Hematologic Malignancies Detection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436272 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Hematologic Malignancies Detection Market Size

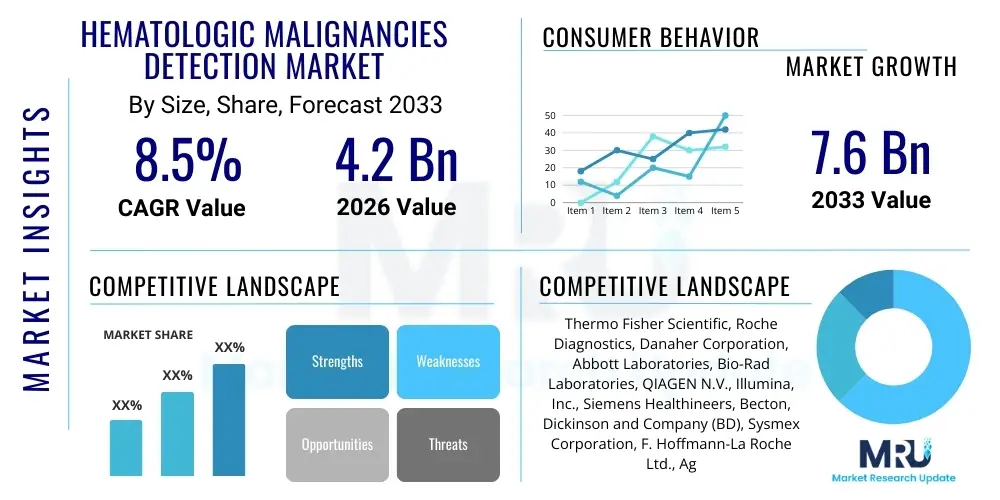

The Hematologic Malignancies Detection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.2 Billion in 2026 and is projected to reach $7.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global incidence of blood cancers, coupled with accelerated technological advancements in molecular diagnostics and personalized medicine. The shift towards non-invasive and highly sensitive detection methods, such as liquid biopsy and next-generation sequencing (NGS), is fundamentally reshaping the diagnostic landscape, offering earlier and more accurate diagnoses.

Hematologic Malignancies Detection Market introduction

The Hematologic Malignancies Detection Market encompasses a wide range of sophisticated diagnostic tools and services used for identifying, classifying, and monitoring cancers originating in the blood, bone marrow, and lymph nodes, including leukemia, lymphoma, and multiple myeloma. These detection products span molecular diagnostics, cytogenetics, flow cytometry, and immunohistochemistry techniques, crucial for accurate disease staging and therapeutic decision-making. Major applications include initial diagnosis, differential diagnosis, risk stratification, and monitoring of minimal residual disease (MRD) following treatment. The primary benefit of these advanced techniques is the improvement of patient outcomes through precise, timely intervention and the ability to tailor chemotherapy or targeted therapies based on specific genetic mutations.

Driving factors for market growth include the aging global population, which correlates with a higher prevalence of hematological disorders, and substantial investments in oncology research leading to the discovery of novel biomarkers. Furthermore, the increasing adoption of automated diagnostic platforms in clinical laboratories enhances throughput and reduces turnaround times, making advanced testing more accessible. Government initiatives and increased awareness campaigns aimed at early cancer detection also contribute significantly to the expanding market footprint. The integration of advanced computational pathology and digital imaging is further streamlining complex diagnostic workflows.

Hematologic Malignancies Detection Market Executive Summary

The Hematologic Malignancies Detection Market is characterized by intense technological innovation, focusing on ultra-sensitive and non-invasive testing methodologies. Key business trends include strategic mergers and acquisitions among major diagnostic companies to consolidate molecular testing portfolios, and increasing collaboration between technology providers and pharmaceutical companies to develop companion diagnostics tailored to novel targeted therapies. Segment trends show a clear dominance and rapid growth within the Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR) segments due to their superior capability in identifying complex genetic alterations and monitoring low levels of residual disease. Hospitals and specialized diagnostic laboratories remain the primary revenue-generating end-users, increasingly adopting centralized testing platforms for efficiency.

Regionally, North America maintains the largest market share, driven by favorable reimbursement policies, high healthcare expenditure, and the early adoption of cutting-edge technologies like liquid biopsy for early detection and monitoring. However, the Asia Pacific region is projected to exhibit the highest CAGR, spurred by improving healthcare infrastructure, rising awareness about cancer screening, and large, untapped patient populations in countries such as China and India. Europe also represents a significant market, influenced by strong research activities and the standardization of diagnostic protocols across the European Union. The global market dynamic is shifting towards decentralized testing capabilities and the implementation of machine learning algorithms to enhance diagnostic accuracy and throughput, presenting significant commercial opportunities for innovators.

AI Impact Analysis on Hematologic Malignancies Detection Market

Common user questions regarding AI's influence in this market revolve around its ability to improve diagnostic speed, enhance image analysis accuracy in cytology/histopathology, and integrate complex molecular data for personalized treatment planning. Users frequently inquire about the reliability of AI algorithms in detecting subtle changes indicative of minimal residual disease (MRD), the regulatory framework governing AI-driven diagnostics, and the potential displacement of skilled laboratory professionals. The key themes summarized from these inquiries highlight a strong expectation that AI will act as a pivotal tool for data interpretation and pattern recognition, especially in high-volume settings, reducing human error and accelerating the identification of critical genetic mutations and morphologic patterns associated with high-risk hematologic malignancies. There is also significant concern regarding data privacy and the need for standardized, validated datasets to train these sophisticated models effectively.

AI is fundamentally transforming the interpretation of large, multidimensional datasets generated by sequencing technologies (NGS) and flow cytometry. Traditional analysis of these datasets is time-consuming and prone to subjective variation, whereas machine learning algorithms can rapidly identify clinically significant patterns, complex chromosomal aberrations, and novel somatic mutations that might be missed by conventional bioinformatics pipelines. Furthermore, AI is increasingly applied in digital pathology, automating cell counting, classifying blast cells, and quantifying malignant infiltration in bone marrow biopsies, thereby providing crucial decision support to pathologists and hematologists. This automation is vital for increasing laboratory throughput and addressing the growing demand for complex diagnostic services globally.

- AI accelerates the interpretation of complex genomic and transcriptomic sequencing data.

- Enhances accuracy in flow cytometry analysis by automating cluster identification and gating strategies.

- Improves prognostic predictions and risk stratification by integrating clinical, morphological, and molecular data.

- Facilitates automated classification and quantification of malignant cells in digital pathology images and peripheral blood smears.

- Enables the development of predictive models for treatment response and monitoring of minimal residual disease (MRD).

- Optimizes laboratory workflow and reduces turnaround time for high-volume testing centers.

DRO & Impact Forces Of Hematologic Malignancies Detection Market

The market trajectory is significantly shaped by robust drivers, constraining factors, and burgeoning opportunities that collectively form the impact forces. The core driver is the dramatic increase in the global incidence and prevalence of blood cancers, necessitating widespread access to sophisticated and sensitive detection methods for early diagnosis and effective staging. Coupled with this is the continuous innovation in diagnostic technologies, particularly the commercialization of high-throughput Next-Generation Sequencing (NGS) platforms and the expansion of liquid biopsy applications for non-invasive monitoring. These technological strides directly improve clinical utility and patient management, pushing market adoption forward. However, the high capital investment required for adopting state-of-the-art instruments like high-parameter flow cytometers and advanced sequencing machines, along with the complex regulatory approval processes for novel diagnostic assays, act as significant restraints, particularly in resource-limited settings.

Opportunities lie predominantly in the realm of precision medicine, where the detection of specific molecular targets allows for highly tailored treatment regimens. The integration of artificial intelligence and machine learning is creating vast opportunities for enhanced data analysis, personalized risk assessment, and the discovery of novel biomarkers, driving the market towards greater efficiency and predictive power. Furthermore, developing affordable, portable diagnostic solutions suitable for point-of-care settings, especially in emerging economies, represents a key growth avenue. The market impact forces are strongly positive, favoring rapid technological adoption over cost sensitivity, provided the new technologies offer demonstrable clinical superiority in terms of sensitivity and specificity, particularly in the challenging area of minimal residual disease detection.

The primary impact force remains the technological push, where new generations of sequencing and imaging tools continually displace older, less sensitive methods. The rising emphasis on MRD monitoring post-therapy, which requires extremely high sensitivity (often 10^-5 or 10^-6), mandates the use of cutting-edge technologies such as digital PCR (dPCR) and highly specialized sequencing panels, thus creating a perpetually strong demand for next-generation detection platforms. Regulatory pressures, while a short-term restraint, ultimately drive market maturation and ensure the quality and validity of diagnostic outputs, reinforcing the long-term credibility of advanced detection solutions.

Segmentation Analysis

The market segmentation analysis provides granular insights into the varied technologies, malignancy types, and end-users driving demand within the hematologic malignancies detection sector. This structure helps identify high-growth areas and specific clinical needs across different diagnostic domains. The technical segmentation reflects the complexity of blood cancer diagnosis, which often requires a multimodal approach combining morphological analysis (IHC/Cytology), immunophenotyping (Flow Cytometry), and deep molecular profiling (NGS/PCR). The leukemia and lymphoma segments dominate the malignancy types due to their higher prevalence and the critical need for rapid, specific subtyping to guide initial treatment protocols. End-user segmentation shows that specialized laboratories and large hospitals, which handle high-volume and complex testing, remain the key revenue contributors.

- By Technology:

- Flow Cytometry

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Immunohistochemistry (IHC)

- Fluorescence In Situ Hybridization (FISH)

- Cytogenetics

- By Malignancy Type:

- Leukemia

- Acute Myeloid Leukemia (AML)

- Acute Lymphoblastic Leukemia (ALL)

- Chronic Myeloid Leukemia (CML)

- Chronic Lymphocytic Leukemia (CLL)

- Lymphoma

- Non-Hodgkin Lymphoma (NHL)

- Hodgkin Lymphoma (HL)

- Multiple Myeloma (MM)

- Myelodysplastic Syndromes (MDS)

- By End-User:

- Hospitals

- Diagnostic Laboratories

- Research and Academic Institutes

- Specialized Cancer Centers

- By Application:

- Initial Diagnosis and Subtyping

- Prognosis and Risk Stratification

- Minimal Residual Disease (MRD) Monitoring

- Recurrence Detection

Value Chain Analysis For Hematologic Malignancies Detection Market

The value chain for hematologic malignancies detection is complex, beginning with upstream raw material suppliers providing specialized reagents, antibodies, enzymes, and consumables necessary for molecular and immunodiagnostic assays. This is followed by the core operational segment, where technology developers and diagnostic kit manufacturers innovate and produce high-value instruments (sequencers, flow cytometers) and validated diagnostic panels. The midstream involves distribution and logistics, ensuring the timely delivery and proper handling of sensitive biological and chemical components, often through specialized cold chain management systems, relying heavily on direct sales channels for expensive instrumentation and indirect distribution through third-party logistics providers for high-volume reagents. The downstream segment consists of the end-users—hospitals, large reference labs, and specialized cancer centers—which perform the testing and provide the diagnostic reports, ultimately interacting with the patient and physician.

Upstream analysis reveals that key suppliers of high-quality specialized components, such as fluorochromes for flow cytometry or specialized oligonucleotide probes for NGS and PCR, hold significant leverage. The efficiency and quality of these raw materials directly influence the performance and reliability of the final diagnostic kits. The manufacturing stage is characterized by significant intellectual property protection and high R&D intensity, particularly in standardizing molecular assays for clinical use. The transition from research-use-only (RUO) to in-vitro diagnostic (IVD) status requires rigorous validation, often increasing the time-to-market but ensuring clinical adoption.

Distribution channels are dual-pronged: direct sales are preferred for large, capital-intensive equipment (e.g., Illumina sequencers, BD flow cytometers), allowing manufacturers to provide specialized installation, training, and maintenance services directly to high-throughput laboratories. Indirect channels, utilizing regional distributors and wholesalers, are typically used for high-volume, low-cost consumables and standardized reagent kits, especially in regions with fragmented healthcare systems. The downstream success is highly dependent on effective clinical validation, physician adoption, and favorable reimbursement policies, which influence the volume and type of tests ordered, thus dictating the final market consumption patterns.

Hematologic Malignancies Detection Market Potential Customers

The primary consumers and end-users of hematologic malignancies detection products and services are healthcare providers and institutions requiring accurate, timely diagnoses for patient management. These include major tertiary care hospitals, which house large oncology departments and pathology laboratories equipped with high-throughput diagnostic platforms. Specialized cancer treatment centers and dedicated hematology clinics represent critical customers dueating their focus on complex cancer cases and intensive monitoring, often driving demand for advanced MRD testing. Additionally, independent or centralized diagnostic reference laboratories form a crucial customer base, as they process samples outsourced by smaller clinics and hospitals, requiring large-scale automation and diverse testing menus.

Academic and governmental research institutes are also important customers, particularly for research-use-only (RUO) versions of emerging technologies, such as advanced spatial transcriptomics and highly customized sequencing panels, which they use to discover new biomarkers and validate novel detection methodologies. Biobanks and tissue repositories also utilize these technologies for comprehensive sample characterization. Furthermore, pharmaceutical and biotechnology companies are increasingly becoming customers for companion diagnostic assays, which are required alongside novel drug therapies to ensure patient selection and monitor treatment efficacy in clinical trials and commercial settings. The growth of personalized medicine further solidifies the role of specialized diagnostic labs capable of managing complex data integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 Billion |

| Market Forecast in 2033 | $7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Bio-Rad Laboratories, QIAGEN N.V., Illumina, Inc., Siemens Healthineers, Becton, Dickinson and Company (BD), Sysmex Corporation, F. Hoffmann-La Roche Ltd., Agilent Technologies, Guardant Health, Myriad Genetics, Adaptive Biotechnologies, Natera, Bio-Techne Corporation, PerkinElmer Inc., Enzo Biochem, Inc., Hologic, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hematologic Malignancies Detection Market Key Technology Landscape

The technology landscape for hematologic malignancies detection is rapidly evolving, moving towards non-invasive, high-throughput, and ultra-sensitive platforms. Next-Generation Sequencing (NGS) is perhaps the most transformative technology, allowing for comprehensive genomic profiling of blood cancers, identifying critical mutations, translocations, and copy number variations simultaneously. NGS enables high-resolution detection of minimal residual disease (MRD), a crucial prognostic marker, particularly in leukemia and multiple myeloma patients. The decreasing cost and increasing speed of sequencing have made it a standard tool, displacing traditional Sanger sequencing and accelerating the adoption of personalized treatment strategies based on a patient's unique molecular signature. Targeted NGS panels are increasingly common, optimizing cost-efficiency while maintaining clinical relevance.

Flow Cytometry remains indispensable for immunophenotyping, serving as the gold standard for classifying cell lineages (B-cells, T-cells, myeloid cells) and rapidly determining the malignant population’s expression profile. Innovations in flow cytometry involve higher-parameter instruments (allowing simultaneous detection of 15+ markers) and standardized EuroFlow panels, which improve inter-laboratory reproducibility and diagnostic accuracy. Furthermore, Polymerase Chain Reaction (PCR), including quantitative PCR (qPCR) and highly sensitive Digital PCR (dPCR), maintains a strong foothold, especially for monitoring known fusion genes (e.g., BCR-ABL in CML) and for absolute quantification of minimal residual disease. dPCR, in particular, offers superior sensitivity compared to qPCR, making it highly valuable in post-treatment monitoring where detection thresholds are extremely low.

The convergence of molecular techniques with automation and informatics is driving the next wave of diagnostic innovation. Liquid biopsy, utilizing cell-free DNA (cfDNA) or circulating tumor cells (CTCs) from blood samples, is gaining traction as a less invasive alternative to bone marrow aspiration, offering real-time monitoring of disease progression and resistance development. This non-invasive approach, often coupled with ultra-deep NGS or highly specific PCR assays, is vital for monitoring relapse and guiding subsequent therapeutic choices. Alongside these molecular tools, advancements in digital pathology and computational image analysis are integrating morphology and molecular findings seamlessly, facilitating faster and more integrated diagnostic pathways.

Regional Highlights

- North America: Dominates the global market share due to high prevalence of blood cancers, advanced healthcare infrastructure, high per capita healthcare spending, and favorable government initiatives and reimbursement policies supporting expensive molecular diagnostics like NGS and specialized flow cytometry. The US market, in particular, is a hotbed for technological innovation, with numerous key market players headquartered there, driving rapid commercialization of new detection platforms, especially in liquid biopsy applications.

- Europe: Represents a mature market characterized by stringent regulatory environments (e.g., IVDR compliance) and a strong emphasis on standardized diagnostics, often supported by pan-European clinical guidelines (e.g., European Hematology Association). Western European countries (Germany, UK, France) are key consumers, driven by high adoption rates of automated hematology analyzers and advanced sequencing technologies for personalized medicine, with significant R&D activity focused on biomarker discovery.

- Asia Pacific (APAC): Expected to record the highest CAGR during the forecast period. This growth is attributable to increasing public and private healthcare investments, a rapidly aging population, greater access to advanced diagnostic techniques in large economies like China, Japan, and India, and rising medical tourism for complex treatments. Market penetration is accelerating as local manufacturers expand production of cost-effective diagnostic kits.

- Latin America (LATAM): Growth is steady, driven primarily by expanding healthcare access and increasing awareness of cancer diagnostics in major economies such as Brazil and Mexico. However, market adoption is often constrained by limited reimbursement coverage and fragmented healthcare systems, necessitating a focus on affordable and robust detection solutions.

- Middle East and Africa (MEA): This region presents nascent opportunities, with market expansion concentrated in affluent Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which are investing heavily in specialized cancer centers and importing advanced diagnostic instrumentation. Sub-Saharan Africa faces significant challenges related to infrastructure and affordability, though efforts are underway to implement centralized molecular testing facilities for high-priority diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hematologic Malignancies Detection Market.- Thermo Fisher Scientific

- Roche Diagnostics

- Danaher Corporation

- Abbott Laboratories

- Bio-Rad Laboratories

- QIAGEN N.V.

- Illumina, Inc.

- Siemens Healthineers

- Becton, Dickinson and Company (BD)

- Sysmex Corporation

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies

- Guardant Health

- Myriad Genetics

- Adaptive Biotechnologies

- Natera

- Bio-Techne Corporation

- PerkinElmer Inc.

- Enzo Biochem, Inc.

- Hologic, Inc.

Frequently Asked Questions

Analyze common user questions about the Hematologic Malignancies Detection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most rapidly growing segment in hematologic malignancies detection?

The Next-Generation Sequencing (NGS) segment is experiencing the highest growth rate. NGS is crucial for comprehensive genomic profiling and ultra-sensitive Minimal Residual Disease (MRD) monitoring, particularly using liquid biopsy samples, offering critical insights for personalized therapeutic decisions and relapse surveillance.

How does liquid biopsy technology impact the diagnosis of blood cancers?

Liquid biopsy, which analyzes cell-free DNA (cfDNA) and circulating tumor cells (CTCs) from peripheral blood, reduces the need for invasive bone marrow biopsies. It is essential for non-invasive real-time monitoring, tracking clonal evolution, detecting acquired drug resistance mutations, and performing early relapse detection post-treatment.

What are the primary restraints affecting market expansion?

Key restraints include the prohibitively high initial capital expenditure for advanced diagnostic instruments, such as high-parameter flow cytometers and clinical sequencers, along with the shortage of highly skilled technical personnel required to operate and interpret complex molecular diagnostic results accurately.

In which application area is high-sensitivity PCR most critical?

High-sensitivity PCR, specifically Digital PCR (dPCR), is most critical in Minimal Residual Disease (MRD) monitoring. MRD monitoring requires detecting cancer cells at extremely low frequencies (down to 1 in 100,000 cells), where the superior precision and absolute quantification capabilities of dPCR provide definitive clinical data on treatment effectiveness.

How is AI integrated into the detection process for blood disorders?

AI and machine learning are integrated primarily to automate the complex analysis of flow cytometry and NGS data. AI algorithms enhance diagnostic speed by identifying subtle patterns, classifying cell types in digital images, and predicting patient outcomes by integrating vast amounts of genomic, proteomic, and clinical data efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager