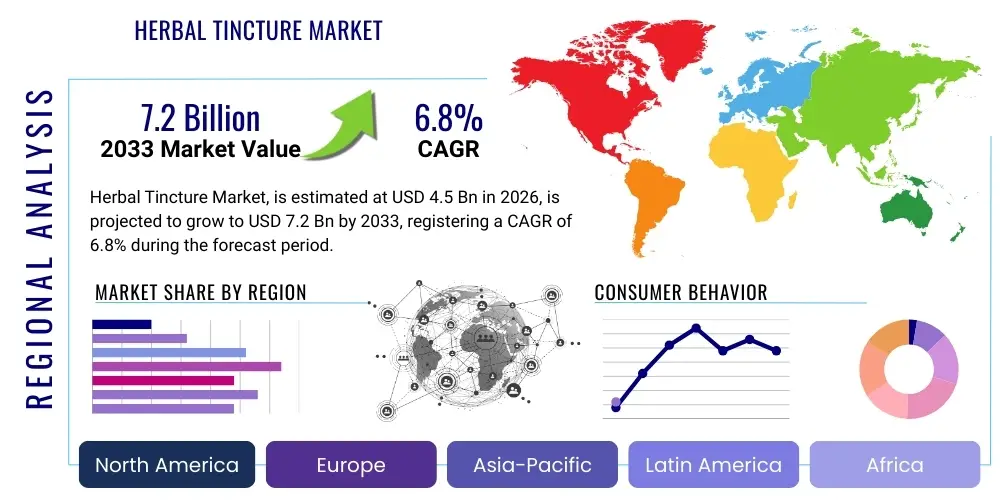

Herbal Tincture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436875 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Herbal Tincture Market Size

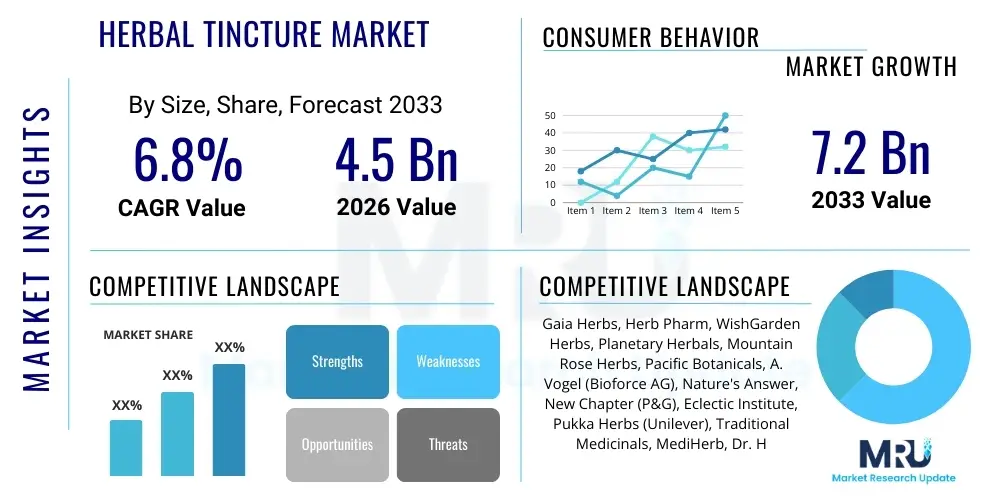

The Herbal Tincture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Herbal Tincture Market introduction

The Herbal Tincture Market encompasses the production, distribution, and sale of concentrated liquid herbal extracts created by soaking herbs (fresh or dried) in a solvent, typically alcohol, glycerin, or vinegar. These extracts offer high bioavailability and efficacy, enabling rapid absorption of active phytochemicals into the bloodstream. Herbal tinctures serve as a foundational element in traditional and modern herbalism, catering to consumer demand for natural remedies for conditions ranging from anxiety and sleep disturbances to immune support and digestive health. The product description emphasizes their potency, extended shelf life compared to fresh herbs, and ease of administration via dropper.

Major applications of herbal tinctures span dietary supplements, functional foods, and cosmetics, although the primary usage remains concentrated in therapeutic and prophylactic health management. Consumers are increasingly using tinctures for personalized medicine, combining various single-herb extracts (simples) or complex blends tailored to specific health goals. Key benefits driving adoption include the preservation of sensitive plant compounds, precise dosage control, and the absence of synthetic excipients often found in pills or capsules. The market is characterized by high fragmentation, featuring numerous small-batch producers focused on organic and ethically sourced raw materials, alongside larger nutraceutical corporations integrating tinctures into their broader supplement portfolios.

Driving factors propelling market expansion include a global paradigm shift towards holistic wellness, heightened awareness regarding the side effects of conventional pharmaceutical drugs, and robust growth in the self-care movement. Additionally, regulatory frameworks supporting the categorization of herbal products as dietary supplements, particularly in North America and Europe, facilitate easier market entry and product innovation. Technological advancements in extraction methods, such as supercritical CO2 extraction, are improving the purity and concentration of active ingredients, further enhancing consumer trust and product efficacy, solidifying the market's upward trajectory across diverse consumer demographics seeking natural alternatives.

Herbal Tincture Market Executive Summary

The Herbal Tincture Market is poised for substantial expansion, driven by converging business trends, including the premiumization of organic and sustainably sourced products, and the rise of direct-to-consumer (D2C) sales models leveraging e-commerce platforms. Manufacturers are strategically focusing on clinical substantiation of traditional herbal claims and incorporating advanced extraction technologies to maximize compound efficacy, thereby justifying premium pricing. Strategic mergers, acquisitions, and collaborations between independent herbalists and large consumer health companies are becoming prevalent, aimed at expanding geographic reach and diversifying product offerings. Furthermore, the trend toward personalized nutrition necessitates smaller-batch, customized tincture blends, opening lucrative niche markets for specialized producers.

Regionally, North America maintains market dominance due to high consumer spending on dietary supplements, established regulatory acceptance of herbal products, and a strong culture of alternative medicine usage, particularly in the United States. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rising disposable incomes, increasing Western influence regarding wellness trends, and the deeply ingrained practice of traditional Chinese medicine (TCM) and Ayurveda, where liquid herbal formulations are standard. European growth is sustained by rigorous quality standards and increasing integration of herbal remedies into mainstream pharmacological practice, notably in Germany and France, alongside strict enforcement of botanical identity and traceability.

Segment trends highlight the dominance of the alcohol-based segment due to its superior extraction efficiency and preservative qualities, though glycerin-based and vinegar-based alternatives are gaining traction, especially among consumers avoiding alcohol, such as pregnant women or children. The segmentation by application shows immune support, stress and sleep management, and digestive health as the fastest-growing therapeutic categories. Single-herb tinctures currently command a larger market share, but complex formulation blends are rapidly increasing in popularity, reflecting the growing sophistication of consumer knowledge and the demand for multi-symptom solutions. The distribution channel analysis confirms the growing importance of online retail and specialty health food stores over conventional pharmacy channels for these niche products.

AI Impact Analysis on Herbal Tincture Market

Common user questions regarding AI's impact on the Herbal Tincture Market center on how technology can validate traditional knowledge, optimize supply chains, and personalize formulation recommendations. Users frequently inquire about AI's role in identifying novel phytochemical interactions, ensuring quality control, and differentiating authentic herbal ingredients from adulterated sources. The key thematic concerns revolve around the ethical use of traditional ecological knowledge (TEK) in AI models and the potential for AI-driven automation to disrupt small-scale artisanal production. Expectations are high regarding AI’s ability to drastically improve the consistency and clinical evidence supporting herbal claims, moving the industry away from purely anecdotal evidence towards evidence-based natural medicine through sophisticated data analytics and machine learning applications in R&D and quality assurance processes.

- AI-driven Predictive Modeling: Utilizing machine learning algorithms to predict efficacy and toxicity profiles of new herbal compound combinations, accelerating R&D cycles and identifying synergistic effects.

- Supply Chain Optimization: Implementing AI for demand forecasting, inventory management, and ensuring raw material traceability from cultivation to final extraction, thereby mitigating risks of contamination or shortages.

- Quality Assurance and Adulteration Detection: Employing advanced image recognition and spectroscopic data analysis (e.g., HPLC-UV, LC-MS) processed by AI to instantly verify the identity, purity, and concentration of botanical raw materials and finished products, surpassing traditional laboratory methods.

- Personalized Tincture Formulation: Developing AI platforms that analyze individual genomic data, lifestyle factors, and specific health concerns to recommend precise, customized multi-herb tincture blends and optimal dosages.

- Automated Extraction Process Control: Using AI to monitor and adjust real-time parameters (temperature, pressure, solvent ratio) during supercritical fluid extraction (SFE) or cold percolation processes, ensuring maximum yield and consistent phytochemical profiles.

- Consumer Engagement and Education: Deploying chatbots and intelligent recommendation systems to educate consumers on specific herb properties, usage protocols, and potential drug interactions, enhancing user confidence and compliance.

DRO & Impact Forces Of Herbal Tincture Market

The Herbal Tincture Market is primarily driven by escalating consumer interest in preventive healthcare and natural remedies, coupled with increasing scientific research validating the efficacy of specific botanical extracts. A significant driver is the widespread perception of herbal products as safer alternatives with fewer side effects compared to synthetic pharmaceuticals, particularly for chronic, non-life-threatening conditions. Furthermore, advancements in analytical chemistry allow manufacturers to provide standardized extracts with verified potencies, bridging the gap between traditional medicine and modern quality expectations. The burgeoning e-commerce sector acts as a powerful enabling force, offering global accessibility to specialized herbal products and educational resources, thereby accelerating consumer adoption.

Restraints, however, pose significant challenges to sustained growth. These include stringent and often inconsistent regulatory hurdles across different geographies regarding health claims and product labeling, which can impede international trade and marketing efforts. The market also suffers from pervasive issues related to raw material standardization and adulteration; inconsistent harvesting practices and geographical variations in plant composition lead to variability in finished product quality, generating consumer skepticism. High production costs associated with sourcing organic, sustainably wildcrafted, and verifiable raw materials, coupled with the necessity for specialized extraction equipment, limit economies of scale for smaller market participants, contributing to overall pricing pressure.

Opportunities for expansion are abundant, particularly through technological innovation, such as utilizing advanced encapsulation techniques (e.g., liposomal delivery) to enhance the bioavailability of hydrophobic herbal compounds. The massive potential lies in tapping into clinical research to validate efficacy for complex modern diseases, which would enable integration into mainstream medical settings. Geographically, underserved markets in developing economies represent substantial future growth potential, driven by improving economic conditions and increased focus on health infrastructure. The impact forces indicate that consumer education and the digitalization of herbal consultations will amplify market penetration, while regulatory clarity and technological refinement in quality control remain critical determinants for market resilience and acceptance among conventional health practitioners.

Segmentation Analysis

The Herbal Tincture Market segmentation provides a granular view of consumer preferences, technological application, and distribution pathways, enabling targeted marketing and product development strategies. The market is primarily dissected based on the type of solvent used in extraction (Alcohol, Glycerin, Vinegar), the application area (Immune Support, Stress & Sleep, Digestive Health, etc.), the type of herb used (Single Herb vs. Complex Blends), and the distribution channel. This multi-faceted analysis reveals key growth pockets, with alcohol-based tinctures dominating due to their longevity and extraction efficiency, while the rapid growth in complex blend formulations highlights the market's pivot towards functional and targeted nutritional solutions based on polyherbal synergy.

- Solvent Type:

- Alcohol-Based Tinctures

- Glycerin-Based Tinctures (Glycerites)

- Vinegar-Based Tinctures (Acetates)

- Other Solvents (e.g., Hydro-alcoholic, specific oils)

- Application:

- Immune System Support

- Stress and Sleep Management (Nervous System)

- Digestive Health (Gastrointestinal)

- Cognitive Health and Focus

- Women's Health (Hormonal Balance)

- Pain and Inflammation Management

- Detoxification and Liver Support

- Other Applications (e.g., Cardiovascular, Respiratory)

- Herb Type:

- Single Herb Tinctures (Simples)

- Complex Blend Formulations (Polyherbal)

- Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Health Stores and Herbal Pharmacies

- Conventional Pharmacies and Drug Stores

- Direct Sales and Practitioner Channels

Value Chain Analysis For Herbal Tincture Market

The Value Chain for the Herbal Tincture Market commences with the crucial Upstream Analysis focused on raw material sourcing. This stage involves the ethical cultivation, wildcrafting, and processing of medicinal herbs, requiring significant expertise in sustainable agricultural practices and botanical identity verification. Suppliers must adhere to stringent quality standards, including heavy metal testing, pesticide residue analysis, and confirmation of active constituent concentrations, which dictates the quality of the final tincture. Key upstream activities involve specialized agricultural cooperatives, certified organic farms, and global commodity traders specializing in high-grade botanicals. The efficacy of the final product is intrinsically linked to the geographical origin and timely harvesting of the raw plants, necessitating robust supplier certification programs and transparency.

The Midstream stage encompasses manufacturing and transformation, starting with the meticulous preparation of the raw plant material (drying, grinding) followed by the extraction process (maceration, percolation) using appropriate solvents. This phase is capital-intensive, requiring specialized equipment for precise temperature and solvent control to maximize the yield and purity of the extract. Subsequent steps include filtration, standardization, blending (for complex formulations), and bottling. Quality control checkpoints are paramount throughout this stage, utilizing techniques such as High-Performance Liquid Chromatography (HPLC) to ensure consistent potency and compliance with cGMP guidelines. Effective standardization practices are critical for maintaining brand credibility and ensuring therapeutic consistency across batches.

Downstream analysis focuses on distribution and sales, covering both Direct and Indirect Channels. Indirect distribution relies heavily on specialty health food stores, nutraceutical distributors, and large e-commerce marketplaces (Amazon, etc.). This channel benefits from wide market reach but involves margin compression due to intermediaries. Direct channels, including brand-specific websites and professional practitioner sales (naturopaths, herbalists), offer higher margins, better control over brand messaging, and deeper customer engagement. The final consumer touchpoint emphasizes educational content, precise labeling, and professional consultation to ensure proper usage, reflecting the high-value, advice-driven nature of the herbal tincture category.

Herbal Tincture Market Potential Customers

The primary segments of potential customers in the Herbal Tincture Market are broadly categorized into consumers actively engaged in holistic wellness, individuals seeking preventative care solutions, and patients dealing with chronic, mild to moderate ailments who prefer natural remedies. This demographic is often highly educated, digitally native, and proactive about their health management, frequently researching ingredients and product sourcing before purchase. Key buying motivations include a desire for products with high bioavailability, clean labels (avoiding synthetic additives), and alignment with specific lifestyle choices, such as veganism, organic sourcing, or alcohol avoidance (driving demand for glycerites).

Specific target groups include the "Wellness Enthusiast," typically women aged 25-55 who integrate supplements into their daily routine for energy, stress, and hormonal balance. Another crucial segment is the "Natural Remedy Seeker," often older adults (50+) who are managing age-related health issues like mild arthritis, sleep problems, or digestive discomfort and are wary of long-term pharmaceutical use. These consumers prioritize trusted historical usage data and endorsements from natural health practitioners. The rapid expansion of the 'Millennial and Gen Z' demographic focusing on mental health also positions them as high-potential buyers, particularly for adaptogenic and nervine tinctures addressing stress and cognitive performance.

Additionally, professional buyers, such as clinical herbalists, naturopathic doctors, and functional medicine practitioners, represent a vital B2B segment. These professionals act as key influencers and bulk purchasers, relying on high-potency, practitioner-grade tinctures for clinical dispensing. Their requirements center on rigorous third-party testing, certified potency, and extensive supplier transparency. The market must cater to both the individual end-user, who values convenience and accessibility via online channels, and the professional buyer, who demands technical data and specialized bulk purchasing options, ensuring the product range is deep and quality is unimpeachable across all offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gaia Herbs, Herb Pharm, WishGarden Herbs, Planetary Herbals, Mountain Rose Herbs, Pacific Botanicals, A. Vogel (Bioforce AG), Nature's Answer, New Chapter (P&G), Eclectic Institute, Pukka Herbs (Unilever), Traditional Medicinals, MediHerb, Dr. Hauschka, NOW Foods, MegaFood, Oregon’s Wild Harvest, Banyan Botanicals, Sun Potion, Vitanica. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Herbal Tincture Market Key Technology Landscape

The technological landscape of the Herbal Tincture Market is defined by continuous advancements in extraction efficiency, quality control, and formulation refinement, moving beyond traditional cold percolation methods. Modern manufacturers are heavily investing in Supercritical Fluid Extraction (SFE), particularly using CO2, which allows for solvent-free extraction at low temperatures. SFE technology yields highly pure, concentrated extracts that are standardized to specific marker compounds without thermal degradation, addressing critical consumer demands for purity and potency. This technique is becoming increasingly vital for extracting non-polar compounds and ensuring the absence of residual synthetic solvents, setting a new benchmark for premium tincture production across the industry.

Furthermore, technology plays a critical role in analytical testing and quality assurance. High-Performance Liquid Chromatography (HPLC), Gas Chromatography–Mass Spectrometry (GC-MS), and Nuclear Magnetic Resonance (NMR) spectroscopy are standard analytical tools used to fingerprint botanical extracts. These methods allow manufacturers to definitively confirm the identity of the plant species, detect potential adulteration (such as adding synthetic fillers or cheaper substitutes), and precisely quantify the level of active pharmacological components in the final tincture. This rigorous technological validation is essential for compliance with global regulatory bodies and building consumer trust in a historically unregulated sector.

Innovative formulation technologies, such as micro-encapsulation and liposomal delivery systems, are emerging as key competitive differentiators. Liposomal encapsulation involves surrounding the herbal extract molecules with microscopic lipid vesicles, dramatically increasing their stability and systemic bioavailability compared to conventional liquid formulations. While still nascent, the application of these drug delivery technologies to herbal tinctures is allowing for the successful delivery of complex or poorly absorbed compounds, such as curcuminoids or certain essential oils, thereby expanding the therapeutic applications and perceived value of the product format. The integration of advanced data analytics and blockchain technology for supply chain transparency further underscores the technological evolution driving market growth.

Regional Highlights

North America, particularly the United States, holds the largest market share in the Herbal Tincture Market, primarily due to the high acceptance of herbal supplements as mainstream health products and strong consumer confidence in naturopathic and complementary medicine. The region benefits from a well-developed infrastructure for product manufacturing, quality testing, and distribution, coupled with a high prevalence of self-medication for conditions like stress, immunity, and chronic pain. High disposable incomes and proactive marketing by key industry players solidify this region's dominance. Regulatory clarity, primarily governed by the Dietary Supplement Health and Education Act (DSHEA), provides a stable environment for product innovation and market entry, albeit with restrictions on explicit therapeutic claims.

Europe represents a mature and highly regulated market, with significant contributions from Germany, France, and the UK. Germany stands out due to the official recognition of phytomedicines by health authorities, leading to higher rates of prescription and integration of herbal tinctures into standard medical practice. The European market focuses heavily on quality standards enforced by organizations like the European Medicines Agency (EMA) and national pharmacopoeias, necessitating rigorous standardization and clinical evidence. Consumer preferences lean towards locally sourced, high-quality, and sustainably produced organic extracts, driving premium pricing and focusing competition on botanical quality and scientific substantiation.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by a synthesis of traditional herbal medicine practices (TCM in China, Ayurveda in India) and rapidly increasing urbanization and Western lifestyle diseases. While traditional remedies often involve liquid decoctions, there is a growing trend towards adopting Western-style, potent alcohol or glycerin-based tinctures for convenience and standardization. Economic growth, rising health consciousness, and a massive population base create immense untapped potential, particularly as local manufacturers increasingly adopt international quality standards (cGMP) to cater to both domestic premium segments and export markets, significantly impacting global demand dynamics during the forecast period.

- North America (USA, Canada): Market leader; driven by high supplement consumption, strong e-commerce penetration, and widespread use of adaptogens and immune support tinctures.

- Europe (Germany, UK, France): High regulatory standards; strong integration of herbal remedies into conventional healthcare (Phytomedicine); demand for certified organic and traceable ingredients.

- Asia Pacific (China, India, Australia): Fastest growth anticipated; modernization of traditional medicine (TCM/Ayurveda); rapid expansion of health and wellness expenditure and urbanization.

- Latin America (Brazil, Mexico): Emerging market; demand driven by affordable natural alternatives and strong indigenous herbal traditions; local sourcing and focus on ethnobotanicals.

- Middle East and Africa (MEA): Nascent market; growth concentrated in urban centers; focus on wellness and detox products; influenced heavily by imports from European and North American brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Herbal Tincture Market.- Gaia Herbs

- Herb Pharm

- WishGarden Herbs

- Planetary Herbals

- Mountain Rose Herbs

- Pacific Botanicals

- A. Vogel (Bioforce AG)

- Nature's Answer

- New Chapter (P&G)

- Eclectic Institute

- Pukka Herbs (Unilever)

- Traditional Medicinals

- MediHerb

- Dr. Hauschka

- NOW Foods

- MegaFood

- Oregon’s Wild Harvest

- Banyan Botanicals

- Sun Potion

- Vitanica

Frequently Asked Questions

Analyze common user questions about the Herbal Tincture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between alcohol-based and glycerin-based herbal tinctures?

The key distinction lies in the solvent and resulting potency. Alcohol-based tinctures (typically 25-90% alcohol) are generally more potent, offering superior extraction of fat-soluble and water-soluble compounds, resulting in a longer shelf life (up to five years). Glycerin-based tinctures (glycerites) use vegetable glycerin as the solvent, making them alcohol-free and naturally sweet, suitable for children or those avoiding alcohol, though they may have a shorter shelf life and lower potency for certain resinous or non-polar plant constituents.

How do advancements in extraction technology impact the quality of herbal tinctures?

Advanced extraction technologies, such as Supercritical Fluid Extraction (SFE) using CO2, significantly enhance tincture quality by ensuring higher purity and consistency. SFE allows for targeted extraction of active compounds without thermal degradation, resulting in a cleaner product free from residual solvents. These methods facilitate the standardization of tinctures to precise phytochemical levels, moving the industry toward evidence-based dosages and reliable product efficacy, which is critical for consumer trust.

Which application segment drives the highest demand in the Herbal Tincture Market?

The Immune System Support and Stress and Sleep Management segments are the primary drivers of demand. Increased public awareness of preventative health, coupled with rising stress levels globally, has fueled significant growth in adaptogenic herbs (like Ashwagandha and Rhodiola) and nervine herbs (like Chamomile and Valerian) offered in tincture format. The ease of sublingual application and rapid absorption make tinctures a preferred format for immediate relief and daily immune maintenance compared to solid dosage forms.

What are the major regulatory challenges faced by herbal tincture manufacturers globally?

Major regulatory challenges include the lack of globally harmonized standards for herbal product classification and health claims. In regions like the EU, stringent requirements for clinical documentation often treat tinctures as quasi-medicines, while in the U.S., they are classified as dietary supplements, limiting explicit disease-related claims. Ensuring consistent Good Manufacturing Practices (cGMP) compliance and navigating complex international labeling requirements regarding botanical identity and potency remain significant hurdles, particularly for global market penetration.

How is e-commerce influencing the distribution and sales landscape of herbal tinctures?

E-commerce has profoundly transformed the market by enabling Direct-to-Consumer (D2C) sales, cutting out intermediaries, and facilitating global reach for niche, artisan producers. Online platforms provide necessary educational content, user reviews, and personalized recommendations, which are crucial for high-involvement herbal purchases. The digital channel allows consumers to access specialized complex blend formulations and organic, sustainably sourced products that are often unavailable in conventional retail pharmacies, accelerating market fragmentation and brand diversification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager