Helicopter Avionics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434318 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Helicopter Avionics Market Size

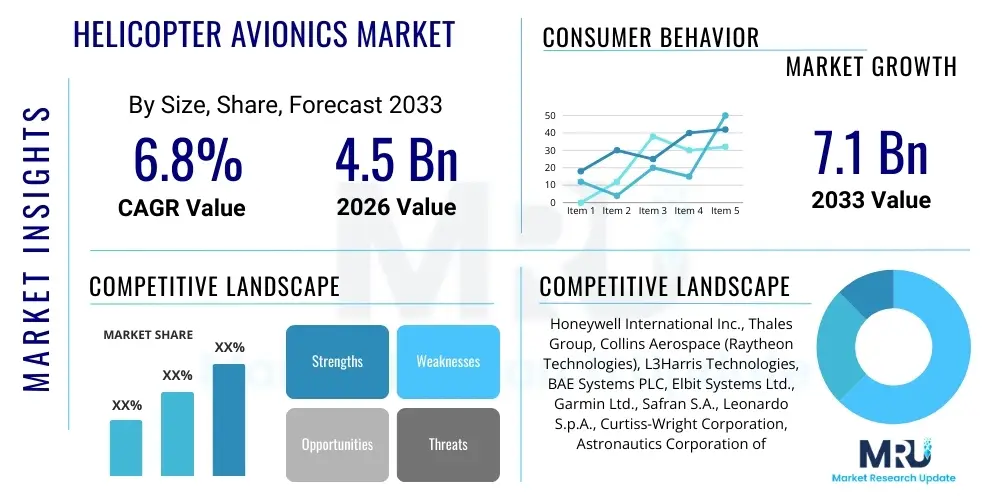

The Helicopter Avionics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by extensive modernization programs within global military fleets, coupled with the increasing demand for advanced safety and navigation systems in the rapidly expanding commercial helicopter sector, particularly for emergency medical services (EMS) and offshore transport operations.

The market expansion is heavily reliant on technological advancements, specifically the adoption of Integrated Modular Avionics (IMA) architectures, which provide enhanced processing power, reduced weight, and improved system integration capabilities. Retrofit and upgrade programs constitute a significant portion of market revenue, as older helicopters require compliance with stringent new airspace regulations, necessitating the installation of sophisticated components like enhanced flight management systems (FMS) and updated surveillance technology such as Automatic Dependent Surveillance-Broadcast (ADS-B) systems.

Furthermore, the shift towards digital cockpits, replacing traditional analog gauges with multi-function displays (MFDs), drives demand in both the Original Equipment Manufacturer (OEM) segment and the aftermarket. The long lifecycle of helicopters ensures sustained aftermarket demand for maintenance, repair, and overhaul (MRO) services, often incorporating mandatory system upgrades to improve operational efficiency, safety, and compatibility across diverse global flight environments.

Helicopter Avionics Market introduction

Helicopter avionics encompass the electronic systems utilized in helicopters, crucial for communication, navigation, flight management, sensing, and display functions. These sophisticated systems range from basic communication radios and transponders to complex, fully integrated digital cockpits incorporating Enhanced Vision Systems (EVS), Synthetic Vision Systems (SVS), advanced weather radar, and high-precision GPS/INS navigation tools. Major applications span military operations (reconnaissance, transport, attack), commercial transport (corporate, oil and gas offshore operations), public services (law enforcement, search and rescue), and the burgeoning segment of Emergency Medical Services (EMS), where reliability and immediate situational awareness are paramount.

The primary benefits derived from modern helicopter avionics include significantly improved operational safety through enhanced situational awareness, reduced pilot workload via automation, and improved navigation accuracy, especially in challenging environments such as low visibility or high-density airspace. They also contribute to enhanced efficiency by optimizing flight paths and fuel consumption. Driving factors for market growth include strict global air safety regulations mandating system upgrades, the geopolitical necessity for military fleet modernization focusing on network-centric warfare capabilities, and the rising global procurement of new generation civil helicopters equipped with state-of-the-art digital architectures.

Modern avionics architecture is increasingly transitioning toward open systems and modularity, facilitating easier integration of new technologies and future upgrades without completely overhauling the entire system. This modular approach, driven by standards like FACE (Future Airborne Capability Environment), allows operators to minimize long-term operational costs and maintain compliance efficiently. The continuous development of satellite communication systems integrated within the avionics suite further enables beyond-line-of-sight communication and real-time data exchange, essential for complex, long-duration missions.

Helicopter Avionics Market Executive Summary

The global Helicopter Avionics Market exhibits strong resilience, underpinned by mandatory regulatory compliance and robust defense spending focused on platform longevity and capability enhancement. Business trends indicate a pivot towards advanced digitalization, with manufacturers heavily investing in Integrated Modular Avionics (IMA) platforms that prioritize cyber resilience and seamless data fusion. The industry is seeing consolidation among major Tier 1 suppliers, who are expanding their service offerings to capture lucrative aftermarket MRO contracts, ensuring long-term revenue streams beyond initial equipment sales. Furthermore, there is a distinct trend toward lightweight, energy-efficient components driven by the necessity to maximize flight range and payload capacity for both civil and military platforms.

Regional trends highlight North America maintaining market dominance, largely attributed to extensive defense procurement programs, such as the Future Vertical Lift (FVL) initiative, and a well-established civil aviation infrastructure demanding continuous upgrades. However, Asia Pacific is projected to register the highest growth rate, fueled by burgeoning economic expansion leading to increased commercial helicopter usage in China, India, and Southeast Asia, coupled with aggressive regional military modernization efforts. Europe follows with steady demand driven by strict EASA safety mandates requiring fleet retrofits and the replacement of older generation helicopters with models featuring sophisticated glass cockpits.

Segment trends confirm that the Aftermarket segment, encompassing retrofits, MRO, and upgrades, holds a substantial market share due to the extended operational lifespan of helicopters, often exceeding 30 years. Component-wise, Flight Management Systems (FMS) and Communication Systems are experiencing rapid growth, necessitated by the need for precision navigation and seamless integration into global air traffic management (ATM) systems. Within platforms, the Medium Helicopter segment, utilized extensively across military transport, SAR, and heavy commercial applications, remains the largest revenue contributor, demanding high-end, redundant avionics packages for mission critical reliability.

AI Impact Analysis on Helicopter Avionics Market

User inquiries regarding AI's influence in the Helicopter Avionics Market frequently center on concerns about the feasibility and safety of autonomous flight, the reliability of AI-driven systems in high-stress operational environments, and the economic implications of utilizing predictive maintenance algorithms. Key themes emerging from these questions involve defining the regulatory pathway for certifying AI-enhanced systems, understanding the balance between automation and human oversight, and assessing how AI integration impacts the existing pilot workforce and MRO protocols. Users are specifically keen on understanding how AI contributes to mission success in degraded visual environments (DVE) and reduces the cognitive load on pilots during complex operations.

AI and machine learning (ML) are rapidly transforming the industry by enabling sophisticated data fusion, crucial for enhancing situational awareness through the seamless integration of external sensor inputs with onboard navigation data. This processing capability allows for the development of advanced decision support tools, providing pilots with real-time risk assessment and optimal route planning, significantly boosting operational safety margins. Furthermore, AI algorithms are foundational to predictive maintenance programs, allowing operators to move from time-based or reactive maintenance to condition-based servicing. By analyzing vast amounts of sensor data, AI identifies subtle anomalies indicative of component wear or potential failures, thereby minimizing unscheduled downtime, optimizing maintenance schedules, and substantially reducing overall ownership costs for fleet operators.

The ultimate impact of AI extends toward achieving higher levels of autonomy, moving from pilot assistance systems (which reduce workload) toward fully autonomous or Optionally Piloted Vehicle (OPV) architectures. While regulatory certification remains a hurdle, these technologies promise transformative efficiency gains, particularly in military logistics, surveillance, and hazardous environment operations where maintaining crew presence is risky or economically prohibitive. AI integration is thus viewed as the primary accelerator for next-generation helicopter design, emphasizing safety, efficiency, and future operational adaptability.

- AI enhances situational awareness through real-time sensor data fusion.

- Predictive maintenance (PdM) algorithms minimize unscheduled grounding and reduce MRO costs.

- AI supports advanced flight planning and dynamic route optimization based on environmental factors.

- Development of autonomous or optionally piloted vehicle (OPV) architectures is accelerated by ML.

- Improved crew decision support systems reduce pilot cognitive load during complex maneuvers.

- AI-driven synthetic and enhanced vision systems (SVS/EVS) improve safety in degraded visual environments.

- Enhancement of cyber security defenses through behavioral monitoring and anomaly detection.

DRO & Impact Forces Of Helicopter Avionics Market

The Helicopter Avionics Market is significantly shaped by a confluence of accelerating drivers, stringent restraints, and lucrative opportunities, all under the influence of powerful macro-environmental forces. Key drivers include rigorous global mandates for air traffic modernization (such as ADS-B Out requirements and future CNS/ATM integration), coupled with sustained and increasing global military expenditure dedicated to upgrading aging helicopter fleets to extend their service life and enhance mission capability. However, the market faces significant restraints, primarily stemming from the extremely long and costly certification processes required by aviation bodies (FAA, EASA) for new avionic hardware and software, creating high barriers to entry. Additionally, the substantial capital investment required for these complex system upgrades often challenges smaller operators and limits the speed of adoption in budget-constrained civil sectors.

Opportunities for growth are primarily concentrated in the aftermarket segment through large-scale retrofit programs aimed at compliance and capability enhancement, particularly the integration of high-definition multi-function displays and advanced connectivity solutions for C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) missions. Furthermore, the emerging market for Urban Air Mobility (UAM) and drone-based logistics presents a future adjacent opportunity, necessitating compact, highly reliable, and certified avionics suites. The overall market dynamics are impacted by political stability (influencing defense budgets), economic cycles (affecting commercial aviation procurement), and rapid technological forces, particularly the push towards open-system architectures (OSA) that promise increased affordability and flexibility in integrating third-party technologies.

Impact forces governing the market's trajectory include the pervasive influence of cyber security threats, which necessitate continuous investment in robust, secure avionics components, making cyber resilience a non-negotiable requirement for both OEMs and MRO providers. Geopolitical tensions fuel defense spending, directly translating into demand for high-performance military avionics. Furthermore, the imperative for reducing carbon emissions pushes technology developers to create lighter, more efficient electronic systems that contribute minimally to overall aircraft weight and fuel consumption, compelling innovation in material science and system miniaturization.

Segmentation Analysis

The Helicopter Avionics Market segmentation provides a granular view of demand distribution across various product types, platforms, applications, and end-user categories, reflecting the diverse operational requirements of the global helicopter fleet. This analysis is critical for manufacturers to align their R&D investments with high-growth areas. The market structure is broadly categorized by the physical component installed (e.g., FMS, Communication), the type of platform utilized (Light, Medium, Heavy), the ultimate application (Military or Commercial), and the buyer type (OEM or Aftermarket).

The Aftermarket segment consistently dominates revenue generation, driven by the structural requirement for fleet operators to perform periodic upgrades to maintain operational relevance and comply with evolving safety standards, such as mandatory ADS-B and satellite-based navigation system installations. In terms of component revenue, Flight Management Systems (FMS) and Navigation Systems command a significant share, given their central role in mission execution, demanding high redundancy and precision, particularly for demanding operations like precision landing in oil rigs or complex SAR missions. Technological complexity and high system prices further bolster the FMS segment's value contribution.

Within the Platform segmentation, the Medium Helicopter category represents the largest revenue base. These versatile platforms (typically in the 4,000 kg to 8,000 kg Maximum Take-off Weight range) are utilized across the broadest spectrum of roles, including specialized military transport, border patrol, and high-volume commercial transport, necessitating comprehensive and often customized avionics packages. The proliferation of these platforms globally, combined with long replacement cycles, ensures persistent demand for both new installations and extensive modernization programs.

- By Component:

- Flight Management System (FMS)

- Communication Systems (VHF, UHF, Satcom)

- Navigation Systems (GPS/GNSS, INS, Radar Altimeters)

- Surveillance Systems (Weather Radar, TCAS, Transponders)

- Electronic Flight Instrument System (EFIS/Glass Cockpits)

- By Platform:

- Light Helicopters

- Medium Helicopters

- Heavy Helicopters

- By Application:

- Commercial (EMS, Corporate, Oil & Gas)

- Military (Attack, Transport, Utility)

- By End-User:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retrofit and MRO)

Value Chain Analysis For Helicopter Avionics Market

The value chain for the Helicopter Avionics Market is characterized by highly specialized stages, beginning with upstream component sourcing and culminating in long-term aftermarket service contracts. The upstream analysis focuses on specialized component suppliers, including manufacturers of advanced semiconductors, sensors (e.g., inertial measurement units), specialized displays, and proprietary software. These suppliers feed raw, often highly regulated, materials and subcomponents to the Tier 1 avionics system integrators. Due to the stringent certification requirements (Design Assurance Level D, C, B, A), suppliers must adhere to complex aerospace standards (like RTCA DO-178C for software and DO-254 for hardware), making the barrier to entry extremely high and resulting in a concentrated supplier base.

Mid-chain activities are dominated by major OEMs and system integrators (e.g., Collins Aerospace, Thales, Honeywell), who design, manufacture, and integrate the complex avionics suites. They manage the certification process and often supply directly to the helicopter airframe manufacturers (like Airbus Helicopters, Leonardo, Bell) in the OEM channel. The distribution channel is predominantly direct: major integrators negotiate large contracts directly with the airframe OEMs or governmental defense organizations for new aircraft installation, ensuring system compatibility and customization tailored to specific platform requirements.

Downstream activities center on the aftermarket, which includes Maintenance, Repair, and Overhaul (MRO) providers, authorized service centers, and independent distributors handling replacement parts and system upgrades. The aftermarket channel is crucial for sustained revenue, often involving indirect sales through global MRO networks to reach helicopter operators worldwide. This segment is characterized by strong customer loyalty tied to authorized service providers, given the specialized nature of repairs and the necessity of using certified components to maintain airworthiness.

Helicopter Avionics Market Potential Customers

The potential customer base for the Helicopter Avionics Market is highly diversified, encompassing large governmental entities, private corporate operators, and specialized commercial service providers. Primary customers include global defense ministries and air forces, which procure advanced avionics for attack, utility, and heavy transport helicopters, demanding robust, high-performance systems with superior redundancy and secure military-grade encryption for C4ISR capabilities. These customers prioritize long-term system support and compatibility with existing military networks.

The second major customer segment consists of commercial fleet operators, including those serving the offshore energy sector (oil and gas transport), which require high-precision navigation systems and sophisticated weather radar to operate reliably in challenging maritime conditions. Additionally, Emergency Medical Services (EMS) and Search and Rescue (SAR) organizations represent a high-value customer group demanding extremely reliable, low-weight systems that facilitate rapid response and safe operation in all weather conditions, often requiring advanced features like night vision compatibility and hover assistance technology.

A third significant segment comprises Original Equipment Manufacturers (OEMs), who act as immediate customers purchasing complete avionics suites for integration into new airframes. These relationships are critical for avionics manufacturers, often involving collaborative design agreements to tailor systems for new helicopter models. Furthermore, private corporate and VIP transport operators represent a smaller but growing segment focused on highly customized, modern glass cockpits offering enhanced comfort and connectivity features, often driving demand for the latest high-resolution display technologies and in-flight communication systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Thales Group, Collins Aerospace (Raytheon Technologies), L3Harris Technologies, BAE Systems PLC, Elbit Systems Ltd., Garmin Ltd., Safran S.A., Leonardo S.p.A., Curtiss-Wright Corporation, Astronautics Corporation of America, Universal Avionics Systems Corporation, General Dynamics Corporation, Cobham (Eaton), Meggitt PLC, GE Aviation, CMC Electronics (Esterline). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helicopter Avionics Market Key Technology Landscape

The technological landscape of the Helicopter Avionics Market is defined by the rapid shift towards highly integrated, software-centric architectures designed to maximize safety and mission effectiveness while minimizing physical footprint and maintenance complexity. Integrated Modular Avionics (IMA) stands as the foundational technology, replacing federated, discrete electronic boxes with centralized computing platforms that host multiple critical and non-critical applications on shared resources. This architecture significantly reduces wiring, weight, and power consumption, crucial factors for enhancing helicopter performance and reducing fuel burn. The move to IMA facilitates system upgrades through software updates rather than costly hardware replacements, offering substantial lifecycle cost savings.

Another pivotal technological advancement is the widespread adoption of Synthetic Vision Systems (SVS) and Enhanced Vision Systems (EVS), often integrated into Electronic Flight Instrument Systems (EFIS), or "glass cockpits." SVS generates 3D topographical views of the surrounding terrain and obstacles based on precise GPS and terrain databases, greatly enhancing situational awareness, especially in DVE (Degraded Visual Environment) conditions such as fog, snow, or brownouts. EVS, using infrared cameras, provides a real-time visual overlay of the external world, penetrating poor visibility. The fusion of SVS and EVS data creates a robust operational picture, significantly reducing the risk of Controlled Flight Into Terrain (CFIT) accidents, a major safety concern for helicopter operations.

Furthermore, the market is undergoing transformation through enhanced connectivity, specifically the integration of advanced satellite communication (Satcom) systems and high-bandwidth datalinks. These technologies support critical functions like real-time health and usage monitoring system (HUMS) data transmission for predictive maintenance, secure voice and data communication for military missions (C4ISR), and seamless integration with future global Air Traffic Management (ATM) systems. The increasing utilization of ruggedized Commercial Off-the-Shelf (COTS) components, adapted for airborne environments, is also lowering manufacturing costs and accelerating the introduction of advanced processing power into the cockpit environment.

Regional Highlights

The Helicopter Avionics Market exhibits distinct regional dynamics driven by differing regulatory environments, defense spending priorities, and the maturity of civil aviation infrastructure. North America, particularly the United States, is the dominant market, primarily due to the large-scale and continuous modernization programs undertaken by the Department of Defense (DoD), aimed at extending the service life of platforms like the Black Hawk and Apache, alongside significant investments in next-generation platforms under the Future Vertical Lift (FVL) initiative. The presence of major Tier 1 avionics manufacturers and a demanding regulatory environment (FAA mandates) further solidify the region's leading position, driving early adoption of highly complex systems.

Europe represents a stable and mature market, influenced strongly by the European Union Aviation Safety Agency (EASA) regulations, which often align with or even exceed FAA standards regarding safety equipment and airspace compliance. Growth is sustained by mandatory fleet upgrades across major civil sectors—especially EMS and corporate transport—and steady, though often collaborative, defense procurement among NATO allies focused on interoperability. The emphasis here is on certified European-manufactured equipment that adheres strictly to continent-specific operational requirements.

Asia Pacific (APAC) is projected to be the fastest-growing market globally. This exponential growth is spurred by rapid economic development leading to increased commercial helicopter usage in sectors like tourism, offshore energy, and corporate travel, particularly in emerging economies like India and China. Concurrently, regional defense spending is surging as countries like Japan, South Korea, and Australia replace aging military fleets and enhance their maritime patrol capabilities, requiring sophisticated military avionics for intelligence and surveillance operations. The region’s focus is on acquiring both new aircraft and high-volume, cost-effective retrofit solutions.

- North America: Market leader, driven by US military FVL programs and rigorous FAA regulatory compliance mandates (ADS-B).

- Europe: Stable growth fueled by EASA mandates for safety upgrades and strong demand in the civil EMS and SAR sectors.

- Asia Pacific (APAC): Highest projected CAGR, supported by massive commercial fleet expansion and escalating regional defense modernization efforts in key countries like India and China.

- Latin America: Characterized by fragmented demand, focused primarily on government and military procurement for border control and natural resource management, often relying on US or European suppliers for retrofit programs.

- Middle East and Africa (MEA): Growth driven by high-value defense contracts, particularly in the Gulf Cooperation Council (GCC) nations, emphasizing advanced surveillance, attack, and VIP transport avionics packages requiring high cyber security standards.

- Australia and New Zealand: Strong focus on maritime and remote operations, driving demand for specialized search and rescue and long-range navigation systems compliant with local regulatory frameworks.

- Russia and CIS: Demand dictated largely by domestic manufacturers and state procurement, focusing on domestically developed avionic systems, though external suppliers penetrate the commercial sector when permitted.

- Brazil: Key market in Latin America, driven by offshore oil and gas industry requiring advanced navigation and safety systems for operations over water.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helicopter Avionics Market.- Honeywell International Inc.

- Thales Group

- Collins Aerospace (Raytheon Technologies)

- L3Harris Technologies

- BAE Systems PLC

- Elbit Systems Ltd.

- Garmin Ltd.

- Safran S.A.

- Leonardo S.p.A.

- Curtiss-Wright Corporation

- Astronautics Corporation of America

- Universal Avionics Systems Corporation

- General Dynamics Corporation

- Cobham (Eaton)

- Meggitt PLC

- GE Aviation

- CMC Electronics (Esterline Technologies)

- Moog Inc.

- Rockwell Collins (Pre-acquisition activity context)

- Northrop Grumman Corporation

Frequently Asked Questions

Analyze common user questions about the Helicopter Avionics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Integrated Modular Avionics (IMA) and why is it critical for helicopter fleets?

IMA is a centralized computing architecture that consolidates multiple functions (navigation, communication, flight management) onto shared processing platforms. It is critical because it significantly reduces weight, power consumption, and wiring complexity, enhances system reliability, and lowers long-term upgrade costs through simplified software updates.

How do regulatory mandates, such as ADS-B, drive growth in the avionics aftermarket?

Regulatory mandates, particularly those requiring updated surveillance technology like ADS-B (Automatic Dependent Surveillance-Broadcast), necessitate the installation of new transponders and GPS receivers across vast fleets globally. Since the operational lifespan of helicopters is long, these requirements fuel massive retrofit programs in the aftermarket segment.

What are the primary challenges in the adoption of next-generation helicopter avionics?

The primary challenges include the extremely rigorous and expensive certification process (FAA/EASA) required for new safety-critical avionics software and hardware, the high initial capital investment required for fleet modernization, and mitigating complex cyber security risks associated with interconnected digital systems.

Which component segment currently holds the largest market share in helicopter avionics?

The Flight Management System (FMS) and Navigation Systems components typically hold the largest market share by value. This is due to the inherent complexity, high cost, and mandatory redundancy required for these systems, which are essential for precision navigation, especially in military, SAR, and offshore commercial operations.

How is Artificial Intelligence (AI) specifically being utilized to improve helicopter operational safety?

AI improves operational safety primarily through enhanced situational awareness via real-time data fusion from various sensors, decision support tools for pilots, and sophisticated predictive maintenance algorithms. These tools reduce human error, optimize performance, and predict component failure before it occurs, significantly reducing risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager