High Density Flexible Graphite Foil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436474 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High Density Flexible Graphite Foil Market Size

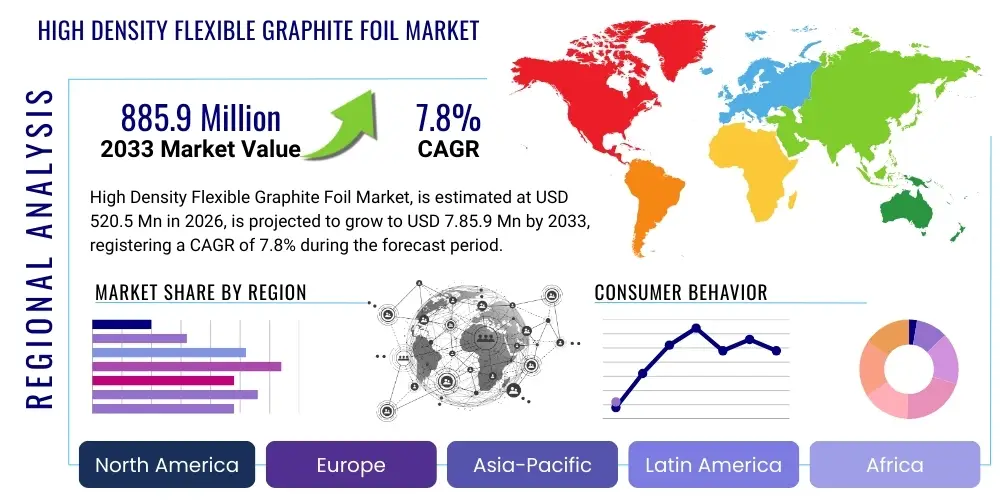

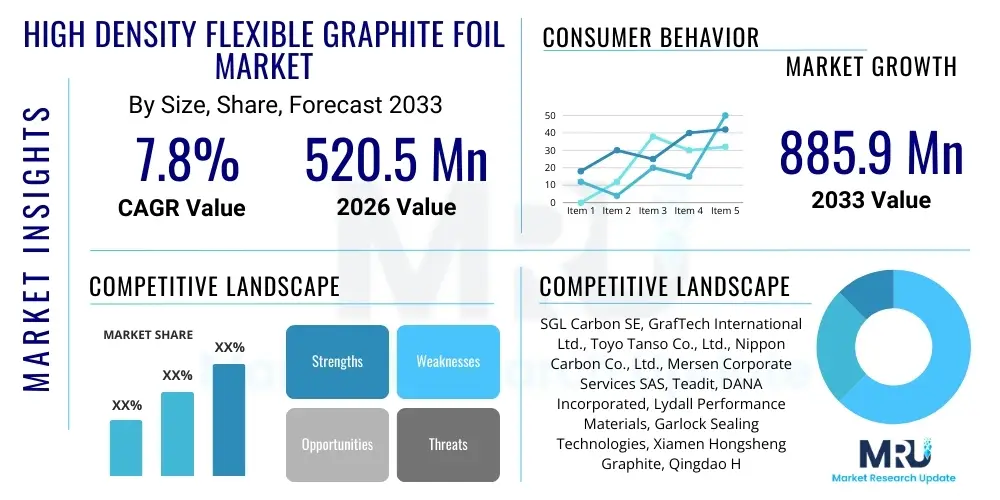

The High Density Flexible Graphite Foil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 520.5 Million in 2026 and is projected to reach USD 885.9 Million by the end of the forecast period in 2033.

High Density Flexible Graphite Foil Market introduction

The High Density Flexible Graphite Foil market encompasses the production, distribution, and application of specialized graphite materials characterized by superior thermal conductivity, chemical inertness, and high compressibility. These foils are manufactured through the expansion of natural graphite flakes using acid intercalation and subsequent pressing and calendering processes, achieving densities significantly higher than standard flexible graphite sheets (typically exceeding 1.2 g/cm³). The unique structure allows these materials to excel in environments requiring robust sealing capabilities under high pressure and temperature, as well as efficient passive thermal management in demanding electronic assemblies. The core value proposition of high-density foils lies in their exceptional performance reliability across diverse industrial sectors, making them indispensable components in modern energy, automotive, and semiconductor technologies.

Product applications are diverse and rapidly expanding, driven primarily by the global transition towards electrification and miniaturization. Major use cases include thermal interface materials (TIMs) in consumer electronics, automotive battery thermal management systems (BTMS), and crucial gaskets and seals in petrochemical and industrial process equipment. Furthermore, high-density graphite foils are increasingly utilized as bipolar plates in fuel cells due to their inherent electrical conductivity, corrosion resistance, and low permeability. The ability of these materials to maintain structural integrity and performance across a wide temperature spectrum, ranging from cryogenic conditions to over 3000°C in non-oxidizing atmospheres, provides a significant competitive advantage over traditional metallic or polymeric alternatives. This versatility ensures sustained demand across mature industrial economies and rapidly developing nations focused on infrastructure modernization.

The market growth is primarily fueled by stringent environmental regulations necessitating leak-proof sealing solutions and the escalating demand for highly efficient heat dissipation in compact electronic devices. Key driving factors include the massive scale-up of electric vehicle (EV) production, which relies heavily on high-density graphite for thermal stabilization and battery pack fire prevention, and the expansion of advanced semiconductor manufacturing (AEC) where thermal management is critical for operational stability and longevity. Moreover, the increasing adoption of renewable energy technologies, particularly hydrogen fuel cells and advanced battery storage systems, mandates high-performance, durable, and lightweight materials, positioning high-density flexible graphite foil as a fundamental enabling technology for the future energy landscape.

High Density Flexible Graphite Foil Market Executive Summary

The High Density Flexible Graphite Foil Market is positioned for robust expansion, predominantly fueled by transformative shifts in the automotive and electronics industries. Business trends indicate a strong move toward product customization, with manufacturers focusing on ultra-thin, high-density foils tailored specifically for microelectronic thermal solutions and specialized gaskets designed for extremely aggressive chemical environments. Strategic mergers, acquisitions, and technological collaborations, particularly those involving Asian manufacturers and Western technology providers, are shaping the competitive landscape, aiming to secure control over raw material supply chains and accelerate material innovation, such as the development of composites integrating graphene or carbon nanotubes to enhance mechanical strength and thermal anisotropy. Price stability and securing high-quality expandable graphite supply remain central challenges influencing operational profitability and market access.

Regionally, Asia Pacific (APAC) stands as the undisputed epicenter of both production and consumption, driven by the colossal manufacturing bases for EVs, batteries, and consumer electronics located primarily in China, South Korea, and Japan. Government initiatives in APAC promoting sustainable energy storage and vehicle electrification provide substantial impetus to the market's trajectory. North America and Europe, while maintaining significant market share in high-value, specialized industrial sealing applications and aerospace, are witnessing accelerated adoption of these foils in their nascent but rapidly scaling EV and green energy sectors. European Union regulations pertaining to industrial emissions and chemical handling further solidify the demand for high-integrity graphite sealing solutions, contributing significantly to the regional revenue growth, albeit at a slower pace compared to the sheer volume growth seen in APAC.

In terms of segment trends, the Application segment focusing on thermal management systems is experiencing the fastest growth, largely surpassing traditional sealing applications, although the latter remains foundational. Within the thermal segment, battery thermal interface materials (TIMs) are particularly dynamic, reflecting the urgency among EV makers to improve battery range and safety through enhanced heat dissipation. By Type, the high-purity (99% carbon content and above) grades are gaining traction due to the stringent requirements of fuel cell technology and nuclear applications, demanding superior chemical resistance and longevity. Manufacturers are continually investing in optimizing the calendering process and quality control protocols to meet the rising demand for ultra-low permeability and consistent thickness required in advanced applications.

AI Impact Analysis on High Density Flexible Graphite Foil Market

Common user questions regarding AI's impact on the High Density Flexible Graphite Foil Market frequently center on efficiency gains, material quality consistency, and application-specific product design. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) can optimize complex manufacturing parameters, such as the graphite expansion ratio and the subsequent calendering pressure, to ensure uniform density and desired thermal performance characteristics across large batches. Concerns often relate to predictive maintenance capabilities for high-precision rolling equipment and the integration of smart quality control systems that can detect micro-defects invisible to the human eye. Furthermore, there is significant expectation that AI tools will accelerate the discovery and formulation of new graphite composite materials, optimizing chemical precursors and processing temperatures to achieve specific anisotropic thermal profiles required for next-generation electronics and high-performance battery packs.

The introduction of AI-driven simulation platforms is fundamentally changing the R&D cycle for flexible graphite foil producers and end-users. ML algorithms can analyze massive datasets related to material stress testing, thermal cycling, and chemical compatibility, allowing engineers to predict material failure points and optimize product geometry (e.g., gasket shape or TIM configuration) before physical prototyping begins. This reduces both development time and material waste, leading to a more efficient and sustainable supply chain. For instance, in EV battery design, AI is used to model complex thermal distribution within the pack, recommending the precise location and thickness of high-density graphite foils to prevent localized hotspots and maximize cell longevity, thereby establishing AI as a core tool for application engineering within the sector.

- AI-enhanced predictive maintenance optimizes calendering machinery lifespan and minimizes unplanned downtime, crucial for maintaining high-density specifications.

- Machine Learning algorithms refine the chemical intercalation and thermal expansion process for raw graphite, improving yield and purity consistency.

- Generative AI tools assist in designing custom anisotropic thermal management solutions based on specific device geometries and heat load requirements.

- AI-powered visual inspection systems enhance quality control, detecting subtle surface and internal defects in the final graphite foil products at high speeds.

- Data analytics driven by AI optimizes global logistics and inventory management for raw materials (expandable graphite) and finished products, mitigating supply chain risks.

DRO & Impact Forces Of High Density Flexible Graphite Foil Market

The market dynamics of High Density Flexible Graphite Foil are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impact forces shaping its trajectory. The primary driving force is the global commitment to sustainable energy and advanced electronics, demanding materials that offer unparalleled thermal and electrical properties within confined spaces. Restraints largely revolve around supply chain vulnerability and the intensive energy requirements of the manufacturing process, while significant opportunities lie in pioneering applications within emerging technologies like 5G infrastructure, advanced aerospace thermal blankets, and stationary grid energy storage systems. The overall impact force is strongly positive, driven by non-negotiable performance requirements in high-growth industries where material failure is simply not permissible, thereby cementing the necessity of high-density graphite solutions.

Drivers: The explosive growth of the Electric Vehicle (EV) sector is arguably the most powerful catalyst. High-density flexible graphite foil is essential for battery thermal management, providing crucial thermal conductivity and serving as a fire retardant layer between cells, enhancing safety and extending battery life. Concurrently, the increasing complexity and power density of consumer electronics (smartphones, laptops, servers) necessitate superior thermal interface materials (TIMs) to manage heat generated by faster processors without compromising device size, making thin, high-density graphite the material of choice. Furthermore, stringent regulatory standards in industrial sealing, particularly in chemical processing and oil and gas, mandate the use of zero-leakage gasketing, bolstering demand for graphite's chemical inertness and resilience.

Restraints: The market faces considerable restraints primarily concerning raw material availability and price volatility. Natural flake graphite, the essential precursor, is subject to geopolitical supply chain risks, heavily concentrated in a few mining regions, leading to fluctuating input costs. The energy-intensive nature of the expansion and calendering processes also poses an economic and environmental challenge, pushing manufacturers to seek energy-efficient production methods. Furthermore, competition from alternative materials, such as synthetic diamond films or advanced polymer-based thermal materials, although typically less efficient in extreme conditions, presents a competitive pressure, especially in cost-sensitive, low-temperature applications. Technical restraints include achieving perfect thickness uniformity over very large foil sheets required by some industrial applications.

Opportunities: Major growth opportunities exist in the hydrogen economy, specifically the manufacture of bipolar plates for Proton Exchange Membrane (PEM) fuel cells, where high-density graphite offers the ideal combination of conductivity, corrosion resistance, and light weight. The rollout of 5G and future 6G communication networks necessitates massive data centers and telecommunications equipment requiring robust and efficient heat dissipation, providing a new substantial revenue stream. Additionally, the development of next-generation nuclear reactors and specialized components for space exploration—requiring materials that function flawlessly in extreme radiation and temperature vacuums—opens niche, high-margin opportunities for ultra-high-purity, high-density foils. Developing sustainable, bio-sourced or synthetic graphite precursors represents a long-term strategic opportunity to mitigate reliance on geopolitical supply chains.

Segmentation Analysis

The High Density Flexible Graphite Foil market is intricately segmented based on Type (purity levels), Application (functionality), and End-Use Industry, reflecting the diverse and demanding requirements across various sectors. Segmentation based on purity is crucial, as the performance metrics such as electrical conductivity and chemical resistance are directly proportional to carbon content, dictating suitability for high-stakes applications like nuclear or fuel cells. Application segmentation differentiates between purely thermal management roles (heat spreading/TIMs) and mechanical sealing roles (gaskets/packing), which involve different density and compression requirements. Understanding these segments is vital for producers to align their manufacturing processes and product specifications with specific industrial needs and regulatory compliance standards.

The segmentation structure highlights the dual nature of the material: its utility as a thermal conductor and as an exceptional sealing material. The rapid commercialization of battery technologies means that the thermal management application segment is projected to dominate revenue growth, while the automotive and industrial sectors remain the foundational pillars of stable demand for sealing products. Geographic segmentation underscores the critical role of APAC as the primary manufacturing hub for electronic goods, driving the demand for high-volume, low-cost thermal foils, contrasted against the higher-margin, specialized industrial sealing market prevalent in North America and Europe. This complex segmentation ensures comprehensive market coverage and granular strategic planning for stakeholders.

- By Type:

- High Purity Flexible Graphite Foil (99.0% Carbon Content and Above)

- Standard Purity Flexible Graphite Foil (98.0% to 99.0% Carbon Content)

- By Thickness:

- Ultra-Thin Foils (Below 100 Microns)

- Standard Thickness Foils (100 Microns to 500 Microns)

- Thick Sheets (Above 500 Microns)

- By Application:

- Thermal Management (Heat Spreading, TIMs, Heat Sinks)

- Gasketing and Sealing (Industrial Gaskets, Valve Packing, Flange Seals)

- Electrical Applications (Bipolar Plates for Fuel Cells, Electrodes)

- Electromagnetic Interference (EMI) Shielding

- By End-Use Industry:

- Automotive and Transportation (Electric Vehicle Batteries, Exhaust Systems)

- Electronics and Semiconductors (Consumer Devices, Data Centers, Power Modules)

- Chemical and Petrochemical (Flanges, Pipelines, Refineries)

- Aerospace and Defense

- Energy (Fuel Cells, Nuclear, Power Generation)

Value Chain Analysis For High Density Flexible Graphite Foil Market

The value chain for the High Density Flexible Graphite Foil market commences with the upstream acquisition and processing of natural flake graphite, predominantly sourced from mines concentrated in China, Brazil, India, and Canada. This raw material undergoes acid intercalation (treatment with sulfuric or nitric acid) and subsequent thermal expansion, transforming the flakes into expanded graphite worm-like structures. This crucial expansion process determines the purity and consistency of the intermediate product. Upstream suppliers’ control over high-quality, large-flake graphite significantly influences the final product cost and density capabilities, making resource security a paramount concern for major foil manufacturers.

The midstream stage involves the specialized manufacturing processes of pressing, rolling, and calendering the expanded graphite into dense, flexible foils. High-density foils require precise control over the calendering pressure and rolling speed to achieve the target density (typically >1.2 g/cm³) and specified thickness uniformity. Manufacturing complexity is heightened by the necessity of integrating various treatments, such as oxidation inhibition or adhesive backing, depending on the end application. Distribution channels are highly specialized; direct sales are common for large industrial customers (e.g., petrochemical giants buying large gasket rolls), while indirect distribution via specialized material distributors and electronic component suppliers is prevalent for consumer electronics and automotive thermal interfaces.

Downstream analysis focuses on the integration of these foils into final products. For thermal applications, foils are die-cut and often laminated onto heat sinks or battery modules. For sealing, the material is formed into gaskets, seals, or packing rings. Direct channels predominate when manufacturers work closely with Tier 1 automotive suppliers or major electronics OEMs for customized designs and high-volume supply, ensuring just-in-time delivery and adherence to rigorous quality standards. Indirect channels, involving regional converters and fabricators, serve smaller industrial end-users requiring standard gasket sizes or moderate volumes of thermal spreading sheets, broadening market accessibility but potentially adding a layer of cost and complexity to the supply chain.

High Density Flexible Graphite Foil Market Potential Customers

The primary customers for High Density Flexible Graphite Foil are sophisticated industrial and high-technology manufacturers who require materials capable of operating under extreme conditions where failure can lead to catastrophic losses or significant downtime. End-users fall mainly within the automotive and electronics sectors, particularly those engaged in Electric Vehicle (EV) manufacturing and advanced semiconductor packaging. EV battery producers and Tier 1 suppliers rely heavily on high-density foils for their thermal run-away protection, fire resistance, and superior heat dissipation properties, making them critical buyers demanding high-volume supply and absolute quality consistency.

Another major category of buyers includes petrochemical and chemical processing plants, oil and gas refineries, and power generation facilities (including nuclear). These customers purchase thick, high-density graphite sheets and rolls for use as robust, chemically inert gaskets, valve packing, and critical fluid sealing materials. Their purchasing criteria prioritize longevity, resistance to aggressive media (acids, alkalis), and stability under high temperatures and pressures, typically involving long-term supply contracts based on strict material specifications and compliance certifications. Additionally, the nascent hydrogen fuel cell industry represents a high-potential growth customer base, acquiring high-purity foils for bipolar plate assembly, demanding both electrical conductivity and superior gas impermeability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520.5 Million |

| Market Forecast in 2033 | USD 885.9 Million |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon SE, GrafTech International Ltd., Toyo Tanso Co., Ltd., Nippon Carbon Co., Ltd., Mersen Corporate Services SAS, Teadit, DANA Incorporated, Lydall Performance Materials, Garlock Sealing Technologies, Xiamen Hongsheng Graphite, Qingdao Haichuan Chemical, Yichang Carbon, Jiangxi Zichen Graphite, Hexcel Corporation, Morgan Advanced Materials, Schunk Carbon Technology, 3M Company, Spetech, Luohe Haoli Carbon, Zibo Qichuang Graphite Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Density Flexible Graphite Foil Market Key Technology Landscape

The manufacturing of High Density Flexible Graphite Foil relies on several highly specialized and proprietary technological processes, central to which is the precision of the calendering and rolling phase. Achieving exceptionally high density (above 1.2 g/cm³) while maintaining flexibility and integrity requires advanced, heavy-duty calendering machinery capable of applying immense, uniform pressure across the material surface. Technological advancements in this area focus on multi-stage rolling processes that minimize material spring-back and ensure consistent thickness tolerance, which is critical for applications like bipolar plates or ultra-thin thermal interface films where minute variations can affect performance. Continuous optimization of roller material composition and temperature control systems is a key area of technological competition among leading manufacturers.

Another crucial technological frontier involves surface modification and composite development. To expand the application range beyond pure sealing and heat spreading, manufacturers are integrating nanotechnology, specifically incorporating carbon nanotubes (CNTs) or graphene oxide, into the graphite matrix. This innovation aims to enhance the mechanical strength (tensile and tear resistance), improve the through-plane thermal conductivity, or provide electromagnetic shielding properties without sacrificing the material's inherent flexibility or chemical resistance. Techniques like chemical vapor deposition (CVD) or advanced slurry mixing and spraying are employed to achieve uniform integration of these additives, leading to tailored materials with anisotropic properties optimized for complex thermal management challenges in high-frequency electronic systems.

Furthermore, technology related to oxidation inhibition is vital, especially for applications operating in air at elevated temperatures (above 400°C), such as exhaust systems or certain industrial seals. Manufacturers utilize proprietary chemical treatments or apply thin protective coatings, often metallic or ceramic-based, to encapsulate the graphite surface, significantly extending the service life of the foil in oxidative environments. The overall technological landscape is shifting towards automation and digital integration, employing sensors and data analytics throughout the production line to monitor and adjust real-time parameters, leading to superior material consistency, higher production yields, and reduced energy consumption, addressing both quality demands and sustainability concerns within the market.

Regional Highlights

The regional market landscape for High Density Flexible Graphite Foil is highly polarized, reflecting global manufacturing trends, regulatory environments, and technological adoption rates across key geographical areas. Asia Pacific (APAC) dominates the market both in terms of production capacity and consumption volume, driven by the concentration of global electronic supply chains and the massive scale of electric vehicle and battery manufacturing in countries like China, South Korea, and Japan. The region benefits from lower production costs and strong government support for clean energy and high-tech manufacturing, ensuring rapid adoption of graphite foils in consumer devices, data centers, and the expanding new energy vehicle sector. APAC’s market is characterized by fierce competition and a strong focus on high-volume, cost-effective thermal management solutions.

North America and Europe represent mature, high-value markets with stringent performance requirements, particularly strong in the industrial sealing, aerospace, and high-performance energy sectors (e.g., nuclear and specialized oil and gas). Europe's market growth is robust, spurred by aggressive emission reduction mandates and significant investment in hydrogen fuel cell technology, particularly in Germany and France, creating sustained demand for high-purity graphite bipolar plates. North America, driven by the resurgence of domestic EV manufacturing and continuous innovation in defense and high-reliability electronics, focuses on premium, customized, and certified high-density foils, valuing technological superiority and supply chain resilience over immediate cost savings. Demand here is characterized by highly specific technical requirements and long qualification cycles for suppliers.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but present substantial growth potential. Latin America’s growth is tied to industrialization and infrastructure projects, particularly in chemical processing and petrochemical sectors requiring high-performance sealing solutions, with Brazil being a key market. MEA’s market is largely influenced by oil and gas operations; the necessity for reliable, leak-proof gasketing in harsh desert environments and high-pressure facilities drives demand for high-density graphite seals. As these regions invest in renewable energy and transition to more advanced manufacturing processes, the adoption of flexible graphite foils for both thermal and sealing applications is expected to accelerate significantly over the forecast period, albeit from a lower base.

- Asia Pacific (APAC): Market leader in volume and growth; fueled by EV battery manufacturing, electronics production, and substantial government investment in green technology. China and South Korea are the largest consumers.

- North America: Focused on high-specification, high-reliability applications in aerospace, defense, and specialized industrial sealing; strong push from domestic EV battery gigafactories.

- Europe: Driven by stringent environmental regulations, advanced industrial manufacturing standards, and rapid development of the hydrogen fuel cell market demanding high-purity foils.

- Latin America: Emerging market focused on industrial expansion, particularly petrochemical and chemical processing industries, valuing robust sealing integrity.

- Middle East and Africa (MEA): Demand heavily concentrated in the oil, gas, and power generation sectors, requiring specialized high-temperature, high-pressure sealing gaskets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Density Flexible Graphite Foil Market.- SGL Carbon SE

- GrafTech International Ltd.

- Toyo Tanso Co., Ltd.

- Nippon Carbon Co., Ltd.

- Mersen Corporate Services SAS

- Teadit

- DANA Incorporated

- Lydall Performance Materials

- Garlock Sealing Technologies

- Xiamen Hongsheng Graphite

- Qingdao Haichuan Chemical

- Yichang Carbon

- Jiangxi Zichen Graphite

- Hexcel Corporation

- Morgan Advanced Materials

- Schunk Carbon Technology

- 3M Company

- Spetech

- Luohe Haoli Carbon

- Zibo Qichuang Graphite Technology

Frequently Asked Questions

Analyze common user questions about the High Density Flexible Graphite Foil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for High Density Flexible Graphite Foil in the current market?

The primary driver is the exponential growth of the Electric Vehicle (EV) industry, specifically the need for highly effective thermal interface materials (TIMs) and fire prevention barriers within lithium-ion battery packs, requiring graphite foils with superior density and conductivity for thermal stability and safety enhancement.

How does the high density characteristic benefit industrial sealing applications?

High density ensures superior material impermeability and compressibility, enabling seals and gaskets to conform effectively under high pressure and temperature without degradation or leakage. This is critical in petrochemical and nuclear applications requiring zero-leakage performance under extreme operating conditions.

Which geographical region holds the largest market share for high-density flexible graphite foil?

Asia Pacific (APAC), particularly China, South Korea, and Japan, dominates the market share due to its established position as the global hub for electronics manufacturing and electric vehicle battery production, driving immense volume demand for thermal management solutions.

What role does High Density Flexible Graphite Foil play in the emerging hydrogen economy?

The material is essential for manufacturing bipolar plates in Proton Exchange Membrane (PEM) fuel cells. Its high electrical conductivity, excellent corrosion resistance, and lightweight nature make it the preferred material for efficiently distributing gases and managing current within the fuel cell stack.

What are the key technological challenges currently facing graphite foil manufacturers?

Key challenges involve ensuring absolute thickness uniformity across large-area foils, controlling raw material purity and volatility, and developing advanced surface modification techniques to enhance oxidation resistance for prolonged service life in high-temperature, oxidative environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager