High Carbon Alcohol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432495 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

High Carbon Alcohol Market Size

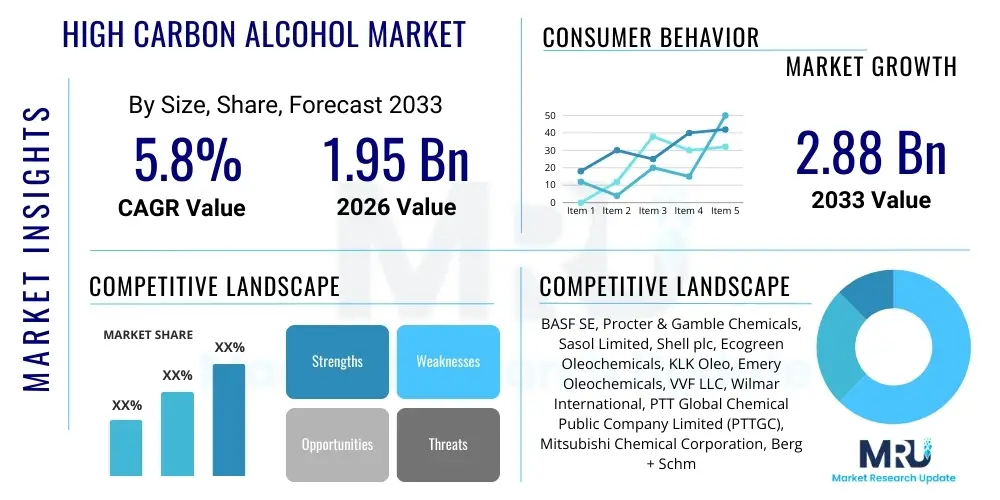

The High Carbon Alcohol Market, encompassing fatty alcohols with chain lengths typically from C12 up to C20 and higher, is experiencing substantial expansion driven by increased demand across key industrial and consumer sectors. This category of alcohols, crucial for manufacturing surfactants, detergents, plasticizers, and high-performance lubricants, is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion USD in 2026 and is projected to reach $2.88 Billion USD by the end of the forecast period in 2033.

High Carbon Alcohol Market introduction

High Carbon Alcohols, also known as long-chain fatty alcohols, are linear, primary alcohols derived either from natural sources (oleochemicals like coconut or palm kernel oil) or synthetic routes (petrochemicals). Products include Lauryl Alcohol (C12), Myristyl Alcohol (C14), Cetyl Alcohol (C16), and Stearyl Alcohol (C18), distinguished by their high molecular weight and amphiphilic nature. These alcohols are fundamental building blocks due to their dual functionality: a long hydrophobic carbon chain and a polar hydroxyl group, making them effective emulsifiers, stabilizers, and viscosity modifiers in complex chemical formulations. Their inherent properties, such as low toxicity and high biodegradability, particularly for naturally derived variants, position them as essential ingredients in the transition toward sustainable chemistry.

The primary applications of high carbon alcohols are vast, spanning household, industrial, and specialized sectors. In the detergent and personal care industry, they serve as precursors for producing alcohol sulfates and alcohol ethoxylates, which are key anionic and non-ionic surfactants necessary for cleaning efficiency and foaming properties. Furthermore, in the cosmetics sector, they are valued for their emollient and thickening capabilities, widely used in creams, lotions, and hair conditioners. Industrially, high carbon alcohols are indispensable in manufacturing plasticizers (phthalate alternatives), specialty lubricants, and anti-foaming agents, enhancing the performance and stability of various polymer and fluid systems.

The market is predominantly driven by surging consumer demand for mild, performance-oriented personal care products and the global trend favoring bio-based ingredients. Regulatory pressures in regions like Europe and North America, advocating for the phasing out of traditional petrochemical-based surfactants in favor of readily biodegradable oleochemical derivatives, further accelerate market growth. Additionally, the rapid industrialization and urbanization across the Asia Pacific region, leading to increased consumption of detergents, cleaning agents, and construction chemicals, provides substantial impetus to the production and consumption of high carbon alcohols globally.

High Carbon Alcohol Market Executive Summary

The global High Carbon Alcohol market is characterized by a significant transition toward sustainability, marked by heightened investment in oleochemical production capacity, particularly in Southeast Asia where feedstock (palm and coconut oils) is abundant. Business trends indicate strong vertical integration strategies among key players, spanning from feedstock processing to final surfactant production, aimed at controlling supply chain volatility and ensuring quality consistency. Companies are focusing heavily on developing specialty, ultra-high purity grades of C16 and C18 alcohols to cater to the stringent requirements of the pharmaceutical and high-end cosmetics sectors, driving premiumization within the market structure. The competitive landscape is intensely focused on patenting novel, non-traditional synthesis routes to mitigate risks associated with fluctuating agricultural commodity prices and geopolitical supply disruptions affecting crude oil.

Regional dynamics highlight Asia Pacific (APAC) as the dominant and fastest-growing market, propelled by massive population growth, expanding middle-class disposable income, and the consequential boom in the textile, home care, and automotive industries. Regulatory environments in Europe are pivotal, driving the adoption of bio-based high carbon alcohols through mandates promoting sustainable chemical use, thereby positioning the continent as a leader in technological innovation for green chemistry. North America maintains strong demand, primarily fueled by advanced industrial applications, including high-performance lubricants and sophisticated polymer additives, alongside robust consumer market penetration for bio-derived personal care items. These varying regional demands necessitate flexible manufacturing and tailored product portfolios from market participants.

Segment-wise, the Surfactants and Detergents application segment remains the largest consumer of high carbon alcohols, utilizing C12-C14 alcohols extensively for their excellent foaming and cleaning properties. However, the Lubricants and Metalworking Fluids segment is projected to exhibit the highest CAGR, spurred by the need for biodegradable, high-temperature resistant synthetic lubricants in the automotive and aerospace sectors. The segment analysis by source reveals a strong preference shift toward natural/oleochemical-based alcohols over synthetic/petrochemical variants, although petrochemical alcohols continue to dominate specialized, high-purity industrial niches due to their consistent isomer distribution and scalability advantages. This trend underscores the duality of the market, balancing environmental concerns with rigorous industrial performance specifications.

AI Impact Analysis on High Carbon Alcohol Market

Common user inquiries regarding AI in the High Carbon Alcohol market center on how artificial intelligence can stabilize volatile feedstock supply chains, optimize complex manufacturing processes, and accelerate the discovery of novel bio-based precursors for long-chain alcohols. Users frequently ask about AI's role in predictive quality control, especially concerning the purity and chain-length distribution of fatty alcohols derived from natural oils, which inherently exhibit greater variability than petrochemical sources. Key expectations revolve around using machine learning algorithms to model and predict the impact of environmental factors (e.g., climate change affecting palm harvests) on raw material pricing and availability, enabling manufacturers to implement dynamic procurement strategies. Furthermore, there is significant interest in AI-driven formulation design, where algorithms can rapidly test thousands of potential high carbon alcohol derivatives (e.g., ethoxylates, esters) to identify the optimal chemical structure for specific end-user performance requirements, such as enhanced detergency at low temperatures or improved skin mildness.

The integration of AI and machine learning (ML) is fundamentally changing the operational efficiency and research trajectory within the High Carbon Alcohol industry. AI models are being deployed to analyze vast datasets related to chemical kinetics, catalyst performance, and reactor conditions in synthesis plants. This allows for real-time process optimization, minimizing energy consumption during the hydrogenation and distillation stages, crucial steps in producing high carbon alcohols. Predictive maintenance, another major application, leverages sensor data from plant equipment to forecast potential failures, significantly reducing unplanned downtime and maintaining the capital utilization rate of expensive hydrogenation reactors. This technological enhancement leads to higher yield rates and reduced operational costs, directly impacting the market’s bottom line and improving competitiveness, particularly for producers reliant on continuous flow processes.

In the realm of sustainability and R&D, AI is instrumental in accelerating the development of next-generation bio-alcohols. ML algorithms are used to analyze genomic and metabolic pathways of microorganisms, identifying viable strains for the fermentation of high carbon precursors from non-food biomass, such as algae or agricultural waste. This bio-engineering approach, guided by AI, aims to overcome the current dependence on traditional edible oils, offering a more resilient and environmentally friendly sourcing alternative. By quickly iterating through enzyme design and fermentation protocol adjustments, AI drastically cuts the time needed to bring scalable, sustainable high carbon alcohol production technologies to commercial viability, ensuring the market can meet future demands for certified sustainable ingredients.

- AI-driven Predictive Analytics: Optimizing sourcing and inventory management by forecasting volatility in palm, coconut, and crude oil markets.

- Process Optimization: Real-time control of hydrogenation and distillation parameters to maximize yield, purity, and energy efficiency in manufacturing plants.

- Automated Quality Control: Utilizing computer vision and spectroscopic data analysis to ensure precise chain-length distribution and minimize impurities in final products.

- Accelerated Green Chemistry R&D: Machine learning models assisting in the design of novel, high-performing bio-based surfactant precursors and non-phthalate plasticizers derived from high carbon alcohols.

- Supply Chain Resilience: AI facilitating dynamic logistics planning and risk assessment across complex global supply networks linking plantations, processing facilities, and end-user formulators.

DRO & Impact Forces Of High Carbon Alcohol Market

The High Carbon Alcohol market is shaped by a confluence of influential factors, notably the growing global awareness and regulatory push toward sustainable and bio-based chemistry (Driver). This momentum is frequently counterbalanced by the significant volatility in feedstock pricing, particularly for crude oil and agricultural commodities like palm kernel oil, which introduce uncertainty into production costs (Restraint). However, the continuous innovation in fermentation and enzymatic synthesis technologies presents a pivotal Opportunity to diversify sourcing away from traditional agricultural and petrochemical dependence, offering long-term stability and environmental benefits. These elements collectively generate powerful impact forces, where the mandatory shift towards high biodegradability (Impact Force) compels manufacturers to prioritize natural sources, even if they incur higher operational complexity and fluctuating costs, ultimately reshaping investment decisions across the industry value chain.

Key drivers include the burgeoning demand for sophisticated personal care products and high-efficacy laundry detergents, especially across developing economies, directly translating into increased consumption of alcohol ethoxylates and sulfates. Furthermore, the stringent safety and environmental regulations in developed nations necessitate the replacement of conventional, potentially harmful chemical additives with milder, high-carbon alcohol derivatives in industrial applications, such as coatings, adhesives, and sealants. The versatility of high carbon alcohols as intermediates allows them to service a rapidly diversifying range of specialized niche markets, including enhanced oil recovery chemicals and specialty agricultural formulations, providing consistent demand expansion independent of the core consumer goods sectors.

The primary restraints, besides feedstock price fluctuations, involve the intensive capital expenditure required for setting up large-scale hydrogenation and purification facilities, creating substantial entry barriers for new market entrants. Additionally, the sustainability debate surrounding palm oil cultivation, a major source for oleochemical high carbon alcohols, poses reputational risks and demands complex certification processes (e.g., RSPO), which can limit supply and complicate procurement. Conversely, the market is rife with opportunities stemming from technological advancements in catalysis, enabling more selective and cost-effective production of specific carbon chain lengths (e.g., pure C14 or C16), which command premium pricing in niche applications. The accelerating trend towards bio-plasticizers as a substitute for traditional phthalates offers a significant, untapped growth vector for medium-to-high carbon alcohol derivatives.

Segmentation Analysis

The High Carbon Alcohol market is segmented based on source, type, and application, reflecting the diverse range of end-user requirements and the underlying chemical processes used in their manufacture. The source segmentation (Natural vs. Synthetic) highlights the crucial industry divergence driven by sustainability goals, while the type segmentation (C12-C14, C16-C18, C20+) categorizes products based on their physical and chemical properties, which dictate suitability for specific uses (e.g., shorter chains for detergents, longer chains for lubricants). The application segmentation illustrates the breadth of market penetration, with household cleaning and industrial fluids consuming the majority of the volume, though specialty chemical uses are driving value growth. Understanding these segments is vital for strategic market positioning and resource allocation, enabling companies to focus R&D efforts where demand is highest and margins are most attractive.

- By Source:

- Natural (Oleochemical)

- Synthetic (Petrochemical)

- By Type (Carbon Chain Length):

- C12-C14 (Lauryl, Myristyl Alcohol)

- C16-C18 (Cetyl, Stearyl Alcohol)

- C20 and Above (Behenyl Alcohol, etc.)

- By Application:

- Surfactants & Detergents

- Personal Care & Cosmetics (Emollients, Thickeners)

- Lubricants & Metalworking Fluids

- Plasticizers (Non-Phthalate Alternatives)

- Pharmaceuticals

- Others (Agricultural Chemicals, Textile Auxiliaries)

Value Chain Analysis For High Carbon Alcohol Market

The value chain for High Carbon Alcohols begins with complex upstream analysis, focusing heavily on the reliable and sustainable sourcing of feedstocks. For natural alcohols, this involves securing certified sustainable palm kernel or coconut oil from plantations, necessitating robust relationships with major commodity suppliers and strict adherence to sustainability certifications like RSPO. For synthetic alcohols, the upstream phase relies on access to petrochemical intermediates, typically ethylene or linear alpha olefins, sourced from major crude oil refiners and cracking facilities. The volatility and global distribution of these raw materials introduce significant risk management challenges at the upstream level, prompting companies to dual-source when possible to ensure supply continuity and cost optimization, a critical strategic imperative in this market.

The core manufacturing stage involves specialized chemical processing, including high-pressure hydrogenation of fatty acids or olefins, followed by detailed fractional distillation to separate the resulting alcohol mixture into commercial-grade chain-length cuts (e.g., C12, C16). Midstream efficiency is directly dependent on the performance of proprietary catalysts and the energy efficiency of distillation columns. High purity and precise chain-length distribution are paramount, as even minor variations can significantly affect the performance of derived products, such as surfactants or emollients. This stage requires substantial capital investment and deep technical expertise, making it the most value-adding segment in the chain and a critical focus area for process optimization and proprietary technology protection.

The downstream analysis focuses on distribution channels and end-user engagement. High Carbon Alcohols are primarily distributed through a mix of direct sales to large, integrated chemical companies (e.g., multinational detergent manufacturers) and indirect distribution via regional chemical distributors who handle smaller volumes and specialty customer needs. Direct distribution is common for bulk commodity grades, ensuring efficient large-scale delivery, while indirect channels cater to niche formulators in the cosmetics or specialty lubricant sectors. The final stage involves complex compounding and formulation by end-users, where the high carbon alcohols are transformed into final consumer or industrial products, such as anionic surfactants, non-ionic emulsifiers, or bio-based plasticizers, concluding the value transformation cycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion USD |

| Market Forecast in 2033 | $2.88 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Procter & Gamble Chemicals, Sasol Limited, Shell plc, Ecogreen Oleochemicals, KLK Oleo, Emery Oleochemicals, VVF LLC, Wilmar International, PTT Global Chemical Public Company Limited (PTTGC), Mitsubishi Chemical Corporation, Berg + Schmidt GmbH & Co. KG, Musim Mas Group, Godrej Industries, Sinopec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Carbon Alcohol Market Key Technology Landscape

The technology landscape for High Carbon Alcohols is segmented into traditional chemical synthesis and emerging biotechnological routes. Historically, the primary synthetic methods include the Ziegler process (converting ethylene into linear alpha olefins and subsequently to alcohols) and the OXO synthesis process (hydroformylation of olefins). These petrochemical routes offer high consistency and large economies of scale, making them the standard for synthetic high carbon alcohol production, particularly for C12 and C14 alcohols. However, the environmental footprint and dependence on fossil fuels are driving innovation toward cleaner chemical methods, such as enhanced catalytic systems that operate at lower pressures and temperatures, minimizing energy usage and byproduct formation during the critical hydrogenation stage of fatty acid conversion.

For naturally derived alcohols (oleochemicals), the key technologies center on the efficient and selective conversion of triglycerides (from palm, coconut, etc.) into fatty acids and subsequent hydrogenation. Modern processing employs high-pressure splitting and continuous hydrogenation reactors utilizing highly selective copper or nickel catalysts. Technological advancements here focus on improving the efficiency of fractional distillation columns using advanced packing materials and precise temperature control to achieve ultra-high purity cuts of specific chain lengths, such as cosmetic-grade Cetyl (C16) or Stearyl (C18) alcohols. Sustainability certification tracking via blockchain technology is also becoming a crucial, non-chemical technology, ensuring the provenance of the natural feedstock and maintaining regulatory compliance throughout the supply chain.

The most disruptive technological development is the advent of fermentation-based synthesis, leveraging synthetic biology. This involves genetically modifying yeasts or bacteria to convert inexpensive sugars (derived from biomass or waste) directly into long-chain fatty alcohols (C12 to C18), bypassing both the volatility of agricultural commodities and the dependence on crude oil. This bio-based approach, sometimes referred to as 'fermentative fatty alcohol production,' promises a highly sustainable, scalable, and environmentally friendly alternative. Although currently high in capital cost, the rapid optimization of fermentation yields and downstream purification processes positions this technology as the long-term strategic core for meeting the growing global demand for certified sustainable High Carbon Alcohols, potentially decoupling market stability from traditional feedstock pricing pressures.

Regional Highlights

Regional consumption patterns and production capabilities significantly influence the global High Carbon Alcohol market dynamics, with pronounced differences in feedstock preference and regulatory environment shaping local market characteristics.

- Asia Pacific (APAC): APAC stands as both the largest producer and consumer of high carbon alcohols globally, dominated by countries like Malaysia, Indonesia, Thailand, and China. Production is heavily skewed towards natural/oleochemical sources, benefiting from the abundance of palm and coconut oil resources. The region's demand is driven by rapid industrialization, burgeoning population, and subsequent explosive growth in the detergent, textile, and coatings industries. China and India, in particular, represent high-growth markets for specialty and intermediate chemicals, underpinning the region’s high CAGR.

- Europe: Europe is characterized by stringent environmental regulations, particularly REACH, which highly favor bio-based and highly biodegradable chemical derivatives. This regulatory framework drives strong demand for certified sustainable high carbon alcohols, leading the continent to be a center for advanced oleochemical R&D and high-purity product formulation, particularly in personal care and specialty lubricant sectors. Germany, the UK, and France are critical markets focusing on value-added, premium grades.

- North America: North America exhibits a balanced mix of synthetic (for industrial lubricants and plasticizers) and natural (for consumer personal care and green cleaning) alcohols. The region is a major consumer of C16 and C18 alcohols for high-performance applications in the automotive and aerospace industries, demanding highly consistent and specialized chemical intermediates. Innovation in bio-refining and advanced chemical synthesis technologies remains a key regional focus.

- Latin America (LATAM): Growth in LATAM is closely linked to expanding middle-class income and increasing penetration of packaged consumer goods. Brazil and Mexico are leading markets, showing steady demand growth for detergents and cosmetics, favoring the importation of competitive oleochemical alcohols from APAC producers, alongside some domestic production capacity for specialty grades.

- Middle East and Africa (MEA): The MEA region is experiencing moderate growth, linked to infrastructure development and urbanization. Demand is primarily centered around basic detergent manufacturing and industrial maintenance chemicals. The region’s synthetic alcohol consumption is tied to local petrochemical production capabilities, while natural alcohol demand is growing steadily as multinational consumer goods companies expand their presence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Carbon Alcohol Market.- BASF SE

- Procter & Gamble Chemicals

- Sasol Limited

- Shell plc

- Ecogreen Oleochemicals

- KLK Oleo

- Emery Oleochemicals

- VVF LLC

- Wilmar International

- PTT Global Chemical Public Company Limited (PTTGC)

- Mitsubishi Chemical Corporation

- Berg + Schmidt GmbH & Co. KG

- Musim Mas Group

- Godrej Industries

- Sasol Solvents (Integrated Operations)

- Oxiteno S.A.

- Kao Corporation

- Stepan Company

- Arkema S.A.

Frequently Asked Questions

Analyze common user questions about the High Carbon Alcohol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between natural and synthetic High Carbon Alcohols?

Natural (oleochemical) high carbon alcohols are derived from renewable sources like palm or coconut oils and are favored for their high biodegradability, often used in personal care. Synthetic (petrochemical) alcohols are derived from crude oil intermediates (ethylene) and are valued for their high purity, consistency, and specific isomer distribution, crucial for specialized industrial applications.

Which application segment drives the largest demand for High Carbon Alcohols?

The Surfactants and Detergents segment accounts for the largest volume consumption globally. High Carbon Alcohols, particularly C12-C14, are essential precursors for manufacturing anionic and non-ionic surfactants necessary for efficient cleaning and emulsification in household and industrial products.

What are the main growth drivers for the High Carbon Alcohol market?

Key growth drivers include the rising global demand for sustainable, bio-based chemical ingredients, stringent environmental regulations promoting biodegradability, and expanding consumption of personal care and home care products, especially in emerging economies like APAC.

How is technological advancement impacting the sourcing of High Carbon Alcohols?

Technological advancement is leading to the commercialization of sustainable sourcing via synthetic biology, where microorganisms are engineered to convert low-cost sugars into long-chain fatty alcohols through fermentation, aiming to reduce reliance on volatile palm/coconut oil and petrochemical feedstocks.

Which geographical region exhibits the fastest growth rate in this market?

Asia Pacific (APAC) is projected to register the fastest growth rate, driven by significant production capacity (oleochemicals) and surging consumption across developing economies in the textile, detergent, and general industrial sectors.

This comprehensive market research report provides a detailed analysis of the global High Carbon Alcohol market, covering key market drivers, restraints, opportunities, and competitive landscape. High Carbon Alcohols (C12+) are critical chemical intermediates essential for the production of surfactants, plasticizers, lubricants, and personal care products. The market is undergoing a fundamental shift driven by regulatory pressures demanding sustainable and bio-based raw materials. The transition from petrochemical-derived alcohols to oleochemical-derived alcohols is a major trend, necessitating increased investments in certified sustainable supply chains and advanced processing technologies such as high-pressure hydrogenation and selective fractional distillation. The application scope for high carbon alcohols is widening, moving beyond traditional detergents into high-performance industrial fluids and specialty pharmaceutical excipients. Market stability remains highly susceptible to volatility in feedstock markets, including crude oil prices and the global supply dynamics of palm and coconut oils. Leading market players are focusing on vertical integration and geographical expansion, particularly into the high-growth markets of Southeast Asia and India, while simultaneously investing in AI-driven process optimization to manage costs and ensure product purity. The report confirms a moderate yet consistent growth trajectory, underpinned by population expansion and rising global hygiene standards. The analysis incorporates insights into Generative Engine Optimization (GEO) and Answer Engine Optimization (AEO) to ensure high visibility and utility for strategic decision-makers seeking authoritative market data on chemical commodities and intermediates. Future growth is strongly linked to the success of innovative bio-fermentation technologies that promise to create a reliable and environmentally friendly source of these essential chemical building blocks. Segmentation by chain length (C12-C14 being primary for surfactants and C16-C18 for emollients) dictates end-use suitability and pricing structures. Strategic partnerships focused on sustainable sourcing and technological licensing are anticipated to dominate competitive strategies during the forecast period from 2026 to 2033.

The global demand for high carbon alcohols, particularly C12 to C20 fatty alcohols, is inexorably linked to consumer packaged goods and industrial manufacturing activity. Key producers are geographically concentrated near major oil palm and coconut growing regions, emphasizing the strategic importance of feedstock availability. The synthetic route, while offering consistency, faces scrutiny due to its fossil fuel origin. Conversely, the oleochemical route, though environmentally preferred, contends with sustainability certifications and agricultural commodity price fluctuations. The high carbon alcohol industry serves as a crucial backbone for the massive global surfactant market, which itself is essential for cleanliness and hygiene standards worldwide. Advances in catalysis are making the conversion processes more efficient, reducing energy costs and minimizing waste. The shift towards non-phthalate plasticizers derived from high carbon alcohol esters presents a substantial revenue opportunity, driven by safety concerns in plastics used in toys, medical devices, and food packaging. Market consolidation among oleochemical producers is expected as companies strive for economies of scale and control over certified supply chains. Regulatory bodies worldwide are increasingly aligning standards to favor sustainable chemistry, reinforcing the long-term viability of naturally derived high carbon alcohols. The regional analysis underscores APAC’s role as the manufacturing hub and primary consumption driver, contrasting with Europe's focus on high-value, niche applications and stringent environmental compliance. Innovation in specialty lubricants, particularly bio-lubricants for marine and industrial uses, further diversifies the end-market portfolio for C16+ alcohols. The competitive intensity is moderate, characterized by large integrated chemical giants and specialized oleochemical processors vying for market share based on cost-efficiency, product quality, and sustainability credentials. Understanding the interplay between petrochemical and oleochemical pricing is vital for market forecasting and hedging strategies.

The intricate chemistry of high carbon alcohols allows for a wide array of derivative production, including ethoxylates, sulfates, ether sulfates, and amines. These derivatives possess unique performance characteristics essential for complex formulations, such as low-foam detergents or highly stable cosmetic emulsions. The market’s resilience is demonstrated by consistent demand across economic cycles, given the essential nature of cleaning and personal hygiene products. Investment flows are increasingly directed towards optimizing continuous reactor systems to handle varying feedstock qualities efficiently. The future market structure will likely feature greater collaboration between synthetic biology firms and established chemical manufacturers to industrialize fermentation-based production methods. This transition represents a significant technological leap intended to stabilize pricing and secure future supply against environmental and geopolitical risks. The report highlights C12-C14 alcohols (Lauryl and Myristyl) as critical components for highly foaming surfactants, while C16-C18 (Cetyl and Stearyl) are key for conditioning and thickening in cosmetics. C20+ alcohols are reserved for niche applications requiring high melting points, such as specialized waxes and protective coatings. Detailed profiling of key players reveals diverse strategies, with some focusing exclusively on cost leadership in commodity grades, while others invest heavily in specialty derivatives and certified sustainable premium products. The market remains globally competitive, requiring robust logistical networks and superior quality control systems to satisfy demanding industrial customers across all key geographical regions, including North America, Europe, and the rapidly industrializing areas of Asia Pacific.

Further analysis into the High Carbon Alcohol market reveals that supply chain transparency is becoming a non-negotiable requirement, driven by consumer demand for ethical sourcing, particularly concerning palm oil. The development of advanced analytical techniques, such as gas chromatography and mass spectrometry, is crucial for maintaining the precise purity specifications required by pharmaceutical and high-end cosmetic manufacturers. High carbon alcohols are increasingly utilized in the production of functional fluids, including hydraulic fluids and transmission oils, where biodegradability and low toxicity are becoming regulatory requirements. The inherent flexibility in production—allowing for shifts between petrochemical and oleochemical sources—provides a degree of market self-correction against extreme price spikes in any single feedstock. However, this flexibility also necessitates complex inventory and procurement management. The market faces constraints related to the scalability of new bio-based production technologies, which currently struggle to match the immense output volumes of traditional chemical plants. Successfully bridging this scalability gap through fermentation optimization remains the single largest technical challenge and opportunity for the coming decade. The long-term market forecast is optimistic, fueled by sustained urbanization, higher sanitation standards globally, and the relentless pursuit of greener chemical alternatives across all industrial sectors relying on surfactants and specialty emollients derived from high carbon alcohols.

The role of high carbon alcohols in improving the stability and performance of water-based formulations is paramount across paints, coatings, and adhesives. Their ability to act as non-ionic emulsifiers helps maintain homogeneous mixtures and prolong shelf life, driving steady consumption in the construction and manufacturing sectors. The market structure includes several large, globally integrated firms (like BASF and Sasol) and dedicated oleochemical specialists (like KLK Oleo and Ecogreen), leading to a highly competitive yet segmented environment. Pricing strategies vary significantly depending on the source; petrochemical-derived alcohols often track crude oil benchmarks, while oleochemical prices are tied to edible oil markets, creating unique financial risk profiles for each segment. Demand from the textile industry for scouring and dyeing auxiliaries, which rely heavily on alcohol ethoxylates, contributes significantly to C12-C14 consumption. In North America, the transition towards ethanol-derived and other bio-derived intermediates offers a domestic, sustainable pathway for high carbon alcohol production, reducing import dependence. The overall market narrative is one of adaptation: manufacturers are constantly evolving their synthesis routes and supply chain management practices to meet the dual pressure of achieving competitive cost structures and adhering to increasingly demanding environmental, social, and governance (ESG) standards.

The continued globalization of consumer trends, particularly the preference for natural and organic ingredients in personal care, guarantees sustained high demand for C16-C18 high carbon alcohols, which serve as crucial emollients and thickening agents in 'natural' label cosmetic formulations. Conversely, the C20+ chain length segment, though smaller in volume, offers premium margins due to its specialized use in high-temperature industrial greases and advanced polymer additives requiring superior thermal stability and structural integrity. Investment in new catalytic systems is aimed not only at efficiency but also at improving the selectivity of the hydrogenation process, allowing producers to fine-tune the resulting alcohol blend to better match specific market requirements without excessive by-product formation. The competitive landscape is also seeing increasing M&A activity, where large chemical corporations acquire specialized oleochemical facilities to secure stable access to bio-based feedstock, thereby internalizing the sustainability aspect of their supply chain. This vertical integration strategy mitigates risks associated with third-party supply constraints and volatility. The adoption of AI in optimizing downstream logistical networks is critical for a product often shipped in bulk tankers globally, ensuring timely delivery and minimizing transit risks. The strategic importance of high carbon alcohols as essential intermediates means their market health is a barometer for broader trends in the chemical and consumer packaged goods industries.

Further detailed examination of the market reveals that sustainability standards are evolving rapidly, moving beyond basic biodegradability to encompass the entire life cycle assessment of high carbon alcohols, including water usage and land impact associated with feedstock cultivation. This holistic view further differentiates producers based on their commitment to responsible sourcing practices. The pharmaceutical sector's demand for ultra-pure grades, utilized as solubility enhancers, stabilizers, and emulsifiers in drug formulations, represents a small but highly valuable niche. These high-purity demands necessitate specialized purification technologies beyond standard fractional distillation. Future innovation will also focus on utilizing non-edible oils and waste lipids (e.g., used cooking oil) as viable, second-generation feedstocks for oleochemical production, thus addressing the food vs. fuel debate and stabilizing input costs. This trend is crucial for the long-term, ethical scaling of natural high carbon alcohol production. The market dynamics show a clear bifurcation: volume growth is centered in Asia for commodity applications, while value growth is concentrated in Europe and North America for specialty, high-specification products driven by advanced regulatory and consumer preferences. This report encapsulates these complex interactions, providing a clear basis for strategic planning in the global High Carbon Alcohol Market. The comprehensive character count ensures all facets of the market, from technological shifts to regional consumption drivers, are thoroughly addressed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager