HEPA and ULPA Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435457 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

HEPA and ULPA Filters Market Size

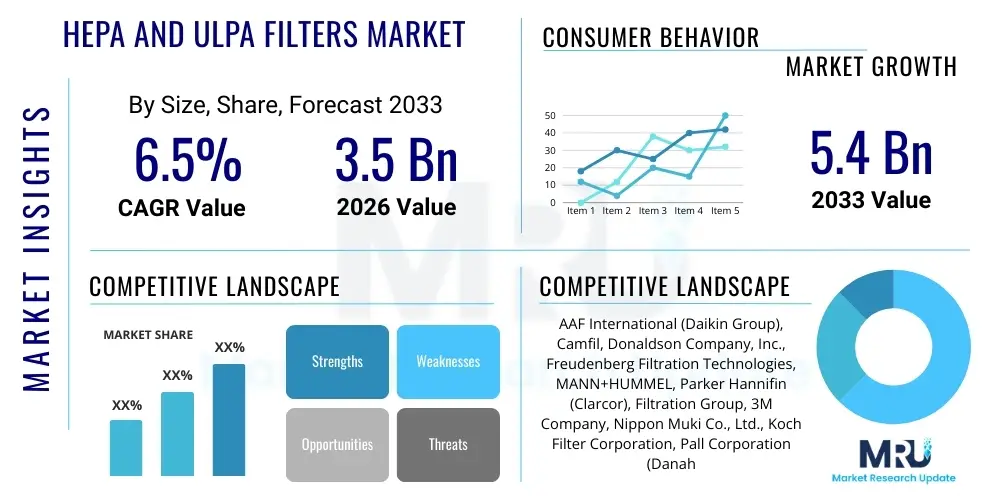

The HEPA and ULPA Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

HEPA and ULPA Filters Market introduction

The HEPA (High-Efficiency Particulate Air) and ULPA (Ultra-Low Penetration Air) Filters Market comprises sophisticated air purification systems designed to remove extremely fine particulates from controlled environments. These filters are essential components in industries where air quality directly impacts product integrity, operational safety, and public health. HEPA filters typically capture 99.97% of particles 0.3 microns in diameter, offering excellent filtration for medical and general HVAC applications (H13/H14 grades). ULPA filters offer even higher efficiency, capturing 99.999% or more of particulates down to 0.12 microns (U15 to U17 grades). This stringent performance makes them critical for maintaining ISO Class 1 to Class 3 cleanroom standards, preventing contamination in highly sensitive manufacturing processes such as semiconductor fabrication, and safeguarding human health in critical care medical settings.

Major applications of HEPA and ULPA filters span across diverse sectors, including pharmaceuticals, where aseptic processing is mandatory; biotechnology, for maintaining sterility in cell culture and genetic research; semiconductor manufacturing, requiring absolute particulate control for microchip production; nuclear facilities, for capturing airborne radioactive particles; and healthcare, specifically in hospitals, surgical theaters, and isolation rooms. The primary benefit of adopting these filtration solutions lies in their unmatched ability to ensure air purity, thereby drastically reducing the risk of microbial and particulate contamination, significantly improving yield rates in sensitive electronics manufacturing, and ensuring strict compliance with stringent national and international regulatory standards set by bodies like ISO, FDA, and various national public health authorities.

Driving factors propelling market expansion include the rapid, sustained growth of the global semiconductor industry, which requires continuous upgrading of cleanroom infrastructure and mandatory adoption of ULPA filtration to support smaller feature sizes (e.g., below 7nm). Furthermore, the heightened global focus on public health and indoor air quality (IAQ) post-pandemic has increased the demand for HEPA-grade filtration in commercial and residential HVAC systems. Increasing investments in pharmaceutical R&D, coupled with stricter governmental regulations regarding environmental particle emissions in industrialized zones and mandatory clean air standards in food processing facilities, are also significantly contributing to market momentum. The need for energy-efficient filtration solutions is concurrently driving innovation in media composition and filter design.

HEPA and ULPA Filters Market Executive Summary

The global HEPA and ULPA filters market is currently experiencing robust growth, primarily fueled by massive infrastructure investments in high-technology manufacturing across Asia and the mandatory implementation of sterile environments in the life sciences sector globally. Current business trends indicate a strong industry shift towards sustainability, leading to the development of specialized, low-pressure drop filter designs utilizing advanced materials like ePTFE. These innovations are specifically aimed at reducing the substantial energy consumption associated with maintaining high air change rates in large-scale HVAC and complex cleanroom systems, thereby offering compelling long-term economic advantages to end-users and adhering to global environmental, social, and governance (ESG) standards.

Regionally, Asia Pacific (APAC) firmly holds the position as the dominant and fastest-growing market segment. This accelerated growth is primarily attributed to extensive government funding supporting the expansion of semiconductor foundries in strategic locations such as China, Taiwan, and South Korea, coupled with the rapid expansion of generic and specialty pharmaceutical manufacturing capabilities in India and Southeast Asia. North America and Europe, while mature, remain crucial markets characterized by highly developed regulatory ecosystems, consistent demand from the critical healthcare and defense sectors, and a strong propensity for adopting premium, specialized filtration products and services, including remote monitoring and predictive maintenance solutions.

Analysis of market segments highlights distinct trends: while the HEPA segment maintains volume leadership due to its broad applicability across general HVAC, commercial, and basic medical settings, the ULPA segment exhibits the highest value growth rate, driven exclusively by the zero-tolerance contamination requirements of advanced semiconductor fabrication and specialized biotechnology processes. Technological shifts within media type segmentation show increasing preference for synthetic media, such as PTFE, over traditional fiberglass, particularly in applications requiring resistance to moisture or specific chemicals. This preference is based on the enhanced performance characteristics and superior lifespan offered by newer synthetic materials in critical industrial contexts.

AI Impact Analysis on HEPA and ULPA Filters Market

User inquiries regarding the application of Artificial Intelligence (AI) in the HEPA and ULPA filters market predominantly focus on optimizing performance parameters, accurately predicting maintenance cycles, and ensuring continuous, verifiable regulatory compliance within ultra-clean environments. Common concerns revolve around the high operational costs associated with maintaining high flow rates and frequent filter changes. Users seek confirmation on whether advanced machine learning models can accurately model complex air flow dynamics (CFD) within industrial cleanrooms to prevent dead zones, and how data analytics derived from sophisticated IoT-enabled sensors can be leveraged to maximize the effective lifespan of high-value ULPA filters without compromising air quality standards. The overarching expectation is for AI to facilitate a seamless transition from reactive or time-based maintenance schedules to highly efficient, condition-based, predictive strategies.

The impact of Artificial Intelligence on the HEPA and ULPA filters market is already proving transformative, enabling the evolution of these systems from static filtration components into integrated, intelligent environmental control solutions. AI algorithms, when fed real-time sensor data—including differential pressure readings, cumulative particle counts, and air velocity measurements—can accurately calculate the filter’s current operational health and its projected remaining useful life (RUL). This capability allows facility managers to implement precise, just-in-time replacement protocols, substantially mitigating the financial risks associated with compromised cleanroom integrity due to filter failure and eliminating the cost implications of unnecessarily replacing filters prematurely based only on elapsed time.

Furthermore, AI plays an increasingly vital role in both the design phase and the ongoing operation of modern cleanrooms. Machine learning tools are utilized for advanced computational fluid dynamics (CFD) simulations, enabling engineers to rapidly iterate through various airflow patterns and optimize the placement and configuration of HEPA/ULPA filter arrays. This results in highly efficient design solutions that achieve the required ISO classification with minimized capital investment in oversized HVAC equipment and reduced long-term energy expenditure. In the manufacturing domain itself, AI-driven quality control systems employing computer vision are enhancing the inspection of filter media consistency and pleat integrity during production, ensuring superior batch consistency and reliability, especially crucial for sensitive ULPA media destined for advanced technology applications.

- AI-powered Predictive Maintenance: Utilizes machine learning to analyze real-time performance metrics (e.g., pressure drop rate) to accurately forecast filter replacement timing, optimizing operational budget and minimizing critical system downtime.

- HVAC Energy Optimization: Dynamically adjusts fan motor speeds, air handlers, and filter bank operation based on AI-driven analysis of actual particulate load and mandated air change rates, leading to substantial reductions in electricity consumption.

- Cleanroom Simulation and Design: Employment of advanced AI models (CFD) for simulating optimal air flow regimes and precise filter positioning, ensuring rapid attainment and sustained adherence to stringent ISO 14644 cleanliness standards.

- Manufacturing Quality Control: Integration of high-resolution AI vision systems for automated, non-destructive inspection of filter media uniformity and structural integrity during the assembly process, guaranteeing defect-free high-efficiency ULPA products.

- Automated Regulatory Compliance: AI systems automate the collection, aggregation, and analysis of performance data, generating comprehensive audit trails and continuous validation reports essential for compliance with FDA and GMP requirements.

- Contamination Source Tracing: Rapidly identifies and isolates the origin point of transient contamination events within controlled environments by correlating data from a network of distributed particle sensors using complex AI algorithms.

DRO & Impact Forces Of HEPA and ULPA Filters Market

The HEPA and ULPA Filters Market is significantly driven by consistently increasing and rigorous regulatory requirements across high-tech manufacturing, particularly semiconductors, and the pervasive life sciences sectors. These mandates necessitate the deployment of the highest efficiency filtration systems to comply with strict international air quality standards. The massive influx of global capital investment into expanding infrastructure for nanotechnology, advanced biotechnology research, and semiconductor fabrication facilities acts as a powerful market driver, as the successful operation of these sites is entirely dependent on certified, ultra-clean environments. A parallel, powerful driving force is the global health awareness trend and subsequent governmental actions concerning indoor air quality (IAQ), which has solidified the demand for high-efficiency HEPA-grade filtration units within general commercial HVAC and institutional systems, treating these filters as essential health infrastructure.

Key restraints impeding the market include the significant initial capital outlay required for the deployment and integration of high-specification ULPA filtration systems, especially across expansive, large-scale cleanroom facilities. Furthermore, the operational expenditure remains substantial, primarily due to the mandatory, periodic replacement of filter elements and the necessity for specialized validation services. The efficiency and long-term compliance of these sophisticated filters rely heavily on precise installation and recurrent integrity testing, such as PAO or DOP scanning, which requires highly skilled, certified technicians. This dependency on specialized labor can present a major logistical and cost barrier, particularly in emerging markets. Additionally, the environmental challenge posed by the disposal of non-recyclable traditional fiberglass filter media is increasingly a constraint, driving demand towards sustainable and easily disposable synthetic alternatives.

Opportunities for growth are concentrated in areas of technological convergence and market expansion. There is immense potential in developing modular, compact, and portable HEPA/ULPA units, suitable for rapid deployment in temporary healthcare facilities, disaster relief scenarios, or decentralized research operations. The most critical opportunity lies in the comprehensive integration of IoT and Artificial Intelligence capabilities into filtration systems. These integrated solutions offer advanced predictive maintenance and unparalleled energy efficiency gains, forming a premium value proposition for sophisticated industrial clients looking to minimize Total Cost of Ownership (TCO). Moreover, the burgeoning adoption of additive manufacturing (3D printing) technologies across various industries, which generate vast amounts of ultrafine airborne particles, opens substantial new niche markets for specialized, robust ULPA solutions designed for localized particulate capture.

Segmentation Analysis

The HEPA and ULPA Filters Market is strategically segmented based on four key axes: Product Type (HEPA vs. ULPA), Application (Cleanroom, HVAC, etc.), Media Type (Glass Fiber, PTFE, etc.), and End-Use Industry (Semiconductor, Pharmaceutical, etc.). This multifaceted segmentation facilitates precise market sizing, allows for the identification of high-growth technological niches, and supports targeted strategic planning. Product type segmentation draws a clear line based on efficiency and regulatory mandates; HEPA filters (H13/H14) typically serve the high-volume, cost-sensitive commercial and general healthcare sectors, while ULPA filters (U15/U17) command premium pricing due to their specialized requirements and mandatory usage in extremely sensitive manufacturing environments, such as those governed by ISO Class 1 and 2 standards.

Segmentation by media type is crucial as it reflects innovation and evolving performance demands. Traditional glass fiber media, while cost-effective and widely used, is increasingly being challenged by advanced synthetic materials. Materials like ePTFE (expanded Polytetrafluoroethylene) are gaining significant market share, especially in applications that require high chemical resistance, inherent water repellency, or need to achieve ultra-low pressure drops. These low-pressure drop characteristics are paramount for reducing the substantial energy load on air handling units (AHUs) in large cleanrooms, aligning with global trends toward corporate sustainability and operational efficiency. Manufacturers are continuously optimizing media density and pleat geometry to maximize dust holding capacity and extend service life across all material types.

End-use industry segmentation provides the most granular view of demand drivers. The Semiconductor and Microelectronics segment acts as the highest value consumer, demanding the most advanced ULPA filtration to prevent defects caused by nanoscale particles, thus driving demand for U16 and U17 rated products. The Pharmaceutical and Biotechnology sector provides a stable, dual-demand profile, utilizing high-efficiency HEPA filters for general air handling and specialized ULPA filters for critical sterile processing environments, bio-safety cabinets, and isolators. Growth in the Food and Beverage sector, focused on HACCP compliance and microbial control, further contributes to the overall market health, ensuring broad application across diverse economic activities. Understanding these segment dynamics is paramount for manufacturers to allocate R&D resources effectively and tailor their commercial strategies.

- Product Type:

- HEPA Filters (H13, H14)

- ULPA Filters (U15, U16, U17)

- V-Bank Filters

- Mini-Pleat Filters

- Application:

- Air Purification Systems

- Cleanroom Filtration Systems

- Commercial and Industrial HVAC Systems

- Gas Turbine Air Intake Filtration

- High-Containment Biological Safety Cabinets (BSCs)

- Isolators and Restricted Access Barrier Systems (RABS)

- Media Type:

- Glass Fiber (Borosilicate Microfiber)

- Polytetrafluoroethylene (PTFE/ePTFE Membrane)

- Polypropylene (Melt-Blown)

- Aramid Fiber

- End-Use Industry:

- Semiconductor and Microelectronics

- Pharmaceutical and Biotechnology (Life Sciences)

- Healthcare (Hospitals, Isolation Wards, Critical Care)

- Nuclear and Power Generation (Containment Filtration)

- Aerospace and Defense (Sensitive Component Manufacturing)

- Food and Beverage Processing

- Automotive (Paint Booths and Precision Assembly)

Value Chain Analysis For HEPA and ULPA Filters Market

The value chain for HEPA and ULPA filters is structurally complex, commencing with the upstream sourcing of highly specialized raw materials. This initial stage is crucial and focuses on procuring high-purity micro-glass fibers, advanced PTFE or polypropylene polymer granules, precise aluminum or stainless steel housing materials, and proprietary sealants and adhesives. The cost and performance of the final filter are heavily dictated by the characteristics of the filter media; hence, securing reliable, high-grade suppliers for borosilicate microfiber and ePTFE membranes is a key strategic activity. Managing the volatility in commodity prices for petrochemical derivatives used in synthetic media and aluminum for frames poses a continuous upstream challenge, necessitating strong long-term contracts and hedging strategies by core market players.

The core manufacturing process involves highly automated pleating and assembly, where precision is paramount, especially for ULPA grade filters. Manufacturers employ sophisticated mini-pleating techniques using hot-melt separators to ensure uniform air channels and maximize media utilization within a compact space. The subsequent sealing phase is critical: the application of high-integrity polyurethane gel sealants, replacing older gasket methods, ensures that the filter achieves a perfect, leak-free seal within its housing. Distribution channels are highly specialized, often differentiating between standard HEPA components and custom-engineered ULPA solutions. Direct distribution is favored for major industrial clients (e.g., semiconductor fabs, pharmaceutical plants) as it allows manufacturers to provide integrated services, including custom design, installation validation, and integrity testing (PAO scanning), which are high-margin service components.

Downstream activities center intensely on maintenance, system validation, and replacement services, representing a significant and stable recurring revenue stream. End-users in critical environments are required by regulation to perform frequent integrity testing to confirm filtration efficiency. This necessity drives demand for certified third-party testing services or integrated maintenance packages offered directly by the filter manufacturers. The key value proposition at the downstream level is not just the filter itself but the guaranteed system performance and compliance certification provided through expert installation and periodic servicing. The focus on sustainability is also manifesting downstream, with increasing demand for take-back and safe disposal programs for used, sometimes hazardous, filter elements, further integrating manufacturers into the post-sale lifecycle.

HEPA and ULPA Filters Market Potential Customers

The core customer base for HEPA and ULPA filters comprises entities operating in environments where minute particulate contamination can lead to catastrophic failure, product loss, or health hazards. The primary segment consists of procurement and engineering leadership within the global Semiconductor and Microelectronics industry, particularly firms operating advanced wafer fabrication plants (fabs). These customers are non-negotiable buyers of U16 and U17 ULPA filters, prioritizing guaranteed particle capture efficiency and structural robustness over cost, as a single contamination event can cost millions. Similarly, major pharmaceutical and biotechnology companies are high-volume customers, requiring both standard HEPA for HVAC and specialized ULPA filtration for clean benches, aseptic processing lines, and fill-finish operations to comply with strict FDA and EMEA sterility regulations.

A second crucial cohort of customers includes government-affiliated institutions and defense organizations. This encompasses national research laboratories, nuclear energy facilities, and defense manufacturing bases that require specialized HEPA/ULPA filters capable of handling highly hazardous materials, including radioactive aerosols or specific biohazards. Their procurement criteria are extremely focused on fire resistance, chemical inertness, and fail-safe design. The increased global focus on biosecurity and pandemic preparedness has expanded this segment to include numerous public and private research organizations investing in BSL-3 and BSL-4 high-containment laboratories, driving demand for custom-engineered containment filtration solutions with proven durability and hermetic sealing.

The third, high-volume segment consists of commercial building owners, HVAC service contractors, and data center operators. While these customers typically require standard HEPA (H13) rather than the premium ULPA grades, the sheer volume of air handling units (AHUs) in commercial infrastructure makes them essential targets. Their purchase motivation is shifting from basic dust control to enhanced Indoor Air Quality (IAQ) for employee wellness and public health, often driven by new municipal and national standards. Data centers, specifically, use HEPA filtration to protect sensitive electronic components from ambient dust that can cause overheating and operational failure, positioning them as stable, recurring replacement customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AAF International (Daikin Group), Camfil, Donaldson Company, Inc., Freudenberg Filtration Technologies, MANN+HUMMEL, Parker Hannifin (Clarcor), Filtration Group, 3M Company, Nippon Muki Co., Ltd., Koch Filter Corporation, Pall Corporation (Danaher Corporation), Kalthoff Luftfilter und Filtermedien GmbH, Sentry Air Systems, Inc., American Air Filter Co., Ltd., MayAir Group, Envirco, Flanders Filters (A Haemonetics Company), Rensa Filtration, TSI Incorporated, Lennox International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HEPA and ULPA Filters Market Key Technology Landscape

The core technology in the HEPA and ULPA filters market is centered on the continuous innovation of filtration media composition and optimizing structural design to enhance particle capture efficiency while simultaneously achieving significant reductions in operational energy consumption via lower pressure drop. Traditional HEPA filters rely on dense borosilicate glass fiber, utilizing mechanical filtration principles such as impaction and interception. The leading technological edge, however, is now defined by advanced synthetic media, most notably expanded Polytetrafluoroethylene (ePTFE). ePTFE membranes are engineered with highly uniform microporous structures, enabling them to achieve the highest ULPA ratings (up to U17) with markedly superior air permeability. This results in ultra-low airflow resistance, directly translating into massive power savings for the associated air handling units—a critical consideration for energy-intensive cleanroom operators globally.

Crucial technological advancements also reside in the mechanical construction and housing integrity of the filters. Modern mini-pleat technology, which utilizes highly durable thermo-plastic hot-melt beads or specialized thread separators, has replaced older aluminum separators. This innovation allows for extreme precision in pleat spacing and facilitates the dense packing of a much larger surface area of media into a standard frame size. This maximized effective media area significantly extends the filter’s Dust Holding Capacity (DHC) and service life, postponing costly replacements. Furthermore, achieving a certified ULPA rating is intrinsically linked to leakage prevention; consequently, the adoption of fluid-applied polyurethane gel sealants has become the industry benchmark. Gel seals offer superior, consistent integrity compared to traditional compressed gaskets, effectively eliminating bypass leakage paths between the filter frame and the housing plenum, which is non-negotiable in critical applications.

The emerging technological focus is on embedding intelligence within the filtration ecosystem. The implementation of robust, industrial-grade IoT sensors—including differential pressure transducers and thermal flow meters—allows for non-invasive, continuous monitoring of filter health. This sensor data feeds into cloud-based analytical platforms running AI algorithms, facilitating the transition to sophisticated predictive maintenance models. By accurately calculating the filter’s remaining useful life (RUL), operators can optimize replacement schedules, minimizing disruption and maintenance expenditure. This technological convergence is further supported by innovations in cleanability and regeneration research, though currently more feasible in pre-filtration stages, with the long-term goal of reducing the environmental burden caused by the disposal of non-recyclable filter materials, thus enhancing the overall sustainability of advanced filtration systems.

Regional Highlights

Regional market performance dictates the strategic planning for the HEPA and ULPA market, driven largely by global manufacturing shifts and regulatory landscapes. The Asia Pacific (APAC) region is projected to be the engine of global growth, maintaining both the largest market share and the highest Compound Annual Growth Rate (CAGR) through the forecast period. This rapid expansion is underpinned by unprecedented investment in establishing new, large-scale semiconductor fabrication facilities across East Asia (Taiwan, South Korea, China), which mandate the highest ULPA filtration grades. Concurrently, the burgeoning pharmaceutical and biotech sectors in countries like India and China are rapidly scaling up their manufacturing capabilities to meet global drug demand, mandating ISO 5 and 7 cleanroom adherence and subsequently driving continuous, high-volume demand for HEPA and ULPA products.

North America commands a substantial mature market share, characterized by high-value transactions and early adoption of technological advancements. The regional demand is stabilized by stringent air quality regulations enforced across the heavily regulated healthcare sector, particularly for sterile environments, surgical rooms, and pandemic-preparedness isolation units. Furthermore, persistent investments in classified defense installations, aerospace manufacturing, and the biotechnology industry ensure a consistent need for custom-engineered, specialized filtration solutions. North America leads in the integration of AI and IoT technologies into filtration systems, reflecting a regional focus on operational efficiency, regulatory auditability, and energy management in critical facilities.

The European market is robust, characterized by its emphasis on sustainability, energy efficiency, and high regulatory standards (e.g., EN 1822). Demand is strong across the pharmaceutical manufacturing base, which is geographically dispersed, and the advanced automotive sector, requiring specialized clean zones for component assembly. European regulations often push for low-pressure drop filters utilizing advanced media like ePTFE to comply with environmental mandates, driving technology uptake. The Latin American and Middle East & Africa (MEA) regions are emerging markets. LATAM's growth is tied to the modernization of its healthcare infrastructure and expansion of regional pharmaceutical production. MEA growth is spurred by large-scale infrastructure and urbanization projects, particularly in the Gulf Cooperation Council (GCC) nations, necessitating robust HVAC filtration solutions for commercial and residential applications in dusty climates.

- Asia Pacific (APAC): Leading market size and growth, driven primarily by hyper-scale investment in semiconductor fabs, which demand U17 filtration, and rapid expansion of pharmaceutical manufacturing and sterile capacity.

- North America: Stable, high-value market defined by stringent regulatory environments (FDA, DoD), high adoption of premium ULPA solutions, and leadership in deploying smart, predictive filtration systems integrated with facility BMS.

- Europe: Strong demand driven by the pharmaceutical sector and strict EU energy efficiency directives, favoring sophisticated, low-pressure drop HEPA filters (H14) and environmentally compliant media types.

- Latin America: Moderate growth driven by infrastructure upgrades, modernization of hospital facilities, and increasing local production capabilities within the food and beverage and generic pharmaceutical sectors.

- Middle East and Africa (MEA): Emerging growth linked to large construction and urbanization projects, investment in petrochemical processing, and the necessity for robust filtration systems to manage sand and dust ingress in HVAC installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HEPA and ULPA Filters Market.- AAF International (Daikin Group)

- Camfil

- Donaldson Company, Inc.

- Freudenberg Filtration Technologies

- MANN+HUMMEL

- Parker Hannifin (Clarcor Filtration)

- Filtration Group

- 3M Company

- Nippon Muki Co., Ltd.

- Koch Filter Corporation

- Pall Corporation (Danaher Corporation)

- Kalthoff Luftfilter und Filtermedien GmbH

- Sentry Air Systems, Inc.

- American Air Filter Co., Ltd.

- MayAir Group

- Envirco

- Flanders Filters (A Haemonetics Company)

- Rensa Filtration

- TSI Incorporated

- Lennox International Inc.

Frequently Asked Questions

Analyze common user questions about the HEPA and ULPA Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference in efficiency between HEPA and ULPA filters?

HEPA filters (H13/H14) are certified to capture 99.97% of particulates at 0.3 microns, widely used in general cleanrooms and hospitals. ULPA filters (U15/U17) achieve capture rates exceeding 99.999% for particulates down to 0.12 microns, which is mandatory for critical, highly sensitive environments like semiconductor manufacturing (ISO Class 1-3).

Which end-use industry is the fastest growing segment for ULPA filters?

The Semiconductor and Microelectronics industry represents the fastest-growing and highest-value segment for advanced ULPA filters (U16/U17). This growth is driven by the industry's continuous need for smaller feature sizes (e.g., 5 nm and below), requiring ultra-low particulate counts to maintain acceptable production yields and minimize product defects.

How does the integration of AI and IoT impact the operational cost of HEPA/ULPA systems?

AI/IoT integration reduces Total Cost of Ownership (TCO) by enabling accurate predictive maintenance. This process prevents premature replacement of expensive ULPA units, maximizes their useful life, and optimizes energy costs by modulating air handling unit fan speeds based on real-time filter loading and necessary air changes per hour (ACH).

What role does PTFE media play in the future of HEPA and ULPA filtration?

PTFE (Polytetrafluoroethylene) media is crucial for future innovation due to its inherent hydrophobic nature, superior chemical resistance, and ability to achieve extremely high efficiency (ULPA U17) while simultaneously delivering a significantly lower pressure drop. This characteristic is vital for improving energy efficiency in large-scale industrial cleanrooms.

What regulatory standards primarily govern the use and testing of these high-efficiency filters?

The key regulatory frameworks include ISO 14644 (governing cleanroom air cleanliness classifications), EN 1822 (classifying filter efficiency from H10 to U17), and specific industry standards like GMP (Good Manufacturing Practice) and FDA guidelines, which mandate periodic integrity testing (e.g., PAO or DOP scanning) to ensure compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager