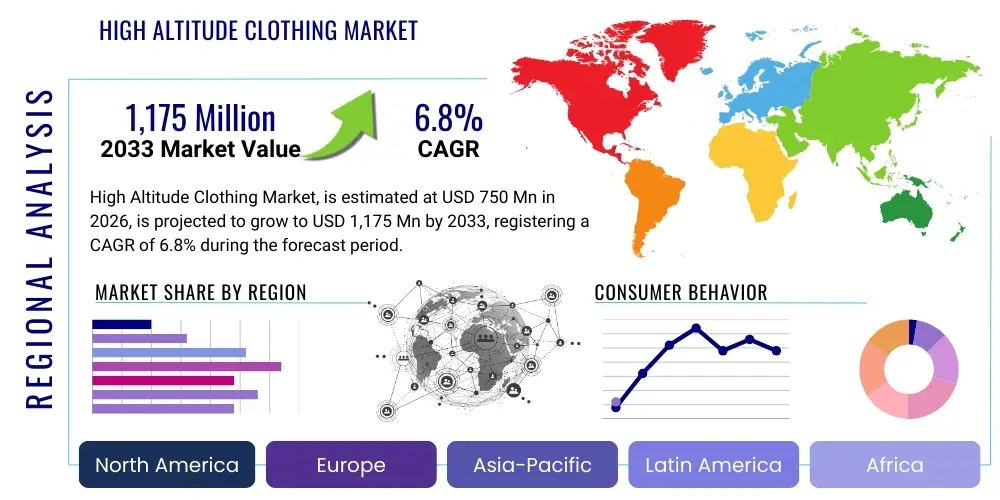

High Altitude Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435448 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

High Altitude Clothing Market Size

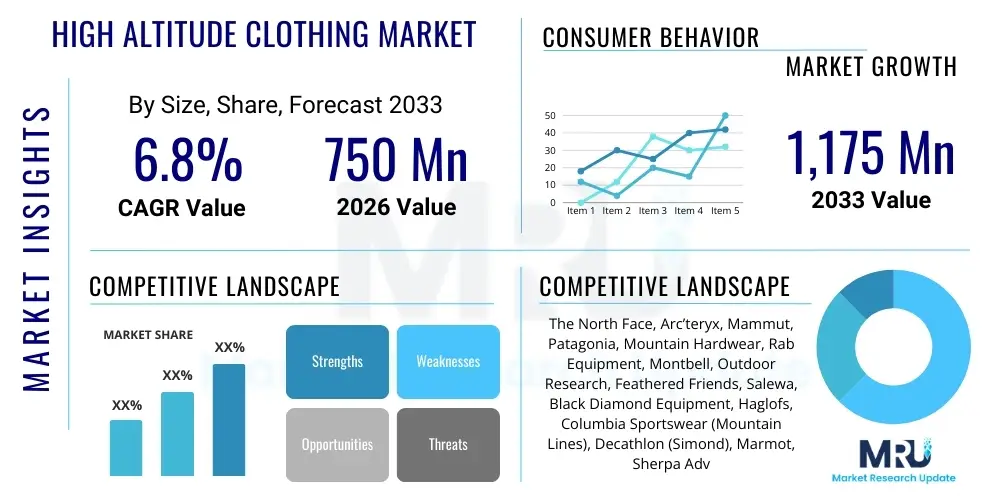

The High Altitude Clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750 Million USD in 2026 and is projected to reach $1,175 Million USD by the end of the forecast period in 2033.

High Altitude Clothing Market introduction

The High Altitude Clothing Market encompasses highly specialized apparel designed for protection against the severe environmental factors prevalent at elevations typically exceeding 8,000 feet, including extreme cold, intense UV radiation, gale-force winds, and low atmospheric pressure. These products are engineered using advanced material science, focusing intensely on achieving optimal warmth-to-weight ratios, superior moisture management, and robust durability to ensure survival and peak operational performance for the wearer. Key product categories range from high-loft insulated expedition parkas and technical shells to moisture-wicking base layers and specialized high-altitude boots, often employing proprietary technologies such as GORE-TEX Pro and specific grades of certified goose down or advanced synthetic insulators like PrimaLoft Gold.

The primary applications for this technical gear are professional mountaineering, military operations in extreme cold weather (ECW) and alpine environments, specialized scientific research expeditions, and high-end adventure tourism focused on climbing and trekking major peaks. The fundamental benefit of this apparel is the maintenance of core body temperature and prevention of cold injuries (hypothermia and frostbite) by creating a regulated microclimate against external weather stresses. The design architecture emphasizes thermal layering systems, crucial for adaptability as environmental conditions shift rapidly at altitude, ensuring the user can manage heat and sweat effectively without compromising safety or mobility during critical phases of an ascent.

Market growth is significantly driven by the escalating global participation in extreme sports, particularly high-altitude trekking and climbing, supported by increased disposable income in major economies and enhanced safety awareness requiring certified, performance-driven gear. Further driving factors include technological advancements in breathable, waterproof membrane materials and the integration of lightweight yet durable components that reduce the physical load on the climber. While the high manufacturing complexity and cost of premium, ethically sourced materials pose a barrier to entry, the unwavering focus on human safety in extreme conditions ensures continuous innovation and sustained demand for high-performance protective clothing.

High Altitude Clothing Market Executive Summary

The global High Altitude Clothing Market demonstrates resilient growth driven by technological advancements in textile engineering and the burgeoning global interest in extreme adventure sports. Business trends indicate a strong polarization towards premium, high-specification products, where leading manufacturers are heavily investing in proprietary thermal modeling software and ethical sourcing verification for insulation materials, particularly high-fill-power goose down. There is a noticeable shift toward integrating enhanced durability and repairability into design, acknowledging the substantial investment consumers make in expedition-grade gear, thus extending the product lifecycle and reinforcing brand loyalty among elite users and professional guides. Mergers and acquisitions remain minimal, but strategic partnerships between specialized fabric developers and finished goods manufacturers are intensifying to secure exclusive access to next-generation membrane technology.

Regionally, the market is spearheaded by North America and Europe, which host established mountaineering cultures, significant disposable income, and dominant market players like The North Face and Arc’teryx. However, the Asia Pacific region, particularly countries bordering the Himalayan range such as Nepal, India, and China, is projected to exhibit the fastest growth. This acceleration is fueled by the rising participation of affluent local consumers in high-altitude activities, coupled with governmental investment in developing specialized domestic rescue and military forces requiring robust, reliable gear. Latin America, specifically the Andean region, also presents substantial growth opportunities, driven by increasing international tourism focused on trekking major peaks like Aconcagua.

Segment trends reveal that the Mountaineering/Expedition category maintains the largest market share due to the stringent performance requirements and non-negotiable safety standards of 8,000-meter climbing. Within product segmentation, insulated outerwear (parkas and suits) commands the highest value due to complexity and material cost, followed closely by specialized high-altitude footwear. The material segment is witnessing intense competition between natural down, which offers the best warmth-to-weight ratio, and highly compressible, water-resistant synthetic insulations, which are gaining traction due to lower cost and improved performance in wet conditions. Distribution trends emphasize direct-to-consumer (D2C) channels and specialty outdoor retailers, which offer the necessary expert consultation required for selecting expedition-level gear.

AI Impact Analysis on High Altitude Clothing Market

Common user questions related to the impact of AI on the High Altitude Clothing Market often revolve around optimizing material composition, personalization of thermal performance, and streamlining complex supply chains. Users are keenly interested in whether AI can predict gear failure based on usage patterns, design custom layering systems specific to an expedition's biometric data and route elevation profile, and automate quality control for technical textile welding and seam sealing. There is a strong expectation that AI will lead to the development of 'smart clothing' integrated with predictive thermal sensors, enhancing safety and performance in remote, extreme environments, ultimately moving from passive protection to proactive thermal management systems tailored to the individual climber's metabolic output and external environmental stressors.

The integration of Artificial Intelligence (AI) and machine learning (ML) is fundamentally transforming the research and development pipeline for technical textiles used in high altitude clothing. AI algorithms are increasingly employed to model and simulate the thermal dynamics of various fabric combinations under extreme pressure and temperature variables, allowing manufacturers to optimize insulation-to-weight ratios significantly faster than traditional physical testing methods. This computational approach reduces material waste, accelerates innovation cycles, and ensures the structural integrity of specialized materials, such as thin-ply carbon fiber composites and advanced ceramic coatings sometimes experimented with in extreme expedition gear. By simulating millions of real-world scenarios, including severe wind chill and moisture saturation, designers can validate performance before physical prototyping, drastically reducing costs and development time for new expedition-ready products.

Furthermore, AI is crucial in optimizing the complex logistics and manufacturing processes inherent in this niche sector. ML models can analyze demand fluctuations across different regional climbing seasons (e.g., Himalayan spring vs. Andes winter) to forecast inventory needs precisely, reducing carrying costs for high-value items which often have long lead times due to specialized component procurement. In manufacturing, AI-powered computer vision systems are deployed for hyper-accurate textile cutting and pattern matching, ensuring minimal material loss, especially for expensive high-performance fabrics. This precision is vital for maintaining the intended thermal performance and structural integrity of the final product, directly impacting user safety at extreme elevations, particularly in the critical processes of down baffling and seam welding that require zero tolerance for error.

- AI-driven optimization of material layering systems based on thermoregulation modeling and physiological data inputs.

- Predictive analytics for complex supply chain management, improving inventory forecasting for highly seasonal and volatile demand spikes in niche gear.

- Automated quality control using computer vision for precision cutting and microscopic seam inspection of technical, multi-layer fabrics.

- Development of 'smart textiles' integrated with biometric and environmental sensors processed by embedded AI for real-time risk assessment and adaptive thermal adjustment.

- Accelerated discovery and formulation of novel high-performance insulation materials through ML-assisted simulations of molecular structures and thermodynamic properties.

DRO & Impact Forces Of High Altitude Clothing Market

The dynamics of the High Altitude Clothing Market are dictated by a stringent balance between escalating demand for extreme adventure safety and the high technological barrier to entry associated with material science innovation. Key drivers include the surge in global adventure tourism targeting high peaks (e.g., climbing the Seven Summits), coupled with substantial governmental and private funding allocated to specialized search and rescue operations that require the most advanced protective apparel. These factors, alongside continuous marketing efforts by leading brands highlighting safety and verifiable performance metrics, sustain premium pricing and ensure continuous investment in critical research and development. The intrinsic requirement for gear that will not fail under duress is the single greatest accelerator in this high-value, performance-driven market segment.

Restraints primarily center on the prohibitive cost of raw materials—especially high-loft goose down sourced ethically and certified by bodies like the Responsible Down Standard (RDS), and patented membrane technologies like GORE-TEX Pro. The technical complexity, specialized labor, and necessity for clean-room manufacturing environments required for producing highly stratified, sealed, and durable garments limit scalability and contribute to significantly higher retail prices, narrowing the consumer base compared to general outdoor apparel. Furthermore, environmental concerns regarding the sourcing of materials, particularly fluorinated chemicals (PFCs) used for durable water repellency (DWR), and the extreme difficulty of recycling complex composite technical textiles pose regulatory and ethical restraints that manufacturers must constantly navigate by investing in eco-friendly alternatives.

Opportunities exist significantly in material breakthroughs focusing on sustainability, particularly the development of high-performance biodegradable or fully recyclable synthetic insulation that can potentially match the warmth-to-weight ratio of natural down, reducing reliance on animal products. The expansion into adjacent professional markets, such as high-altitude drone piloting, stratospheric aerospace testing, and specialized industrial maintenance in extreme cold environments, also presents new specialized niches requiring adaptation of core textile technologies. Impact forces, driven by strict safety regulations from mountaineering associations and the unforgiving nature of the environment, dictate that innovation must prioritize failure minimization, making stringent performance validation, certification (e.g., EN standards), and provable field reliability critical competitive forces within the market structure.

Segmentation Analysis

The High Altitude Clothing Market is systematically segmented based on product type, material, application, and distribution channel, reflecting the varied needs of users operating in diverse extreme cold and high-stress environments. Product type segmentation distinguishes between highly technical Outerwear, essential Base and Mid Layers, and critical Accessories, each designed with unique functional requirements—from shell layers providing absolute wind and water protection, to inner layers managing moisture transfer away from the skin. Material segmentation is crucial, differentiating high-performance natural insulation (down) from advanced synthetic insulations, reflecting trade-offs between warmth, weight, and performance in damp conditions. This rigorous segmentation allows manufacturers to target specific niche requirements, such as the lightweight needs of fast-and-light climbers versus the sheer thermal mass required for polar expeditions.

Application analysis highlights the dominant role of Mountaineering and Expedition activities, which demand the highest specification of gear due to prolonged exposure and extreme temperatures, thereby commanding the highest average selling prices (ASPs). The Military and Defense segment also requires rigorous performance standards but often prioritizes durability, camouflage, and standardization across units. The emergence of high-end specialized trekking, distinct from general leisure hiking, drives demand for intermediate-level technical gear that bridges the gap between everyday outdoor wear and full expedition suits. Distribution channels differentiate between traditional brick-and-mortar specialty stores, which offer necessary fitting expertise and consultation for complex layering systems, and the expanding e-commerce channels which provide wider access and competitive pricing, particularly for replacement components and accessories.

Understanding these segment dynamics is critical for market positioning. For instance, focusing on the material segment requires continuous R&D investment to secure patents for next-generation fibers, while focusing on application segments requires specialized partnerships with guiding organizations or government procurement agencies. The increasing consumer awareness regarding technical specifications (e.g., fill power, membrane hydrostatic head rating, breathability score) further drives segment refinement, ensuring that marketing efforts are highly detailed and focused on performance metrics rather than aesthetic qualities, confirming the market's reliance on empirical data and functional superiority.

- By Product Type:

- Outerwear (Expedition Parkas, Shell Jackets, Insulated Pants)

- Mid-Layers (Fleece, Lightweight Insulation Jackets)

- Base Layers (Merino Wool, Synthetic Moisture-Wicking Tops and Bottoms)

- Footwear and Accessories (High-Altitude Boots, Specialized Gloves, Mittens, Headwear)

- By Material:

- Natural Down (Goose Down, Duck Down - Classified by Fill Power)

- Synthetic Insulation (PrimaLoft, Thinsulate, Proprietary Blends)

- Technical Textiles (GORE-TEX, eVent, Pertex, Reinforced Nylon/Cordura)

- By Application:

- Mountaineering and Expedition Climbing (8,000m+)

- Military and Defense Operations (Arctic/Alpine Warfare)

- Specialized High-Altitude Trekking

- Scientific Research and Rescue Operations

- By Distribution Channel:

- Specialty Outdoor Retail Stores

- Online Retail (E-commerce Platforms and D2C Websites)

- Hypermarkets and Department Stores (Limited Selection)

- Direct Sales (Government/Institutional Procurement)

Value Chain Analysis For High Altitude Clothing Market

The value chain for High Altitude Clothing is inherently complex and highly specialized, beginning with the upstream analysis dominated by the sourcing and treatment of critical raw materials. This initial stage involves ethical procurement of high-fill-power down, often requiring extensive certification and traceability (RDS), and the negotiation of intellectual property rights for high-performance membrane textiles (e.g., licensing of GORE-TEX). Given the high cost and functional criticality of these inputs, manufacturers rely on a limited pool of specialized suppliers, leading to significant concentration risk and strong pricing power at the upstream level. Quality control at this stage—ensuring material integrity, consistency, and performance under laboratory conditions—is paramount, as failure here directly jeopardizes the final product's safety rating.

The subsequent midstream processing involves highly technical manufacturing, including precision cutting, complex baffling construction for down retention, and critical seam sealing using advanced thermal welding techniques to ensure waterproof and windproof integrity. Unlike standard apparel manufacturing, high altitude clothing requires clean-room environments and skilled labor specializing in handling delicate yet functional technical fabrics. Downstream analysis focuses on distribution channels. While direct and indirect channels coexist, specialized outdoor retailers play a crucial role in indirect distribution. These retailers provide essential customer education, fitting consultations, and warranty services necessary for complex, expensive layering systems, acting as critical points of contact for customers making high-stakes purchasing decisions.

Direct channels (D2C via proprietary websites) are increasing in importance, offering manufacturers higher margins and direct control over brand messaging and customer data, allowing for highly personalized marketing efforts focused on specific expeditions or climbing styles. Institutional procurement, particularly from military and government rescue organizations, operates largely through direct sales and specialized tender processes, representing a stable, high-volume segment that values reliability and contractual compliance above retail trends. The efficiency of the value chain is ultimately measured not just by cost optimization, but by the ability to maintain zero-defect manufacturing standards under rapid seasonal demand cycles, ensuring that highly specialized gear reaches remote markets efficiently and reliably.

High Altitude Clothing Market Potential Customers

The primary consumers and end-users of High Altitude Clothing are individuals and organizations requiring absolute protection and performance capability in life-threatening cold environments. This includes elite professional mountaineers and climbing guides who rely on expedition suits and robust layering systems for prolonged survival and performance above 6,000 meters, representing the segment demanding the highest fill-power down, maximum durability, and lightest weight. These users require custom fitting and the latest technological advancements, often driving the premium pricing segment. Another significant end-user base is high-altitude trekking tourists, typically affluent consumers engaging in guided trips to locations such as Everest Base Camp or Kilimanjaro, who require high-quality, reliable, though often slightly less technical, outer and mid-layers for temperatures down to -20°C.

Beyond the leisure and professional sports segment, governmental and institutional buyers constitute a major source of demand. Military and defense forces operating in extreme cold weather or alpine theatres require standardized, durable, and camouflage-specific high altitude clothing systems (often procured in large volumes). Similarly, professional search and rescue (SAR) teams, meteorological researchers, and high-altitude research scientists constitute niche but critical customer groups. These institutional buyers prioritize functional reliability, adherence to strict performance specifications (often military or national standards), and long-term supply agreements over retail trends, leading to strong, consistent revenue streams for established market players who hold the necessary procurement certifications.

The market is also seeing an expansion into adjacent professional applications, such as specialized industry technicians working on high-altitude infrastructure (e.g., telecom towers, observatories) and the growing sector of high-altitude drone operations, where operators require specialized thermal protection for stationary work in exposed conditions. The unifying characteristic among all these customer segments is the non-negotiable requirement for safety and performance; failure of the apparel is not just an inconvenience but a potential fatality, making the purchasing decision heavily reliant on brand reputation, certified test results, and expert endorsement from proven expedition leaders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million USD |

| Market Forecast in 2033 | $1,175 Million USD |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The North Face, Arc’teryx, Mammut, Patagonia, Mountain Hardwear, Rab Equipment, Montbell, Outdoor Research, Feathered Friends, Salewa, Black Diamond Equipment, Haglofs, Columbia Sportswear (Mountain Lines), Decathlon (Simond), Marmot, Sherpa Adventure Gear, Karrimor, Zamberlan, La Sportiva, Eider |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Altitude Clothing Market Key Technology Landscape

The High Altitude Clothing market is fundamentally defined by continuous technological innovation, primarily focusing on improving the three core parameters of performance: insulation efficiency, weight reduction, and moisture management. The landscape is dominated by proprietary membrane technologies, notably those offering superior waterproof-breathable performance (e.g., GORE-TEX Pro, eVent, proprietary future fabrics). These membranes are critical for preventing external moisture penetration while allowing internal perspiration to escape, thus mitigating the catastrophic risk of internal dampness leading to rapid conductive heat loss at high altitudes. Manufacturers heavily invest in optimizing membrane lamination techniques and Durable Water Repellent (DWR) finishes, increasingly prioritizing environmentally friendly, PFC-free DWR treatments to meet evolving regulatory and consumer expectations.

Insulation technology constitutes the second pillar of the landscape. While high-fill-power (800+ FP) goose down remains the gold standard for static warmth-to-weight performance, significant advancements are occurring in synthetic insulation. Modern synthetic fillers, like Primaloft Gold and various proprietary cluster fibers, are engineered to mimic the structure of down while retaining heat when wet—a crucial advantage in mixed cold/wet conditions. The technological focus is on creating insulation that is highly compressible, durable, and structurally resilient against repeated packing and unpacking, maintaining its thermal loft over the long term. This involves complex fiber construction and thermal mapping integration into the garment design, ensuring insulation is strategically placed where heat loss is greatest.

Furthermore, digital technologies are rapidly becoming a key competitive differentiator. This includes the use of Computational Fluid Dynamics (CFD) and thermal imaging analysis during the design phase to pinpoint cold spots and optimize baffle design, especially for full expedition suits. Advanced textile joining techniques, such as ultrasonic welding and precise laser cutting, replace traditional stitching in critical areas to minimize bulk, eliminate needle holes (which compromise waterproof integrity), and increase garment strength. These technological processes are essential not only for performance enhancement but also for meeting the increasingly demanding certification standards required by professional users and expedition regulatory bodies globally.

Regional Highlights

- North America: North America, led by the United States and Canada, represents the largest and most technologically mature market for high altitude clothing. This dominance is attributed to a strong heritage of mountaineering in ranges like the Rockies and Alaska, high disposable income levels among outdoor enthusiasts, and the presence of globally leading outdoor apparel brands (e.g., The North Face, Mountain Hardwear, Arc’teryx). The region is a key driver of R&D and technological adoption, often serving as the primary testing ground for next-generation fabrics and insulation systems before global rollout. Demand is highly concentrated in the premium and ultra-premium segments, with a significant institutional requirement from military and specialized rescue organizations operating in sub-arctic conditions.

- Europe: Europe maintains a substantial market share, fueled by a deeply ingrained alpine culture centered around the Alps and Pyrenees. Countries like Germany, Switzerland, and Norway are major hubs for both consumption and manufacturing, housing key players such as Mammut and Salewa. The European market exhibits strong regulatory pressures regarding sustainability and ethical sourcing, pushing manufacturers to adopt strict environmental certifications (e.g., Bluesign standards, RDS). The demand structure is diversified, ranging from professional guides requiring highest-end gear to a massive market for high-altitude trekking tourism across continental mountain ranges.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period, driven by the increasing affluence of populations in China and India, and the geographical proximity to the world's highest peaks (the Himalayas). While currently dominated by imports of high-end Western brands, local manufacturers in China are rapidly improving their technological capabilities to capture the growing domestic market for specialized trekking and climbing gear. Investment in infrastructure and the growing domestic adventure tourism sector are key economic indicators supporting this growth. Nepal and Pakistan are critical secondary markets due to their importance as logistical hubs for international expeditions.

- Latin America: The Latin American market, focused predominantly on the Andean region (Chile, Argentina, Peru), is heavily influenced by international tourism targeting peaks like Aconcagua. Consumption is split between rental markets serving international climbers and a growing domestic segment of adventure enthusiasts. The market growth relies significantly on improvements in local distribution channels and the establishment of local specialty retailers capable of handling technical sales and servicing high-value gear.

- Middle East and Africa (MEA): This region holds the smallest share but offers niche opportunities in areas like the Atlas Mountains (Morocco) and specialized military procurements. The limited local demand for true high-altitude gear means the market is reliant on imports, with growth potential tied to specialized scientific expeditions and geopolitical requirements rather than mass tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Altitude Clothing Market.- The North Face (VF Corporation)

- Arc’teryx (Amer Sports)

- Mammut Sports Group AG

- Patagonia Inc.

- Mountain Hardwear (Columbia Sportswear)

- Rab Equipment (Equip Outdoor Technologies Ltd)

- Montbell Co., Ltd.

- Outdoor Research

- Feathered Friends

- Salewa (Oberalp Group)

- Black Diamond Equipment

- Haglofs AB

- Marmot (Newell Brands)

- Decathlon (Simond Brand)

- Sherpa Adventure Gear

- Karrimor

- Zamberlan

- La Sportiva

- Eider (Lafuma Group)

- Helly Hansen (Canadian Tire Corporation)

Frequently Asked Questions

Analyze common user questions about the High Altitude Clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between high-altitude and standard winter clothing?

High-altitude clothing is engineered for survival in sub-zero temperatures (often below -30°C) with low atmospheric pressure and extreme wind chill, prioritizing complex layering systems, zero-tolerance windproofing, and high-fill-power insulation. Standard winter gear is generally designed for lower altitudes and urban cold, lacking the stratification and material robustness required for sustained expedition use.

Why is ethical sourcing, such as Responsible Down Standard (RDS), critical in this market?

Ethical sourcing, particularly the RDS, is critical because high-altitude garments heavily rely on high-loft natural down, often obtained from geese. Certification ensures that the down is ethically collected and not sourced through cruel practices like live-plucking. Consumer demand and brand reputation in the premium outdoor sector are increasingly dependent on transparent and verifiable ethical supply chains, impacting brand loyalty and market access.

How significant is the military and defense segment to the high altitude clothing market?

The military and defense segment is highly significant, driving substantial, stable revenue streams due to large-volume procurement requirements for specialized alpine and arctic warfare gear. This segment often demands custom specifications related to durability, camouflage, and standardization, and acts as an early adopter for material technologies that later transition into the consumer expedition market.

What role does technology play in mitigating the risk of hypothermia at extreme altitudes?

Technology plays a critical role through advanced membrane breathability (managing internal moisture/sweat to prevent evaporative cooling), optimal insulation (achieving maximum thermal retention with minimal weight), and AI-assisted design (thermal mapping to eliminate cold spots). The goal is to provide a non-permeable shell against external elements while effectively managing the user’s metabolic heat and moisture output, which is the primary cause of sudden hypothermia.

Which geographic region is expected to show the highest growth rate in this market?

The Asia Pacific (APAC) region, specifically driven by the economic growth and burgeoning adventure tourism sectors in countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). Proximity to the world's largest mountain ranges (the Himalayas) and rising middle-class disposable incomes are the core accelerators for this regional expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager