Heavy Trucks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434031 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Heavy Trucks Market Size

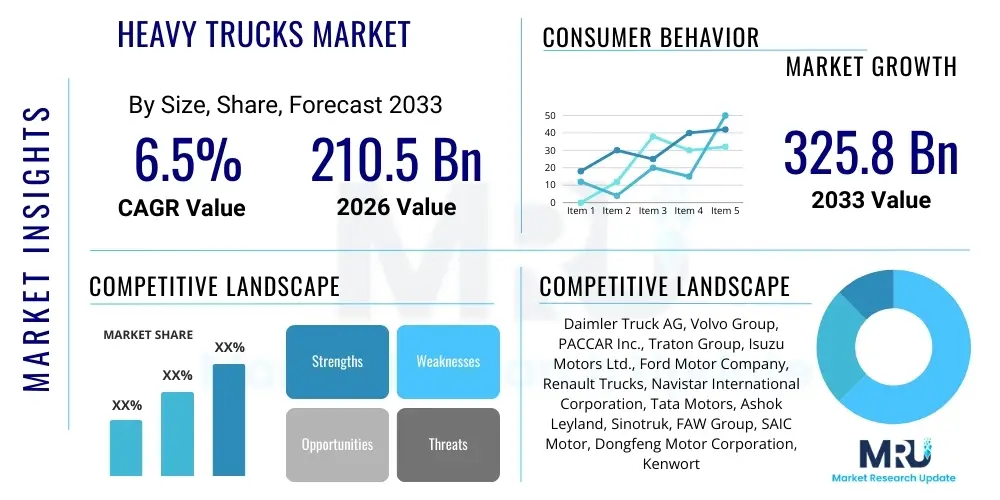

The Heavy Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 210.5 Billion in 2026 and is projected to reach USD 325.8 Billion by the end of the forecast period in 2033.

Heavy Trucks Market introduction

The Heavy Trucks Market encompasses the manufacturing, distribution, and sale of commercial vehicles typically classified as Class 8 (Gross Vehicle Weight Rating exceeding 33,000 pounds or 15,000 kg). These robust machines are fundamentally designed for long-haul transportation, heavy construction, specialized industrial operations, and complex logistics chains across diverse global geographies. The primary function of these trucks is the efficient movement of large volumes of freight, raw materials, or specialized equipment, positioning them as the backbone of modern global trade and infrastructure development. Product descriptions vary significantly by configuration, including tractor units for pulling semi-trailers, straight trucks for rigid body applications, and specialized vocational trucks such as dump trucks, concrete mixers, and refuse carriers. Continuous innovation in aerodynamics, powertrain efficiency, and safety systems defines the competitive landscape.

Major applications of heavy trucks span across several critical sectors, prominently including general logistics and freight transportation, where they facilitate both domestic and international trade routes. The construction and mining industries rely heavily on specialized heavy trucks for moving aggregates, earth, and heavy machinery on rough terrain. Furthermore, the industrial sector utilizes these vehicles for supply chain management, delivery of finished goods, and transportation of hazardous materials. The inherent benefits of heavy trucks involve unmatched payload capacity, durability, operational longevity, and the ability to maintain consistent schedules for time-sensitive deliveries. The shift towards globalized manufacturing and e-commerce has substantially amplified the demand for robust and reliable transportation infrastructure, directly benefiting this market segment.

Driving factors propelling the expansion of the Heavy Trucks Market include rapid industrialization in emerging economies, governmental investments in infrastructure projects, and the modernization of aging fleets in developed nations to meet stringent emission regulations (such as Euro VI and EPA standards). The adoption of advanced telematics, fleet management software, and sensor technologies, alongside the increasing focus on driver safety and comfort, are transforming operational efficiencies. Furthermore, the pivotal transition towards alternative fuel vehicles, particularly battery electric and hydrogen fuel cell trucks, spurred by global decarbonization mandates, is creating significant investment opportunities and reshaping market dynamics, ensuring sustained growth throughout the forecast period.

Heavy Trucks Market Executive Summary

The Heavy Trucks Market is poised for substantial growth, driven predominantly by global economic recovery, sustained expansion of e-commerce logistics, and necessary fleet modernization cycles mandated by evolving environmental regulations. Key business trends indicate a significant strategic shift toward platform standardization and modular design among major original equipment manufacturers (OEMs) to capitalize on economies of scale and accelerate the deployment of electrified powertrains. Competition remains intense, focused increasingly on total cost of ownership (TCO) rather than just initial purchase price, pushing manufacturers to integrate advanced diagnostics, predictive maintenance capabilities, and sophisticated safety features like Advanced Driver Assistance Systems (ADAS). Investment in autonomous driving technologies, though nascent, represents a critical long-term growth avenue, requiring substantial partnerships between traditional truck makers and specialized technology providers.

Regionally, Asia Pacific continues to dominate the market in terms of volume, primarily due to robust infrastructure development in China and India, coupled with rapid urbanization driving logistical demands. North America, characterized by long-haul transportation needs, remains the leader in terms of technological adoption, particularly concerning automation and high-efficiency diesel engines, while regulatory pressures favoring ZEV (Zero Emission Vehicles) deployment are strongest in specific states and provinces. Europe is rapidly adopting stringent emission standards, accelerating the transition away from conventional diesel, and is establishing itself as a key testing ground for hydrogen fuel cell technology, supported by substantial government subsidies and infrastructure planning aimed at decarbonizing road freight transport.

Segment trends reveal a rapid diversification away from traditional diesel dominance, with significant growth projected for the Electric/Hybrid and Natural Gas segments. The demand for Day Cab configurations is growing proportionally with the rise of regional distribution centers servicing metropolitan areas, although Sleeper Cabs remain essential for transcontinental logistics. Application-wise, the Logistics and Freight segment retains the largest market share, but the Construction & Mining segment demonstrates resilience, bolstered by global infrastructure stimulus packages. Furthermore, the integration of telematics services (a high-value segment) is becoming standard, shifting the value proposition from hardware sales to bundled mobility solutions, allowing for optimized route planning and reduced operational downtime across all major vehicle classes.

AI Impact Analysis on Heavy Trucks Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Heavy Trucks Market reveals a primary focus on three core themes: operational efficiency, safety enhancements, and the timeline for full automation. Users frequently inquire about how AI algorithms optimize fuel consumption, reduce maintenance costs through predictive analytics, and enhance supply chain visibility through intelligent routing. Concerns often center on data security, the reliability of AI-driven decisions in complex driving scenarios (such as adverse weather), and the potential socio-economic impact on professional drivers. Expectations are high regarding the integration of machine learning in fleet management systems to improve asset utilization and reduce the Total Cost of Ownership (TCO), viewing AI not just as a technology but as a foundational element for the next generation of logistics platforms. The consensus is that AI will be implemented iteratively, starting with L2/L3 assistance features before progressing to highly autonomous L4 systems deployed in controlled environments, necessitating clear regulatory frameworks.

AI's influence is transforming the heavy truck ecosystem from vehicle design to post-sale services. In vehicle manufacturing, AI-powered design tools optimize structural integrity and aerodynamic profiles, leading to lighter, more fuel-efficient trucks. Operationally, AI systems continuously analyze vast datasets related to driving behavior, road conditions, and mechanical performance to provide real-time recommendations, thereby maximizing uptime. This integration extends beyond the truck itself; logistics operators are using AI to predict fluctuations in freight demand, allocate resources optimally, and manage inventory levels efficiently. The competitive advantage is increasingly shifting toward companies that can effectively leverage AI to transform raw data into actionable intelligence, reducing both environmental impact and operational expenditures, aligning with corporate sustainability goals.

The adoption curve for AI in heavy trucking is accelerating due to advancements in sensor technology, edge computing, and robust connectivity (5G). These technologies enable AI models to process complex environments instantly, crucial for autonomous driving functionalities. Predictive maintenance, an established AI application, uses algorithms to monitor component wear and tear, scheduling maintenance precisely before failure occurs, thereby preventing costly unplanned downtime. Furthermore, AI is critical for developing sophisticated safety features, including advanced collision mitigation systems that utilize deep learning to differentiate objects and predict potential hazards more accurately than traditional systems, significantly improving road safety metrics across the industry.

- Optimization of Route Planning and Dynamic Scheduling using Machine Learning algorithms.

- Implementation of Predictive Maintenance through AI analysis of telematics data, minimizing unplanned downtime.

- Enhancement of Advanced Driver Assistance Systems (ADAS) through deep learning for improved hazard detection.

- Development and testing of L4/L5 Autonomous Driving Systems, particularly for hub-to-hub operations.

- Improvement in Fuel Efficiency via AI-controlled engine management and transmission shifting strategies.

- Real-time monitoring of driver fatigue and performance through in-cab AI vision systems.

- Supply Chain Visibility and Demand Forecasting powered by generative AI and pattern recognition.

DRO & Impact Forces Of Heavy Trucks Market

The dynamics of the Heavy Trucks Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's impact forces. A primary driver is the burgeoning global freight movement, fueled by increased cross-border trade and the exponential growth of e-commerce, which necessitates expanding and renewing commercial fleets worldwide. Simultaneously, stringent governmental regulations mandating lower carbon emissions and higher fuel efficiency standards act as a dual force—a driver for innovation in powertrain technology (electrification) and a restraint due to the substantial capital expenditure required for compliance and the uncertainty surrounding charging/refueling infrastructure development. The pursuit of operational cost reduction, particularly through automation and predictive maintenance, further drives technology adoption across the logistics industry, solidifying the market's trajectory towards digitalization.

Significant restraints include the high initial acquisition cost of advanced heavy trucks, especially those utilizing electric or hydrogen powertrains, making the investment difficult for smaller fleet operators without subsidies. Furthermore, the global shortage of crucial semiconductor components and persistent supply chain bottlenecks continue to hinder manufacturing throughput, delaying vehicle deliveries and impacting inventory levels. Another key restraint involves the resistance to rapid technological change among certain traditional operators and the required reskilling of maintenance personnel to handle complex, electrified vehicle architectures. Infrastructure limitations, specifically the lack of high-capacity charging stations or hydrogen fueling networks, particularly on major long-haul routes, pose a geographical limitation on the widespread adoption of Zero Emission Vehicles (ZEVs).

Opportunities in the market are centered around the rapid commercialization of alternative fuel vehicles, particularly Hydrogen Fuel Cell Electric Vehicles (FCEVs), which offer competitive range and faster refueling times compared to Battery Electric Vehicles (BEVs) for Class 8 applications. The emergence of Truck-as-a-Service (TaaS) models and subscription-based offerings provides manufacturers with new revenue streams and lowers the entry barrier for customers. Additionally, the development of Level 4 autonomous technology for depot-to-depot trucking promises significant reductions in labor costs and improved operational safety over the long term. These opportunities, coupled with ongoing infrastructural investments in regions like Southeast Asia and Latin America, collectively exert a powerful, positive impact force, reshaping the competitive strategy toward sustainable and intelligent heavy transportation solutions.

Segmentation Analysis

The Heavy Trucks Market is comprehensively segmented based on several critical parameters, including vehicle type, axle configuration, application, and fuel type, providing granular insights into demand patterns and technological preferences across different operational environments. Analyzing these segments is essential for OEMs to tailor their product offerings, optimize supply chain strategies, and focus R&D investments effectively. The differentiation between Sleeper Cab and Day Cab segments, for instance, reflects the distinct requirements of long-haul versus regional distribution, impacting cabin features, fuel tank capacity, and connectivity needs. Similarly, segmentation by axle type directly correlates with payload capacity and regulatory weight limits enforced in various jurisdictions.

The segmentation by application reveals the diversity of usage, with Logistics and Construction remaining the foundational pillars of demand, each requiring vastly different vehicle specifications in terms of ruggedness, power take-off (PTO) capabilities, and specialized body attachments. The most transformative segmentation shift, however, is observed within the Fuel Type category. While diesel engines currently hold the dominant market share globally, their relative proportion is expected to decline significantly over the forecast period. This decline is balanced by the exponential forecasted growth in the Electric/Hybrid and Natural Gas segments, driven by regulatory pressure and favorable Total Cost of Ownership models in specific geographies, especially urban logistics hubs.

Understanding the interplay between these segments is crucial for strategic planning. For example, the growth in the Electric segment is predominantly occurring within the Day Cab (regional logistics) application, whereas the longer-haul Sleeper Cab application is becoming the primary battleground for Hydrogen Fuel Cell versus high-density diesel alternatives. This detailed market mapping ensures that manufacturers and suppliers can effectively position their offerings to capture growth in high-potential niches, such as heavy-duty vocational electric trucks designed for refuse collection or port operations, where predictable routes and centralized charging infrastructure minimize operational barriers associated with electrification.

- By Type:

- Sleeper Cab

- Day Cab

- By Axle Type:

- 3-4 Axles

- 5 or more Axles

- By Application:

- Logistics and Freight Transportation

- Construction and Mining

- Industrial and Manufacturing

- Waste Management and Utility Services

- Others (e.g., Defense, Specialized Transport)

- By Fuel Type:

- Diesel

- Natural Gas (CNG/LNG)

- Electric (Battery Electric Vehicles - BEV)

- Hybrid

- Hydrogen Fuel Cell

Value Chain Analysis For Heavy Trucks Market

The Value Chain for the Heavy Trucks Market is a complex, multi-tiered structure beginning with raw material extraction and ending with vehicle decommissioning and recycling. Upstream activities involve the sourcing of critical components and materials, including high-strength steel, aluminum alloys, advanced plastics, and sophisticated electronic hardware such as semiconductors, sensors, and battery packs. OEMs maintain highly integrated supply chains, often relying on tier-one suppliers for major sub-systems like engines (though many vertically integrate powertrain manufacturing), axles, transmissions, and increasingly, specialized battery management systems (BMS) and software platforms. Efficiency at the upstream level is paramount, as fluctuations in commodity prices and supply stability directly impact manufacturing costs and delivery timelines.

The core manufacturing and assembly stage involves advanced robotics and high-precision engineering to ensure vehicle reliability and compliance with safety and emission standards. This stage also includes significant R&D investment focused on developing proprietary platforms for modular production, especially crucial for accommodating both conventional and electric powertrains on the same production line. Downstream activities involve distribution, sales, and comprehensive after-market services. Distribution primarily occurs through established dealer networks (indirect channel), which manage localized sales, financing, and maintenance contracts. However, some specialized manufacturers utilize direct sales models for large governmental or corporate fleet procurements.

The post-sale phase is increasingly important, driven by the shift towards a service-oriented business model. After-market services include parts sales, scheduled maintenance, repair operations, and, critically, the provision of telematics and digital fleet management solutions (Direct and Indirect services). The emergence of electric heavy trucks introduces a new complexity to the downstream chain, requiring specialized battery maintenance services, dedicated charging infrastructure installation support, and future battery recycling or second-life usage programs. This segment provides significant, high-margin revenue streams and builds customer loyalty, making the efficiency of the after-market network a key competitive differentiator.

Heavy Trucks Market Potential Customers

The potential customer base for the Heavy Trucks Market is highly diverse, spanning various industries that rely on high-capacity ground transport for their core operations. The primary end-users are large-scale logistics and freight forwarding companies that operate extensive fleets for regional, national, and international haulage. These buyers prioritize fuel efficiency, driver retention features (comfort and safety), advanced telematics integration, and predictable Total Cost of Ownership (TCO) over a multi-year lifecycle. Their purchasing decisions are often centralized and highly sensitive to regulatory changes and macroeconomic factors affecting global trade volumes.

A second major segment comprises construction, infrastructure development, and mining companies. These customers require highly robust, specialized vocational trucks—such as dump trucks, concrete pump trucks, and heavy haulers—designed for demanding, off-road environments. Their priorities lie in vehicle durability, high torque performance, axle load capacity, and ease of maintenance in remote locations. These purchases are heavily influenced by government infrastructure spending cycles and commodity price trends, which dictate the feasibility of large-scale projects requiring new equipment investments.

Further potential customers include municipal and governmental agencies (for refuse collection, utilities, and public works), specialized transport companies (for oversized or hazardous materials), and agricultural conglomerates needing heavy trucks for seasonal material movement. As the market pivots toward ZEVs, corporate fleets committed to environmental, social, and governance (ESG) goals, particularly in retail and manufacturing, are becoming influential buyers, often serving as early adopters of electric and hydrogen truck technologies to meet their internal sustainability mandates and project a green brand image.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 210.5 Billion |

| Market Forecast in 2033 | USD 325.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler Truck AG, Volvo Group, PACCAR Inc., Traton Group, Isuzu Motors Ltd., Ford Motor Company, Renault Trucks, Navistar International Corporation, Tata Motors, Ashok Leyland, Sinotruk, FAW Group, SAIC Motor, Dongfeng Motor Corporation, Kenworth, Peterbilt, Hino Motors, IVECO S.p.A., Nikola Corporation, Oshkosh Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Heavy Trucks Market Key Technology Landscape

The technological landscape of the Heavy Trucks Market is undergoing a fundamental transformation, moving away from purely mechanical systems toward sophisticated electro-mechanical and digital platforms. The primary focus areas are powertrain electrification and digitalization, driven by regulatory demands and the economic incentive of reduced operational expenses. In electrification, two distinct pathways are dominating development: Battery Electric Vehicles (BEVs) optimized for regional and port applications, utilizing high-density lithium-ion or solid-state batteries; and Hydrogen Fuel Cell Electric Vehicles (FCEVs), which are emerging as the more viable solution for high-utilization, long-haul routes due to their energy density and rapid refueling capabilities. This shift requires immense progress in power electronics, thermal management systems, and specialized high-voltage components.

Digitalization technologies are equally critical, centered around advanced telematics, IoT connectivity, and sophisticated onboard computing platforms. Modern heavy trucks are equipped with dozens of sensors collecting data on vehicle performance, component health, driver behavior, and external environment conditions. This data powers crucial applications such as predictive maintenance, fleet optimization software (which often integrates AI), and enhanced compliance monitoring. Furthermore, Advanced Driver Assistance Systems (ADAS), including adaptive cruise control, lane-keeping assistance, and automatic emergency braking, utilize radar, lidar, and camera systems, serving as the necessary foundational layer for future semi-autonomous and fully autonomous driving capabilities.

The long-term technological trajectory is focused on full vehicle autonomy (Level 4 and 5). This requires the integration of high-performance computing units capable of real-time sensor fusion, complex decision-making, and fail-operational architecture to ensure safety without human intervention. While full autonomy remains technically complex and faces regulatory hurdles, platooning technology—where multiple trucks drive closely together, electronically linked and controlled by the lead vehicle to improve aerodynamics and fuel economy—represents a near-term application of advanced connectivity and control systems. Cybersecurity is also becoming paramount to protect these highly connected vehicles from external threats, ensuring the integrity and reliability of fleet operations and logistics data.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to maintain the largest market share by volume, driven by robust economic expansion, massive governmental infrastructure projects in China and India, and the rising demand for efficient logistics spurred by burgeoning e-commerce sectors across Southeast Asia. China remains the world's largest single market for heavy trucks, although the adoption curve for ZEVs is accelerating rapidly, supported by state mandates and subsidies. India is undergoing a significant transition toward modernizing its fleet, spurred by new safety and emission norms (Bharat Stage VI equivalent), creating substantial replacement demand.

- North America: This region is characterized by long-haul transportation routes and high average mileage per vehicle, making fuel efficiency and TCO paramount. The U.S. and Canada are early adopters of advanced safety technologies (ADAS) and sophisticated fleet management systems. Regulatory mandates from jurisdictions like California (Advanced Clean Trucks regulation) are aggressively accelerating the deployment of BEVs and FCEVs for regional and port operations, significantly driving innovation in battery and hydrogen infrastructure.

- Europe: Europe is a leader in adopting stringent environmental standards (Euro VI) and is pioneering the decarbonization of road freight. The region shows strong governmental and private sector investment in hydrogen infrastructure (e.g., in Germany and the Netherlands), positioning FCEVs as a primary long-term solution for cross-border haulage. The market is highly concentrated among major European OEMs, focusing heavily on connected services and sustainable logistics solutions tailored to urban delivery restrictions.

- Latin America (LATAM): Market growth in LATAM is closely linked to commodity prices and industrial output, particularly in Brazil and Mexico. While diesel engines still dominate, there is a gradual but accelerating interest in natural gas (LNG/CNG) trucks, driven by local availability and cost advantages relative to diesel. Fleet modernization is a steady driver, although economic instability and varying regulatory frameworks across countries pose challenges to standardized ZEV adoption.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states, supported by infrastructure development associated with major economic diversification projects (e.g., Saudi Arabia's Vision 2030). Demand is focused on robust, high-durability trucks capable of operating in extreme temperatures. The adoption of advanced telematics is rising in this region to optimize operational performance and security across vast, challenging territories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Heavy Trucks Market.- Daimler Truck AG

- Volvo Group

- PACCAR Inc. (Kenworth and Peterbilt)

- Traton Group (MAN and Scania)

- Isuzu Motors Ltd.

- Ford Motor Company (Heavy Commercial Vehicles)

- Renault Trucks (A Volvo Group company)

- Navistar International Corporation (A Traton Group company)

- Tata Motors

- Ashok Leyland

- Sinotruk (China National Heavy Duty Truck Group)

- FAW Group

- SAIC Motor

- Dongfeng Motor Corporation

- Hino Motors (A Toyota Group company)

- IVECO S.p.A.

- Nikola Corporation (Focus on Electric and Hydrogen FCEV)

- BYD Auto Industry Co., Ltd. (Focus on Electric)

- Oshkosh Corporation (Specialty/Defense Vehicles)

- Mack Trucks (A Volvo Group company)

Frequently Asked Questions

Analyze common user questions about the Heavy Trucks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the Heavy Trucks Market, and which segment will drive it?

The Heavy Trucks Market is projected to grow at a 6.5% CAGR through 2033, driven primarily by the transition toward the Electric/Hybrid and Hydrogen Fuel Cell segments, fueled by global decarbonization mandates and advancements in battery technology, alongside sustained demand from the e-commerce logistics sector.

How are government regulations impacting the design and sales of heavy trucks globally?

Stringent governmental regulations, particularly the Euro VI equivalent standards in Europe and Asia, and the ZEV mandates in North America, necessitate massive investment in advanced powertrain technology (electrification and low-emission diesel), increasing the complexity and initial acquisition cost of new vehicles, while accelerating fleet turnover cycles.

What role does Artificial Intelligence play in optimizing fleet operations for heavy truck owners?

AI is crucial for enhancing operational efficiency by providing predictive maintenance scheduling, real-time route optimization, driver safety monitoring, and advanced fuel consumption management. These systems reduce unexpected downtime and lower the Total Cost of Ownership (TCO) for large fleet operators.

Which regional market holds the highest potential for high-volume heavy truck sales?

Asia Pacific (APAC), particularly China and India, maintains the highest potential for sales volume due to continuous rapid infrastructure expansion, urbanization, and the immense scale of domestic logistics requirements, necessitating constant investment in new and modernized fleets.

What are the primary challenges facing the widespread adoption of electric heavy trucks for long haulage?

The main challenges are the current limitations in battery energy density versus required range, the high initial capital expenditure for ZEVs, and, most critically, the underdeveloped national charging infrastructure capable of supporting high-speed, high-power charging along major long-haul freight corridors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Air Brake System Market Size Report By Type (Air Disc Brake, Air Drum Brake), By Application (Heavy Trucks and Trailers, Buses, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Over The Air Engine Control Module Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ethernet, Controller Area Network (CAN), Local Internet Network (LIN)), By Application (Passenger Vehicles, Commercial Vehicles, Heavy Trucks and Busses), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager