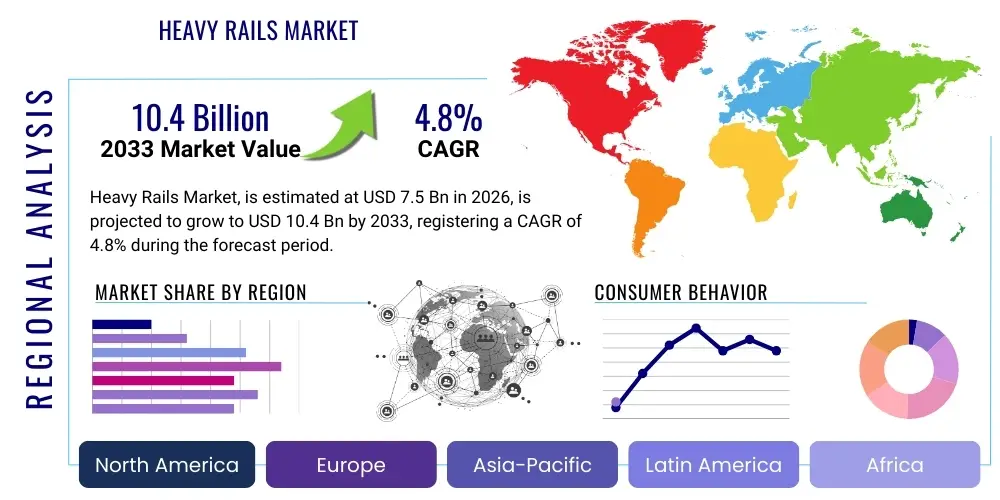

Heavy Rails Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435392 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Heavy Rails Market Size

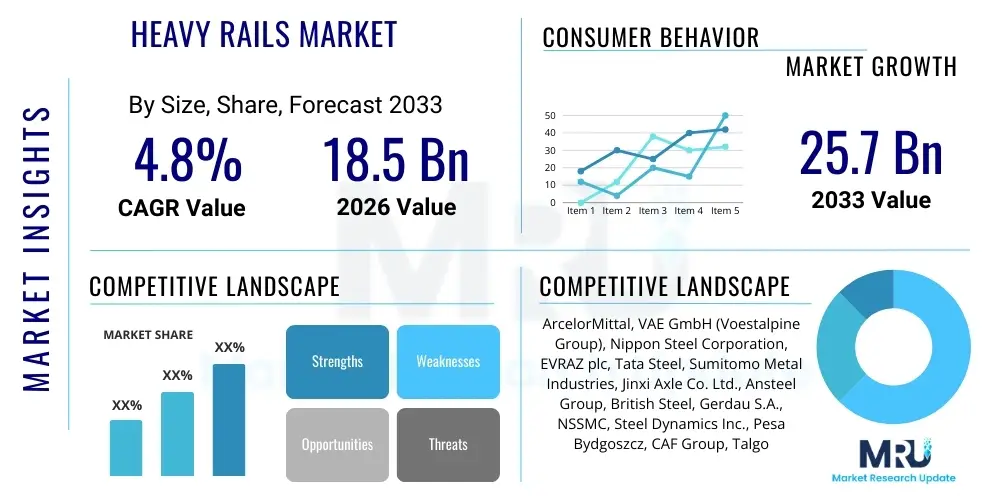

The Heavy Rails Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $25.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally underpinned by renewed governmental focus on infrastructure resilience and capacity expansion globally, particularly driven by emerging economies prioritizing mass transit solutions and established economies focusing on high-speed rail deployment and heavy haul modernization.

Heavy Rails Market introduction

Heavy rails, generally defined as steel rails weighing 60 kilograms per meter (kg/m) or more, are the critical foundation for modern, high-capacity railway networks worldwide. These specialized steel products are engineered to withstand immense static and dynamic loads, high speeds, and intense abrasive wear, making them indispensable for heavy haul freight operations, high-speed passenger lines, and complex industrial tracks. The primary applications span public transportation infrastructure, including metropolitan subways and intercity connectivity, and industrial sectors such as mining, ports, and steel mills requiring robust internal transport systems. The market’s resilience stems from the necessity for materials capable of ensuring operational safety, minimizing maintenance downtime, and maximizing asset longevity under stringent operational requirements.

The inherent benefits of utilizing heavy rails include significantly enhanced load-bearing capacity, which directly translates to improved train frequency and increased axle loads permissible in freight transportation. Furthermore, the specialized metallurgy, often incorporating elements like manganese, silicon, and chromium, results in superior wear resistance and reduced susceptibility to fatigue cracking, extending the lifespan of the track structure. Driving factors for market expansion are multifaceted, anchored by rapid global urbanization necessitating efficient mass transit, coupled with major governmental initiatives like China’s Belt and Road Initiative and Europe’s Trans-European Transport Network (TEN-T), which demand massive procurement of high-performance heavy rail products to link economic centers.

Product innovation focuses heavily on developing premium rail grades, such as heat-treated and alloyed steel rails, designed specifically to meet the rigorous demands of sustained high-speed operations (exceeding 250 km/h) and extreme heavy haul scenarios (axle loads above 35 tonnes). These advancements not only support faster transport times but also contribute substantially to lifecycle cost reduction for railway operators by delaying the need for rail replacement and repair. The market thus navigates a balance between high-volume standard rail production for maintenance and the increasing demand for highly specialized, technologically advanced rail segments that promise superior performance and environmental benefits through efficient energy use.

Heavy Rails Market Executive Summary

The global Heavy Rails Market is undergoing a strategic transformation characterized by increasing investment in sustainable and high-performance infrastructure, creating distinct business trends across geographical segments. Asia Pacific currently dominates the market volume due to unprecedented high-speed rail construction in China and India’s massive network modernization projects. Conversely, North American market trends are heavily focused on the replacement and maintenance of existing heavy-haul freight lines, driving demand for premium wear-resistant rail grades suitable for extreme operational stresses. European markets emphasize standardization and interconnection, pushing for specialized low-noise, low-vibration rail technologies to comply with strict environmental regulations in urban areas.

Regionally, while APAC continues its dominance through infrastructure development, the revitalization of infrastructure spending in North America and strategic upgrades in Europe represent significant growth opportunities, particularly in the premium rail segment. Business trends indicate a movement towards vertical integration among major steel manufacturers, who are increasingly offering complete track solutions, including specialized turnouts, fasteners, and installation services, thereby capturing a greater share of the project value chain. Furthermore, sustainability is becoming a key metric, with operators prioritizing manufacturers demonstrating lower carbon footprints in their steel production processes and offering rails with extended service life to minimize material consumption.

Segment trends confirm a clear shift from conventional carbon steel rails toward specialized alloy steel and heat-treated rails, particularly within the high-speed and heavy haul applications, reflecting the industry’s drive for enhanced durability and safety. The application segment growth is highly correlated with public spending; thus, high-speed rail networks, driven primarily by government investment, are projected to be the fastest-growing application segment. Conversely, the maintenance and replacement cycle within established freight networks ensure continuous, stable demand in the freight transportation segment. Overall, the market remains highly consolidated, with a few global steel giants controlling the majority of the production capacity, necessitating strategic sourcing and partnership formation among railway developers.

AI Impact Analysis on Heavy Rails Market

User queries regarding the impact of Artificial Intelligence (AI) on the Heavy Rails Market frequently revolve around optimizing lifecycle management, enhancing safety protocols, and addressing the capital intensity of infrastructure maintenance. Common questions focus on how AI-driven predictive maintenance can reduce catastrophic failures, the economic viability of implementing real-time rail inspection systems using machine learning, and the potential displacement of manual labor in track maintenance and quality control. Users express high expectations regarding AI's ability to maximize uptime and extend asset life through sophisticated anomaly detection, but simultaneously voice concerns about data integration across disparate legacy railway systems and the need for standardized AI deployment protocols across national rail networks. The consensus is that AI will shift the market focus from reactive repair to proactive, condition-based renewal, fundamentally changing the service and maintenance landscape.

- AI-driven Predictive Maintenance (PdM): Utilizes sensor data (vibration, acoustic, thermal) to anticipate rail wear, fatigue, and defects, optimizing maintenance schedules and minimizing unscheduled downtime.

- Automated Inspection Systems: Machine learning algorithms analyze images and sensor inputs from drone, carriage, or stationary monitoring systems to detect surface cracks, gauge variations, and alignment issues faster and more accurately than human inspection.

- Optimized Logistics and Inventory Management: AI models predict future rail replacement demand based on traffic patterns and environmental stressors, leading to optimized stocking levels for rail manufacturers and faster supply chain response.

- Enhanced Manufacturing Quality Control: Computer vision systems and AI analyze the microstructure and surface finish of newly rolled rails during production, ensuring defect detection prior to delivery and improving overall product quality consistency.

- Route Planning and Traffic Management: AI optimizes train scheduling and speed profiles based on real-time track conditions, reducing dynamic loading impacts on the rails and prolonging track life.

DRO & Impact Forces Of Heavy Rails Market

The Heavy Rails Market is influenced by a dynamic interplay of factors where robust global infrastructure development acts as the primary catalyst, while high entry barriers and material price volatility impose significant constraints. The persistent and growing global demand for efficient, high-speed connectivity, coupled with the urgent requirement to modernize aging railway assets in established economies, drives consistent revenue streams. Concurrently, the operational necessity for safety enhancements and lifecycle cost reduction compels railway authorities to procure higher-grade, specialized rails (e.g., heat-treated and corrosion-resistant), sustaining innovation. These core drivers create a positive momentum, particularly within dense urban corridors and transnational trade routes demanding enhanced resilience and faster throughput.

However, the market faces inherent limitations due to the extreme capital intensity required for both manufacturing (involving large rolling mills and sophisticated heat treatment facilities) and installation, creating significant regulatory hurdles and long project approval timelines that often delay procurement cycles. Furthermore, the market's dependence on primary inputs like iron ore, coking coal, and ferroalloys makes it highly susceptible to global commodity price fluctuations, which directly impact the profitability of rail manufacturers and the project costs for operators. Political instability in regions undergoing major infrastructure development also poses a restraint, potentially freezing large-scale projects and impacting demand predictability.

Opportunities within the heavy rails sector are concentrated around technological advancements, particularly the widespread adoption of specialized rail grades that offer extended service life in demanding environments, such as those exposed to coastal corrosion or extreme temperature variances. The push toward smart railway systems integrates the physical rail with digital monitoring infrastructure, creating new opportunities for service providers and specialized sensor manufacturers. Additionally, the growing focus on environmental sustainability is opening doors for manufacturers utilizing green steel production methods and offering lightweight, high-performance rails that reduce friction and energy consumption. The impact forces indicate a net positive market direction, with macroeconomic drivers strongly outweighing the structural restraints, especially in regions committed to large-scale decarbonization and intermodal freight expansion.

Segmentation Analysis

The Heavy Rails Market segmentation provides a clear view of where specialized demand and volume growth are concentrated, primarily dissecting the market based on metallurgical composition (Type) and end-use environment (Application). By Type, the distinction lies between standard carbon steel rails, which constitute the bulk of maintenance and repair volume for general lines, and the increasingly crucial premium grades, such as R260 and 350HT, which undergo specialized heat treatment or alloying processes to achieve superior hardness, wear resistance, and reduced internal stress. This technological segmentation reflects the ongoing need for longer rail life and reduced maintenance frequency in high-stress environments. The shift toward premium rails is a defining characteristic, offering operators reduced Total Cost of Ownership (TCO) despite higher initial acquisition costs.

Application segmentation reveals the diverse operational requirements across the railway industry. Freight Transportation, particularly heavy-haul freight, requires rails optimized for high static loads and repetitive cyclic loading, necessitating robust sections and specialized material hardness to combat rolling contact fatigue and abrasive wear. Conversely, High-Speed Rail Networks demand rails focused on smoothness, track geometry stability, and fatigue performance under very high dynamic speeds, often requiring specialized profile designs and welding techniques to ensure seamless transitions. Urban Transit systems, including metros and trams, prioritize noise reduction and tighter curve radius performance, driving demand for specific rail profiles and specialized noise-dampening fastenings.

- By Type:

- Standard Carbon Steel Rails (e.g., U71Mn, 50Mn)

- Heat-Treated Rails (Head-Hardened Rails)

- Alloy Steel Rails (e.g., Chrome, Manganese)

- Premium and Specialized Rails (e.g., Low-noise, Corrosion-resistant)

- By Application:

- High-Speed Rail Networks (HSR)

- Freight Transportation (Heavy Haul)

- Urban Transit (Subway, Metro, Tram)

- Industrial Applications (Mining, Ports, Private Sidings)

- By Material Grade:

- Carbon Steel

- High-Manganese Steel

- Specialty Alloy Steels (Cr-V, Cr-Ni)

Value Chain Analysis For Heavy Rails Market

The value chain for the Heavy Rails Market begins with intensive upstream activities focused on raw material procurement, encompassing high-grade iron ore, coking coal, and critical alloying elements such as manganese, chromium, and vanadium, which determine the final rail performance characteristics. Steel manufacturing, the core value-add process, involves sophisticated primary steel production, followed by complex rolling processes that shape the steel into specified rail profiles, concluding with specialized treatments like head hardening or controlled cooling to optimize metallurgical structure and mechanical properties. The concentration of key manufacturers who possess the necessary large-scale rolling mill capacity and advanced processing technology dictates the high barriers to entry and controls pricing power within this stage.

Distribution channels for heavy rails are highly structured, predominantly relying on direct contractual relationships between the few global manufacturers and national or regional railway authorities and large-scale infrastructure Engineering, Procurement, and Construction (EPC) companies. Due to the product’s weight, dimensions, and critical quality requirements, indirect distribution via general industrial distributors is minimal. Specialized logistics are required for transportation, often utilizing dedicated rail freight or specialized heavy road transport, emphasizing the complexity of the downstream supply chain. Post-sales services, including rail welding services, grinding, inspection, and eventual replacement, represent significant long-term value capture points for specialized service providers.

Upstream risks include volatility in metallurgical coke and scrap steel prices, impacting production costs directly. Downstream activities are heavily influenced by government tendering processes, long decision cycles, and the need for strict compliance with national safety standards (e.g., AREMA, EN standards). The increasing demand for specialized, high-performance rails necessitates greater investment in R&D and quality control throughout the chain. Successful market players are those who can achieve high yield rates in their rolling operations while maintaining stringent quality control over the specialized heat treatment process, ensuring competitive pricing without compromising the safety-critical requirements of the final product.

Heavy Rails Market Potential Customers

Potential customers for heavy rails are predominantly large public sector entities and private corporations operating mission-critical infrastructure where high capacity and safety are non-negotiable operational requirements. The primary end-users are National Railway Authorities and State-Owned Enterprises (SOEs) responsible for maintaining and expanding national passenger and freight networks, such as Amtrak in the US, Deutsche Bahn in Germany, or China Railway. These entities are characterized by large, multi-year procurement contracts and demand strict adherence to domestic and international material specifications, focusing heavily on lifecycle cost and reliability when making purchasing decisions.

Beyond public authorities, major private heavy haul freight operators, particularly in North America (Class I Railroads) and resource-rich regions (Australia, Brazil), represent a critical customer segment. These private companies require the highest possible grade of heavy rail to support extreme axle loads (often 30-40 tonnes per axle) and high-density traffic, driving demand for premium, highly wear-resistant, and fatigue-resistant rails. Their buying decisions are purely economic, focused on minimizing track maintenance costs and maximizing operational uptime, justifying the premium price points for specialized heat-treated products.

Furthermore, urban planning and transportation departments, along with large infrastructure EPC firms specializing in metropolitan transit projects, constitute another vital customer base. They procure heavy rails for subway tunnels, light rail, and urban heavy rail systems, where unique requirements like noise reduction, curved track geometry, and minimized construction disruption influence product selection. Finally, industrial users, including large mining conglomerates and port operators, purchase heavy rails for their internal dedicated railway systems used to transport bulk commodities, prioritizing extremely durable and heavy section rails capable of handling continuous, cyclical loading in often corrosive or harsh operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $25.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, VAE GmbH (Voestalpine Group), Nippon Steel Corporation, EVRAZ plc, Tata Steel, Sumitomo Metal Industries, Jinxi Axle Co. Ltd., Ansteel Group, British Steel, Gerdau S.A., NSSMC, Steel Dynamics Inc., Pesa Bydgoszcz, CAF Group, Talgo, CRRC, Koppers Holdings Inc., Pandrol, RailTech Solutions, Harsco Rail |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Rails Market Key Technology Landscape

The technological landscape of the Heavy Rails Market is defined by continuous material science advancements aimed at enhancing durability, reducing wear, and minimizing maintenance cycles. A pivotal technology is Head Hardening (HH), an advanced heat treatment process applied to the rail head after rolling. This process significantly increases the pearlite structure, leading to superior hardness (typically 350 HBW and above) without compromising the ductility of the rail foot and web. HH rails are crucial for high-stress applications like sharp curves, steep gradients, and high-axle-load freight lines, drastically reducing the rate of rolling contact fatigue and requiring less frequent grinding or replacement, thereby lowering the TCO for operators.

Another significant area of innovation involves alloying technologies, particularly the inclusion of elements like chromium (Cr) or vanadium (V) into the steel composition. Chrome alloy rails offer enhanced resistance to corrosion, vital for coastal lines and tunneling environments, and provide improved resistance to wear under high-load conditions compared to standard carbon rails. Furthermore, the development of specialized rail profiles—often asymmetric or designed with unique radii—aims to optimize wheel-rail interaction, reducing noise emissions and vibration, a critical requirement for urban railway systems complying with stringent environmental and residential standards. These profile designs are often validated using sophisticated simulation and finite element analysis (FEA) software before industrial production.

Beyond the rail steel itself, technology extends to advanced track infrastructure monitoring and welding techniques. Flash Butt Welding (FBW) is the standard for creating long, continuous welded rail (CWR) segments, minimizing joints which are historically weak points and sources of noise. However, there is growing adoption of specialized mobile FBW units and high-quality aluminothermic welding consumables for in-track repairs. The integration of advanced non-destructive testing (NDT) methods, such as ultrasonic inspection and eddy current testing, is essential for quality assurance during manufacturing and throughout the rail's service life, ensuring the detection of subsurface defects that could lead to catastrophic failure, thereby enhancing overall rail network reliability and safety standards.

Regional Highlights

The Heavy Rails Market exhibits pronounced regional variances driven by economic development, infrastructure maturity, and specific railway priorities (freight dominance vs. passenger speed). Asia Pacific (APAC) stands as the undisputed market leader, propelled primarily by China’s aggressive expansion of its high-speed rail network and mass transit systems, alongside India's massive railway gauge conversion and modernization efforts. This region requires both high volume of standard rails for maintenance and increasing quantities of premium rails for new high-speed lines, sustaining high demand and production capacity.

North America (NA) is characterized by a strong focus on heavy haul freight, where Class I railroads prioritize durability and maximum load capacity. The market here is replacement-driven, demanding specialized, high-performance, head-hardened rails designed to endure extreme abrasive wear and fatigue from trains carrying enormous loads of commodities like coal, grain, and intermodal containers. While passenger rail investment is smaller, the maintenance cycle of the massive freight network ensures stable, high-value demand for premium products.

Europe represents a mature market focusing heavily on interconnectivity, standardization, and environmental compliance. Demand is stable, centered on upgrading existing networks to support the TEN-T framework and urban rail renewal projects. The emphasis is on low-vibration, low-noise rails and stringent safety specifications. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging growth regions, with large-scale projects planned in countries like Saudi Arabia (GCC Rail) and Brazil (mining-related freight lines), offering significant contract opportunities for global manufacturers seeking market diversification.

- Asia Pacific (APAC): Dominant growth region; focus on High-Speed Rail (HSR) construction and urban metro expansion in China, India, and Southeast Asia.

- North America: Stable demand driven by replacement and maintenance of heavy haul freight lines; high preference for specialized, ultra-wear-resistant rail grades.

- Europe: Focus on network standardization, environmental compliance, and deployment of low-noise rail solutions for intercity and urban corridors.

- Middle East & Africa (MEA): Significant potential driven by large-scale infrastructure projects (e.g., freight corridors, regional connectivity) funded by oil revenues and development initiatives.

- Latin America (LATAM): Growth tied to raw material export chains, driving demand for heavy rails in mining and resource transportation sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Rails Market.- ArcelorMittal

- VAE GmbH (Voestalpine Group)

- Nippon Steel Corporation

- EVRAZ plc

- Tata Steel

- Sumitomo Metal Industries

- Jinxi Axle Co. Ltd.

- Ansteel Group

- British Steel

- Gerdau S.A.

- NSSMC

- Steel Dynamics Inc.

- Pesa Bydgoszcz

- CAF Group

- Talgo

- CRRC

- Koppers Holdings Inc.

- Pandrol

- RailTech Solutions

- Harsco Rail

Frequently Asked Questions

Analyze common user questions about the Heavy Rails market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard rails and heat-treated rails?

Heat-treated (head-hardened) rails undergo a specialized thermal process after rolling, significantly increasing the hardness and strength of the rail head. This enhances wear resistance and fatigue life, making them essential for high-stress applications like sharp curves, high-speed lines, and heavy-haul freight, vastly extending the service interval compared to standard carbon steel rails.

Which application segment drives the highest demand in the Heavy Rails Market?

While standard freight transportation networks account for stable, large-volume replacement demand, the High-Speed Rail Networks application segment is projected to be the fastest growing globally, driven by substantial governmental investment in developing new intercity connectivity, particularly across Asia Pacific and specific regions of Europe.

How does AI technology impact the maintenance lifecycle of heavy rails?

AI primarily impacts the maintenance lifecycle by enabling predictive maintenance (PdM). Machine learning analyzes real-time sensor data from the track to accurately forecast potential rail failures, allowing operators to transition from costly reactive repairs to highly efficient, optimized, condition-based maintenance, thereby maximizing operational uptime and reducing component failure risks.

What are the key restraint factors affecting market growth?

The key restraint factors are the extremely high initial capital expenditure required for railway infrastructure development, the dependency on volatile global commodity prices (iron ore, coking coal) which influence manufacturing costs, and the complex, time-consuming governmental and regulatory approval processes necessary for new projects.

Which geographic region holds the largest market share for heavy rails, and why?

Asia Pacific (APAC), specifically China, holds the largest market share due to unparalleled, continuous governmental investment in railway infrastructure expansion, including the development of the world's largest high-speed rail network and extensive urban transit system upgrades, demanding massive volumes of specialized and standard heavy rails.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager