Hemoglobin A1C Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435900 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hemoglobin A1C Analyzer Market Size

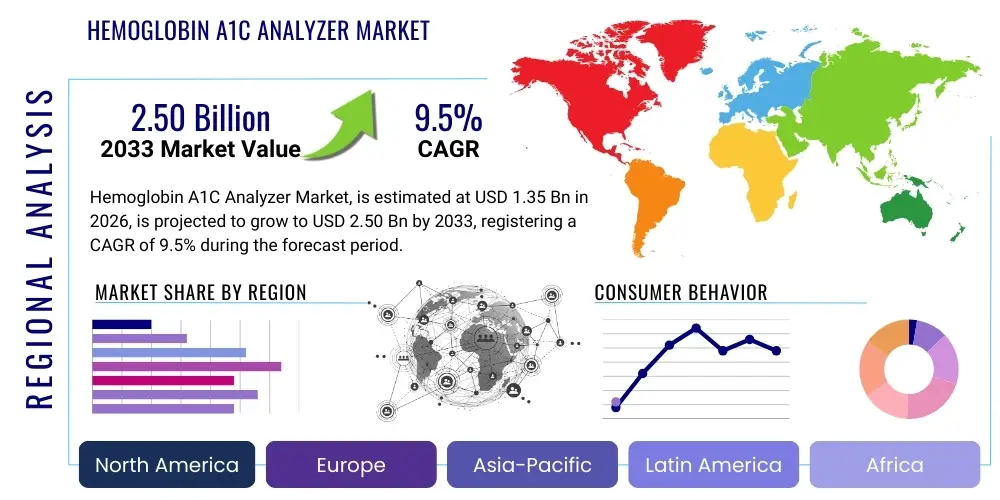

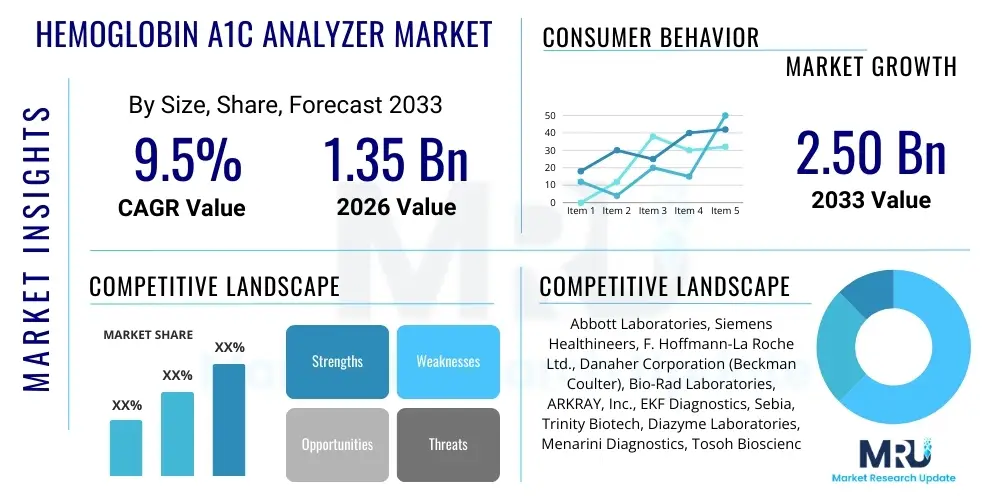

The Hemoglobin A1C Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.50 Billion by the end of the forecast period in 2033.

Hemoglobin A1C Analyzer Market introduction

The Hemoglobin A1C (HbA1c) Analyzer Market encompasses devices and consumables utilized globally for measuring the average blood glucose levels over the preceding two to three months. This measurement is crucial for the diagnosis, monitoring, and management of diabetes mellitus, a rapidly escalating chronic condition worldwide. The core product, the HbA1c analyzer, leverages various technologies, including High Performance Liquid Chromatography (HPLC), immunoassay, enzymatic assays, and boronate affinity chromatography, to provide accurate and precise results. These devices range from high-throughput, centralized laboratory instruments (benchtop) to compact, Point-of-Care Testing (POCT) systems designed for clinics, physician offices, and home use, reflecting a major shift toward decentralized diagnostics. The primary application of these analyzers is robust diabetes screening and monitoring, allowing healthcare providers to assess long-term glycemic control efficacy and adjust treatment plans accordingly. The growing prevalence of sedentary lifestyles, coupled with rising obesity rates and an aging global population, acts as a foundational driver for sustained market expansion. Furthermore, enhanced awareness campaigns regarding early diabetes detection and the establishment of stringent diagnostic guidelines by international health organizations are reinforcing the demand for reliable HbA1c testing solutions across all geographical regions.

Product complexity varies significantly across the market, reflecting diverse user needs and regulatory environments. Benchtop systems, typically utilizing HPLC, offer superior accuracy and are the gold standard for central reference laboratories, justifying their higher capital investment and operational costs. Conversely, POCT devices prioritize speed, ease of use, and portability, often employing immunoassay or boronate affinity techniques. These portable devices are increasingly critical in remote settings and primary care environments where immediate results influence patient management decisions. The inherent benefits of these analyzers include their ability to offer objective data on long-term glycemic status, which is superior to traditional fasting glucose tests in assessing risk and treatment efficacy. Additionally, advancements in microfluidics and sensor technology are continuously improving the turnaround time and reducing sample size requirements, further enhancing the utility of these analytical instruments in busy clinical settings. Reliability and standardization are key requirements, driving manufacturers to invest heavily in calibration and quality control features to meet strict international guidelines for diabetes diagnostics.

Key driving factors accelerating the adoption of HbA1c analyzers include the massive global burden of diabetes, with millions of new cases diagnosed annually, demanding effective monitoring tools. Government initiatives and reimbursement policies favoring preventive health screening and chronic disease management substantially boost market penetration, particularly in developing economies where diagnostic infrastructure is rapidly expanding. Technological innovations focused on improving efficiency, reducing measurement interference, and minimizing testing errors are also significant drivers. The market is highly competitive, characterized by continuous research and development efforts aimed at creating user-friendly, cost-effective devices suitable for diverse healthcare delivery models, ensuring sustained growth throughout the forecast period. The shift towards personalized medicine also elevates the importance of precise and frequent HbA1c measurements, further solidifying the market's trajectory.

Hemoglobin A1C Analyzer Market Executive Summary

The Hemoglobin A1C Analyzer Market is experiencing robust growth fueled primarily by the global pandemic of diabetes and the concurrent technological advancements that enable highly accurate and convenient testing. Current business trends indicate a definitive shift toward decentralized testing models, prioritizing Point-of-Care (POCT) HbA1c solutions that offer rapid results and enhance clinical decision-making speed, especially in primary care and outpatient settings. Strategic mergers, acquisitions, and collaborations focused on integrating advanced diagnostic capabilities, particularly microfluidics and artificial intelligence (AI) for enhanced data interpretation, define the competitive landscape. Key market players are concentrating on expanding their consumable portfolios and securing long-term contracts with large hospital networks and diagnostic chains to maintain revenue stability and market share dominance. Furthermore, sustainability and interoperability—ensuring that analyzer data integrates seamlessly with Electronic Health Records (EHRs)—are emerging as critical success factors influencing purchasing decisions across institutional buyers.

From a regional perspective, North America maintains its position as the dominant market, attributable to high diabetes prevalence, established healthcare infrastructure, substantial reimbursement coverage for HbA1c testing, and the early adoption of technologically sophisticated devices. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by a burgeoning diabetic population, increasing healthcare expenditure, improving access to advanced diagnostic technologies, and governmental focus on chronic disease management programs in countries like China and India. Europe exhibits steady, mature growth, focusing heavily on regulatory compliance and the standardization of testing protocols. Market penetration in Latin America and the Middle East & Africa (MEA) is accelerating, spurred by urbanization, changing dietary habits contributing to higher diabetes rates, and investments in diagnostic infrastructure development, though challenges related to pricing and complex distribution channels persist in these emerging economies.

Segment trends highlight the continued technological dominance of High Performance Liquid Chromatography (HPLC) in laboratory settings for its high precision, maintaining its status as the reference method. However, the fastest growth is observed in boronate affinity and immunoassay technologies, specifically utilized in portable POCT devices, responding directly to the demand for accessibility. The End-User segment sees diagnostic laboratories and hospitals retaining the largest market share due to testing volume, but the fastest expansion is predicted in physician offices and retail clinics, underscoring the shift toward distributed testing models. The market for consumables, including reagents and cartridges specific to the analyzers, constitutes the largest revenue component within the overall market, exhibiting consistent growth linked directly to the installed base of the analyzers and the mandated frequency of diabetes monitoring.

AI Impact Analysis on Hemoglobin A1C Analyzer Market

Users commonly question how Artificial Intelligence (AI) and machine learning (ML) will transform the accuracy, data interpretation, and workflow efficiency of Hemoglobin A1C testing, moving beyond simple measurement. Key concerns revolve around the integration challenges of AI algorithms with existing lab information systems (LIS) and Point-of-Care (POC) platforms, and how AI can ensure data security and privacy while handling sensitive patient glycemic trends. There is high user expectation that AI will be used not only for predictive analytics—identifying patients at high risk of developing complications based on HbA1c variability—but also for optimizing internal laboratory processes, such as predictive maintenance of analyzers and enhanced quality control monitoring, reducing human error and operational downtime. Furthermore, users anticipate AI-driven clinical decision support systems that synthesize HbA1c results with other patient biomarkers to provide personalized treatment recommendations directly to clinicians, thereby improving long-term diabetes outcomes and bridging the gap between raw data and actionable medical insights.

- AI-driven pattern recognition enhances quality control by identifying subtle drifts or inconsistencies in reagent performance and instrument calibration before they lead to inaccurate patient results, ensuring superior analytical reliability.

- Machine learning algorithms optimize laboratory throughput by predicting peak testing times and intelligently scheduling maintenance activities, maximizing analyzer uptime and minimizing bottlenecks in high-volume central labs.

- Integration of AI facilitates predictive analytics, utilizing sequential HbA1c measurements alongside demographic and lifestyle data to forecast future glycemic status and complication risk, enabling proactive clinical intervention.

- AI-powered decision support tools translate complex HbA1c data into simplified, actionable treatment recommendations for clinicians, supporting therapy adjustments based on longitudinal patient response patterns.

- Natural Language Processing (NLP) capabilities within diagnostic platforms allow for automated report generation and seamless integration of HbA1c results into Electronic Health Records (EHRs), streamlining administrative workflow and data traceability.

- AI assists in standardizing result interpretation across diverse geographical locations and healthcare settings, minimizing inter-operator variability and ensuring regulatory compliance in reporting methodologies.

- Development of advanced algorithms can potentially compensate for known interferences (e.g., hemoglobin variants or uremia) in specific assay methods, improving result accuracy in complex patient populations where traditional methods might fail.

DRO & Impact Forces Of Hemoglobin A1C Analyzer Market

The dynamics of the Hemoglobin A1C Analyzer Market are fundamentally shaped by a confluence of driving factors, critical restraints, and substantial opportunities, collectively defining the impact forces influencing its direction. The foremost driver is the surging global incidence and prevalence of both Type 1 and Type 2 diabetes, requiring continuous, reliable monitoring tools for long-term glycemic control. Concurrent technological advancements, particularly in POCT devices offering quicker, more accessible, and less invasive testing methods, significantly push market adoption. Opportunities arise from untapped potential in emerging economies where diagnostic infrastructure is expanding rapidly, combined with the increasing adoption of personalized medicine which demands precise, frequently measured biomarkers like HbA1c. Conversely, the market faces restraints, primarily the high initial cost associated with advanced benchtop analyzers (like HPLC systems) and the ongoing expense of proprietary reagents and consumables, posing significant budget constraints for smaller clinics or resource-limited regions. Moreover, technical challenges related to assay interference from hemoglobin variants (hemoglobinopathies) in certain populations introduce complexities in measurement, which requires specialized analyzer technologies or robust verification protocols, acting as a technical restraint against universal adoption.

The primary impact force driving market expansion is regulatory support coupled with increasing patient awareness. International guidelines, such as those from the American Diabetes Association (ADA), consistently endorse HbA1c as the standard diagnostic and monitoring tool, compelling healthcare systems globally to implement routine testing. This endorsement creates an undeniable pull for analyzer technology. However, a significant restraining impact force is the competition from alternative glucose monitoring methods, specifically Continuous Glucose Monitoring (CGM) systems. While CGM provides real-time data and detailed glucose variability insights, it does not fully replace the long-term objective assessment provided by HbA1c, forcing manufacturers to highlight the complementary nature and distinct clinical value of their analyzers. The opportunity force is strongly rooted in telehealth and remote monitoring expansion, where portable HbA1c devices are integrated into broader chronic disease management platforms, enhancing patient adherence and reducing the necessity for frequent in-person clinic visits. This digitalization of diabetes care represents a lucrative growth pathway for technology providers.

Addressing the restraint of cost sensitivity, particularly in high-volume public health settings, requires manufacturers to develop cost-effective, durable platforms suitable for centralized procurement tenders. Overcoming technical restraints involves continuous research into robust assay chemistries that minimize interference and ensure measurement stability across diverse patient samples, maintaining clinical utility. The overall impact forces favor continued growth, driven by the non-negotiable medical necessity of diabetes management and technological innovation, outweighing the challenges posed by high equipment cost and the competitive landscape from newer glucose tracking technologies. The long-term trend is toward systems that combine the accuracy of traditional laboratory testing with the convenience and speed of POCT, ensuring universal access to critical glycemic assessment tools across the entire spectrum of healthcare delivery.

Segmentation Analysis

The Hemoglobin A1C Analyzer Market is extensively segmented based on several critical dimensions including technology, product type, application, and end-user, providing a granular view of market dynamics and adoption patterns. Segmentation by technology is vital as it dictates accuracy, throughput, and cost, encompassing established methods like High Performance Liquid Chromatography (HPLC), which serves as the reference standard, alongside faster, lower-cost options such as immunoassay and boronate affinity methodologies. Product segmentation delineates the market between high-volume, centralized laboratory (benchtop) analyzers and rapidly growing, user-friendly Point-of-Care Testing (POCT) devices, reflecting the shift toward decentralized care models. Analysis based on end-user clearly identifies hospitals and diagnostic laboratories as the largest consumers due to the volume of tests conducted, while physician offices and retail clinics represent the fastest expanding segments, driven by convenience and accessibility. These segmentations are crucial for strategic planning, allowing companies to tailor product development, pricing strategies, and distribution channels to target specific clinical needs and geographic requirements.

- Technology:

- High Performance Liquid Chromatography (HPLC)

- Immunoassay (e.g., Turbidimetric Inhibition Immunoassay - TINA)

- Enzymatic Assays

- Boronate Affinity Chromatography

- Product Type:

- Benchtop Analyzers (High-throughput systems for centralized labs)

- Portable Analyzers (Point-of-Care Testing - POCT devices)

- Application:

- Diabetes Diagnosis and Monitoring

- Clinical Trials and Research

- Risk Assessment for Cardiovascular Complications

- End-User:

- Hospitals and Clinics

- Diagnostic Laboratories (Reference Labs)

- Physician Offices and Retail Clinics

- Home Care and Personalized Settings

Value Chain Analysis For Hemoglobin A1C Analyzer Market

The value chain for the Hemoglobin A1C Analyzer Market begins with rigorous upstream activities encompassing research and development, raw material procurement, and the complex manufacturing of precision components. Key upstream suppliers provide specialized chemical reagents, advanced sensor technology, microfluidic components, and high-quality optical and electronic systems necessary for accurate analysis. Manufacturers must maintain stringent control over the quality and sourcing of these inputs, as the reliability of the final diagnostic result is directly dependent on the purity and consistency of reagents, particularly those used in chromatography and immunoassay kits. The R&D phase is characterized by continuous efforts to reduce assay interference, improve sample throughput, and miniaturize components to enhance portability, requiring significant capital investment and specialized scientific expertise. Efficient upstream management is vital for controlling the cost of goods sold, which is inherently high due to the complex nature of the patented technologies and chemical formulations required for calibration and testing.

The middle segment involves the core manufacturing, assembly, branding, and regulatory approval processes (such as FDA clearance and CE marking), which adds significant value and ensures market legitimacy. Distribution channels manage the flow of finished analyzers and, critically, recurring consumable supplies (reagents, cartridges, calibration kits) from manufacturers to end-users. The market utilizes both direct and indirect distribution models. Direct channels are typically employed for high-value benchtop systems sold to large hospital networks, allowing for personalized sales support, installation, and customized training. Indirect channels, involving authorized distributors, wholesalers, and specialized medical device retailers, are more common for POCT devices and consumable supplies, ensuring wide geographic reach and efficiency in supply chain logistics, particularly in fragmented markets.

The downstream activities center on the installation, training, maintenance, and post-sale technical support provided to hospitals and laboratories, which is crucial for maximizing device uptime and ensuring user proficiency. Consumables represent the annuity revenue stream for manufacturers, requiring a robust and resilient logistics network to ensure timely delivery of perishable reagents. Potential customers, or end-users, include hospitals, independent diagnostic labs, and physician office laboratories (POLs). Value is created downstream by providing comprehensive service contracts and data connectivity solutions (software integration with LIS/EHR), transforming the raw analyzer into an integrated component of the overall healthcare IT infrastructure. This integration enhances clinical utility, demonstrating that value creation extends beyond the physical hardware to include sustained service and digital ecosystem support.

Hemoglobin A1C Analyzer Market Potential Customers

Potential customers for Hemoglobin A1C analyzers span the entire healthcare ecosystem, ranging from large centralized institutions requiring high-volume throughput to small, remote clinics demanding portability and ease of use. The largest segment of end-users consists of specialized diagnostic laboratories and large hospital laboratory networks, which utilize advanced, high-precision benchtop analyzers (primarily HPLC systems) to process massive volumes of samples and serve as reference points for standardization and quality control. These entities prioritize analytical accuracy, low cost per test (despite high initial investment), and seamless integration with complex Laboratory Information Systems (LIS). These buyers often engage in long-term contracts with major manufacturers to ensure consistent supply of reagents and reliable maintenance support, given the critical nature of diabetes testing results in patient management protocols. Their purchasing decisions are highly influenced by regulatory compliance and accreditation requirements.

A second major customer segment includes primary care settings, physician offices, community health centers, and increasingly, retail clinics and pharmacies adopting Point-of-Care Testing (POCT) devices. These end-users prioritize portability, fast turnaround time (STAT results), minimal training requirements, and simple operational interfaces. POCT analyzers, often based on immunoassay or boronate affinity technology, are vital in improving patient adherence by offering immediate feedback and facilitating clinical decisions during a single patient visit. The growth in this segment is driven by the global move toward decentralized diagnostics and preventative healthcare initiatives aiming to bring essential testing closer to the patient population, particularly in underserved geographical areas where access to large reference laboratories is limited or delayed. These smaller entities often have lower capital budgets but contribute significantly to the total volume of consumables consumed over time.

Furthermore, academic research institutions and pharmaceutical companies conducting clinical trials represent a niche yet crucial customer base. They utilize highly specialized analyzers to track glycemic control precisely within research protocols for developing new diabetes treatments or understanding disease progression. Their primary criteria include precision, calibration standards, and the ability to handle small sample volumes reliably. Finally, the emerging category of home care and personalized health management platforms is also becoming a potential customer base, though currently focused primarily on simplified, disposable HbA1c tests. As technology advances, more robust, consumer-friendly analyzers could shift some routine monitoring tasks out of clinical settings and into the patient's home, creating a new avenue for direct-to-consumer sales models and widening the potential customer demographic significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.50 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Siemens Healthineers, F. Hoffmann-La Roche Ltd., Danaher Corporation (Beckman Coulter), Bio-Rad Laboratories, ARKRAY, Inc., EKF Diagnostics, Sebia, Trinity Biotech, Diazyme Laboratories, Menarini Diagnostics, Tosoh Bioscience, PTS Diagnostics, SD Biosensor, HemoCue AB (a Danaher company), ACON Laboratories, Inc., Transasia Bio-Medicals, Sinocare Inc., Bionime Corporation, Lifescan IP Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hemoglobin A1C Analyzer Market Key Technology Landscape

The technological landscape of the Hemoglobin A1C Analyzer Market is dynamic, characterized by continuous refinement of established methods and rapid commercialization of newer, user-centric technologies, each offering a distinct balance of speed, accuracy, and cost-effectiveness. High Performance Liquid Chromatography (HPLC) remains the foundational, reference methodology, valued for its ability to separate and accurately quantify various hemoglobin fractions, thereby minimizing interference from common hemoglobinopathies—a critical advantage in diverse populations. While HPLC systems are typically large, complex, and confined to centralized laboratories, manufacturers are focusing on automating sample preparation and reducing chromatographic run times to enhance throughput without compromising the gold-standard precision. Parallel developments in boronate affinity chromatography offer excellent correlation with HPLC results while providing the stability needed for integration into highly portable, rapid POCT platforms, making this technology a dominant force in decentralized testing due to its relative immunity to hemoglobin variants compared to some immunoassays.

Immunoassay techniques, including turbidimetric inhibition immunoassays (TINA), are widely adopted due to their low complexity, high throughput potential, and compatibility with standard clinical chemistry analyzers already present in hospital settings. Although historically susceptible to interference from specific hemoglobin variants, continuous advancements in reagent formulation and proprietary antibody design are mitigating these limitations, broadening their applicability. Enzymatic assays represent another rapidly growing segment, offering a fast, direct measurement of A1C based on the reaction of enzymes with glycated peptides. The primary technological push across all platforms involves the integration of microfluidics, miniaturizing the analytical process, reducing necessary reagent volumes, and improving the overall efficiency of sample processing, which directly translates into lower operational costs and faster results across both benchtop and portable systems.

Furthermore, the market is leveraging digital technology to enhance utility. Modern analyzers are increasingly equipped with robust connectivity features, including Wi-Fi, Bluetooth, and cloud computing integration, facilitating seamless data transfer to Electronic Health Records (EHRs) and Laboratory Information Systems (LIS). This focus on interoperability is a critical technological trend, ensuring regulatory compliance and improving data traceability for quality assurance. The development trajectory is clearly aimed at achieving superior analytical performance in a physically smaller footprint, enabling high-quality HbA1c testing to be performed rapidly outside the traditional laboratory environment, effectively democratizing access to this crucial diagnostic biomarker globally. Future research is concentrating on non-invasive or minimally invasive sampling techniques and multi-analyte platforms that can simultaneously measure HbA1c alongside other relevant metabolic biomarkers, providing a more holistic patient profile.

Regional Highlights

North America currently holds the largest market share in the Hemoglobin A1C Analyzer Market. This dominance is attributed to several structural factors: an exceptionally high prevalence of both diagnosed and undiagnosed diabetes, robust healthcare infrastructure ensuring wide accessibility to advanced testing, and favorable reimbursement policies for diabetes monitoring and management. The region, particularly the United States, is characterized by the early and widespread adoption of innovative diagnostic technologies, including high-throughput HPLC systems in reference laboratories and sophisticated POCT devices in clinics. Furthermore, the presence of numerous key market players, high levels of patient awareness, and proactive governmental health initiatives focused on chronic disease screening contribute significantly to market maturity and sustained revenue generation. Demand here is increasingly driven by the need for interconnected, data-driven diagnostic systems that integrate results directly into complex EHR ecosystems.

Asia Pacific (APAC) is anticipated to emerge as the fastest-growing regional market throughout the forecast period. This accelerated growth is primarily fueled by the region's massive and rapidly expanding diabetic population, especially in demographic giants like China and India, where urbanization and lifestyle changes are driving up incidence rates dramatically. While penetration rates were historically low, significant governmental investment in healthcare infrastructure development, coupled with increasing disposable income and growing health insurance coverage, is expanding access to modern diagnostic tools. Localized manufacturing and favorable regulatory environments supporting the import of advanced medical devices are further stimulating market adoption. The focus in APAC is often on implementing cost-effective, durable analyzers suitable for large-scale public health screening programs and decentralized testing in rural areas.

Europe represents a mature market with steady, substantial growth, characterized by strong regulatory oversight and a preference for standardized testing methodologies. Countries within Western Europe maintain high levels of technological adoption, mirroring North American trends but often emphasizing stringent quality assurance standards and cost-efficiency within public health systems. Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting moderate but accelerating growth. Market expansion in these areas is spurred by improving economic conditions, increased awareness regarding diabetes complications, and international health aid promoting the use of essential diagnostic tools. However, these regions face challenges related to fragmented distribution networks, fluctuating currency exchange rates impacting imported device costs, and the need for greater investment in specialized technical training for analyzer operation and maintenance, requiring market players to adapt their business models accordingly.

- North America: Dominant market share; driven by high diabetes prevalence, established reimbursement policies, and early adoption of technologically advanced POCT and benchtop systems.

- Asia Pacific (APAC): Fastest growing region; propelled by massive diabetic populations in China and India, increasing healthcare spending, and expanding diagnostic infrastructure development.

- Europe: Stable, mature growth; strong emphasis on regulatory compliance, standardization, and integration of cost-effective diagnostic solutions within established public healthcare frameworks.

- Latin America: Growing market potential; expanding access to healthcare, but constrained by pricing sensitivity and distribution challenges in diverse geographic territories.

- Middle East & Africa (MEA): Emerging growth; increasing chronic disease incidence driven by lifestyle changes, coupled with government investment in specialized diagnostic facilities and clinical pathology laboratories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hemoglobin A1C Analyzer Market.- Abbott Laboratories

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation (Beckman Coulter)

- Bio-Rad Laboratories

- ARKRAY, Inc.

- EKF Diagnostics

- Sebia

- Trinity Biotech

- Diazyme Laboratories

- Menarini Diagnostics

- Tosoh Bioscience

- PTS Diagnostics

- SD Biosensor

- HemoCue AB (a Danaher company)

- ACON Laboratories, Inc.

- Transasia Bio-Medicals

- Sinocare Inc.

- Bionime Corporation

- Lifescan IP Holdings

Frequently Asked Questions

Analyze common user questions about the Hemoglobin A1C Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hemoglobin A1C Analyzer Market?

The primary factor driving market growth is the soaring global prevalence of diabetes mellitus, necessitating continuous and reliable diagnostic tools for monitoring long-term glycemic control. Coupled with this is the accelerating demand for fast, convenient Point-of-Care Testing (POCT) solutions that enhance patient compliance and clinical decision efficiency, especially in non-hospital settings. Technological improvements in accuracy and reduction of assay interference further sustain this upward trajectory across both emerging and established economies.

Which technology is considered the gold standard for HbA1c testing, and why?

High Performance Liquid Chromatography (HPLC) is universally regarded as the gold standard or reference method for HbA1c testing due to its superior analytical specificity and precision. HPLC accurately separates and measures glycated hemoglobin from non-glycated fractions, mitigating interference from common hemoglobin variants (hemoglobinopathies), ensuring high reliability for complex clinical samples and reference laboratory accreditation standards globally.

How are Point-of-Care Testing (POCT) analyzers impacting market dynamics?

POCT analyzers, typically utilizing boronate affinity or immunoassay technologies, are significantly transforming the market by shifting testing from centralized laboratories to decentralized locations like physician offices and retail clinics. Their impact includes faster turnaround times, improved accessibility, reduced reliance on phlebotomy, and the ability to provide immediate clinical feedback, which is crucial for timely adjustment of diabetes treatment protocols and enhancing patient engagement.

What are the main restraints affecting the adoption of Hemoglobin A1C analyzers?

The main restraints include the high initial capital investment required for advanced benchtop analyzer systems (such as HPLC), making them prohibitive for smaller healthcare providers. Additionally, the recurring high cost of proprietary reagents and consumables, alongside technical challenges related to assay interference caused by certain hemoglobin variants in specific population groups, presents a technical barrier to universal, cost-effective adoption, particularly in resource-constrained markets.

Which region offers the most significant growth opportunity for HbA1c analyzer manufacturers?

The Asia Pacific (APAC) region presents the most significant growth opportunity, largely due to its enormous and growing diabetic population, coupled with rapidly expanding healthcare infrastructure and increased public and private investment in diagnostic capabilities across key economies like China, India, and Southeast Asia. Manufacturers are capitalizing on the rising demand for both affordable, high-volume centralized systems and portable POCT solutions to address the vast geographic and demographic needs of the region effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager