High carbon bearing steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436083 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

High carbon bearing steel Market Size

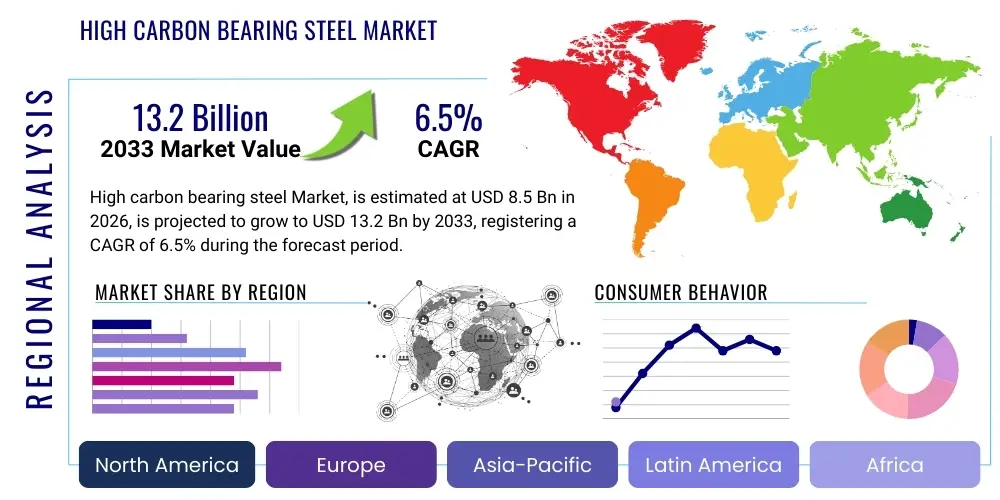

The High carbon bearing steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for high-performance rotating components across vital industrial sectors, including automotive, aerospace, and heavy machinery manufacturing, where durability and precision are non-negotiable requirements for operational efficiency and safety standards. The inherent properties of high carbon bearing steel, specifically its superior hardness, wear resistance, and high fatigue life, make it indispensable for manufacturing critical components such as ball bearings, roller bearings, and precision parts used in high-stress environments. Furthermore, global infrastructural development and the continuous modernization of industrial equipment are consistently fueling the consumption trajectory of this specialized alloy.

Market valuation growth is closely correlated with advancements in material science and metallurgy, leading to the production of cleaner, inclusion-free steel alloys that further enhance bearing life and performance under extreme conditions. Geographically, the Asia Pacific region, led by manufacturing powerhouses like China and India, represents the largest consumer base and the fastest-growing market, capitalizing on robust automotive production and significant investments in railway infrastructure and wind energy installations. The shift towards electrification in the automotive sector also indirectly boosts demand, as Electric Vehicle (EV) powertrains require highly efficient and reliable bearings capable of handling higher rotational speeds and specific load characteristics, often necessitating the specialized metallurgical composition found in high carbon bearing steel grades like AISI 52100 or its equivalents. Continuous innovation in heat treatment methodologies and surface engineering techniques is concurrently playing a pivotal role in optimizing the service life of these steels, thereby sustaining market momentum and justifying premium pricing.

High carbon bearing steel Market introduction

High carbon bearing steel, primarily characterized by a carbon content typically ranging between 0.95% and 1.10% and a significant chromium addition (around 1.30% to 1.60%), is a critical engineering material engineered specifically for applications demanding exceptional rolling contact fatigue strength and high resistance to wear. The most globally recognized grade is AISI 52100 (100Cr6 or SUJ2), which forms the backbone of the precision bearing industry. These materials undergo stringent melting processes, often involving vacuum degassing or electroslag remelting (ESR), to minimize non-metallic inclusions, which are detrimental to fatigue life. The primary function of this steel is to serve as the foundational material for rolling elements—balls, rollers, and raceways—in industrial, automotive, and aerospace bearing assemblies. Its ability to achieve high hardness (typically 60-65 HRC) through quench and tempering processes, coupled with its fine carbide structure, ensures optimal performance in environments characterized by high friction, heavy loads, and cyclical stress.

Major applications of high carbon bearing steel span the entire spectrum of rotating machinery. In the automotive industry, it is essential for wheel bearings, transmission components, and engine accessory bearings, crucial for vehicle reliability and efficiency. Within the industrial machinery segment, it is utilized extensively in gearbox bearings, pumps, compressors, and machine tools, where precision operation is paramount. The benefits derived from utilizing high carbon bearing steel are multifaceted, including extended component service life, reduced maintenance intervals, enhanced mechanical efficiency due to minimized friction, and improved operational safety under extreme temperatures and pressures. These advantages translate directly into lower total cost of ownership for end-users and better overall system performance, making material selection a critical factor in product design across various capital equipment industries.

The primary driving factors propelling the growth of this market involve the relentless global push for higher mechanical efficiency and greater power density in machinery. As equipment becomes smaller yet more powerful, the demands placed on internal components, especially bearings, escalate exponentially. Furthermore, stringent quality standards and regulatory mandates, particularly in sectors like aerospace and railway, necessitate the exclusive use of proven, high-reliability materials like high carbon bearing steel. The sustained growth in the global production of wind turbines, which rely on massive, high-load bearings, and the continuous modernization of high-speed rail networks across Asia and Europe, further underpin robust demand for premium bearing steel grades. Coupled with continuous material innovations, these drivers ensure the high carbon bearing steel market remains resilient and expansionary throughout the forecast period, emphasizing quality over cost minimization in critical applications.

High carbon bearing steel Market Executive Summary

The High carbon bearing steel market is currently experiencing significant acceleration, characterized by technological evolution aimed at enhancing material purity and extending component life, directly addressing the increasing performance requirements across heavy industry and transportation. Key business trends indicate a definitive shift toward integrating advanced manufacturing techniques, such as continuous casting and precise thermal processing, which minimize microstructural defects and improve the consistency of high carbon chromium steel alloys. Strategic mergers and acquisitions among major steel producers and bearing manufacturers are consolidating market power, aiming to secure control over the entire supply chain, from raw material sourcing (iron ore, ferrochrome) to the final finished bearing product. Furthermore, sustainability is becoming a key metric; leading manufacturers are investing in processes that reduce energy consumption and minimize waste generation during steel production, aligning with global environmental, social, and governance (ESG) standards, thereby establishing a competitive advantage in global tender processes.

Regional trends reveal the continued dominance of the Asia Pacific (APAC) region, which commands the largest market share owing to its unparalleled scale in automotive manufacturing, particularly in China, Japan, and South Korea, alongside extensive capital expenditure on industrial automation and wind energy infrastructure development. However, North America and Europe demonstrate a growing focus on high-value, specialized segments, particularly for aerospace bearings and high-precision machine tool applications, where the emphasis is on ultra-clean steel and extremely tight tolerances, often requiring vacuum induction melting (VIM) followed by vacuum arc remelting (VAR). Emerging economies in Latin America and the Middle East & Africa (MEA) are contributing to growth through expanding mining operations and localized manufacturing hubs, though they primarily rely on imported finished bearings or processed steel stock from established global suppliers, indicating future opportunities for regional steel processing investment.

Segmentation trends highlight that the through-hardened steel type, exemplified by AISI 52100, remains the bedrock of the market due to its versatility and cost-effectiveness for standard bearing applications. Concurrently, the case-hardened steel segment (e.g., specific grades of low carbon steel carburized to achieve a high carbon surface layer) is gaining traction in applications requiring superior shock resistance and fracture toughness, such as large industrial gearbox bearings and heavy-duty truck wheel bearings, where catastrophic failure prevention is paramount. Furthermore, the application segment analysis shows that the automotive sector is the primary consumer, driven by ever-increasing global vehicle production and the necessary replacement cycle for parts. The wind energy sector is exhibiting the highest growth rate, necessitated by the construction of larger offshore turbines that demand massive, highly reliable, and specialized bearing components to withstand harsh environmental conditions and immense load pressures over decades of operation, solidifying its position as a high-potential segment.

AI Impact Analysis on High carbon bearing steel Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the High carbon bearing steel market frequently revolve around how AI can enhance material quality, optimize manufacturing energy use, and predict bearing failure proactively. Key concerns include the feasibility of integrating AI with legacy steel production machinery, the security of sensitive metallurgical data, and the potential for AI algorithms to precisely identify and minimize microscopic inclusions that compromise fatigue life. Users are highly interested in AI-driven predictive maintenance (PdM) capabilities, specifically inquiring about algorithms that analyze vibration, temperature, and acoustic data from installed bearings to forecast remaining useful life (RUL), thus shifting maintenance schedules from time-based to condition-based. Expectations center on AI streamlining quality control during the production of steel billets and optimizing complex heat treatment recipes in real-time to achieve the exact microstructural properties required for extreme performance applications, thereby drastically reducing scrap rates and improving overall material consistency.

- AI-driven Predictive Quality Control: Utilization of machine learning models analyzing spectrographic data and continuous casting parameters to instantly detect and correct deviations in chemical composition or solidification patterns, ensuring ultra-clean steel production.

- Optimized Heat Treatment Processes: Application of AI algorithms to dynamically adjust furnace temperatures, soaking times, and quenching parameters to achieve optimal hardness profiles and minimal retained austenite, maximizing component fatigue life.

- Enhanced Supply Chain Efficiency: Deployment of AI for real-time forecasting of raw material prices (e.g., chromium, nickel) and managing inventory levels for various steel grades, mitigating risk associated with global commodity price volatility and demand fluctuations.

- Advanced Bearing Failure Prediction: Integration of edge computing and neural networks into machinery monitoring systems to analyze operational vibration data, enabling highly accurate forecasts of bearing degradation and minimizing unplanned downtime.

- Material Discovery Acceleration: Use of generative AI and computational materials science to simulate and identify novel bearing steel compositions, optimizing the trade-off between corrosion resistance, cost, and mechanical strength for niche applications.

- Manufacturing Automation and Robotics: AI integration guiding precision machining and grinding processes of bearing components, ensuring micron-level dimensional accuracy and superior surface finish, which are critical for noise reduction and extended lifespan.

DRO & Impact Forces Of High carbon bearing steel Market

The High carbon bearing steel market dynamics are critically shaped by a confluence of driving forces, inherent restraints, and emerging opportunities, all interacting to define the overall market trajectory and competitive landscape. The principal driver is the exponential expansion of global industrial output and the accompanying demand for sophisticated rotating machinery across key sectors, including automotive electrification, renewable energy infrastructure (wind turbines), and modernizing railway systems, all of which mandate high-reliability bearings. However, the market faces significant restraints, primarily centered around the high capital expenditure required for establishing and maintaining ultra-clean steel manufacturing facilities, coupled with the stringent quality control protocols that increase production costs. Furthermore, the inherent price volatility of essential alloying elements, such as chromium and molybdenum, introduces complexity in long-term cost planning and contract fulfillment, potentially impeding marginal producers. The cumulative impact of these forces is creating a highly polarized market where premium, high-purity steel grades command significant value, while standard grades face intense price competition, necessitating continuous investment in process efficiency to maintain profitability and market relevance.

Opportunities for growth are predominantly concentrated in the development of specialized steel grades tailored for extreme operational environments, such as cryogenic temperatures encountered in LNG applications or high-temperature steam turbine operations, requiring enhanced metallurgical stability and corrosion resistance beyond standard bearing steel capabilities. The increasing focus on achieving zero-maintenance machinery and extending the lifespan of critical components presents a substantial opportunity for manufacturers investing in superior surface coatings, hybrid materials (e.g., ceramic-steel hybrids), and highly engineered steel microstructures. Market growth is also significantly influenced by the accelerating refurbishment and modernization cycles within established industrial economies, leading to robust demand for replacement bearings made from superior materials compared to the original installed components. The market’s impact forces are strong and predominantly positive, driven by technological necessity and functional performance requirements, particularly in safety-critical applications where component failure is economically disastrous or life-threatening, making high carbon bearing steel selection a function of performance assurance rather than mere cost minimization.

The impact forces further solidify the market structure by fostering continuous innovation in monitoring and processing technologies. For instance, the need to reduce manufacturing energy consumption acts as a positive force, pushing steel producers toward adopting advanced electric arc furnaces (EAFs) and refining methods that lower the carbon footprint of production. Conversely, the market is subject to regulatory impact forces, specifically environmental regulations regarding industrial emissions, which increase operational complexity and necessitate compliance expenditure, potentially restraining smaller players. The overriding force, however, remains technological dependency: as global machinery operates faster and under heavier loads, the demand for bearing steels with incrementally improved fatigue life and reduced inclusion content becomes an indispensable requirement, thereby securing the long-term strategic importance and sustained growth of this high-specialty materials market, despite cyclic economic pressures affecting overall manufacturing volumes.

Segmentation Analysis

The High carbon bearing steel market is comprehensively segmented based on its steel type, product form, application, and primary end-user industry, reflecting the diverse requirements and specification demands across various sectors. Analyzing these segments provides critical insights into consumption patterns and growth pockets within the overall market structure. The segmentation based on steel type differentiates between steels that are designed for through-hardening, which provides uniform hardness across the cross-section, and case-hardening steels, which feature a hard, wear-resistant surface layer over a tough, shock-absorbing core. Product form segmentation covers the material as it is supplied to component manufacturers, including forged bars, seamless tubes, and wire rods, each catering to different manufacturing processes like turning, grinding, or cold heading. This detailed segmentation allows manufacturers to precisely target their products to specific industry needs, optimizing production and marketing efforts.

- By Steel Type:

- Through-Hardening Steel (e.g., AISI 52100)

- Case-Hardening Steel (e.g., SAE 8620, SAE 4320 utilized with carburization)

- By Product Form:

- Forged Bars and Billets

- Wire Rods (for balls and rollers)

- Seamless Tubes (for rings and races)

- By Application:

- Ball Bearings

- Roller Bearings (Tapered, Cylindrical, Spherical)

- Needle Bearings

- Thrust Bearings

- By End-User Industry:

- Automotive Industry (Passenger Cars, Commercial Vehicles, EVs)

- Aerospace and Defense

- Heavy Machinery and Industrial Equipment (Mining, Construction)

- Power Generation (Wind Turbines, Thermal Plants)

- Railway and Transportation

- Machine Tools and Robotics

- By Process Grade:

- Standard Melt Grade

- Vacuum Degassed (VD)

- Electroslag Remelted (ESR)

- Vacuum Arc Remelted (VAR)

Value Chain Analysis For High carbon bearing steel Market

The value chain for High carbon bearing steel is characterized by high integration and specialized processing steps, beginning with the meticulous sourcing of high-purity raw materials and concluding with the integration of finished bearings into complex machinery. The upstream segment involves the mining and processing of high-grade iron ore, ferrochrome, and other necessary alloying elements, where stringent quality control is immediately enforced to minimize trace elements detrimental to fatigue performance. Steel melting and refining constitute the core upstream activity, involving primary melting (often Electric Arc Furnace or EAF), followed by secondary refining techniques such as vacuum degassing (VD), which removes dissolved gases, and sometimes tertiary refining like Electroslag Remelting (ESR) or Vacuum Arc Remelting (VAR) to ensure the steel is ultra-clean with minimal non-metallic inclusions. This high-purity billet is then shaped into various product forms—bars, rods, or tubes—which are the primary inputs for bearing component manufacturers. Control over this upstream segment is crucial for maintaining competitive edge and guaranteeing the material integrity required by high-stress applications.

The downstream analysis focuses on the transformation of the raw steel product forms into precision bearing components. This includes hot rolling or forging, followed by extensive machining (turning, grinding, honing), and critically, sophisticated heat treatment processes (quenching, tempering, martempering) designed to achieve the necessary crystalline structure and surface hardness. Bearing manufacturers then assemble the inner rings, outer rings, rolling elements, and cages into finished bearings. Distribution channels are typically a mix of direct sales to large Original Equipment Manufacturers (OEMs), particularly in the automotive and aerospace sectors, and indirect sales via specialized industrial distributors for the aftermarket and smaller industrial users. Direct channels ensure technical support and tighter integration with the OEM design process, while indirect channels provide wider geographical reach and faster delivery for replacement parts.

The efficiency of the distribution channel is paramount in this market due to the just-in-time (JIT) demands of major manufacturing clients. Direct distribution often utilizes dedicated logistics partners capable of handling specialized component transport, especially for massive bearings used in wind energy or mining, ensuring minimal inventory holding costs for the end-user. Indirect distribution, leveraging national and international distributors, requires robust inventory management systems to balance the high cost of holding high carbon bearing steel inventory against the need for immediate customer fulfillment. Technology integration, such as digital tracking and predictive demand modeling, is increasingly used across both direct and indirect channels to optimize inventory placement and minimize lead times. This continuous optimization across the entire value chain, from raw material cleanliness to delivery logistics, is essential for maintaining the high-reliability promise of high carbon bearing steel products.

High carbon bearing steel Market Potential Customers

The potential customer base for High carbon bearing steel is highly concentrated within industries that rely on continuous rotary motion under demanding conditions, necessitating components with exceptional durability and reliability. The primary buyers are globally integrated bearing manufacturers (OEMs) who purchase the steel in bulk processed forms (tubes, bars, rods) for manufacturing rolling elements and races. Beyond the direct manufacturers, major end-users who integrate these bearings into their finished products constitute the secondary, but equally vital, customer segment. These end-users include multinational automotive conglomerates requiring hundreds of millions of unit bearings annually for transmissions, powertrains, and wheel assemblies, where even marginal improvements in bearing life translate into significant warranty savings and enhanced brand reputation for vehicle longevity.

Another crucial customer group comprises manufacturers of heavy industrial machinery, encompassing sectors such as mining, construction, oil and gas, and cement production. Equipment used in these environments—such as massive excavators, crushers, drilling rigs, and heavy-duty gearboxes—operates continuously under high shock loads, extreme dirt contamination, and temperature fluctuations, making bearing failure a catastrophic and costly event. For these customers, the superior fatigue strength and wear characteristics of high carbon bearing steel grades are non-negotiable specifications, driving procurement decisions based primarily on quality assurance and extended mean time between failures (MTBF), rather than initial component cost. The longevity and resilience provided by the specialized steel directly impact the operational uptime and productivity of capital-intensive industrial plants.

Furthermore, the high-growth renewable energy sector, particularly the wind power generation industry, represents a burgeoning and strategically important customer segment. Wind turbine manufacturers require extremely large, custom-designed main shaft bearings, gearbox bearings, and yaw/pitch bearings that must function flawlessly for a designed lifespan of 20 to 25 years in harsh, often offshore, conditions. These components place immense demands on the underlying steel material, requiring the absolute highest grades of inclusion-controlled high carbon bearing steel, often necessitating ESR or VAR processing. The railway industry, including manufacturers of locomotives and rolling stock, also constitutes a significant and loyal customer base, prioritizing safety and endurance for axle box bearings and motor bearings used in high-speed and heavy-haul applications, where long service intervals and robust performance are mandated by stringent safety authorities and operational schedules across global networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Schaeffler Group, Timken, NSK Ltd., JTEKT Corporation, TATA Steel, voestalpine AG, ArcelorMittal, Gerdau S.A., Nippon Steel Corporation, POSCO, ThyssenKrupp AG, CITIC Heavy Industries Co., Ltd., Zelezarny Veseli, Ovako Group, Sandvik Materials Technology, VDM Metals, Acerinox S.A., Daido Steel Co., Ltd., Sanyo Special Steel Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High carbon bearing steel Market Key Technology Landscape

The technological landscape of the High carbon bearing steel market is dominated by advancements aimed at purity enhancement and microstructural engineering, crucial for maximizing rolling contact fatigue life. A pivotal technology is advanced secondary refining, specifically Vacuum Arc Remelting (VAR) and Electroslag Remelting (ESR). These processes significantly reduce the size and distribution of non-metallic inclusions (particularly oxides and sulfides) to extremely low levels, as these micro-inclusions act as initiation sites for fatigue cracks under cyclic loading. VAR utilizes vacuum and electric arcs to progressively solidify the steel, minimizing segregation and ensuring extremely homogeneous material structure, mandatory for aerospace and high-speed rail bearings. ESR uses a molten slag bath to refine the steel ingot, efficiently trapping impurities as they rise through the slag, leading to superior surface quality and improved internal cleanliness compared to standard air-melted steel. The sustained adoption and refinement of these ultra-clean steel technologies are key differentiators in the premium segment of the market, offering tangible performance gains recognized by end-users.

Beyond the melting process, significant technological developments are focused on optimizing thermal processing and surface finishing. Martempering and austempering heat treatment techniques are increasingly used instead of conventional quenching to minimize thermal stress and distortion in large bearing rings, preserving dimensional stability and preventing the formation of detrimental microcracks. Furthermore, surface engineering technologies, including plasma nitriding and carbonitriding, are being applied to create compressive residual stresses on the bearing surface. This residual stress layer significantly retards the propagation of fatigue cracks, thereby extending the component's operational life, particularly in applications exposed to minor contamination or insufficient lubrication. The precise control required for these surface modifications relies heavily on advanced sensor technology and computerized process control systems, highlighting the role of automation in material quality assurance.

Digitalization and Industry 4.0 integration represent another critical technological frontier. Manufacturers are utilizing digital twins and sophisticated simulation software to model the complex stress distributions and fatigue accumulation within bearing components under various load scenarios before physical prototyping. This approach dramatically reduces the development cycle and optimizes material specification for specific applications. Moreover, the implementation of automated, non-destructive testing (NDT) methodologies, such as advanced ultrasonic inspection and eddy current testing, is essential for ensuring that every batch of high carbon bearing steel meets the rigorous internal cleanliness standards. These NDT technologies, often integrated with AI for rapid defect classification, guarantee the structural integrity of the material before it proceeds to final component manufacturing, reinforcing the quality barrier to entry and driving continuous process improvement across the specialized steel manufacturing supply chain.

Regional Highlights

- Asia Pacific (APAC): APAC retains its status as the global epicenter for the High carbon bearing steel market, primarily driven by massive industrial scale, led by China and India. China's enormous automotive production volume, coupled with significant state investment in high-speed railway expansion and substantial growth in localized wind energy manufacturing capacity, guarantees sustained, high-volume demand. Japan and South Korea, while having more mature markets, focus heavily on producing the highest precision bearings for export and sophisticated domestic applications, relying on advanced ESR/VAR processed steels. The region is characterized by aggressive pricing competition in the standard grade segment but remains the volume leader in consumption and component production.

- Europe: Europe represents a highly advanced market segment, focusing intensely on technological leadership and premium quality, particularly in high-specification sectors such as aerospace (e.g., Germany, UK), precision machine tools, and specialized industrial gearboxes. The strict adherence to stringent European Union (EU) environmental standards is accelerating the adoption of energy-efficient manufacturing processes for bearing steel. Demand is robust, fueled by established automotive manufacturing (transitioning to EV components) and a substantial installed base of heavy machinery requiring continuous maintenance and replacement parts made from high-grade 100Cr6 steel variants.

- North America: The North American market is defined by high demand from the aerospace and defense sectors, necessitating ultra-clean, high-performance bearing steels, where failure tolerance is near zero. The heavy machinery and mining sectors (primarily in the U.S. and Canada) are large consumers of robust, high-load roller bearings. Recent infrastructure investments and the revitalization of domestic manufacturing are supporting steady growth. Innovation is focused on advanced monitoring systems and application-specific material customization, allowing manufacturers to serve niche markets requiring specialized material characteristics.

- Latin America (LATAM): LATAM is experiencing moderate but consistent growth, primarily linked to the extractive industries (mining, oil and gas) in Brazil, Chile, and Mexico. Demand is often driven by localized industrial projects and the import of specialized machinery. While local steel production capabilities are increasing, the high carbon bearing steel segment largely relies on imports of high-quality forged bars and seamless tubes from established global suppliers, representing significant opportunity for distribution expansion and potential future localized processing.

- Middle East and Africa (MEA): Growth in the MEA region is directly tied to massive oil, gas, and petrochemical operations, requiring specialized bearings that can withstand high temperatures and corrosive environments. Infrastructure expansion, particularly in the UAE and Saudi Arabia, including ambitious construction and transportation projects, is contributing to demand. The market generally depends on imported finished bearings and steel, prioritizing product certification and proven durability over local sourcing due to the critical nature of the applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High carbon bearing steel Market, encompassing both the primary steel producers and the major bearing manufacturers who are the primary consumers of these specialized alloys.- SKF (Aktiebolaget Svenska Kullagerfabriken)

- Schaeffler Group (FAG/INA)

- Timken Company

- NSK Ltd.

- JTEKT Corporation (Koyo)

- Nippon Steel Corporation

- POSCO

- voestalpine AG

- ArcelorMittal

- TATA Steel

- CITIC Heavy Industries Co., Ltd. (CITIC Special Steel Group)

- Sanyo Special Steel Co., Ltd.

- Daido Steel Co., Ltd.

- ThyssenKrupp AG

- Ovako Group

- Gerdau S.A.

- Aperam S.A.

- Sandvik Materials Technology

- Zelezarny Veseli, a.s.

- Acerinox S.A.

Frequently Asked Questions

Analyze common user questions about the High carbon bearing steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for High carbon bearing steel in the forecast period?

The primary driver is the accelerating global transition to electric vehicles (EVs) and the massive expansion of renewable energy infrastructure, particularly large-scale wind turbines. Both sectors require high-performance, durable bearings capable of handling higher rotational speeds, heavier loads, and extended operational lifespans, directly increasing demand for ultra-clean, high-purity high carbon bearing steel grades like AISI 52100 and its engineered variants.

How does the quality of High carbon bearing steel relate to the bearing fatigue life?

The fatigue life of a bearing is inversely proportional to the presence and size of non-metallic inclusions within the steel microstructure. High carbon bearing steel processed using advanced methods like Electroslag Remelting (ESR) or Vacuum Arc Remelting (VAR) minimizes these inclusions, significantly enhancing the rolling contact fatigue strength and extending the component's operational life, making material purity the single most critical factor for performance assurance.

What are the key differences between through-hardened and case-hardened bearing steels?

Through-hardened steel, such as AISI 52100, achieves uniform hardness across its entire cross-section, ideal for smaller, precision bearings under moderate loads. Case-hardened steels feature a hard, high-carbon surface layer (the case) over a soft, tough, low-carbon core. This structure provides superior shock resistance and fracture toughness, making them preferred for larger, heavy-duty applications where high shock loads are expected, such as in heavy machinery gearboxes.

Which geographical region is expected to exhibit the fastest growth in the High carbon bearing steel market?

The Asia Pacific (APAC) region, spearheaded by manufacturing powerhouses like China, is projected to maintain the fastest growth rate. This growth is underpinned by continuous, large-scale investments in industrial infrastructure, robust automotive manufacturing expansion, and ambitious domestic development programs in high-speed rail and utility-scale wind and solar power generation, requiring substantial bearing volumes.

How is AI impacting the production and quality control of High carbon bearing steel?

AI is fundamentally transforming steel production by enabling predictive quality control systems that analyze real-time melting data to minimize impurities. Furthermore, AI optimizes complex heat treatment schedules to achieve precise microstructures, and it is crucial for developing advanced simulation models (digital twins) used to predict material performance and extend component design life before physical manufacturing commences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager