Hem Flange Adhesives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439959 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Hem Flange Adhesives Market Size

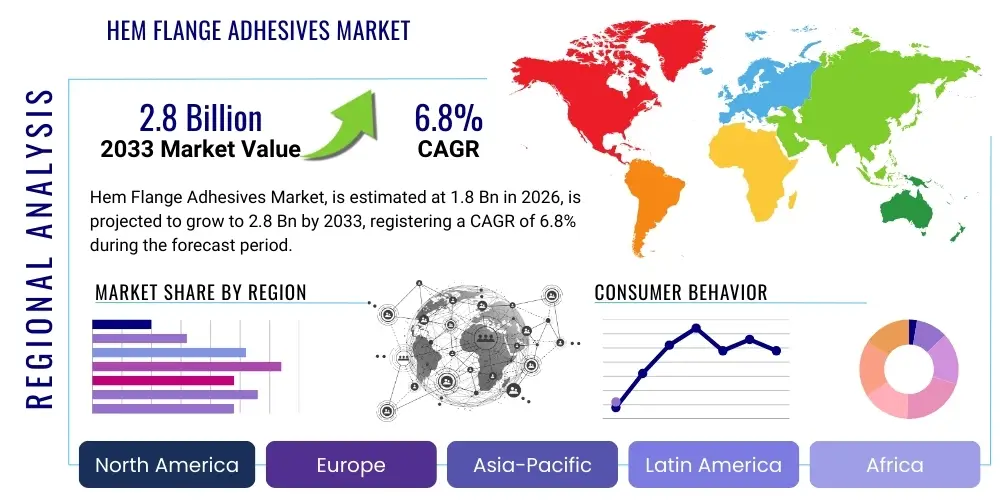

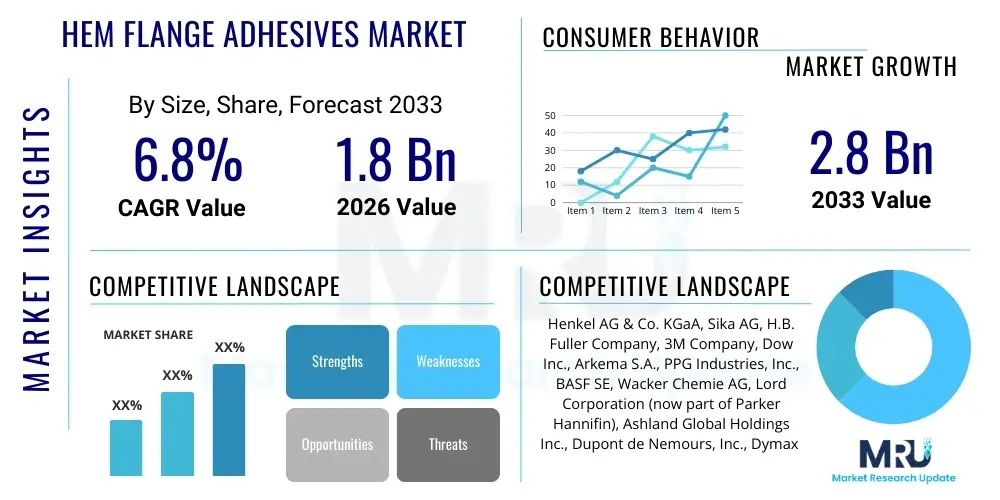

The Hem Flange Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by the escalating demand for lightweight, high-performance materials in the automotive industry, where these specialized adhesives play a critical role in modern vehicle assembly. The continuous innovation in adhesive formulations to meet evolving performance and sustainability standards further underpins this market expansion. Manufacturers are increasingly adopting hem flange adhesives to enhance structural integrity, improve aesthetics, and provide superior corrosion protection, especially in critical body-in-white applications.

Hem Flange Adhesives Market introduction

Hem flange adhesives are specialized structural bonding solutions extensively utilized in the automotive manufacturing sector, particularly for joining outer and inner panels of vehicle components such as doors, hoods, trunk lids, and fenders. These advanced adhesives replace or complement traditional mechanical fastening methods like welding, offering significant advantages in terms of vehicle aesthetics, structural rigidity, noise, vibration, and harshness (NVH) reduction, and corrosion resistance. The application involves bonding the hemmed edges of panels, creating a strong, continuous bond that distributes stress more evenly across the joint, thereby enhancing the overall durability and safety of the vehicle. This technology is crucial for achieving modern automotive design objectives, including sleek finishes and improved aerodynamic performance, while contributing to the vehicle's long-term integrity.

The primary applications of hem flange adhesives lie within the body-in-white stage of automotive assembly, where they contribute to the structural integrity of various closures and components. Beyond conventional passenger and commercial vehicles, their use is expanding into electric vehicles (EVs) due to the heightened emphasis on lightweighting and battery protection. The benefits derived from these adhesives are multifaceted: they enable the use of thinner gauge materials without compromising strength, facilitate multi-material joining (e.g., steel to aluminum), reduce overall vehicle weight for improved fuel efficiency or extended EV range, and enhance crash performance by absorbing impact energy. Furthermore, the ability of these adhesives to seal joints effectively prevents moisture ingress, significantly reducing the risk of corrosion and extending the lifespan of vehicle parts.

Key driving factors for the hem flange adhesives market include the global automotive industry's relentless pursuit of lightweight vehicle designs to meet stringent emission standards and improve fuel economy. The proliferation of electric vehicles, which demand innovative lightweighting solutions to maximize battery range, further fuels this demand. Advancements in adhesive technology, leading to stronger, faster-curing, and more environmentally friendly formulations, also act as significant market catalysts. Additionally, the increasing focus on vehicle safety, passenger comfort, and aesthetic appeal continues to propel the adoption of hem flange adhesives over traditional joining techniques. These factors collectively underscore the indispensable role of hem flange adhesives in shaping the future of automotive manufacturing and design.

Hem Flange Adhesives Market Executive Summary

The Hem Flange Adhesives Market is characterized by dynamic business trends reflecting the ongoing evolution within the automotive industry. A prominent trend is the increasing strategic partnerships and collaborations between adhesive manufacturers and automotive OEMs, aimed at developing bespoke adhesive solutions tailored to new vehicle platforms and material combinations. This collaborative approach ensures that adhesive technologies remain at the forefront of innovation, addressing complex bonding challenges associated with advanced high-strength steels, aluminum alloys, and composite materials. Furthermore, there is a growing emphasis on automating the adhesive application process to improve production efficiency, reduce labor costs, and ensure consistent bond quality. Suppliers are also focusing on expanding their global manufacturing footprints to better serve international automotive production hubs and mitigate supply chain risks.

Regional trends indicate that Asia Pacific, particularly countries like China, India, and Japan, remains a powerhouse for market growth due to its robust automotive production volumes and increasing adoption of advanced manufacturing techniques. Europe and North America, while mature markets, demonstrate significant demand driven by stringent safety regulations, the widespread shift towards electric vehicles, and a strong emphasis on premium vehicle segments where sophisticated bonding solutions are paramount. Latin America and the Middle East & Africa regions are also exhibiting steady growth, fueled by rising automotive sales, expanding manufacturing capabilities, and a growing recognition of the performance benefits offered by hem flange adhesives. These regional dynamics highlight a globally expanding market with localized pockets of intense innovation and demand.

Segment-wise, the market is witnessing shifts towards epoxy-based and polyurethane-based adhesives due to their excellent structural properties, durability, and versatility in multi-material bonding applications. The application segment continues to be dominated by critical vehicle closures such as hoods and doors, which benefit immensely from the enhanced structural integrity and aesthetic finish provided by these adhesives. Moreover, the passenger vehicle segment holds the largest market share, driven by high production volumes and consumer demand for safer, lighter, and more visually appealing cars. However, the commercial vehicle segment is also poised for significant growth as manufacturers increasingly seek to reduce vehicle weight to improve fuel efficiency and payload capacity. The ongoing R&D in bio-based and sustainable adhesive formulations represents a future growth avenue across all segments, aligning with broader industry goals for environmental responsibility.

AI Impact Analysis on Hem Flange Adhesives Market

The integration of Artificial Intelligence (AI) and machine learning (ML) technologies is poised to revolutionize the hem flange adhesives market, addressing several key user concerns regarding quality, efficiency, and material optimization. Users are keen to understand how AI can improve the precision and consistency of adhesive application, minimize waste, and enhance predictive maintenance for application equipment. There's significant interest in AI's potential to accelerate the development of new adhesive formulations by simulating material interactions and predicting performance characteristics, thereby reducing R&D cycles and costs. Furthermore, users are exploring how AI-driven analytics can optimize supply chain management for adhesive raw materials, ensuring better inventory control and resilience against disruptions. The overarching expectation is that AI will elevate the entire lifecycle of hem flange adhesives, from formulation and manufacturing to application and post-production quality assurance, ultimately leading to superior product performance and operational efficiencies.

Another area of considerable interest for market participants lies in AI's capability to enhance quality control throughout the manufacturing and application processes. Users are concerned with ensuring defect-free bonds and maintaining consistent performance across large-scale production runs. AI-powered vision systems and sensor data analysis can provide real-time monitoring of adhesive bead geometry, curing parameters, and joint integrity, identifying potential issues before they escalate. This proactive approach significantly reduces rework, scrap rates, and associated costs, while simultaneously boosting overall product reliability. Moreover, the ability of AI to analyze vast datasets from production lines allows for continuous process optimization, learning from variations and autonomously adjusting parameters to achieve optimal bonding conditions.

The impact of AI also extends to addressing the market's need for advanced material science and application customization. As automotive designs become more complex, involving diverse material combinations and intricate geometries, the demand for highly specific adhesive properties grows. AI algorithms can analyze performance data from various simulations and real-world applications, identifying optimal adhesive chemistries for particular material pairings and environmental conditions. This accelerates the development of bespoke solutions and enables manufacturers to quickly adapt to new design challenges. Users anticipate that AI will facilitate a deeper understanding of adhesive behavior under stress, fatigue, and varying temperatures, leading to the creation of more robust and durable hem flange adhesive systems that meet the stringent demands of modern automotive engineering.

- AI-driven optimization of adhesive application parameters for increased precision and reduced material waste.

- Predictive analytics for equipment maintenance, minimizing downtime and enhancing production line efficiency.

- Accelerated R&D of novel adhesive formulations through AI-powered material simulation and property prediction.

- Enhanced real-time quality control with AI vision systems detecting defects in adhesive beads and bond integrity.

- Improved supply chain resilience and inventory management for raw materials using AI-driven forecasting.

- Personalized adhesive solutions based on AI analysis of specific material combinations and performance requirements.

- Automation of complex bonding processes, reducing manual labor and improving consistency across production.

DRO & Impact Forces Of Hem Flange Adhesives Market

The Hem Flange Adhesives Market is propelled by several significant drivers, notably the global automotive industry's relentless pursuit of lightweighting strategies to comply with stringent emission regulations and enhance fuel efficiency. As manufacturers increasingly adopt multi-material designs, the demand for specialized adhesives capable of bonding dissimilar substrates (e.g., steel to aluminum or composites) grows exponentially, positioning hem flange adhesives as an indispensable solution. The rapid expansion of electric vehicle (EV) production globally further stimulates market growth, as lightweighting plays a crucial role in maximizing battery range and overall vehicle performance. Continuous advancements in adhesive technologies, offering improved strength, durability, faster cure times, and better environmental profiles, also serve as a powerful market driver, expanding the scope and efficacy of these bonding solutions. Moreover, the rising consumer demand for safer, quieter, and aesthetically superior vehicles pushes OEMs to integrate advanced bonding techniques that reduce NVH levels and create seamless body panels.

Despite the strong growth trajectory, the market faces certain restraints. The relatively high initial investment required for sophisticated adhesive application equipment, including robots and precision dispensing systems, can be a barrier for smaller manufacturers or those in developing economies. Additionally, hem flange adhesives often necessitate specific storage and handling conditions, such as temperature control and shelf-life management, which can add complexity and cost to the manufacturing process. Competition from traditional joining methods like spot welding, though declining for certain applications, still exists and requires adhesive manufacturers to continually demonstrate superior performance benefits and cost-effectiveness. The need for specialized training for personnel involved in adhesive application and quality control also represents a hurdle that requires sustained investment.

Opportunities for market expansion are abundant, particularly in emerging automotive markets across Asia Pacific and Latin America, where vehicle production is steadily increasing and a shift towards advanced manufacturing processes is evident. The ongoing development of bio-based and sustainable adhesive formulations presents a significant opportunity to cater to growing environmental concerns and regulatory pressures, fostering innovation in greener bonding solutions. Furthermore, the increasing adoption of automated and robotic application systems across the automotive industry creates avenues for adhesive manufacturers to develop intelligent, high-throughput products compatible with these advanced manufacturing lines. The potential for hem flange adhesives to expand beyond primary automotive applications into niche segments within the aerospace and marine industries, where lightweighting and structural integrity are paramount, also offers promising growth prospects. Impact forces such as technological advancements continually redefine performance benchmarks, while evolving environmental regulations influence formulation developments. Economic fluctuations can affect automotive production volumes, and supply chain disruptions can impact raw material availability. Finally, changing consumer preferences for vehicle attributes indirectly drive demand for the aesthetic and performance enhancements provided by these adhesives.

Segmentation Analysis

The Hem Flange Adhesives Market is comprehensively segmented to provide a granular understanding of its diverse landscape, categorized primarily by type, application, vehicle type, and end-use industry. This segmentation allows for a detailed analysis of market dynamics, identifying specific growth drivers, competitive landscapes, and emerging opportunities within each category. Understanding these segments is crucial for stakeholders to tailor their product development, marketing strategies, and investment decisions effectively. The inherent versatility of hem flange adhesives, stemming from their varied chemical compositions and performance characteristics, enables their application across a wide spectrum of automotive manufacturing processes, catering to distinct requirements based on the desired strength, flexibility, cure time, and material compatibility. This intricate breakdown helps in pinpointing precise market needs and forecasting future trends more accurately.

- By Type:

- Epoxy-based: Known for excellent strength, rigidity, and resistance to environmental factors, widely used for structural bonding.

- Polyurethane-based: Offers good flexibility, impact resistance, and adhesion to various substrates, suitable for applications requiring dynamic movement.

- Acrylic-based: Provides fast curing, strong adhesion, and good peel strength, often preferred for high-speed assembly lines.

- Others (e.g., Silane Modified Polymers (SMP), Hybrid Adhesives): Emerging formulations offering specialized properties and performance advantages.

- By Application:

- Hoods: Crucial for structural integrity and aesthetic appeal of the vehicle's front.

- Doors: Essential for bonding inner and outer panels, enhancing safety and sound insulation.

- Trunk Lids/Tailgates: Used for bonding panels, contributing to overall vehicle body rigidity.

- Fenders: Applied for joining panels, improving corrosion resistance and aesthetic finish.

- Others (e.g., Roof Panels, Pillars): Expanding applications in other vehicle body parts for structural reinforcement and lightweighting.

- By Vehicle Type:

- Passenger Vehicles: The largest segment due to high production volumes and continuous innovation in design and materials.

- Commercial Vehicles: Growing segment driven by demand for lightweighting to improve fuel efficiency and payload capacity.

- Electric Vehicles (EVs): A rapidly expanding category, highly reliant on advanced adhesives for lightweighting and battery protection.

- By End-Use Industry:

- Automotive OEMs (Original Equipment Manufacturers): Primary consumers, integrating adhesives directly into new vehicle production.

- Automotive Aftermarket/Repair: Used for collision repair and maintenance, though to a lesser extent for primary hem flange bonding.

- Aerospace: Niche applications requiring high-strength, lightweight bonding solutions for structural components.

- Marine: Used in boat and ship manufacturing for structural bonding and sealing, benefiting from corrosion resistance properties.

- Other Industrial: Specialized applications in other manufacturing sectors requiring similar bonding characteristics.

Value Chain Analysis For Hem Flange Adhesives Market

The value chain for the Hem Flange Adhesives Market begins with upstream activities involving the sourcing and processing of various raw materials, which are critical for the formulation of these specialized adhesives. This upstream segment encompasses key chemical components such as resins (epoxy, polyurethane, acrylic), hardeners, catalysts, fillers, and additives, sourced from petrochemical companies and specialty chemical suppliers. The quality, availability, and cost of these raw materials significantly influence the final product's performance and market price. Manufacturers in this stage focus on optimizing material procurement, ensuring quality control, and engaging in research and development to discover new, more efficient, and sustainable base chemistries. Strong relationships with reliable raw material suppliers are paramount to maintaining a consistent supply chain and product quality, especially given the technical specifications required for automotive applications.

Moving downstream, the value chain progresses to the core manufacturing and formulation of hem flange adhesives. Leading adhesive companies, equipped with advanced R&D capabilities and manufacturing facilities, transform raw materials into finished adhesive products tailored for specific automotive applications. This stage involves complex chemical synthesis, compounding, and rigorous testing to meet stringent industry standards for strength, durability, temperature resistance, and cure profiles. The adhesives are then packaged and distributed to end-users. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves adhesive manufacturers supplying directly to large automotive OEMs (Original Equipment Manufacturers), often with dedicated technical support and custom solutions. This approach allows for closer collaboration, ensuring the adhesive meets precise vehicle design and manufacturing process requirements. Indirect distribution, conversely, involves a network of distributors, wholesalers, and specialized retailers who serve smaller manufacturers, repair shops, and the aftermarket segment, providing broader market access and localized support.

The value chain culminates with the end-use application in automotive assembly plants and, to a lesser extent, in other industrial sectors. OEMs integrate hem flange adhesives into their production lines, often employing robotic automation for precise and high-volume application. Post-application, quality control and curing processes are critical to ensure optimal bond performance and vehicle integrity. Effective direct communication between adhesive suppliers and OEMs is vital at this stage to provide technical assistance, training, and troubleshooting. The indirect channels support smaller-scale operations and the automotive aftermarket, providing readily available adhesive products for repair and refurbishment. The overall efficiency and cost-effectiveness of the hem flange adhesives market are highly dependent on the seamless coordination and collaboration across all these stages, from raw material sourcing to final application and post-sales support, emphasizing the interconnectedness of the entire value chain.

Hem Flange Adhesives Market Potential Customers

The primary potential customers and end-users of hem flange adhesives are overwhelmingly concentrated within the global automotive manufacturing sector. This includes large-scale Original Equipment Manufacturers (OEMs) such as Ford, General Motors, Volkswagen, Toyota, Honda, Hyundai, BMW, Mercedes-Benz, and Tesla, which utilize these adhesives extensively in their body-in-white assembly lines. These OEMs integrate hem flange adhesives into the production of millions of vehicles annually, seeking solutions that enhance structural integrity, enable lightweighting, improve crash safety, reduce noise, vibration, and harshness (NVH), and offer superior corrosion resistance. Their purchasing decisions are driven by stringent performance specifications, long-term supply agreements, technical support, and the ability of adhesive suppliers to innovate and provide tailored solutions for increasingly complex vehicle designs and multi-material architectures. The growing trend of platform sharing and modular vehicle construction among OEMs also creates sustained demand for standardized yet high-performance adhesive solutions.

Beyond traditional automotive OEMs, a significant and rapidly expanding segment of potential customers includes manufacturers of electric vehicles (EVs). New EV startups and established automotive players shifting towards electrification represent a lucrative customer base, as lightweighting is even more critical for EVs to maximize battery range and energy efficiency. Hem flange adhesives offer an ideal solution for bonding battery trays, body panels, and other structural components in EVs, often involving advanced materials like aluminum and carbon fiber composites. These customers prioritize adhesives that provide superior strength-to-weight ratios, excellent thermal management properties, and robust performance under dynamic stress unique to EV powertrains. The demand from the EV sector is projected to be a primary growth engine for the hem flange adhesives market in the coming decade, driven by aggressive production targets and continuous technological innovation in electric mobility.

While automotive OEMs constitute the vast majority of demand, there are also niche potential customers in related industries. These include specialized vehicle manufacturers (e.g., heavy trucks, buses, recreational vehicles), and to a lesser extent, certain segments within the aerospace and marine industries. In these sectors, the demand for lightweight, high-strength bonding solutions that can withstand harsh environmental conditions and improve durability is growing. Additionally, independent automotive repair shops and the aftermarket segment represent a smaller but consistent customer base, purchasing hem flange adhesives for collision repair and restoration purposes. These customers typically require versatile, easy-to-apply solutions that replicate OEM-level performance for structural repairs. The diverse needs across these customer groups underscore the broad applicability and evolving market landscape for hem flange adhesives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, 3M Company, Dow Inc., Arkema S.A., PPG Industries, Inc., BASF SE, Wacker Chemie AG, Lord Corporation (now part of Parker Hannifin), Ashland Global Holdings Inc., Dupont de Nemours, Inc., Dymax Corporation, Huntsman Corporation, Master Bond Inc., Permabond LLC, Cyberbond LLC, ITW Performance Polymers, SCIGRIP (a Weld-On company), Bostik (an Arkema company). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hem Flange Adhesives Market Key Technology Landscape

The technology landscape for the Hem Flange Adhesives Market is characterized by continuous innovation aimed at enhancing performance, application efficiency, and sustainability. A significant area of focus is the development of advanced adhesive chemistries, including two-component epoxy-based systems, polyurethane-based formulations, and acrylic adhesives, each tailored to specific requirements. Epoxy adhesives, for instance, are being engineered with improved toughness and adhesion to diverse substrates, crucial for multi-material vehicle architectures involving high-strength steels and aluminum. Polyurethane adhesives are evolving to offer superior flexibility, impact resistance, and faster cure times, while acrylics are gaining traction for their rapid bonding capabilities, enabling quicker assembly processes. Hybrid adhesive technologies, combining the best attributes of different chemistries, are also emerging to address complex bonding challenges and offer a balance of strength, flexibility, and environmental resistance.

Beyond chemical composition, technological advancements in application methods are equally critical. Automated robotic dispensing systems are becoming standard in modern automotive assembly plants, ensuring precise and consistent adhesive bead placement, optimized bond line thickness, and reduced material waste. These systems are often integrated with vision systems and sensor technology for real-time monitoring and quality control, ensuring that every bond meets stringent specifications. Furthermore, advancements in curing technologies, such as induction curing and UV curing for certain formulations, are reducing production cycle times and energy consumption. The development of self-piercing rivet (SPR) compatible adhesives, which can withstand the forces of rivet insertion while maintaining a strong bond, represents another specialized technological advancement catering to composite and dissimilar material joining challenges.

Another crucial aspect of the technology landscape involves the drive towards more sustainable and environmentally friendly solutions. This includes the development of low-VOC (Volatile Organic Compound) and solvent-free adhesive formulations to comply with increasingly strict environmental regulations and improve workplace safety. Research into bio-based and renewable raw materials for adhesive synthesis is also gaining momentum, aiming to reduce the reliance on petrochemical derivatives and minimize the ecological footprint of adhesive products. Furthermore, advancements in adhesive rheology and thixotropy are allowing for tailored flow properties, preventing sag and squeeze-out during application, which contributes to cleaner assembly processes and improved aesthetics. These technological strides collectively enhance the value proposition of hem flange adhesives, making them an indispensable component in the future of advanced manufacturing.

Regional Highlights

- North America: This region is a mature market driven by significant automotive production, particularly in the US and Canada. Stringent safety regulations and the strong emphasis on vehicle lightweighting to meet fuel efficiency standards are key drivers. The rapid expansion of electric vehicle manufacturing and investment in advanced manufacturing technologies further bolsters market growth. Major OEMs and adhesive manufacturers in this region are actively engaged in R&D to develop next-generation bonding solutions.

- Europe: Europe represents a highly innovative and advanced market for hem flange adhesives, with countries like Germany, France, and the UK leading in automotive engineering. The region's focus on premium vehicle segments, electric vehicle adoption, and strict environmental regulations requiring sustainable adhesive solutions contribute to its robust growth. Collaborative research between academic institutions, adhesive companies, and OEMs is a significant characteristic, fostering continuous technological advancements and specialized product development.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily fueled by the massive automotive production bases in China, India, Japan, and South Korea. Rapid industrialization, increasing disposable incomes, and the expanding middle class are driving higher vehicle sales and production volumes. The region is witnessing a swift adoption of advanced manufacturing techniques and a strong push towards electric vehicles, creating immense demand for high-performance hem flange adhesives. Local players are also emerging, intensifying competition and innovation.

- Latin America: This region, particularly Brazil and Mexico, presents a growing market opportunity driven by increasing automotive production and sales. As vehicle manufacturing capabilities expand, there is a rising demand for modern bonding solutions to improve vehicle quality and meet regional market standards. Economic stability and foreign investments in the automotive sector are crucial for sustained growth, with local manufacturers increasingly seeking cost-effective yet reliable adhesive technologies.

- Middle East and Africa (MEA): The MEA market for hem flange adhesives is nascent but shows promising growth, primarily influenced by expanding automotive assembly operations in countries like South Africa, Turkey, and Iran. Investment in infrastructure and manufacturing capabilities, coupled with increasing demand for modern vehicles, is driving the adoption of advanced adhesive technologies. The region's long-term growth is dependent on economic diversification and the establishment of robust automotive supply chains, with a rising awareness of the benefits of structural adhesives.

- China: As the world's largest automotive market and producer, China is a critical growth engine for hem flange adhesives. The country's aggressive push into electric vehicle manufacturing, coupled with significant investments in smart factories and automated production lines, drives massive demand. Both global and domestic adhesive suppliers are heavily invested in localizing production and R&D to cater to the unique demands of the Chinese market, which prioritizes high volumes, cost-efficiency, and rapid innovation cycles.

- India: India is another rapidly emerging market within APAC, characterized by a burgeoning automotive industry and increasing consumer demand for affordable yet quality vehicles. The government's "Make in India" initiative and focus on local manufacturing are propelling the adoption of advanced technologies, including hem flange adhesives. The shift towards lightweight vehicles and the nascent but growing EV segment are key factors contributing to the market's expansion, requiring suppliers to offer solutions that balance performance with cost-effectiveness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hem Flange Adhesives Market.- Henkel AG & Co. KGaA: A global leader in adhesives, sealants, and functional coatings, offering a broad portfolio of hem flange adhesive solutions for automotive applications.

- Sika AG: Specializes in bonding, sealing, damping, reinforcing, and protecting solutions, with a strong presence in the automotive industry for structural adhesives.

- H.B. Fuller Company: A leading global adhesive provider, developing innovative bonding solutions for various industries, including advanced automotive applications.

- 3M Company: Known for its diversified technology and manufacturing, offering a range of industrial adhesives and tapes tailored for automotive assembly.

- Dow Inc.: A materials science company providing high-performance adhesive technologies, including polyurethane and epoxy systems, for lightweight automotive designs.

- Arkema S.A.: Offers a wide array of specialty materials, including high-performance adhesives under its Bostik brand, critical for automotive bonding.

- PPG Industries, Inc.: A global supplier of paints, coatings, and specialty materials, with adhesive products contributing to automotive body assembly and protection.

- BASF SE: One of the world's largest chemical producers, providing raw materials and specialized formulations for adhesive manufacturers serving the automotive sector.

- Wacker Chemie AG: Focuses on silicone-based and polymer-based solutions, including specialty adhesives that offer unique properties for automotive applications.

- Lord Corporation (now part of Parker Hannifin): Known for its advanced adhesive systems and vibration/motion control technologies, with a strong presence in automotive structural bonding.

- Ashland Global Holdings Inc.: Supplies specialty chemicals, including performance-enhancing additives and raw materials for adhesive formulations.

- Dupont de Nemours, Inc.: A science and engineering company providing advanced materials, including high-performance polymers and adhesives for automotive lightweighting.

- Dymax Corporation: Specializes in light-curable adhesives, coatings, and encapsulants, offering rapid curing solutions for high-speed assembly processes.

- Huntsman Corporation: A global manufacturer of differentiated chemicals, including a range of polyurethane and epoxy systems used in adhesive production.

- Master Bond Inc.: Develops a diverse line of high-performance epoxy, polyurethane, silicone, and other specialty adhesives for demanding applications.

- Permabond LLC: A global manufacturer of engineering adhesives, providing high-quality cyanoacrylates, anaerobics, epoxies, and structural acrylics.

- Cyberbond LLC: Offers a comprehensive portfolio of industrial adhesives, including high-strength bonding agents suitable for automotive manufacturing.

- ITW Performance Polymers: A global manufacturer of industrial-strength adhesives, epoxies, and repair compounds, serving various industrial sectors including automotive.

- SCIGRIP (a Weld-On company): Produces high-performance structural adhesives, particularly acrylic-based solutions known for their strong bonding capabilities.

- Bostik (an Arkema company): A leading global adhesive specialist, providing a wide range of smart adhesive solutions for the automotive and transportation markets.

Frequently Asked Questions

Analyze common user questions about the Hem Flange Adhesives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using hem flange adhesives in automotive manufacturing compared to traditional joining methods?

Hem flange adhesives offer numerous advantages over conventional spot welding or mechanical fasteners, significantly enhancing vehicle performance and aesthetics. They enable superior structural integrity by distributing stress more evenly across joints, leading to improved crash safety and overall vehicle durability. These adhesives also facilitate significant lightweighting by allowing the use of thinner gauge materials and multi-material designs, crucial for better fuel efficiency in internal combustion engine (ICE) vehicles and extended range in electric vehicles (EVs). Furthermore, they provide excellent corrosion protection by sealing joints against moisture and environmental elements, reduce noise, vibration, and harshness (NVH) for a quieter and more comfortable ride, and contribute to a smoother, more aesthetically pleasing exterior finish without visible weld marks. The versatility of these adhesives allows for bonding diverse materials, which is essential for modern vehicle architectures.

How do hem flange adhesives contribute to the lightweighting goals of the automotive industry, especially for electric vehicles?

Hem flange adhesives are instrumental in achieving ambitious lightweighting objectives within the automotive industry, a critical factor for both traditional and electric vehicles. By providing strong, continuous bonds, these adhesives allow manufacturers to use lighter-weight materials such as aluminum, advanced high-strength steels, and composite plastics without compromising structural integrity. Unlike spot welding, which creates localized stress points, adhesives distribute loads over a larger area, often enabling the use of thinner material gauges. For electric vehicles, lightweighting is particularly vital as every kilogram saved can directly translate to an increased battery range, improved energy efficiency, and enhanced driving dynamics. Adhesives facilitate the safe and secure bonding of large battery packs and modules to the vehicle chassis, contributing to the overall structural efficiency and performance of EVs. This capability makes them a cornerstone technology for the future of sustainable mobility.

What are the key types of hem flange adhesives available in the market, and how do their properties differ?

The hem flange adhesives market is primarily categorized by chemical composition, with epoxy-based, polyurethane-based, and acrylic-based adhesives being the most prominent types, each offering distinct properties tailored to specific application requirements. Epoxy-based adhesives are renowned for their exceptional strength, rigidity, and resistance to harsh environmental conditions, making them ideal for high-stress structural applications where maximum durability is required. Polyurethane-based adhesives, conversely, offer greater flexibility and impact resistance, providing excellent adhesion to various substrates while accommodating thermal expansion and contraction, which is crucial for dynamic vehicle components. Acrylic-based adhesives stand out for their rapid curing times and strong peel strength, suitable for high-speed assembly lines where quick bonding is essential to maintain production efficiency. Other emerging types, such as silane modified polymers (SMPs) and hybrid adhesives, combine benefits from different chemistries to offer balanced performance characteristics, addressing evolving material and process complexities in automotive manufacturing.

What role does automation and advanced manufacturing play in the adoption and application of hem flange adhesives?

Automation and advanced manufacturing technologies play a pivotal role in the widespread adoption and efficient application of hem flange adhesives, transforming automotive assembly lines. Robotic dispensing systems are integral, ensuring high precision, consistency, and repeatability in applying adhesive beads, which is crucial for optimal bond performance and minimizing material waste. These automated systems can navigate complex geometries and apply adhesives with millimeter accuracy, far surpassing manual application capabilities. Furthermore, integration with advanced sensors and vision systems enables real-time quality control, detecting any deviations in bead size or placement instantly, thereby preventing defects and reducing rework. Automated curing processes, such as induction heating, accelerate the bonding process, shortening cycle times and increasing overall production throughput. The synergy between high-performance adhesives and intelligent automation not only enhances manufacturing efficiency and reliability but also enables the integration of these advanced materials into high-volume vehicle production, driving innovation in automotive assembly.

What are the future trends and opportunities for innovation in the Hem Flange Adhesives Market?

The future of the Hem Flange Adhesives Market is characterized by several key trends and promising opportunities for innovation. A significant trend is the continued development of sustainable adhesive formulations, including low-VOC (Volatile Organic Compound), solvent-free, and bio-based options, driven by increasing environmental regulations and corporate sustainability goals. Innovation will also focus on developing adhesives capable of bonding an even broader range of dissimilar materials, crucial for next-generation multi-material vehicle architectures. Faster curing technologies, potentially incorporating smart sensing or self-healing capabilities, are expected to emerge, further improving production efficiency and product longevity. The integration of artificial intelligence (AI) and machine learning (ML) will revolutionize adhesive R&D, application optimization, and quality control, leading to more intelligent and adaptive bonding solutions. Furthermore, expansion into emerging automotive markets and niche applications beyond traditional passenger vehicles, such as heavy-duty commercial vehicles and specialized industrial equipment, presents significant growth avenues, fueled by a continuous demand for lightweight, high-performance, and durable bonding solutions across various sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager