Helium Gas Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432030 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Helium Gas Market Size

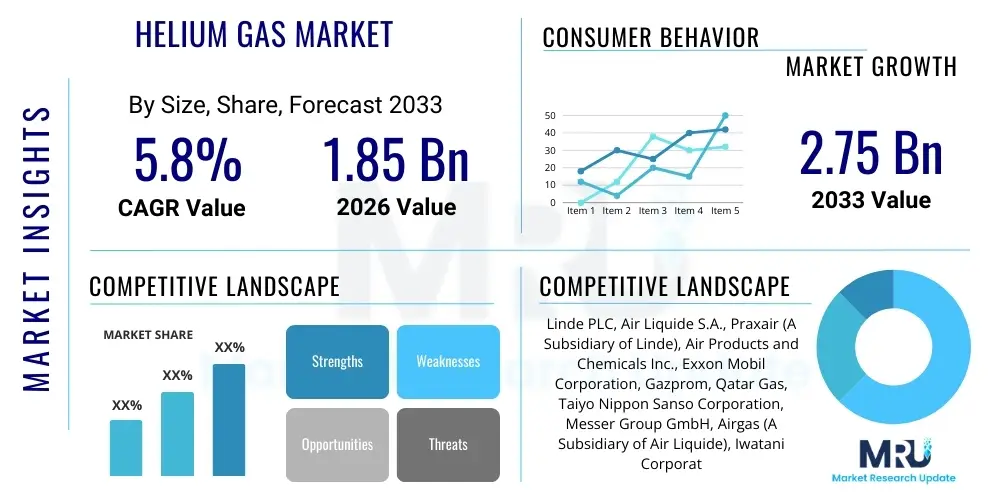

The Helium Gas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

Helium Gas Market introduction

The global Helium Gas Market is characterized by its vital role across highly specialized and technologically advanced industries. Helium, being an inert, colorless, odorless, and non-flammable noble gas, possesses unique properties, most notably its extremely low boiling point (4.2 Kelvin or -269 °C), which makes it indispensable for cryogenic applications. Its primary utility lies in cooling superconducting magnets used in Magnetic Resonance Imaging (MRI) and Nuclear Magnetic Resonance (NMR) spectrometers. The increasing global prevalence of chronic diseases and the subsequent need for advanced diagnostic technologies are consistently driving the demand for high-purity liquid helium, forming a cornerstone of the market's stability and growth trajectory. Furthermore, its light weight and non-reactive nature also cement its importance in controlled atmosphere applications where stability is paramount.

Beyond medical diagnostics, helium gas is critical in various high-tech manufacturing and industrial sectors. Semiconductor fabrication, which requires a highly stable and inert atmosphere for the production of microchips and integrated circuits, consumes significant volumes of high-purity helium. Similarly, the manufacturing of fiber optic cables relies heavily on helium for cooling and purging processes to ensure optical clarity and high performance. The aerospace and defense industries utilize helium for purging rocket fuel tanks, pressuring liquid propellants, and creating lift in specialized lighter-than-air vehicles. These diverse, high-value applications ensure that the demand for helium remains inelastic despite its high extraction and purification costs. Given its finite natural resources and complex supply chain dependent on natural gas fields, market dynamics are often dictated by geopolitical stability and production efficiency at major liquefaction plants.

The overarching benefits of helium gas, such as its superb thermal conductivity, low density, and absolute non-reactivity, define its market necessity. Key driving factors include exponential growth in global semiconductor and electronics production, continuous expansion of healthcare infrastructure requiring advanced imaging equipment (especially in emerging economies), and sustained investment in space exploration and satellite deployment missions. Market participants are increasingly focusing on recycling and recovery technologies to mitigate supply chain volatility and address the scarcity concerns associated with this vital element, leading to technological advancements in purification systems designed for closed-loop industrial processes.

Helium Gas Market Executive Summary

The Helium Gas Market is currently undergoing significant transformation, driven primarily by robust demand from the healthcare and electronics manufacturing sectors, coupled with recurring supply chain challenges. Business trends indicate a strong move toward implementing advanced helium conservation and recycling technologies, particularly in major consumption hubs like North America and Asia Pacific, to stabilize operational costs and ensure supply continuity amidst geopolitical pressures affecting key production sources. Investments are surging in new resource exploration, focusing on reserves not traditionally associated with natural gas production, alongside enhanced purification facilities designed to handle lower-concentration feedstock, thus diversifying the supply landscape. This strategic diversification aims to mitigate the high volatility historically experienced in helium pricing and availability, offering long-term resilience for end-user industries.

Regional trends distinctly highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily fueled by massive semiconductor capacity expansion in countries such as China, South Korea, and Taiwan, alongside rapidly developing MRI infrastructure across India and Southeast Asia. North America remains a crucial market, acting as both a major producer (historically the U.S. Federal Helium Reserve) and a primary consumer, especially within high-end research, cryogenics, and advanced manufacturing. European demand is characterized by stringent environmental standards driving innovation in efficient usage and recycling technologies, particularly within scientific research and advanced industrial cooling applications. The Middle East and Africa (MEA) play a vital role primarily on the supply side, leveraging substantial natural gas reserves rich in helium content to become key global exporters.

Segmentation trends reveal that the Liquid Helium segment, crucial for MRI cooling and large-scale cryogenics, maintains the largest market share in terms of value, owing to its high purity requirements and critical function in sensitive equipment. However, the Gaseous Helium segment, used extensively in welding, leak detection, and balloon inflation, exhibits substantial volume growth due to its widespread applicability across numerous industrial processes. The segment defined by application in the Electronics and Semiconductor industry is projected to record the highest CAGR, reflecting the unprecedented global investment in data centers, 5G technology, and advanced computing devices which necessitates massive quantities of the gas for fabrication purposes. The market's stability relies heavily on balancing the high-volume industrial needs with the high-purity, low-temperature demands of the medical sector.

AI Impact Analysis on Helium Gas Market

User queries regarding AI's influence on the Helium Gas Market frequently center on how machine learning can enhance efficiency in extraction, distribution logistics, and resource management, especially concerning scarcity. Key themes involve the potential for AI-driven predictive maintenance in liquefaction plants, optimization of the complex global supply chain for cryogenic gases, and utilizing advanced analytics to locate new, viable helium deposits. Users are keen to understand if AI can effectively lower the highly variable operational costs associated with helium production and improve the notoriously challenging resource allocation in times of shortage. There is a clear expectation that AI will primarily serve to stabilize supply and optimize consumption, rather than directly impacting the fundamental chemical properties or applications of the gas itself, focusing heavily on operational resilience and forecasting accuracy.

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is set to revolutionize the operational aspects of the helium supply chain, offering significant improvements in efficiency, predictive capabilities, and resource management. In upstream operations, AI can analyze geological data, seismic surveys, and historical extraction metrics to more accurately predict the yield and concentration of helium in natural gas streams, thereby optimizing drilling locations and minimizing exploration costs. Furthermore, sophisticated ML models can be deployed to monitor complex liquefaction and purification equipment, providing real-time failure warnings and facilitating preventative maintenance schedules. This shift from reactive to predictive maintenance drastically reduces unplanned downtime in high-capital facilities, ensuring a more reliable output of both liquid and gaseous helium required for global consumption.

Downstream, AI is being utilized to optimize the logistical complexity inherent in distributing liquid helium, which requires specialized cryogenic ISO containers and rapid transport due to boil-off losses. ML algorithms analyze variables such as transit routes, real-time weather conditions, and customer demand cycles to create dynamic distribution plans that minimize transit time and maximize product delivery efficiency. For large-scale consumers, particularly semiconductor foundries and research hospitals, AI-powered consumption monitoring systems can track helium usage patterns, detect minor leaks early, and suggest optimized usage protocols, leading directly to reduced wastage and improved resource conservation, a critical factor given the gas's non-renewable status and high market price volatility. This integration of smart technology enhances overall market stability and responsiveness.

- AI optimizes geological surveying and reservoir modeling for efficient helium source identification.

- Machine Learning enhances predictive maintenance schedules for liquefaction and purification plants, minimizing expensive downtime.

- AI-driven logistics algorithms optimize global cryogenic shipping routes, reducing transit time and minimizing boil-off losses.

- Smart consumption monitoring systems in end-user facilities use AI to detect leaks and reduce operational waste.

- Advanced analytics improve demand forecasting accuracy, allowing producers to align supply better with high-tech industry requirements.

DRO & Impact Forces Of Helium Gas Market

The Helium Gas Market is characterized by a strong dynamic tension between indispensable demand, driven by high-tech applications, and finite, geopolitically sensitive supply sources. The primary drivers include the relentless global expansion of MRI capacity in healthcare, the massive scaling up of semiconductor fabrication plants required for modern electronics, and sustained government investment in space exploration programs that rely on helium for purging and pressurization. Conversely, the market is severely restrained by limited natural sources, coupled with high capital expenditure and energy requirements for extraction and liquefaction, leading to inherent supply inelasticity. Significant geopolitical instability in major producing regions, particularly Qatar and the United States, poses a perennial challenge to global supply stability, impacting pricing and availability for critical end-users worldwide. These forces collectively dictate a high-value, high-risk market environment where conservation and recycling technologies present the most viable long-term opportunities.

Opportunities within the market largely revolve around technological advancements designed to circumvent the resource limitations. This includes the development and commercial deployment of advanced helium recovery systems in large-scale industrial and medical installations (e.g., zero-boil-off cryostats for MRI machines), enabling closed-loop usage and substantially reducing dependence on new supply. Furthermore, targeted exploration and development of unconventional helium reserves—those not directly co-produced with natural gas—represent a significant long-term opportunity for supply diversification. The increasing use of helium in cutting-edge applications, such as fusion energy research and quantum computing, which require ultra-low temperatures and high purity, also guarantees a specialized, high-growth niche market moving forward. Investing in localized purification capabilities closer to demand centers can also mitigate logistical risks and transport costs associated with long-distance cryogenic shipping.

The impact forces within the market are predominantly technological and regulatory. Technological leaps in cryocooler efficiency are challenging the dependence on liquid helium in some smaller-scale research applications, representing a potential restraint. Conversely, regulatory mandates for higher purity standards in semiconductor and medical applications drive up the requirement for specialized high-grade helium. Economic impact forces include the inverse relationship between volatile natural gas prices (the source material) and helium production costs, which directly affects end-user pricing strategies. The crucial impact force remains the supply shock resilience; historical shutdowns of major facilities have demonstrated the market's sensitivity, forcing industry stakeholders to prioritize long-term contracts and diversified procurement strategies to ensure operational continuity.

Segmentation Analysis

The Helium Gas Market is comprehensively segmented based on its physical state (Gaseous and Liquid), the nature of its consumption (End-Use Application), and the required purity level. Understanding these segmentations is critical for market participants, as pricing, logistical complexity, and supply chain requirements vary drastically across categories. The physical state segmentation is fundamental, distinguishing between bulk Gaseous Helium, often utilized in welding and balloon applications, and highly specialized, high-purity Liquid Helium, which commands a premium due to its essential role in cryogenic cooling for medical and high-science fields. Purity levels, ranging from 99.9% to ultra-high 99.9999%, define suitability for sensitive applications like semiconductor etching and fiber optics manufacturing, where minute contaminants can severely compromise product quality and performance, thus driving demand for customized supply solutions.

The segmentation by end-use application provides the clearest indication of market growth drivers and recession resilience. The Medical segment, dominated by MRI machine operation, exhibits stable, inelastic demand essential for global healthcare infrastructure. The Electronics and Semiconductor segment, however, is the most dynamic, experiencing cyclical but intense growth fueled by technological cycles in computing power and data storage. Furthermore, the segmentation by distribution mode—bulk supply via ISO tanks versus cylinder supply for smaller users—affects the logistical footprint and capital investment required by suppliers, leading to varying competitive landscapes within these sub-segments. Geographic segmentation reflects the imbalance between production (primarily MEA and North America) and consumption (APAC and Europe), necessitating complex global trade patterns.

- By State

- Liquid Helium

- Gaseous Helium

- By Application

- Cryogenics (MRI, NMR, SQUIDs)

- Aerospace and Defense (Purging, Pressurization)

- Electronics and Semiconductor Manufacturing (Etching, Deposition)

- Welding and Metal Fabrication (Shielding Gas)

- Fiber Optics Manufacturing

- Leak Detection and Analytical Instruments

- Balloon Inflation and Decoration

- By End-User

- Healthcare and Medical

- Industrial Manufacturing

- Electronics

- Research and Academia

- Aerospace and Government

Value Chain Analysis For Helium Gas Market

The helium gas value chain is characterized by high upstream concentration and stringent downstream requirements. Upstream activities involve the exploration, extraction, and purification of crude helium, typically sourced as a byproduct from natural gas reservoirs where concentrations can range from 0.1% to over 7%. This stage is capital-intensive, requiring specialized cryogenic processing plants (liquefiers) to separate and purify the helium to marketable grades. Key global producers, often integrated oil and gas companies or state-owned entities, control this initial phase, creating inherent supply bottlenecks. Midstream operations involve the bulk transportation of liquid helium using highly insulated, specialized ISO containers (cryogenic tanks) across vast distances, a phase where boil-off losses and logistical efficiency are critical determinants of final product cost and market stability.

Downstream activities focus on final distribution, which involves transferring the bulk liquid helium into smaller, customized containers (dewars or high-pressure cylinders) for distribution to end-users such as hospitals, research laboratories, and fabrication plants. This phase is handled by industrial gas companies that possess the infrastructure for regional gas handling, blending, and customer service. Distribution channels are highly specialized: Direct sales are common for bulk purchasers (e.g., large semiconductor manufacturers) requiring dedicated, consistent supply via long-term contracts. Indirect sales involve local distributors and specialty gas dealers who cater to smaller users like academic institutions and local welding shops, often supplying standard gaseous cylinders. The efficiency of the downstream segment is highly reliant on sophisticated inventory management to account for the volatile nature of liquid helium supply.

The complexity of the value chain means profit margins are often squeezed in the midstream due to high logistical and energy costs, while the highest value is captured by upstream producers and specialized downstream distributors who can guarantee high-purity, reliable supply to critical end-users. The interdependence between the natural gas industry (for feedstock) and the specialized cryogenics industry (for processing) makes the helium market distinct. Increasing automation and vertical integration, particularly in managing the liquefaction process and minimizing transport losses, are key strategies adopted by major market players to gain competitive advantage and ensure reliability throughout the entire chain, from wellhead to the final point of consumption, thereby influencing global pricing dynamics and access to the finite resource.

Helium Gas Market Potential Customers

Potential customers for high-purity helium gas span across technologically demanding and specialized sectors where the gas’s unique properties are indispensable for core operations. The most critical end-users are within the Healthcare industry, specifically hospitals and diagnostic centers that operate Magnetic Resonance Imaging (MRI) machines, which require vast quantities of liquid helium for cooling their superconducting magnets. These users prioritize purity, reliability, and long-term supply contracts due to the catastrophic operational impact of helium shortage or contamination. Another major segment includes semiconductor fabrication plants (fabs) and electronics manufacturers that utilize helium as a carrier gas, in etching processes, and as an inert atmosphere crucial for producing high-quality microchips, integrated circuits, and advanced display technologies.

The Aerospace and Defense sectors represent highly strategic customers, utilizing helium for purging propulsion systems, pressurizing liquid fuels in rockets and satellites, and for leak testing critical systems due to its small atomic size, which facilitates the detection of minute breaches. Furthermore, scientific research institutions, universities, and government laboratories constitute a foundational customer base, requiring ultra-pure helium for fundamental cryogenics research, particle physics experiments (e.g., superconducting detectors), and the development of emerging technologies like quantum computing and superconducting quantum interference devices (SQUIDs). These research customers typically demand the highest purity grades and specialized handling for small volumes.

Finally, industrial manufacturing, particularly within specialized welding (TIG/MIG) and metal fabrication, constitutes a high-volume, though often lower-purity, segment of the market. Helium, sometimes mixed with argon, is employed as a shielding gas to protect the weld pool from atmospheric contamination, ensuring strong, clean joints in materials like aluminum and copper alloys. Other industrial consumers include manufacturers of optical fibers, where helium is essential for cooling and purification during the drawing process, and companies specializing in high-precision leak detection for industrial systems and pipelines. These diverse industrial buyers seek cost-effective, readily available supply solutions tailored to specific industrial process requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Liquide S.A., Praxair (A Subsidiary of Linde), Air Products and Chemicals Inc., Exxon Mobil Corporation, Gazprom, Qatar Gas, Taiyo Nippon Sanso Corporation, Messer Group GmbH, Airgas (A Subsidiary of Air Liquide), Iwatani Corporation, Buzwair Industrial Gases, G.S. Gelios Ltd., Weil Group Resources LLC, Axcelis Technologies, Proton OnSite, Matheson Tri-Gas, Resonetics, Gulf Cryo, Acme Cryogenics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helium Gas Market Key Technology Landscape

The technological landscape of the Helium Gas Market is primarily defined by advancements in extraction efficiency, liquefaction processes, and, critically, conservation technologies designed to mitigate scarcity. In the upstream segment, sophisticated membrane separation and pressure swing adsorption (PSA) technologies are increasingly used to process natural gas streams with lower helium concentrations, thereby broadening the viable feedstock sources beyond traditional high-concentration fields. Furthermore, improved heat exchanger designs and optimized expander cycles within liquefiers are lowering the substantial energy consumption required to achieve cryogenic temperatures, leading to reduced operational costs and higher production yields from existing facilities, crucial for maintaining competitive pricing globally.

Perhaps the most transformative technological shift is occurring in the downstream conservation sector. The development and widespread implementation of zero-boil-off (ZBO) cryostats for high-end applications like MRI systems are revolutionizing demand management. ZBO technology employs sophisticated cryocoolers (often Gifford-McMahon or Pulse Tube coolers) to re-condense helium gas that naturally boils off from the liquid reservoir back into liquid form, dramatically extending the time between costly refills. Similarly, high-efficiency helium recovery and recycling systems are becoming standard in semiconductor fabs and large research laboratories, capturing and purifying spent helium for reintroduction into the system, drastically reducing reliance on external supply and enhancing supply security for critical users.

The integration of advanced sensing and IoT technologies is also a significant trend. Real-time monitoring of cryogenic tank pressures, temperature fluctuations, and flow rates allows distributors and end-users to preemptively detect leaks—a major source of waste—and optimize inventory levels based on actual usage patterns. These smart monitoring solutions provide crucial data analytics necessary for optimizing complex logistical networks required for cryogenic transportation. Innovation also continues in specialized high-purity applications, such as isotopic separation techniques required for specific scientific research and nuclear applications, ensuring that the technology base evolves to meet the increasingly stringent purity demands of emerging high-tech sectors like quantum computing and specialized lithography.

Regional Highlights

The global distribution of helium production and consumption creates distinct regional market dynamics, with key drivers varying significantly across major geographies. Asia Pacific (APAC) stands out as the primary engine of demand growth, fueled by rapid industrialization, particularly in the electronics and semiconductor sectors across East Asia (China, Taiwan, South Korea), and expanding healthcare infrastructure in South Asia. This region is a net importer, highly dependent on supply chains originating from the Middle East and North America, leading to significant logistical and pricing risks but offering substantial market expansion opportunities for suppliers.

North America is characterized by its dual role as a major producer (historically the U.S. Federal Helium Reserve) and a leading high-tech consumer. The shift in U.S. policy regarding the federal reserve and increasing investment in private production facilities, particularly in states like Texas, Oklahoma, and Wyoming, dictate global pricing and supply stability. Demand here is dominated by aerospace, advanced research, and established semiconductor industries, driving continuous investment in domestic conservation technologies to secure strategic supply.

Europe represents a mature market with stable, high-value demand, predominantly centered in Germany, the UK, and France, driven by large research organizations (like CERN), advanced manufacturing, and comprehensive healthcare systems. European focus is heavily weighted towards sustainability and efficiency, resulting in high adoption rates for helium recycling and conservation equipment, making it a critical market for technological innovation in cryogenic equipment. The Middle East and Africa (MEA), specifically Qatar and Algeria, are geographically crucial as major low-cost production centers, leveraging vast natural gas reserves to become the world's leading bulk helium exporters, directly influencing the commodity's global availability and geopolitical pricing structure.

- Asia Pacific (APAC): Dominates consumption growth due to explosive expansion in semiconductor manufacturing (e.g., fabs in Taiwan, China) and rapidly increasing deployment of MRI diagnostic units in developing economies like India.

- North America: A major consumer and key historic producer, characterized by high demand from aerospace (NASA, SpaceX) and highly advanced research sectors; focused on developing new private sources post-Federal Reserve drawdowns.

- Europe: Mature, stable market with high purity requirements driven by scientific research (e.g., particle physics, fusion energy) and medical imaging; leads in the adoption of sophisticated recycling and cryocooler technologies.

- Middle East and Africa (MEA): Critical global supply hub, primarily Qatar and Algeria, leveraging natural gas resources; market activity focuses heavily on extraction, liquefaction, and bulk export capacity expansion.

- Latin America (LATAM): Emerging demand primarily tied to healthcare expansion and small-scale industrial welding needs; highly reliant on imports, seeking stable supply contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helium Gas Market, spanning upstream production, liquefaction, and global distribution.- Linde PLC

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Exxon Mobil Corporation

- Gazprom

- Qatar Gas

- Taiyo Nippon Sanso Corporation

- Messer Group GmbH

- Airgas (A Subsidiary of Air Liquide)

- Iwatani Corporation

- Buzwair Industrial Gases

- G.S. Gelios Ltd.

- Weil Group Resources LLC

- Axcelis Technologies

- Proton OnSite

- Matheson Tri-Gas

- Resonetics

- Gulf Cryo

- Acme Cryogenics

- Praxair (A Subsidiary of Linde)

Frequently Asked Questions

Analyze common user questions about the Helium Gas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the current price volatility of helium gas?

Helium price volatility is primarily driven by three factors: the inelasticity of supply resulting from finite natural gas co-production sources; geopolitical instability affecting major producers like Qatar and Russia; and unexpected production outages at key global liquefaction facilities, which instantly strain the limited global inventory and increase logistical costs.

How significant is the semiconductor industry's demand for high-purity helium?

The semiconductor industry represents one of the most significant and rapidly growing segments of helium demand. High-purity helium is essential for maintaining inert atmospheres during critical fabrication steps like etching, deposition, and cooling, ensuring the quality and yield of advanced microchips and integrated circuits crucial for 5G and AI hardware.

What technologies are being developed to address the scarcity and finite nature of helium?

The core technologies addressing scarcity are centered on conservation. This includes the implementation of zero-boil-off (ZBO) cryostats in MRI machines, advanced, high-efficiency helium recovery and recycling systems in research labs and manufacturing facilities, and the development of membrane separation techniques to process low-concentration gas fields.

Is there a viable synthetic alternative to natural helium for cryogenic applications?

No, there is currently no commercially viable synthetic alternative to natural helium. Its unique physical properties—especially its exceptionally low boiling point (4.2 K) and inertness—are unmatched by any other substance, making it indispensable for superconducting cryogenics, MRI cooling, and specific high-tech industrial processes.

Which geographical region holds the largest production capacity for raw helium?

The Middle East, specifically Qatar, and North America (the United States) historically and currently hold the largest global production and export capacity for raw helium, although new large-scale projects are emerging in Russia and East Africa, diversifying the traditional supply dominance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager