High-End Bicycle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432741 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

High-End Bicycle Market Size

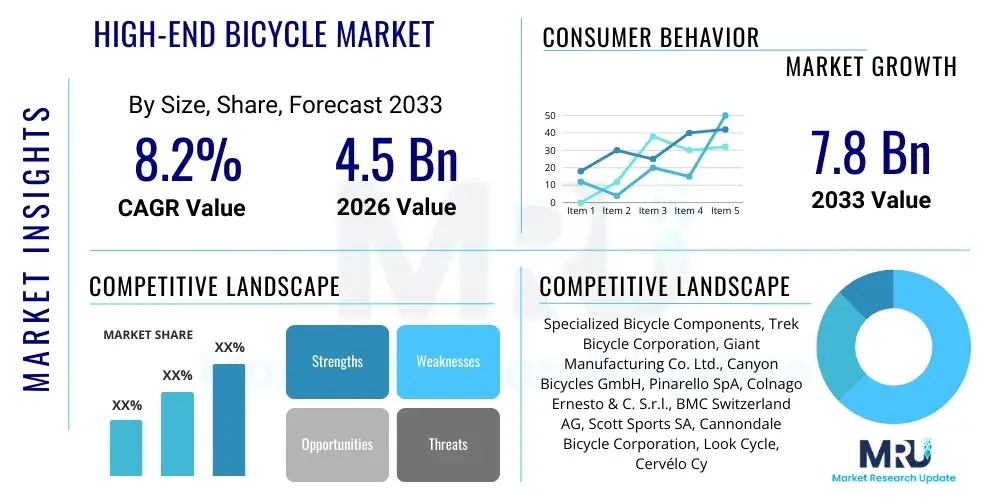

The High-End Bicycle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033. This growth is intrinsically linked to rising global discretionary incomes, particularly within developed economies and emerging affluent classes in Asia Pacific, coupled with a sustained focus on health, fitness, and professional sports participation. The increasing demand for lightweight, technologically advanced, and specialized cycling equipment drives this significant market expansion, positioning high-end bicycles as both performance tools and luxury status symbols.

High-End Bicycle Market introduction

The High-End Bicycle Market encompasses specialized cycling products typically priced above USD 3,000, characterized by the use of premium materials such as aerospace-grade carbon fiber, titanium, and advanced lightweight aluminum alloys, integrated with sophisticated components like electronic shifting systems and high-performance hydraulic disc brakes. These bicycles are engineered for superior performance, focusing intensely on aerodynamic efficiency, minimal weight, customized geometry, and exceptional ride quality, catering to professional racers, serious amateur competitors, and affluent recreational enthusiasts. The core value proposition of this market lies in providing an optimized cycling experience that leverages cutting-edge technology and precision manufacturing, distinguishing these products significantly from standard consumer bicycles.

The primary applications of high-end bicycles span across competitive road racing, demanding mountain biking disciplines (such as cross-country and enduro), specialized triathlon events, and the rapidly growing gravel and adventure cycling segments. Furthermore, a smaller but highly profitable application exists in the luxury leisure and specialized commuting sectors, where durability, aesthetic design, and high component quality justify the substantial investment. Market growth is sustained by the continuous introduction of incremental technological improvements, such as enhanced battery life for electronic components, superior vibration dampening for carbon structures, and complex integration of components to reduce drag and improve overall efficiency.

Key driving factors propelling the market include the global rise in health and fitness awareness, which encourages investment in high-quality sporting equipment, alongside the burgeoning number of organized competitive cycling events worldwide, necessitating professional-grade gear. Moreover, increasing disposable incomes in key regions allow consumers to purchase these premium products as lifestyle investments. The market benefits substantially from continuous material science innovations, particularly in carbon fiber manufacturing techniques that allow for highly complex frame shapes and significant weight reduction without compromising structural integrity or stiffness, thereby delivering tangible performance benefits to the end-user. Environmental concerns also subtly contribute, positioning cycling as a sustainable and premium mobility option.

- Market Intro: Focuses on specialized bicycles using premium materials (carbon fiber, titanium) priced typically above USD 3,000, designed for maximum performance, precision, and efficiency.

- Product Description: Includes road, mountain, gravel, and triathlon bikes featuring electronic shifting, aerodynamic optimization, disc brakes, and customizable geometry.

- Major Applications: Professional racing, competitive amateur cycling, high-performance fitness training, and specialized endurance/adventure riding.

- Benefits: Superior speed, reduced weight, enhanced durability, precise handling, and optimized power transfer, leading to competitive advantage and exceptional riding experience.

- Driving factors: Rising global affluence, increasing health consciousness, technological advancements in composite materials, and expansion of competitive cycling infrastructure.

High-End Bicycle Market Executive Summary

The High-End Bicycle Market is characterized by robust resilience and a consistent upward trajectory, largely insulated from typical economic downturns due to its niche focus on affluent consumers and dedicated athletes. Major business trends emphasize the vertical integration of leading manufacturers to control both component supply and distribution channels, aiming to enhance product customization and reduce lead times for complex assembly processes. There is a noticeable trend towards adopting advanced manufacturing techniques, including sophisticated finite element analysis (FEA) modeling to perfect frame structure and the application of automation in component assembly, ensuring consistency in ultra-lightweight designs. Furthermore, the strategic focus is shifting towards providing digital integration services, such turning the bicycle into a connected device capable of real-time performance tracking and predictive maintenance alerts, thereby enhancing customer loyalty and providing new revenue streams.

Regionally, Europe maintains its historical dominance, particularly in the road cycling segment, driven by strong cultural cycling heritage, numerous high-profile professional races, and established specialty retail networks. However, the Asia Pacific region is rapidly emerging as the most dynamic growth engine, fueled by the rapid expansion of the ultra-high-net-worth individual (UHNWI) population in countries like China, Japan, and South Korea, who increasingly view high-end bicycles as both performance gear and luxury goods. North America demonstrates strong growth in niche, specialized segments, particularly high-end mountain bikes (MTB) and the rapidly expanding gravel segment, reflecting consumer demand for versatility and adventure cycling. Manufacturers are consequently adapting their supply chains and marketing strategies to better address the unique competitive landscape and consumer preferences within these diverse geographic markets, often establishing regional R&D hubs focused on terrain-specific optimization.

Segment trends reveal that while traditional Road Bicycles remain the largest revenue generator, the Gravel/Adventure segment is exhibiting the fastest growth rate, compelling brands to invest heavily in versatile frame designs that balance speed and durability. Critically, the integration of electric assist technology (E-Bikes) into the high-end spectrum is transforming product offerings, creating an E-High-End category focused on performance-driven motors and lightweight battery integration, rather than mere accessibility. Material segmentation remains dominated by high-modulus carbon fiber, which continuously benefits from research aimed at improving stiffness-to-weight ratios. The overall market strategy is moving towards personalized experiences, utilizing advanced data analytics to offer custom bike fitting and component selection, thus reinforcing the premium nature of the products and ensuring sustained consumer expenditure in a highly competitive luxury sporting goods environment.

AI Impact Analysis on High-End Bicycle Market

User queries regarding AI in the high-end bicycle market heavily revolve around optimization, customization, and user experience enhancement. Consumers are keenly interested in how Artificial Intelligence can fundamentally alter the buying process by offering unparalleled precision in bike sizing and geometry (fit optimization), moving beyond traditional metrics to incorporate dynamic riding data and physiological inputs. Another major theme is the expectation that AI will revolutionize the design and manufacturing phase, specifically through optimizing carbon fiber layup patterns to achieve maximum strength and stiffness with minimum material usage, a task currently highly dependent on specialized human expertise. Finally, users frequently question AI’s role in real-time performance monitoring and smart componentry, such as predictive shifting or self-adjusting electronic suspension systems that dynamically adapt to terrain changes, offering tangible competitive advantages and improved safety for the rider, thereby moving the high-end bicycle towards becoming a truly 'smart' vehicle.

In response to these core concerns, the high-end bicycle industry is leveraging AI primarily across three functional domains: R&D, manufacturing, and consumer interaction. In research and development, machine learning algorithms are being employed to process vast amounts of computational fluid dynamics (CFD) data and finite element analysis (FEA) results, leading to the design of more aerodynamically efficient frames and components faster than conventional iterative prototyping. This optimization reduces the development cycle and ensures that newly released models offer a verifiable performance leap. AI tools are also essential in simulating real-world fatigue and stress tests on prototype materials, predicting failure points, and ensuring the absolute reliability demanded by the premium price point.

The most profound impact of AI is emerging in hyper-personalization. Through sophisticated 3D scanning and motion capture systems, AI algorithms analyze a rider's unique morphology, flexibility, and power output characteristics. This analysis generates bespoke frame geometry specifications and ideal component dimensions (e.g., crank length, handlebar width, saddle setback) that cannot be achieved through standard off-the-shelf sizing. This level of customization reinforces the luxury value proposition, moving the sale from a standardized product to a tailored performance instrument. Furthermore, integrated sensors linked to AI platforms allow for the collection and analysis of in-ride data, providing coaches and riders with actionable insights far exceeding simple power output metrics, including pedaling efficiency analysis and energy expenditure prediction for optimized training plans and race strategies.

- AI-Driven Design Optimization: Machine learning algorithms analyze structural integrity and aerodynamic simulations (CFD/FEA) to perfect frame shapes and carbon layup schedules for maximum stiffness and minimum weight.

- Hyper-Personalized Bike Fit: Utilizes 3D body scanning and dynamic motion analysis to generate specific, customized frame geometry and component sizing recommendations, enhancing rider comfort and power transfer efficiency.

- Predictive Maintenance and Diagnostics: Integrated smart sensors monitor component wear (e.g., chain stretch, brake pad depth, bearing fatigue) and use AI to predict failure points, notifying users before critical events occur.

- Smart Suspension Systems: AI algorithms process real-time terrain data, rider input (cadence, pressure), and speed to instantly adjust electronic suspension dampening and rebound characteristics in high-end mountain bikes (MTB).

- Supply Chain and Manufacturing Efficiency: Optimizes production scheduling and inventory management for specialized, high-cost materials (e.g., high-modulus carbon sheets), minimizing waste and lead times for custom orders.

- Enhanced Training and Performance Analytics: AI platforms integrate diverse sensor data (power meter, heart rate, GPS) to provide deeply individualized training load recommendations and fatigue management strategies for elite athletes.

DRO & Impact Forces Of High-End Bicycle Market

The dynamics of the High-End Bicycle Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the Impact Forces influencing future growth trajectories. The primary driver remains the confluence of rising global wealth and the enduring trend towards experiential and health-focused consumerism, where purchasing a high-end bicycle signifies both commitment to a healthy lifestyle and the acquisition of a precision-engineered luxury item. Technological drivers, especially those related to component miniaturization (e.g., fully wireless electronic shifting) and composite material science (e.g., graphene-enhanced carbon fibers), ensure that new product releases offer compelling performance advantages, sustaining the upgrade cycle among dedicated enthusiasts. These powerful market forces create a stable demand base that appreciates quality, performance, and brand heritage above general price sensitivity, maintaining high profit margins for market leaders.

However, the market faces significant structural restraints that limit mass adoption. Foremost among these is the extremely high capital investment required for product acquisition, often necessitating specialized financing or representing a substantial discretionary expenditure, making the market highly sensitive to macroeconomic shocks or fluctuations in consumer confidence. Furthermore, the inherent durability and long lifespan of high-quality components mean replacement cycles are prolonged, often stretching five to ten years for a premium frame, which slows recurring sales volume growth. Supply chain complexity, particularly the reliance on a few key global component suppliers (e.g., Shimano, SRAM, Campagnolo), represents a vulnerability, as disruptions can severely impact production lead times and inventory levels for high-demand models, potentially driving consumers towards alternative luxury outdoor leisure activities.

Opportunities for expansion lie predominantly in strategic innovation and diversification. The most promising opportunity is the integration of performance-oriented E-Bikes into the high-end category, appealing to older, affluent riders seeking assistance on challenging terrain or long distances without compromising on frame aesthetics or component quality. Customization, driven by advancements like 3D printing for tailored small parts (e.g., handlebars, saddles), allows brands to capture higher margins and solidify customer loyalty by offering a truly unique product. The market is also heavily impacted by substitution risk—high-end electric motorcycles or specialized fitness equipment can divert consumer spending. Regulatory impact forces include safety standards for new technologies (like integrated lighting or smart systems) and trade policies affecting the global movement of specialized components, necessitating manufacturers to maintain flexible and geographically diverse production and assembly operations to mitigate external risks.

Segmentation Analysis

The High-End Bicycle Market is fundamentally segmented based on three key parameters: Type of Bicycle, Material Used, and Application. Understanding these segments is critical for manufacturers to align their R&D investments with specific consumer demands. The Type segment is the most defining, encompassing Road Bikes, Mountain Bikes (MTB), and specialized categories like Triathlon and Gravel Bikes. Road bikes traditionally hold the largest market share due to their history in competitive cycling and widespread amateur participation, further subdivided into Aero, Lightweight Climbers, and Endurance models, each optimized for distinct performance metrics. The MTB segment, driven by technical innovation in full-suspension designs and component durability, captures significant high-margin revenue, particularly in the premium downhill and enduro sub-segments.

The Material segmentation demonstrates the market’s technological maturity, with Carbon Fiber dominating the landscape due to its superior stiffness-to-weight ratio and ability to be molded into complex aerodynamic shapes. Within carbon fiber, specialized sub-segments exist based on modulus rating (standard, high, ultra-high modulus) which directly correlate with price and performance characteristics. Aluminum and Titanium, while secondary, maintain dedicated niche segments: high-end aluminum often serves as a robust entry point into the premium market, while titanium appeals to consumers prioritizing long-term durability, bespoke craftsmanship, and corrosion resistance over absolute minimal weight. The choice of material dictates both manufacturing complexity and the final retail price point, heavily influencing brand positioning.

Application segmentation differentiates between Professional/Competitive Use and Recreational/Enthusiast Use. Competitive use drives the demand for the absolute lightest, most aerodynamically efficient, and technology-rich models (e.g., wireless electronic groupsets, power meters), often sold through professional team sponsorships that validate the product's performance credentials. Recreational and enthusiast applications, while still demanding high quality, often prioritize comfort, versatility (e.g., tire clearance for gravel), and integrated features like luggage mounts, reflecting a growing consumer interest in adventure and bikepacking. Strategic pricing and distribution efforts must be tailored differently for each application segment, recognizing that competitive sales are often influenced by team mandates, while enthusiast purchases rely heavily on specialty dealer consultation and peer reviews.

- Type:

- Road Bicycles (Aero, Climbing, Endurance)

- Mountain Bicycles (Cross-Country, Enduro, Downhill)

- Gravel/Adventure Bicycles (Fastest Growing Segment)

- Triathlon/Time Trial Bicycles (Highly Specialized Aerodynamics)

- Material:

- Carbon Fiber (High-Modulus Dominance)

- Titanium (Bespoke and Durability Niche)

- Advanced Aluminum Alloys

- Application:

- Professional Racing and Competition

- Performance Recreational and Fitness

- Luxury Leisure and Custom Builds

- Componentry:

- Electronic Shifting Systems (Wireless/Wired)

- Hydraulic Disc Brakes

- High-End Wheelsets (Carbon Fiber Aerodynamic)

Value Chain Analysis For High-End Bicycle Market

The value chain for the High-End Bicycle Market is complex, characterized by high specialization and heavy reliance on globally distributed Tier 1 and Tier 2 component suppliers. The upstream segment involves the sourcing and processing of extremely high-grade raw materials, primarily specialized aerospace-grade carbon fiber sheets (pre-pregs), titanium tubing, and high-precision aluminum billets. Component manufacturers like Shimano, SRAM, and Campagnolo dominate the supply of mission-critical systems such as drivetrains, braking systems, and electronic shifting mechanisms. These components represent a significant portion of the final product cost, and their intellectual property and quality control are paramount. Manufacturers must establish stringent long-term contracts and quality assurance protocols with these specialized suppliers to ensure a consistent flow of premium, defect-free parts necessary for high-end assembly.

The midstream process, where the bicycle frame is manufactured and assembled, involves sophisticated techniques, particularly for carbon fiber frames. This includes hand lay-up of carbon sheets, precision curing in autoclaves, painting, and quality control (often involving ultrasonic testing or X-ray inspection to detect voids or defects). Assembly then integrates the specialized components onto the frame. Manufacturers focusing on high-end production often keep these crucial, proprietary processes in-house or utilize highly trusted, exclusive contract manufacturers, primarily located in Asia, though some specialized European and North American brands maintain local artisan production for titanium and bespoke carbon builds. Efficiency in this stage dictates lead times, which are a major competitive factor in the high-end segment where consumers expect timely delivery of custom specifications.

Downstream activities involve distribution channels, which are generally bifurcated into direct and indirect models. The traditional indirect channel utilizes highly knowledgeable, specialized Independent Bicycle Dealers (IBDs) who offer critical services such as professional bike fitting, after-sales service, and warranty support, justifying the high price point through expert consultation. The direct channel, which has gained traction in recent years, involves manufacturers selling directly to consumers (D2C) via sophisticated online configurators. While D2C offers higher margins and direct customer data access, it requires manufacturers to develop robust logistics for complex, fully assembled products and establish service partnerships to cover warranty and maintenance needs, often partnering with local mobile technicians or specific IBDs for support. Effective supply chain management is crucial to minimize warehousing costs for high-value inventory and ensure swift fulfillment of tailored orders.

High-End Bicycle Market Potential Customers

The primary customer base for the High-End Bicycle Market consists of individuals characterized by high disposable income, a strong commitment to performance and fitness, and an appreciation for advanced engineering and brand prestige. This segment is broadly divided into professional athletes and serious amateur racers who require equipment providing a measurable competitive edge; these customers are typically highly knowledgeable about component specifications, frame stiffness metrics, and aerodynamic integration. For this group, performance criteria—such as grams saved, wattage transfer efficiency, and electronic integration—are the core determinants of purchase, often driven by marginal gains philosophy and team affiliation, resulting in frequent component upgrades and replacement cycles guided by evolving technology standards.

A second crucial segment includes affluent recreational enthusiasts, often high-net-worth individuals who participate in cycling for lifestyle, fitness, and social engagement. These buyers value the brand heritage, aesthetic design, quality of materials (e.g., bespoke paint schemes, titanium craftsmanship), and the overall luxury experience associated with the purchase. While performance is important, factors like comfort, customization options, and the ability to ride long distances reliably often weigh heavily in the decision process. This group views the high-end bicycle as an investment in well-being and a symbol of status, and they are less sensitive to incremental technological updates but highly responsive to new frame launches and limited-edition models that offer exclusivity.

A rapidly expanding third customer profile is the high-end commuter or urban cyclist who demands reliability, low maintenance, and lightweight precision for daily use. While this segment is smaller than the others, they purchase high-end bikes (often specialized single-speed or lightweight urban models) for their durable construction, premium components, and stealth factor, valuing performance characteristics in an urban environment, such as quick acceleration and robust braking. Manufacturers are increasingly targeting this demographic with models that integrate smart technology, high-end lighting, and clean aesthetics (e.g., internal cable routing) to differentiate themselves from mass-market offerings. For all segments, the purchasing decision is invariably preceded by extensive research, relying heavily on professional reviews, peer recommendations, and detailed consultations with specialized bicycle retailers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Trek Bicycle Corporation, Giant Manufacturing Co. Ltd., Canyon Bicycles GmbH, Pinarello SpA, Colnago Ernesto & C. S.r.l., BMC Switzerland AG, Scott Sports SA, Cannondale Bicycle Corporation, Look Cycle, Cervélo Cycles, Merida Industry Co. Ltd., Wilier Triestina S.p.A., Time Sport International, R&A Cycles, Orbea, Argon 18, 3T Cycling, Parlee Cycles, Moots Cycles. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High-End Bicycle Market Key Technology Landscape

The High-End Bicycle Market is fundamentally technology-driven, relying heavily on ongoing innovation in materials science and electronic integration to justify premium pricing and performance claims. Central to this landscape is the continuous refinement of carbon fiber manufacturing processes, including automated and robotic lay-up techniques that reduce human error and ensure uniformity in the structural integrity of ultra-lightweight frames. Manufacturers are increasingly employing advanced composites, such as high-modulus and ultra-high-modulus carbon strands, sometimes enhanced with nanoscale materials like graphene, to create frames that exhibit unprecedented stiffness-to-weight ratios, offering superior power transfer and handling precision required by elite cyclists. Further technological advancement focuses on vibration dampening characteristics integrated directly into the carbon structure, enhancing rider comfort without compromising race-day performance, a critical feature for endurance and gravel models.

Beyond materials, the landscape is defined by smart component integration and electronic precision. Electronic shifting systems (e.g., Shimano Di2, SRAM eTap AXS, Campagnolo EPS) have become the de facto standard in the premium road and mountain bike segments, offering instantaneous, highly accurate gear changes with minimal manual effort, often integrated wirelessly for cleaner aesthetics and enhanced aerodynamics. The shift towards hydraulic disc brakes is also complete across all high-end segments, replacing traditional rim brakes due to superior all-weather stopping power and reduced fatigue during long descents. These electronic and hydraulic systems are interconnected, often allowing for firmware updates and personalized configuration via smartphone applications, moving the bicycle from a purely mechanical device to a sophisticated, connected machine capable of data logging and system diagnostics.

Future technological advancements are centered on seamless integration, digital measurement, and customization. Integrated aerodynamics dictate frame design, where cables, brake lines, and even components are routed internally or hidden entirely to minimize drag. Power meters, once external accessories, are now frequently integrated into cranks or pedals as standard equipment on high-end models, providing essential training data. Furthermore, additive manufacturing (3D printing), particularly using materials like titanium or specific polymers, is being utilized for bespoke small components such as seat masts, handlebars, and small accessory mounts, allowing for an unprecedented level of personalized geometry and weight reduction for specific customer needs. The convergence of these technologies ensures that the market continually delivers substantial performance upgrades, perpetuating consumer demand for the latest high-end models.

- Advanced Carbon Fiber Composites: Utilization of ultra-high-modulus carbon strands and nanoscale additives (e.g., graphene) to maximize stiffness while minimizing weight.

- Electronic Integrated Drivetrains: Fully wireless and semi-wireless electronic shifting systems offering precise, instantaneous gear changes and configurable shift mapping.

- Computational Fluid Dynamics (CFD): Extensive use of simulation tools to optimize frame tube shapes, component integration, and rider position for superior aerodynamic efficiency.

- Hydraulic Disc Braking Systems: Standard across premium road and mountain bikes, offering superior modulation, reliability, and stopping power in all conditions.

- Integrated Power Measurement: Factory installation of highly accurate power meters (crank-based or pedal-based) for precise training and performance analysis.

- 3D Printing/Additive Manufacturing: Customization of intricate, low-volume components (e.g., titanium dropouts, specialized mounts) for bespoke fit and marginal weight savings.

Regional Highlights

- Europe (Leading Market): Europe represents the historical heartland and largest revenue generator for the high-end segment, particularly driven by Italy, France, Germany, and the UK. This dominance is supported by a deeply ingrained cycling culture, high participation rates in competitive road racing, and the strong presence of legacy performance brands (e.g., Pinarello, Colnago). Germany, specifically, drives innovation in engineering and is a primary consumer of high-end mountain bikes and premium E-Bikes. Market maturity means growth is steady, focusing on replacement sales and technology upgrades, supported by robust distribution networks of specialized independent retailers.

- North America (Innovation Hub): The U.S. and Canada are characterized by a high willingness to adopt new technologies and a strong demand for specialized cycling disciplines. North America leads in the consumption of high-end Mountain Bikes (especially Full Suspension Enduro and Trail categories) and the rapidly expanding Gravel segment. The market is highly influenced by brand marketing and social media trends. Direct-to-consumer (D2C) models have gained significant traction here, pioneered by brands seeking to cut out retail intermediaries and offer customization directly to the end-user, often resulting in strong margin realization.

- Asia Pacific (Fastest Growing Market): APAC, led by China, Japan, and South Korea, is the region exhibiting the highest growth rate, fueled by expanding affluence and increasing visibility of international cycling events. High-end bicycles are often purchased as luxury status items in major metropolitan areas, leading to strong demand for aesthetically superior and technologically advanced road bikes. Japan maintains a robust high-end component manufacturing and consumption ecosystem. The regulatory environment concerning E-Bikes is complex but evolving, presenting significant untapped potential for high-performance electric models in urban centers.

- Latin America (Emerging Potential): Growth is concentrated in countries like Brazil and Mexico, driven by increasing middle-class income and rising participation in endurance and competitive cycling. The high cost of imports and complex tariffs necessitate localized assembly or distribution partnerships, often resulting in highly localized pricing strategies. Consumer preference leans heavily toward high-performance road bikes and entry-level premium MTB models.

- Middle East and Africa (Niche Luxury): This region, particularly the UAE and Saudi Arabia, shows high demand for ultra-premium and bespoke models due to concentrated wealth. Cycling infrastructure is developing, focusing primarily on high-end road cycling and indoor performance training. The market remains smaller but highly profitable, focusing on exclusive, customized purchasing experiences and highly specialized retail environments catering to affluent clientele.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High-End Bicycle Market.- Specialized Bicycle Components

- Trek Bicycle Corporation

- Giant Manufacturing Co. Ltd.

- Canyon Bicycles GmbH

- Pinarello SpA

- Colnago Ernesto & C. S.r.l.

- BMC Switzerland AG

- Scott Sports SA

- Cannondale Bicycle Corporation

- Look Cycle

- Cervélo Cycles

- Merida Industry Co. Ltd.

- Wilier Triestina S.p.A.

- Time Sport International

- R&A Cycles

- Orbea

- Argon 18

- 3T Cycling

- Parlee Cycles

- Moots Cycles

Frequently Asked Questions

Analyze common user questions about the High-End Bicycle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the High-End Bicycle Market?

The primary driver is the increase in global high-net-worth and ultra-high-net-worth individuals, combined with sustained consumer focus on health, competitive sports participation, and advanced component technology, justifying premium pricing for performance advantages.

How is carbon fiber technology influencing current high-end bicycle manufacturing?

Carbon fiber remains dominant due to continuous advancements in lay-up techniques and composite science, utilizing ultra-high-modulus strands and AI-driven design optimization to achieve superior stiffness, exceptional aerodynamics, and minimal overall weight for enhanced performance.

Which segment of the high-end market is expected to experience the fastest growth rate?

The Gravel/Adventure Bicycle segment is projected to exhibit the fastest growth, appealing to consumers seeking versatility, durability, and comfort for mixed-surface riding, blurring the lines between traditional road and mountain biking categories.

What role do electronic shifting systems play in the premium bicycle segment?

Electronic shifting systems are essential for premium bicycles, offering precise, instantaneous, and highly reliable gear changes, contributing to performance optimization and rider experience. They are crucial for both competitive efficiency and maintaining a clean, aerodynamic aesthetic through wireless integration.

What is the expected average lifespan of a high-end carbon fiber frame?

While the functional lifespan of a high-end carbon frame is typically extensive (often exceeding 10 years if well-maintained and free from structural damage), dedicated enthusiasts often upgrade every 3 to 5 years to incorporate the latest technological advancements in geometry and material science.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager