Hexamine for Industrial Uses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433695 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hexamine for Industrial Uses Market Size

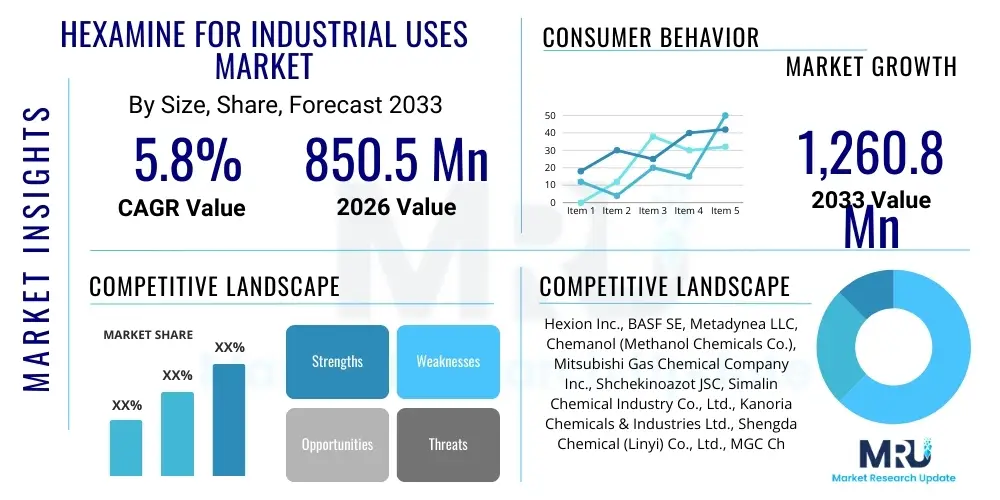

The Hexamine for Industrial Uses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,260.8 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the robust expansion of the synthetic resin industry, particularly in emerging economies, where Hexamine serves as a critical curing agent and hardener. Furthermore, the sustained demand from the rubber processing sector, essential for manufacturing tires and industrial elastomers, provides a stable foundation for market expansion, offsetting potential volatility in other downstream applications. The market size reflects significant investments in production capacity globally, particularly in Asia Pacific, aiming to meet the accelerating consumption patterns across the construction and automotive industries.

Hexamine for Industrial Uses Market introduction

The Hexamine for Industrial Uses Market centers around Hexamethylenetetramine (HMTA), a heterocyclic organic compound derived from the condensation reaction of formaldehyde and ammonia. This colorless crystalline compound is highly versatile due to its caged structure, offering unique properties as a crosslinking agent, curing accelerator, and raw material in chemical synthesis. Key applications defining this market include its extensive use in the manufacturing of phenolic resins (like Bakelite) for molding compounds and laminates, and its crucial role as a vulcanization accelerator and anti-reversion agent in the rubber industry, enhancing the structural integrity and durability of rubber products used in transportation and infrastructure. The inherent stability and effectiveness of Hexamine make it indispensable across diverse heavy industries.

The primary driving forces underpinning the market’s expansion are the rapid urbanization and industrialization across developing nations, which fuel demand for robust construction materials and high-performance automotive components. Phenolic resins, cured using Hexamine, are essential in friction materials, abrasive tools, and insulation, sectors experiencing steady growth linked to global GDP. Additionally, the compound’s application in pharmaceuticals, military explosives (such as RDX production), and specific agricultural chemicals, though niche, contributes to its overall market valuation and application diversity. Manufacturers are continually focusing on improving synthesis efficiency and purity to meet stringent quality requirements across these sensitive end-use industries.

Hexamine provides considerable benefits, including excellent thermal stability, ease of handling, and predictable curing characteristics, making it superior to many alternative agents in high-temperature applications. The market is characterized by medium consolidation, with large-scale manufacturers controlling raw material supply (formaldehyde and ammonia) and process technology, enabling optimized cost structures. The future outlook involves innovation in low-emission applications and sustainable production methods to address rising environmental concerns, ensuring Hexamine remains a competitive and necessary chemical intermediate across its core industrial segments.

Hexamine for Industrial Uses Market Executive Summary

The Hexamine for Industrial Uses Market demonstrates resilient business trends, primarily characterized by shifts in global manufacturing centers and strategic efforts toward process optimization. The primary segment driving immediate growth is the Synthetic Resins application, particularly phenolic molding compounds used in electronics and automotive parts, reflecting a strong correlation between Hexamine demand and industrial output indices globally. Business models are evolving to focus on integrated supply chains, mitigating price volatility of precursor materials like methanol and natural gas. Key market participants are pursuing capacity expansions in cost-effective regions, particularly Southeast Asia and the Indian Subcontinent, to capitalize on lower operational costs and proximity to high-growth end-user markets. Furthermore, competitive strategies emphasize product quality consistency, essential for specialized applications such as friction materials and adhesives.

Regional trends indicate that the Asia Pacific (APAC) region remains the undisputed leader in consumption and production, driven predominantly by China’s massive manufacturing base and India’s burgeoning infrastructure development. APAC’s dominance is supported by favorable governmental policies promoting industrial growth and the high concentration of automotive and construction material manufacturers. In contrast, North America and Europe show steady, mature growth, focusing more on high-value applications, such as advanced composite materials and specialty coatings, where regulatory compliance and high-purity standards dictate market pricing. The Middle East and Africa (MEA) region is emerging as a potential growth hub, fueled by investments in infrastructure projects and developing petrochemical capabilities, increasing the local demand for resin hardeners and rubber additives.

Segment trends reveal a sustained dominance of the powder form of Hexamine due to its ease of incorporation into various chemical processes and cost-effectiveness. However, the granular form is gaining traction in specialized applications where dust mitigation and controlled dissolution rates are paramount, such as large-scale industrial compounding. Within end-use segments, the Automotive industry represents the largest consumer, relying on Hexamine for brake pads, clutch facings, and tire production. The Construction sector follows closely, driven by the need for durable wood adhesives and high-performance insulation foams. The strategic imperative for market players across all segments is balancing large-volume, low-margin resin production with high-purity, niche-market offerings for defense and pharmaceuticals.

AI Impact Analysis on Hexamine for Industrial Uses Market

Common user questions regarding AI's impact on the Hexamine market revolve around efficiency gains, predictive quality control, and intelligent supply chain management. Users frequently inquire if AI can stabilize the volatile input costs of ammonia and formaldehyde, and how Machine Learning (ML) models can be deployed to optimize complex synthesis reactors, specifically minimizing by-product formation and energy consumption during the Hexamine production process. There is significant interest in using AI for predictive maintenance of highly corrosive chemical processing equipment, thereby reducing unplanned downtime and enhancing operational safety. Furthermore, users seek clarity on how AI-driven market analysis can forecast application-specific demand (e.g., anticipating shifts in rubber consumption versus resin use) to optimize inventory and production scheduling, directly addressing the core challenges of raw material price fluctuations and inventory obsolescence inherent in the commodity chemical space.

- AI-Powered Predictive Maintenance: Utilizing sensor data and ML algorithms to forecast equipment failures in synthesis reactors and dryers, reducing downtime by up to 20% and extending asset lifespan in high-temperature, corrosive environments.

- Supply Chain Optimization: Implementing AI tools to model complex global logistics, factoring in raw material price volatility (formaldehyde, ammonia), transportation costs, and regulatory constraints to achieve optimal procurement and distribution pathways.

- Process Parameter Optimization: Deploying ML to analyze real-time reaction kinetics, optimizing temperature, pressure, and flow rates during the ammonolysis reaction to maximize Hexamine yield and purity while minimizing energy intensity.

- Enhanced Quality Control: Using computer vision and analytical data modeling to ensure crystalline uniformity and detect impurities rapidly, crucial for high-specification end-uses like aerospace composites and pharmaceutical intermediates.

- Demand Forecasting Accuracy: Employing deep learning models to integrate macroeconomic indicators, automotive sales data, and construction indices to generate highly accurate forecasts for regional Hexamine consumption, stabilizing production output.

- Safety and Environmental Monitoring: Utilizing AI to analyze emission data and operational parameters in real-time, ensuring stringent compliance with environmental regulations and proactively identifying hazardous conditions.

DRO & Impact Forces Of Hexamine for Industrial Uses Market

The Hexamine market is strongly influenced by a combination of foundational drivers, significant structural restraints, and emerging opportunities, all acting as critical impact forces shaping the competitive landscape. Primary drivers include the massive and non-substitutable role of Hexamine in the manufacturing of Bakelite and other phenolic resins, essential for structural components, electrical insulation, and durable coatings in industrial environments. This demand is intrinsically linked to global industrial output and sustained growth in the automotive sector, where Hexamine derivatives are crucial for enhancing the performance and longevity of friction materials. Furthermore, its established position as a highly effective and relatively cost-efficient vulcanization agent in the rubber industry ensures stable, recurring demand, irrespective of short-term economic fluctuations in related sectors. The intrinsic chemical efficiency of Hexamine as a hardener provides a considerable barrier to entry for potential substitutes.

Restraints, however, pose persistent challenges to market expansion. The key restraint is the high volatility and direct dependence on the price of upstream raw materials, particularly ammonia and methanol (used to produce formaldehyde). Since these are derived from fossil fuels, their prices are subject to global energy market swings and geopolitical instabilities, compressing the operating margins of Hexamine producers. Additionally, Hexamine’s handling and storage present logistical constraints due to its flammability and regulatory oversight regarding its use, particularly in regions where strict safety protocols govern chemical processing and transport. Regulatory pressure concerning formaldehyde emissions during the curing process, driven by health and safety concerns, forces manufacturers and end-users to seek low-emission alternatives, slightly dampening growth in highly regulated markets like Western Europe.

Opportunities for future growth are rooted in technological advancements and market diversification. The emergence of green chemistry principles provides an avenue for Hexamine producers to develop sustainable synthesis methods, potentially reducing the reliance on volatile fossil fuel derivatives and improving the market’s environmental profile. Furthermore, Hexamine finds increasing utility in niche, high-value applications, such as specialized coatings for aerospace, catalysts in advanced chemical processes, and high-purity applications in pharmaceutical synthesis, which command premium pricing and offer higher margin potential. The development of advanced, encapsulated Hexamine formulations tailored for specific reaction kinetics in polymer blending presents a technological opportunity to enhance product performance and ease of use. These strategic elements collectively determine the long-term viability and growth rate of the Hexamine market, pushing producers toward efficiency and compliance.

Segmentation Analysis

The Hexamine for Industrial Uses market is comprehensively segmented based on its physical form, the primary application where it is utilized, and the specific end-use industry that consumes the final product. Understanding these segmentations is crucial for accurate market forecasting and strategic planning, as consumption patterns and growth rates vary significantly across different segments. The synthetic resins application consistently dominates the market volume due to the necessity of Hexamine as an essential crosslinking agent in thermosetting plastics, particularly phenolic and amino resins that are integral to structural and thermal components. Segmentation by form highlights the preference for the powder form in bulk industrial processes due to its large surface area and cost-effectiveness, although granular and compressed tablet forms are gaining popularity for controlled dosing and dust reduction in manufacturing environments demanding stringent environmental controls.

The segmentation by end-use industry illustrates the diverse utility of Hexamine, ranging from the high-volume Automotive sector—where it is essential for brake linings, clutch components, and specialized rubber compounds—to the more specialized military and defense applications, primarily for the production of RDX explosives. The construction segment represents a critical consumer, utilizing Hexamine-cured resins in wood-based materials (plywood and particleboard adhesives) and insulating foams, directly correlating market demand with global infrastructure spending and housing starts. This multi-dimensional segmentation allows market stakeholders to precisely target their product formulations and marketing efforts toward high-growth niches, such as specialized rubber chemicals that require high purity and tight specification compliance, ensuring optimized resource allocation and maximizing competitive advantage.

- By Application:

- Synthetic Resins (Phenolic, Amino)

- Rubber Processing Chemicals (Vulcanization Accelerators, Anti-Reversion Agents)

- Explosives and Propellants (RDX, HMX precursors)

- Adhesives and Coatings (Formaldehyde scavengers, hardeners)

- Pharmaceutical Intermediates and Medical Applications

- Textile and Dyes

- By Form:

- Powder

- Granular

- Liquid Solutions (Specialty)

- Compressed Tablets

- By End-Use Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Mining and Explosives

- Chemical Manufacturing

- Aerospace and Defense

- Electronics and Electrical Insulation

Value Chain Analysis For Hexamine for Industrial Uses Market

The value chain for the Hexamine market is characterized by moderate integration, starting with the upstream sourcing of key hydrocarbon-derived raw materials. The upstream segment is heavily reliant on the petrochemical industry for methanol (which is converted to formaldehyde) and natural gas (the primary feedstock for ammonia production). Producers often face intense price bargaining and supply volatility from these commodity suppliers. Formaldehyde and ammonia production typically involve large, capital-intensive chemical plants, and the integrated nature of these processes often gives companies with backward integration into methanol or ammonia production a significant cost advantage, allowing them to better manage margin compression during periods of input price spikes. The manufacturing phase involves the controlled reaction of formaldehyde and ammonia in the presence of heat, followed by complex crystallization, drying, and grinding processes to achieve the required industrial specifications (powder, granular, or tablet forms), which requires sophisticated chemical engineering expertise and stringent quality control protocols.

The downstream analysis focuses on the complex distribution channels required to serve a fragmented end-user base. Hexamine is distributed through two primary channels: direct sales and indirect sales. Direct sales are typically preferred for large-volume buyers, such as major synthetic resin manufacturers and large tire producers, facilitating contractual stability and technical support. Indirect distribution utilizes a network of specialized chemical distributors and regional traders who handle smaller, more varied orders and provide localized logistics, inventory management, and regulatory compliance assistance to mid-sized and smaller end-users across diverse geographic areas. This complexity is compounded by the need to handle Hexamine as a potentially hazardous material, requiring specialized transport and storage solutions that adhere to international chemical safety standards.

The final consumption stage involves the integration of Hexamine into the end-user’s production process. For the automotive sector, this means blending it precisely into rubber compounds or friction material formulations; for the construction industry, it involves incorporation into resin systems for wood glues and insulation. The value added at this stage is highly dependent on the quality and consistency of the Hexamine supplied, as purity directly impacts the curing kinetics and final physical properties of the end product. Therefore, the most critical value drivers throughout the chain include minimizing raw material conversion costs, optimizing process yields, ensuring absolute product consistency, and providing reliable, just-in-time delivery to geographically dispersed industrial clusters globally.

Hexamine for Industrial Uses Market Potential Customers

The primary potential customers for Hexamine are clustered across large-scale industrial sectors requiring reliable crosslinking and hardening agents, dominated by the Polymer and Composite Manufacturers. These customers, including producers of phenolic molding compounds, plywood, particleboard, and brake linings, require Hexamine in large, consistent volumes to ensure the structural integrity and heat resistance of their products. This segment is characterized by long-term supply contracts and stringent technical specifications, making relationship management and quality assurance crucial for suppliers. Secondary major customers include the Rubber Processing Industry, encompassing tire manufacturers and producers of industrial seals and gaskets, who rely on Hexamine derivatives as essential vulcanization accelerators to improve the resilience and aging properties of elastomers, maintaining high standards for performance in harsh operating environments.

Another significant customer group is the Specialized Chemical and Defense Sector. This includes manufacturers of high-energy military explosives, such as RDX and HMX, where Hexamine serves as a pivotal chemical precursor. This market niche, while lower in volume, demands exceptionally high purity Hexamine and operates under highly secured and regulated procurement processes. Furthermore, manufacturers of specialty adhesives and coatings, particularly those used in demanding environments like aerospace and marine applications, are growing potential customers. These buyers utilize Hexamine to achieve rapid curing times and enhanced durability in thermoset systems. Understanding the precise purity and physical form requirements (e.g., granular versus powder) for each customer segment allows Hexamine producers to tailor their offerings, maximizing utility and premium pricing opportunities in specialized industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,260.8 Million |

| Growth Rate | CAGR 5.8 % |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexion Inc., BASF SE, Metadynea LLC, Chemanol (Methanol Chemicals Co.), Mitsubishi Gas Chemical Company Inc., Shchekinoazot JSC, Simalin Chemical Industry Co., Ltd., Kanoria Chemicals & Industries Ltd., Shengda Chemical (Linyi) Co., Ltd., MGC Chemicals, AARTI INDUSTRIES LTD., SPC Chemical Group, Ercros S.A., Shandong Dongming Petrochemical Group, Saudi Basic Industries Corporation (SABIC), GFS Chemicals Inc., The Chemical Company (TCC), Lihai Chemical, Ningxia Coal Industry Co. Ltd., and Seema Chemical Works. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hexamine for Industrial Uses Market Key Technology Landscape

The core technology landscape in the Hexamine market is centered around optimizing the industrial synthesis process, which typically involves the liquid-phase reaction of ammonia and formaldehyde under controlled temperature and pressure conditions, followed by crystallization and drying. Key technological advancements focus on achieving higher product purity, which is crucial for applications such as pharmaceuticals and high-specification explosives, by implementing advanced filtration and recrystallization techniques. Modern manufacturing plants leverage Continuous Stirred Tank Reactors (CSTRs) and proprietary kinetic modeling software to ensure highly efficient conversion rates and minimize unwanted side product formation, such as dimethyl ether or other nitrogenous compounds. Furthermore, technologies focusing on energy recovery and closed-loop systems are increasingly being adopted to improve the overall sustainability and cost-competitiveness of Hexamine production, directly addressing rising energy costs and environmental scrutiny.

A secondary, yet critical, technological area is the development of specific product forms tailored to end-user needs. For instance, producers are investing in sophisticated granulation and pelletizing technologies to create dust-free, free-flowing Hexamine forms. These specialized forms offer better handling, improved safety profiles, and enhanced dosing accuracy when incorporated into complex polymer compounding processes, particularly in high-speed rubber and plastics manufacturing lines. The implementation of advanced sensor technology, coupled with real-time process control (RPC), allows manufacturers to maintain strict crystalline structure consistency, a non-negotiable parameter for friction material and resin curing applications where predictable reaction rates are essential for product performance and reliability.

The future technology landscape is moving towards sustainable synthesis and digitalization. Research is intensifying into alternative, potentially bio-based feedstocks for formaldehyde and ammonia production, aiming to de-link Hexamine production from volatile petrochemical supply chains. Digitalization, integrating IoT and AI/ML systems within the plant environment, is becoming a standard best practice, enabling predictive quality assurance, optimizing utility consumption, and streamlining regulatory reporting. This shift toward smart manufacturing allows established players to achieve superior economies of scale and maintain a competitive edge through reduced operational variance and enhanced response capability to market demand fluctuations. The focus is systematically shifting from basic reaction chemistry to sophisticated downstream processing and data-driven operational management.

Regional Highlights

Regional dynamics play a paramount role in the Hexamine for Industrial Uses Market, with production and consumption concentrated primarily in industrialized and rapidly industrializing zones. Asia Pacific (APAC) currently holds the largest market share and exhibits the highest growth rate. This dominance is attributable to the massive manufacturing bases in China and India, which are major global hubs for automotive component production, construction materials (plywood, laminates), and electronics. The high consumption of phenolic resins in these countries, supported by large populations and extensive infrastructure projects, drives consistent and escalating demand for Hexamine as a hardener. Furthermore, relatively lower labor costs and supportive governmental policies for chemical manufacturing in countries like South Korea and Taiwan further solidify APAC’s status as the central axis of the Hexamine market. Production facilities in this region often operate at maximum capacity to meet both domestic and export requirements, making capacity utilization a key performance indicator.

North America and Europe represent mature markets characterized by steady demand and a strong focus on high-specification, high-purity applications. In North America, the Hexamine market is buoyed by stable demand from the automotive after-market and robust aerospace and defense sectors, which require ultra-high-purity Hexamine for specialized applications, including RDX production. European demand is stable but faces stringent environmental regulations, particularly regarding formaldehyde emissions and REACH compliance, compelling end-users to adopt highly efficient curing processes and demanding suppliers to provide low-emission formulations. The emphasis in these regions is less on volume growth and more on technological sophistication, product customization, and adherence to rigorous sustainability standards, often resulting in higher average selling prices for Hexamine products compared to APAC.

Latin America and the Middle East & Africa (MEA) are emerging regions offering significant long-term growth potential. Latin America, particularly Brazil and Mexico, demonstrates increasing demand driven by local automotive manufacturing and growing construction activities, requiring essential rubber chemicals and adhesives. The MEA region is experiencing increasing industrialization, fueled by large governmental investments in infrastructure and petrochemical expansion projects in countries like Saudi Arabia and the UAE. As domestic production capabilities for plastics and composites expand within the Gulf Cooperation Council (GCC) states, the reliance on imported Hexamine is gradually decreasing, although local production is still catching up. These regions are characterized by less stringent environmental controls compared to Europe, enabling faster industrial scaling, but their market growth is highly susceptible to internal economic stability and global oil price trends, which influence local project funding and industrial feedstock costs.

- Asia Pacific (APAC): Dominant market share fueled by automotive and construction sectors in China and India; high growth rate due to rapid industrialization.

- North America: Stable, mature market focusing on high-purity applications, defense, and specialized friction materials; strong regulatory environment driving product innovation.

- Europe: Moderate growth, high compliance costs due to REACH and environmental regulations; emphasis on sustainability and specialized resin formulations for high-value composites.

- Latin America (LATAM): Emerging market driven by local automotive assembly and infrastructure development; potential for future capacity expansion.

- Middle East & Africa (MEA): Growing industrial consumption linked to petrochemical and construction investments; gradual development of local production capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hexamine for Industrial Uses Market.- Hexion Inc.

- BASF SE

- Metadynea LLC

- Chemanol (Methanol Chemicals Co.)

- Mitsubishi Gas Chemical Company Inc.

- Shchekinoazot JSC

- Simalin Chemical Industry Co., Ltd.

- Kanoria Chemicals & Industries Ltd.

- Shengda Chemical (Linyi) Co., Ltd.

- MGC Chemicals (part of Mitsubishi Gas Chemical)

- AARTI INDUSTRIES LTD.

- SPC Chemical Group

- Ercros S.A.

- Shandong Dongming Petrochemical Group

- Saudi Basic Industries Corporation (SABIC)

- GFS Chemicals Inc.

- The Chemical Company (TCC)

- Lihai Chemical

- Ningxia Coal Industry Co. Ltd.

- Seema Chemical Works

Frequently Asked Questions

Analyze common user questions about the Hexamine for Industrial Uses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary industrial function of Hexamine and its growth drivers?

Hexamine, or Hexamethylenetetramine, primarily functions as a curing agent for phenolic and amino resins and as a vulcanization accelerator in the rubber industry. Its growth is primarily driven by expanding global output in the automotive sector (friction materials, tires) and the construction industry (adhesives, structural materials), particularly in high-growth regions like Asia Pacific.

How significant is the impact of raw material price volatility on the Hexamine market?

The impact is highly significant. Hexamine production relies heavily on ammonia and formaldehyde, both derivatives of natural gas and methanol. Fluctuations in global energy prices and petrochemical markets directly influence the manufacturing costs of Hexamine, often leading to reduced operating margins for producers lacking backward integration into feedstock supply.

Which application segment accounts for the largest share of Hexamine consumption globally?

The Synthetic Resins segment, specifically the production of phenolic resins (like Bakelite) used in molding compounds, laminates, and adhesives, accounts for the largest consumption share. These resins are indispensable across electrical, construction, and automotive friction applications due to their exceptional heat resistance and mechanical strength, facilitated by Hexamine curing.

What technological advancements are shaping the future of Hexamine production?

Future advancements are focused on process optimization through digitalization, including AI-driven predictive maintenance and real-time process control (RPC) to enhance purity and yield. Additionally, there is growing emphasis on developing sustainable, low-emission Hexamine formulations and exploring non-fossil fuel feedstocks to meet stringent environmental compliance standards, particularly in Europe and North America.

Why is the Asia Pacific region dominating the Hexamine for Industrial Uses Market?

APAC dominates due to its status as the world’s largest manufacturing hub, hosting vast production capacities for automotive parts, tires, and construction materials. High urbanization rates, large-scale infrastructure projects, and favorable industrial policies in countries like China and India ensure overwhelming demand for Hexamine as a core chemical intermediate, solidifying regional market leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager