Hedge Fund Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433813 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hedge Fund Market Size

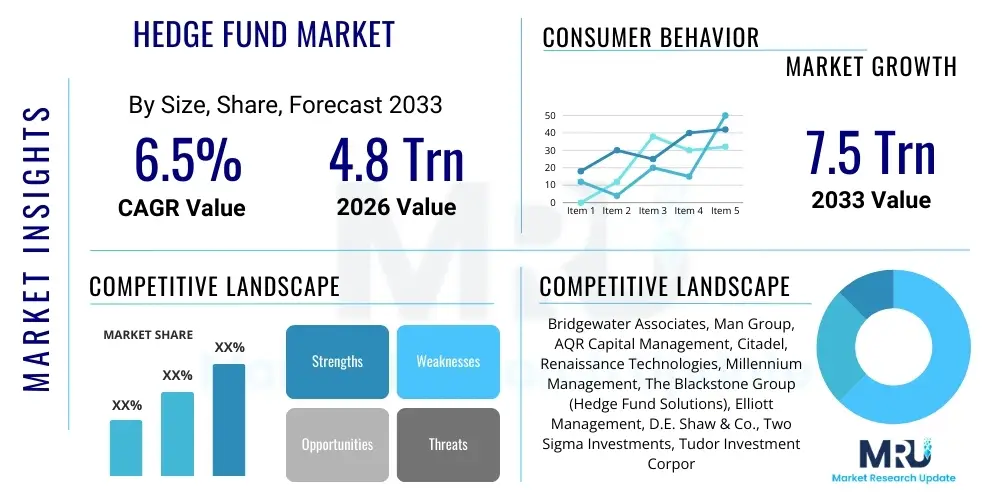

The Hedge Fund Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Trillion in 2026 and is projected to reach USD 7.5 Trillion by the end of the forecast period in 2033. This consistent growth trajectory reflects the increasing institutional demand for portfolio diversification and absolute return strategies, especially in a persistent environment of market volatility and low yields in traditional asset classes. The shift towards multi-strategy platforms and sophisticated quantitative methodologies further validates the market's resilience and capacity for attracting significant capital inflows from global pension funds and sovereign wealth entities seeking enhanced risk-adjusted returns in complex trading cycles. This expansion is driven not only by large-scale capital accumulation but also by the increasing professionalization of smaller funds that are adopting institutional-grade operational infrastructure to meet stricter investor due diligence requirements globally.

Hedge Fund Market introduction

The global Hedge Fund Market encompasses professionally managed investment funds utilizing complex, often high-risk, strategies to generate superior returns for accredited investors. These strategies typically involve leveraging derivatives, short selling, and arbitrage opportunities across various asset classes, fundamentally differentiating hedge funds from traditional investment vehicles like mutual funds. The primary objective is absolute return generation, regardless of broader market conditions, often incorporating specialized expertise in global macro, long/short equity, or highly automated quantitative methodologies. The sophistication of these vehicles requires rigorous regulatory adherence, particularly concerning investor suitability and transparency, though they generally face less stringent rules than public funds. Furthermore, the specialized nature of investment mandates allows hedge funds to access niche, less liquid markets, such as private credit, specialized real estate equity, and unique venture capital opportunities, providing differentiated exposure unavailable through standard public market indices.

Major applications of hedge funds include institutional investment management for endowments, pensions, and sovereign wealth funds, providing portfolio diversification and inflation protection that conventional assets often lack, particularly during periods of economic contraction. The sustained demand for differentiated alpha sources and tailored risk management solutions continues to drive institutional allocation toward alternative investments globally. Product descriptions vary significantly by strategy, but core offerings focus on complex liquid and illiquid asset management, customized fee structures often tied closely to performance (the "2 and 20" model is increasingly negotiable), and limited investor liquidity features intended to support long-term, specialized investment horizons. Investment products are increasingly packaged into regulated structures, such as UCITS funds in Europe, offering greater liquidity and regulatory protection to a broader institutional base, yet retaining core hedge fund strategy elements, reflecting a hybridization of the asset class to cater to broader investor needs.

The market’s substantial growth is underpinned by several powerful driving factors. Firstly, the structural need among institutional asset owners to meet high actuarial return targets continues to compel them to allocate capital toward hedge funds that can deliver superior risk-adjusted returns, especially as bond yields remain constrained. Secondly, rapid technological advancements, particularly the maturation of data analytics and artificial intelligence, enable funds to execute increasingly sophisticated trading strategies, improving operational efficiency and generating new sources of alpha derived from unconventional data. Benefits derived from participation include enhanced portfolio stability, reduced correlation risk during market downturns, and access to unique market opportunities closed off to typical retail investors. The growing focus on Environmental, Social, and Governance (ESG) investment criteria is also acting as a key driver, compelling funds to innovate their compliance and reporting structures to capture ethically minded institutional capital, solidifying the market's trajectory towards significant expansion throughout the forecast period.

Hedge Fund Market Executive Summary

The Hedge Fund Market is currently undergoing a structural evolution, moving away from pure active management towards hybrid models that integrate advanced quantitative techniques and technological superiority. Key business trends include the ongoing consolidation of mid-sized funds into mega-managers capable of achieving significant operational scale and cost efficiencies, alongside a pronounced industry-wide shift toward integrating Environmental, Social, and Governance (ESG) compliant strategies, particularly influential in European asset allocation decisions. Investors are demanding far greater fee transparency and verifiable alignment of interests, leading to increased adoption of performance-only fee structures, hurdle rates, or tiered management fee models based on AUM and strategy complexity. Furthermore, enhancing operational robustness, driven by sophisticated cybersecurity measures, advanced cloud-based computing, and stringent regulatory compliance technology (RegTech), has become a core competitive differentiator, mitigating significant operational and technological risks inherent in complex global trading and data handling.

Regional trends indicate North America maintaining its overwhelming dominance, benefiting from a highly mature institutional investor base, the most liquid and sophisticated capital markets globally, and a concentration of leading technological innovation hubs that crucially support advanced quantitative strategies. However, the Asia Pacific (APAC) region, specifically countries like China, Singapore, and Japan, is emerging as the fastest-growing market, driven by rapidly rising local wealth management demand, financial market liberalization, and supportive regulatory reforms that facilitate local fund establishment and cross-border investment flows. Europe remains highly focused on integrating intricate regulatory regimes like MiFID II and AIFMD, while establishing specialized strategies targeting European distressed debt, structured credit, and impact investing, influenced heavily by ongoing geopolitical instability and divergent macroeconomic shifts within the Eurozone.

In terms of segmentation trends, the Multi-Strategy segment continues to capture the largest and most rapidly growing share of assets under management (AUM), prized by institutional investors for its diversification benefits, flexibility, and ability to pivot across uncorrelated asset classes, thus providing robust downside protection. Technology adoption is creating a clear and growing distinction between traditional funds and funds utilizing advanced machine learning algorithms for strategy execution (Pure Quant Funds), where technological infrastructure is the primary source of competitive advantage. The End-User landscape is witnessing increased and sustained participation from pension funds seeking sophisticated liability matching and enhanced volatility mitigation, further solidifying the trend toward risk-managed, absolute-return focused offerings within the institutional investor class, while Family Offices seek highly customized, tax-efficient mandates.

AI Impact Analysis on Hedge Fund Market

Common user inquiries regarding AI's influence on the Hedge Fund Market typically revolve around operational displacement, the scalability of alpha generation capabilities, and the crucial regulatory compliance risks associated with complex, often opaque black-box models. Users frequently question how AI algorithms can predict subtle market anomalies and behavioral finance inefficiencies more effectively and rapidly than human fundamental analysts, whether the increased reliance on synchronized machine learning models will inadvertently lead to greater systemic risks or sudden flash crashes, and what specific technical and analytical skill sets future portfolio managers will require to supervise these advanced systems effectively. There is also significant concern among investors about data privacy, the ethical implications of using alternative data, and the enduring competitive advantage derived from proprietary, high-quality datasets and sophisticated analytical tools which may restrict access to smaller firms. Key expectations center on AI driving substantial cost efficiencies in research, trade execution, and settlement processes, customizing investment products on a massive scale for large institutional clients, and fundamentally changing the due diligence process for evaluating fund managers, shifting focus from historical human performance to technological infrastructure and data strategy.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the competitive landscape of the hedge fund industry, moving beyond simple automation to sophisticated, self-improving decision-making support systems. AI algorithms are now critical in dramatically enhancing signal detection by processing vast, unconventional datasets—such as satellite imagery, aggregated sentiment analysis from social media, and supply chain logistics data—at speeds and scales unattainable by human analysts. This enhanced analytical capability allows funds to identify non-consensus, asymmetric investment opportunities and execute complex, high-frequency trades with superior precision and minimized market impact, thus significantly boosting the potential for generating persistent, non-correlated alpha. The adoption curve is steepest and most technologically advanced among large quantitative funds, but smaller fundamental funds are increasingly leveraging outsourced AI platforms and third-party data visualization tools to stay competitive in research and execution, partially democratizing access to powerful analytical technologies.

Furthermore, AI plays an indispensable role in strengthening operational resilience, optimizing capital efficiency, and modernizing risk management frameworks within hedge funds. By employing ML models for comprehensive, multi-factor stress testing of portfolios against thousands of hypothetical macroeconomic and geopolitical scenarios, funds can more accurately quantify and proactively manage tail risks, significantly improving regulatory compliance and internal governance standards. The comprehensive automation of middle and back-office functions—including trade reconciliation, real-time compliance monitoring, performance attribution, and regulatory reporting—drastically reduces operational costs, mitigates key-personnel risk, and minimizes the incidence of costly human error. This technological imperative ensures that funds prioritizing digital transformation can reliably attract and retain institutional capital, as sophisticated investors increasingly view advanced, integrated AI infrastructure as a non-negotiable prerequisite for robust, scalable, and auditable investment operations in today's increasingly volatile global markets.

- Enhanced Alpha Generation: AI facilitates rapid, multi-dimensional processing of alternative data for highly predictive modeling, leading to superior trading signal identification and instantaneous execution across multiple asset classes.

- Optimized Risk Management: Machine learning models drastically improve portfolio stress-testing capabilities, provide dynamic volatility forecasting, and enable real-time identification of systemic and correlation risks.

- Operational Efficiency: Comprehensive automation of middle and back-office functions (compliance, reconciliation, reporting, valuation) significantly lowers the structural operating expense ratio (ORE) of the fund.

- Personalized Client Solutions: AI algorithms enable mass customization of complex investment strategies and managed account mandates to precisely meet specific institutional risk/return profiles and liquidity preferences.

- Data Strategy Supremacy: Competitive advantage shifts fundamentally toward funds that possess proprietary, high-quality data ingestion, cleaning, and processing pipelines, effectively turning data into a unique, defensible asset.

- Regulatory Technology (RegTech) Integration: AI tools and natural language processing streamline compliance checking and automated surveillance against complex and rapidly evolving global financial regulations (e.g., Dodd-Frank, MiFID II).

- Shift in Talent Requirements: Increased demand for specialized data scientists, machine learning engineers, cloud architecture experts, and quantitative analysts capable of bridging the gap between finance and complex computational models.

DRO & Impact Forces Of Hedge Fund Market

The dynamics of the Hedge Fund Market are shaped by a complex, high-stakes interplay of core Drivers, operational Restraints, and strategic Opportunities (DRO), collectively forming significant Impact Forces that dictate market direction, investor appetite, and growth potential. The primary driver remains the persistent institutional hunger for non-correlated, risk-adjusted returns and sophisticated portfolio diversification tools, which fuels consistent, large-scale capital allocation from global pension funds, endowments, and sovereign wealth entities into alternative asset classes. Concurrently, the explosive technological advancements in quantitative modeling, cloud computing, and massive data processing create a lucrative opportunity landscape where high-frequency, machine learning, and systematic macro strategies can generate superior, scalable returns that defy traditional market limitations. However, structural growth is critically restrained by increasing regulatory scrutiny and the resultant compliance costs post-financial crises, alongside the pervasive challenge of fee compression, where large institutional investors demand substantially lower management fees for core strategies, pressuring funds to achieve extreme operational and cost efficiency.

Impact forces stemming from geopolitical instability, heightened trade tensions, and the recent regime of rising interest rates introduce both severe systematic risks and highly lucrative niche opportunities. Increased global market volatility often significantly benefits tactical macro and event-driven hedge funds capable of rapidly capitalizing on policy shifts, market dislocation, and corporate restructuring events. Conversely, the proliferation of global transparency requirements—such as FATCA, CRS, and AIFMD in Europe—imposes extremely substantial compliance burdens, requiring specialized technology and expertise, which disproportionately affects smaller fund managers, thereby strongly driving structural market consolidation toward technologically dominant mega-managers. The structural restraint of high entry barriers, including immense capital requirements, access to premium prime brokerage services, and the critical need for specialized quantitative talent, limits the success of new entrants, allowing established players with deep pockets and superior technology infrastructure to further solidify their dominance in market share.

The synergistic effect of these powerful forces results in a market environment that rigorously rewards scale, profound specialization, and seamless technological integration across the entire investment cycle. Funds that successfully integrate advanced, proprietary data analytics, maintain stringent operational risk controls that meet institutional standards, and offer tailored, ESG-compliant investment products are overwhelmingly best positioned for sustained capital inflows and long-term success. Conversely, funds that rely solely on outdated, generic strategies or fail to modernize their technology stack face sustained capital outflows, difficulty attracting top-tier talent, and struggle to justify high fee structures in a competitive environment. Therefore, the core impact force propelling the market forward is the continuous, rapid cycle of innovation and adaptation required to simultaneously meet the dual, non-negotiable demands of institutional investors: consistent, verifiable absolute returns combined with robust, transparent risk management and verifiable adherence to ethical and responsible investment practices.

Segmentation Analysis

The Hedge Fund Market is structurally segmented based primarily on investment strategy, offering a necessary granular view of how managers allocate capital and generate alpha across different risk profiles and market conditions. This segmentation is crucial as it fundamentally dictates the associated fee structures, the liquidity provisions offered to investors, the level of regulatory oversight, and the specific target institutional investor base. The market is broadly categorized into strategies like Equity-Focused (Long/Short, Short Bias, Sector Specific), Event-Driven (Merger Arbitrage, Activist Investing, Distressed Debt), Relative Value (Fixed Income Arbitrage, Convertible Arbitrage, Volatility Arbitrage), and Macro Strategies (Discretionary Global Macro, Systematic Macro). These diverse and often non-correlated approaches ensure that the hedge fund industry can cater to highly specific institutional requirements, such as minimizing volatility in pension portfolios, exploiting complex corporate actions, or capitalizing on broad, directional economic shifts across global markets.

Further granularity exists within the primary asset class focus and the organizational structure of the funds themselves. Asset classes managed include liquid equities, high-yield and investment-grade fixed income, physical and derivative commodities, foreign exchange currencies, and complex multi-asset portfolios. The organizational segmentation often distinguishes between single-manager funds, which focus intensively on a narrow, high-conviction strategy with a small team, and multi-manager platforms (or "pods" shops), which house multiple independent, specialized teams trading diverse strategies, offering higher diversification and significantly lower idiosyncratic risk to investors. This multi-manager structure has witnessed explosive growth recently, attracting substantial institutional capital due to its proven operational robustness, sophisticated centralized risk management, and its potential for delivering smoother, less volatile returns compared to reliance on the performance of a single-strategy fund.

The End-User segmentation explicitly highlights the market's heavy reliance on institutional capital sources. Pension funds (both public and corporate), endowments, foundations, and sovereign wealth funds represent the dominant and fastest-growing capital sources, driven by strict liability matching obligations and the relentless pursuit of superior risk-adjusted returns exceeding standard market benchmarks. Although High Net Worth Individuals (HNWIs) and Family Offices remain important, particularly for niche strategies and bespoke mandates, the comprehensive institutionalization of the industry necessitates greater adherence to institutional standards regarding operational robustness, transparency, standardized reporting (e.g., using Open Protocol), and sophisticated internal governance, making institutional grade service a critical, non-negotiable feature across all successful fund segments.

- Strategy Type:

- Long/Short Equity

- Global Macro (Discretionary and Systematic)

- Event-Driven (Merger Arbitrage, Distressed Debt, Activist)

- Relative Value (Fixed Income Arbitrage, Convertible Arbitrage)

- Credit/Fixed Income (High Yield, Private Credit)

- Multi-Strategy (Diversified Platform)

- Quantitative (Pure Quant, Systematic Trading)

- Fund Structure:

- Single-Manager Funds

- Fund of Funds

- Multi-Manager Platforms

- Investor Type:

- Pension Funds (Public and Corporate)

- Endowments and Foundations

- Sovereign Wealth Funds

- High Net Worth Individuals (HNWIs) and Family Offices

- Geographic Focus:

- Developed Markets Focus (NA, Europe)

- Emerging Markets Focus (APAC, LATAM)

Value Chain Analysis For Hedge Fund Market

The hedge fund value chain is distinctly focused on maximizing the efficiency of intellectual capital and trade execution, beginning with the upstream analysis phase where proprietary data sourcing, cleaning, and processing are paramount for generating alpha. Upstream activities involve extensive fundamental research, complex macroeconomic modeling, and increasingly, the development and continuous refinement of sophisticated quantitative algorithms to generate actionable investment ideas (alpha signals). This data acquisition and processing phase utilizes highly specialized cloud computing platforms and complex data visualization tools, often involving bespoke data partnerships with niche vendors like geospatial data firms or detailed credit card transaction aggregators, demanding massive computational power. Critical partners in this phase include alternative data providers, specialized research boutiques, and advanced cloud computing vendors necessary for handling and integrating big data analytics into trading models. The quality, uniqueness, and speed of processing of the input data and the predictive models applied directly determine the fund's competitive edge, requiring substantial upfront investment in technological infrastructure and highly specialized data science talent.

Midstream execution involves the actual portfolio construction, rigorous, real-time risk oversight, sophisticated trade placement, and the core function of efficient capital allocation across strategies. This crucial stage requires seamless, low-latency interaction with global prime brokers, custodians, and highly optimized execution management systems (EMS) and order management systems (OMS) that are designed to minimize transaction costs, reduce market impact, and manage slippage. Robust internal risk systems, frequently employing machine learning models for real-time stress testing, exposure aggregation, and dynamic margin monitoring, are essential components of the midstream process, ensuring that stringent regulatory limits and internal risk mandates are strictly adhered to across diverse and often highly leveraged trading strategies. The distribution channel, representing the downstream component, is primarily dominated by direct, relationship-based engagement between the fund managers (General Partners) and the institutional investors (Limited Partners). While third-party placement agents are often utilized for initial fundraising and accessing specific niche geographic markets or investor types, the overwhelming bulk of institutional capital flows via direct mandates and sophisticated managed accounts, reflecting the high-touch, trust-based, and highly customized nature of this premier asset class.

The entire hedge fund value chain is structurally underpinned by robust operational infrastructure, encompassing advanced technology for regulatory compliance (RegTech), comprehensive fund accounting, investor capital movements, and sophisticated investor relations platforms designed for transparent reporting. Indirect channels, although declining in influence, include Fund of Funds, which pool capital and allocate it across various underlying hedge funds, offering essential diversification and delegated due diligence for smaller institutional players or those lacking dedicated hedge fund research teams. However, the prevailing institutional trend is towards rapid disintermediation, with large institutional buyers preferring direct access to top-tier managers to critically minimize fee layers and ensure direct, real-time transparency regarding underlying investments, portfolio exposure, and operational controls. Efficiency in the middle and back office, often achieved through strategic outsourcing of key non-core functions to specialized third-party administrators and technology providers, is vital for maintaining industry-leading low expense ratios and satisfying the increasingly rigorous and complex operational due diligence (ODD) demands of sophisticated limited partners, thus transforming back-office service quality from a mere cost center into a significant strategic differentiator in institutional appeal and capital attraction.

Hedge Fund Market Potential Customers

The primary customer base for the Hedge Fund Market consists overwhelmingly of sophisticated institutional investors who possess both the immense capital volume and the requisite high-level risk tolerance and investment sophistication required for these specialized products. These end-users, or buyers, are fundamentally driven by the critical need to achieve absolute returns that consistently surpass standard public bond and equity benchmarks while simultaneously seeking investment strategies that offer low, often negative, correlation to broad market indices for genuine portfolio diversification. Potential core customers include the world's largest public and corporate pension funds, who utilize hedge funds extensively to meet highly challenging long-term liability obligations; globally recognized university endowments and charitable foundations, who seek aggressive, consistent growth coupled with long-term, inflation-adjusted capital preservation; and powerful sovereign wealth funds managing national reserves for generational continuity.

A rapidly expanding and increasingly influential segment of the customer base includes large, sophisticated Single- and Multi-Family Offices, and Ultra-High Net Worth Individuals (UHNWIs) who require highly customized investment solutions for complex, multi-jurisdictional wealth preservation, transfer, and generational legacy planning. Unlike typical retail investors, these powerful clients often seek co-investment opportunities alongside the general partner or specialized bespoke mandates tailored specifically to their unique liquidity, tax, and governance requirements. The key characteristic uniting these diverse and sophisticated buyers is their absolute requirement to perform extremely thorough and independent operational and investment due diligence (ODD and IDD) on prospective fund managers, prioritizing funds with impeccable governance, robust compliance, transparent processes, and a proven ability to deliver verifiable, non-generic alpha generation across multiple complex market cycles.

Furthermore, major global insurance companies are increasingly becoming crucial end-users, strategically allocating significant portions of their general accounts to alternative strategies to substantially boost investment income and enhance total returns, particularly during persistent low-yield environments which pressure their core business profitability. For all potential customers, the willingness to commit and lock up capital for extended periods (given the typically lower liquidity provisions of many hedge fund investments) and their acceptance of performance-based incentive fees, structured around hurdle rates, are fundamental prerequisites for entry. Consequently, the marketing, capital raising, and investor relations efforts of top-tier hedge funds are almost exclusively directed towards these professional, accredited institutions capable of conducting the required detailed due diligence and accepting the complex, leveraged risks involved in alternative investing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Trillion |

| Market Forecast in 2033 | USD 7.5 Trillion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgewater Associates, Man Group, AQR Capital Management, Citadel, Renaissance Technologies, Millennium Management, The Blackstone Group (Hedge Fund Solutions), Elliott Management, D.E. Shaw & Co., Two Sigma Investments, Tudor Investment Corporation, Och-Ziff Capital Management (Sculptor Capital Management), Baupost Group, Capula Investment Management, Balyasny Asset Management, Marshall Wace, Farallon Capital Management, Brevan Howard, Winton Group, Schonfeld Strategic Advisors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hedge Fund Market Key Technology Landscape

The modern hedge fund operates within a highly sophisticated and resource-intensive technological ecosystem centered around high-performance computing (HPC), advanced proprietary data management systems, and low-latency trading platforms. Key technology adoption is driven by the necessity for execution speed, strategy complexity, and data scalability, particularly among high-frequency and quantitative funds. This foundational infrastructure includes massive investment in cloud-based or private cloud resources, offering highly scalable computational resources for rigorous back-testing of complex strategies and handling the ingestion and processing of massive, non-traditional datasets in real time. Furthermore, the integration of ultra-low-latency trading systems optimized for direct market access (DMA) and proprietary execution algorithms is mandatory for maximizing returns and minimizing market impact across diverse global exchanges. Crucially, robust, multi-layered cybersecurity protocols and systems are paramount, given the extreme sensitivity of investment strategies and institutional capital, making advanced threat detection, behavior analytics, and breach prevention technologies non-negotiable components of the essential technological landscape.

The most transformative technologies currently influencing the industry are Artificial Intelligence (AI), Machine Learning (ML), and Deep Learning (DL). These tools are utilized not just for high-level prediction and signal generation, but also for automated compliance monitoring (RegTech), optimizing multi-factor portfolio construction based on millions of correlated and non-correlated market variables, and analyzing unstructured and alternative data sources—such as text, images, and satellite geolocation data—to uncover proprietary, non-consensus investment insights. The primary competitive edge is increasingly determined by a fund's ability to seamlessly and rapidly integrate diverse proprietary and third-party data feeds into advanced, self-iterating analytical models, requiring robust and resilient data ingestion pipelines (Data Lakes), sophisticated data governance frameworks, and dedicated, highly skilled data science teams to manage and continuously improve these complex quantitative systems effectively throughout market cycles.

Beyond core alpha generation and execution, technology plays a foundational role in achieving operational excellence, a key factor in attracting institutional capital. Funds leverage specialized enterprise resource planning (ERP) systems tailored for complex financial services, highly sophisticated portfolio accounting and valuation software (NAV calculations), and advanced integrated risk management platforms (e.g., Value at Risk systems, Counterparty Risk Management). The structural trend towards Multi-Manager platforms necessitates the adoption of highly scalable, modular technology architecture capable of supporting independent trading pods and segregated P&L reporting while simultaneously maintaining centralized, real-time risk control and stringent compliance oversight across all mandates. This continuous technological evolution represents a significant and escalating capital expenditure for funds, but it is unequivocally essential for meeting institutional demands for operational efficiency, execution precision, low slippage, and comprehensive, standardized risk transparency required by global institutional investors.

Regional Highlights

North America, decisively spearheaded by the United States, commands the largest share of the global Hedge Fund Market, driven by its unparalleled depth of institutional capital (pensions, endowments), the highly mature regulatory environment that encourages financial innovation, and the dense concentration of the world's most successful and technologically advanced hedge fund managers in centers like New York, Boston, and Connecticut. The region benefits profoundly from a robust and dynamic financial ecosystem supporting highly specialized investment—including accessible venture capital funding for financial technology development, the most liquid and actively traded capital markets globally, and a strong institutional culture of aggressively pursuing alternative investments to achieve high actuarial targets. The sheer scale, complexity, and rapid pace of the financial instruments traded within North America necessitate continuous innovation in trading technologies, sophisticated risk modeling, and advanced regulatory compliance solutions, securing its position as the global financial hub for the industry.

Europe represents the second-largest market by AUM, although it remains highly complex, fragmented, and significantly influenced by varying national regulatory regimes alongside the overarching, often prescriptive EU directives such as AIFMD, UCITS, and MiFID II. The United Kingdom, despite Brexit, maintains its dominance as the primary European hub, particularly for European-focused macro, event-driven, and systematic strategies, leveraging its historical financial expertise and service provider infrastructure. Growth in continental Europe is increasingly focused on specialized areas like complex distressed debt and specialized real estate opportunities, due to ongoing economic uncertainties in the Eurozone, and the rapid, mandate-driven adoption of Environmental, Social, and Governance (ESG) criteria, which compels European funds to integrate sophisticated sustainability factors into their investment models. Navigating complex regulatory compliance costs and managing cross-border operational complexity remain defining structural characteristics of the competitive European hedge fund landscape.

The Asia Pacific (APAC) region is strongly projected to exhibit the highest Compound Annual Growth Rate during the forecast period. This dramatic expansion is fueled by rising institutional and private wealth, particularly in rapidly growing economies like China, where the domestic hedge fund market is professionalizing quickly due to favorable regulatory reforms, and in established financial markets like Japan, Singapore, and Hong Kong, which serve as critical regional financial centers. The progressive liberalization of financial markets in several APAC economies, alongside increasing allocation by large sovereign wealth funds and ultra-high-net-worth individuals seeking domestic and regional exposure, is attracting significant international fund manager presence establishing local offices. Demand in APAC leans heavily towards strategies focused on regional equity long/short opportunities, fixed income arbitrage, and credit opportunities arising from rapid regional economic shifts, corporate governance improvements, and massive infrastructure development projects, presenting unique alpha sources not present in Western markets.

- North America: Dominant global market share; driven by deep institutional assets (pensions, endowments) and technological leadership in quantitative finance (US concentration); highest rate of AI adoption.

- Europe: Second largest market; growth focused on mandatory ESG-compliant strategies and opportunistic credit/distressed debt; high complexity due to regulatory fragmentation (AIFMD, MiFID II) drives consolidation.

- Asia Pacific (APAC): Fastest growing region; fueled by increasing institutional and private wealth in China, Singapore, and Japan; strong focus on regional equity market opportunities and regulatory liberalization.

- Latin America (LATAM): Niche market focused on capitalizing on local currency macro volatility, inflation arbitrage, and commodity exposure; growth is highly contingent on political stability and attracting reliable foreign institutional capital.

- Middle East & Africa (MEA): Growth driven primarily by mandates from powerful sovereign wealth funds seeking global diversification and high-conviction exposure to developed and emerging markets; high concentration of capital and manager demand in UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hedge Fund Market.- Bridgewater Associates

- Man Group

- AQR Capital Management

- Citadel

- Renaissance Technologies

- Millennium Management

- The Blackstone Group (Hedge Fund Solutions)

- Elliott Management

- D.E. Shaw & Co.

- Two Sigma Investments

- Tudor Investment Corporation

- Sculptor Capital Management (formerly Och-Ziff)

- Baupost Group

- Capula Investment Management

- Balyasny Asset Management

- Marshall Wace

- Farallon Capital Management

- Brevan Howard

- Winton Group

- Schonfeld Strategic Advisors

Frequently Asked Questions

Analyze common user questions about the Hedge Fund market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hedge funds and traditional mutual funds?

Hedge funds are largely exempt from many restrictive regulations (like the US Investment Company Act of 1940) and are legally structured to be open exclusively to accredited or institutional investors. They employ complex, high-conviction strategies such as high leverage, short selling, and derivatives usage to achieve absolute returns, independent of the market direction, whereas mutual funds are highly regulated, limited in their strategy flexibility, and primarily target the retail investor base.

How is the current market environment influencing hedge fund fee structures and compensation?

Intense investor pressure, particularly from large institutional allocators, is driving systemic fee compression across the industry, forcing a shift away from the rigid "2 and 20" model. Leading managers are now frequently negotiating for significantly lower management fees (closer to 1.0% or 1.5%) and implementing higher performance hurdles (benchmark plus alpha) or tiered performance fees, pushing the industry toward a stronger alignment of interests via performance-only compensation.

What critical role does alternative data play in generating proprietary alpha for modern hedge fund strategies?

Alternative data (Alt Data), encompassing unconventional sources like satellite imagery, aggregated credit card transaction data, mobile app usage metrics, and web scraping results, is now absolutely critical for generating proprietary, forward-looking alpha signals. Modern hedge funds utilize sophisticated AI and machine learning platforms to rapidly process and analyze these non-traditional inputs, thereby gaining an information edge that is non-consensus and actionable before that insight becomes reflected in consensus market pricing, fundamentally benefiting both quantitative and sophisticated fundamental funds.

Which hedge fund strategies are currently expected to perform best during periods of high inflation and sustained rising interest rates?

Global Macro strategies are typically best positioned to benefit substantially from high volatility and sharply shifting global monetary policy, as they can take broad directional, cross-asset bets across currencies, commodities, interest rates, and fixed income markets. Additionally, Event-Driven funds focused on corporate distressed debt and specialized fixed income arbitrage tend to perform well, capitalizing on corporate refinancing challenges, credit spread widening, and restructuring opportunities arising from higher debt servicing costs and tightening capital market liquidity.

How are strict Environmental, Social, and Governance (ESG) mandates affecting capital flows into the hedge fund industry?

ESG mandates, which are particularly powerful in European pension and endowment sectors and rapidly gaining global traction, are channeling substantial new capital towards hedge funds that can demonstrably integrate sustainability and sophisticated governance factors into their entire investment process and reporting structure. Funds failing to provide transparent, quantifiable ESG metrics or those heavily invested in controversial sectors are increasingly facing exclusion, or significant capital reduction, making ESG compliance a critical, non-optional factor for long-term capital retention and successful institutional capital inflow.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager