Helium Recovery Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435122 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Helium Recovery Systems Market Size

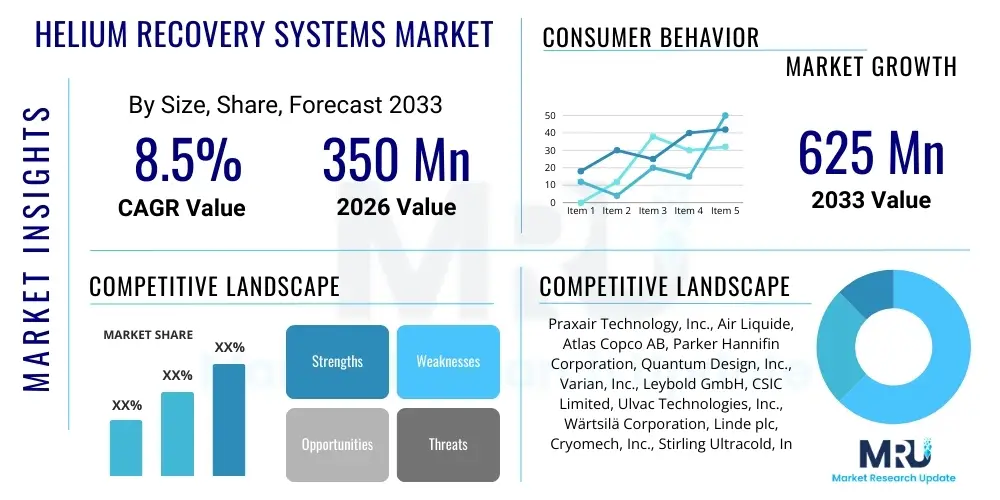

The Helium Recovery Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 625 Million by the end of the forecast period in 2033.

Helium Recovery Systems Market introduction

The Helium Recovery Systems Market encompasses technologies designed to capture, purify, and reuse helium gas that would otherwise be vented into the atmosphere during various industrial, scientific, and medical processes. Helium, a finite and irreplaceable noble gas, is vital for applications requiring extremely low temperatures or an inert atmosphere, such as superconducting magnet cooling in Magnetic Resonance Imaging (MRI) machines, semiconductor fabrication, fiber optics manufacturing, and advanced research facilities including particle accelerators. The imperative to conserve this scarce resource, coupled with its volatile price fluctuations and geopolitical supply risks, is driving robust investment in effective recovery infrastructure globally.

A typical helium recovery system involves several stages, including collection, compression, purification, and storage. Collection often occurs through specialized piping that captures vented or evaporated helium (boil-off) from cryogenic equipment. High-efficiency compressors then reduce the volume of the recovered gas, preparing it for purification technologies like Pressure Swing Adsorption (PSA) or cryogenic separation, which remove atmospheric contaminants (oxygen, nitrogen, water vapor) to achieve the ultra-high purity required for reuse. The primary benefits of implementing these systems include significant operational cost reduction for end-users by minimizing reliance on external helium supplies, ensuring supply chain stability, and contributing positively to corporate sustainability mandates.

The driving factors for market expansion are multifaceted, centered primarily on the growing global demand for helium in advanced technological sectors—particularly in healthcare, where the installation base of MRI machines continues to expand, and in electronics manufacturing, which relies heavily on helium for cooling and creating inert environments. Furthermore, increasing regulatory pressure in developed economies to promote resource efficiency, alongside the inherent necessity to mitigate the economic risks associated with rising helium prices and periodic supply shortages, fundamentally underscores the attractiveness and long-term viability of investment in helium recovery solutions.

Helium Recovery Systems Market Executive Summary

The Helium Recovery Systems Market is experiencing robust acceleration driven by the critical intersection of resource scarcity and technological advancement. Business trends indicate a strong move toward modular, scalable, and fully automated recovery solutions that minimize footprint and simplify operation, making them accessible to smaller research institutions and independent industrial users alongside large-scale facilities like major hospitals and semiconductor fabrication plants. Key players are focusing heavily on enhancing purification efficiency, particularly targeting systems capable of handling low-concentration helium streams, thus maximizing overall recovery yield. Strategic partnerships between cryogenic equipment manufacturers and recovery system providers are becoming commonplace to offer integrated, closed-loop solutions, positioning these systems as standard operating components rather than optional add-ons.

Regionally, North America maintains the largest market share, fueled by extensive research and development spending, a vast installed base of sophisticated medical imaging equipment (MRI), and the presence of leading aerospace and defense contractors that are significant helium consumers. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is primarily attributable to massive governmental and private investment in semiconductor fabrication facilities (Fabs) in countries such as China, Taiwan, and South Korea, coupled with the burgeoning adoption of advanced diagnostic imaging technologies across newly developed healthcare infrastructure in emerging economies. The necessity for local supply chain resilience, reducing reliance on expensive transatlantic or transpacific helium shipments, further accelerates APAC market adoption.

Segment trends reveal a preference for cryogenic recovery systems in high-volume, high-purity applications, such as large scientific experiments and bulk industrial usage, due to their superior efficiency in achieving very low impurity levels. Conversely, the non-cryogenic segment, leveraging technologies like membrane separation and Pressure Swing Adsorption (PSA), is gaining traction in smaller scale applications or where rapid deployment and lower initial investment are critical considerations. The healthcare end-use segment, dominated by MRI recovery solutions, remains the largest revenue generator, while the electronics and semiconductor segment is exhibiting the most aggressive year-over-year growth, reflecting the intense global race for semiconductor manufacturing capacity and the associated need for process gas efficiency.

AI Impact Analysis on Helium Recovery Systems Market

User queries regarding the impact of Artificial Intelligence (AI) on the Helium Recovery Systems Market frequently center on themes of predictive operational efficiency, optimized resource allocation, and enhanced system reliability. Common questions include how AI can improve the notoriously complex purification processes, predict potential equipment failures in compressors and vacuum pumps, and dynamically adjust system parameters (such as flow rates and pressure levels) based on real-time boil-off data from source equipment (like MRI scanners or cryostats). Users express high expectations that AI integration will mitigate human error, reduce maintenance downtime, and ultimately maximize the economic return on high-capital recovery systems by achieving consistently higher recovery rates and purity levels with less energy expenditure.

AI’s influence is primarily transforming recovery system management from reactive maintenance to proactive, predictive resource conservation. By deploying machine learning algorithms trained on vast datasets of system performance metrics—including gas temperature, compressor load cycles, purity sensor readings, and energy consumption—AI models can detect subtle anomalies that precede component failure. This capability allows operators to schedule maintenance precisely when needed, rather than relying on fixed intervals, thereby maximizing uptime. Furthermore, AI optimization algorithms can continually refine the operational settings of the recovery units, adjusting purification cycles (e.g., PSA timing) to perfectly match the highly variable and often intermittent gas input flow characteristic of diverse end-use applications, ensuring peak efficiency regardless of the operational state of the source equipment.

The integration of deep learning and robust data analytics also offers significant opportunities in designing the next generation of recovery systems. AI can simulate various operational environments and input gas compositions, allowing manufacturers to create smarter, adaptive control logic embedded directly into the system hardware. This leads to ‘self-healing’ or automatically adjusting systems that can rapidly compensate for unexpected contaminations or process interruptions, maintaining stringent purity requirements essential for sensitive applications like superconducting magnets and lithography tools. This predictive capability translates directly into increased financial viability for end-users, lowering the total cost of ownership (TCO) and justifying the significant initial capital outlay associated with high-grade helium conservation technology.

- AI-driven Predictive Maintenance: Reduces unscheduled downtime of compressors and purification modules, increasing system availability and longevity.

- Dynamic Process Optimization: Machine learning algorithms adjust purification cycle parameters in real-time to maximize recovery yield and purity under fluctuating input conditions.

- Energy Consumption Minimization: AI optimizes compressor load and refrigeration cycles, reducing the substantial electricity costs associated with running recovery units.

- Anomaly Detection: Rapid identification and flagging of unusual gas composition or pressure dips indicating leaks or system integrity issues.

- Automated Remote Diagnostics: Enables quicker troubleshooting and maintenance support through intelligent cloud-based monitoring interfaces.

DRO & Impact Forces Of Helium Recovery Systems Market

The dynamics of the Helium Recovery Systems Market are primarily shaped by powerful drivers related to global resource economics and technological necessity, balanced by significant restraints concerning capital expenditure and technical complexity, which together generate compelling opportunities for market innovation and expansion. The overarching driver is the inherent scarcity of helium, categorized as a non-renewable, strategic resource, coupled with the volatile and escalating costs of sourcing new supply. This economic pressure transforms recovery systems from a luxury investment into an essential operational strategy for helium-intensive industries, ensuring resource security and predictable budgeting. The impact forces stemming from these factors necessitate continuous innovation in purification efficiency and system reliability to justify the high initial investment required.

Key drivers include the burgeoning adoption of cryogenically cooled technologies, particularly the exponential growth in global MRI installations in healthcare, and the relentless expansion of semiconductor fabrication, which critically depends on helium for etching and maintaining ultraclean environments. Furthermore, stringent environmental, social, and governance (ESG) standards are compelling large corporations and research institutions to adopt resource conservation strategies, positioning helium recovery as a vital component of corporate sustainability mandates. Restraints, however, pose considerable challenges; these include the typically high capital expenditure (CapEx) associated with purchasing and installing high-capacity recovery and purification equipment, the operational complexity requiring specialized training for maintenance, and the physical space constraints often found in existing facilities, making retrofit installations challenging.

Opportunities for growth are concentrated in the development of flexible, small-scale, and containerized recovery systems tailored for mid-sized users, lowering the barrier to entry for universities and smaller manufacturing operations. Significant potential also lies in leveraging advanced materials science for highly efficient, non-cryogenic purification methods (like advanced membranes) that reduce the reliance on intensive refrigeration, thereby lowering both CapEx and operating expenditure (OpEx). The strong push toward localized supply chains, minimizing transportation dependence and associated logistical costs and risks, further catalyzes the adoption of on-site recovery solutions. The net impact of these forces strongly favors market growth, compelling vendors to focus on modularity, high energy efficiency, and predictive maintenance features to overcome cost and complexity hurdles.

Segmentation Analysis

The Helium Recovery Systems Market is primarily segmented across product type, capacity, application, and end-use, reflecting the diverse requirements of industries reliant on high-purity helium. Analyzing these segments provides critical insights into market penetration and growth trajectories, particularly highlighting the trade-offs between system efficiency, initial cost, and suitability for specific process demands. The product segment is crucial, dividing the market mainly into cryogenic and non-cryogenic solutions, with cryogenic systems traditionally dominating high-volume, extremely high-purity markets due to their superior separation capabilities at low temperatures, while non-cryogenic methods offer lower cost entry points and operational simplicity for smaller, less demanding applications.

The application segmentation reveals the primary drivers of demand, with MRI cooling constituting the largest segment, driven by global healthcare expansion and the mandatory requirement for helium conservation in expensive magnet operations. The semiconductor and electronics manufacturing segment, however, is forecast to exhibit the highest CAGR, spurred by global efforts to onshore semiconductor production and the inherent need to recycle process gases in cleanroom environments. Capacity segmentation, ranging from small-scale laboratory units to high-capacity industrial systems, demonstrates market maturity, indicating that solutions are available to address the needs of consumers across the entire spectrum, from academic research labs generating minimal boil-off to major industrial plants with continuous, high-volume helium usage.

End-user analysis further refines the understanding of market dynamics, confirming that healthcare and industrial manufacturing collectively account for the majority of installations, followed closely by government and academic research institutions. Research labs, especially those involved in high-energy physics, material science, and quantum computing, rely heavily on reliable, high-purity helium for cooling superconducting equipment. The trend toward customized solutions, where system components (compressors, purifiers, storage tanks) are tailored specifically to the unique pressure and purity requirements of the end-user's application, is a key characteristic of market evolution, ensuring optimal performance and maximizing the economic return on recovery investment across all segmented categories.

- Product Type

- Cryogenic Helium Recovery Systems

- Non-Cryogenic Helium Recovery Systems (e.g., PSA, Membrane Separation)

- Capacity

- Small Capacity (Below 50 L/hr)

- Medium Capacity (50 L/hr to 200 L/hr)

- High Capacity (Above 200 L/hr)

- Application

- MRI and Medical Devices

- Semiconductor and Electronics Manufacturing

- Aerospace and Defense

- Research and Development (R&D)

- Fiber Optics Production

- End-Use Industry

- Healthcare

- Manufacturing (Industrial)

- Academic and Research Institutions

- Government and National Laboratories

Value Chain Analysis For Helium Recovery Systems Market

The value chain for the Helium Recovery Systems Market begins with upstream suppliers, primarily manufacturers of specialized components critical for system functionality, namely high-efficiency cryogenic compressors, advanced purification filters, vacuum pumps, and specialized heat exchangers. This stage is crucial as the performance and reliability of the final recovery unit heavily depend on the quality and energy efficiency of these core components. Suppliers focusing on durable, low-maintenance components, especially those integrating smart monitoring capabilities, hold significant leverage. Innovation at this upstream level, such as developing more energy-efficient cryocoolers and purer adsorbent materials for PSA units, directly influences the overall cost-effectiveness and performance characteristics of the downstream recovery systems.

The midstream comprises the original equipment manufacturers (OEMs) who design, assemble, integrate, and test the complete helium recovery systems. These manufacturers are responsible for optimizing the complex interplay between compression, purification, and storage technologies, customizing system capacity, and ensuring compliance with stringent safety and purity standards. Distribution channels vary; large OEMs often utilize direct sales forces for major installations (e.g., selling directly to large university research centers or hospital networks) to provide comprehensive installation, commissioning, and long-term maintenance contracts. Conversely, regional distributors and value-added resellers (VARs) handle sales and support for smaller, standardized systems and laboratory models, offering local expertise and quicker response times.

Downstream consists of the end-users who install and operate the recovery systems. These customers include hospital radiology departments, semiconductor fabrication plants, research laboratories, and aerospace testing facilities. The downstream segment is characterized by a strong demand for reliable after-sales service, periodic maintenance, and technical support due to the high-stakes nature of the applications (e.g., preventing MRI magnet quenching). The success of the system is ultimately measured by the long-term cost savings achieved through helium recycling, making the effectiveness of maintenance and operational training a critical value-added service provided by the system suppliers. Indirect distribution, though less common for customized large systems, involves supplying components or smaller, plug-and-play units through industrial gas distributors or laboratory equipment catalogs.

Helium Recovery Systems Market Potential Customers

The primary potential customers for Helium Recovery Systems are large institutions and industrial entities that rely on superconducting technology or require extremely inert atmospheres, resulting in significant and quantifiable helium boil-off or loss. The largest segment remains the healthcare sector, specifically hospitals and specialized diagnostic centers operating multiple Magnetic Resonance Imaging (MRI) machines. The high cost of maintaining a sufficient supply of liquid helium for magnet cooling makes recovery systems essential for operational continuity and financial viability. These customers prioritize reliability, minimal system footprint, and high integration capability with existing MRI infrastructure, seeking systems that provide automated, continuous operation with minimal disruption to patient services.

A rapidly expanding customer segment comprises semiconductor fabrication units, known as fabs, which utilize vast quantities of helium in processes such as etching, lithography, and cooling during chip manufacturing. As the complexity of integrated circuits increases and the demand for manufacturing capacity grows globally, the necessity for efficient, large-scale helium recycling within these cleanroom environments becomes paramount. These industrial buyers require robust, high-capacity systems capable of handling large volumes of potentially contaminated process gas, emphasizing purification efficiency and systems that meet stringent industrial safety standards and continuous high-throughput demands.

Furthermore, academic and governmental research institutions represent a stable base of potential customers. This includes national laboratories, university physics departments, and space agencies that operate complex scientific equipment like nuclear magnetic resonance (NMR) spectrometers, mass spectrometers, high-energy particle accelerators, and superconducting quantum devices. While their usage volumes might be lower or intermittent compared to industrial fabs, these customers demand the absolute highest level of gas purity for their sensitive experiments. They often seek modular, scalable systems that can be adapted to changing research requirements, prioritizing technical support and the long-term guaranteed availability of ultra-high purity recovered gas necessary for breakthrough scientific endeavors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 625 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Praxair Technology, Inc., Air Liquide, Atlas Copco AB, Parker Hannifin Corporation, Quantum Design, Inc., Varian, Inc., Leybold GmbH, CSIC Limited, Ulvac Technologies, Inc., Wärtsilä Corporation, Linde plc, Cryomech, Inc., Stirling Ultracold, Inc., CHART Industries, Inc., PHPK Technologies, Inc., Trillium Engineering, Inc., ICEoxford Ltd., Acme Cryogenics, Agilent Technologies, Inc., and Air Products and Chemicals, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Helium Recovery Systems Market Key Technology Landscape

The technological landscape of the Helium Recovery Systems Market is defined by the sophistication of methods used for collection, compression, and, most critically, purification. The dominant technology, particularly for applications requiring ultra-high purity (99.999% or better), is cryogenic separation. This process involves cooling the recovered, compressed gas stream down to extremely low temperatures, often using liquid nitrogen or specialized cryocoolers, causing contaminants like nitrogen, oxygen, and water vapor to freeze or condense out, leaving behind purified helium. While highly effective, cryogenic systems involve high capital costs and significant energy usage for sustained refrigeration, driving continuous research into more energy-efficient cryocooler designs and optimization of heat exchange processes to lower the overall operating expenditure (OpEx).

Complementary and alternative technologies are primarily non-cryogenic purification methods, which offer compelling solutions for smaller-scale operations or situations where lower capital investment is mandatory. Pressure Swing Adsorption (PSA) technology is widely used in the non-cryogenic segment. PSA systems utilize specialized adsorbent materials (molecular sieves or activated carbon) that selectively trap contaminant gases under high pressure, releasing the contaminants when the pressure is subsequently lowered, thus separating the purified helium. Recent advancements in material science are enhancing the selectivity and regeneration efficiency of adsorbents, allowing PSA systems to handle more complex gas mixtures and achieve higher purity levels, blurring the lines between the capabilities of cryogenic and non-cryogenic solutions for certain applications.

Furthermore, membrane separation technology is gaining traction, particularly for preliminary purification stages or systems dealing with lower concentration helium streams. This method employs semipermeable membranes that allow helium, due to its small molecular size, to pass through preferentially, separating it from larger contaminant molecules. The integration of advanced control systems, incorporating IoT sensors and AI optimization algorithms, represents the future of this landscape. These smart systems enable predictive maintenance, dynamic adjustments to compression ratios based on real-time boil-off rates, and automated monitoring of gas purity, transforming the recovery process into an efficient, self-regulating, and highly reliable operation that maximizes throughput and minimizes human intervention.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the vast installed base of high-field MRI systems and cutting-edge government and academic research laboratories, particularly in the United States. High research and development spending, coupled with strict regulatory emphasis on resource conservation and the presence of major aerospace and defense industries, solidify North America's leadership position. The demand is further buoyed by early adoption of integrated, automated recovery solutions by major hospital systems aiming for operational resilience against helium supply risks.

- Europe: Europe represents a mature market characterized by stringent environmental regulations and significant investment in large scientific facilities like CERN. Market growth here is steady, focusing heavily on enhancing the efficiency of existing systems and replacing older, less efficient recovery units. Germany, the UK, and France are key contributors, driven by advanced manufacturing sectors, a robust healthcare infrastructure, and a strong preference for localized, high-pquality recovery technology provided by established European industrial gas companies.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC’s expansion is fueled by unprecedented growth in semiconductor manufacturing capacity, particularly in East Asia. Countries like China, Taiwan, and South Korea are heavily investing in state-of-the-art fabs that require efficient helium recycling to remain competitive. Additionally, rapidly modernizing healthcare infrastructure across Southeast Asia increases the demand for MRI units, making helium recovery an integral part of new hospital construction projects seeking long-term operational cost control.

- Latin America: The market in Latin America is nascent but growing, primarily concentrated in major economies such as Brazil and Mexico. Demand stems mainly from large academic institutions and specialized medical centers. Growth is constrained by budget limitations and a reliance on imported technology, but the escalating global price of helium is providing a strong economic incentive for larger facilities to adopt recovery systems to achieve long-term savings.

- Middle East and Africa (MEA): This region exhibits cautious growth focused mainly on specific, high-value applications. The Middle East, particularly the GCC countries, sees demand driven by large-scale government-funded research initiatives and burgeoning healthcare services. Adoption in Africa remains limited, largely restricted to major urban centers and specialized industrial gas operations, where the lack of established domestic helium supply chains makes localized recovery highly beneficial for ensuring process continuity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Helium Recovery Systems Market.- Praxair Technology, Inc.

- Air Liquide

- Atlas Copco AB

- Parker Hannifin Corporation

- Quantum Design, Inc.

- Varian, Inc.

- Leybold GmbH

- CSIC Limited

- Ulvac Technologies, Inc.

- Wärtsilä Corporation

- Linde plc

- Cryomech, Inc.

- Stirling Ultracold, Inc.

- CHART Industries, Inc.

- PHPK Technologies, Inc.

- Trillium Engineering, Inc.

- ICEoxford Ltd.

- Acme Cryogenics

- Agilent Technologies, Inc.

- Air Products and Chemicals, Inc.

Frequently Asked Questions

Analyze common user questions about the Helium Recovery Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary economic benefits of investing in a Helium Recovery System?

The primary economic benefits are significant reduction in operational expenditure (OpEx) by minimizing reliance on external helium supply, stabilization of the gas supply chain against volatile market prices, and avoidance of costly downtime caused by helium shortages. Recovery systems typically offer a compelling return on investment (ROI) over their lifespan due to conserved resource value.

How does the efficiency of cryogenic systems compare to non-cryogenic recovery methods?

Cryogenic systems generally achieve higher purity levels (up to 99.9999%) and are suitable for high-volume applications, often reaching 95-99% recovery efficiency. Non-cryogenic systems (like PSA) offer lower initial capital cost and simplicity, typically suitable for smaller volumes or streams with purity requirements slightly below ultra-high grade, providing efficiency in the range of 90-95% depending on gas composition.

Which industry segment is driving the fastest adoption of new recovery technologies?

The Semiconductor and Electronics Manufacturing industry segment is currently exhibiting the fastest growth in adopting advanced helium recovery technology. This is driven by massive global investment in new fabrication facilities (Fabs) and the necessity to manage extremely high process gas consumption efficiently to maintain competitiveness and reduce environmental impact.

What operational challenges are associated with maintaining Helium Recovery Systems?

Operational challenges include the high energy consumption of compressors and cryocoolers, the need for specialized technical expertise for maintenance, and managing the varying contaminant load in the input gas stream. Modern systems mitigate these issues through predictive maintenance software and automated purity monitoring systems.

What role does the global shortage and rising cost of helium play in market growth?

The finite nature and critical scarcity of helium, coupled with geopolitical supply chain risks, serve as the foundational driver for market growth. The high and volatile cost of new helium forces consumers to view recovery systems not as an option but as a necessary long-term operational investment to ensure stable, cost-effective access to the resource.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager