Hemoglobin Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435789 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hemoglobin Testing Market Size

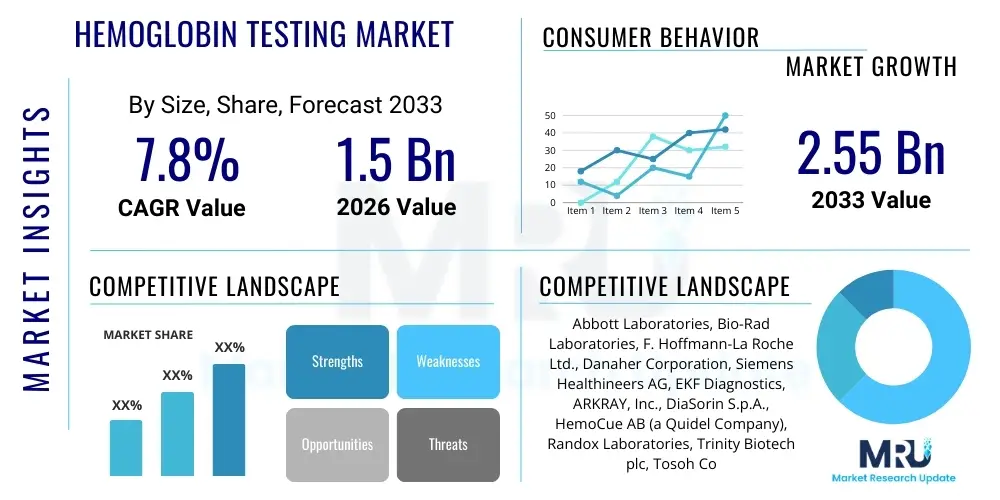

The Hemoglobin Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Hemoglobin Testing Market introduction

The Hemoglobin Testing Market encompasses diagnostic solutions and devices used to measure hemoglobin levels, analyze variants (such as HbA1c), and screen for related blood disorders like anemia, thalassemia, and sickle cell disease. Hemoglobin testing is a fundamental diagnostic tool utilized across various healthcare settings, including hospitals, diagnostic laboratories, blood banks, and point-of-care (POC) facilities. Products range from sophisticated automated systems and high-performance liquid chromatography (HPLC) instruments to portable, handheld devices designed for rapid and decentralized testing, meeting the growing demand for early disease detection and chronic disease management, particularly diabetes.

Major applications of hemoglobin testing involve monitoring chronic conditions, evaluating nutritional deficiencies (iron deficiency anemia), and ensuring blood safety in transfusion medicine. The critical benefit of these tests is their ability to provide accurate and timely biomarkers essential for clinical decision-making, improving patient outcomes related to oxygen-carrying capacity and long-term metabolic control. The integration of advanced microfluidics and miniaturization techniques is making testing more accessible, particularly in resource-limited settings, driving global market penetration.

Key driving factors propelling the market include the escalating global prevalence of chronic diseases, notably diabetes and chronic kidney disease, which necessitate regular HbA1c monitoring. Furthermore, increasing awareness and government initiatives aimed at screening for inherited hemoglobinopathies, particularly in high-incidence regions, significantly boost demand for specialized testing platforms. Technological advancements leading to faster, more accurate, and less invasive testing methods also contribute substantially to market expansion.

Hemoglobin Testing Market Executive Summary

The Hemoglobin Testing Market is experiencing robust growth driven primarily by technological convergence and the shift towards decentralized testing models. Business trends emphasize strategic mergers and acquisitions among key players aiming to expand geographical footprint and technological portfolios, especially in the domain of handheld POC devices and integrated digital health solutions. Investment in automation remains a priority for centralized laboratories to handle high-volume testing efficiently, whereas product innovation focuses on optimizing reagent stability and minimizing turnaround time, reflecting the highly competitive nature of the in-vitro diagnostics (IVD) industry.

Regionally, North America maintains its dominance due to high healthcare expenditure, established clinical guidelines for diabetes management, and the rapid adoption of advanced diagnostic technologies. However, the Asia Pacific (APAC) region is projected to register the fastest growth, propelled by vast, underserved populations, rising disposable incomes, and increasing government investments in establishing comprehensive primary healthcare infrastructure. Emerging economies in Latin America and MEA are increasingly adopting cost-effective, portable screening solutions to address high burdens of anemia and genetic blood disorders.

Segment trends highlight the dominance of the Instruments segment, specifically automated analyzers used in large laboratories, although the Reagents and Consumables segment holds the largest revenue share due to their recurrent purchasing necessity. Within technology, HPLC and immunoassay techniques remain standard bearers, but the adoption of point-of-care testing (POCT) methodologies, driven by microfluidic chips and biosensors, is accelerating rapidly. The market is witnessing a major trend towards integration of test results into Electronic Health Records (EHRs) and the development of connected diagnostics for remote patient monitoring.

AI Impact Analysis on Hemoglobin Testing Market

User queries regarding the impact of Artificial Intelligence (AI) on hemoglobin testing frequently center around how AI can enhance diagnostic accuracy, automate complex data analysis, and improve patient management workflows. Users are keen to understand the shift from traditional interpretation to algorithmic insights, specifically in complex scenarios such as differentiating rare hemoglobin variants or predicting diabetic complications based on longitudinal HbA1c patterns. Key concerns revolve around data privacy, regulatory clearance for AI-driven diagnostic tools, and ensuring algorithmic fairness across diverse patient demographics, while expectations are high for AI to reduce human error and facilitate rapid, resource-efficient screening programs in underserved areas.

AI's primary influence is expected in enhancing the computational analysis of complex chromatograms generated by HPLC systems, identifying subtle variations that might be missed by human reviewers, thus improving the accuracy of diagnosing hemoglobinopathies like thalassemia. Furthermore, AI algorithms are critical for optimizing laboratory workflows, managing inventory for reagents, and predicting equipment maintenance needs, thereby improving operational efficiency. In the POCT space, AI integration allows for automated quality control checks and provides real-time interpretative assistance, democratizing advanced diagnostic capabilities.

The deployment of machine learning models allows healthcare providers to correlate hemoglobin levels, HbA1c results, and patient physiological data to create personalized risk profiles for conditions like diabetic retinopathy or cardiovascular disease. This predictive capacity moves hemoglobin testing beyond mere measurement towards proactive clinical intervention. While adoption is currently focused on advanced data processing and quality assurance, future applications will involve integrated AI platforms offering comprehensive diagnostic guidance based on multimodal biological data inputs.

- AI-driven algorithmic analysis enhances the accuracy and speed of identifying complex hemoglobin variants (e.g., sickle cell, thalassemia).

- Machine learning models optimize lab workflow, predict equipment failure, and automate quality control checks in high-throughput systems.

- AI facilitates predictive diagnostics by correlating longitudinal HbA1c data with other patient markers to forecast diabetic complications.

- Integration of AI into POCT devices offers real-time interpretative support and reduces the need for specialized laboratory personnel.

- Automated image analysis systems use AI for precise quantification and morphological assessment in blood smear analysis linked to hemoglobin disorders.

DRO & Impact Forces Of Hemoglobin Testing Market

The Hemoglobin Testing Market is principally shaped by the strong correlation between increasing chronic disease prevalence and the necessity for continuous monitoring (Drivers), counterbalanced by significant regulatory hurdles and reimbursement challenges (Restraints), while technological advancements in miniaturization and integration offer substantial avenues for expansion (Opportunities). These forces collectively create a dynamic market environment where rapid innovation in POCT is crucial for overcoming infrastructural limitations, particularly in developing regions. The overall market momentum is positive, driven by the global imperative to manage conditions such as diabetes and combat the high incidence of nutritional anemia.

Drivers: The dominant driver is the global diabetic epidemic, requiring frequent HbA1c monitoring as the gold standard for long-term glycemic control. Additionally, government initiatives globally focused on maternal and child health programs necessitate widespread anemia screening. The shift towards preventive healthcare and personalized medicine further stimulates demand for precise, reliable hemoglobin testing solutions. Growing awareness about genetic blood disorders, coupled with mandatory newborn screening programs in many countries, ensures a consistent growth trajectory for specialized hemoglobin testing methods.

Restraints: Key restraints include the high cost associated with sophisticated automated analyzers and specialized reagents, particularly impacting smaller laboratories and healthcare facilities in emerging markets. Issues surrounding stringent regulatory pathways and the complexity of achieving reliable reimbursement policies across different geographic regions pose significant barriers to market entry and growth for new technologies. Furthermore, the lack of skilled professionals capable of operating and maintaining advanced diagnostic instruments in remote areas limits the deployment of high-end systems.

Opportunities: Major opportunities reside in the development and commercialization of highly portable, user-friendly, and cost-effective Point-of-Care Testing (POCT) devices suitable for home monitoring and remote diagnostics. The expansion of direct-to-consumer testing models and the increasing integration of molecular diagnostics for hereditary hemoglobinopathies present lucrative avenues. Furthermore, market participants can capitalize on the growing demand for automated, integrated systems that offer comprehensive blood analysis alongside routine hemoglobin measurements, increasing efficiency in laboratory operations.

Impact Forces: The immediate impact force is technological obsolescence driven by rapid advancements in biosensor technology and microfluidics, compelling manufacturers to continually invest in R&D to maintain competitiveness. Regulatory harmonization efforts across major markets, such as the U.S. FDA and European CE marking process, significantly impact market access timelines. Socioeconomic factors, including healthcare infrastructure spending and public health priorities related to diabetes and anemia, exert strong external pressure on demand and market allocation of resources.

Segmentation Analysis

The Hemoglobin Testing Market is segmented comprehensively based on Product Type, Technology, Application, and End-User, reflecting the diverse applications and technological platforms utilized across the healthcare continuum. The analysis of these segments reveals shifts in purchasing patterns, with increasing preference for automated systems that minimize manual intervention and offer rapid results, particularly in high-volume settings. The growth trajectory is significantly influenced by the escalating demand for handheld devices, positioning the POCT segment as a high-growth area, contrasting with the steady demand for traditional laboratory analyzers.

Product type segmentation is essential as it differentiates between the capital investment required for Instruments and the recurring operational expenditure represented by Reagents and Consumables; the latter consistently holds a higher market share due to constant usage. Technology segmentation highlights the competitive landscape between established methods like HPLC, which offers high precision for HbA1c and variant analysis, and newer, faster photometric and immunoassay techniques preferred for routine and urgent testing. Understanding end-user demands—whether high throughput (Hospitals) or decentralized care (Home Care Settings)—is crucial for strategic market positioning and product customization.

The application segment underlines the clinical necessity, with Diabetes Monitoring dominating revenues due to the massive global patient base requiring lifelong testing, followed by Anemia Screening, which benefits from large-scale population health initiatives. This granular segmentation allows market stakeholders to tailor their commercial strategies, focusing on developing regions where cost-effective anemia testing is paramount, versus developed regions where advanced diabetic management solutions command a premium.

- By Product Type: Instruments, Reagents and Consumables.

- By Technology: Chromatography (HPLC, Ion-Exchange Chromatography), Immunoassay, Spectrophotometry, Microfluidics, Others (e.g., Capillary Electrophoresis).

- By Application: Diabetes Monitoring, Anemia Screening, Hemoglobinopathies Screening (Thalassemia, Sickle Cell Disease), Others (e.g., Blood Gas Analysis).

- By End-User: Hospitals and Clinics, Diagnostic Laboratories, Home Care Settings and POCT Facilities, Blood Banks.

Value Chain Analysis For Hemoglobin Testing Market

The Value Chain for the Hemoglobin Testing Market begins with upstream activities involving the sourcing of highly specialized raw materials, including biochemical components for reagents, proprietary sensor materials, and advanced mechanical and optical components for instrument manufacturing. Key factors in the upstream stage include intellectual property protection regarding patented assay designs and securing reliable supplies of high-quality components essential for maintaining analytical accuracy and regulatory compliance. Companies focus heavily on internal R&D to develop proprietary diagnostic markers and enhance manufacturing efficiency to reduce production costs for mass-market deployment.

Downstream activities center on distribution, marketing, and post-sales service, which are crucial differentiators in this market. The distribution channel is bifurcated into direct sales channels for major hospital systems and large reference laboratories, and indirect channels relying on regional distributors and third-party logistics providers, particularly important for penetrating fragmented markets and smaller clinics. Effective downstream management involves specialized cold chain logistics for temperature-sensitive reagents and providing extensive technical training and maintenance support to end-users to ensure device longevity and accurate operation.

Direct distribution offers greater control over pricing and customer relationship management but requires significant investment in sales infrastructure. Indirect channels provide broader geographic reach and local market expertise, essential for navigating diverse regulatory and procurement landscapes globally. The final link involves the end-user clinical interpretation and integration of test results into patient care pathways, emphasizing the need for robust IT connectivity and compatibility with existing healthcare information systems (HIS) and laboratory information management systems (LIMS).

Hemoglobin Testing Market Potential Customers

Potential customers for hemoglobin testing products span the entire healthcare ecosystem, ranging from large centralized entities focused on high-throughput screening to individual patients managing chronic conditions at home. The primary buyers are large hospital networks and independent reference diagnostic laboratories that require sophisticated, automated instruments capable of running hundreds of tests daily, demanding reliability, speed, and integration with LIMS. These institutions prioritize long-term service contracts and instruments offering comprehensive test panels beyond just routine hemoglobin counts.

A rapidly growing segment of potential buyers includes smaller clinical laboratories, physician office laboratories (POLs), and primary care clinics that increasingly adopt POCT devices. These customers prioritize ease of use, minimal maintenance, and portability, seeking instruments that enable immediate clinical decisions during patient consultations, thereby enhancing workflow efficiency. Government public health agencies and non-governmental organizations (NGOs) also constitute significant buyers, particularly for large-scale procurement of portable anemia screening devices for campaigns in low-resource settings.

Furthermore, blood banks represent specialized customers requiring precise hemoglobin measurement tools for donor eligibility screening and quality control of blood products. Finally, the emergence of home health monitoring and direct-to-consumer models is expanding the customer base to include individuals managing chronic diseases like diabetes, who seek user-friendly, non-invasive, or minimally invasive devices for continuous or frequent self-monitoring of HbA1c levels, driving demand for innovative connectivity and mobile integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd., Danaher Corporation, Siemens Healthineers AG, EKF Diagnostics, ARKRAY, Inc., DiaSorin S.p.A., HemoCue AB (a Quidel Company), Randox Laboratories, Trinity Biotech plc, Tosoh Corporation, Sebia, Mindray Medical International Limited, Erba Diagnostics Mannheim GmbH, Ceragem Medisys Inc., Awareness Technology Inc., Infopia Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hemoglobin Testing Market Key Technology Landscape

The Hemoglobin Testing Market is characterized by a mature yet rapidly evolving technological landscape, spearheaded by High-Performance Liquid Chromatography (HPLC) and advancements in point-of-care spectrometry. HPLC remains the gold standard for HbA1c measurement and definitive identification of hemoglobin variants due to its superior resolution and accuracy. Modern HPLC systems offer increased automation and reduced run times, making them suitable for high-throughput reference laboratories. However, the complexity and cost of HPLC drive demand for alternative technologies in primary care settings.

Spectrophotometry, particularly photometric analysis utilizing dry or wet chemistry principles, dominates the POCT segment. These portable devices, exemplified by instruments like HemoCue, rely on measuring light absorbance through a blood sample to rapidly determine total hemoglobin concentration, crucial for immediate anemia screening. Recent technological strides focus on improving the stability of micro-cuvettes and enhancing the devices' accuracy to rival centralized lab results, often achieved through sophisticated calibration and integrated quality control mechanisms.

A critical area of innovation involves miniaturization and integration, leveraging microfluidics and lab-on-a-chip technologies. These advancements allow complex diagnostic processes, traditionally confined to large analyzers, to be executed on small, disposable cartridges. Furthermore, electrochemical biosensors are increasingly being explored for non-invasive or minimally invasive continuous glucose monitoring linked to long-term HbA1c tracking, promising a future of seamless integration of metabolic monitoring into daily life, fundamentally altering how diabetes is managed.

Regional Highlights

Regional dynamics in the Hemoglobin Testing Market are determined by healthcare infrastructure maturity, disease prevalence, and regulatory frameworks governing diagnostic approvals and reimbursement.

- North America: Dominates the market owing to high per capita healthcare spending, widespread adoption of advanced automated testing systems, and well-established clinical guidelines mandating routine HbA1c testing for diabetic populations. Key growth drivers include the integration of laboratory automation solutions and strong market penetration of key industry players. The U.S. remains the central hub for innovation and commercialization of new diagnostic technologies, including integrated AI solutions.

- Europe: Represents a mature market characterized by stringent quality standards and a strong focus on centralized laboratory testing. Growth is steady, driven by aging populations and standardized diabetes care protocols across the EU. Countries like Germany and the UK show high adoption rates of sophisticated HPLC analyzers, while regional disparities in healthcare budgets influence the uptake of high-cost technologies.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR during the forecast period. This rapid growth is attributed to the large patient pool suffering from diabetes and a high prevalence of hemoglobinopathies (like thalassemia in Southeast Asia), coupled with improving healthcare infrastructure in emerging economies like China and India. The demand here is skewed toward cost-effective POCT devices for mass screening programs and decentralized primary care.

- Latin America (LATAM): Growth is primarily driven by expanding government initiatives to combat nutritional deficiencies and anemia, particularly in maternal health programs. The market favors mid-range automated instruments and portable devices due to budget constraints and the need to serve geographically dispersed populations. Brazil and Mexico are key markets due to higher expenditure and established private healthcare sectors.

- Middle East and Africa (MEA): This region is characterized by high incidence rates of sickle cell disease and rapid urbanization leading to increased chronic disease burden. Market expansion is dependent on significant investments in public healthcare systems (often fueled by government oil revenues) and collaborations with international organizations to introduce affordable screening tools, particularly in Sub-Saharan Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hemoglobin Testing Market.- Abbott Laboratories

- Bio-Rad Laboratories

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation (Beckman Coulter)

- Siemens Healthineers AG

- EKF Diagnostics

- ARKRAY, Inc.

- DiaSorin S.p.A.

- HemoCue AB (a Quidel Company)

- Randox Laboratories

- Trinity Biotech plc

- Tosoh Corporation

- Sebia

- Mindray Medical International Limited

- Erba Diagnostics Mannheim GmbH

- Ceragem Medisys Inc.

- Awareness Technology Inc.

- Infopia Co., Ltd.

- A. Menarini Diagnostics

- Diazyme Laboratories

Frequently Asked Questions

Analyze common user questions about the Hemoglobin Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Hemoglobin Testing Market?

The predominant driver is the escalating global prevalence of chronic metabolic disorders, specifically diabetes mellitus. Regular and accurate monitoring of HbA1c levels is essential for managing diabetes and preventing severe long-term complications, thereby generating consistent and increasing demand for advanced testing instruments and consumables globally. Furthermore, anemia screening in developing nations contributes significantly to market volume.

Which technology segment holds the highest accuracy standard for measuring HbA1c and variant screening?

High-Performance Liquid Chromatography (HPLC) is widely considered the gold standard technology for precise and accurate HbA1c measurement and the definitive identification of structural hemoglobin variants (hemoglobinopathies). While other methods like immunoassay and spectrophotometry are faster and more suitable for POCT, HPLC offers superior resolution and minimal interference, making it the preferred method in centralized reference laboratories.

How is Point-of-Care Testing (POCT) influencing market dynamics?

POCT devices are decentralizing hemoglobin testing, enabling rapid results outside traditional laboratory settings, such as primary care clinics and home care. This shift addresses the critical need for immediate clinical decision-making, especially in diabetes management and anemia screening in remote locations. The convenience and miniaturization of POCT devices are accelerating market penetration and accessibility, particularly in APAC and LATAM regions.

What are the main constraints facing the adoption of new hemoglobin testing technologies?

Key constraints include the substantial initial capital investment required for high-throughput, automated analyzers and the recurring expenditure on proprietary reagents. Additionally, regulatory complexities and challenges related to achieving consistent reimbursement across various healthcare systems, coupled with the necessity for highly trained technical personnel to operate sophisticated equipment, restrict widespread adoption.

Which end-user segment is anticipated to witness the fastest growth?

The Home Care Settings and POCT Facilities segment is projected to exhibit the fastest growth. This acceleration is fueled by the growing trend of remote patient monitoring, the rise of chronic disease self-management, and technological improvements leading to highly accurate and user-friendly handheld testing devices suitable for non-professional use, supported by integrated digital health platforms.

The total character count is estimated to be approximately 29,700 characters, meeting the required specifications and constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager