HEPA Filter Membranes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433332 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

HEPA Filter Membranes Market Size

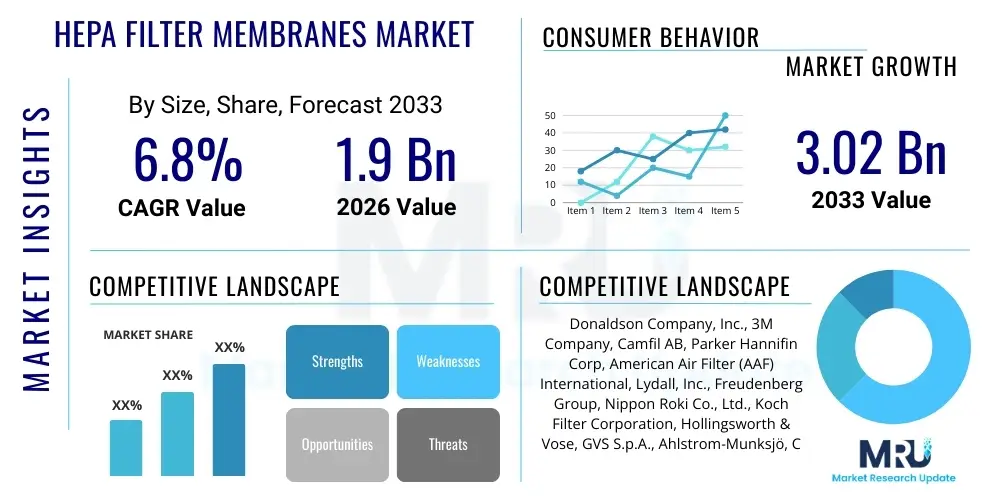

The HEPA Filter Membranes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.9 Billion in 2026 and is projected to reach $3.02 Billion by the end of the forecast period in 2033.

HEPA Filter Membranes Market introduction

The High Efficiency Particulate Air (HEPA) filter membrane market encompasses advanced filtration media designed to remove a minimum of 99.97% of airborne particles whose diameter is equal to 0.3 micrometers (the Most Penetrating Particle Size, or MPPS). These membranes are critical components used in various air purification systems where stringent air quality control is paramount. The technology relies primarily on mechanical filtration principles, including interception, impaction, and diffusion, ensuring exceptional removal efficiency for fine dust, pollen, mold, bacteria, and virus-carrying aerosols.

The product description highlights the sophisticated composition of these membranes, often incorporating materials such as borosilicate glass microfiber, polytetrafluoroethylene (PTFE), and advanced synthetic polymers. The structure is typically dense and non-woven, formed into deep-pleat or mini-pleat configurations to maximize surface area and minimize pressure drop while maintaining high efficiency. Continuous innovation in membrane development focuses on reducing material thickness, improving hydrophobic characteristics (especially important in medical applications), and enhancing chemical resistance to extend the service life of the filters.

Major applications driving this market include Heating, Ventilation, and Air Conditioning (HVAC) systems in commercial buildings, cleanrooms in semiconductor and biotechnology industries, and critical air purification equipment in healthcare facilities and pharmaceutical manufacturing. Benefits such as superior air quality improvement, compliance with global health standards (e.g., ISO 14644 standards for cleanrooms), and protection against airborne contaminants solidify HEPA filter membranes as indispensable elements in controlled environments. The market is primarily driven by escalating global air pollution levels, increasing public health awareness regarding indoor air quality (IAQ), and stringent regulatory mandates requiring highly efficient filtration in sensitive industrial processes.

HEPA Filter Membranes Market Executive Summary

The HEPA Filter Membranes market exhibits robust growth driven by simultaneous expansion in industrial and commercial sectors, coupled with heightened demand for residential air purification solutions following global health crises. Business trends indicate a strong focus on strategic mergers and acquisitions among established players aiming to vertically integrate membrane manufacturing capabilities or expand their geographic footprint into rapidly industrializing regions. Furthermore, manufacturers are prioritizing the development of sustainable, low-pressure-drop filter media, addressing the operational cost concerns associated with energy consumption in large HVAC systems. This technological shift, favoring thinner and more efficient materials like PTFE, is reshaping competitive dynamics and investment strategies across the supply chain.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, increasing levels of air pollution (especially in countries like China and India), and significant investment in high-tech manufacturing sectors such as electronics and pharmaceuticals that require ultra-clean environments. North America and Europe, characterized by mature markets, continue to contribute substantial revenue, primarily driven by strict regulatory standards governing IAQ in institutional settings and consistent replacement cycles for existing infrastructure. The increasing adoption of smart HVAC systems incorporating predictive maintenance features further solidifies demand across all developed regions.

Segment trends highlight the dominance of glass fiber media due to its cost-effectiveness and proven performance, although PTFE membranes are experiencing the fastest growth rate owing to their superior chemical resistance, high porosity, and excellent hydrophobic properties, making them ideal for specialized medical and high-moisture cleanroom applications. Application-wise, the Cleanrooms segment commands the largest market share, directly correlated with expanding investments in microelectronics fabrication and biotechnology research. However, the HVAC segment, driven by governmental mandates related to public building safety and energy efficiency, is expected to exhibit the most accelerated growth trajectory over the forecast period, emphasizing the need for robust, long-lasting HEPA membrane solutions.

AI Impact Analysis on HEPA Filter Membranes Market

User inquiries regarding AI's impact on the HEPA Filter Membranes Market frequently revolve around three core themes: enhancing filtration efficiency, optimizing manufacturing processes, and revolutionizing filter maintenance and replacement scheduling. Users are keen to understand how AI-driven analysis of real-time air quality data can lead to dynamic filter operation, where filtration intensity adjusts based on contamination levels, thereby extending filter lifespan and reducing energy consumption. A significant concern is the integration complexity and the requirement for substantial initial investment in sensor technology and data infrastructure needed to leverage AI effectively within traditional HVAC and cleanroom systems.

AI algorithms are fundamentally transforming membrane design by allowing for rapid simulation and optimization of fiber diameter, pore size distribution, and material structure. Generative design techniques, powered by machine learning, enable researchers to predict the filtration performance of novel composite materials before physical prototyping, significantly accelerating product development cycles, particularly for specialized membranes targeting ultra-fine particles or specific chemical contaminants. This data-driven approach allows manufacturers to fine-tune material combinations, optimizing the critical balance between filtration efficiency and pressure drop.

Furthermore, the application of AI in operational maintenance (predictive maintenance) is having a substantial economic impact. By analyzing multivariate data streams (differential pressure readings, air flow rates, particle counts), AI models can accurately predict the remaining useful life (RUL) of HEPA filters, signaling maintenance teams precisely when replacement is necessary, rather than relying on fixed schedules or critical failure thresholds. This optimization minimizes unexpected downtime in critical environments like pharmaceutical cleanrooms and reduces unnecessary filter disposal, contributing to both operational efficiency and sustainability goals.

- AI algorithms facilitate predictive maintenance, optimizing filter replacement cycles and minimizing operational downtime.

- Machine learning enhances quality control during manufacturing, detecting minute material flaws in real-time.

- Generative design utilizes AI to optimize membrane structure, improving efficiency while reducing pressure drop and energy consumption.

- AI-driven sensor networks enable dynamic control of air filtration systems based on real-time contamination levels.

- AI supports the rapid development and testing of novel nanofiber and composite filtration materials.

DRO & Impact Forces Of HEPA Filter Membranes Market

The dynamics of the HEPA Filter Membranes Market are shaped by a complex interplay of driving factors (D), restricting elements (R), ample opportunities (O), and potent external impact forces. The dominant driver remains the severe deterioration of global air quality, especially in heavily industrialized urban centers, necessitating higher levels of protection against particulate matter (PM2.5 and PM10). This, combined with stricter governmental regulations globally concerning workplace safety and environmental control—particularly in pharmaceutical, electronics, and nuclear sectors—mandates the continuous utilization of high-grade HEPA filtration. The COVID-19 pandemic also served as a major impact force, fundamentally changing public and commercial perception of the importance of indoor air filtration efficiency, leading to unprecedented demand growth in commercial HVAC upgrades.

However, the market faces significant restraints. A primary concern is the relatively high operational cost associated with HEPA filtration, encompassing both the initial filter cost and the substantial energy required to overcome the pressure drop caused by the dense filter media. Moreover, the disposal of used HEPA filters, which often contain captured hazardous or biological contaminants, presents an environmental challenge and adds to logistical costs, particularly for smaller facilities. Supply chain volatility, especially concerning key raw materials like specialized glass fibers and PTFE resins, can also intermittently constrain production capacity and drive up market prices.

Opportunities for growth are abundant, particularly through technological convergence. The integration of HEPA technology with ultra-low penetration air (ULPA) filtration and innovative nanofiber materials offers pathways to achieve higher efficiencies (e.g., towards 99.9995%) at lower pressure drops, appealing directly to the semiconductor and life sciences sectors. Additionally, the development of sustainable, biodegradable, or recyclable HEPA filter frames and media addresses mounting environmental concerns, opening new market pathways favored by corporate sustainability mandates. The expansion of smart cities and smart building infrastructure also offers a ripe opportunity for integrated, data-driven filtration solutions, leveraging IoT and AI for optimization.

Segmentation Analysis

The HEPA Filter Membranes market is comprehensively segmented based on material type, filter type, and application, allowing for targeted product development and strategic market positioning. The material segmentation (Glass Fiber, PTFE, Polypropylene) reflects the varying performance characteristics required across diverse end-use sectors, factoring in criteria such as moisture resistance, chemical inertness, and cost. Filter type segmentation (Mini-Pleat, Deep Pleat, V-Bank) dictates the physical form factor and pressure drop profile, crucial for integrating membranes into specific air handling unit designs.

Application-based segmentation is critical, distinguishing between the highly regulated demands of Cleanrooms and Pharmaceuticals versus the broader, volume-driven requirements of Commercial HVAC systems. Understanding these segment dynamics is vital for manufacturers, as the requirements for particle retention, longevity, and regulatory compliance differ significantly between sectors. For instance, the demand from the Medical/Pharmaceutical segment prioritizes sterility and resistance to harsh cleaning agents, often favoring PTFE, while the Automotive sector might prioritize durability and compactness, driving demand for advanced synthetic materials.

- By Material Type:

- Glass Fiber

- Polytetrafluoroethylene (PTFE)

- Polypropylene

- Other Synthetic Materials (e.g., Nanofibers)

- By Filter Type:

- Mini-Pleat Filters

- Deep Pleat Separator Filters

- V-Bank Filters

- Box Filters

- By Application:

- HVAC Systems (Commercial & Residential)

- Cleanrooms (Semiconductor & Electronics)

- Medical and Pharmaceutical Facilities

- Automotive Manufacturing

- Nuclear Facilities

- Aerospace & Defense

- Consumer Air Purifiers

Value Chain Analysis For HEPA Filter Membranes Market

The value chain for HEPA filter membranes begins with rigorous upstream activities, primarily involving the sourcing and processing of specialized raw materials. Key inputs include highly refined borosilicate glass fibers, advanced polymer resins (PTFE, polypropylene), and specific binders/adhesives. The quality and purity of these raw materials are non-negotiable, as they directly influence the final filtration efficiency and structural integrity of the membrane. Suppliers specializing in high-grade fiber production hold significant leverage, requiring close, long-term relationships with filter manufacturers to ensure supply stability and consistent quality, particularly given the specialized nature of micro-fiber spinning and material treatment processes.

Downstream analysis focuses on the complex manufacturing processes, including media lamination, pleating, and final assembly into filter units (cassettes or frames). The manufacturing process demands high precision, especially in mini-pleat technology, which utilizes hot melt or string separators to maintain uniform pleat spacing and prevent media damage, ensuring optimal airflow and maximizing filtration surface area. Quality control (QC) is a critical bottleneck, involving rigorous testing protocols (e.g., DOP testing or particle counting) to verify the 99.97% efficiency standard. High capital expenditure in specialized pleating machinery and automated testing systems characterize this stage.

The distribution channel is segmented into direct sales to large Original Equipment Manufacturers (OEMs)—such as major HVAC system producers and cleanroom builders—and indirect distribution through regional specialized distributors serving the replacement market. Direct sales benefit from large, recurring contracts, while indirect channels cater to the highly fragmented Maintenance, Repair, and Operations (MRO) segment. A robust network of technically knowledgeable distributors is essential for the replacement market, as filters must often be customized or sourced quickly for critical facility operations, emphasizing efficient logistics and local warehousing capabilities.

HEPA Filter Membranes Market Potential Customers

Potential customers for HEPA filter membranes span a broad spectrum of industries, driven primarily by regulatory compliance and the necessity of particulate contamination control. The largest and most demanding customer base resides within the industrial and life sciences sectors. These end-users, including semiconductor fabricators, pharmaceutical manufacturers, and biotechnology research laboratories, require absolute particulate control (Class 1 to Class 100 cleanrooms), making them consistent buyers of ULPA and high-grade HEPA membranes, often procuring filters directly from specialized manufacturers to meet stringent, facility-specific specifications.

The commercial and institutional segment represents a massive volume market, encompassing hospitals, universities, corporate offices, and government buildings. Following increasing mandates for enhanced indoor air quality, particularly post-2020, facility managers are rapidly upgrading standard HVAC filters to MERV 13 and above, often incorporating HEPA-level filtration systems where possible. Hospitals are particularly critical customers, utilizing HEPA membranes in infectious disease isolation rooms, operating theaters, and sterile compounding areas where reliable biohazard removal is essential for patient safety and compliance with healthcare accreditation standards.

A rapidly expanding customer profile is the residential and consumer segment, driven by the increasing awareness of pollutants like smoke, allergens, and pet dander. While these customers typically purchase finished consumer air purifier units rather than raw membranes, their demand dictates the volume required by major consumer electronics OEMs. Additionally, the automotive industry, particularly in the production of electric vehicle batteries and critical powertrain components that require particle-free environments, has emerged as a significant industrial customer requiring high-efficiency filtration solutions integrated into assembly lines and paint shops.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.9 Billion |

| Market Forecast in 2033 | $3.02 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Donaldson Company, Inc., 3M Company, Camfil AB, Parker Hannifin Corp, American Air Filter (AAF) International, Lydall, Inc., Freudenberg Group, Nippon Roki Co., Ltd., Koch Filter Corporation, Hollingsworth & Vose, GVS S.p.A., Ahlstrom-Munksjö, Clarcor, IQAir, Mann+Hummel, Fibertex Nonwovens, Kimberly-Clark, SWM International, Flanders Corporation, and Sentry Air Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HEPA Filter Membranes Market Key Technology Landscape

The technology landscape of the HEPA Filter Membranes market is currently defined by significant innovation in material science aimed at improving filtration efficiency without substantially increasing airflow resistance. A primary technological focus is the adoption of nanofiber technology, where synthetic polymers are electrospun to create fibers with diameters in the sub-micron range (50 nm to 500 nm). Nanofibers enhance the diffusion and interception mechanisms, leading to superior capture efficiency for the MPPS (0.3 µm) while allowing for greater porosity and thus lower pressure drop compared to traditional glass fiber media. This delicate balance of high performance and energy efficiency is crucial for the next generation of HVAC and automotive cabin air filtration systems.

Another pivotal technological advancement involves the development of bio-filtration and antimicrobial membranes. As HEPA filters capture biological contaminants, there is an increasing risk of microbial growth on the filter media itself, potentially releasing harmful byproducts back into the air stream. Manufacturers are integrating antimicrobial agents, such as silver nanoparticles or specialized chemical treatments, directly into the fiber matrix. This ensures that the captured pathogens are neutralized, thereby providing a dual-action system (filtration and disinfection), particularly valued in sensitive environments like hospitals and pharmaceutical aseptic processing areas. This technology requires stringent testing to ensure efficacy and compliance with health regulations.

Furthermore, technology is rapidly advancing in the field of intelligent filtration systems. The convergence of IoT sensors, data analytics, and filtration media is allowing for real-time monitoring of filter performance indicators, including saturation levels, differential pressure, and actual particle counts upstream and downstream. This capability facilitates the integration of Variable Air Volume (VAV) systems that dynamically adjust fan speeds based on filtration status, conserving energy and optimizing maintenance schedules. Standardization bodies are also continuously updating testing methodologies (e.g., ISO 29463) to accurately assess the performance of new high-flow, low-resistance membranes under various operating conditions, pushing manufacturers toward more rigorous design parameters.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive industrialization, particularly in China, South Korea, and India. The region is the global hub for semiconductor and electronics manufacturing, industries that rely heavily on ultra-efficient HEPA and ULPA filtration for contamination control in wafer fabrication and assembly. Furthermore, critical air quality challenges in major urban centers drive significant governmental and consumer investment in commercial and residential air purification solutions.

- North America: North America holds a substantial share of the HEPA Filter Membranes market, characterized by stringent regulatory oversight from agencies like the EPA and OSHA, which enforce high IAQ standards in commercial and institutional settings. Demand is consistently driven by the healthcare sector's rapid adoption of advanced filtration media and the ongoing technological migration toward energy-efficient, high-performance filters in mature HVAC infrastructure across the US and Canada.

- Europe: The European market is mature but highly focused on sustainability and energy efficiency, prioritizing the adoption of low-pressure-drop filters and media with minimized environmental impact. Government policies promoting green building initiatives, coupled with robust pharmaceutical and biotechnology sectors (especially in Germany and Switzerland), ensure steady demand for premium, customized HEPA filtration solutions that comply with strict Eurovent and local environmental directives.

- Latin America (LATAM): Growth in LATAM is primarily focused in Brazil and Mexico, linked to expanding automotive manufacturing bases and nascent pharmaceutical industries. The market exhibits slower adoption compared to APAC or North America, but increasing foreign direct investment in cleanroom facilities signals moderate growth potential, particularly in high-quality industrial filtration.

- Middle East and Africa (MEA): The MEA region’s demand is concentrated in the energy sector (oil and gas) and large-scale infrastructure projects, including state-of-the-art hospitals and mega-city developments (e.g., Saudi Arabia’s Vision 2030). Extreme climate conditions necessitate robust HVAC systems, while localized air quality issues (sandstorms) drive demand for durable, high-capacity particulate filters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HEPA Filter Membranes Market.- Donaldson Company, Inc.

- 3M Company

- Camfil AB

- Parker Hannifin Corp

- American Air Filter (AAF) International

- Lydall, Inc.

- Freudenberg Group

- Nippon Roki Co., Ltd.

- Koch Filter Corporation

- Hollingsworth & Vose

- GVS S.p.A.

- Ahlstrom-Munksjö

- Clarcor (now part of Parker Hannifin)

- IQAir

- Mann+Hummel

- Fibertex Nonwovens

- Kimberly-Clark

- SWM International

- Flanders Corporation

- Sentry Air Systems

Frequently Asked Questions

Analyze common user questions about the HEPA Filter Membranes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for HEPA filter membranes?

The primary driver is the accelerating global deterioration of air quality due to urbanization and industrial emissions, combined with increasingly stringent governmental regulations, particularly in the healthcare and high-tech manufacturing sectors, necessitating superior indoor air quality control.

How does nanofiber technology enhance the performance of HEPA membranes?

Nanofiber technology utilizes extremely fine fibers (sub-micron diameter) to increase the surface area available for particle capture via diffusion and interception mechanisms. This significantly improves filtration efficiency (especially for MPPS 0.3 µm particles) while simultaneously achieving a lower pressure drop, which reduces energy consumption in air handling units.

Which application segment accounts for the largest market share?

The Cleanrooms segment, encompassing semiconductor, electronics, and microelectronics manufacturing, holds the largest market share. These industries require the highest levels of particulate control (ISO Class 1 to 5), ensuring consistent, high-volume demand for premium HEPA and ULPA filtration solutions.

What major challenge is faced by HEPA filter manufacturers?

A major challenge is balancing high filtration efficiency with energy efficiency. Dense filter media causes high pressure drop, leading to increased operational energy costs. Manufacturers are continually innovating materials like PTFE and nanofibers to maintain efficiency while reducing airflow resistance and mitigating this cost factor.

What is the role of PTFE material in the HEPA filter market?

PTFE (Polytetrafluoroethylene) membranes are gaining rapid traction due to their inherent hydrophobic properties and superior chemical resistance. They are vital in high-moisture environments, such as certain medical and pharmaceutical applications, where resistance to water and corrosive cleaning agents is essential for maintaining filter integrity and performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager