High Heat ABS Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433525 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

High Heat ABS Resin Market Size

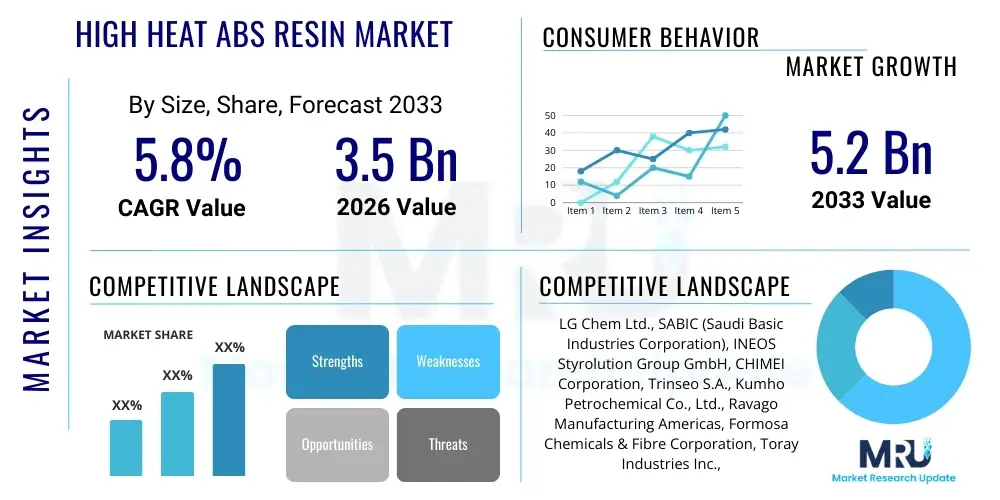

The High Heat ABS Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

High Heat ABS Resin Market introduction

The High Heat ABS Resin Market encompasses specialized engineering thermoplastic materials designed to withstand significantly elevated temperatures compared to standard ABS grades, while maintaining excellent mechanical properties, dimensional stability, and processability. This enhanced thermal resistance is typically achieved through modifications in polymerization processes, blending with high-temperature polymers, or the incorporation of specific additives. These resins are critical components in industries requiring materials that perform reliably under challenging thermal conditions, particularly within automotive, electrical and electronics (E&E), and consumer appliance sectors.

High Heat ABS resins are prized for their unique combination of properties, including superior heat deflection temperature (HDT), good impact strength, high rigidity, and aesthetic appeal. Key applications include automotive interior parts (dashboard components, vents, pillars), electronic housing units exposed to heat generation, and complex parts in domestic appliances like coffee makers and hair dryers. The driving factors behind the market’s expansion are primarily the stringent safety and performance requirements in the automotive industry, the miniaturization of electronic devices leading to higher operating temperatures, and the increasing global emphasis on lightweighting and energy efficiency.

The core benefit of utilizing High Heat ABS over conventional plastics or other engineering polymers is the favorable balance between performance and cost-effectiveness. While materials like polycarbonates or specialized polyamides offer high heat resistance, High Heat ABS provides a more economical solution without significant compromises on essential characteristics such as flowability during molding and surface quality. This versatility makes it an indispensable material for manufacturers seeking to optimize product longevity and comply with rising regulatory standards regarding thermal endurance and material integrity in harsh operational environments.

High Heat ABS Resin Market Executive Summary

The global High Heat ABS Resin market is experiencing robust growth, driven primarily by accelerating demand from the automotive sector for lightweight and thermally stable interior components that meet stringent safety standards and aesthetic requirements. Significant business trends include the consolidation of production capabilities among key chemical manufacturers and increased R&D investment focused on developing bio-based or recycled content High Heat ABS variants to align with sustainability goals. The market exhibits a clear shift toward specialized, customized grades tailored for specific end-use applications, such as grades offering enhanced UV resistance alongside high thermal stability for exterior or semi-exposed applications. Geographically, Asia Pacific remains the central growth engine due to burgeoning automotive manufacturing, particularly in China and India, and the region's dominance in global electronics production.

Segment trends reveal that the highest growth rate is anticipated in the automotive segment, fueled by the transition to electric vehicles (EVs), which require thermally stable resins for battery cooling systems, charging ports, and specialized electronic controls operating at elevated temperatures. Technology-wise, mass polymerization techniques and advanced compounding methods are preferred for achieving optimal heat performance and consistent quality. Regionally, while APAC dominates volume, North America and Europe are characterized by high-value applications, focusing on highly specialized, premium-grade High Heat ABS resins used in precision electronics and medical devices where tolerance for thermal expansion must be extremely tight. The market structure remains moderately consolidated, with major global chemical companies holding substantial market share through extensive product portfolios and global distribution networks.

Overall market dynamics suggest that while raw material price volatility (especially for acrylonitrile and butadiene) poses a structural constraint, the strong underlying demand from essential industries ensures sustained expansion. Key players are strategically expanding production capacity in high-growth regions like Southeast Asia to reduce logistics costs and serve local manufacturing hubs more efficiently. The push towards regulatory compliance concerning volatile organic compound (VOC) emissions in automotive interiors is also driving demand for low-emission High Heat ABS grades, further stimulating technological innovation across the value chain and positioning the market favorably for continuous evolution through the forecast period.

AI Impact Analysis on High Heat ABS Resin Market

User queries regarding the impact of Artificial Intelligence (AI) on the High Heat ABS Resin Market primarily revolve around optimizing manufacturing processes, predicting material performance under varying thermal loads, and enhancing supply chain resilience. Key themes include the use of AI in computational chemistry for rapid new product development (NPD), utilizing machine learning (ML) algorithms for predictive quality control during polymerization and compounding, and leveraging big data analytics to forecast fluctuating raw material prices and demand patterns. Users are specifically concerned with how AI can minimize batch-to-batch variability, a critical issue in high-performance polymer manufacturing, and whether AI can accelerate the simulation of long-term thermal aging effects, thereby reducing the time-to-market for novel high-temperature resistant grades. Expectations center on AI enabling "smart manufacturing" environments, where real-time process adjustments maximize yield and energy efficiency.

The application of AI and Machine Learning (ML) is fundamentally transforming the R&D and manufacturing phases of High Heat ABS production. In research, generative AI models are being used to simulate millions of molecular compositions, identifying optimal monomer ratios and additive packages (such as heat stabilizers and flame retardants) that yield superior heat deflection temperatures and mechanical robustness. This computational approach drastically cuts down traditional lab testing time, speeding up the discovery of next-generation resins that exceed current performance benchmarks. For manufacturing plants, AI-powered predictive maintenance minimizes costly unplanned downtime, while neural networks analyze sensory data from extruders and compounding machines to maintain optimal temperature and pressure profiles, ensuring consistent material quality that is paramount for demanding automotive and E&E applications.

Furthermore, AI significantly impacts the supply chain and commercial strategy for High Heat ABS resins. Predictive analytics tools forecast shifts in end-user demand across various sectors (e.g., anticipating a surge in EV component needs), allowing producers to optimize inventory levels and feedstock procurement (acrylonitrile, butadiene, styrene) in anticipation of price volatility. This integration of data intelligence enhances operational efficiency and strengthens competitiveness. The adoption of smart quality assurance systems, utilizing computer vision combined with ML, provides real-time defect detection in molded parts, setting a new standard for precision and reliability in the high-performance plastics sector, thus supporting the market’s pivot towards zero-defect manufacturing standards.

- AI-driven optimization of polymerization kinetics for superior thermal stability.

- Machine learning algorithms for predictive maintenance of compounding equipment, reducing downtime.

- Computational chemistry and generative AI for faster simulation and development of novel high-heat resistant formulations.

- Predictive supply chain analytics to stabilize raw material procurement and manage price risk.

- Real-time quality control systems using computer vision for detecting micro-defects in finished High Heat ABS components.

- Enhanced energy efficiency in molding processes through AI optimization of heating cycles and cooling times.

- Advanced modeling of long-term aging and thermal degradation to guarantee product longevity in harsh environments.

DRO & Impact Forces Of High Heat ABS Resin Market

The High Heat ABS Resin Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively determine its growth trajectory and competitive landscape. A primary driver is the pervasive demand for thermally stable, aesthetically pleasing, and lightweight materials within the global automotive industry, particularly for interior and under-the-hood applications where regulatory standards mandate materials capable of enduring extreme temperatures without warping or compromising safety integrity. Additionally, the rapid expansion and increasing complexity of the electronics sector, characterized by component miniaturization leading to higher operating temperatures, further fuels the need for specialized high-heat plastics, ensuring reliable performance in demanding consumer and industrial devices. These drivers are fundamentally linked to macroeconomic trends such as urbanization, increased disposable income in emerging economies, and the global push towards electric mobility.

However, the market faces significant restraints that temper its potential growth. The most critical constraint is the inherent volatility in the pricing and supply of key raw materials, specifically acrylonitrile, butadiene, and styrene (ABS). These petrochemical derivatives are subject to crude oil price fluctuations, geopolitical instability, and supply chain bottlenecks, directly impacting the manufacturing costs and profit margins of resin producers. Furthermore, High Heat ABS resins face intense substitution threats from alternative high-performance engineering plastics, such as modified polyphenylene oxide (PPO) blends, high-performance polyamides (HPPA), and specialized polycarbonates, which sometimes offer superior thermal or chemical resistance for specific niche applications, requiring continuous investment in R&D to maintain a competitive edge based on cost-performance ratio.

The opportunities within this market are vast and centered around technological innovation and geographical expansion. A major opportunity lies in the burgeoning electric vehicle (EV) market, where High Heat ABS resins are vital for battery enclosures, internal charging components, and thermal management systems, leveraging their good dielectric properties and flame retardancy potential. Moreover, the growing global emphasis on sustainability presents an opportunity for companies to develop and commercialize bio-based High Heat ABS alternatives or utilizing advanced recycling technologies to create circular economy materials with comparable thermal performance, catering to the rising corporate and consumer demand for environmentally responsible products. Strategic expansion into underserved regional markets, particularly in rapidly industrializing parts of Southeast Asia and Latin America, also offers substantial future growth potential for market leaders.

Segmentation Analysis

The High Heat ABS Resin Market is systematically segmented based on various criteria, including the Method of Production, Application, and End-Use Industry, enabling granular analysis of demand patterns and targeted strategic deployment. Segmentation by production method often differentiates between mass polymerization, emulsion polymerization, and compounding processes, each yielding resins with distinct thermal and mechanical profiles suitable for different performance requirements, with mass polymerization generally preferred for high-volume, cost-sensitive grades. Application segmentation details the specific use cases of the resin, such as injection molded parts, extruded sheets, or specialty films, each requiring specific flow and viscosity characteristics from the resin base. The analysis provides deep insights into which segments are driving current demand and where future innovation is most likely to yield significant commercial success, allowing stakeholders to align investment with high-growth areas.

The primary segmentation based on End-Use Industry is crucial for understanding market dynamics, distinguishing between automotive, electrical and electronics (E&E), consumer goods, and industrial applications. The automotive segment consistently accounts for the largest market share due to the indispensable role of High Heat ABS in interior components like instrument panels, central consoles, and air vents, which are subjected to continuous solar radiation and fluctuating cabin temperatures. In the E&E sector, demand is driven by housing units for power supplies, specialized connectors, and components in large appliances where inherent heat is generated, necessitating materials that maintain structural integrity under prolonged thermal stress, often requiring flame-retardant modifications.

Further granular segmentation often incorporates specific performance characteristics, such as high-gloss versus matte finish grades, or grades offering specific property enhancements like superior UV resistance or increased chemical resistance. This level of detail is critical for specialized industries like medical device manufacturing, which requires tight material tolerances and specific resistance profiles for sterilization processes. Overall, the structural segmentation confirms the market's reliance on the automotive and electronics sectors, simultaneously highlighting emerging opportunities in specialized applications where standard ABS cannot meet the required performance specifications, solidifying the market's trajectory towards performance-driven customization.

- By Method of Production:

- Mass Polymerization

- Emulsion Polymerization

- Compounding/Blending

- By Application:

- Automotive Interior Components (Instrument Panels, Vents, Consoles)

- Electrical and Electronics Housing (Power Supplies, Connectors, Switches)

- Consumer Appliances (Coffee Makers, Hair Dryers, Toasters)

- Industrial Parts

- By End-Use Industry:

- Automotive

- Electrical and Electronics (E&E)

- Consumer Goods

- Building and Construction

- Others (Medical, Industrial)

- By Grade:

- Standard High Heat Grades (HDT 95°C - 105°C)

- Super High Heat Grades (HDT > 105°C)

- Flame Retardant High Heat Grades

Value Chain Analysis For High Heat ABS Resin Market

The value chain of the High Heat ABS Resin market begins with the upstream sourcing and production of key feedstocks: acrylonitrile, butadiene, and styrene (ABS monomers). This phase is capital-intensive and highly dependent on the petrochemical industry, as fluctuations in crude oil pricing directly influence monomer costs. Major chemical companies often integrate backwards into monomer production to secure supply and achieve cost efficiencies. The subsequent core stage involves the polymerization and compounding of these monomers, where specialized processes—such as grafting high-heat performance additives or modifying polymer ratios—are applied to achieve the desired thermal stability and mechanical characteristics of the High Heat ABS resin pellets. Quality control at this stage is crucial, as the thermal stability must meet precise specifications for demanding end-use applications like those found in the automotive industry.

Moving downstream, the distribution channel is critical for efficiently moving the specialized resin pellets from manufacturers to processors (compounders and molders). Distribution typically involves a mix of direct sales channels for major, high-volume purchasers (e.g., large Tier 1 automotive suppliers) and indirect sales through specialized regional distributors or agents for smaller consumers or highly customized orders. These distributors often provide technical support and smaller batch customization services. The indirect channels facilitate penetration into fragmented regional markets and offer logistical flexibility. The efficiency of this distribution network, especially regarding storage and timely delivery, directly impacts the competitiveness of resin suppliers and ensures that the highly engineered material maintains its integrity before processing.

The final phase involves the material conversion by processors—primarily injection molders, extruders, and fabricators—who transform the resin pellets into finished components. These components are then sold to Original Equipment Manufacturers (OEMs) in sectors such as automotive (for vehicle assembly), electronics (for final product assembly), and consumer appliance manufacturing. The collaboration between resin manufacturers and downstream processors is vital for optimizing mold design and processing parameters to utilize the high-heat properties effectively. This downstream utilization defines the ultimate market success, where materials are chosen based on proven performance, consistency, and compliance with strict industry standards (e.g., thermal aging tests, VOC limits in automotive applications). The strong focus on performance integrity necessitates a tightly controlled and collaborative value chain.

High Heat ABS Resin Market Potential Customers

Potential customers for High Heat ABS resins are predominantly large-scale industrial manufacturers and Original Equipment Manufacturers (OEMs) across sectors that require materials offering thermal resistance significantly higher than standard plastics but still demanding cost-effectiveness and excellent processability. The largest segment of end-users is the automotive industry, specifically Tier 1 and Tier 2 suppliers responsible for producing critical interior components such as dashboard frames, air vents, central console bezels, pillar covers, and various components surrounding the engine bay or high-heat areas. These buyers are driven by strict regulatory requirements for dimensional stability under sun load testing and overall safety standards, necessitating guaranteed thermal performance and low Volatile Organic Compound (VOC) emissions.

The second major consumer base comprises the Electrical and Electronics (E&E) industry, including manufacturers of consumer electronics, IT peripherals, and large domestic appliances. Within this segment, buyers include companies producing housing for power adapters, internal structural components of servers, circuit board carriers, and enclosures for high-wattage kitchen appliances (e.g., ovens, sophisticated coffee machines, rice cookers). These end-users prioritize materials that offer inherent flame retardancy alongside high heat deflection, ensuring product safety and longevity when components are subjected to continuous heat generation during operation. The constant drive towards miniaturization and higher power density in electronics ensures sustained demand for superior heat-dissipating and resistant polymers.

Beyond these primary sectors, other potential customers include manufacturers in the Building and Construction sector, where High Heat ABS is sometimes used for specialized piping, fittings, and thermal barriers. The medical device industry also represents a niche, high-value customer segment, requiring specialized grades for components that need to withstand repeated sterilization cycles (though often challenged by other high-performance materials). Ultimately, any large-volume manufacturer looking to upgrade from standard engineering plastics due to increased thermal operating requirements, while seeking to maintain the high flow characteristics and cost advantages associated with ABS, becomes a prime potential customer for High Heat ABS resin producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Chem Ltd., SABIC (Saudi Basic Industries Corporation), INEOS Styrolution Group GmbH, CHIMEI Corporation, Trinseo S.A., Kumho Petrochemical Co., Ltd., Ravago Manufacturing Americas, Formosa Chemicals & Fibre Corporation, Toray Industries Inc., LyondellBasell Industries Holdings B.V., Chi Mei Materials Technology Corp., PetroChina Company Limited, Asahi Kasei Corporation, Samsung SDI Co., Ltd., ENTEC Polymers, Jiangsu Lihong Petrochemical Co. Ltd., Versalis S.p.A., China National Petroleum Corporation (CNPC), TotalEnergies SE, and TSRC Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Heat ABS Resin Market Key Technology Landscape

The technology landscape for High Heat ABS resins is primarily defined by advancements in polymerization processes and specialized compounding techniques aimed at elevating the material's Heat Deflection Temperature (HDT) and maintaining optimal mechanical integrity. The most critical technological approaches involve manipulating the internal structure of the ABS polymer. This is often achieved through high-grafting ratios of styrene-acrylonitrile (SAN) onto the polybutadiene rubber phase, coupled with the introduction of proprietary thermal stabilizers and performance modifiers. Mass polymerization, specifically continuous mass polymerization, is favored for high-volume production due to its low contamination potential and process efficiency, while controlled emulsion polymerization allows for finer control over the rubber particle size and morphology, which directly influences impact resistance at elevated temperatures. Innovation focuses on achieving a narrower molecular weight distribution for enhanced flow properties during injection molding, critical for complex automotive parts.

A significant area of technological focus is the development of blends utilizing co-polymers such as Polycarbonate (PC) or Methyl Methacrylate (PMMA) to boost thermal performance beyond the limits of pure ABS modifications. PC/ABS blends are widely used, offering a balance of high heat resistance, impact strength, and good processability. However, the true high-heat grades often rely on specialized, proprietary additive packages that function as high-efficiency heat stabilizers, preventing polymer degradation and discoloration under prolonged thermal exposure. Furthermore, in response to stringent regulatory demands, particularly in the automotive industry, technologies are being refined to produce low-VOC (Volatile Organic Compound) High Heat ABS grades, requiring meticulous control over residual monomer content and volatile additive usage, often necessitating vacuum degassing processes and optimized drying protocols during pelletization.

The digitalization of manufacturing, underpinned by AI and advanced sensor technology, constitutes a pivotal shift in the technology landscape. Modern production facilities are increasingly adopting sophisticated process control systems that utilize real-time rheological data and thermal imaging to ensure uniformity in compounding and melt processing. This technological integration not only guarantees batch-to-batch consistency—a non-negotiable requirement for OEMs—but also facilitates the rapid scale-up of newly developed formulations. Future technological development is expected to concentrate heavily on sustainable processing, including chemical recycling methods capable of depolymerizing High Heat ABS back into monomers, and the integration of advanced compounding equipment that minimizes shear heat generation, thus preserving the integrity of heat-sensitive additives during pellet production.

Regional Highlights

Geographically, the High Heat ABS Resin market exhibits significant regional disparities in terms of production capacity, consumption volume, and regulatory influence. Asia Pacific (APAC) dominates the global market, both in terms of manufacturing capacity and end-use consumption. This dominance is attributable to the region's massive automotive manufacturing base (especially in China, Japan, and South Korea) and its status as the world's primary hub for electronics production. Rapid industrialization and urbanization in emerging economies like India and Southeast Asia further contribute to increasing demand for consumer appliances and infrastructure components, driving high volume consumption of high-performance plastics. APAC manufacturers benefit from lower operating costs and proximity to feedstock supplies, establishing the region as the key pricing and innovation benchmark.

North America and Europe represent mature markets characterized by stringent quality standards and a high propensity for adopting premium, specialized grades of High Heat ABS, particularly those incorporating enhanced flame retardancy or specific aesthetic properties required by European automotive OEMs. While consumption volume is lower compared to APAC, the average selling price (ASP) for High Heat ABS resins in these regions is typically higher due to the focus on high-value applications, such as sophisticated medical equipment and advanced driver-assistance system (ADAS) components in vehicles. Furthermore, increasing regulatory pressure related to sustainability and circular economy principles in Europe is catalyzing innovation toward bio-based and recyclable High Heat ABS solutions.

- Asia Pacific (APAC): Leads global consumption and production volume; strong demand from established automotive hubs (Japan, South Korea) and rapidly expanding electronics manufacturing in China and Taiwan.

- North America: High-value market driven by automotive safety standards and premium consumer electronics; focus on specialized, technically advanced High Heat ABS grades.

- Europe: Characterized by stringent environmental regulations (REACH); strong demand from high-end automotive interior producers and significant investment in sustainable plastic alternatives.

- Latin America (LATAM): Emerging growth region, primarily driven by automotive assembly and appliance manufacturing in Brazil and Mexico; dependent on imported resins or local compounding operations.

- Middle East and Africa (MEA): Small but growing market; demand linked to localized appliance assembly and potential future infrastructure projects, often served by major global producers through regional distributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Heat ABS Resin Market.- LG Chem Ltd.

- SABIC (Saudi Basic Industries Corporation)

- INEOS Styrolution Group GmbH

- CHIMEI Corporation

- Trinseo S.A.

- Kumho Petrochemical Co., Ltd.

- Ravago Manufacturing Americas

- Formosa Chemicals & Fibre Corporation

- Toray Industries Inc.

- LyondellBasell Industries Holdings B.V.

- Chi Mei Materials Technology Corp.

- PetroChina Company Limited

- Asahi Kasei Corporation

- Samsung SDI Co., Ltd.

- ENTEC Polymers

- Jiangsu Lihong Petrochemical Co. Ltd.

- Versalis S.p.A.

- China National Petroleum Corporation (CNPC)

- TotalEnergies SE

- TSRC Corporation

Frequently Asked Questions

Analyze common user questions about the High Heat ABS resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between High Heat ABS and standard ABS resin?

High Heat ABS is chemically modified, often by increasing the Acrylonitrile content or incorporating specific co-polymers, resulting in a significantly higher Heat Deflection Temperature (HDT), typically exceeding 95°C, making it suitable for applications exposed to continuous elevated temperatures that would cause standard ABS to deform.

Which end-use industry is the largest consumer of High Heat ABS resins globally?

The automotive industry is the largest end-user segment, primarily utilizing High Heat ABS for interior parts such as dashboards, central consoles, and air conditioning vents that require stable dimensional performance under prolonged solar heat exposure and cabin temperatures.

What major factors restrain the growth of the High Heat ABS Resin Market?

The market growth is primarily restrained by the volatility and high cost of raw material monomers (acrylonitrile, butadiene, styrene), which are petrochemical derivatives, and intense competition from superior-performing engineering plastics like PC/ABS blends and specialized polyamides in high-specification niche markets.

How does the shift to Electric Vehicles (EVs) impact the demand for High Heat ABS?

The EV transition positively drives demand, as High Heat ABS is increasingly used in thermal management components, battery housing parts, and specialized electronics enclosures where high temperatures and required material stability are critical for safety and operational efficiency.

Which geographical region holds the largest market share for High Heat ABS resins?

Asia Pacific (APAC) holds the largest market share due to its vast manufacturing capacity in automotive and electronics production, coupled with rapid urbanization and strong domestic demand across countries like China, South Korea, and Japan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager