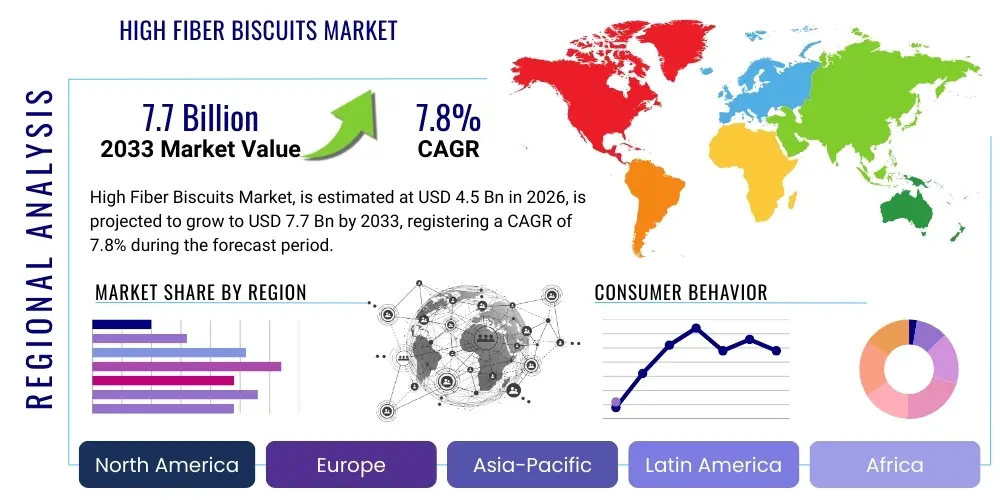

High Fiber Biscuits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437031 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Fiber Biscuits Market Size

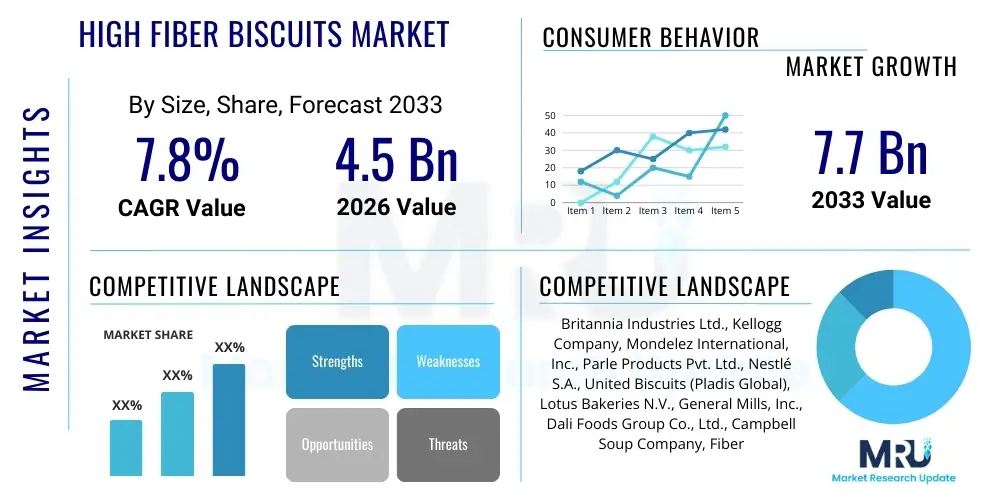

The High Fiber Biscuits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

High Fiber Biscuits Market introduction

The High Fiber Biscuits market encompasses the complex ecosystem surrounding the formulation, manufacturing, distribution, and consumer purchase of baked goods that intentionally prioritize a high concentration of dietary fiber. These products are fundamentally positioned within the functional food category, diverging significantly from traditional confectionery biscuits by focusing on measurable health benefits, primarily digestive regulation, blood sugar stabilization, and enhanced satiety. The composition often integrates complex carbohydrates from whole grains such as oats, wheat bran, rye, and barley, alongside highly purified or specialty added fibers, including chicory root extract (inulin), resistant starches, and psyllium husks. The market’s dynamism stems from its direct response to global public health trends, particularly the increasing prevalence of obesity, type 2 diabetes, and chronic gastrointestinal distress, conditions often linked to insufficient fiber intake in modernized Western diets. Consequently, high fiber biscuits serve as a crucial bridge between convenient snacking and necessary nutritional supplementation, driving their rising adoption globally across diverse consumer demographics.

The core proposition of high fiber biscuits is their multifunctional utility. They are not merely replacement snacks but are actively sought out for therapeutic and preventative dietary applications. Major applications span use as a high-integrity breakfast component, a sustained energy source for mid-day consumption, and a healthier alternative in children's lunch boxes, mitigating concerns about excessive sugar consumption prevalent in conventional snack aisles. The benefits are scientifically supported: the high fiber content promotes a healthy gut microbiome, aids in the peristaltic movement of the digestive tract, and slows the absorption of glucose, leading to less volatile blood sugar levels, a critical factor for diabetic consumers. Furthermore, the increased feeling of fullness (satiety) contributes significantly to weight management programs by naturally reducing overall caloric intake. The sophistication of product development has seen manufacturers move beyond simple bran additions to incorporate prebiotics and micronutrient fortification, transforming the biscuits into comprehensive wellness tools. This focus on verifiable health outcomes rather than just taste distinguishes this market segment and underpins its long-term sustainable growth trajectory, appealing deeply to the modern, health-conscious consumer who seeks efficacy and convenience in their food choices.

The driving factors behind this buoyant market expansion are deeply rooted in behavioral economics and globalized health advocacy. A crucial accelerator is the pervasive trend of preventive healthcare, where consumers proactively seek foods to maintain well-being rather than relying solely on reactive treatment. This consciousness is heavily influenced by digital media, where information on gut health and nutrition is readily available and widely disseminated by influencers and health professionals. Furthermore, innovation in ingredient science has successfully overcome historical constraints related to taste and texture; modern high fiber biscuits are significantly more palatable and structurally appealing than their predecessors, widening consumer acceptance. The infrastructural driver is the robust expansion of organized retail and e-commerce platforms, which offer unparalleled product visibility, detailed nutritional filtering capabilities, and reliable cold chain logistics for potentially more sensitive functional ingredients. The regulatory landscape, especially in developed economies, which now mandates clearer labeling and promotes specific dietary guidelines emphasizing fiber, further solidifies the market's foundation and ensures continuous focus on high-quality, scientifically valid product development, thereby reducing information asymmetry and building consumer trust.

High Fiber Biscuits Market Executive Summary

The High Fiber Biscuits Market exhibits robust growth propelled by underlying macro trends in preventive healthcare and nutritional awareness, strategically managed through product differentiation and digital market penetration. Business trends indicate that major multinational food corporations are heavily investing in securing proprietary fiber technology and establishing vertically integrated supply chains to ensure the purity and consistent sourcing of specialty ingredients, thereby controlling costs and guaranteeing high-quality input materials crucial for meeting stringent health claims. A notable commercial trend is the acquisition of niche, agile brands specializing in high-demand segments such as gluten-free, organic, or low-glycemic high fiber biscuits, allowing large players to instantly capture specialized market share without lengthy internal R&D cycles. Simultaneously, pressure from consumer groups and regulators is accelerating the adoption of sustainable practices, including the use of recyclable packaging and commitments to ingredient traceability, influencing brand perception and competitive standing.

Regionally, the market presents a clear dichotomy in growth dynamics. North America and Europe continue to command the largest market value, driven by high consumer spending on premium functional foods and established retail infrastructures. Competition here is intense, focusing heavily on specialized health attributes like high protein content and minimal sugar. In contrast, the Asia Pacific (APAC) region is indisputably the high-growth trajectory market. This rapid expansion is fundamentally supported by vast population size, swift urbanization, and a burgeoning middle class in countries like India, China, and Indonesia that are increasingly prioritizing Western-style health foods. Strategies in APAC prioritize scaling production for affordability and adapting flavor profiles to local preferences, ensuring the product is perceived as both healthy and palatable to a vast, previously untapped consumer base. Latin America and MEA are progressing markets, where growth hinges on improved cold chain logistics and targeted educational marketing campaigns.

Segmentation trends reveal a strong consumer preference for functional specificity. By Ingredient Type, the growth of Added Functional Fibers (especially prebiotics like Fructans and Inulin) is outpacing that of traditional whole grains, reflecting increasing consumer sophistication regarding targeted gut health benefits. Distribution channel analysis confirms the transformative role of e-commerce, which, while not yet surpassing the volume sales of Supermarkets/Hypermarkets, is registering the fastest expansion. Online retail is uniquely positioned to handle the complexity of niche high fiber products, offering detailed nutritional filtering, direct-to-consumer services, and subscription models that simplify repeat purchasing for dedicated health seekers. Overall, the market is shifting toward personalized, transparent, and ethically sourced high fiber options, mandating continuous technological and supply chain innovation from market participants to sustain competitive relevance and long-term expansion.

AI Impact Analysis on High Fiber Biscuits Market

The influence of Artificial Intelligence (AI) on the High Fiber Biscuits market extends across the entire value chain, revolutionizing everything from initial ingredient discovery to personalized consumer interaction. User and industry questions frequently probe AI's ability to tackle the perennial challenge of balancing high fiber content with superior sensory characteristics. Specifically, there is high interest in how machine learning algorithms can rapidly screen vast databases of novel fiber sources (e.g., specialized pulses, non-traditional grains, or algae-derived components) and predict their optimal integration into baked matrices, effectively bypassing lengthy and expensive manual trial-and-error R&D cycles. Furthermore, stakeholders are concerned with leveraging AI for predictive market analysis—determining which combinations of texture, flavor, and fiber type will resonate best with hyper-specific demographic segments (e.g., high-fiber low-carb for keto adherents), maximizing product launch success rates. Concerns also encompass the ethical implications and data security requirements of utilizing personalized health data derived from wearables or genetic tests to inform bespoke biscuit production, signaling a necessary investment in secure data infrastructure and transparent data governance policies to maintain consumer trust.

AI's role in operational efficiency is equally transformative and critical for profitability. In the manufacturing phase, AI-powered control systems are deployed to precisely regulate oven temperatures, humidity levels, and conveyor speeds, parameters that are hyper-sensitive for high-fiber doughs which are susceptible to moisture loss and prone to excessive drying or burning due to different thermal properties. These systems utilize real-time sensor data and predictive models to maintain perfect baking profiles, ensuring consistent fiber retention and texture integrity across millions of units, thereby significantly reducing batch variance and energy consumption. Moreover, sophisticated robotic automation guided by AI is enhancing packaging speed and minimizing errors in complex handling tasks, crucial for maintaining low operational costs necessary to keep healthy products competitive against conventional snacks. This integration of intelligent automation mitigates human error and allows for highly flexible production runs, catering efficiently to the diverse product lines demanded by modern segmented markets, from small-batch organic lines to high-volume conventional offerings, all while ensuring stringent hygiene standards.

For the consumer, AI is facilitating unprecedented levels of personalization and engagement, moving beyond basic product recommendations. Companies are utilizing machine learning to analyze purchasing behavior, search histories, preference feedback, and nutritional goals derived from consumer inputs to tailor marketing campaigns and product recommendations with high accuracy. In the emerging field of Nutrigenomics, AI algorithms could eventually link a consumer's specific genetic disposition or gut microbiome profile to the most beneficial type of dietary fiber, leading to the offering of highly individualized high fiber biscuit subscriptions delivered directly to their doorstep. This deep personalization fosters brand loyalty and transforms the biscuit from a simple food item into a personalized health intervention, greatly enhancing its perceived value. Ultimately, the successful integration of AI is viewed as the key differentiator enabling companies to meet the future demands for speed, customization, nutritional accuracy, operational transparency, and enhanced sustainability in the health-focused packaged food sector, providing a significant competitive edge over less technologically developed competitors.

- AI-driven Predictive Analytics: Optimizing ingredient sourcing, accurate demand forecasting, and sophisticated inventory management, which significantly reduces spoilage and waste in raw material handling (e.g., specialized whole grains, specialty fibers). Predictive models estimate optimal retail placement, promotional strategies, and pricing based on regional dietary patterns and health consumption metrics.

- Automated Quality Control: Utilizing machine vision systems and high-resolution AI algorithms to inspect biscuit consistency, monitor bake uniformity, and confirm packaging integrity in real-time. This ensures superior product quality, strict compliance with declared fiber content standards, and rapid, preventative identification of production line deviations before large scale defects occur.

- Personalized Formulation: AI models analyzing large datasets of consumer health data (e.g., dietary restrictions, reported gut microbiome results) to recommend and facilitate the creation of customized high fiber biscuit formulations, increasingly delivered via specialized DTC channels, thereby pioneering hyper-personalized nutritional solutions.

- Accelerated R&D: Utilizing computational food science to simulate the physicochemical interaction of various fiber types (e.g., insoluble vs. soluble, different lengths of inulin chains) with starches and proteins. This rapidly identifies optimal ratios to develop new texture and flavor combinations, drastically shortening the time-to-market for innovative, palatable high-fiber products that address specific dietary needs.

- Supply Chain Traceability: Implementing integrated blockchain and AI-powered monitoring platforms to provide immutable, end-to-end records of fiber source origins, processing conditions, and nutritional verification. This substantially enhances consumer trust and substantiates complex 'clean label' and sustainability claims with verifiable data.

- Robotics and Process Optimization: Deploying AI-controlled robotics in precise stages like high-shear mixing, complex forming, and fragile packing. This allows the efficient management of non-standard doughs associated with high fiber inclusion, leading to higher throughput, greater consistency in manufacturing, and improved hygiene standards.

DRO & Impact Forces Of High Fiber Biscuits Market

The trajectory of the High Fiber Biscuits Market is governed by a potent set of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces shaping industry strategy and consumer acceptance. A predominant driver is the global epidemiological shift towards sedentary lifestyles and processed food consumption, resulting in a surge in chronic diseases like cardiovascular ailments, obesity, and diabetes, all of which are medically linked to low fiber intake, placing significant pressure on public health systems. This societal health burden has triggered widespread public awareness campaigns, funded by governments and NGOs, and substantial medical endorsement for increasing dietary fiber, directly translating into consumer demand for functional, convenient products like high fiber biscuits. The driver is further intensified by demographic aging, as the elderly population requires easily digestible, fiber-rich foods to maintain digestive regularity and overall health. Furthermore, aggressive and successful marketing campaigns by major CPG companies have effectively repositioned these products as appealing, sophisticated, health-conscious snacks rather than purely medicinal aids, significantly expanding their consumer base.

However, the market faces significant structural and perceptual Restraints that temper its explosive potential. The foremost challenge remains sensory acceptance; achieving a palatable texture and flavor profile that competes favorably with traditional, often highly sweetened and fatty, biscuits is technically demanding and requires considerable R&D investment. High fiber inclusion often results in dry, crumbly, or overly dense textures, which can deter repeat purchases despite the perceived health benefits, necessitating trade-offs between nutritional density and consumer hedonics. Economically, the cost structure is a major restraint. Sourcing premium, verifiable functional fibers (especially organic, non-GMO, or novel varieties) and implementing the specialized processing technologies required for their optimal integration drives up the final retail price, making these products less accessible to price-sensitive consumers compared to budget-friendly conventional snacks, creating a disparity in access to healthy options. Additionally, navigating the stringent and varied regulatory frameworks globally concerning permitted health claims (e.g., "Good source of fiber," "Aids digestion") requires significant investment and country-specific labeling adjustments, slowing down cross-border market penetration and increasing compliance costs.

Despite these challenges, substantial Opportunities exist for future market expansion and value creation. The largest opportunity lies in diversification and specialization, particularly targeting specific consumer needs such as gluten intolerance, veganism, and ketogenic-compatibility. Developing high fiber biscuits that simultaneously meet these 'free-from' criteria opens up lucrative, high-margin niche markets that command premium pricing due to the complexity of formulation. Geographically, leveraging the massive, untapped consumer base in emerging economies, especially in Tier 2 and Tier 3 cities across Asia where modernization is accelerating health awareness but infrastructure is developing, promises considerable long-term growth. Moreover, forging strategic partnerships with digital wellness applications, fitness tracking devices, and professional nutritionists allows companies to integrate their products directly into customized wellness plans, solidifying the product's functional position and driving consumer loyalty through prescriptive consumption rather than impulse purchasing. The overall impact force matrix suggests that while innovation, sensory excellence, and cost management remain critical competitive factors, the overwhelming long-term trend towards preventative health and functional food consumption will continue to exert positive pressure, propelling the High Fiber Biscuits market towards substantial forecasted growth.

Segmentation Analysis

The segmentation analysis of the High Fiber Biscuits market provides a granular understanding of consumer behavior, ingredient preferences, and channel dynamics, essential for effective market penetration strategies. Segmentation by Ingredient Type is foundational, distinguishing between naturally high-fiber base ingredients (like whole oats and wheat bran, which appeal to consumers seeking simple, recognizable ingredients) and highly processed, added functional fibers (such as inulin, derived often from chicory root, or specific resistant starches, which are incorporated for targeted functional benefits). The choice of fiber dictates the specific nutritional claim and application focus—for instance, inulin-based biscuits often target prebiotic and gut health benefits, while whole-grain options appeal more broadly to consumers seeking natural, unprocessed dietary additions and sustained energy. This clear distinction allows manufacturers to tailor marketing messages precisely to the desired health outcomes, ranging from general wellness to specific therapeutic support.

Flavor Profile segmentation reveals consumer willingness to adapt high fiber snacks into various eating occasions, reflecting the product's successful transition from a purely health aid to a versatile snack. While Plain or Original flavors are often preferred for breakfast or pairing with coffee, the Sweet segment (including chocolate, berry, and honey variants) captures the impulse purchase market and serves as a direct, healthier substitute for traditional dessert biscuits, provided the sugar content is managed effectively. The rapidly growing Savory segment (including cheese, herb, and seeded options) caters to the rising trend of replacing conventional high-carb bread products with fiber-rich crackers or savory biscuits during meal times or cheese pairings. The ability to innovate rapidly within these flavor categories, ensuring that taste does not detract from the functional benefit while adhering to low sugar/low sodium requirements, is a crucial competitive factor requiring advanced food technology expertise.

Distribution Channel analysis confirms the ongoing shift in purchasing dynamics, which is heavily influenced by consumer need for convenience and information. Supermarkets and Hypermarkets remain critical for brand visibility and volume sales, offering consumers the convenience of a single shopping trip and the ability to compare multiple brands physically. However, Online Retail is not merely a supplementary channel but an accelerating primary route, especially for specialty brands and those offering subscription services. E-commerce facilitates immediate access to detailed ingredient lists, comparative nutritional information, and customer reviews—all vital decision factors for the highly label-literate, health-conscious buyer. Furthermore, Specialty Stores (pharmacies, health food retailers) maintain importance as they lend credibility and expert endorsement to functional food products, often acting as launchpads for new, premium fiber ingredient formulations before they transition to mass market retail. Understanding this channel mix allows for optimized inventory management, regional supply chain customization, and targeted promotional spending based on where the target consumer segment typically shops for health-focused goods.

- By Ingredient Type:

- Whole Grains (Oats, Wheat Bran, Rye): Dominates volume; appealing for natural and unprocessed perception, cost-effective base ingredient.

- Added Functional Fibers (Inulin, Polydextrose, Resistant Starch, Fructans): Fastest growth segment; leveraged for specific prebiotic and digestive health claims and superior incorporation into dough matrices.

- Fruit and Vegetable Fibers (Apple fiber, Carrot fiber, Citrus fiber): Niche segment; favored in organic and natural formulations for clean label appeal and subtle flavoring.

- By Flavor Profile:

- Plain/Original: Core segment for meal accompaniment and general consumption, highly versatile.

- Sweet (Chocolate, Honey, Fruit): High-growth segment appealing to consumers seeking healthy dessert substitutes; requires rigorous sugar management and use of natural sweeteners.

- Savory/Spiced (Cheese, Herb, Seeded): Emerging segment capitalizing on the demand for healthier cracker/bread alternatives for snacking or appetizer usage.

- By Distribution Channel:

- Supermarkets/Hypermarkets (Modern Trade): Highest volume sales; critical for broad brand establishment and mass consumer reach.

- Convenience Stores: Important for impulse purchases and single-serving options, particularly in high-density urban areas and travel hubs.

- Online Retail (E-commerce): Fastest growth channel; essential for niche brands, bulk orders, and direct consumer engagement with detailed nutritional data and personalized recommendations.

- Specialty Stores (Health Food Stores, Pharmacies): Key channel for premium, functional, and specialized dietary products (e.g., clinical nutrition or specific allergen-free lines).

- By Nature:

- Conventional: Large volume, generally more affordable, standard production methods.

- Organic: Premium segment driven by consumer demand for non-GMO, pesticide-free ingredients and higher perceived quality; commands a significant price premium.

- By End-User:

- Adults (General Population): Largest consumer group, motivated by overall health maintenance, fitness, and convenience.

- Seniors: Highly motivated segment driven by digestive regularity and preventative health needs; often requires easy-to-chew formulations.

- Children: Growing segment, focused on fortified, low-sugar options for healthier childhood snacking, driven by parental health concerns.

- By Region:

- North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA).

Value Chain Analysis For High Fiber Biscuits Market

The High Fiber Biscuits value chain is characterized by stringent requirements regarding ingredient quality and specialized manufacturing techniques, demanding close collaboration between stakeholders to ensure nutritional integrity and claim verification. The Upstream analysis starts with the critical sourcing of raw materials, which is bifurcated into commodity suppliers providing staple grains (wheat, oats) and highly specialized ingredient manufacturers providing refined functional fibers (such as high-purity inulin, FOS, and resistant starches). Given the health-centric nature of the product, robust supplier vetting, including auditing for agricultural practices and processing purity, is mandatory to ensure ingredients meet specific nutritional profiles and comply with purity standards (e.g., allergen control, heavy metal testing). Furthermore, the upstream stage includes extensive R&D activities focused on isolating and stabilizing new fiber components that offer enhanced functional benefits without negatively affecting product texture or flavor, a process heavily reliant on collaboration with nutritional science firms and agricultural technology providers.

The Core Manufacturing stage involves complex, technologically advanced processing steps. The inherent characteristics of high-fiber ingredients—high water absorption capacity, abrasive nature, and reduced gluten network development—necessitate proprietary, often customized mixing protocols and specialized machinery to create cohesive, workable dough that can withstand automated handling. Baking technologies, often utilizing advanced forced air convection, humidity zoning, and sometimes vacuum baking, are critical to ensuring the final product is consistently crisp, retains maximum fiber efficacy, and prevents undesirable texture development (like excessive hardness or crumbling). Post-processing activities include continuous quality assurance checks using machine vision, rigorous microbiological testing for contaminants, and the critical packaging phase. Advanced packaging solutions, including multi-layer barrier films and modified atmosphere packaging (MAP) or high-speed flow wrappers, are deployed to mitigate moisture reabsorption and oxidation, thereby maximizing the typically shorter shelf life of these often less-processed products, which is vital for maintaining product integrity across long distribution distances.

Downstream analysis focuses on effective distribution and market access, addressing the needs of both high-volume and specialized segments. The distribution channel network is heterogeneous: Indirect channels, utilizing national wholesalers, large distributors, and vast modern trade retailers (Supermarkets/Hypermarkets), account for the majority of sales volume due to their wide geographic reach and established consumer foot traffic. However, Direct channels, particularly through company-operated e-commerce portals and specialized wellness apps, are gaining significant prominence as they offer manufacturers enhanced control over pricing, immediate access to consumer feedback data, and the ability to manage profitable subscription models for loyal customers seeking regular supply of specialized dietary products. Effective channel management requires sophisticated Enterprise Resource Planning (ERP) systems and logistics platforms capable of tracking specific inventory attributes (like lot number and freshness) in real-time and ensuring optimal shelf availability, especially as the demand for specialized, low-volume SKUs increases. Penetration into emerging markets often necessitates forging localized partnerships with third-party logistics (3PL) providers familiar with regional regulatory requirements and dispersed, traditional retail networks.

High Fiber Biscuits Market Potential Customers

The target audience for High Fiber Biscuits is segmented across multiple age groups and health motivators, yet all share a common denominator: an active interest in utilizing diet for health optimization and convenience. The largest and most economically significant segment comprises health-conscious Adults (25-55 years old) who are proactive about preventive health, fitness, and digestive wellness. This demographic values convenience alongside nutrition, seeking quick, pre-portioned snacks that fit into demanding professional lives and contribute meaningfully to their daily fiber requirements. These buyers often integrate fiber biscuits into controlled snacking routines or use them as functional supplements post-workout, demonstrating a heightened willingness to pay a premium for verifiable nutritional content, clean labels (e.g., low sugar, non-GMO, organic), and ethical sourcing claims. Their purchasing decisions are heavily influenced by digital content, fitness communities, and ingredient transparency.

The Senior population (65+ years) constitutes a particularly crucial, needs-driven customer segment. Due to age-related changes in metabolism, increased incidence of chronic constipation, and conditions like diverticular disease, fiber-rich diets are often clinically recommended as a primary measure for maintaining quality of life. This group prioritizes products with easy-to-understand health benefits, appropriate portion sizes, and textures that are soft or easy-to-chew (if specifically formulated to avoid brittle textures). Purchasing decisions in this segment are highly influenced by medical advice and recommendations from caregivers or institutional dietitians, making strategic partnerships with healthcare providers and specialized senior living facilities an effective market entry strategy. The need for sustained, reliable nutritional support makes them ideal candidates for subscription services and bulk purchasing models, prioritizing dependability and efficacy over novelty.

A rapidly expanding segment is families with Young Children (3-12 years), where parental concern over rising childhood obesity, sugar intake, and the desire to establish healthy eating habits drives demand for healthier snack alternatives. Manufacturers target this group by offering small, portion-controlled, and often fortified high fiber biscuits with appealing, yet moderated, flavors (e.g., mild fruit or vegetable inclusions), specifically marketed as 'better-for-you' alternatives to conventional sugary cookies. The educational and marketing focus here is on communicating the benefits of digestive regularity, sustained energy, and added micronutrients to parents, while ensuring the product meets children’s palatability standards. Finally, the segment of individuals with specific Dietary Restrictions (e.g., Celiac disease, lactose intolerance, nut allergies) are high-value customers who seek specialized high-fiber, gluten-free, or dairy-free options, representing a critical niche market that demands premium pricing but requires absolute adherence to rigorous allergen control protocols, third-party certification, and transparent cross-contamination policies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Britannia Industries Ltd., Kellogg Company, Mondelez International, Inc., Parle Products Pvt. Ltd., Nestlé S.A., United Biscuits (Pladis Global), Lotus Bakeries N.V., General Mills, Inc., Dali Foods Group Co., Ltd., Campbell Soup Company, Fiber Gourmet, Inc., Nature Valley (Brand of General Mills), Annie's Homegrown (Brand of General Mills), Nairn's Oatcakes Ltd., Schär AG / Dr. Schär SpA, McVitie's (Brand of Pladis), Sottolestelle S.r.l., Quaker Oats Company (Subsidiary of PepsiCo), Oatmeal Baking Company, Kashi Company (Subsidiary of Kellogg Company). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Fiber Biscuits Market Key Technology Landscape

The High Fiber Biscuits market demands sophisticated technological integration to overcome the inherent challenges associated with formulating and baking fiber-rich products, ensuring both nutritional efficacy and consumer appeal. A central aspect of this technology is advanced Rheology Modification and Precision Mixing. Fiber, especially concentrated functional fibers like resistant starches or purified inulin, dramatically alters the viscosity, elasticity, and water-holding capacity of the biscuit dough, often leading to uneven density, non-uniform expansion, and a tough, undesirable final texture if not precisely managed. Manufacturers utilize specialized high-speed, controlled-shear mixing and kneading equipment, often integrated with automated moisture sensors and AI-driven feedback loops, to manage the hydration process meticulously and ensure homogeneous distribution of fiber particles throughout the dough matrix, preventing ingredient clumping and maintaining structural integrity necessary for high-volume automated processing lines.

Furthermore, specialized Baking and Heat Transfer Technology is paramount for achieving sensory quality in nutritionally constrained formulations. Because many high fiber formulations are also intentionally low in sugar or fat—ingredients that typically aid in desirable browning, moistness, and flavor development—manufacturers rely on complex oven systems capable of precise temperature and humidity zoning. Impingement ovens, hybrid convection/radiant ovens, and specialized vacuum baking techniques are increasingly used to achieve rapid, uniform heat penetration. This minimizes the necessary baking time, thereby preserving the thermal stability and bioactivity of sensitive functional components such as heat-sensitive prebiotics, probiotics, or added vitamins that are often co-formulated with the fiber. These optimized thermal management systems are critical for managing the delicate balance between structural integrity and preventing excessive dehydration, which would compromise the texture and sensory profile, thereby providing a core competitive advantage to technologically advanced producers.

Beyond the core baking process, the industry leverages cutting-edge technology in Quality Assurance and intelligent Packaging solutions. Non-destructive testing methods, including high-resolution hyperspectral imaging and X-ray inspection, are used extensively on the production line to verify uniformity in size, weight, internal density, and to detect the smallest foreign materials, ensuring strict adherence to global food safety and precise nutritional labeling standards. In packaging, there is significant investment in developing and implementing sustainable, biodegradable, and recyclable high-barrier materials that effectively extend shelf life by protecting the products from moisture ingress and oxidation, critical concerns for whole-grain and low-additive formulations. The adoption of smart packaging, such as time-temperature indicators and dynamic QR codes linked to blockchain-secured supply chain data, offers consumers unprecedented transparency regarding the sourcing and nutritional history of the fiber ingredients. The integration of high-level automation, particularly robotic pick-and-place systems, also significantly contributes to hygienic handling and faster packaging speeds, solidifying the technological advantage of market leaders in this competitive functional food sector.

Regional Highlights

The North American market for High Fiber Biscuits is distinguished by its high market maturity, high disposable incomes, and intense focus on premium, health-specific formulations. Market growth, while steady, is driven by continuous product innovation catering to highly specialized lifestyle diets such as Keto-friendly, Paleo, and certified Organic, responding to the highly diversified consumer base. Consumers in the US and Canada are highly responsive to preventative health messaging, fueling sustained demand for products that explicitly claim benefits related to gut microbiome balance, anti-inflammatory properties, and blood sugar management. This often requires the inclusion of advanced functional fibers like resistant dextrins and specialized prebiotic blends. Distribution is optimized through major, digitally integrated retailers and highly efficient e-commerce platforms that facilitate access to niche, high-priced specialty brands, underscoring the high purchasing power and sophisticated, information-seeking consumer base of the region. Regulatory compliance with the FDA's nutritional fact panel requirements, particularly concerning definitions of "good source" and "excellent source" of fiber, is a core operational necessity, guiding ingredient limits and labeling transparency.

Europe represents a highly segmented market heavily influenced by robust food standards and strong consumer preference for natural, whole ingredients. The UK, Germany, and France are the leading contributors, characterized by a long-standing tradition of consuming high fiber breakfast cereals and digestive biscuits. The European Food Safety Authority (EFSA) plays a pivotal role, mandating scientific substantiation for all health claims related to fiber and digestion, which compels manufacturers to invest heavily in clinical trials for their functional ingredients, fostering a high degree of consumer trust in verified products. Key product trends include an intense focus on "No Added Sugar" and "Clean Label" initiatives, driving demand for fiber sources that are naturally derived and minimally processed, resulting in a higher market share for whole-grain and oat-based biscuits. The market is also heavily impacted by sustainability mandates and corporate social responsibility pressures, pushing companies toward eco-friendly packaging and verifiable, traceable ingredient sourcing, often emphasizing local European grain suppliers.

The Asia Pacific (APAC) region is forecasted to be the global growth epicenter, projected to lead the market in CAGR, propelled by sweeping demographic and economic transformations. Rapid urbanization across major economies like China, India, and Indonesia is leading to a significant dietary transition away from traditional, unprocessed foods toward convenient, shelf-stable, packaged snacks. The increasing awareness of lifestyle diseases, particularly Type 2 Diabetes and cardiovascular issues, is dramatically raising the demand for low-glycemic, high-fiber alternatives that integrate easily into modern diets. Manufacturers are tasked with adapting global product concepts to local tastes, often utilizing rice or millet-based fibers alongside traditional grains and mild spices to ensure broad local acceptance. Distribution growth relies critically on penetrating both the established modern trade channels in major cities and the vast, unorganized traditional retail networks in secondary and tertiary markets, often requiring tailored supply chain solutions to manage regional logistics complexities. The combination of massive population density and rising per capita health expenditure makes APAC the most strategically important region for future investment in the high fiber biscuit category.

- North America: Market maturity, strong focus on specialty diets (gluten-free, organic, keto-compatible), high willingness to pay for premium functional benefits. Dominated by large consumer packaged goods companies leveraging extensive retail networks. Innovation centered on low-carb fiber solutions and advanced gut health claims, governed by strict FDA labeling.

- Europe: Emphasis on clean label, low sugar formulations, and stringent regulatory compliance (EFSA). Strong market presence in the UK and Western Europe, driven by digestive health concerns and high standards for natural sourcing. Sustainability and ethical sourcing are major consumer criteria.

- Asia Pacific (APAC): Highest projected CAGR, fueled by urbanization, rapidly rising health awareness, and increasing disposable income growth in developing economies like China and India. Localized flavor profile adaptations and scalable manufacturing for high volume and affordability are key.

- Latin America (LATAM): Developing market, highly sensitive to price points. Growth is observed predominantly in urban centers (Brazil, Mexico), focusing on affordable high-fiber options aimed at sugar and fat reduction. Market penetration requires infrastructural stability improvements.

- Middle East & Africa (MEA): Emerging market with high heterogeneity, driven by government initiatives promoting health and wellness, particularly in the affluent GCC countries where non-communicable diseases are rising. Potential for rapid expansion contingent on improved import logistics and catering to consumers seeking international, recognizable health brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Fiber Biscuits Market.- Britannia Industries Ltd. (Strong presence in APAC, particularly India)

- Kellogg Company (Global leader with diverse brand portfolio including Kashi)

- Mondelez International, Inc. (Leveraging established global distribution networks and brand recognition)

- Parle Products Pvt. Ltd. (Dominant player in the affordable segment across South Asia)

- Nestlé S.A. (Focusing on nutritional science, fortification, and institutional catering)

- United Biscuits (Pladis Global, owner of brands like McVitie's and Carr's)

- Lotus Bakeries N.V. (Known for natural ingredients and specialty Belgian biscuits)

- General Mills, Inc. (Active through subsidiaries like Nature Valley and Annie's Homegrown)

- Dali Foods Group Co., Ltd. (Significant regional player in the complex Chinese snack food market)

- Campbell Soup Company (Diversifying into health-focused packaged snacks and crackers)

- Fiber Gourmet, Inc. (Niche player specializing in high-fiber, low-calorie, and low-net-carb alternatives)

- Nature Valley (Brand of General Mills, focusing on portable, convenient, functional snacks)

- Annie's Homegrown (Brand of General Mills, specializing in organic and natural high-fiber options)

- Nairn's Oatcakes Ltd. (UK-based company specializing in high-fiber oat-based crackers and biscuits)

- Schär AG / Dr. Schär SpA (Leading European brand in dedicated gluten-free and often high-fiber baking)

- McVitie's (Brand of Pladis, successfully incorporating high-fiber variants into classic product lines)

- Sottolestelle S.r.l. (Italian company specializing in organic, whole-grain, and traditionally baked goods)

- Quaker Oats Company (Subsidiary of PepsiCo, leveraging extensive oat fiber and whole-grain expertise)

- Oatmeal Baking Company (Focusing on specialized health-food distribution and unique fiber blends)

- Kashi Company (Subsidiary of Kellogg Company, emphasizing natural, organic ingredients and high fiber content)

- Biscoff (Part of Lotus Bakeries, expanding into healthier, fortified options)

- Dr. Oetker (European entity with presence in baked goods and mixes)

- Hain Celestial Group (Focused on natural and organic snacks)

Frequently Asked Questions

Analyze common user questions about the High Fiber Biscuits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the High Fiber Biscuits Market globally?

The market growth is primarily driven by the rising global prevalence of chronic lifestyle diseases like diabetes and digestive disorders, increasing consumer awareness regarding the essential role of dietary fiber in gut health and weight management, and continuous product innovation resulting in significantly improved taste and texture profiles for healthy snacks. Supportive government health campaigns and the rapid expansion of organized retail and e-commerce also play crucial roles globally.

Which region is expected to show the fastest market growth through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This acceleration is attributed to rapid urbanization, increasing disposable income, shifting consumer preferences towards convenient functional foods, and greater adoption of Western health-focused dietary habits in populous nations like China and India.

What are the primary challenges restraining the widespread adoption of high fiber biscuits?

Key restraints include the persistent technical challenge of formulating high fiber products that match the palatability of traditional biscuits, often leading to consumer resistance and texture issues. Additionally, the high cost associated with sourcing specialized, verified functional and organic fiber ingredients limits product affordability and subsequent mass market penetration, particularly in price-sensitive developing markets.

How is technology, specifically AI, influencing product development in this industry?

AI is significantly influencing R&D by enabling accelerated formulation optimization, allowing manufacturers to rapidly predict the ideal ratios of fibers and ingredients for enhanced nutritional profiles and stable sensory outcomes without extensive physical prototyping. AI is also critical in highly accurate demand forecasting, sophisticated inventory management, and implementing advanced, non-destructive quality control using machine vision systems across high-volume production lines.

What is the most consumed ingredient type in the High Fiber Biscuits Market and why?

The segment utilizing whole grains, particularly oats and wheat bran, currently holds the largest market share. This dominance is due to consumer familiarity, the perception of natural health benefits associated with whole foods, regulatory simplicity in labeling, and the relatively lower cost compared to highly processed functional fibers like purified inulin or resistant starch, making them ideal for large-volume, conventional offerings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager