High Capacity Air Fryer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434369 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

High Capacity Air Fryer Market Size

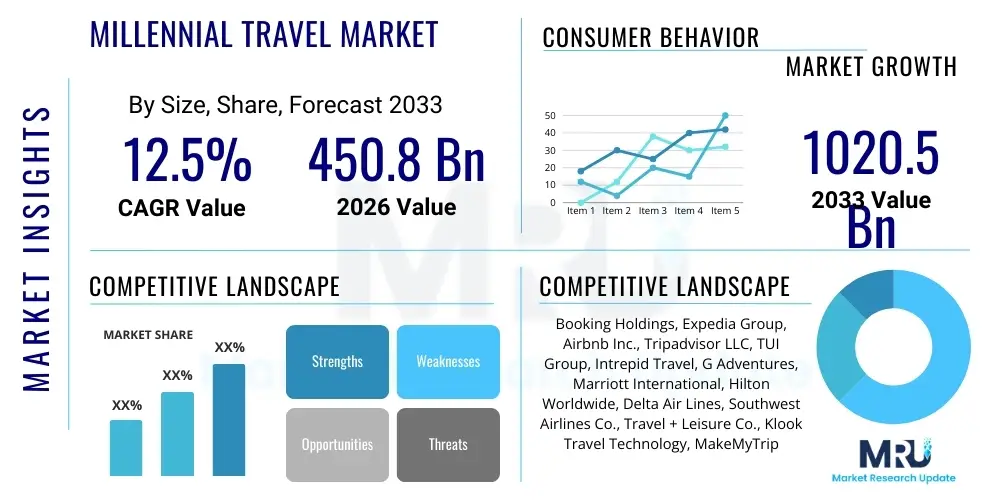

The High Capacity Air Fryer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

High Capacity Air Fryer Market introduction

The High Capacity Air Fryer Market encompasses convection-based kitchen appliances designed specifically for large volume cooking, typically defined as having a basket or chamber capacity exceeding 6 quarts (or approximately 5.7 liters). These appliances utilize rapid air circulation technology, often combined with a heating element, to mimic the results of deep frying using minimal to no oil. The core product description revolves around delivering healthier cooking alternatives while accommodating the needs of larger households, commercial settings such as small cafes, or users engaged in batch cooking and meal preparation. Unlike their smaller counterparts, high-capacity models often feature advanced functionalities like dual-zone cooking, integrated smart sensors for temperature modulation, and specialized pre-set programs tailored for bulk items such as whole chickens or large batches of frozen foods. The increasing consumer focus on nutritious diets, coupled with the desire for time-efficient cooking solutions, acts as a pivotal driver for this market segment's expansion.

Major applications for high-capacity air fryers extend beyond simple frying to include roasting, baking, grilling, and dehydrating large food quantities, offering multifunctionality that consolidates several kitchen appliances into one. They are particularly utilized for preparing full meals for large families (four or more individuals), hosting parties, or simplifying professional meal prep, which has become a significant lifestyle trend. Key benefits include the substantial reduction in oil usage, leading to food that is lower in fat and calories, rapid cooking times compared to conventional ovens, and ease of cleanup due to non-stick surfaces and dishwasher-safe components. Furthermore, the capacity to handle large items without compromising cooking uniformity is a defining characteristic, appealing directly to consumers who previously found standard air fryers too restrictive for their culinary needs. This market introduction establishes the High Capacity Air Fryer as a premium, highly functional appliance driven by efficiency and health-conscious consumption patterns.

Driving factors for sustained market growth include rapid urbanization and shrinking kitchen footprints, where a versatile, multi-functional appliance offers high value. The proliferation of digital cooking content and recipe guides optimized for air frying has also increased user confidence and adoption rates. Supply chain innovations leading to cost reductions in components like powerful heating elements and durable non-stick coatings are making these appliances more accessible globally. Moreover, continuous product refinement focused on aesthetic design, smart connectivity (Wi-Fi integration), and energy efficiency further solidifies the market position. The combination of health benefits, operational convenience, and technological integration positions the high-capacity air fryer as a central component of the modern kitchen appliance ecosystem.

High Capacity Air Fryer Market Executive Summary

The High Capacity Air Fryer Market is undergoing significant evolution driven by robust business trends focusing on product diversification and smart integration. Current business trends indicate a strong shift towards multi-zone or dual-basket models, catering to simultaneous preparation of different dishes, thus enhancing consumer convenience and utility. Key players are aggressively investing in durable materials and sophisticated user interfaces (touchscreens, intuitive controls) to justify the higher price point associated with large capacity appliances. Supply chain efficiency and strategic partnerships with major retail chains, both online and physical, are critical for maintaining competitive advantage and ensuring rapid market penetration, especially in emerging economies. The focus on long-term warranties and post-sales support is also emerging as a key differentiator, influencing consumer purchasing decisions regarding premium kitchen electronics.

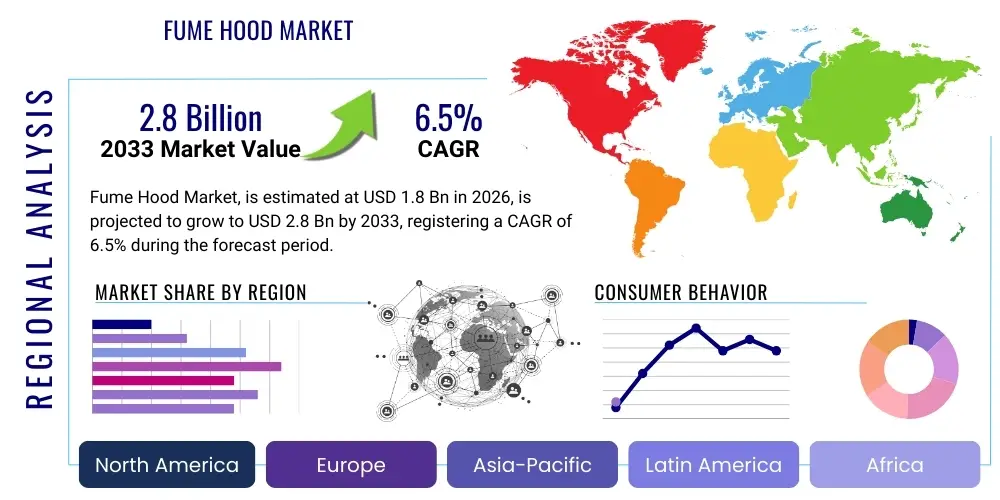

Regionally, North America and Europe currently dominate the market, primarily due to high disposable incomes, mature consumer awareness regarding healthy cooking, and established retail infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, fueled by rapid household formation, increasing adoption of Western cooking styles, and growing urbanization leading to higher demand for efficient home appliances. Regional trends also show variations in capacity preference; while North America prefers models exceeding 10 quarts for family meals, European markets often prioritize space efficiency alongside capacity. Regulatory standards pertaining to energy consumption and appliance safety also dictate regional product specifications, requiring localized product development and marketing strategies.

Segmentation trends highlight the dominance of the Basket Style air fryers in the high-capacity segment due to their familiarity and ease of use, although Oven Style air fryers (often exceeding 12 quarts and offering rotisserie functionality) are capturing significant market share among power users and those seeking maximum versatility. The distribution channel segment is rapidly tilting towards E-commerce, which offers greater product variety, detailed customer reviews, and comparative pricing, crucial factors for consumers investing in premium appliances. Technology segmentation reveals a sharp increase in demand for smart air fryers featuring Wi-Fi connectivity, integration with voice assistants, and app-based remote control, appealing primarily to tech-savvy millennials and Gen Z households.

AI Impact Analysis on High Capacity Air Fryer Market

User inquiries regarding Artificial Intelligence (AI) in the High Capacity Air Fryer Market overwhelmingly center on enhancing user experience, optimizing cooking consistency, and improving energy efficiency. Common questions revolve around whether AI can automatically detect the quantity and type of food loaded (e.g., how many chicken wings are present) and adjust cooking time and temperature dynamically to ensure perfect results without manual intervention. Users express expectations for AI-driven predictive maintenance notifications, personalized recipe recommendations based on past usage patterns, and seamless integration with broader smart home ecosystems, allowing for complex multi-step cooking instructions managed via voice command. Concerns often focus on data privacy related to usage tracking and the potential for AI features to inflate the appliance's cost significantly, questioning the return on investment for high-end smart features versus basic functionality.

- AI-Powered Food Recognition: Sensors and integrated machine learning algorithms analyze food type, weight, and density to automatically set optimal cooking parameters, eliminating guesswork and ensuring consistent results, especially crucial for large batches.

- Predictive Maintenance: AI monitors internal component performance (heating element, fan motor) to predict potential failures, alerting users proactively and scheduling necessary maintenance, extending product lifespan and minimizing downtime.

- Personalized Recipe Generation: Algorithms analyze user preferences, dietary restrictions, and frequently cooked meals to suggest new, high-capacity optimized recipes and adjust existing cooking programs in real-time.

- Dynamic Energy Optimization: AI modulates power usage based on the required thermal output and ambient kitchen conditions, leading to optimized energy consumption and reduced utility costs during long cooking cycles.

- Voice Command Integration: Enhanced integration with major voice assistants (Alexa, Google Assistant) allows users to start, pause, or monitor cooking status hands-free, improving kitchen workflow and safety.

- Quality Control in Manufacturing: AI vision systems are used in the production line to detect minute defects in heating elements, non-stick coatings, and assembly quality, ensuring high standards for premium, high-capacity units.

DRO & Impact Forces Of High Capacity Air Fryer Market

The High Capacity Air Fryer Market is propelled by significant drivers, notably the accelerating consumer adoption of healthier cooking methods that require less fat, coupled with the rising demand from large families and group users seeking efficiency and volume. Restraints primarily include the high initial purchase price associated with large capacity, multi-functional units compared to conventional ovens or smaller air fryers, and existing supply chain volatility impacting component costs and availability. Opportunities are substantial, focusing on penetration into untapped emerging markets and the continued integration of smart home technology (IoT, AI) to elevate the user experience, while also developing highly energy-efficient models to address global sustainability mandates. The interaction of these forces shapes market trajectory: robust consumer demand (Driver) often mitigates the high cost (Restraint), enabling manufacturers to capitalize on premium product innovation (Opportunity), which ultimately leads to accelerated market maturation and consolidation.

Impact forces within this market are diverse and intense. The technological impact force is high, characterized by continuous innovation in heating technology (improving air circulation uniformity) and capacity expansion (developing space-efficient multi-zone designs). The competitive intensity is also high, with global giants and specialized appliance manufacturers fiercely competing on price, features, and warranty support, resulting in rapid product cycles. Regulatory forces, particularly concerning food safety, materials usage (PFOA/PFAS-free coatings), and electrical efficiency, impose moderate but mandatory compliance costs, acting as a barrier to entry for smaller players. Furthermore, macroeconomic conditions, such as global inflation and consumer confidence, directly influence purchasing power, affecting the high price elasticity of these premium appliances. The overall market dynamics suggest a strong upward trajectory driven by consumer preference but tempered by cost sensitivity and aggressive competition.

Segmentation Analysis

The High Capacity Air Fryer Market is meticulously segmented across multiple dimensions to accurately gauge market penetration, consumer behavior, and competitive landscape. The primary segmentation criteria include product type (Basket Style, Oven Style, Paddle Style), capacity size (e.g., 6-10 Quarts, Above 10 Quarts), technology (Analog/Manual, Digital/Smart), distribution channel (Online Retail, Offline Retail), and end-user (Residential, Commercial). This detailed categorization allows manufacturers to tailor marketing strategies and product development efforts toward specific high-value demographics, such as targeting the 'Above 10 Quarts' Oven Style segment for institutional or semi-commercial use, while focusing '6-10 Quarts' Digital Basket models on the average large residential household seeking smart connectivity and convenience. Understanding these segments is crucial for forecasting accurate demand and optimizing inventory management across regional markets.

- By Product Type:

- Basket Style (Traditional Pull-Out Drawer)

- Oven Style (Multi-Rack with Rotisserie Function)

- Paddle Style (Automated Stirring Mechanism)

- By Capacity Size:

- 6 Quarts to 8 Quarts

- 8 Quarts to 12 Quarts

- Above 12 Quarts (Large Family/Institutional Grade)

- By Technology:

- Digital/Touchscreen Controlled

- Analog/Manual Dial Controlled

- Smart/IoT Enabled (Wi-Fi, App Control)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores)

- By End User:

- Residential (Large Families, Batch Cookers)

- Commercial (Small Cafes, Catering Services)

Value Chain Analysis For High Capacity Air Fryer Market

The value chain for the High Capacity Air Fryer Market begins with upstream activities focused on the sourcing and manufacturing of specialized components, which include high-efficiency heating elements, powerful convection fans and motors, advanced microcontrollers and PCBs for smart functionality, and food-grade non-stick materials for the cooking baskets and racks. Strategic supplier relationships are critical at this stage, particularly for ensuring the steady supply of copper, specialized plastics, and integrated circuits. Component quality dictates the final product's reliability and longevity, making procurement standardization and quality assurance protocols highly important. Following component acquisition, the assembly process involves complex manufacturing and quality control, often concentrated in key manufacturing hubs in Asia Pacific, where economies of scale reduce unit costs, preparing the final product for market entry.

The downstream flow centers on efficient distribution and market penetration strategies. High capacity air fryers, being relatively bulky and higher-value items, require optimized logistics to minimize shipping damage and warehousing costs. Distribution channels are segmented into direct sales (brand websites), indirect sales through online retail giants (Amazon, Walmart online), and traditional offline retail (big-box stores, specialty appliance retailers). The shift toward E-commerce is pronounced, as digital platforms enable extensive product comparison, leverage user reviews, and facilitate promotional campaigns targeting specific demographics. Indirect sales through established third-party retailers remain essential for visibility and consumer tactile experience, especially in regions where physical inspection of large appliances is preferred before purchase.

Direct distribution channels allow manufacturers greater control over branding, pricing, and customer data, fostering a direct relationship that supports subscription services (e.g., recipe libraries) or extended warranty upsells. Indirect distribution, while sacrificing control, offers unparalleled market reach and access to existing consumer bases. Maximizing efficiency across the value chain involves minimizing raw material waste, optimizing manufacturing throughput to handle high-demand cycles (like holidays), and utilizing advanced data analytics in downstream logistics to predict regional demand accurately. The final link involves post-sale support, including technical assistance, warranty fulfillment, and management of user-generated content (reviews and feedback), which feeds directly back into future product development cycles.

High Capacity Air Fryer Market Potential Customers

The primary customer base for High Capacity Air Fryers centers around large residential households, typically defined as families with four or more members who require substantial cooking volumes for daily meals. This demographic highly values the ability to cook an entire meal simultaneously, such as a whole roast chicken or a large volume of side dishes, without needing multiple cooking cycles, thereby significantly reducing meal preparation time and overall energy consumption compared to using traditional ovens. These buyers often possess moderate to high disposable incomes and are motivated by health consciousness, actively seeking appliances that facilitate low-fat cooking without sacrificing the texture or flavor of food. They prioritize appliances with robust build quality, advanced digital controls, and sufficient internal space to handle large culinary endeavors, viewing the higher purchase price as a worthwhile investment in efficiency and dietary improvement.

A rapidly expanding segment of potential customers includes professional meal preparers and individuals committed to batch cooking. These users, often health enthusiasts or athletes, utilize the high capacity to prepare numerous meals for the week ahead in a single cooking session, demanding durability and precise temperature control for consistent results across large volumes of protein or complex carbohydrates. Furthermore, small commercial entities, such as boutique catering services, small office kitchens, or specialized food trucks, constitute a viable potential customer base. For these businesses, the high capacity air fryer offers a space-saving, energy-efficient alternative to industrial deep fryers or conventional ovens, allowing them to produce small to moderate volumes of fried, roasted, or baked goods rapidly and with consistent quality, meeting increasingly stringent health and safety standards while optimizing their operational footprint.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cosori, Ninja, Instant Brands, Philips, Breville, Cuisinart, GoWISE USA, Chefman, PowerXL, Dash, NuWave, T-fal, De'Longhi, Zavor, Kalorik, Emeril Lagasse, Gourmia, Vremi, Mueller, Xiaomi (via OEM partners) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Capacity Air Fryer Market Key Technology Landscape

The technological core of the High Capacity Air Fryer Market revolves around advanced high-speed convection systems and thermal regulation mechanisms optimized for volume. Unlike standard convection ovens, air fryers use highly concentrated heating elements coupled with powerful fans that circulate superheated air (up to 400°F or 200°C) at extreme speeds. For high-capacity models, achieving thermal uniformity across a large cooking chamber is the primary technical challenge. This has led to innovations in fan placement (often top-mounted with deflectors) and basket design (perforated metal with specific geometry) to ensure that food items, whether placed on multiple racks in an oven style or stacked in a large basket, receive consistent heat exposure. Furthermore, manufacturers are focusing on rapid heating technology, utilizing high wattage components (1700W to 2000W+) to minimize preheating time, a crucial selling point for time-constrained consumers.

A significant technological development is the incorporation of sophisticated digital sensors and microprocessors. Modern high-capacity units feature precise PID controllers that maintain temperature stability throughout the entire cooking cycle, compensating for heat loss when the basket is opened or when cooking dense, frozen items. This precision is vital for large batches where small temperature fluctuations can result in uneven cooking. Furthermore, smart technology integration, including embedded Wi-Fi chips and Bluetooth connectivity, is becoming standard. These features enable remote monitoring, firmware updates, and the execution of complex multi-stage cooking programs downloaded directly from mobile applications, greatly enhancing the functionality beyond simple timer and temperature settings, and positioning these appliances squarely within the IoT ecosystem.

Material science also plays a crucial role in the technological landscape, particularly concerning durability and safety. The move toward advanced PFOA and PTFE-free non-stick coatings is mandatory due to growing consumer safety concerns and regulatory pressures. High-capacity models must withstand heavier loads and higher usage frequency, requiring robust stainless steel construction and high-quality, heat-resistant plastics for external casings. The introduction of dual-zone technology, which utilizes independent heating elements and controls within a single large unit, represents a major engineering feat, effectively allowing users to run two distinct cooking programs simultaneously. This technological evolution increases the appliance's utility and justifies the premium pricing associated with these highly engineered kitchen tools, driving differentiation in a crowded market.

Regional Highlights

- North America: This region stands as the largest and most mature market for High Capacity Air Fryers, characterized by high consumer awareness regarding air frying technology and a cultural preference for large, multi-functional kitchen gadgets that support American family sizes and entertaining habits. Demand is heavily concentrated in smart, oven-style models exceeding 8 quarts. Strong e-commerce infrastructure and highly competitive pricing strategies among major brands like Ninja and Instant Brands drive substantial sales volumes. The region's focus on low-fat diets strongly aligns with the core value proposition of these appliances, leading to sustained market dominance.

- Europe: The European market demonstrates robust growth, particularly in Western economies (Germany, UK, France), driven by stringent energy efficiency standards and a growing interest in convenient meal preparation. While capacity preference is slightly more varied than North America, focusing on the 6-10 quart range, the demand for high-quality, aesthetically pleasing appliances is paramount. Key drivers include space-saving benefits in smaller European kitchens compared to conventional ovens, and regulatory emphasis on appliance longevity and safety features.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, fueled by rising disposable incomes, rapid urbanization, and the adoption of Western culinary trends. Countries like China and India present massive untapped potential. Although smaller capacity models traditionally dominated, the high capacity segment is gaining traction due to increasing household sizes and the popularity of batch cooking. Manufacturing hubs in this region also facilitate quicker localized product iterations and cost optimization, enabling aggressive pricing to capture a growing middle-class consumer base.

- Latin America (LATAM): This emerging market shows steady growth, driven by shifting consumer lifestyles and increasing awareness of health benefits. Market penetration is currently lower than in developed regions, but economic recovery and expansion of organized retail are contributing to increased sales. Consumers are price-sensitive, often preferring highly durable, lower-tech digital models over high-end smart appliances.

- Middle East and Africa (MEA): Growth in MEA is moderate but concentrated in urban centers, particularly the GCC countries, where high disposable incomes support the purchase of premium, high-capacity appliances for large family gatherings and traditional culinary preparations. The hot climate often favors appliances that minimize kitchen heat generation, making air fryers an attractive alternative to conventional ovens, though logistical challenges and varying retail maturity levels influence distribution complexity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Capacity Air Fryer Market.- Cosori (Parent Company: Vesync Co. Ltd.)

- Ninja (SharkNinja Operating LLC)

- Instant Brands (A Division of Cornell Capital)

- Philips (Koninklijke Philips N.V.)

- Breville (Breville Group Limited)

- Cuisinart (A Conair Corporation Brand)

- GoWISE USA

- Chefman

- PowerXL (Dash/StoreBound)

- NuWave, LLC

- T-fal (Groupe SEB)

- De'Longhi S.p.A.

- Zavor

- Kalorik

- Emeril Lagasse (Licensing arrangement)

- Gourmia

- Vremi

- Mueller Austria

- Aigostar

- Dash (StoreBound)

Frequently Asked Questions

Analyze common user questions about the High Capacity Air Fryer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the optimal capacity range for a High Capacity Air Fryer intended for a family of five?

The optimal capacity range for efficiently serving a family of five is typically between 8 quarts and 12 quarts. This size allows for cooking whole chickens, large batches of fries, or full-size frozen pizzas, significantly reducing the need for multiple cooking cycles and saving substantial meal preparation time.

How do High Capacity Oven Style Air Fryers compare to traditional Countertop Convection Ovens in terms of energy efficiency?

High Capacity Air Fryer Ovens are generally more energy-efficient than traditional convection ovens due to their smaller internal volume and powerful, highly concentrated heating elements. They require significantly less preheating time and cook food faster, leading to lower overall energy consumption per meal preparation cycle.

What are the primary maintenance concerns associated with high-wattage High Capacity Air Fryers?

The primary maintenance concerns relate to the longevity of the heating element and fan motor due to frequent, high-temperature operation. Regular cleaning of the heating element area and ensuring the non-stick coating remains intact are crucial for maintaining optimal performance, flavor quality, and preventing smoke generation.

Are smart features, such as Wi-Fi connectivity and app control, considered essential for premium High Capacity Air Fryer models?

While not strictly essential for basic function, smart features are increasingly viewed as standard for premium High Capacity Air Fryers. They provide advanced functionalities like remote monitoring, personalized recipe libraries, customized cooking programs, and integration into the smart home ecosystem, justifying the higher investment for tech-savvy consumers seeking maximum convenience.

Which segmentation—Basket Style versus Oven Style—dominates the high-capacity segment in terms of market value?

While Basket Style air fryers hold higher unit volume sales due to their familiarity, the Oven Style air fryers, particularly those exceeding 10 quarts, capture a significant portion of market value. This is due to their higher average selling price (ASP), greater feature set (e.g., rotisserie, dehydrating), and appeal to both large residential users and light commercial buyers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager