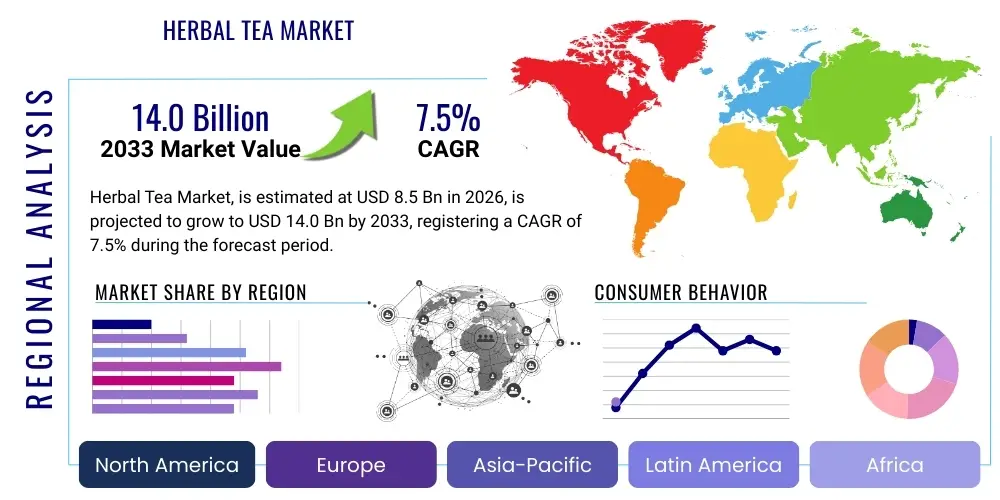

Herbal Tea Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437550 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Herbal Tea Market Size

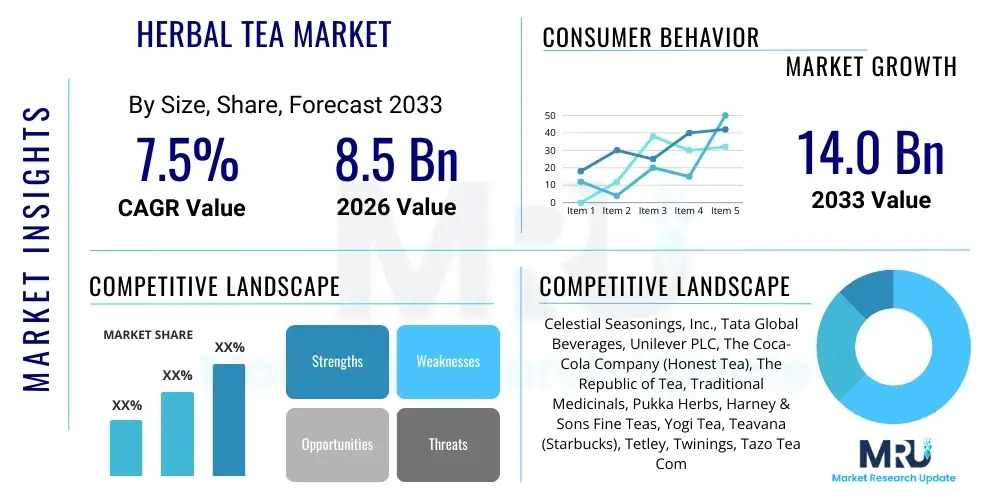

The Herbal Tea Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $14.0 Billion by the end of the forecast period in 2033.

Herbal Tea Market introduction

The Herbal Tea Market encompasses beverages derived from the infusion or decoction of various plant parts, including flowers, roots, spices, or leaves, excluding those traditionally classified as true teas (derived from Camellia sinensis). These botanical infusions, often referred to as tisanes, are primarily consumed for their perceived health benefits, aromatic profiles, and inherent therapeutic properties. Key products range from traditional single-ingredient teas like chamomile and peppermint to complex functional blends targeting specific wellness outcomes such as digestive aid, sleep improvement, and immune support. The global rise in health consciousness and a pronounced shift away from artificially sweetened carbonated drinks fuel the widespread adoption of herbal teas across diverse demographics.

Major applications of herbal teas span both the conventional beverage segment and the functional food and nutraceutical sectors. In the beverage segment, they serve as daily consumption alternatives, enjoyed hot or iced. Industrially, extracts derived from popular herbs like ginger, turmeric, and hibiscus are increasingly utilized as natural flavoring agents or active ingredients in cosmetic and pharmaceutical applications, expanding the market scope beyond direct consumer consumption. The versatility of these products, coupled with innovations in flavor combinations and sustainable sourcing, is solidifying their position as a core component of the wellness economy.

The principal benefits driving market expansion include the non-caffeinated nature of most varieties, making them suitable for evening consumption, and their association with traditional medicine, particularly Ayurveda and Traditional Chinese Medicine (TCM). Driving factors are anchored in consumer demand for natural, clean-label products, the increasing prevalence of lifestyle diseases requiring dietary management, and aggressive marketing campaigns by large beverage companies highlighting the functional attributes of specific herb combinations. Furthermore, regulatory support for natural health products in developed economies accelerates product innovation and market penetration.

Herbal Tea Market Executive Summary

The Herbal Tea Market is characterized by robust business trends centered on sustainability, customization, and functional enhancement. Key business strategies involve vertical integration, securing ethically sourced raw materials, and leveraging digital platforms for direct-to-consumer (D2C) sales, especially targeting younger, health-conscious demographics. Innovation is focused on optimizing bioavailability of active compounds and introducing novel formats, such as cold-brew herbal concentrates and effervescent dissolvable tablets. The competitive landscape is fragmented, featuring large international beverage conglomerates alongside highly specialized artisanal tea producers, driving continuous quality improvement and niche market development.

Regionally, Asia Pacific (APAC) maintains the largest market share due to the deep-rooted cultural acceptance and daily consumption of herbal infusions in countries like China and India, supplemented by rapid urbanization and rising disposable incomes. However, North America and Europe demonstrate the highest growth potential (CAGR), driven by the strong adoption of functional and premium organic tea variants, high consumer spending on wellness products, and proactive dietary modifications focused on stress reduction and sleep health. Latin America and the Middle East and Africa (MEA) are emerging regions, where increased awareness regarding natural remedies and expanding organized retail infrastructure are opening new distribution avenues.

Segment trends reveal that fruit/herbal blends are gaining traction due to their enhanced palatability and appeal to mainstream consumers seeking alternatives to traditional medicinal flavors. By application, the stress relief and relaxation segment is experiencing exponential growth, reflecting global societal trends toward managing anxiety and improving sleep quality without pharmaceutical interventions. The distribution landscape is rapidly shifting toward e-commerce platforms, which offer extensive product variety and transparent sourcing information, aligning with the clean-label demands of modern consumers, though supermarkets and hypermarkets remain foundational for mass-market availability.

AI Impact Analysis on Herbal Tea Market

Common user inquiries concerning AI's impact on the Herbal Tea Market frequently revolve around personalized health recommendations, supply chain transparency, and quality assurance. Users express keen interest in how AI can analyze individual biomarkers or dietary data to recommend specific herbal blends optimized for their unique physiological needs (personalized wellness). Concerns often focus on the ethical sourcing verification facilitated by AI-driven blockchain traceability and the potential for AI-controlled automated farming to impact the livelihood of traditional small-scale farmers. Expectations center on enhanced product efficacy testing through AI modeling of compound interactions and predictive analytics to forecast demand for seasonal or rare herbs, thereby optimizing inventory and minimizing waste across the supply chain.

- Personalized Recommendation Systems: AI algorithms analyze user-reported symptoms, fitness data, and genetic predispositions to suggest highly customized herbal tea blends for targeted wellness outcomes, significantly enhancing customer engagement and product relevance.

- Supply Chain Transparency and Traceability: Implementation of AI-enhanced blockchain technology ensures real-time tracking of raw materials from farm to consumer, verifying origin, organic status, and fair trade practices, addressing the crucial consumer demand for ethical sourcing.

- Predictive Quality Control: Machine learning models monitor and analyze sensory data (aroma, color, texture) and chemical profiles during harvesting and processing, identifying potential contaminants or inconsistencies faster than traditional methods, guaranteeing product safety and premium quality.

- Optimized Formulation and R&D: AI assists researchers in modeling the synergistic effects of various phytochemicals, accelerating the development of highly potent, evidence-based functional tea blends by simulating biological interactions before laboratory testing.

- Automated Cultivation and Yield Forecasting: AI-driven precision agriculture techniques are applied to herbal farming, optimizing irrigation, nutrient delivery, and pest control, leading to higher yields, reduced environmental impact, and consistent raw material quality.

- Demand Forecasting and Inventory Management: Advanced analytics predict consumer purchasing patterns, seasonal spikes, and regional preferences with high accuracy, allowing manufacturers and retailers to minimize stockouts and reduce perishable inventory waste.

DRO & Impact Forces Of Herbal Tea Market

The trajectory of the Herbal Tea Market is strongly influenced by a synergy of drivers focused on health and wellness, moderated by significant restraints related to standardization and competition, while offering substantial opportunities in personalized medicine and emerging markets. The primary driver is the global consumer pivot towards preventive healthcare, leading to increased adoption of natural remedies. Restraints include the high cost of certified organic raw materials and the lack of standardized regulatory classifications for herbal blends, which can confuse consumers and hinder large-scale medical endorsements. Opportunities lie in leveraging technological advancements for bioavailability enhancement and penetrating underrepresented geographic regions where traditional medicine practices are deeply ingrained but modern retail is expanding. The overall impact forces indicate a highly favorable environment for growth, provided industry stakeholders can effectively manage regulatory complexities and ensure transparent, science-backed product claims.

Key drivers include the demonstrable success of several herbal ingredients (like ginger, turmeric, and echinacea) in clinical trials for minor ailments, boosting consumer confidence. Furthermore, the aggressive anti-sugar campaigns globally have pushed consumers away from high-sugar beverages towards naturally flavored, non-caloric options like herbal teas. The impact of these drivers is magnified by increasing media coverage and social media influencers advocating for natural, plant-based diets and holistic wellness routines. This confluence creates a powerful market pull, compelling even traditional coffee and soft drink companies to diversify their portfolios with extensive herbal tea lines.

Conversely, significant restraints often involve the seasonality and climate sensitivity of specific herbs, leading to volatile raw material costs and supply inconsistencies, particularly for ethically or sustainably sourced ingredients. The market also faces substantial competition not only from functional true teas (green tea) but also from rapidly evolving categories such as functional beverages, vitamin-infused waters, and cold-pressed juices. Overcoming these restraints requires strategic investment in controlled environment agriculture (CEA) for high-value herbs and collaborative efforts across the industry to lobby for clearer regulatory pathways that differentiate high-quality herbal products from generic supplements. Successful navigation of these forces determines market leadership and sustained growth throughout the forecast period.

The opportunity landscape is defined by the ongoing fusion of wellness and technology. Bioavailability enhancement techniques, such as encapsulation or nano-emulsification, represent a critical area for investment, allowing smaller doses of herbs to deliver higher therapeutic effects. Geographic expansion into developing economies, where traditional health practices intersect with growing middle-class purchasing power, offers untapped potential. Furthermore, creating medical-grade herbal formulations backed by clinical evidence for chronic condition management presents a high-margin opportunity, positioning herbal teas not merely as lifestyle beverages but as clinically relevant dietary interventions, significantly amplifying their market value proposition.

Segmentation Analysis

The Herbal Tea Market is segmented primarily based on Product Type, Flavor, Distribution Channel, and Application, providing a granular view of consumer preferences and market dynamics. Product Type segmentation distinguishes between loose leaf, tea bags, and ready-to-drink (RTD) formats, reflecting differences in convenience and perceived quality. Flavor segmentation highlights the consumer pivot from traditional herbal profiles to complex fruit and spice combinations. The Distribution Channel analysis confirms the rising dominance of e-commerce alongside traditional brick-and-mortar retail, while Application segmentation delineates the functional drivers of demand, focusing on areas like health, wellness, and specific therapeutic benefits.

Analyzing these segments reveals critical shifts in consumer behavior. The convenience offered by RTD herbal teas and packaged tea bags drives volume growth, catering to busy urban lifestyles, despite the preference for loose leaf among purists for superior flavor and freshness. Flavor innovation, particularly the integration of exotic fruits and adaptogenic mushrooms, is key to attracting younger consumers previously disengaged from the category. The fastest-growing application segments are those addressing mental health and immunity, underscoring the market's response to global health crises and pervasive stress.

Strategic success within this market requires manufacturers to diversify their offerings across formats and channels. For instance, launching premium, organic loose-leaf products through specialized online retailers, while simultaneously introducing affordable, high-volume tea bags into mass retail chains ensures maximum market penetration. Understanding the regional nuances within each segment—such as the high demand for medicinal applications in Asia versus the lifestyle and flavor-driven demand in the West—is essential for optimizing product portfolio and marketing execution.

- By Product Type:

- Tea Bags

- Loose Leaf Tea

- Ready-to-Drink (RTD) Tea

- Herbal Concentrates and Extracts

- By Flavor:

- Chamomile

- Peppermint

- Ginger

- Rooibos

- Hibiscus

- Fruit and Spice Blends (e.g., Apple Cinnamon, Berry)

- Others (Lemon Balm, Echinacea)

- By Application:

- Relaxation and Sleep Support

- Digestive Health

- Immune System Support

- Detox and Weight Management

- General Wellness and Hydration

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores (Tea Houses)

- Convenience Stores

- Online Retail (E-commerce)

Value Chain Analysis For Herbal Tea Market

The Value Chain of the Herbal Tea Market begins with upstream activities focused on the cultivation and ethical sourcing of diverse botanicals. This stage is critical, as the quality and therapeutic efficacy of the final product are directly dependent on the purity, climate, and harvesting techniques employed by farmers. Key upstream players include specialized agricultural cooperatives, wild-harvesters, and suppliers of organic certifying bodies. Ensuring sustainable practices and fair trade principles at this level is paramount for maintaining brand credibility, especially for premium and organic market segments, requiring robust partnership models and traceability systems.

Midstream processing involves drying, curing, cleaning, cutting, and blending the raw herbs. Advanced processing technologies are employed here to preserve volatile oils and active components, using methods like flash-freezing or specialized low-temperature drying. Manufacturers then focus on formulation, where R&D teams create blends that balance flavor profiles with functional benefits. Packaging—ranging from sustainable, compostable tea bags to sophisticated aluminum cans for RTD products—is also a core midstream activity, influenced by consumer demand for eco-friendly solutions and extended shelf life.

Downstream activities center on distribution and sales. The distribution channel is complex, featuring direct and indirect pathways. Direct distribution includes D2C websites and flagship retail stores, offering maximum control over branding and customer interaction. Indirect distribution relies heavily on established networks, utilizing wholesalers, large retail chains (supermarkets/hypermarkets), and rapidly expanding third-party e-commerce logistics providers. Specialty health food stores also play a vital role, particularly for high-end, niche, or certified nutraceutical herbal products. Effective inventory management and cold chain logistics (for some RTD products) are essential downstream challenges.

Herbal Tea Market Potential Customers

The primary end-users and potential buyers in the Herbal Tea Market are highly diverse, spanning various age groups, income brackets, and geographic locations, unified by an overarching pursuit of wellness and healthier beverage alternatives. The largest segment comprises health-conscious millennials and Gen Z consumers who prioritize functional benefits, ethical sourcing, and aesthetically pleasing packaging. These buyers are digitally savvy, rely heavily on peer reviews and influencer recommendations, and are willing to pay a premium for organic, rare, or adaptogenic ingredients tailored for stress relief or cognitive enhancement.

Another significant customer segment is the aging population (Baby Boomers and older Gen X) who often consume herbal teas for traditional medicinal purposes, focusing on specific health issues such as arthritis, high blood pressure, or digestive disorders. This group places greater value on established scientific backing, traditional brands, and availability in conventional retail channels like pharmacies and grocery stores. Their purchasing decisions are often driven by physician recommendations or long-held cultural beliefs regarding the efficacy of specific herbs, favoring proven single-ingredient teas like ginger or senna.

Furthermore, commercial buyers, including restaurants, cafés, and institutional food service providers, represent a growing market, increasingly seeking high-quality, diverse herbal tea selections to meet customer demand for healthy and premium non-alcoholic options. The nutraceutical and pharmaceutical industries also act as major buyers of herbal extracts, using them as base ingredients in dietary supplements, cosmetics, and functional foods. Targeting these institutional buyers requires robust supply chain compliance, large-scale production capabilities, and guaranteed standardization of active compounds.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $14.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Celestial Seasonings, Inc., Tata Global Beverages, Unilever PLC, The Coca-Cola Company (Honest Tea), The Republic of Tea, Traditional Medicinals, Pukka Herbs, Harney & Sons Fine Teas, Yogi Tea, Teavana (Starbucks), Tetley, Twinings, Tazo Tea Company, BOH Tea, Organic India, Alvita Tea. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Herbal Tea Market Key Technology Landscape

The technological evolution within the Herbal Tea Market focuses primarily on maximizing product efficacy, ensuring safety, and optimizing sustainable production processes. A significant area of advancement is in extraction and preservation technologies. Techniques such as Supercritical Fluid Extraction (SFE), particularly using CO2, are being increasingly adopted to isolate volatile essential oils and highly sensitive bioactive compounds from herbs without using harsh solvents. This method ensures maximum potency and purity, crucial for functional tea formulations. Similarly, specialized low-temperature drying (e.g., vacuum drying or freeze-drying) is employed immediately post-harvest to prevent enzymatic degradation, maintaining the herb’s color, aroma, and therapeutic properties far better than traditional sun or air drying.

Furthermore, packaging technology plays a pivotal role in maintaining quality and responding to consumer demands for sustainability. Innovations include the development of biodegradable and compostable tea bags (often made from PLA or non-GMO cornstarch), replacing traditional plastic or nylon meshes. Advanced barrier films and nitrogen flushing in packaging machinery are utilized to prevent oxidation and moisture ingress, significantly extending the shelf life of highly perishable herbal ingredients. For the RTD segment, aseptic filling technologies and high-pressure processing (HPP) are adopted to provide clean-label preservation, avoiding the need for artificial preservatives while ensuring microbial safety.

Beyond processing, digital technologies are crucial for competitive advantage. Sophisticated sensory analysis tools, often incorporating AI for pattern recognition, are used to standardize flavor and aroma profiles across different batches and harvests. Traceability is enhanced through digital tracking systems, sometimes integrated with blockchain, verifying the provenance and organic status of ingredients, satisfying regulatory demands and consumer trust. These technological investments, particularly in extraction and quality assurance, are essential for brands aiming to differentiate themselves in the premium functional tea segment and secure long-term market leadership.

Regional Highlights

Regional dynamics heavily influence the Herbal Tea Market's structure, reflecting varying consumption patterns, cultural history, and regulatory frameworks across the globe. Asia Pacific (APAC) dominates the market in terms of volume consumption, driven by countries like China and India where herbal remedies (such as Ayurvedic and TCM infusions) are integral to daily life and recognized health treatments. The sheer population size, coupled with rapid economic growth and increasing adoption of branded, packaged herbal teas over traditional home brews, cements APAC's position. Growth here is fueled by demand for functional teas targeting metabolic health and immune support.

North America and Europe collectively represent the most valuable markets for premium and functional herbal teas, characterized by high Average Selling Prices (ASP). In these regions, consumption is less about tradition and more about lifestyle choice, preventive health, and stress mitigation. The robust regulatory environment in the EU, particularly regarding organic certifications and permissible claims, pushes manufacturers toward high transparency. The fastest growth is observed in specialty stores and online channels in these regions, catering to affluent consumers focused on niche, single-origin, or adaptogenic blends like ashwagandha and holy basil.

Latin America (LATAM) and the Middle East and Africa (MEA) are characterized as emerging markets. LATAM shows strong growth potential due to local traditions regarding herbs (e.g., yerba mate region) and increasing Western influence on wellness trends. MEA’s market growth is slower but steady, particularly within urban centers where disposable income is rising and there is a growing appreciation for imported, high-quality herbal products, specifically those offering detoxification or digestive benefits. Investment in local sourcing and establishing localized production facilities will be critical for sustained penetration in these developing regions.

- Asia Pacific (APAC): Market volume leader; driven by cultural acceptance (TCM, Ayurveda); high demand for ginger, turmeric, and traditional blends; experiencing high shift towards branded, organic packaged teas.

- North America: Highest growth rate for functional and premium segments; strong consumer interest in adaptogens (stress relief, cognitive function); high dependence on e-commerce distribution and advanced marketing strategies.

- Europe: Mature market with stringent regulatory standards (clean-label, organic certification); focus on sustainably sourced, traceable ingredients; major consumers of chamomile, peppermint, and complex wellness blends.

- Latin America (LATAM): Emerging market with growing appreciation for international wellness trends; strong regional base in indigenous herbs; retail expansion is a key growth driver.

- Middle East and Africa (MEA): Growing urban consumption; emphasis on detoxification and digestive health teas; influenced by health awareness campaigns and rising tourism driving exposure to global brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Herbal Tea Market.- Celestial Seasonings, Inc.

- Tata Global Beverages

- Unilever PLC

- The Coca-Cola Company (Honest Tea)

- The Republic of Tea

- Traditional Medicinals

- Pukka Herbs

- Harney & Sons Fine Teas

- Yogi Tea

- Teavana (Starbucks)

- Tetley

- Twinings

- Tazo Tea Company

- BOH Tea

- Organic India

- Alvita Tea

- Stash Tea Company

- Bigelow Tea Company

- Adagio Teas

- Numi, Inc.

Frequently Asked Questions

Analyze common user questions about the Herbal Tea market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the increased demand for functional herbal teas globally?

The primary driver is the widespread consumer shift toward preventive health measures and natural remedies, coupled with a desire to reduce caffeine and sugar intake. Functional teas, which target specific health outcomes like improved sleep, stress reduction (adaptogens), and immune support, align perfectly with the modern holistic wellness trend, increasing their perceived value beyond simple hydration.

How is sustainability impacting sourcing and production within the Herbal Tea Market?

Sustainability is a core focus, driven by consumer demand for ethical sourcing and environmental responsibility. Manufacturers are increasingly adopting sustainable farming practices, seeking certifications (e.g., Fair Trade, Organic), and investing in biodegradable packaging materials to minimize environmental footprint and ensure supply chain stability, often resulting in higher product pricing but greater brand loyalty.

Which segments of the Herbal Tea Market are projected to experience the fastest growth?

The Ready-to-Drink (RTD) format segment is expected to exhibit the fastest volume growth due to convenience, catering to on-the-go consumption. By application, teas focusing on mental wellness, including anxiety reduction and cognitive enhancement (using ingredients like L-theanine and adaptogens), are witnessing the most rapid value growth in developed economies, reflecting current societal health needs.

What are the main regulatory challenges faced by herbal tea producers?

The main challenges involve the lack of standardized global definitions and clinical evidence for many herbal ingredients. Producers must navigate complex regulations regarding health claims, ensuring marketing assertions do not cross the line from dietary supplement benefits into medical treatment claims, which requires rigorous documentation and often limits the scope of public messaging.

How significant is the role of e-commerce in the distribution of herbal teas?

E-commerce is highly significant, acting as a crucial growth engine, particularly for niche, premium, and artisanal brands that require minimal physical shelf space. Online platforms offer unparalleled product variety, facilitate direct-to-consumer relationships, and allow for transparent storytelling about sourcing and ethical practices, resonating strongly with the target health-conscious consumer base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager