Helical Gear Reducers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432686 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Helical Gear Reducers Market Size

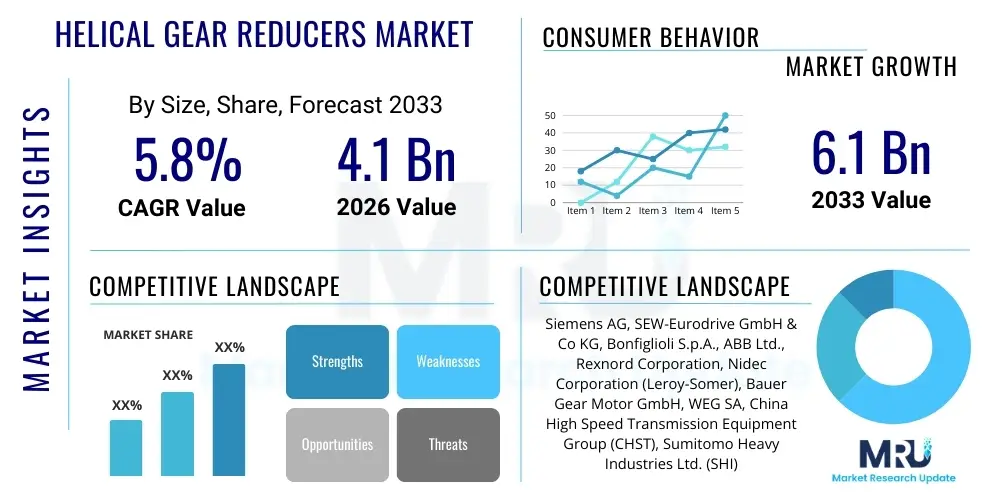

The Helical Gear Reducers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Helical Gear Reducers Market introduction

Helical gear reducers, also known as helical gearboxes, are critical mechanical components utilized across diverse industrial sectors for efficiently transferring power and adjusting torque and speed output from a motor. These reducers employ gears with teeth cut at an angle to the axis of rotation, which allows for smoother, quieter operation and higher torque transmission capacity compared to traditional spur gears. Their design provides increased tooth contact ratio, significantly reducing shock loading and vibration, thereby enhancing the lifespan and reliability of the connected machinery. The robustness and high efficiency of helical gear systems make them indispensable in heavy-duty applications requiring continuous, dependable performance, such as large conveyor systems, material processing, and industrial mixers.

The primary function of a helical gear reducer is to maximize the efficiency of mechanical power transmission while ensuring precise speed reduction tailored to specific operational requirements. Major applications span industries including Cement & Aggregate, Mining, Power Generation, Chemical Processing, and Food & Beverage manufacturing. Key benefits include superior load-carrying capacity, reduced noise emissions—a crucial factor in meeting stringent industrial safety and environmental standards—and inherent energy efficiency, contributing to lower operational costs for end-users. The continuous refinement in gear manufacturing techniques, including precision grinding and surface hardening, further boosts the performance envelope of these devices, allowing them to handle higher power densities within compact footprints.

Market growth is predominantly driven by the accelerating pace of industrial automation globally, particularly in developing economies embarking on extensive infrastructure projects. The increasing demand for energy-efficient machinery mandated by global sustainability initiatives, coupled with the necessity for reliable motion control in sophisticated manufacturing processes, are pivotal driving factors. Furthermore, the rapid expansion of the logistics and warehousing sector, which relies heavily on high-throughput material handling equipment, substantially contributes to the sustained demand for high-performance helical gear reducers. Technological advancements focusing on modular design and integration capabilities are also expanding the addressable market for these components.

Helical Gear Reducers Market Executive Summary

The Helical Gear Reducers Market is characterized by steady, moderate growth, propelled by robust industrial recovery and sustained capital investment in manufacturing infrastructure across Asia Pacific (APAC). Business trends indicate a strong inclination towards customized and application-specific gearboxes, moving beyond standard catalog offerings to meet precise operational parameters like higher thermal ratings and enhanced power density. Key manufacturers are focusing heavily on integrating advanced monitoring technologies, such as IoT sensors and predictive maintenance capabilities, transforming gear reducers from passive mechanical components into smart, interconnected assets that improve overall equipment effectiveness (OEE). This strategic shift ensures greater competitiveness and value proposition in a mature market segment, promoting long-term replacement and upgrade cycles.

Regionally, Asia Pacific maintains its dominance, driven by rapid industrialization in countries like China, India, and Southeast Asian nations, alongside massive investments in transportation infrastructure and renewable energy projects. North America and Europe, while growing at a slower pace, exhibit high demand for premium, high-efficiency (IE4 and above) reducers tailored for demanding applications such as aerospace, precision robotics, and pharmaceutical manufacturing. The stricter regulatory environment in these developed regions regarding energy consumption and noise pollution further dictates the adoption of high-precision, low-backlash helical systems. Competition remains intense, centered around product reliability, after-sales service, and the ability to deliver integrated power transmission solutions.

In terms of segmentation, the market for parallel shaft helical gear reducers holds the largest share due to its versatility and high torque capacity, especially prevalent in heavy industries like mining and cement production. However, the bevel helical segment is poised for rapid growth, favored in applications requiring right-angle drives and compact installation, such as material handling and food processing lines. The market is also seeing increasing penetration of gearboxes classified by power rating, with the mid-power range (50 kW to 250 kW) witnessing significant uptake, reflecting the standardization and automation of medium-scale manufacturing units globally. The push for modular systems that simplify inventory management and maintenance procedures continues to shape segmentation trends.

AI Impact Analysis on Helical Gear Reducers Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Helical Gear Reducers Market commonly center on themes such as predictive maintenance efficacy, the potential for AI-driven design optimization, and the role of machine learning in improving manufacturing throughput and quality control. Users are keen to understand how AI-powered vibration and thermal analysis systems can preemptively detect minor mechanical faults, drastically reducing catastrophic failures and unplanned downtime in critical industrial processes. Furthermore, there is significant interest in utilizing generative design algorithms to engineer lighter, more efficient gear sets while adhering to complex stress and thermal constraints. The overall expectation is that AI will transition helical gear reducers from simple mechanical components to sophisticated, data-generating nodes essential for achieving Industry 4.0 objectives.

- AI enables highly accurate predictive maintenance models, leveraging real-time sensor data (vibration, temperature, oil analysis) to forecast component failure, extending Mean Time Between Failures (MTBF).

- Generative design tools powered by AI optimize gear tooth profiles and housing geometries, maximizing power density and minimizing material usage, leading to smaller, lighter gearboxes.

- AI algorithms enhance quality control in manufacturing by analyzing microscopic surface finishes and acoustic signatures during production, ensuring zero-defect output.

- Machine learning models optimize energy consumption by dynamically adjusting motor speed and gear ratio selection based on real-time load profiles and efficiency maps.

- AI assists in supply chain resilience by forecasting component demand and raw material price fluctuations, streamlining procurement for complex gear reducer assemblies.

DRO & Impact Forces Of Helical Gear Reducers Market

The dynamics of the Helical Gear Reducers Market are shaped by a strong combination of industrial drivers, technical constraints, and evolving regulatory opportunities. Key market drivers include the global trend toward industrial automation and the proliferation of sophisticated manufacturing plants that require precise and reliable speed control mechanisms. Restraints often revolve around the high initial cost associated with customized, high-precision helical gearboxes, especially those incorporating advanced materials and monitoring technologies, potentially slowing adoption among smaller manufacturers. Opportunities are vast in the maintenance and repair segment, focusing on digital transformation, including the integration of IoT for remote diagnostics and the development of specialized reducers for emerging sectors like electric vehicles (EV) manufacturing infrastructure and advanced robotics.

Impact forces, analyzed through a modified Porter's Five Forces framework, suggest moderate to high industry competition due to the large number of global and regional players offering differentiated products. The bargaining power of buyers is moderate, influenced by standardization in low-end segments but reduced significantly for specialized, high-torque applications where supplier expertise is critical. The threat of substitutes, primarily from belts, chains, and alternative transmission systems, is generally low in heavy-duty applications where the helical gearbox's mechanical efficiency and durability are unmatched. New market entrants face high barriers related to precision manufacturing capital costs and the necessity for proven reliability and long operational history, maintaining the stability of the established competitive landscape.

Specifically, the adoption of IE3 and IE4 efficiency standards globally acts as a significant driver, compelling manufacturers to invest in superior helical designs that reduce energy loss, often requiring stricter material science and machining tolerances. Conversely, the market remains susceptible to volatile raw material prices, particularly steel alloys and specialized lubricants, which directly impact manufacturing costs and pricing strategies. However, the rise of refurbishment and remanufacturing services presents a notable opportunity, allowing suppliers to extend the product lifecycle, cater to budget-sensitive markets, and align with circular economy principles, thereby stabilizing long-term revenue streams.

Segmentation Analysis

The Helical Gear Reducers Market is structurally segmented based on crucial attributes including product type, power rating, mounting type, and primary end-use application, providing a detailed view of specific market dynamics and growth trajectories. Product segmentation distinguishes between specialized types such as parallel shaft helical, bevel helical, and worm helical combinations, each designed for specific operational needs concerning footprint, torque output, and orientation. Segmentation by power rating helps suppliers target specific industrial scales, ranging from fractional kilowatt units used in small automation to multi-megawatt reducers critical for heavy mining and power generation facilities. This detailed segmentation aids stakeholders in developing focused marketing strategies and optimizing production based on dominant application requirements and regional industrial concentration.

- By Product Type:

- Parallel Shaft Helical Gear Reducers

- Bevel Helical Gear Reducers

- Worm Helical Gear Reducers

- Planetary Helical Gear Reducers

- Right-Angle Helical Gear Reducers

- By Power Rating:

- Up to 50 kW (Low Power)

- 50 kW to 250 kW (Medium Power)

- Above 250 kW (High Power)

- By Mounting Type:

- Foot Mounted

- Flange Mounted

- Shaft Mounted

- By End-Use Industry:

- Cement & Aggregate

- Mining & Metals

- Power Generation (Conventional and Renewable)

- Chemical, Oil & Gas

- Food & Beverage Processing

- Material Handling & Logistics

- Water and Wastewater Management

Value Chain Analysis For Helical Gear Reducers Market

The value chain for helical gear reducers is complex, spanning raw material sourcing, precision machining, assembly, distribution, and extensive aftermarket services. The upstream analysis focuses on the procurement of high-grade raw materials, primarily specialized steel alloys (such as alloyed structural steel 20CrMnTi, 42CrMo), cast iron, and non-ferrous metals for casings and internal components. Raw material quality is paramount, directly influencing the gearbox's thermal capacity, durability, and load-carrying capability. Key upstream activities involve forging, heat treatment (carburizing, nitriding), and precision grinding of gears, demanding highly specialized manufacturing expertise and substantial capital investment in advanced CNC machinery and metrology equipment to achieve necessary tolerances (typically DIN class 5 to 7).

Midstream activities involve the core manufacturing processes, including the assembly of gears, shafts, bearings, and seals into the housing, followed by rigorous testing protocols encompassing noise, vibration, temperature, and torque capacity verification. This stage is dominated by specialized gear manufacturing companies and integrated power transmission solution providers. Distribution channels are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) for standardized projects and indirect channels utilizing regional distributors, industrial suppliers, and certified system integrators for maintenance, repair, and operational (MRO) markets. The selection of the channel is often dependent on the geographic reach and complexity of the required solution, with custom heavy-duty units frequently necessitating direct manufacturer-to-customer interaction.

Downstream analysis centers on the utilization and servicing of the gear reducers by various end-user industries. OEMs incorporate these reducers into larger machinery (e.g., conveyor belts, crushers, agitators), driving substantial volume demand. Post-sales service, including routine maintenance, spare parts supply, refurbishment, and digital diagnostic services (condition monitoring), constitutes a critical component of the value proposition and revenue generation, often contributing significantly to the life cycle profitability for the manufacturer. The transition towards smart factory installations is shifting value further downstream, requiring manufacturers to provide digital integration and remote asset management capabilities.

Helical Gear Reducers Market Potential Customers

Potential customers for helical gear reducers are broadly defined as industrial entities that require reliable, efficient, and speed-controlled mechanical power transmission systems to operate critical machinery in continuous processes. The major buyers include large Original Equipment Manufacturers (OEMs) specializing in material handling equipment, such as bulk logistics systems, port cranes, and automated storage and retrieval systems (AS/RS). Furthermore, the core process industries—Cement, Mining & Metals, and Chemical Processing—represent significant end-users due to their requirement for massive, highly reliable gearboxes for applications like ball mills, rotary kilns, crushers, and large pumps and agitators. Demand is also strong from the Power Generation sector, particularly in wind turbine yaw and pitch drives and cooling tower applications, where high durability and minimal maintenance are non-negotiable prerequisites for operational continuity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, SEW-Eurodrive GmbH & Co KG, Bonfiglioli S.p.A., ABB Ltd., Rexnord Corporation, Nidec Corporation (Leroy-Somer), Bauer Gear Motor GmbH, WEG SA, China High Speed Transmission Equipment Group (CHST), Sumitomo Heavy Industries Ltd. (SHI), Elecon Engineering Company Limited, Altra Industrial Motion Corp., David Brown Santasalo, FLSmidth A/S, Rossi Group, Nord Drivesystems, Tsubakimoto Chain Co., Renold PLC, Cone Drive Operations. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helical Gear Reducers Market Key Technology Landscape

The technological landscape of the helical gear reducers market is defined by advancements aimed at increasing power density, improving operational efficiency, and integrating digital capabilities. Precision machining techniques, particularly CNC gear grinding and hobbing, are critical, enabling manufacturers to achieve highly accurate tooth profiles (ISO/DIN quality classes 5-7). This precision significantly reduces noise, minimizes power loss through friction, and extends the service life of the components. Furthermore, the use of advanced surface treatments, such as specialized coatings and optimized case hardening processes (e.g., plasma nitriding), enhances wear resistance and pitting strength, allowing gearboxes to handle consistently higher load cycles without premature failure. Manufacturers are constantly refining thermal management solutions, including optimized housing designs with increased surface area and forced cooling systems, to maintain operational temperatures and prevent lubricant breakdown under extreme conditions.

A second crucial area of technological advancement is the focus on modular and highly flexible gear system design. Modular design philosophy allows manufacturers to interchange components (gears, shafts, bearings) across different reducer sizes and types, simplifying inventory management, reducing lead times for custom assemblies, and facilitating easier field maintenance and part replacement. This approach supports rapid deployment and scalability for complex industrial setups. Manufacturers are utilizing specialized computational fluid dynamics (CFD) and finite element analysis (FEA) software during the design phase to optimize housing rigidity, minimize vibration, and ensure optimal lubrication flow paths, confirming performance before physical prototyping. This digital engineering approach accelerates product development cycles significantly.

Finally, the integration of Industry 4.0 technologies has introduced 'smart' gearboxes equipped with embedded sensors for monitoring key parameters like vibration spectrum, oil quality, and operating temperature in real-time. This capability facilitates Condition Monitoring Systems (CMS) and Predictive Maintenance (PdM). These systems rely on high-speed data acquisition and secure communication protocols (like EtherCAT or PROFINET) to transmit operational data to cloud-based analytics platforms. The convergence of reliable mechanical performance with sophisticated digital diagnostics is essential for maintaining competitiveness, offering customers the ability to optimize asset utilization and move away from time-based preventative maintenance schedules.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for helical gear reducers, primarily fueled by extensive investments in infrastructure development, burgeoning manufacturing sectors in China, India, and ASEAN countries, and rapidly expanding industrial automation initiatives. The region's substantial demand stems from heavy industries like cement, mining, steel production, and large-scale material handling projects (ports, airports). Government initiatives promoting localized manufacturing and industrial zones further stimulate demand. Manufacturers in this region focus on volume production of medium-to-high power reducers, prioritizing cost-effectiveness alongside robustness required for continuous-duty cycles typical in the regional industrial base.

- North America: The North American market is characterized by a strong emphasis on technology, high efficiency, and compliance with stringent environmental and safety regulations. Demand here is driven by modernization projects in the oil and gas sector, expansion of high-tech logistics and automated warehousing, and the rapid growth of the automotive and aerospace manufacturing industries. Buyers prioritize gearboxes integrated with IoT capabilities for remote monitoring and diagnostics. The market seeks premium, low-backlash, and high-precision helical reducers, often meeting or exceeding IE4 efficiency standards, reflecting a focus on minimizing total cost of ownership (TCO) rather than upfront component cost.

- Europe: Europe represents a mature market demanding highly specialized and energy-efficient helical gear solutions, strongly influenced by the EU's directives on sustainability (e.g., Ecodesign requirements). Key drivers include the region's strong focus on renewable energy (especially wind power, requiring specialized planetary-helical combinations) and precision manufacturing sectors (robotics, pharmaceuticals). Germany, Italy, and France are hubs for gear manufacturing excellence, exporting high-quality, customized, modular systems globally. The European market leads in the adoption of digitalization, requiring gear manufacturers to offer comprehensive lifecycle services and data integration capabilities.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity price fluctuations, heavily reliant on the mining (Chile, Peru) and oil & gas (Brazil, Mexico) industries. Demand for heavy-duty, robust helical gear reducers is steady in these sectors. While capital expenditure can be volatile, the replacement and MRO market remains stable. Manufacturers focus on providing durable, easy-to-maintain units capable of operating reliably in harsh, often remote, environmental conditions. Market penetration of advanced digital monitoring solutions is gradually increasing, driven by international safety and efficiency mandates.

- Middle East and Africa (MEA): The MEA market is primarily propelled by significant investments in oil and gas infrastructure, petrochemical processing plants, and large-scale construction projects (e.g., economic city developments in Saudi Arabia and the UAE). Demand centers around high-power, customized helical and bevel-helical reducers for pump drives, compressors, and extensive water management systems. Africa presents long-term growth opportunities driven by mining sector expansion and nascent industrialization, requiring durable, reliable gear solutions that can withstand high temperatures and dust contamination.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helical Gear Reducers Market.- Siemens AG

- SEW-Eurodrive GmbH & Co KG

- Bonfiglioli S.p.A.

- ABB Ltd.

- Rexnord Corporation

- Nidec Corporation (Leroy-Somer)

- Bauer Gear Motor GmbH

- WEG SA

- China High Speed Transmission Equipment Group (CHST)

- Sumitomo Heavy Industries Ltd. (SHI)

- Elecon Engineering Company Limited

- Altra Industrial Motion Corp.

- David Brown Santasalo

- FLSmidth A/S

- Rossi Group

- Nord Drivesystems

- Tsubakimoto Chain Co.

- Renold PLC

- Cone Drive Operations

- Emerson Electric Co.

Frequently Asked Questions

Analyze common user questions about the Helical Gear Reducers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of helical gear reducers over spur gear reducers?

Helical gear reducers offer superior benefits including quieter operation, higher load-carrying capacity, increased efficiency, and smoother power transmission due to the angular alignment of their teeth, which allows for gradual engagement and continuous tooth contact.

Which end-use industry drives the highest demand for high-power helical gear reducers?

The Mining & Metals industry, followed closely by Cement & Aggregate production, drives the highest demand for high-power (above 250 kW) helical gear reducers, as these sectors rely on continuous operation of heavy machinery like crushers, mills, and kilns requiring substantial torque.

How does Industry 4.0 affect the design and function of modern helical gearboxes?

Industry 4.0 integration involves equipping helical gearboxes with smart sensors (IoT) and connectivity capabilities, enabling real-time condition monitoring, predictive maintenance planning, reduced downtime, and optimization of operational efficiency through data analytics.

What is the projected CAGR for the Helical Gear Reducers Market between 2026 and 2033?

The Helical Gear Reducers Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period of 2026 to 2033, driven largely by global industrial automation initiatives and infrastructure spending in Asia Pacific.

What factors determine the selection between a parallel shaft and a bevel helical gear reducer?

Selection depends primarily on the required output shaft orientation and space constraints. Parallel shaft reducers are used for inline power transmission, offering high efficiency and torque. Bevel helical reducers are chosen when a 90-degree (right-angle) change in direction is needed in a compact setup.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Helical Gear Reducers Market Size Report By Type (Parallel-axis helical gear reducer, Perpendicular-axis helical gear reducer), By Application (Oil Industry, Food & Beverage Industry, Power Industry, Mining Industry, Other Applications), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Helical Gear Reducers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Perpendicular-axis helical gear reducer, Parallel-axis helical gear reducer), By Application (Power Industry, Food & Beverage Industry, Oil Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager