Helicopter Cross Tubes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436563 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Helicopter Cross Tubes Market Size

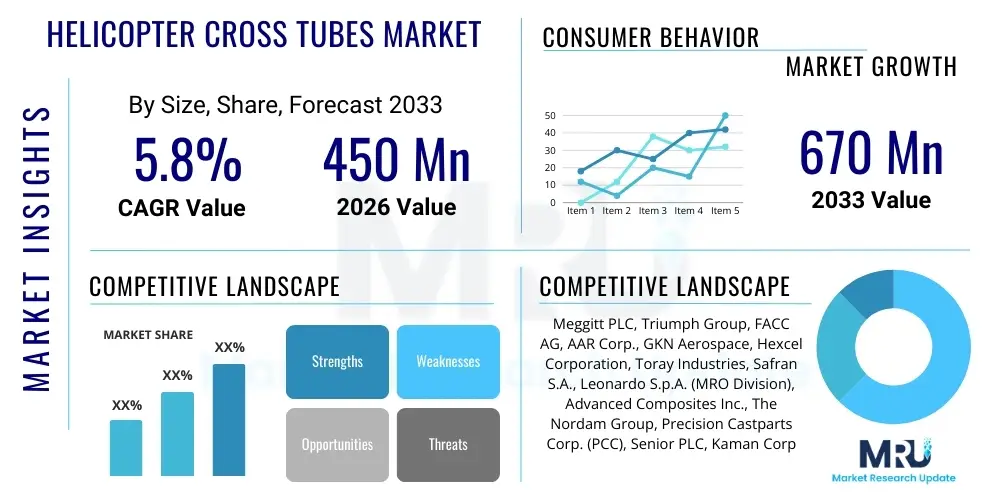

The Helicopter Cross Tubes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Helicopter Cross Tubes Market introduction

The Helicopter Cross Tubes Market encompasses the manufacturing, distribution, and maintenance of critical structural components used primarily within the skid landing gear assemblies of rotary-wing aircraft. These tubes are essential safety components designed to absorb kinetic energy during landing, especially hard landings or dynamic roll-overs, thereby protecting the fuselage structure, engine mounts, and crucially, the occupants. The performance characteristics of cross tubes—including their resilience, fatigue life, and energy absorption capacity—are strictly governed by stringent aerospace regulatory standards such as those enforced by the FAA and EASA.

Cross tubes are typically manufactured from high-strength materials, often requiring precise metallurgical control. Traditional materials include specialized alloys of steel and titanium, favored for their high tensile strength and proven durability in harsh operating environments. However, the industry is increasingly transitioning toward advanced composite materials, such as carbon fiber reinforced polymers (CFRP), which offer significant weight reduction benefits while maintaining or exceeding the required impact absorption specifications. This transition is a key driver, aiming to enhance fuel efficiency and payload capacity for both civil and military helicopters across various mission profiles.

Major applications of helicopter cross tubes span the entire rotary-wing fleet, including commercial transport, emergency medical services (EMS), search and rescue (SAR), offshore oil and gas operations, and extensive military utility and attack missions. The primary benefit these components provide is unparalleled structural integrity and crucial crashworthiness, directly addressing pilot and passenger safety during routine operations and unforeseen events. Key driving factors accelerating market growth include increasing global helicopter fleet utilization, rising demand for advanced safety features in new aircraft designs, and the mandatory replacement and maintenance cycles within the robust Maintenance, Repair, and Overhaul (MRO) sector.

Helicopter Cross Tubes Market Executive Summary

The Helicopter Cross Tubes Market is poised for stable expansion, underpinned by increasing global defense budgets prioritizing rotary-wing capabilities and continuous modernization efforts within the civil aviation sector. Business trends indicate a strong focus on supply chain resilience and material innovation, particularly the integration of lightweight composites and high-performance alloys to enhance aircraft operational metrics. Original Equipment Manufacturers (OEMs) are investing in advanced manufacturing techniques, such as friction stir welding and additive manufacturing, to optimize component geometries and reduce production lead times, responding effectively to the escalating production rates for popular models like the Bell 429 and the Airbus H145 series.

Regionally, North America remains the dominant market, largely due to extensive military procurement contracts, a robust general aviation segment, and the presence of major global helicopter manufacturers and large MRO service providers. Asia Pacific is emerging as the fastest-growing region, driven by rapid urbanization necessitating improved EMS capabilities, expansion of oil and gas exploration requiring enhanced offshore transport, and substantial growth in both commercial helicopter fleet size and defense modernization programs across countries like China and India. European market growth is steady, emphasizing compliance with rigorous EASA safety regulations and focusing on fleet replacement cycles utilizing quieter and more efficient aircraft designs.

Segmentation trends highlight the increasing market share of composite cross tubes over traditional metallic variants, reflecting the aerospace industry’s overarching drive toward weight reduction. Within the application segment, the Military segment holds the largest revenue share due to the severe operating conditions and stringent durability requirements of defense aircraft, while the Civil & Commercial segment, particularly EMS and utility operations, demonstrates the highest growth potential. The aftermarket (MRO) sector is critical, representing a significant portion of revenue as cross tubes are fatigue-sensitive components requiring periodic inspection, repair, and replacement, ensuring sustained market activity independent of new helicopter deliveries.

AI Impact Analysis on Helicopter Cross Tubes Market

Common user inquiries regarding AI’s influence on the Helicopter Cross Tubes Market primarily revolve around how artificial intelligence and machine learning can enhance structural integrity testing, optimize material selection for crashworthiness, and streamline supply chain logistics for complex components. Users seek to understand AI's role in predictive maintenance (forecasting cross tube fatigue life based on operational load cycles) and its potential in generative design to create lighter, more resilient tube geometries that meet increasingly strict safety standards. The overarching theme is the expectation that AI will transition the manufacturing and MRO processes from reactive component replacement to proactive, data-driven optimization, thereby reducing operational costs and improving aircraft availability.

AI's application in material science promises significant disruption by analyzing vast datasets concerning material stress responses, environmental degradation, and manufacturing inconsistencies. Machine learning algorithms can identify optimal alloy compositions or composite layup schedules that maximize energy absorption during impact while minimizing weight, a complex trade-off traditionally requiring extensive physical testing. Furthermore, in the manufacturing phase, AI-powered quality control systems, utilizing computer vision and sensor data from non-destructive testing (NDT), can rapidly identify micro-cracks or welding defects that are imperceptible to human inspectors, drastically improving the reliability of the final product and reducing the risk of premature failure in flight operations.

In the aftermarket, AI and Digital Twin technologies are transforming how cross tubes are maintained. By processing real-time flight data—including measured g-forces during hard landings or abrupt maneuvers—AI models can calculate the remaining useful life of a specific tube with high accuracy. This capability allows MRO providers and operators to schedule replacements precisely when necessary, avoiding unnecessary downtime and preventing catastrophic structural failures. The integration of AI tools into enterprise resource planning (ERP) systems also optimizes inventory management for spare cross tubes, ensuring critical components are available precisely where they are needed globally, minimizing aircraft on the ground (AOG) situations, which is vital for high-utilization fleets like EMS helicopters.

- AI-driven Generative Design: Optimizes cross tube geometry for maximum impact absorption and minimum weight.

- Predictive Maintenance (Pdm): Forecasts component fatigue life based on analyzed operational load profiles (flight data).

- Enhanced Quality Control: Uses machine learning for automated defect detection in NDT processes (ultrasonics, eddy current).

- Material Informatics: Accelerates the development and selection of high-performance composite and alloy materials.

- Supply Chain Optimization: AI algorithms improve forecasting and logistics for critical spare parts inventory management.

DRO & Impact Forces Of Helicopter Cross Tubes Market

The dynamics of the Helicopter Cross Tubes Market are governed by a complex interplay of safety regulations, technological advancements, and economic realities within the aerospace industry, collectively summarized by the Drivers, Restraints, and Opportunities (DRO) framework. Key drivers include stringent global airworthiness directives mandating periodic inspection and replacement of life-limited components, particularly after incidents involving hard landings, thereby fueling consistent demand in the MRO segment. Furthermore, the global expansion of civil helicopter operations, especially in emerging economies for utility and corporate transport purposes, necessitates an increasing supply of durable and certified cross tubes. The continuous pursuit of enhanced crashworthiness standards by regulatory bodies pushes manufacturers toward innovation, demanding components that can withstand higher impact forces, which acts as a powerful, non-negotiable market driver.

Restraints primarily revolve around the high initial cost and complexity associated with manufacturing and certification. Cross tubes, being primary load-bearing structures, require intensive material testing and certification, leading to long lead times and high associated development expenses. The shift towards advanced materials, while beneficial for performance, introduces complexities in manufacturing processes, such as precise composite layup techniques or specialized welding for titanium alloys, driving up production costs. Additionally, the limited number of suppliers capable of meeting the rigorous aerospace quality standards creates potential supply bottlenecks, and fluctuations in the prices of specialty aerospace-grade raw materials (like high-strength carbon fibers or aerospace steel) can compress profit margins for manufacturers and service providers.

Opportunities for market growth are significant, particularly in the realm of technological adoption and emerging market penetration. The opportunity to integrate additive manufacturing (3D printing) for producing complex, optimized geometries for specific legacy aircraft models or prototyping new designs promises to reduce material waste and customization lead times. The lucrative MRO segment presents continuous opportunity, especially as the global helicopter fleet ages, requiring frequent replacement of cross tubes. Furthermore, strategic opportunities lie in developing next-generation composite tubes that are lighter, offer superior energy absorption, and exhibit reduced vulnerability to environmental factors such as corrosion or UV exposure, thereby offering a competitive edge and commanding premium pricing across both OEM and aftermarket sales channels.

The impact forces shaping this market are substantial and multi-faceted. The immediate regulatory impact force compels compliance and drives demand based on mandated inspection and replacement intervals. The economic force, particularly fuel price volatility, strongly influences the demand for lighter composite components to enhance operational efficiency, accelerating material substitution. Technological forces continually introduce new manufacturing capabilities (e.g., advanced bonding, friction stir welding) that challenge existing production methods and quality control standards. Finally, the competitive force among OEMs drives intensive research and development to incorporate superior cross tube designs into new helicopter platforms, leveraging safety and performance as key differentiators in competitive tender processes globally.

Segmentation Analysis

The Helicopter Cross Tubes Market is systematically segmented based on various technical and operational characteristics to provide a clear understanding of demand patterns and strategic market entry points. Key segmentation dimensions include Material Type, which distinguishes between traditional metals and modern composites based on performance requirements and cost considerations; Application, classifying demand based on the end-user mission profile (Military vs. Civil); and Helicopter Type, grouping the market based on size and operational capacity (Light, Medium, and Heavy Lift). Understanding these segments is crucial for manufacturers to tailor their production capabilities and target specific market needs, such as the high-durability, anti-ballistic requirements of military applications versus the weight-sensitive, low noise requirements of civil EMS operations.

The segmentation by Material Type, comprising Metallic (Steel, Titanium, Aluminum Alloys) and Composite (Carbon Fiber, Fiberglass), is fundamental to market valuation. While metallic tubes offer established durability and lower upfront costs, composites are witnessing accelerated adoption due to their superior strength-to-weight ratio and inherent resistance to fatigue and corrosion, despite their higher initial component cost. Application segmentation clearly delineates the market’s primary revenue streams: Military applications typically generate high volume, low-mix demand driven by standardized procurement, whereas Civil applications are characterized by high-mix, lower volume, driven by diverse models and specialized MRO requirements, including tubes certified for specific environmental conditions or operational altitudes.

Furthermore, the segmentation based on Helicopter Type (Light, Medium, Heavy) reflects the structural loading requirements placed on the cross tubes. Light helicopters (e.g., Robinson R44, Bell 505) require smaller, lighter components, often utilizing aluminum alloys or basic composites, with maintenance driven by flight hours. Medium-lift helicopters (e.g., Black Hawk, AW139) represent the largest segment by value, demanding high-strength steel or advanced composites due to increased payload and dynamic landing loads. Heavy-lift platforms (e.g., Chinook, Mi-26) necessitate exceptionally robust and complex cross tube assemblies, often integrating specialized alloys and complex welding techniques to manage massive operational weights and high stress during aggressive maneuvering or heavy-duty slinging operations, ensuring market diversity across the entire product spectrum.

- By Material Type:

- Metallic Alloys (Steel, Titanium, Aluminum)

- Composite Materials (Carbon Fiber Reinforced Polymer - CFRP, Fiberglass)

- By Application:

- Military Helicopters (Attack, Utility, Transport)

- Civil & Commercial Helicopters (EMS, SAR, Offshore, Corporate, Utility)

- By Helicopter Type:

- Light Lift Helicopters

- Medium Lift Helicopters

- Heavy Lift Helicopters

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO and Replacement)

Value Chain Analysis For Helicopter Cross Tubes Market

The value chain for the Helicopter Cross Tubes Market begins with the upstream sourcing of highly specialized aerospace-grade raw materials. This stage is critical as the performance and certification of the final component depend entirely on the quality and traceability of materials like high-strength steel alloys (e.g., 4130 steel), specialized titanium, or aerospace-certified carbon fiber prepregs. Suppliers in this phase face rigorous qualification processes to meet AS9100 quality standards and often require long-term contracts with stable pricing to manage the supply volatility of these strategic materials. Material processing, including precise forming, heat treatment, or composite layup, constitutes the second vital step, transforming raw stock into semi-finished tubes, where cost efficiency and minimizing waste are primary objectives for profitability.

The midstream manufacturing phase involves high-precision machining, complex welding (particularly for metallic tubes using TIG or friction stir techniques), bonding, and assembly, often followed by specialized anti-corrosion treatments or protective coatings. This stage is highly capital-intensive, requiring specialized machinery and highly skilled technicians. Post-manufacturing, the components undergo intensive non-destructive testing (NDT), including magnetic particle inspection or ultrasonic testing, to ensure zero defects, followed by final regulatory certification (FAA/EASA conformity). The intellectual property surrounding proprietary manufacturing techniques and energy absorption mechanisms provides a significant competitive advantage to specialized cross tube manufacturers.

Distribution channels for helicopter cross tubes are bifurcated into direct and indirect routes. Direct distribution primarily serves the OEM segment, where manufacturers supply tubes directly to major helicopter assemblers like Airbus Helicopters, Bell, or Leonardo, integrated into new aircraft production lines under long-term supply agreements. Indirect distribution dominates the aftermarket (MRO) sector, utilizing specialized third-party MRO facilities, authorized distributors, and logistics partners to supply replacement tubes to helicopter operators globally. Due to the critical safety function of cross tubes, traceability and certified spare parts management through authorized channels are paramount, ensuring that only genuine, flight-certified components are installed, which helps maintain the integrity of the downstream user fleet.

Helicopter Cross Tubes Market Potential Customers

Potential customers for helicopter cross tubes are segmented into three primary categories: Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Overhaul (MRO) service providers, and Direct Operators (Military, Civil Government, and Commercial). OEMs, such as Airbus Helicopters, Bell Textron, Sikorsky, and Leonardo, represent the core demand for new components, integrating cross tubes into their new helicopter production lines. These customers demand highly standardized products, adherence to stringent build specifications, and large-volume delivery capabilities, often negotiating long-term pricing structures. The relationship with OEMs is strategic, as securing a place on the Bill of Materials (BOM) for a major platform ensures decades of subsequent MRO revenue.

MRO service providers form the largest customer base in the aftermarket segment. This includes independent MRO shops, authorized service centers run by OEMs, and in-house maintenance departments of major fleet operators. These customers require rapid availability of certified replacement cross tubes to minimize aircraft downtime (AOG), prioritizing robust quality control documentation and competitive lead times. As cross tubes are often life-limited or damage-prone during hard landings, the cyclical replacement demand from the MRO sector provides stable, predictable revenue stream for component suppliers, often demanding a high level of logistical support for global distribution.

Direct operators represent the final customer group. This includes global military forces and defense departments that operate vast fleets of utility and attack helicopters, demanding rugged, military-spec tubes, often procured through governmental tenders. Civil government operators, such as coast guards, law enforcement agencies, and fire fighting services, also constitute a significant customer base, requiring highly reliable components for critical public service missions. Finally, large commercial operators, especially those involved in offshore oil and gas transport or large-scale utility operations, purchase replacement parts either directly or through their chosen MRO partner, placing a high value on component longevity and minimal total cost of ownership (TCO).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meggitt PLC, Triumph Group, FACC AG, AAR Corp., GKN Aerospace, Hexcel Corporation, Toray Industries, Safran S.A., Leonardo S.p.A. (MRO Division), Advanced Composites Inc., The Nordam Group, Precision Castparts Corp. (PCC), Senior PLC, Kaman Corporation, Chromalloy Gas Turbine Corporation, Spirit AeroSystems, Albany International Corp., UTC Aerospace Systems (Collins Aerospace), Composite Technology, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helicopter Cross Tubes Market Key Technology Landscape

The technological landscape for helicopter cross tubes is rapidly evolving, driven by the demand for lighter weight, improved crashworthiness, and extended service life. A major focus is the shift towards advanced composite fabrication technologies, specifically automated fiber placement (AFP) and resin transfer molding (RTM) for carbon fiber cross tubes. These technologies allow for precise control over fiber orientation, maximizing the component's ability to absorb energy under specific load paths while significantly reducing weight compared to equivalent metallic structures. Furthermore, the integration of advanced sensors directly into composite layups (smart structures) is an emerging technology that enables real-time monitoring of strain and fatigue, paving the way for true condition-based monitoring rather than scheduled maintenance, offering substantial operational cost savings.

In the domain of metallic cross tubes, advancements in materials science are centering on high-strength, lightweight titanium alloys (e.g., Ti-6Al-4V) and innovative manufacturing techniques. Friction Stir Welding (FSW) is increasingly utilized for joining complex metallic sections, offering superior joint strength and fatigue resistance compared to traditional fusion welding, which is critical for components subject to high dynamic loads. Additive Manufacturing (AM), particularly for metal parts (DMLS or SLM), is gaining traction for producing complex internal geometries that were previously impossible to achieve, allowing for optimized energy absorption mechanisms within the tube structure itself. While AM is currently more prevalent in prototyping and tooling, its eventual role in low-volume, high-value replacement parts for legacy fleets is significant.

Maintenance and repair technologies are also undergoing transformation. Non-Destructive Testing (NDT) techniques, such as advanced phased array ultrasonic testing (PAUT) and thermography, are becoming more sophisticated and automated, capable of detecting minute internal flaws or delaminations in both metallic and composite cross tubes with greater accuracy and speed. Surface treatment technologies, including advanced ceramic coatings and cold spray techniques, are being applied to metallic tubes to enhance corrosion resistance and reduce wear, particularly for helicopters operating in harsh maritime or desert environments. These technological shifts are not merely incremental improvements but fundamentally reshape how cross tubes are designed, manufactured, and maintained, ensuring compliance with future rigorous airworthiness standards while minimizing lifecycle costs for operators globally.

Regional Highlights

- North America (Dominant Market Share):

North America holds the largest market share, predominantly driven by the immense military procurement and MRO activities centered around the US Department of Defense (DoD). The presence of major OEMs like Bell Textron, Sikorsky (Lockins Martin), and Boeing, coupled with a vast and aging fleet of both military and commercial helicopters, ensures constant demand for cross tubes, both for new builds and extensive aftermarket services. Regulatory frameworks established by the FAA dictate precise standards for crashworthiness and component lifespan, providing a stable regulatory environment. Furthermore, high utilization rates in sectors such as oil and gas transport (Gulf of Mexico) and expansive EMS networks create consistent demand for maintenance and replacement parts. Investment in next-generation vertical lift platforms by the US military, such as the Future Vertical Lift (FVL) program, further solidify the region's technological leadership and market scale, driving innovations in high-performance cross tube materials and structural health monitoring systems.

The U.S. government’s continuous investment in helicopter upgrades and life extension programs for platforms like the UH-60 Black Hawk and AH-64 Apache necessitates a robust domestic supply chain for critical structural components. Canada also contributes significantly through search and rescue operations and resource exploration activities, maintaining a steady demand for certified helicopter maintenance. The region's market is characterized by a strong emphasis on traceability and certified sources, with stringent quality control standards implemented throughout the supply chain. This dominance is reinforced by extensive R&D facilities dedicated to aerospace material science and structural dynamics testing, ensuring that North American suppliers remain at the forefront of impact attenuation technology.

- Europe (Stable Growth and Regulatory Focus):

The European market exhibits stable, moderate growth, primarily influenced by strict safety and environmental regulations set by the European Union Aviation Safety Agency (EASA). European demand is largely centered on upgrading existing fleets, particularly within the civil sector (corporate transport, utility), and maintaining robust EMS services. Major European OEMs like Airbus Helicopters and Leonardo drive new component demand. A key characteristic of the European market is the focus on advanced materials that contribute to noise reduction and fuel efficiency, alongside mandatory component replacement dictated by flight hours and service bulletins. The military market in Europe, while smaller than the US, maintains consistent demand through multinational collaborative defense programs.

Countries such as the UK, France, and Germany are significant contributors, maintaining large fleets for maritime patrol and internal security. The complexity of cross-border operations within the EU necessitates harmonized maintenance standards, benefiting suppliers who can provide certified parts quickly across the continent. The aftermarket is well-developed, capitalizing on the need to maintain diverse fleet types adhering to high operational standards. Manufacturers here prioritize compliance with REACH regulations concerning material usage and sustainability, often favoring suppliers who demonstrate environmental responsibility in their manufacturing processes and material sourcing. The emphasis on high-quality, long-life components mitigates some of the cost pressures seen in other, more price-sensitive regions.

- Asia Pacific (Fastest Growing Market):

The Asia Pacific region is projected to be the fastest-growing market, propelled by escalating defense expenditures, rapid urbanization, and corresponding expansion of civil aviation infrastructure. Nations like China, India, Japan, and South Korea are heavily investing in helicopter fleet modernization for both military transport and commercial applications, including disaster relief and corporate travel. The growth in offshore oil and gas exploration in Southeast Asia also drives high-utilization rates for heavy and medium-lift helicopters, resulting in accelerated demand for replacement cross tubes in the MRO segment.

However, the APAC market presents varied demands; while industrialized nations demand high-tech composite tubes, emerging economies often prioritize cost-effectiveness and robustness, potentially favoring metallic tubes for legacy platforms. Market participants must navigate diverse regulatory environments, though general adherence to international standards (FAA/EASA) is becoming increasingly common, especially for commercial fleets. The challenge lies in establishing reliable distribution networks and authorized MRO capabilities across geographically disparate countries. Local manufacturing partnerships and joint ventures are strategic necessities for suppliers seeking to capitalize on large-scale procurement tenders and circumvent import tariffs, making regional localization a critical success factor in this burgeoning market.

- Latin America and MEA (Emerging Opportunities):

Latin America and the Middle East & Africa (MEA) represent emerging markets characterized by specialized demand. Latin America’s growth is driven by mining, resource extraction, and paramilitary operations, requiring durable utility helicopters. MEA is heavily influenced by defense spending, particularly in the UAE and Saudi Arabia, and the substantial use of helicopters in the energy sector for personnel transport across volatile operating conditions. These regions typically rely heavily on imported aircraft and components, making logistics and certified local support crucial. Demand is often price-sensitive but highly reliant on certification and proven ruggedness, favoring suppliers with strong track records in demanding operational theaters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helicopter Cross Tubes Market.- Meggitt PLC

- Triumph Group

- FACC AG

- AAR Corp.

- GKN Aerospace

- Hexcel Corporation

- Toray Industries

- Safran S.A.

- Leonardo S.p.A. (MRO Division)

- Advanced Composites Inc.

- The Nordam Group

- Precision Castparts Corp. (PCC)

- Senior PLC

- Kaman Corporation

- Chromalloy Gas Turbine Corporation

- Spirit AeroSystems

- Albany International Corp.

- UTC Aerospace Systems (Collins Aerospace)

- Composite Technology, Inc.

- Honeywell International Inc. (Aerospace Division)

Frequently Asked Questions

Analyze common user questions about the Helicopter Cross Tubes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of cross tubes in a helicopter landing gear system?

The primary function of helicopter cross tubes, typically part of the skid landing gear, is to absorb and dissipate kinetic energy during landing impact, particularly hard landings. They act as critical shock absorbers, protecting the fuselage, rotor system, and occupants from structural damage, thus enhancing the aircraft's overall crashworthiness and ensuring structural integrity.

How do composite materials impact the design and performance of helicopter cross tubes?

Composite materials, such as CFRP, significantly impact cross tube design by offering a superior strength-to-weight ratio compared to traditional metallic alloys. This weight reduction enhances fuel efficiency and payload capacity, while their tailored layups allow for optimized energy absorption profiles, improving crash survivability and fatigue life, though often at a higher unit cost.

Which factors are driving the demand in the Helicopter Cross Tubes Aftermarket (MRO) segment?

Demand in the MRO segment is primarily driven by stringent airworthiness directives that mandate periodic inspection and replacement of life-limited components. Furthermore, the increasing global utilization of aging helicopter fleets, combined with the high probability of cross tube damage during hard landings or frequent operations in harsh environments, necessitates consistent and robust replacement cycles.

What is the role of Additive Manufacturing (AM) in the production of cross tubes?

Additive Manufacturing (3D printing) is leveraged in the cross tubes market primarily for prototyping and producing complex metallic geometries with optimized internal structures for enhanced energy absorption. For the aftermarket, AM offers opportunities for low-volume, on-demand production of certified spare parts, especially for older or legacy helicopter platforms where traditional tooling is uneconomical.

Which geographical region exhibits the highest growth potential for cross tube suppliers?

Asia Pacific (APAC) exhibits the highest growth potential, fueled by substantial military modernization programs across major economies like China and India, and the rapid expansion of civil helicopter services, including EMS and corporate transport, necessitating a significant increase in both new component supply and subsequent aftermarket support infrastructure over the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager