Herpes Marker Testing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438940 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Herpes Marker Testing Market Size

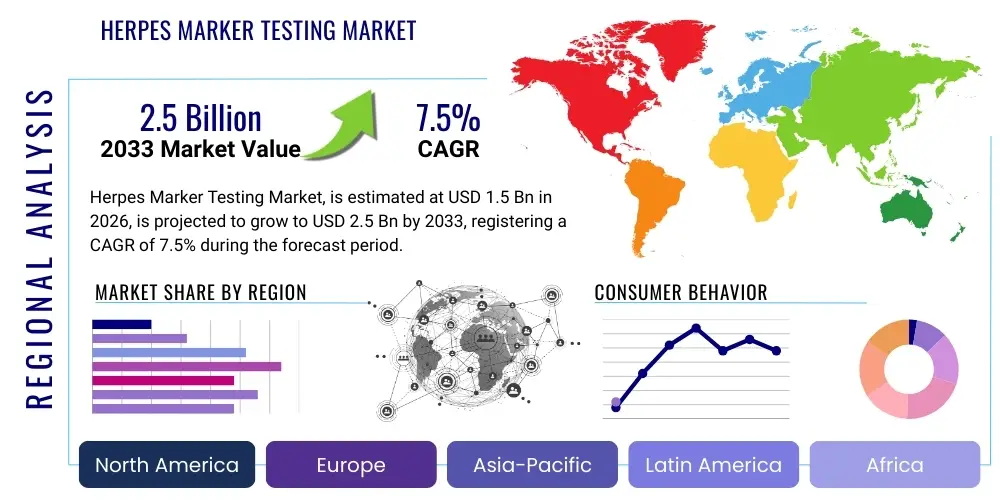

The Herpes Marker Testing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the rising global prevalence of Herpes Simplex Virus (HSV) infections, coupled with increased awareness regarding the importance of early and accurate diagnosis, particularly in high-risk populations such as pregnant women and immunocompromised individuals. Technological advancements, specifically the shift toward highly sensitive molecular diagnostic methods, are key facilitators of this expansion.

The market expansion is characterized by continuous innovation in testing modalities, moving from traditional viral culture and antibody-based serology to advanced Nucleic Acid Amplification Tests (NAATs). These modern testing methods offer superior sensitivity, specificity, and faster turnaround times, making them indispensable in clinical settings for rapid patient management decisions. Furthermore, governmental and non-governmental initiatives aimed at sexually transmitted infection (STI) screening and control programs are expected to boost testing volumes across developed and developing nations, solidifying the market's robust long-term potential.

Herpes Marker Testing Market introduction

The Herpes Marker Testing Market encompasses diagnostic solutions used to detect the presence of Herpes Simplex Virus type 1 (HSV-1) and type 2 (HSV-2) markers, which include viral DNA, specific antibodies (IgG and IgM), and antigens. The primary products in this market range from conventional laboratory assays, such as ELISA (Enzyme-Linked Immunosorbent Assay) for antibody detection, to sophisticated molecular diagnostics, notably Polymerase Chain Reaction (PCR) and its variations. These tests are vital for confirming active infections, determining past exposure, and differentiating between the two primary types of the virus, which is crucial for appropriate treatment planning and epidemiological surveillance.

Major applications for herpes marker testing include the diagnosis of genital herpes, oral herpes (cold sores), neonatal herpes, and encephalitis caused by HSV. End-users span hospitals, specialty clinics (dermatology and sexual health clinics), reference laboratories, and Point-of-Care (PoC) settings. Key benefits derived from accurate testing include timely initiation of antiviral therapy, minimizing transmission risk through informed behavioral changes, and preventing severe complications, particularly in vulnerable groups like neonates who can suffer devastating outcomes from undetected infections. The diagnostic process aids healthcare providers in managing recurrent episodes and offering crucial counseling services.

Driving factors underpinning the market growth include the escalating global burden of STIs, improvements in healthcare access and infrastructure in emerging economies, and persistent research and development efforts leading to the commercialization of highly automated and rapid testing platforms. Moreover, societal destigmatization initiatives surrounding STIs, coupled with proactive health campaigns, are encouraging more individuals to seek testing, thereby increasing the overall market throughput. The demand for multiplex assays capable of simultaneously detecting multiple viral pathogens further contributes to the market's positive trajectory, streamlining laboratory workflows and enhancing diagnostic efficiency.

Herpes Marker Testing Market Executive Summary

The Herpes Marker Testing Market is characterized by intense technological innovation, shifting the landscape toward high-throughput molecular diagnostics, which are replacing traditional serological and culture methods due to superior performance characteristics. Business trends emphasize strategic partnerships between diagnostic manufacturers and large reference laboratories to enhance distribution networks and broaden the availability of advanced testing platforms. Furthermore, there is a pronounced focus on developing cost-effective, decentralized testing solutions, particularly PoC devices, to meet the urgent diagnostic needs in resource-limited settings and emergency departments, thereby accelerating treatment initiation and improving public health outcomes.

Regionally, North America maintains market dominance, driven by established healthcare infrastructure, high awareness levels, and significant R&D spending directed toward infectious disease diagnostics. However, the Asia Pacific region is forecasted to exhibit the highest CAGR, primarily fueled by massive population bases, improving economic conditions leading to better healthcare expenditure, and increasing awareness programs targeting STI prevention and diagnosis. Europe represents a mature market focusing on standardized screening protocols and leveraging centralized laboratory facilities, contributing consistently to global revenue generation.

Segment trends indicate that the molecular diagnostics segment (NAATs) holds the largest and fastest-growing share due to its inherent accuracy and utility in early-stage diagnosis and differentiation between HSV-1 and HSV-2. In terms of end-users, diagnostic laboratories and reference labs remain the largest consumers of high-volume automated systems, although the adoption rate in hospitals for critical care diagnostics is accelerating. The segmentation based on test type (IgG vs. IgM vs. DNA) shows a growing preference for DNA testing, especially for active lesions and primary infections, providing actionable viral load and typing information crucial for clinical management.

AI Impact Analysis on Herpes Marker Testing Market

User inquiries regarding Artificial Intelligence (AI) in the Herpes Marker Testing Market primarily revolve around how AI can enhance diagnostic accuracy, streamline high-volume laboratory processes, and potentially enable predictive modeling for localized outbreaks. Users are keenly interested in the integration of machine learning algorithms with digital imaging systems for analyzing viral culture or immunological staining results, seeking validation that AI can reduce inter-observer variability and accelerate turnaround times in conventional methods. Furthermore, significant discussion centers on AI’s capability to analyze complex multiplex PCR data or large seroprevalence datasets to identify novel epidemiological patterns and refine risk stratification models for specific patient demographics, ensuring testing resources are allocated efficiently.

Key concerns users express include data privacy and security when handling sensitive STI test results, the regulatory pathway for AI-driven diagnostic software, and the need for rigorous validation studies to ensure AI models perform reliably across diverse populations and varying clinical presentations of herpes. There is an expectation that AI will move beyond simple data analysis to assist in clinical decision support, helping providers interpret indeterminate test results or guiding optimal treatment regimens based on patient history and localized drug resistance patterns. This shift implies AI will become a critical component of laboratory information systems (LIS), optimizing sample flow and resource utilization.

The overarching expectation is that AI integration will lead to a transformative leap in efficiency and precision. Specifically, generative algorithms are expected to assist in the rapid design and optimization of new primer and probe sets for molecular assays, addressing emerging viral variants with greater speed than traditional R&D cycles. Furthermore, predictive maintenance of sophisticated diagnostic instruments, managed by AI, is anticipated to minimize downtime in high-volume testing facilities, ensuring continuous operational throughput, which is vital during peak infection seasons or outbreak scenarios, thereby safeguarding public health diagnostic capacity.

- AI enhances the interpretation of complex molecular diagnostic results, improving sensitivity and specificity.

- Machine learning algorithms optimize laboratory workflows, reducing sample processing time and manual errors.

- Predictive analytics aids in real-time epidemiological tracking and forecasting of HSV outbreaks.

- AI supports the development of rapid, highly accurate Point-of-Care (PoC) diagnostic platforms.

- Integration with Electronic Health Records (EHR) allows for personalized testing recommendations and risk assessment.

DRO & Impact Forces Of Herpes Marker Testing Market

The Herpes Marker Testing Market is driven by the high and increasing global incidence of HSV infections and the subsequent public health need for effective control strategies. The market is also strongly supported by continuous technological advancements, particularly the development and adoption of highly sensitive Nucleic Acid Amplification Tests (NAATs) which offer superior diagnostic utility over older methods. Restraints, however, include the lack of standardized testing protocols across different geographical regions, leading to variability in results and clinical management. Furthermore, the high initial cost of fully automated molecular diagnostic instruments presents a significant barrier to entry, particularly for smaller clinics and diagnostic centers in developing economies, restricting access to advanced testing methodologies.

Opportunities for market expansion are significant, primarily residing in the untapped potential of emerging markets where awareness and healthcare infrastructure are rapidly improving. The development of low-cost, disposable, and user-friendly Point-of-Care (PoC) testing devices represents a major commercial opportunity, allowing for rapid diagnosis and treatment initiation outside traditional laboratory settings, particularly crucial for screening in prenatal care and community health programs. Moreover, the increasing research focus on co-infection diagnostics (testing for HSV alongside other STIs like HIV or syphilis) provides avenues for multiplex assay development, enhancing market penetration and offering greater value to healthcare systems through bundled testing solutions.

The impact forces influencing the market are multifaceted, combining regulatory stringency with payer policies. Regulatory approval processes for novel diagnostic markers and testing platforms dictate the speed of market introduction, especially in regions governed by bodies like the FDA or EMA. Reimbursement policies, managed by government health systems and private insurers, profoundly affect test adoption rates; inadequate coverage for new or expensive molecular tests can restrain growth even when clinical evidence supports their superiority. Ultimately, the market is continually shaped by competitive pressure among manufacturers to reduce per-test costs while maintaining high quality, balancing accessibility with diagnostic performance in a highly sensitive public health domain.

Segmentation Analysis

The Herpes Marker Testing Market is comprehensively segmented based on three primary factors: Test Type, End-User, and Region. Test Type segmentation distinguishes between highly accurate molecular diagnostics (NAATs) and traditional methods such as Serology (IgG, IgM) and Microscopy/Culture. End-User segmentation categorizes consumption across major healthcare settings, including hospitals, diagnostic laboratories, and physician offices. This structured approach allows stakeholders to analyze market penetration, technological adoption rates, and regional expenditure patterns effectively, providing granular insights into demand dynamics and competitive positioning within specific market niches.

The dominance of the Molecular Diagnostics segment is noteworthy, driven by the shift towards precision medicine and the critical need for early and specific diagnosis of HSV infections, especially in cases of asymptomatic shedding or neonatal infections where viral load detection is paramount. Serological testing, while less effective for acute diagnosis, remains vital for epidemiological studies and determining past exposure, contributing steadily to revenue. Geographical segmentation reveals contrasting growth patterns; while mature markets focus on consolidation and high-throughput automation, developing regions prioritize basic accessibility and the rollout of affordable, rapid testing solutions suitable for widespread screening programs and decentralized healthcare delivery models.

Furthermore, within the end-user landscape, diagnostic laboratories, including specialized reference laboratories, account for the largest market share due to their capacity for processing high volumes of complex molecular tests and maintaining highly specialized equipment. However, the fastest growth is anticipated in the Point-of-Care (PoC) setting, reflecting a global trend toward decentralized testing that enables faster clinical interventions and enhances patient compliance. This demand for immediate results is spurring significant investment in miniaturized, robust, and easy-to-use testing kits that do not require specialized laboratory infrastructure, fundamentally altering the traditional diagnostic workflow.

- Test Type

- Molecular Diagnostics (NAATs, PCR, Real-time PCR)

- Serology (IgG, IgM)

- Viral Culture and Microscopy

- Antigen Detection

- End-User

- Diagnostic Laboratories

- Hospitals and Clinics

- Physician Offices

- Research and Academic Institutes

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Herpes Marker Testing Market

The value chain for the Herpes Marker Testing Market begins with upstream activities focused on the research, development, and manufacturing of core components. This includes the production of specialized reagents, proprietary enzymes (such as polymerases for PCR), primary antibodies, and viral culture media. Key players in this stage are often specialized biotechnology firms and large multinational life science companies that supply high-purity raw materials crucial for maintaining the sensitivity and specificity of diagnostic assays. Significant investment in intellectual property protecting novel probe and primer design is characteristic of this initial phase, ensuring the quality and performance foundation of the final diagnostic product.

The midstream segment involves the assembly, quality control, and large-scale manufacturing of the complete testing kits and the associated instruments (e.g., thermal cyclers, automated immunoassay analyzers). This stage also includes regulatory filing and obtaining necessary clearances (FDA, CE Mark) to commercialize the diagnostic products. Distribution channels form a critical link in the midstream to downstream flow, encompassing both direct sales forces employed by major diagnostic corporations and indirect distribution through third-party specialized medical distributors who manage logistics, warehousing, and local market reach. Direct channels are typically utilized for high-value, complex instrumentation, ensuring specialized installation and training, while indirect channels are crucial for disseminating consumables and reagents widely and efficiently.

Downstream activities center on the deployment and utilization of the testing products by end-users—hospitals, reference labs, and PoC facilities. This final segment includes the actual performance of the test, result interpretation, and integration with patient care pathways. Service and support, including technical assistance, maintenance, and training provided by the manufacturers or distributors, are essential for ensuring accurate testing execution and maximizing instrument uptime. The efficiency of this downstream segment directly influences patient outcomes and overall healthcare quality, making robust post-sale support a critical competitive differentiator within the market.

Herpes Marker Testing Market Potential Customers

The primary consumers and end-users of herpes marker testing products are highly structured healthcare institutions requiring accredited diagnostic capabilities. Diagnostic and reference laboratories represent the largest immediate customer base. These centralized facilities purchase high-volume, automated molecular and serological platforms to process thousands of samples daily, often serving a wide network of smaller clinics and physician offices. Their purchasing decisions are driven by factors such as throughput, automation capabilities, cost-per-test efficiency, and regulatory compliance standards, particularly for accreditation in high-complexity testing, ensuring the sustained commercial viability for manufacturers of large-scale testing systems.

Hospitals, particularly those with strong infectious disease departments, emergency rooms, and maternal and child health units, constitute another vital customer segment. Hospitals require rapid turnaround times for critical decision-making, especially in cases of suspected neonatal herpes or viral encephalitis, where delays can be fatal. Consequently, hospitals are primary purchasers of fast molecular tests and specialized kits suitable for immediate, in-house laboratory processing. The procurement cycle within hospitals is often complex, involving clinical lab directors, infectious disease specialists, and centralized purchasing committees, necessitating comprehensive clinical evidence and robust cost-benefit analysis from potential suppliers.

Furthermore, smaller clinical settings, including Physician Offices and specialized clinics such as obstetrics/gynecology clinics, sexual health clinics, and dermatology practices, are emerging as significant potential customers, particularly for Point-of-Care (PoC) solutions. These smaller entities prioritize ease of use, minimal required training, and the ability to deliver results during a single patient visit, enhancing patient satisfaction and compliance. Public health agencies and academic research institutions also represent a consistent, albeit smaller, segment, focusing on purchasing reagents and high-fidelity testing platforms for epidemiological surveillance, clinical trials, and developing next-generation diagnostic methodologies, playing a crucial role in validating emerging marker tests.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bio-Rad Laboratories, Abbott Laboratories, DiaSorin S.p.A., F. Hoffmann-La Roche Ltd., Hologic Inc., Thermo Fisher Scientific Inc., Danaher Corporation (Cepheid), Quest Diagnostics, Siemens Healthineers, Becton, Dickinson and Company (BD), BioMérieux SA, Luminex Corporation (A brand of DiaSorin), Serosep Ltd., Grifols, S.A., Trivitron Healthcare, OraSure Technologies, Sekisui Diagnostics, Trinity Biotech, PerkinElmer Inc., Bio-Techne Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Herpes Marker Testing Market Key Technology Landscape

The technological landscape of the Herpes Marker Testing Market is dominated by Nucleic Acid Amplification Tests (NAATs), primarily conventional Polymerase Chain Reaction (PCR) and highly automated Real-Time PCR (qPCR) systems. These molecular techniques offer unparalleled sensitivity and specificity, allowing for the direct detection and quantification of HSV DNA, which is crucial for distinguishing active infection from latency and accurately typing the virus (HSV-1 vs. HSV-2). The innovation within this area focuses on integrating these complex assays onto compact, cartridge-based platforms, significantly simplifying the testing procedure and minimizing the need for extensive laboratory infrastructure, thus driving the growth of decentralized testing within PoC settings.

A parallel significant technology involves advanced serological testing, specifically Enhanced Chemiluminescence Immunoassays (CLIAs) and high-throughput ELISAs, which are utilized for antibody detection (IgG and IgM). While serology is being refined, the crucial technological advancement here lies in glycoprotein G (gG) specific assays. The gG protein is non-cross-reactive between HSV-1 and HSV-2, enabling accurate type-specific differentiation, a major improvement over older, less specific serological tests. Modern serological instruments are integrated into large, fully automated clinical chemistry and immunoassay analyzers, emphasizing speed and standardization in high-volume testing environments like reference laboratories.

Emerging technologies promise to further revolutionize the market. Digital PCR (dPCR) offers absolute quantification of viral DNA without the need for standard curves, providing enhanced precision, particularly for monitoring low viral loads in immunocompromised patients or detecting asymptomatic shedding. Furthermore, the convergence of microfluidics and biosensors is paving the way for ultra-rapid, highly portable diagnostic devices. Technologies based on CRISPR-Cas systems are also being explored for their potential to provide single-molecule detection of HSV DNA with instrument-free visualization, potentially leading to the next generation of highly sensitive and accessible diagnostic tools suitable for home testing or remote field applications, democratizing access to complex molecular diagnostics.

Regional Highlights

- North America: This region holds the largest market share, driven by a highly advanced healthcare system, substantial government investment in STI screening programs, and early adoption of premium molecular diagnostics. The US, in particular, benefits from the presence of major diagnostic companies and robust R&D activities. High patient awareness and sophisticated reimbursement mechanisms further solidify its market position. The primary focus here is on high-throughput automation and integrating AI into laboratory information systems for efficiency gains and data analysis.

- Europe: The European market is mature and characterized by centralized healthcare structures and standardized quality regulations (CE-IVD marking). Western European countries (Germany, UK, France) are key contributors, emphasizing accurate type-specific serological testing and sophisticated molecular techniques for complicated cases like neurological herpes. The market is also seeing increasing demand for consolidated testing platforms capable of simultaneously detecting multiple viral agents.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by expanding healthcare access, increasing disposable income, and government initiatives aimed at controlling infectious diseases. Countries like China and India present vast, untapped markets where the shift from basic microscopy to modern serology and molecular testing is accelerating. The region's growth is contingent on the development and deployment of affordable, scalable diagnostic solutions suitable for high-density populations and varied infrastructure levels.

- Latin America (LATAM): The market in LATAM is driven by public health campaigns addressing STIs, though growth is often hampered by challenging reimbursement scenarios and economic volatility. Brazil and Mexico are the largest contributors. The focus is increasingly shifting towards implementing cost-effective, durable molecular platforms and expanding the availability of rapid tests in public health clinics to improve diagnostic reach.

- Middle East and Africa (MEA): This region is smaller but exhibits considerable potential, particularly in the Gulf Cooperation Council (GCC) countries with high healthcare expenditure. In Africa, the prevalence of HSV infections, often co-morbid with HIV, creates a substantial demand for robust and reliable testing. Adoption rates are generally lower, prioritizing accessible serological screening and rugged PoC solutions that can function effectively despite logistical challenges and intermittent power supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Herpes Marker Testing Market.- Bio-Rad Laboratories

- Abbott Laboratories

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Hologic Inc.

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Cepheid)

- Quest Diagnostics

- Siemens Healthineers

- Becton, Dickinson and Company (BD)

- BioMérieux SA

- Luminex Corporation (A brand of DiaSorin)

- Serosep Ltd.

- Grifols, S.A.

- Trivitron Healthcare

- OraSure Technologies

- Sekisui Diagnostics

- Trinity Biotech

- PerkinElmer Inc.

- Bio-Techne Corporation

Frequently Asked Questions

Analyze common user questions about the Herpes Marker Testing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most accurate method for diagnosing an active Herpes Simplex Virus (HSV) infection?

The most accurate method for diagnosing an active HSV infection, particularly from an active lesion, is Nucleic Acid Amplification Testing (NAAT), such as PCR. PCR detects viral DNA directly, offering superior sensitivity and allowing for differentiation between HSV-1 and HSV-2 types much faster than traditional viral culture methods.

How are Point-of-Care (PoC) testing solutions changing the Herpes Marker Testing Market?

PoC testing solutions are decentralizing diagnosis by enabling rapid testing outside of traditional reference laboratories. These cartridge-based systems provide results in minutes, facilitating immediate clinical decision-making, improving patient follow-up, and expanding testing access in resource-limited settings.

What is the primary difference between IgG and IgM testing in herpes diagnostics?

IgM antibodies typically appear shortly after the initial exposure (acute infection) but decline quickly. IgG antibodies persist indefinitely in the body and indicate a past or latent infection. IgG testing, specifically type-specific IgG based on glycoprotein G (gG) markers, is crucial for determining seroprevalence and counseling patients on risk and transmission.

What regulatory trends are impacting the commercialization of new herpes diagnostic tests?

Regulatory bodies like the FDA and EMA are increasingly emphasizing stringent performance validation and clinical utility data, particularly for novel molecular and PoC diagnostics. There is also a growing focus on requiring type-specific differentiation capability for new serological assays to ensure accurate epidemiological data and patient management.

Which geographical region exhibits the fastest growth potential in herpes marker testing?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This accelerating growth is attributed to massive improvements in healthcare infrastructure, rising public awareness regarding STIs, and substantial government investments in expanding infectious disease diagnostic capabilities across key countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager