation claims, and substantial operational efficiencies compared to manual or purely industrial automation setups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KUKA AG, ABB Ltd., FANUC Corporation, Universal Robots (Teradyne Inc.), Yaskawa Electric Corporation, Kawasaki Heavy Industries, Mitsubishi Electric Corporation, Hanwha Corporation, Comau S.p.A., Rethink Robotics GmbH, Techman Robot Inc., DENSO Corporation, NACHI-FUJIKOSHI CORP., Staubli International AG, F&P Robotics AG, Franka Emika GmbH, AUBO Robotics, MABI Robotic AG, Doosan Robotics, Hyundai Robotics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Payload Cobots Market Key Technology Landscape

The technological landscape of the Heavy Payload Cobots Market is defined by innovations aimed at balancing immense power with certified safety, addressing the inherent challenges of collaboration when manipulating high inertia masses. A critical development is the sophistication of integrated force-torque sensing systems embedded within the robotic joints and wrist. These high-precision sensors allow the cobot controller to react instantaneously to unexpected external forces or contact with human operators, enabling rapid and safe deceleration in compliance with ISO 15066 standards, even while carrying significant weights. Furthermore, manufacturers are increasingly utilizing advanced material science, employing carbon fiber composites and lightweight alloys to construct robust yet lighter robotic arms, thereby maximizing the payload-to-robot weight ratio and improving energy efficiency.

Another major technological pillar involves enhanced software and control architectures. Modern heavy payload cobots utilize advanced kinematic modeling and high-speed processors to perform complex trajectory planning and dynamic payload compensation in real-time. This compensation is crucial for maintaining repeatability and precision when the cobot handles varying loads or operates at high speeds. User-friendliness is being prioritized through graphical, flow-chart-based, or tablet-based programming interfaces, simplifying the deployment process for complex, heavy-duty tasks that previously required specialized robot programmers. The integration of 3D vision systems paired with machine learning algorithms is standard, allowing for adaptive handling of large components whose exact placement may vary on the production line.

Connectivity and digital integration form the third core area of innovation. Heavy payload cobots are increasingly equipped with Industrial Internet of Things (IIoT) capabilities, enabling seamless integration with factory MES (Manufacturing Execution Systems) and ERP (Enterprise Resource Planning) systems. This allows for real-time performance monitoring, remote diagnostics, and predictive maintenance schedules for high-stress components like gearboxes and motor windings. Furthermore, the adoption of open-source or highly standardized communication protocols (such as OPC UA or ROS-Industrial) facilitates easier deployment of customized third-party end-effectors and integration into heterogeneous manufacturing environments, crucial for handling the diverse range of heavy tooling required across different industries.

Regional Highlights

Regional dynamics heavily influence the adoption and growth rate of the Heavy Payload Cobots Market, driven by localized industrial maturity, labor economics, and regulatory environments. Asia Pacific (APAC) holds the largest market share and is expected to exhibit the fastest growth throughout the forecast period. This dominance is primarily attributed to the high concentration of automotive, consumer electronics, and general manufacturing industries in China, Japan, and South Korea, coupled with significant governmental investment in industrial automation initiatives (e.g., "Made in China 2025"). The immense scale of production in these countries makes the efficiency gains provided by heavy payload cobots—particularly in high-volume palletizing and component assembly—economically irresistible, despite varying wage levels compared to Western markets.

North America, particularly the United States, represents a highly sophisticated market characterized by early adoption and high value applications in aerospace, defense, and high-tech logistics. The driving factor here is not only efficiency but the critical need to address escalating labor costs and severe skills shortages in precision manufacturing sectors. European countries, led by Germany and Italy, demonstrate robust demand, propelled by strict occupational health and safety regulations (which mandate automation of heavy, repetitive tasks) and a strong foundation of advanced machinery production. European companies are often early adopters of high-payload, high-precision collaborative systems for specialized assembly and welding applications in niche manufacturing, focusing heavily on safety certifications and interoperability.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets, currently focused on implementing heavy payload cobots primarily in resource extraction industries (oil and gas component handling) and large infrastructure projects. While adoption rates are slower due to economic volatility and lower average industrial automation maturity, long-term growth is projected, fueled by infrastructure development projects and diversification away from reliance solely on raw materials. These regions present an opportunity for RaaS models to gain traction, mitigating the high initial investment required, thereby democratizing access to heavy automation technologies in developing industrial bases.

- Asia Pacific (APAC): Largest market share, driven by mass manufacturing (Automotive, Electronics) in China and Japan, focusing on high throughput and scale.

- North America: Strong demand in high-value, high-precision sectors like Aerospace and advanced Logistics, motivated by high labor costs and efficiency.

- Europe: High adoption driven by stringent safety regulations and strong capital investment in specialized machinery, led by Germany and Scandinavia.

- Latin America (LATAM): Emerging growth centered on resource industries and initial investments in automotive production facilities.

- Middle East and Africa (MEA): Nascent market focusing on large infrastructure projects and energy sector component handling; growth potential reliant on economic diversification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Payload Cobots Market.- KUKA AG

- ABB Ltd.

- FANUC Corporation

- Universal Robots (Teradyne Inc.)

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries

- Mitsubishi Electric Corporation

- Hanwha Corporation

- Comau S.p.A.

- Rethink Robotics GmbH

- Techman Robot Inc.

- DENSO Corporation

- NACHI-FUJIKOSHI CORP.

- Staubli International AG

- F&P Robotics AG

- Franka Emika GmbH

- AUBO Robotics

- MABI Robotic AG

- Doosan Robotics

- Hyundai Robotics

Frequently Asked Questions

Analyze common user questions about the Heavy Payload Cobots market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the definitive difference between a heavy payload cobot and a standard industrial robot?

The primary difference lies in the collaborative functionality. Heavy payload cobots are equipped with advanced safety features (force-torque limiting, speed monitoring, safety-rated soft materials) enabling them to operate safely alongside human workers without needing physical caging, conforming to ISO 15066 standards. Traditional industrial robots prioritize speed and payload capacity but must be segregated from human workers for safety.

Which industry currently utilizes heavy payload collaborative robots the most?

The Automotive sector remains the leading end-user for heavy payload cobots. They are essential for automating complex, repetitive, and strenuous tasks such as chassis assembly, heavy component handling, and specialized welding operations where safety and component weight necessitate collaborative strength and precision in shared workspaces.

What are the key safety concerns related to cobots handling high inertia loads?

The key safety concern is managing inertia and momentum during unexpected stops or collisions. Manufacturers address this through robust force-sensing capabilities, predictive safety algorithms that dynamically reduce speed proportional to human proximity, and highly responsive braking systems to ensure that impact energy remains below the regulated safety thresholds when manipulating heavy parts.

How does AI improve the performance and safety of heavy payload collaborative robots?

AI significantly enhances performance by enabling real-time optimal path planning and dynamic load compensation, maximizing efficiency. For safety, machine learning improves collision avoidance by predicting human movement and fine-tuning instantaneous speed reductions, ensuring the heavy arm maintains collaborative safety certifications even during high-stress operations.

What is the typical Return on Investment (ROI) period for adopting heavy payload cobots in manufacturing?

While the initial cost is high, the ROI period for heavy payload cobots typically ranges from 1.5 to 3 years. This rapid return is primarily driven by substantial reductions in labor costs, elimination of workplace injury claims associated with heavy lifting, significant improvements in production throughput, and enhanced product quality consistency in high-volume operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager