Hermetic Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433467 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Hermetic Motors Market Size

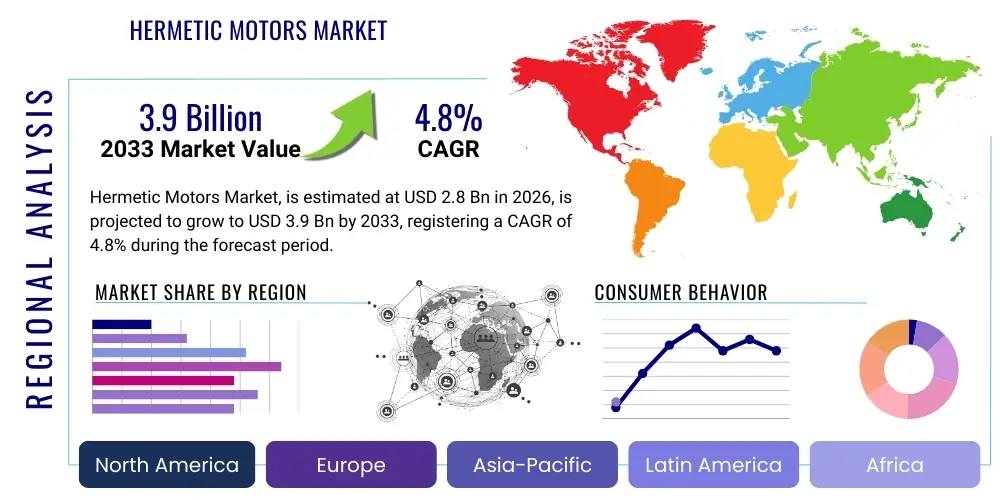

The Hermetic Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $2.8 Billion in 2026 and is projected to reach $3.9 Billion by the end of the forecast period in 2033.

Hermetic Motors Market introduction

The Hermetic Motors Market encompasses electric motors specifically designed to operate within a sealed, pressure-tight casing, typically integrated directly into a compressor unit, primarily used in refrigeration, air conditioning (HVAC), and other fluid handling applications where leakage is strictly prohibited. These motors eliminate the need for traditional shaft seals, which are common points of failure and refrigerant loss, thereby ensuring system integrity and maximizing operational efficiency. The primary product description centers on custom-engineered stator and rotor assemblies that are resistant to chemical erosion from refrigerants and lubricants, capable of high-speed operation, and engineered for long operational lifecycles without external maintenance.

Major applications of hermetic motors include driving compressors in residential and commercial HVAC systems, cold storage facilities, supermarket display cases, and industrial chillers. Their intrinsic safety against fluid contamination makes them indispensable in sensitive environments and critical infrastructure. The primary benefits derived from using hermetic motors are enhanced energy efficiency, significantly reduced maintenance costs due to the sealed design, and environmental compliance through minimized refrigerant emissions. Furthermore, the compact design allows for better integration into space-constrained systems, pushing manufacturers towards adoption in modern, high-density cooling solutions.

The market growth is fundamentally driven by stringent global regulations concerning energy consumption and environmental impact, particularly the phasing out of high Global Warming Potential (GWP) refrigerants which necessitate redesigns compatible with new, mildly flammable refrigerants (like R-32 or R-1234yf). Furthermore, the rapid expansion of the cold chain logistics sector, especially in emerging economies, coupled with increased consumer demand for efficient air conditioning systems, continuously fuels the demand for high-performance, durable hermetic motor-compressor units. Technological advancements focusing on integrating Variable Speed Drives (VSD) with hermetic motors also contribute substantially to market expansion by offering superior speed control and improved part-load efficiency.

Hermetic Motors Market Executive Summary

The Hermetic Motors Market is characterized by robust growth, driven primarily by evolving regulatory mandates focused on environmental sustainability and energy conservation in the heating, ventilation, air conditioning, and refrigeration (HVAC&R) sectors. Key business trends include the shift towards Permanent Magnet Synchronous Motor (PMSM) technology coupled with inverter control, enhancing the efficiency rating of the overall system well beyond traditional induction motors. Manufacturers are heavily investing in digitalization and predictive maintenance features integrated into motor control units, aiming to provide comprehensive, full-lifecycle solutions to Original Equipment Manufacturers (OEMs).

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive urbanization, infrastructure development, and escalating demand for air conditioning units in populous countries like China and India. North America and Europe, while mature, demonstrate strong demand for replacement motors and high-efficiency units complying with stricter efficiency standards (e.g., SEER and EER ratings). Latin America and MEA exhibit promising growth, specifically within the expanding commercial refrigeration and food processing sectors, necessitating reliable cold chain components.

Segment trends indicate that the application segment covering residential and light commercial HVAC systems holds the largest market share, though the industrial refrigeration segment is projected to show the highest CAGR due to increasing industrial automation and stringent temperature control requirements in manufacturing and pharmaceuticals. By motor type, the induction motor segment currently dominates due to its cost-effectiveness and proven reliability, but the PMSM segment is rapidly gaining traction, expected to surpass induction motor revenue in the long term, reflecting the industry's unwavering commitment to achieving maximum energy efficiency and minimizing total cost of ownership (TCO).

AI Impact Analysis on Hermetic Motors Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Hermetic Motors Market frequently revolve around predictive maintenance capabilities, optimization of motor design using generative AI, and enhanced control algorithms for variable speed drives (VSDs). Users are keen to understand how AI-driven diagnostics can minimize costly downtime, how machine learning (ML) models can fine-tune operational efficiency based on real-time environmental data, and whether AI can accelerate the R&D process for new, high-efficiency motor materials and configurations. The key themes summarized are centered on maximizing operational uptime, extending product lifespan, optimizing energy utilization in dynamic load conditions, and leveraging data analytics for quality control during manufacturing and assembly of highly sensitive hermetic components.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, temperature, current) analyzed by ML models to forecast potential motor failures within hermetic compressors, enabling just-in-time servicing and reducing unplanned downtime.

- Optimized VSD Control: Implementing AI/ML algorithms to dynamically adjust motor speed and torque based on immediate system demand and historical performance data, maximizing seasonal energy efficiency (SEER/IPLV).

- Generative Design: Employing AI tools to explore thousands of potential rotor/stator geometries and winding configurations, accelerating the development of motors optimized for new refrigerants and specific pressure envelopes.

- Enhanced Quality Control: Using computer vision and deep learning techniques during the manufacturing process to detect minute defects in welding, insulation, and component alignment critical for maintaining the hermetic seal integrity.

- Supply Chain Optimization: Leveraging AI for demand forecasting and inventory management of critical raw materials (e.g., copper, specialized laminations, magnetic materials) essential for high-volume motor production.

DRO & Impact Forces Of Hermetic Motors Market

The market for hermetic motors is shaped by several dynamic forces. Key drivers include rigorous governmental regulations promoting energy efficiency standards worldwide (e.g., Minimum Energy Performance Standards - MEPS), coupled with the pervasive shift towards low-GWP refrigerants necessitating motor redesigns compatible with these new chemical environments. These environmental and efficiency mandates compel OEMs to adopt advanced motor technologies, particularly inverter-driven systems featuring hermetic designs. Simultaneously, the rapid growth in global construction activities, urbanization, and the corresponding need for reliable cooling solutions in commercial and residential infrastructure act as powerful market accelerators.

However, the market faces significant restraints. The primary challenge is the high initial capital investment associated with advanced motor technologies, especially PMSM and VSD integrated systems, which can deter adoption in price-sensitive markets. Furthermore, the hermetic nature of the motor prevents on-site repair, leading to replacement rather than maintenance, increasing lifecycle costs for end-users, though this also creates a strong aftermarket for replacement units. Technical complexities related to thermal management inside the sealed environment and ensuring material compatibility with aggressive refrigerants pose ongoing R&D hurdles for manufacturers, demanding precise engineering and specialized fabrication processes.

Opportunities abound in developing economies where the penetration of high-efficiency HVAC and refrigeration equipment is relatively low but rising rapidly. Another critical opportunity lies in the burgeoning market for heat pump applications, particularly in cold climates, which require robust and efficient hermetic compressors. The shift towards natural refrigerants (like CO2 and propane) opens niche markets requiring extremely high-pressure or explosion-proof hermetic motor designs. Impact forces, therefore, lean heavily towards regulatory push and technological pull; regulatory pressure mandates higher efficiency, while technological innovation, often driven by competitive differentiation in efficiency and reliability, provides the means to meet these demands effectively.

Segmentation Analysis

The Hermetic Motors Market is segmented across several critical dimensions, including Motor Type, End-Use Application, and Refrigerant Type, providing a detailed understanding of market dynamics and targeted opportunities. Analyzing these segments is essential for stakeholders to align their production capabilities and market strategies with evolving demand patterns. The segmentation reflects the diversity required by the HVAC&R industry, which mandates motors optimized for specific temperature ranges, pressures, and chemical compatibility. Understanding the nuances between standard induction motors and high-efficiency PMSMs, for instance, dictates investment priorities in manufacturing capabilities and R&D efforts.

The End-Use Application segmentation highlights the critical dependency on sectors like residential air conditioning, which drives volume, versus specialized industrial applications (like cold storage or chemical processing), which drive value and technological complexity. Furthermore, the segmentation by Refrigerant Type is increasingly vital due to global regulatory changes (like the Kigali Amendment), forcing manufacturers to categorize and adapt their motor designs to handle new, low-GWP refrigerants (e.g., HFOs, R-32, CO2). This granular analysis ensures that market projections accurately reflect the transition and adoption rates across different product lifecycles and regulatory landscapes worldwide, providing a comprehensive map of market requirements.

- By Motor Type:

- Induction Motors (Asynchronous Motors)

- Permanent Magnet Synchronous Motors (PMSM)

- Brushless DC Motors (BLDC)

- By Application:

- Residential HVAC (Window AC, Split AC)

- Commercial HVAC (Chillers, Rooftop Units)

- Commercial Refrigeration (Display Cases, Ice Machines)

- Industrial Refrigeration (Cold Storage, Process Cooling)

- Heat Pumps

- By Refrigerant Type:

- HFC-based Refrigerants (e.g., R-410A)

- HFO-based Refrigerants (e.g., R-1234yf, R-1234ze)

- Natural Refrigerants (e.g., R-717 Ammonia, R-744 CO2, R-290 Propane)

- By Horsepower (HP) Rating:

- Up to 1 HP

- 1 HP to 5 HP

- Above 5 HP

Value Chain Analysis For Hermetic Motors Market

The value chain for the Hermetic Motors Market begins with upstream activities, primarily involving the procurement and processing of specialized raw materials. This includes high-grade electrical steel laminations crucial for efficiency, copper and aluminum wiring, high-temperature insulation materials, and rare earth magnets (for PMSM types). Key upstream providers are large steel mills and magnet manufacturers who supply crucial components that dictate the motor's performance characteristics, requiring strict adherence to metallurgical and magnetic specifications. Efficiency and cost optimization at this stage significantly impact the final product competitiveness, driving manufacturers to seek long-term supply agreements and vertical integration.

Midstream activities involve the core manufacturing processes: precision winding of the stator, dynamic balancing of the rotor, and critical assembly processes, including specialized welding techniques necessary to ensure the hermetic seal of the motor and compressor shell. This stage requires significant investment in automated winding machines, vacuum impregnation equipment, and sophisticated quality control testing facilities to detect microscopic leaks and ensure electrical integrity under pressure. Original Equipment Manufacturers (OEMs) of compressors often integrate motor production internally, while specialized motor manufacturers supply third-party compressor builders, segmenting the midstream market.

Downstream distribution channels are dominated by direct sales to large HVAC&R equipment manufacturers (OEMs) who integrate the hermetic motor directly into their finalized compressors and systems. Indirect distribution primarily focuses on the aftermarket and replacement sector, utilizing authorized distributors, wholesale parts suppliers, and specialized HVAC servicing companies. The dominance of the OEM channel reflects the custom nature of hermetic motor design, which must be tailored to the specific compressor and refrigerant characteristics. Efficient logistics and after-sales support are crucial in the downstream, as the reliability of the entire cooling system hinges on the motor's long-term performance.

Hermetic Motors Market Potential Customers

Potential customers for hermetic motors are predominantly the Original Equipment Manufacturers (OEMs) specializing in advanced refrigeration and air conditioning compressors and units. These buyers require motors that are highly customized for seamless integration with their compressor designs (e.g., scroll, rotary, or reciprocating types) and optimized for specific refrigerant chemistries and operating pressures. Reliability and energy efficiency are paramount purchasing criteria, given the long operational lifespan expected of these sealed systems and the regulatory pressure for high performance.

Key end-users span across diverse industrial and commercial sectors. Major customer groups include residential HVAC system integrators purchasing millions of units annually, large-scale commercial building developers requiring energy-efficient chillers, and global food and beverage companies investing in cold chain infrastructure. The specialized nature of the product means purchasing decisions are highly technical, often involving rigorous testing and qualification processes before motor designs are approved for mass production, underscoring the necessity for motor suppliers to maintain high engineering expertise and robust manufacturing quality control.

Other vital customers include pharmaceutical companies needing highly reliable, temperature-controlled storage and logistics systems, data center operators prioritizing powerful and continuous cooling to prevent server overheating, and governmental bodies procuring large-scale infrastructure projects requiring centralized cooling systems. These diverse buyer needs translate into demand for a wide range of motor specifications, from fractional horsepower units for domestic use to multi-horsepower motors required for large industrial chillers operating with natural refrigerants like CO2, highlighting the broad spectrum of purchasing requirements within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.8 Billion |

| Market Forecast in 2033 | $3.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Nidec Corporation, Mitsubishi Electric Corporation, Siemens AG, Regal Rexnord Corporation, Johnson Controls International Plc, WEG S.A., Brook Crompton, Grundfos Holding A/S, VEM Group, Kirloskar Electric Company, Hitachi Ltd., Tecumseh Products Company, AB Electrolux, Danfoss A/S, GE Appliances (Haier), BITZER Kuhlmaschinenbau GmbH, GMCC, Highly Group, Daikin Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hermetic Motors Market Key Technology Landscape

The technological landscape of the Hermetic Motors Market is rapidly evolving, driven primarily by the pursuit of higher energy efficiency and adaptability to new refrigerants. A major trend involves the migration from standard AC Induction Motors to advanced motor types such as Permanent Magnet Synchronous Motors (PMSM) and Brushless DC (BLDC) motors. PMSM technology offers superior efficiency, especially under variable load conditions, due to the elimination of rotor current losses. This efficiency gain is crucial for meeting evolving international efficiency standards like IE4 and IE5. Furthermore, the integration of these motors with sophisticated Variable Speed Drives (VSDs, also known as inverters) allows for precise speed and capacity control, which is essential for modern HVAC&R systems to optimize part-load performance and minimize power consumption.

Another significant technological focus is on materials science and motor construction. Since hermetic motors operate immersed in a mix of refrigerant and oil, material compatibility is vital. Manufacturers are developing specialized insulation systems (e.g., Polyetherimide, or specific enamels) and lamination materials resistant to corrosive chemical interactions with low-GWP refrigerants like HFOs and R-32, which can otherwise degrade motor performance and lifespan. The development of high-pressure motor casings and optimized winding techniques is crucial for systems utilizing natural refrigerants such as CO2 (R-744), which operates at extremely high pressures compared to traditional HFC systems.

The emerging landscape is also heavily influenced by digitalization and IoT integration. Next-generation hermetic motors are increasingly being equipped with integrated sensors for real-time monitoring of vibration, temperature, current draw, and pressure. This data facilitates the implementation of edge computing and AI-driven predictive maintenance systems. These smart motors not only enhance reliability by detecting early signs of failure but also contribute to overall system optimization, feeding performance data back to centralized building management systems (BMS). This trend transforms the motor from a simple power source into an intelligent component of the broader cooling infrastructure.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share and is expected to exhibit the highest growth rate during the forecast period, primarily due to unprecedented infrastructure development, rapid urbanization, and rising disposable incomes fueling demand for residential and commercial air conditioning. Countries like China, India, and Southeast Asian nations are massive manufacturing hubs for HVAC&R equipment, benefiting from favorable regulatory environments encouraging domestic production and adoption of high-efficiency cooling technologies.

- North America: Characterized by stringent energy efficiency standards (like those mandated by the Department of Energy) and a mature market, North America shows steady demand focused on replacing older equipment with premium, inverter-driven hermetic compressors. The region is a leader in adopting specialized industrial refrigeration and data center cooling solutions, driving the adoption of high-horsepower and high-efficiency PMSM motors.

- Europe: Europe is defined by its strong environmental focus, particularly the implementation of the F-Gas Regulation, which drives the rapid phase-down of HFC refrigerants. This regulatory push necessitates motor redesigns compatible with natural refrigerants (R-290, CO2) and HFOs. The substantial growth in the residential and commercial heat pump sector across Europe also significantly contributes to the demand for specialized, highly reliable hermetic motors.

- Latin America (LATAM): Growth in LATAM is driven by expanding middle classes, increased industrialization, and investment in modern cold chain infrastructure, particularly in countries like Brazil and Mexico. The market is moderately price-sensitive, balancing between cost-effective induction motors and the growing need for efficient commercial refrigeration units.

- Middle East and Africa (MEA): High ambient temperatures across the Gulf Cooperation Council (GCC) countries and parts of Africa necessitate robust and high-capacity cooling solutions. Market expansion is closely tied to large construction projects, tourism infrastructure, and growing demand for industrial cold storage, pushing demand for resilient hermetic motors capable of operating efficiently in extreme thermal conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hermetic Motors Market.- Emerson Electric Co.

- Nidec Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Regal Rexnord Corporation

- Johnson Controls International Plc

- WEG S.A.

- Brook Crompton

- Grundfos Holding A/S

- VEM Group

- Kirloskar Electric Company

- Hitachi Ltd.

- Tecumseh Products Company

- AB Electrolux

- Danfoss A/S

- GE Appliances (Haier)

- BITZER Kuhlmaschinenbau GmbH

- GMCC (Midea Group)

- Highly Group

- Daikin Industries Ltd.

- Ingersoll Rand Inc.

- Carrier Global Corporation

- Panasonic Corporation

- Secop GmbH

- Fusheng Industrial Co., Ltd.

- Sanden Holdings Corporation

- Taikang Group Co., Ltd.

- Zhejiang Sanhua Co., Ltd.

- Eaton Corporation plc

Frequently Asked Questions

Analyze common user questions about the Hermetic Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a hermetic motor and what is its primary advantage?

A hermetic motor is an electric motor sealed within a pressurized, leak-proof casing, typically integrated directly into a refrigeration or HVAC compressor unit. Its primary advantage is the elimination of external shaft seals, drastically reducing refrigerant leakage, minimizing maintenance, and ensuring long-term operational integrity and compliance with environmental regulations.

How do global refrigerant phase-downs impact the Hermetic Motors Market?

Refrigerant phase-downs (e.g., HFC reduction under the Kigali Amendment) necessitate a shift towards new low-GWP refrigerants (HFOs, R-32, natural refrigerants). These new chemistries require complete redesigns of motor materials, insulation, and winding techniques to ensure chemical compatibility and withstand varying operating pressures, driving R&D and market modernization.

Which motor technology is gaining the most traction in hermetic applications?

Permanent Magnet Synchronous Motors (PMSM) coupled with Variable Speed Drives (VSDs) are gaining the most traction. PMSMs offer superior efficiency compared to traditional induction motors, particularly crucial for meeting stringent governmental energy efficiency standards and optimizing performance in variable load HVAC&R systems.

What are the key application segments driving demand for hermetic motors?

The key application segments driving demand are Residential and Commercial HVAC (Air Conditioning), which drives high volume, and Commercial and Industrial Refrigeration (Cold Chain), which demands high reliability and accounts for the greatest growth in high-horsepower, specialized motor variants.

What role does predictive maintenance play in the future of hermetic motors?

Predictive maintenance utilizes integrated sensors and AI/ML algorithms to monitor motor health parameters (vibration, temperature). This capability forecasts potential failures within the sealed unit, minimizing costly unplanned downtime, extending the lifespan of the entire compressor system, and optimizing system efficiency in real-time operation.

What is the current trend regarding motor size and capacity?

There is a dual trend: miniaturization for residential and small commercial applications focusing on compact, high-power-density BLDC motors, and increasing capacity in the industrial sector, driven by demand for large chillers and heat pumps, requiring multi-horsepower hermetic motors operating under extreme conditions like those found in CO2 systems.

How do high manufacturing costs act as a restraint in the market?

The manufacturing process for high-efficiency hermetic motors, particularly PMSM types, requires expensive rare-earth magnets, complex high-precision winding machinery, and rigorous quality control for sealing. This results in a higher initial capital expenditure compared to conventional open motors, restraining adoption in cost-sensitive markets despite the long-term energy savings.

What is the significance of the IE classification in the Hermetic Motors Market?

The International Efficiency (IE) classification (IE3, IE4, IE5) is crucial as regulatory bodies mandate minimum efficiency standards for electric motors. Hermetic motor manufacturers are continuously upgrading designs, especially integrating PMSM and VSDs, to meet or exceed these high IE classifications, ensuring products are globally compliant and market competitive in energy conservation.

Which region currently leads the global Hermetic Motors Market?

Asia Pacific (APAC), particularly China and India, leads the global Hermetic Motors Market in terms of volume and consumption. This dominance is attributed to massive industrial growth, widespread infrastructure development, and the soaring demand for residential and commercial air conditioning equipment within the region.

What challenges are associated with motor cooling in hermetic systems?

Cooling in hermetic systems is complex because the motor is sealed. Heat dissipation relies heavily on the refrigerant and oil passing through the motor cavity. Challenges include ensuring the thermal stability of insulation materials and designing efficient internal fluid pathways to prevent hot spots, especially during high-speed operation or system overload conditions.

How does the integration of Variable Speed Drives (VSDs) enhance hermetic motor performance?

VSD integration allows the hermetic motor to operate at variable speeds rather than fixed speeds. This enables the compressor capacity to precisely match the cooling load, significantly improving Seasonal Energy Efficiency Ratios (SEER) and reducing power consumption during partial load operation, which accounts for the majority of the operational lifecycle.

Who are the primary buyers in the downstream value chain?

The primary buyers in the downstream value chain are large Original Equipment Manufacturers (OEMs) of air conditioning units, heat pumps, and commercial/industrial refrigeration systems. They purchase hermetic motors for direct integration into their proprietary compressor models before selling the final cooling system to commercial or residential end-users.

What impact does the use of CO2 (R-744) have on hermetic motor design?

The use of CO2 as a refrigerant requires specialized hermetic motors capable of withstanding extremely high operating pressures (often supercritical), necessitating ultra-robust motor casings, advanced insulation systems, and specific magnetic materials to ensure reliability and safety under these demanding conditions.

Is the aftermarket for replacement hermetic motors significant?

Yes, the aftermarket is significant. Since hermetic motors are sealed and generally non-repairable on-site, a failure typically mandates replacing the entire motor or compressor unit. This continuous need for replacement units drives a steady, substantial aftermarket for service technicians and parts distributors.

What role does computational fluid dynamics (CFD) play in motor development?

CFD is crucial for optimizing internal motor geometry. Developers use CFD to model and simulate the complex flow of refrigerants and lubricants within the motor cavity, ensuring efficient thermal management, adequate lubrication of bearings, and minimal fluid drag, thereby maximizing overall motor efficiency and longevity within the sealed environment.

How are manufacturers addressing concerns about rare earth material dependency in PMSMs?

Manufacturers are actively exploring alternatives and optimizing magnet usage. This includes developing PMSM designs that use fewer rare earth materials, integrating advanced sensorless control algorithms to maximize efficiency with lower-grade magnets, and increasing efforts toward material recycling and supply chain diversification.

What is the long-term outlook for the Hermetic Motors Market in cold chain logistics?

The outlook is highly positive. The expansion of global pharmaceutical, food processing, and e-commerce industries necessitates robust cold chain logistics. Hermetic motors are essential components in refrigerated transport and storage, guaranteeing precise temperature control and reliability, making this sector a primary driver of market growth.

What considerations are made for motor insulation in high-temperature environments?

Insulation systems must be meticulously selected to prevent degradation due to high temperatures and chemical interaction with the oil/refrigerant mixture. Advanced materials (e.g., specific enamels, high-performance polymers) are used to ensure that dielectric properties remain stable over decades of operation, preventing electrical short circuits within the sealed unit.

How do energy regulations in North America (like SEER/EER increases) affect motor demand?

Increased Seasonal Energy Efficiency Ratio (SEER) and Energy Efficiency Ratio (EER) mandates force manufacturers to use high-efficiency motors, predominantly PMSM and VSD technology, often requiring multi-stage or variable-capacity compressors. This significantly increases demand for technologically advanced hermetic motors capable of achieving these higher performance benchmarks.

What is the distinction between a semi-hermetic and a fully hermetic motor?

A fully hermetic motor is permanently sealed and non-serviceable; the motor and compressor are housed in a single welded shell. A semi-hermetic motor is also sealed but uses bolted casings and access panels, allowing for field servicing, rewindings, or minor repairs, although it still maintains a leak-proof design during operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager