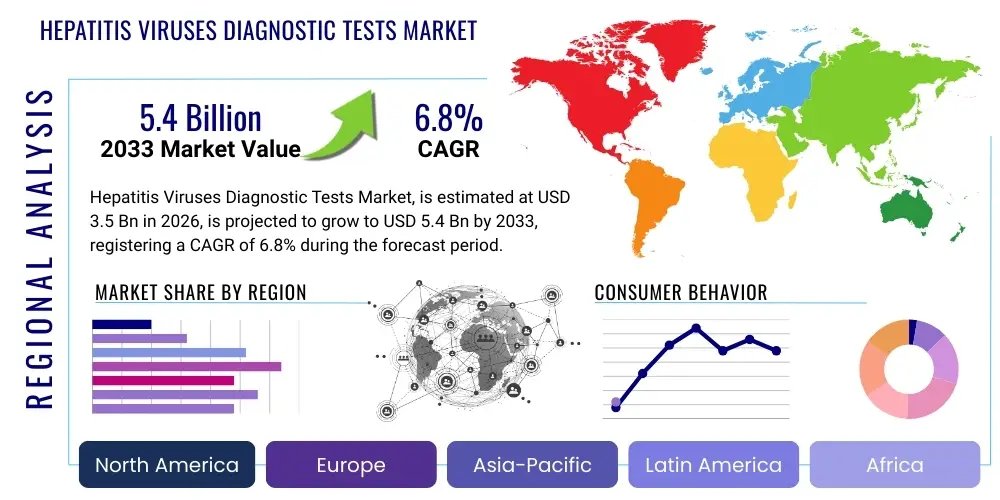

Hepatitis Viruses Diagnostic Tests Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437190 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Hepatitis Viruses Diagnostic Tests Market Size

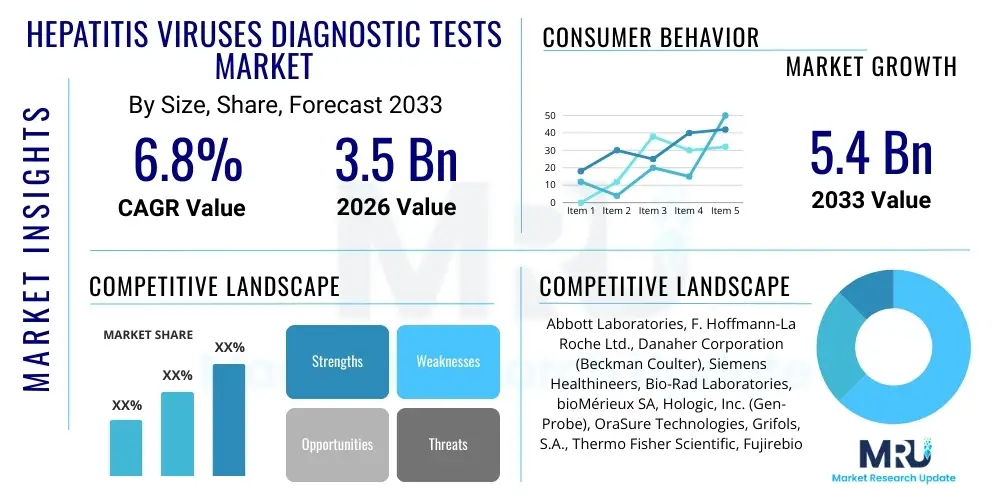

The Hepatitis Viruses Diagnostic Tests Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.4 Billion by the end of the forecast period in 2033.

Hepatitis Viruses Diagnostic Tests Market introduction

The global market for Hepatitis Viruses Diagnostic Tests encompasses a broad range of laboratory assays and rapid diagnostic tools essential for the screening, diagnosis, and monitoring of viral hepatitis infections, primarily Hepatitis A (HAV), B (HBV), C (HCV), D (HDV), and E (HEV). These diagnostic solutions leverage technologies such as Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence Immunoassay (CLIA), and increasingly sophisticated Nucleic Acid Testing (NAT) methods, including Polymerase Chain Reaction (PCR) and next-generation sequencing, to detect viral antigens, antibodies, or viral genetic material. The continuous evolution of diagnostic platforms, shifting towards higher sensitivity, faster turnaround times, and point-of-care (POC) capabilities, drives market expansion.

Major applications of these diagnostic tests include blood screening in transfusion centers, clinical diagnosis in hospitals and private laboratories, population-based screening programs, and monitoring the efficacy of antiviral treatments. The primary goal is early detection, which is crucial for preventing chronic liver disease, cirrhosis, and hepatocellular carcinoma—severe complications associated with chronic HBV and HCV infections. Furthermore, improved diagnostics facilitate enhanced epidemiological surveillance and public health interventions aimed at eliminating viral hepatitis as a major public health threat by 2030, in line with global health organization mandates.

Key factors driving market growth include the rising global prevalence of viral hepatitis, particularly in developing regions, increased public health initiatives supported by governments and non-governmental organizations to enhance screening accessibility, and technological advancements leading to the development of highly accurate and automated testing platforms. The introduction of highly effective direct-acting antiviral (DAA) therapies for HCV has also spurred demand for companion diagnostics and monitoring tools. Benefits derived from these diagnostic solutions include improved patient outcomes through timely intervention, reduced transmission rates through effective blood bank screening, and better management of chronic disease burden on healthcare systems globally.

Hepatitis Viruses Diagnostic Tests Market Executive Summary

The Hepatitis Viruses Diagnostic Tests Market demonstrates robust growth driven by significant advancements in molecular diagnostics and rising global health priorities focused on disease eradication. Business trends highlight a strong shift toward decentralized testing models, prioritizing the integration of high-throughput automated systems in centralized laboratories and the deployment of user-friendly Point-of-Care Testing (POCT) devices in resource-limited settings. Strategic partnerships between diagnostic manufacturers and pharmaceutical companies are becoming common, particularly to support clinical trials and post-market monitoring of novel antiviral drugs. Furthermore, mergers and acquisitions are consolidating the market landscape, allowing key players to expand their product portfolios and geographical reach, particularly targeting emerging economies where hepatitis prevalence remains high.

Regional trends indicate North America and Europe currently hold significant market shares due to well-established healthcare infrastructure, high awareness regarding preventative screening, and robust reimbursement policies. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive population size, increasing government investments in infectious disease control programs, and a high endemic burden of HBV and HCV. Latin America and the Middle East & Africa (MEA) are also experiencing accelerated growth as international aid programs increase the availability of low-cost diagnostic kits and essential medical training, improving diagnostic penetration beyond major metropolitan centers.

Segment trends reveal that Nucleic Acid Testing (NAT) remains the fastest-growing technology segment, largely due to its superior sensitivity and ability to detect early-stage infection and monitor viral load accurately, crucial for treatment decisions. In terms of end-users, hospitals and clinical laboratories retain the largest share, but blood banks and plasma centers represent a highly critical, high-volume segment driven by stringent safety regulations. The HCV segment dominates the market revenue currently, reflecting the global scale-up of screening programs and the monitoring requirements associated with DAA therapy. Conversely, the rising focus on HBV elimination strategies and the need for long-term monitoring is sustaining steady demand within that market segment.

AI Impact Analysis on Hepatitis Viruses Diagnostic Tests Market

Common user questions regarding AI's influence in the Hepatitis Viruses Diagnostic Tests Market often center on how automation impacts accuracy, speed, and cost efficiency in laboratory settings, particularly concerning molecular testing and image analysis. Users frequently inquire about the reliability of AI algorithms in interpreting complex viral load data and identifying treatment resistance patterns. There is also significant interest in the potential of AI-driven epidemiological models to predict outbreak risks and optimize resource allocation for mass screening campaigns. The overriding themes reflect an expectation that AI will enhance data management, streamline diagnostic workflows, and ultimately improve the precision and personalization of hepatitis management pathways, reducing reliance on manual interpretation and mitigating human error in high-throughput environments.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to revolutionize several facets of the hepatitis diagnostic landscape, moving beyond simple automation to predictive analytics and decision support systems. In large clinical laboratories, AI algorithms are being employed to optimize the efficiency of molecular testing platforms, managing sample throughput, prioritizing urgent testing requests, and ensuring quality control. This enhances the operational capacity of laboratories, allowing them to process the increasing volume of tests generated by large-scale public health screening initiatives, thereby lowering the overall cost per test and accelerating results delivery to clinicians. AI’s role is particularly transformative in high-volume, repetitive tasks where pattern recognition is critical.

Furthermore, AI plays a crucial role in enhancing diagnostic precision and clinical utility. ML models can analyze complex patient data sets, integrating laboratory results (serology, viral load), clinical symptoms, and imaging data to provide prognostic scores for patients with chronic hepatitis, predicting the risk of progression to cirrhosis or liver cancer. This predictive capability supports personalized medicine approaches, helping physicians determine the optimal timing for intervention or treatment intensification. AI also assists in interpreting complex genomic sequences derived from next-generation sequencing (NGS) of the hepatitis virus, rapidly identifying subtle mutations associated with drug resistance, which is vital for guiding the selection of highly effective second-line antiviral therapies.

- AI-driven optimization of laboratory workflow and sample prioritization, increasing throughput efficiency.

- Machine Learning algorithms enhance the accuracy of interpreting complex molecular diagnostic results, such as viral genotyping and drug resistance profiling.

- Predictive analytics utilizing patient data (viral load, liver markers) to forecast disease progression (e.g., cirrhosis, HCC risk).

- Integration of AI in automated imaging analysis (e.g., ultrasound, MRI) to detect subtle liver damage associated with chronic hepatitis.

- Development of smart diagnostics and decision support tools for point-of-care testing in remote or low-resource settings.

- AI-enabled epidemiological modeling for real-time tracking of hepatitis incidence and planning resource distribution for vaccination and screening programs.

DRO & Impact Forces Of Hepatitis Viruses Diagnostic Tests Market

The Hepatitis Viruses Diagnostic Tests Market is shaped by a confluence of influential factors, categorized as Drivers (D), Restraints (R), Opportunities (O), and Impact Forces. Key drivers include the escalating global burden of chronic hepatitis infections, specifically HBV and HCV, coupled with heightened awareness campaigns promoting early screening and diagnosis. Significant opportunities arise from the increasing adoption of highly sensitive molecular diagnostics and the expansion of point-of-care (POC) testing technology into decentralized healthcare settings. However, the market faces restraints such as the relatively high cost associated with advanced NAT technologies, limited healthcare budgets in low- and middle-income countries, and challenges in establishing effective screening infrastructure, particularly in rural areas. The collective impact of these forces dictates the pace of technological adoption and market penetration globally.

Drivers primarily center on public health imperatives and technological advancement. Global initiatives, such as the World Health Organization’s (WHO) strategy to eliminate viral hepatitis by 2030, are compelling governments worldwide to invest heavily in mass screening and linkage-to-care programs, directly increasing the demand for testing kits and instruments. The rapid development and regulatory approval of highly sensitive diagnostic assays, which can detect infection earlier or monitor viral load with greater precision, also drive market value. Furthermore, the mandatory screening of blood and blood products remains a non-negotiable driver, ensuring continuous high volume demand from blood banks and plasma collection centers internationally. These fundamental demands create a stable and growing base for the diagnostic industry.

Restraints are often structural or economic. The primary barrier in many developing markets remains the affordability of sophisticated molecular diagnostics, despite the availability of cost-effective rapid tests. Issues related to regulatory harmonization across different geographical regions also pose a challenge for global players seeking streamlined product launches. Opportunities, on the other hand, are focused on innovation and market expansion. The move towards multiplex testing, allowing simultaneous detection of multiple hepatitis viruses or coinfections, represents a significant growth area. Additionally, harnessing telehealth and mobile health technologies to improve follow-up care and result delivery further expands the market's reach and effectiveness, particularly enhancing patient compliance with long-term monitoring protocols.

Segmentation Analysis

The Hepatitis Viruses Diagnostic Tests Market is comprehensively segmented based on technology, product type, infection type, and end-user, providing a granular view of market dynamics and growth potential across various dimensions. Technology segmentation defines the methods used for detection, distinguishing between immunoassay-based tests (for antibodies and antigens) and nucleic acid-based tests (for viral RNA/DNA). Product segmentation includes consumables (reagents, kits) and instruments (analyzers, automated systems). Analyzing these segments helps stakeholders understand where investment in research and development is yielding the highest returns and which diagnostic modalities are gaining traction due to superior performance characteristics or cost-efficiency.

Infection type segmentation clearly delineates the demand based on the specific hepatitis virus being diagnosed (HAV, HBV, HCV, HDV, HEV). HBV and HCV segments collectively account for the majority of the market share due to their chronic nature and high global prevalence, necessitating both initial screening and long-term viral load monitoring. The End-User analysis identifies the key purchasers of diagnostic solutions, ranging from large centralized hospitals and national blood banks, which demand high-throughput automated systems, to smaller clinical laboratories and public health centers, which increasingly adopt simpler, decentralized testing platforms like POCT kits. This stratification is crucial for manufacturers to tailor their marketing and distribution strategies effectively.

- By Technology:

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Chemiluminescence Immunoassay (CLIA)

- Polymerase Chain Reaction (PCR) and Nucleic Acid Testing (NAT)

- Rapid Diagnostic Tests (RDTs) / Point-of-Care Testing (POCT)

- Microarray

- By Product:

- Consumables (Kits, Reagents, Calibrators, Controls)

- Instruments (Automated Analyzers, Semi-Automated Systems, Readers)

- By Infection Type:

- Hepatitis B Virus (HBV)

- Hepatitis C Virus (HCV)

- Hepatitis A Virus (HAV)

- Hepatitis D Virus (HDV)

- Hepatitis E Virus (HEV)

- By End-User:

- Hospitals and Clinical Laboratories

- Blood Banks and Plasma Centers

- Diagnostic Centers

- Physician Office Laboratories (POLs)

- Public Health Agencies and Research Institutes

Value Chain Analysis For Hepatitis Viruses Diagnostic Tests Market

The value chain for the Hepatitis Viruses Diagnostic Tests Market starts with upstream activities involving core research and development (R&D) focused on discovering novel biomarkers and optimizing detection methodologies, followed by the sourcing of highly specialized raw materials such as proprietary enzymes, antibodies, and high-quality chemical reagents. Manufacturing involves complex processes of reagent formulation, kit assembly under strict quality control standards (ISO, CLIA), and the production of sophisticated analytical instruments. Key value addition in the upstream segment is derived from intellectual property, technological differentiation, and robust patent protection, especially for advanced NAT technologies which offer superior analytical performance.

Midstream activities primarily encompass distribution and logistics, which are critical due to the often temperature-sensitive nature of reagents and kits. The distribution channel is segmented into direct sales, managed by market leaders who serve large, high-volume customers like national blood banks and major hospital systems, and indirect sales, utilizing a network of third-party distributors and regional wholesalers, essential for reaching smaller laboratories and international markets. Effective cold chain management and inventory optimization are vital components in maintaining product efficacy and reducing waste across the supply chain, ensuring global availability in diverse climatic conditions.

Downstream activities involve end-user consumption, encompassing the diagnostic testing services delivered by hospitals, specialized laboratories, and public health campaigns. The final stage involves the interpretation of results and integration into patient Electronic Health Records (EHRs), concluding with clinical decision-making regarding treatment or prevention protocols. Direct influence is exerted through extensive training and technical support provided by manufacturers to end-users to ensure correct assay execution and interpretation, while indirect value is captured through regulatory adherence and participation in global quality assurance schemes that validate test accuracy and reliability across the healthcare ecosystem.

Hepatitis Viruses Diagnostic Tests Market Potential Customers

The primary customers and end-users of Hepatitis Viruses Diagnostic Tests are diverse organizations that require accurate and timely detection capabilities, spanning the entire continuum of healthcare from preventive screening to complex therapeutic monitoring. Hospitals and integrated clinical laboratories constitute the largest customer base, relying on these tests for general patient admissions screening, pre-surgical evaluations, and specialized infectious disease testing within inpatient and outpatient settings. These facilities demand high-throughput, fully automated analyzers capable of processing thousands of samples daily with minimal manual intervention, prioritizing efficiency, integration with Laboratory Information Systems (LIS), and comprehensive menus covering all major hepatitis strains.

A second crucial segment comprises national and regional blood banks, plasma collection centers, and organ transplantation registries. For these entities, diagnostic testing is mandatory and mission-critical, focused exclusively on preventing transfusion-transmitted infections (TTI). They require highly sensitive screening assays, primarily utilizing NAT technology, which minimizes the 'window period' where acute infections might go undetected by antibody tests, ensuring the safety of the global blood supply. Their purchasing decisions are heavily influenced by stringent regulatory compliance (e.g., FDA, EMA standards) and the reliability of vendor supply chains.

Furthermore, government public health agencies and non-governmental organizations (NGOs) are significant purchasers, especially in high-prevalence areas where mass screening programs are implemented to identify undiagnosed populations and link them to treatment. This segment typically drives demand for affordable, robust, and easy-to-use Point-of-Care Testing (POCT) solutions, such as rapid antibody and antigen tests, which are essential for conducting testing in remote areas or community clinics where centralized laboratory infrastructure is lacking. Research institutions and pharmaceutical companies also constitute a smaller, yet valuable, customer group, utilizing these tests for clinical trials, epidemiology studies, and surveillance activities.

| Report Attributes | Report Details | |

|---|---|---|

| Market Size in 2026 | $3.5 Billion | |

| Market Forecast in 2033 | $5.4 Billion | |

| Growth Rate | 6.8% CAGR | |

| Historical Year | 2019 to 2024 | |

| Base Year | 2025 | |

| Forecast Year | 2026 - 2033 | |

| DRO & Impact Forces |

| |

| Segments Covered |

| |

| Key Companies Covered | Abbott Laboratories, F. Hoffmann-La Roche Ltd., Danaher Corporation (Beckman Coulter), Siemens Healthineers, Bio-Rad Laboratories, bioMérieux SA, Hologic, Inc. (Gen-Probe), OraSure Technologies, Grifols, S.A., Thermo Fisher Scientific, Fujirebio Inc., Becton, Dickinson and Company (BD), Quest Diagnostics, DiaSorin S.p.A., Serologicals Corporation, Sysmex Corporation, Advanced Diagnostic Laboratory (ADL), MedMira Inc., Trinity Biotech, Altona Diagnostics GmbH. | |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) | |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hepatitis Viruses Diagnostic Tests Market Key Technology Landscape

The technology landscape of the Hepatitis Viruses Diagnostic Tests Market is characterized by a dual focus: optimizing high-throughput serological screening in centralized settings and advancing molecular diagnostics for precision and early detection. Immunoassay platforms, primarily ELISA and Chemiluminescence Immunoassay (CLIA), remain the cornerstone for initial screening, utilizing highly specific antigen and antibody detection methods. CLIA, in particular, has seen increased adoption over traditional ELISA due to its superior sensitivity, wider dynamic range, and high degree of automation, allowing laboratories to process large batches of samples quickly and accurately, which is essential for blood banks and high-volume clinical labs globally. Technological innovation in this area is focused on improving assay multiplexing capabilities and reducing reagent consumption to lower per-test costs.

The most significant technological driver, however, is Nucleic Acid Testing (NAT), predominantly performed via quantitative and real-time PCR (qPCR). NAT offers unparalleled sensitivity by directly detecting viral RNA or DNA, enabling diagnosis during the acute phase before antibody seroconversion occurs (the 'window period'), and providing critical viral load measurements necessary for monitoring treatment response, especially for chronic HBV and HCV. Advanced NAT systems are moving towards fully integrated, 'sample-to-result' automated platforms that minimize handling and reduce the risk of contamination. Furthermore, the burgeoning field of Next-Generation Sequencing (NGS) is beginning to play a niche, but important, role in deep sequencing of viral genomes to study resistance mechanisms and track complex epidemiological transmission patterns.

The third major technological trend involves Point-of-Care Testing (POCT) and Rapid Diagnostic Tests (RDTs). These technologies prioritize simplicity, portability, and rapid results, making them ideal for decentralized settings, mobile clinics, and primary care physicians' offices, significantly improving access to testing in resource-limited environments. Modern POCT devices often utilize lateral flow immunoassays or microfluidic technologies, providing results in minutes. The current focus of R&D in POCT is enhancing their analytical sensitivity to approach that of laboratory-based methods, and integrating digital connectivity for seamless data reporting and linkage to care programs, addressing the logistical challenges associated with managing viral hepatitis epidemics in vast and remote populations.

Regional Highlights

The geographical distribution of the Hepatitis Viruses Diagnostic Tests Market revenue is uneven, reflecting disparate levels of healthcare spending, disease prevalence, and public health infrastructure maturity across major global regions. North America (led by the U.S. and Canada) maintains the largest market share, driven by high disposable incomes, substantial government expenditure on healthcare, universal mandatory blood screening programs, and the early adoption of advanced molecular diagnostics. The region benefits from strong regulatory frameworks (e.g., FDA approvals) that foster innovation, leading to a high penetration rate of cutting-edge technologies like digital PCR and fully automated NAT systems in clinical practice. Moreover, favorable reimbursement policies for both screening and monitoring tests underpin the market's stability and growth in this region.

Europe represents the second-largest market, characterized by comprehensive universal healthcare systems and coordinated public health efforts, particularly within the European Union, focused on HCV elimination. Western European countries exhibit high adoption rates for sophisticated testing methods, mirroring North America. However, Central and Eastern European markets are showing accelerated growth as they align their diagnostic protocols with global best practices and receive support from regional health organizations to expand screening for chronic hepatitis, addressing previously neglected patient populations. Market dynamics in Europe are strongly influenced by national procurement policies and stringent quality standards set by organizations like the European Centre for Disease Prevention and Control (ECDC).

Asia Pacific (APAC) is projected to be the fastest-growing market during the forecast period. This rapid expansion is primarily fueled by the exceptionally high endemic burden of HBV and HCV in countries like China, India, and Southeast Asia, necessitating massive investments in diagnostic infrastructure. Increasing government initiatives to combat infectious diseases, coupled with improving economic conditions and growing medical tourism, are expanding the access to and affordability of diagnostic testing. The APAC region is a significant consumer of cost-effective rapid diagnostic tests (RDTs) but is rapidly scaling up the installation of automated molecular systems in major urban centers, presenting a dual market opportunity for both high-end and low-cost solutions.

- North America: Dominates the market share; characterized by high adoption of NAT, strong reimbursement, and rigorous blood screening mandates. Key markets are the US and Canada.

- Europe: Mature market with high penetration of automated immunoassays and molecular tests; driven by robust public health programs targeting HCV elimination and standardized screening protocols.

- Asia Pacific (APAC): Highest growth potential globally; massive patient pool (especially HBV/HCV); increasing government spending on infectious disease control; rapid uptake of both low-cost RDTs and high-end automated systems. Key growth nations include China, India, and Japan.

- Latin America (LATAM): Growing market influenced by improved healthcare access and international aid focused on hepatitis screening; increasing demand for decentralized testing solutions.

- Middle East and Africa (MEA): High endemic burden, particularly in Sub-Saharan Africa; growth is highly dependent on funding from global health organizations (e.g., Global Fund, WHO) for rapid test deployment and basic laboratory infrastructure build-out.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hepatitis Viruses Diagnostic Tests Market.- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation (Beckman Coulter)

- Siemens Healthineers

- Bio-Rad Laboratories

- bioMérieux SA

- Hologic, Inc. (Gen-Probe)

- OraSure Technologies

- Grifols, S.A.

- Thermo Fisher Scientific

- Fujirebio Inc.

- Becton, Dickinson and Company (BD)

- Quest Diagnostics

- DiaSorin S.p.A.

- Serologicals Corporation

- Sysmex Corporation

- Advanced Diagnostic Laboratory (ADL)

- MedMira Inc.

- Trinity Biotech

- Altona Diagnostics GmbH

Frequently Asked Questions

Analyze common user questions about the Hepatitis Viruses Diagnostic Tests market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between serological and molecular testing for hepatitis viruses, and which technology is leading market growth?

Serological tests (like ELISA or CLIA) detect the body's immune response (antibodies) or viral proteins (antigens), indicating past or current infection status. Molecular tests, specifically Nucleic Acid Testing (NAT) such as PCR, directly detect the presence and quantify the amount of viral genetic material (RNA or DNA). NAT is critical for diagnosis during the acute 'window period' before antibody production and for monitoring treatment efficacy (viral load). NAT technology is currently leading market growth due to its superior sensitivity, specificity, and crucial role in managing chronic HBV and HCV infections.

How are Point-of-Care Testing (POCT) solutions transforming the diagnosis of viral hepatitis, especially in developing regions?

POCT solutions, including Rapid Diagnostic Tests (RDTs), are transforming diagnosis by decentralizing testing away from centralized laboratories, making it immediately accessible in primary care settings, community clinics, and remote areas. POCT devices provide fast results (typically under 20 minutes) using simple finger-prick blood samples, eliminating the need for complex infrastructure and long wait times. In developing regions with high endemic burdens, POCT dramatically improves screening rates, facilitates immediate linkage to care, and helps overcome logistical challenges related to sample transportation and loss to follow-up, thereby supporting global elimination goals by increasing diagnostic penetration.

Which specific hepatitis virus diagnosis segment contributes the most significant revenue to the market, and why is monitoring viral load so critical?

The Hepatitis C Virus (HCV) segment currently contributes the most significant revenue to the market, closely followed by Hepatitis B Virus (HBV). This dominance stems from the high global prevalence of chronic HBV and HCV infections, which necessitate widespread initial screening and long-term management. Monitoring viral load (the quantity of circulating virus) is critical because it is the primary indicator used by clinicians to assess disease activity, determine when to initiate antiviral treatment, and, most importantly, confirm the success of therapy. For HCV, achieving a sustained virological response (SVR) after treatment is monitored by viral load tests, making them indispensable components of the therapeutic pathway.

What are the main regulatory and economic barriers limiting the widespread adoption of advanced diagnostic technologies in emerging markets?

The widespread adoption of advanced diagnostic technologies, particularly highly automated NAT systems, faces significant regulatory and economic barriers in emerging markets. Economically, the initial capital expenditure for instruments and the recurring costs of proprietary reagents are often prohibitive for healthcare systems operating with limited public budgets. Regulatory challenges include fragmented national approval processes, which delay market entry, and inconsistent quality control standards across different regions, which necessitate significant investment in localized validation and infrastructure build-out. Furthermore, securing sustainable procurement and reimbursement for newer, more expensive tests remains a critical hurdle that slows down widespread integration into routine care protocols.

How is technological convergence, such as the integration of AI and molecular diagnostics, expected to improve treatment outcomes for chronic hepatitis?

Technological convergence, specifically the fusion of AI with molecular diagnostics, is expected to substantially improve treatment outcomes by enhancing diagnostic precision and streamlining patient management. AI algorithms analyze complex molecular data, such as viral genotyping and sequence mutations, to rapidly identify drug resistance markers, allowing clinicians to select the most effective, personalized direct-acting antiviral (DAA) regimen upfront. Additionally, AI optimizes high-throughput laboratory operations, ensuring faster turnaround times for viral load monitoring, which is essential for timely decision-making during treatment. This integration minimizes therapeutic failures, reduces costs associated with ineffective treatment, and accelerates the patient’s path toward cure or suppression, thereby improving overall public health metrics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager