High Flux Magnetics Powder Core Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432167 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High Flux Magnetics Powder Core Market Size

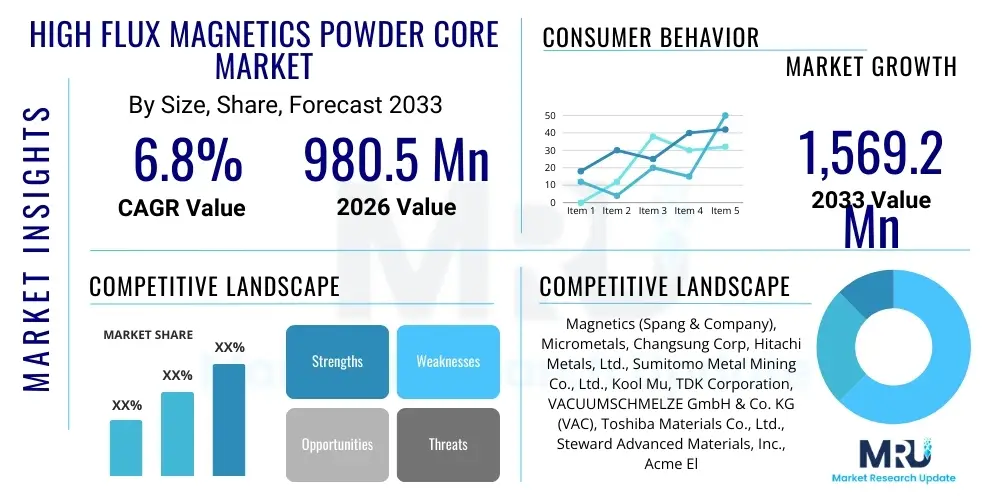

The High Flux Magnetics Powder Core Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 980.5 Million in 2026 and is projected to reach USD 1,569.2 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-efficiency power conversion solutions and the stringent requirements for miniaturization in consumer electronics and automotive electrification sectors.

High Flux Magnetics Powder Core Market introduction

The High Flux Magnetics Powder Core Market encompasses specialized magnetic cores utilized primarily in power conversion applications, including inductors, chokes, and transformers. These cores are manufactured using compacted, insulated iron powder, offering a unique combination of high saturation flux density and low core losses under high-frequency operation. High flux cores are particularly valued for their high DC bias current capability, which allows inductors to maintain high inductance values even when subjected to substantial direct current, a critical factor in modern switch-mode power supplies (SMPS), motor drives, and renewable energy inverters. The superior magnetic stability and mechanical robustness of high flux cores make them indispensable components for systems demanding optimal performance and reliability in challenging operating environments.

The principal applications driving the adoption of high flux powder cores include electric vehicle (EV) charging infrastructure, server power supplies for data centers, 5G telecommunications equipment, and photovoltaic (PV) inverters. These cores enable the design of highly compact and energy-efficient power components, directly addressing industry trends toward greater power density and reduced thermal management complexity. Key benefits derived from utilizing high flux cores include improved energy efficiency, reduced component footprint, lower electromagnetic interference (EMI), and enhanced system reliability across a broad temperature range. The inherent stability and low loss characteristics, especially at high frequencies, position them as superior alternatives to traditional ferrite cores in many high-power density applications.

The market expansion is significantly propelled by several macro-environmental factors, including the global push for energy efficiency standards, rapid deployment of renewable energy sources, and the exponential growth of data centers requiring robust power delivery systems. Furthermore, the pervasive trend of automotive electrification, necessitating high-performance inductors for on-board chargers, DC-DC converters, and traction inverters, serves as a primary driver. Technological advancements in powder metallurgy and core manufacturing techniques, leading to cores with even lower parasitic losses and higher saturation levels, further solidify the market's growth potential and applicability across diverse industrial and consumer electronic segments.

High Flux Magnetics Powder Core Market Executive Summary

The High Flux Magnetics Powder Core Market is experiencing robust expansion, fundamentally propelled by increasing investments in renewable energy infrastructure and the burgeoning demand for high-performance power management solutions in the automotive and telecommunications sectors. Business trends highlight a strong focus on material innovation, specifically the development of composite powder cores that offer enhanced thermal stability and reduced eddy current losses at gigahertz frequencies. Strategic collaborations between core manufacturers and semiconductor companies are becoming increasingly common to optimize core design for new generations of wide-bandgap (WBG) semiconductors, such as SiC and GaN, which operate at higher switching frequencies and require specialized magnetic components. Companies are prioritizing supply chain resilience and geographical diversification to mitigate risks associated with raw material sourcing, particularly iron powder and specialized insulating coatings.

Regionally, Asia Pacific (APAC) dominates the market, primarily due to the concentration of major electronics manufacturing hubs, large-scale deployment of 5G infrastructure, and aggressive governmental policies supporting electric vehicle adoption, particularly in China, Japan, and South Korea. North America and Europe are showing accelerated growth, largely attributed to stringent energy efficiency regulations (e.g., EU Ecodesign Directive) and significant public and private funding directed toward smart grid development and data center expansion. These regions are major consumers of high-reliability, high-specification cores used in mission-critical applications, driving demand for premium products and advanced manufacturing tolerances. The competitive landscape remains moderately consolidated, with key players focusing on expanding their product portfolios to cover a wider range of permeability options and core geometries to suit diverse end-user specifications.

Segment-wise, the toroidal core geometry maintains the largest market share due to its superior flux confinement and efficiency, making it ideal for large power inductors and chokes. However, the molded/block core segment is witnessing the fastest growth rate, fueled by the trend toward surface-mount technology (SMT) and miniaturization in portable and consumer electronics. In terms of application, Power Supply & DC-DC Converters represent the most substantial market segment, reflecting their universal need across industrial, IT, and consumer applications. Furthermore, the Automotive segment, particularly components used in Electric Vehicle (EV) systems (like battery chargers and traction inverters), is projected to exhibit the highest CAGR through the forecast period, driven by global electrification mandates and the increasing need for high power density solutions within limited space constraints.

AI Impact Analysis on High Flux Magnetics Powder Core Market

Common user questions regarding AI's impact on the High Flux Magnetics Powder Core Market often center on how AI-driven optimization techniques can improve core manufacturing efficiency, predict material degradation, and influence the design parameters of inductors used in AI hardware. Users are keenly interested in whether AI modeling can accelerate the development of new high flux materials with lower losses, and how AI-managed power systems (like those in hyperscale data centers) will alter the performance requirements for magnetic components. There is a prevalent concern about the increased power density and thermal management challenges in AI training and inference hardware, where advanced magnetic cores are essential for stable power delivery. The key themes revolve around AI facilitating predictive maintenance in production, optimizing core geometries for specific high-frequency AI applications, and potentially reducing the physical testing cycle required for new core designs, thus accelerating time-to- market for highly optimized components.

The application of Artificial Intelligence (AI) and Machine Learning (ML) techniques is poised to revolutionize the design and manufacturing processes within the High Flux Magnetics Powder Core market, primarily by enhancing material simulation capabilities and streamlining quality control. AI algorithms can analyze vast datasets derived from production parameters—such as compaction pressure, annealing temperature, and powder particle size distribution—to identify optimal processing windows that minimize core losses and maximize saturation flux density. This predictive modeling capacity reduces reliance on expensive and time-consuming physical prototyping, enabling manufacturers to rapidly iterate on new core designs specifically tailored for high-frequency switching applications demanded by modern electronics, including AI servers and high-speed communications equipment. Furthermore, AI-powered computer vision systems are being integrated into production lines to ensure instantaneous defect detection, maintaining extremely tight tolerance levels and improving overall product consistency, which is critical for high-reliability applications.

Beyond manufacturing, AI significantly influences the end-use environment of high flux powder cores, especially within power management systems for data centers and advanced computing. AI-driven power system management optimizes power distribution dynamically based on workload, transient load response, and temperature fluctuations. This requires magnetic components, specifically the high flux inductors, to perform reliably under extremely varied and often challenging operating conditions. AI also contributes to predictive failure analysis by monitoring the core's performance characteristics (such as inductance droop or thermal rise) in real-time, allowing for proactive maintenance and ensuring the stability of critical infrastructure. The proliferation of AI accelerators and specialized server hardware, which demand very high transient current capability and extremely low noise power delivery, directly increases the technical specifications and market size for premium, ultra-low-loss high flux powder cores. AI thus acts both as an enabler for optimized production and a significant driver of end-user demand for high-performance magnetic materials.

- AI optimizes material composition and processing parameters for minimum core loss.

- Predictive modeling using ML accelerates the design cycle for new core geometries.

- AI-enhanced quality control systems ensure ultra-high product reliability and defect detection.

- Increased demand for specialized cores in AI server power delivery units (PDUs) and voltage regulators (VRMs).

- AI-driven smart grids and power management systems necessitate highly stable magnetic components under dynamic loads.

- Automation of winding and assembly processes facilitated by robotic and AI control systems.

- Simulation of thermal performance and inductance droop under extreme AI hardware operating conditions.

DRO & Impact Forces Of High Flux Magnetics Powder Core Market

The dynamics of the High Flux Magnetics Powder Core Market are governed by a robust set of Drivers, significant Restraints, and promising Opportunities, collectively shaping the Impact Forces that dictate market direction and growth. The primary Drivers stem from the fundamental industry shift towards enhanced energy efficiency and the global mandate for reduced carbon emissions, spurring massive adoption of core materials capable of minimizing wasted power. Coupled with this is the explosive growth of high-frequency switching topologies enabled by next-generation semiconductors, which require the specific low-loss characteristics provided by high flux cores. Conversely, the market faces significant Restraints, particularly the inherent cost volatility of key raw materials like iron powder, which directly impacts manufacturing margins and end-product pricing. Furthermore, the specialized knowledge and capital investment required for high-precision powder metallurgy pose substantial barriers to entry for new players, limiting market competition and potentially slowing innovation diffusion. The Impact Forces analysis reveals that while technological drivers push the market forward, economic constraints related to material costs and intellectual property complexity act as counteracting elements that must be managed strategically.

Opportunities in this sector are vast, particularly focused on developing highly customized core solutions for emerging high-growth segments. The proliferation of 5G infrastructure, electric vehicle charging stations (Level 3 DC fast charging), and advanced medical imaging equipment represents untapped potential where high flux cores provide indispensable performance advantages in terms of power density and thermal robustness. Moreover, there is a substantial opportunity in material science, specifically in creating composite powder cores that integrate various metallic and non-metallic powders to achieve superior magnetic permeability and even lower power losses across extremely wide frequency spectra (up to MHz range). Successfully navigating the constraints of raw material supply through long-term contracts or vertical integration, coupled with aggressive R&D into automated, high-volume production techniques, will allow key market participants to capitalize effectively on these emerging opportunities and solidify market leadership.

The collective impact forces demonstrate a net positive trajectory for the market, driven overwhelmingly by non-negotiable technological shifts. The transition to higher power densities and higher switching frequencies in nearly all electronics—from consumer devices to industrial machinery—mandates the use of high-performance magnetic cores. While the technical challenge of managing core losses at escalating frequencies remains a restraint, this challenge itself fuels investment into better, more efficient high flux materials. Therefore, the market growth is heavily dependent on sustained innovation in powder insulation technologies and compaction methods to consistently deliver products that meet increasingly stringent performance benchmarks in critical applications such as renewable energy integration and high-speed data processing, making technological superiority the most potent impact force influencing demand.

Segmentation Analysis

The High Flux Magnetics Powder Core market is meticulously segmented across dimensions including Material Type, Core Geometry, Application, and End-Use Industry, reflecting the diverse technical requirements across the power electronics landscape. This granular segmentation allows manufacturers to tailor products precisely for specific performance criteria, such as maximizing DC bias capability for automotive applications or minimizing AC losses for high-frequency switching in IT infrastructure. The material segment, predominantly featuring iron powder composites, differentiates based on proprietary insulating coatings and processing techniques that determine the core's permeability and saturation characteristics. Geometrical segmentation addresses physical design constraints and electromagnetic requirements, with toroidal cores dominating volume applications, while molded and block cores gain traction in surface-mount designs demanding compactness.

Application-based segmentation is crucial, as the performance metrics required for a power supply DC-DC converter differ significantly from those needed for a high-power factor correction (PFC) choke or an uninterruptible power supply (UPS) system. The demand in each segment is directly tied to macro trends; for instance, the rapid expansion of data centers fuels the Power Supply segment, while regulatory pressure for efficient energy harvesting drives the Renewables segment. End-Use industry analysis provides insights into structural demand shifts, identifying automotive, industrial, and consumer electronics as the primary demand generators. The industrial sector, covering motor drives, automation systems, and heavy-duty power supplies, typically demands cores with exceptional thermal stability and mechanical robustness to ensure longevity in harsh environments, whereas consumer electronics prioritize miniaturization and cost efficiency.

Understanding these segment interactions is vital for strategic positioning. For instance, the high growth expected in the Automotive sector (EVs) will necessitate higher volumes of specialized high-temperature, high DC bias cores (likely block/molded geometry), driving innovation in the Iron-Nickel and Iron-Silicon material segments. The complexity of power electronics design mandates that suppliers not only offer a broad range of standard products but also possess the flexibility for rapid customization. Consequently, market players are increasingly investing in advanced manufacturing flexibility and digital simulation tools to meet the heterogeneous performance requirements spanning low-power consumer electronics to megawatt-scale renewable energy systems, ensuring tailored solutions drive market uptake across all key segments simultaneously.

- By Material Type:

- Iron Powder Composites

- Iron-Silicon Alloys (e.g., Sendust)

- Iron-Nickel Alloys (e.g., Molybdenum Permalloy Powder or MPP)

- High Flux Iron Powder (HF)

- Iron-Silicon-Aluminum (FeSiAl)

- By Core Geometry:

- Toroidal Cores

- E/I Cores

- Pot Cores

- Block/Molded Cores

- Cylindrical Cores

- By Application:

- Power Supply & DC-DC Converters

- Inverters and Converters (Renewable Energy)

- Inductors and Chokes (Filtering and Storage)

- Power Factor Correction (PFC) Inductors

- Transformers

- By End-Use Industry:

- Automotive (Electric Vehicles and Charging)

- Telecommunications (5G Infrastructure)

- Industrial (Motor Drives, Automation)

- Consumer Electronics (Adapters, Chargers)

- IT & Data Centers (Servers, UPS Systems)

- Renewable Energy (Solar and Wind Power)

Value Chain Analysis For High Flux Magnetics Powder Core Market

The value chain for the High Flux Magnetics Powder Core Market commences with the upstream sourcing of foundational raw materials, primarily high-purity iron powder, specialized insulation coatings (often phosphate or proprietary organic compounds), and alloying elements such as nickel, molybdenum, silicon, and aluminum. Upstream activities are dominated by specialized chemical and metallurgical companies that must ensure consistent quality and precise particle size distribution of the raw powders, as these factors critically influence the final magnetic properties, including permeability and core loss. Given the specialized nature of these materials and the global reliance on specific mining and refining regions, volatility in commodity pricing is a persistent risk in this stage. Manufacturers of the powder cores themselves then engage in complex processes like powder preparation, compaction (often using high-pressure presses), thermal processing (annealing), and final protective coating application to achieve the desired core geometry and magnetic performance.

The finished powder cores transition through the midstream, primarily involving distribution channels that connect manufacturers to various Original Equipment Manufacturers (OEMs) and Electronics Manufacturing Services (EMS) providers. Distribution is bifurcated into direct sales channels for large, customized industrial orders (e.g., major automotive or aerospace clients) and indirect distribution through specialized electronics component distributors for smaller volume or standard products destined for consumer electronics and general industrial applications. Effective inventory management and technical support are key differentiators in this distribution phase, as design engineers frequently require specific application assistance to select the optimal core for complex power topologies. The integration of digital platforms and sophisticated logistics management systems is essential for ensuring timely delivery and responsiveness to rapidly fluctuating OEM demand cycles globally.

Downstream activities involve the integration of the high flux powder cores into final power electronic products, such as inductors, chokes, and transformers, which are then assembled into end-user systems across diverse industries. The largest downstream buyers include manufacturers of electric vehicle charging systems, servers and data center infrastructure, industrial motor drives, and solar inverters. The performance and efficiency of the final power system are highly dependent on the quality and characteristics of the magnetic core, making the core a mission-critical component. Feedback from downstream users regarding in-field performance, thermal behavior, and reliability requirements drives iterative improvements in the upstream material science and core manufacturing processes, completing the cyclical nature of the value chain. Continuous technical collaboration between core manufacturers and downstream component integrators is crucial for rapid innovation and maintaining a competitive edge in high-performance application sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Million |

| Market Forecast in 2033 | USD 1,569.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magnetics (Spang & Company), Micrometals, Changsung Corp, Hitachi Metals, Ltd., Sumitomo Metal Mining Co., Ltd., Kool Mu, TDK Corporation, VACUUMSCHMELZE GmbH & Co. KG (VAC), Toshiba Materials Co., Ltd., Steward Advanced Materials, Inc., Acme Electric, Amidon Associates, Inc., Ferroxcube (Yageo), Vishay Intertechnology, Inc., Laird Performance Materials |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Flux Magnetics Powder Core Market Potential Customers

The primary potential customers and end-users of High Flux Magnetics Powder Cores are concentrated within high-growth, technology-intensive sectors that require advanced power delivery and conditioning. These customers are typically major multinational Original Equipment Manufacturers (OEMs) and large Electronics Manufacturing Services (EMS) providers. For instance, manufacturers specializing in EV powertrain components, such as traction inverters and battery management systems (BMS), are significant buyers, demanding cores that can handle high currents and elevated temperatures with minimal loss. Similarly, companies designing and assembling server power supplies (PSUs) and voltage regulator modules (VRMs) for hyperscale data centers represent a core customer base, valuing the high saturation flux density and superior thermal performance of these magnetic materials to maximize system efficiency in highly condensed server racks.

The industrial sector, particularly manufacturers of high-performance motor drives (VFDs) and automation equipment, represents another crucial customer segment. These applications require magnetic cores for input and output chokes that must reliably filter harmonics and manage electrical noise under continuous heavy load cycles. The longevity and stability of the cores in harsh industrial environments—often exposed to vibrations and extreme temperatures—are paramount buying criteria for these users. Moreover, potential customers include utility-scale renewable energy system integrators and inverter manufacturers (for both solar and wind power), who rely on high flux cores for highly efficient DC-AC power conversion and grid synchronization filtering. The critical nature of these applications means purchasing decisions are driven more by performance specifications (low loss, high DC bias) and supplier reliability rather than purely by marginal cost differences.

Furthermore, telecommunications equipment manufacturers, especially those developing 5G base stations and remote radio heads (RRHs), are rapidly increasing their demand for compact, efficient magnetic cores. The density and power requirements of 5G infrastructure necessitate miniaturized power solutions where traditional magnetic materials often fail to meet the performance criteria. Potential customers in this domain seek custom core designs that seamlessly integrate with advanced thermal management solutions. Finally, the growing market for medical devices, particularly MRI and high-precision diagnostic equipment, also constitutes a smaller but high-value customer segment, emphasizing ultra-low electromagnetic interference (EMI) and precision performance, reinforcing the need for specialized, premium high flux powder core solutions tailored to stringent regulatory and performance specifications.

High Flux Magnetics Powder Core Market Key Technology Landscape

The technological landscape of the High Flux Magnetics Powder Core Market is characterized by continuous material science innovation focused on minimizing power loss, increasing saturation flux density (Bs), and improving performance under high-frequency and high-temperature operation. A primary technological focus involves advanced powder metallurgy techniques, specifically optimizing the insulating layer surrounding each metallic particle. New proprietary nano-scale insulation coatings, often developed using chemical vapor deposition or advanced chemical precipitation methods, are critical for maintaining high resistivity between particles, thereby dramatically reducing eddy current losses, especially as switching frequencies in power electronics push into the hundreds of kilohertz range. Furthermore, composite core technology, integrating materials like iron, silicon, and aluminum (FeSiAl/Sendust) or iron and nickel (MPP), utilizes sophisticated blending and pressing techniques to achieve tailored magnetic properties that balance high saturation with low permeability and low loss, catering specifically to filter and storage inductor applications.

Manufacturing process innovations are equally pivotal. High-precision compaction technologies, including cold pressing and warm pressing, are continuously being refined to achieve higher density and mechanical strength in the finished core, minimizing internal stresses that could degrade magnetic performance. Annealing processes, often performed in controlled atmospheres, are optimized using complex thermal profiles to relieve stress and establish the desired crystalline structure and magnetic domains, thereby setting the final permeability characteristics. A critical technological trend is the shift towards advanced geometries, such as molded or pressed block cores, which enable highly compact Surface Mount Technology (SMT) inductor designs necessary for miniaturized electronics. This requires sophisticated tooling and manufacturing precision to ensure core tolerance and repeatability across high-volume production runs, supported by automated optical inspection and non-destructive testing methodologies.

The convergence of magnetic core technology with Wide-Bandgap (WBG) semiconductors, such as Silicon Carbide (SiC) and Gallium Nitride (GaN), is rapidly shaping the technology roadmap. WBG devices facilitate operation at significantly higher frequencies (up to several megahertz) than traditional silicon components, necessitating magnetic cores that exhibit minimal AC losses at these extreme frequencies. This technological challenge drives ongoing research into high-performance FeSiAl and specialized high flux composites, pushing the boundaries of material stability and thermal management. Simulation and modeling software (e.g., Finite Element Analysis or FEA) integrated with AI/ML tools are now indispensable technologies, allowing engineers to predict core performance under specific circuit conditions with high accuracy, accelerating the development and validation of new core materials and geometries designed for next-generation power electronics requiring ultra-high efficiency and power density.

Regional Highlights

The High Flux Magnetics Powder Core Market exhibits distinct growth patterns and demand drivers across major geographic regions. Each region's market size and growth rate are influenced by local industrial policies, technological adoption rates, and investment levels in key infrastructure areas like 5G, data centers, and electric mobility.

- Asia Pacific (APAC): APAC is the global powerhouse for the High Flux Magnetics Powder Core market, primarily driven by massive electronics manufacturing bases in China, Taiwan, South Korea, and Japan. The region benefits from substantial government investments in renewable energy infrastructure (solar and wind), rapid deployment of 5G networks, and aggressive incentives for electric vehicle manufacturing and adoption. China, in particular, dominates both production and consumption, characterized by a high volume of demand for components in consumer electronics, industrial motor drives, and EV charging ecosystems. The focus here is on achieving high volume, cost-competitive production while simultaneously innovating in materials for high-frequency applications.

- North America: This region is characterized by high demand for premium, high-reliability cores, primarily driven by the hyperscale data center industry, advanced aerospace and defense sectors, and sophisticated industrial automation systems. North America is a major adopter of high-efficiency power standards and is rapidly increasing its EV infrastructure build-out. Innovation often focuses on integrating high flux cores with advanced thermal management systems to handle the extreme power densities required by AI servers and mission-critical power supplies. Strict regulatory compliance regarding energy efficiency further mandates the use of ultra-low-loss core materials.

- Europe: Europe represents a technologically mature market emphasizing sustainable energy transition and automotive electrification. Driven by stringent environmental regulations, particularly the EU's Ecodesign Directive, demand is high for cores used in high-efficiency industrial motor drives, renewable energy inverters, and sophisticated on-board chargers for EVs. Germany, France, and Nordic countries lead in adopting smart grid technologies and high-efficiency industrial power supplies. The market here prioritizes long-term reliability and compliance with high-safety standards, often favoring European or specialized Asian suppliers who can meet these quality benchmarks.

- Latin America (LATAM): The LATAM market is in an emerging growth phase, primarily driven by industrial expansion, modernization of telecommunications infrastructure, and nascent efforts in renewable energy deployment (especially solar energy in Brazil and Chile). Demand is often focused on industrial power supplies and standardized electronic components, with growth potential tied directly to economic stability and foreign investment in manufacturing and infrastructure projects.

- Middle East and Africa (MEA): Growth in MEA is highly localized, largely centered around Gulf Cooperation Council (GCC) countries investing heavily in smart city projects, data center construction, and diversification away from oil, including solar power initiatives. The requirement for high-temperature stability in magnetic cores is critical due to the extreme climate conditions. Infrastructure projects and telecommunications upgrades (particularly in South Africa and the UAE) are the main drivers of demand for standard and specialized high flux cores.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Flux Magnetics Powder Core Market.- Magnetics (Spang & Company)

- Micrometals

- Changsung Corp

- Hitachi Metals, Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Kool Mu

- TDK Corporation

- VACUUMSCHMELZE GmbH & Co. KG (VAC)

- Toshiba Materials Co., Ltd.

- Steward Advanced Materials, Inc.

- Acme Electric

- Amidon Associates, Inc.

- Ferroxcube (Yageo)

- Vishay Intertechnology, Inc.

- Laird Performance Materials

- Delta Electronics, Inc. (Magnetics Division)

- Cosmo Ferrites Limited

- Fuji Electric Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Epcos AG (TDK Group)

Frequently Asked Questions

Analyze common user questions about the High Flux Magnetics Powder Core market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of High Flux Powder Cores over traditional ferrite cores?

The primary advantage of High Flux (HF) powder cores is their significantly superior DC bias characteristic, meaning they maintain high inductance even when substantial DC current passes through the winding. They also offer higher saturation flux density (Bs) and better thermal stability, making them ideal for high-power, high-current filtering and energy storage applications, especially in environments like EV chargers or large UPS systems.

Which end-use industry is expected to drive the highest growth in the High Flux Magnetics Powder Core Market?

The Automotive sector, particularly the rapid proliferation of Electric Vehicles (EVs) and the associated high-power charging infrastructure, is projected to be the fastest-growing segment. High flux cores are essential in EV on-board chargers, DC-DC converters, and traction inverters, demanding high performance under severe thermal and current conditions.

How do High Flux cores contribute to energy efficiency in power electronics?

High Flux cores contribute to energy efficiency by exhibiting low core losses (both hysteresis and eddy current losses) at high switching frequencies and large current swings. This minimizes wasted energy converted to heat, allowing designers to achieve higher power density and requiring less substantial cooling systems, thereby increasing overall system efficiency.

What role does the powder insulation technology play in core performance?

Powder insulation technology is crucial as it creates a distributed air gap within the core material. This thin, highly resistive layer isolates individual metal particles, preventing the formation of large eddy currents, which are the main source of high-frequency power loss. Proprietary nano-scale insulation is vital for maintaining high core resistivity and low AC losses.

What key material types are commonly used to manufacture High Flux Magnetics Powder Cores?

Common materials include pure Iron Powder Composites, Iron-Silicon-Aluminum (FeSiAl, known as Sendust), and Iron-Nickel Alloys such as Molybdenum Permalloy Powder (MPP). High flux cores specifically leverage specialized iron powder formulations that offer exceptional DC bias performance and high saturation levels compared to other powder core families.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager