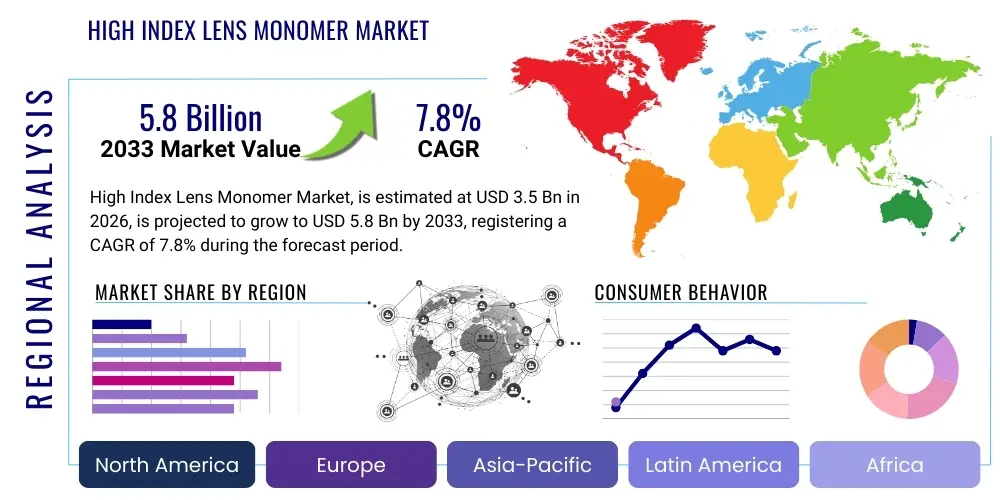

High Index Lens Monomer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434698 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

High Index Lens Monomer Market Size

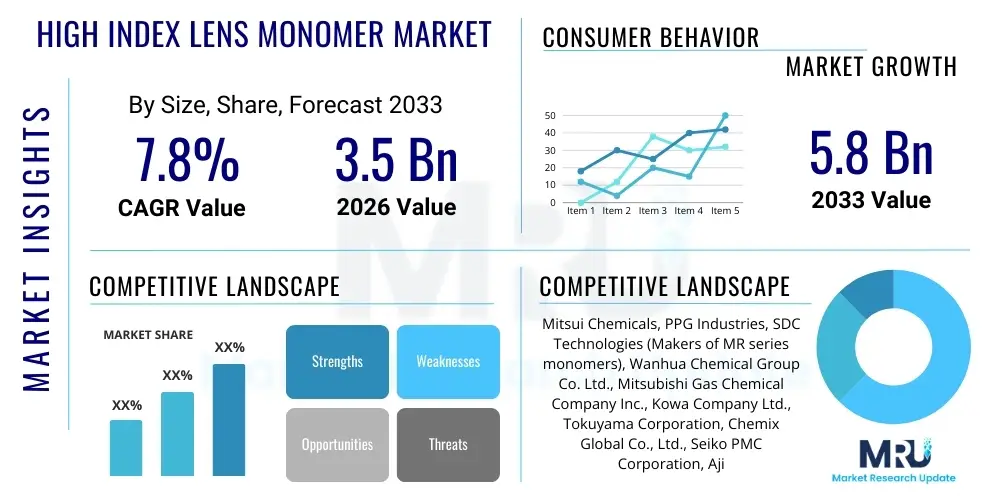

The High Index Lens Monomer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global incidence of refractive errors, particularly myopia and presbyopia, coupled with technological advancements leading to the commercialization of superior, thinner, and lighter ophthalmic lenses. The demand for aesthetically pleasing and comfortable eyewear is pushing manufacturers to adopt advanced monomer technologies, such as sulfur-containing thiourethane monomers, which facilitate high refractive indices (typically 1.60 and above) without compromising optical clarity or mechanical stability. The market growth is also intricately linked to improving healthcare infrastructure and rising disposable incomes in emerging economies, enabling wider access to advanced vision correction solutions.

High Index Lens Monomer Market introduction

The High Index Lens Monomer Market encompasses the production and supply of specialized chemical building blocks used in the manufacturing of ophthalmic lenses with high refractive indices. These monomers, characterized by their high density and ability to significantly bend light, allow lens manufacturers to produce lenses that are remarkably thinner and lighter than traditional plastic (CR-39) or glass lenses, especially for individuals requiring high dioptric power correction. Key high index monomers include sulfur-containing polyurethanes and thiourethanes (such as MR-7, MR-8, MR-10, and MR-17), which offer superior optical properties while maintaining excellent mechanical strength and processability. These materials address critical consumer pain points associated with thick, heavy eyewear, particularly aesthetic concerns and discomfort associated with stronger prescriptions, thereby driving significant uptake across global optical supply chains.

Major applications of high index lens monomers are predominantly concentrated in the production of prescription spectacle lenses, though they are also utilized in specialized contact lenses and safety eyewear requiring enhanced durability and light transmission properties. The primary benefit derived from these materials is the reduction in lens thickness and weight, improving both the cosmetic appearance and the long-term comfort for the wearer. For instance, a lens made from a 1.67 index monomer can be approximately 30% thinner than a standard 1.50 index lens. Furthermore, the inherent optical clarity and compatibility with advanced coatings, such as anti-reflective, scratch-resistant, and UV protection layers, solidify their position as the material of choice for premium vision correction products. This integration capability allows manufacturers to offer comprehensive vision solutions that meet stringent consumer demands for performance and aesthetics.

The market is fundamentally driven by robust demographic trends, notably the rapidly aging global population which requires increasing levels of presbyopia correction, and the surging prevalence of myopia, particularly across East Asian nations. The increasing awareness regarding eye health and the societal shift towards fashion-conscious eyewear have further accelerated the adoption of high index lenses. Moreover, continuous innovation in polymerization processes, aimed at optimizing the balance between refractive index and Abbe number (which relates to chromatic aberration), ensures that the lens performance remains exceptional even at the highest indices. These driving factors, combined with sophisticated marketing by optical retailers highlighting the comfort and aesthetic superiority of high index options, collectively propel market expansion across all geographical segments. The shift away from traditional glass lenses due to weight and safety concerns also provides a sustained tailwind for high index plastic monomers.

High Index Lens Monomer Market Executive Summary

The High Index Lens Monomer Market is experiencing robust growth fueled by advancements in material science and profound shifts in global demographics concerning vision correction needs. Current business trends indicate a strong focus among key manufacturers on developing ultra-high index monomers (1.74 and above) that provide maximum thickness reduction without sacrificing the critical Abbe number characteristics. Strategic partnerships between monomer suppliers and large-scale ophthalmic lens laboratories are becoming increasingly common to streamline the supply chain and ensure customized material flow based on regional demand patterns. Furthermore, sustainability is emerging as a key business driver, pushing R&D towards more eco-friendly production methods and less energy-intensive casting processes. The premium pricing associated with high index materials, driven by the specialized synthesis required, contributes positively to the overall market valuation, allowing for sustained investment in innovation and capacity expansion.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed leader in both consumption and manufacturing capacity, primarily due to the severe epidemic levels of myopia in countries like China, Japan, and South Korea, necessitating high-power lens prescriptions. APAC nations also serve as major production hubs for ophthalmic lenses, driving enormous demand for raw monomers. North America and Europe, characterized by mature and highly regulated markets, demonstrate strong demand for advanced, integrated lens solutions, including photochromic and polarized lenses made from high index materials. These regions emphasize customization and premiumization, focusing less on sheer volume and more on specialized formulations that offer enhanced wearer benefits, thereby attracting high Average Selling Prices (ASPs). Market penetration in Latin America and the Middle East and Africa (MEA) remains lower but is accelerating due to improving economic conditions and greater access to modern optical health services.

Segment trends reveal that the Thiourethane Monomers segment dominates the market by type, owing to their superior ability to achieve high refractive indices (e.g., 1.67 and 1.74) while maintaining relatively low specific gravity compared to early high index materials. Application analysis shows spectacle lenses holding the largest market share, directly correlated with the rising incidence of vision impairment and the necessity of correction. Within spectacle lenses, multi-focal and progressive addition lenses (PALs) are the fastest-growing sub-segment utilizing high index monomers, as these complex designs benefit immensely from the reduced edge thickness that high index materials provide. The ongoing trend of miniaturization and comfort in eyewear ensures sustained demand across all primary material segments, reinforcing the market’s positive long-term outlook and encouraging vertical integration across the supply chain.

AI Impact Analysis on High Index Lens Monomer Market

Analysis of user queries regarding AI’s influence on the High Index Lens Monomer Market reveals primary concerns centered on material discovery, process optimization, and personalized manufacturing. Users are keen to understand how artificial intelligence and machine learning (ML) algorithms can accelerate the identification and synthesis of novel polymer structures with even higher refractive indices (above 1.74) while simultaneously improving the crucial Abbe number characteristics—a traditionally challenging trade-off. There is also significant interest in AI applications for optimizing the complex casting and curing cycles required for these specialized monomers, aiming to reduce defects, minimize waste, and shorten overall production time. Expectations are high that AI will democratize custom lens manufacturing by enabling predictive quality control and precise monomer batch formulation adjustments in real-time based on environmental and raw material variables, ensuring consistent optical performance and reducing reliance on costly, trial-and-error R&D methods.

The immediate impact of AI is visible in computational chemistry, where ML models are used to predict the properties of theoretical monomers before costly synthesis attempts are made. This in silico approach drastically reduces the time and resources required for high index material innovation. Furthermore, AI-driven process control systems are being implemented in polymerization reactors and casting molds to monitor temperature, pressure, and curing time with unparalleled precision. These systems use predictive analytics to anticipate potential deviations in batch quality, adjusting parameters automatically, thereby significantly improving manufacturing yield rates and consistency, which is particularly vital for expensive, high-performance monomers. This analytical capability translates directly into lower manufacturing costs and increased production throughput, making high index lenses more accessible and competitive.

In the downstream segment, AI is beginning to influence lens design and personalization. Generative design algorithms can utilize patient-specific biometric data, frame choice, and prescription parameters to optimize the complex surface geometry of high index progressive lenses, mitigating peripheral distortion and maximizing the clear visual field. This personalized design requires highly consistent and predictable monomer performance, reinforcing the need for AI-enhanced quality control throughout the supply chain. Ultimately, AI acts as a crucial enabler, bridging advanced material science with highly customized manufacturing, securing the competitive edge for monomer suppliers and lens manufacturers who successfully integrate these predictive technologies into their operational frameworks. The long-term vision involves fully autonomous, smart factories capable of producing zero-defect, highly specialized high index lenses on demand.

- AI accelerates the discovery of new ultra-high index polymer structures (refractive index > 1.74) through computational chemistry and ML modeling.

- Predictive analytics optimizes complex casting polymerization processes, reducing curing time and minimizing defect rates in expensive monomer batches.

- Machine learning algorithms enhance quality control by monitoring raw material purity and adjusting formulation variables in real-time for consistent optical quality.

- AI-driven generative design aids in personalized high index progressive lens (PAL) optimization based on individual wearer biometrics, improving visual performance.

- Integration of AI in supply chain management improves forecasting and inventory planning for specific high index monomer types (e.g., MR-8 and MR-17).

DRO & Impact Forces Of High Index Lens Monomer Market

The High Index Lens Monomer Market is governed by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), creating significant Impact Forces. The primary driver is the accelerating global prevalence of refractive errors, necessitating stronger prescriptions where the aesthetic and comfort advantages of thin, light high index lenses become paramount. Opportunities are primarily focused on technological breakthroughs in polymer chemistry leading to materials with improved Abbe numbers (reduced chromatic aberration) at higher indices, alongside geographic expansion into rapidly developing economies where middle-class populations are increasingly able to afford premium vision correction. However, the market is restrained by the inherently high cost of sulfur-containing raw materials, the complexity and energy intensiveness of the casting polymerization process, and the ongoing challenge of balancing refractive index with acceptable optical quality.

Key impact forces driving the market include the shift in consumer preference away from thick, traditional lenses towards aesthetically superior and comfortable eyewear, heavily influenced by fashion trends and increased spending power on personal well-being. This societal pressure forces optical retailers to promote high index options as standard for medium-to-high prescriptions, thereby pulling demand directly from the monomer suppliers. Conversely, the high barrier to entry for new monomer manufacturers—requiring substantial investment in specialized synthesis facilities and rigorous quality control protocols—acts as a moderating force, maintaining the oligopolistic structure of the core monomer supply chain. Regulatory factors, particularly in North America and Europe regarding material safety and UV protection standards, also influence product development, pushing innovation towards materials that naturally incorporate enhanced protective features, thereby expanding the market scope.

The long-term trajectory is heavily influenced by the opportunity to integrate advanced functionalities directly into the monomer matrix. This includes developing high index photochromic or polarized monomers that eliminate the need for surface coatings, simplifying the lens manufacturing process and improving durability. Furthermore, the imperative for sustainable and circular economy practices presents both a challenge and an opportunity: developing bio-based or recycled high index polymers could unlock significant market segments, particularly in environmentally conscious European and North American markets. Overcoming the cost and complexity restraints through continuous process optimization and leveraging advanced manufacturing techniques, possibly aided by AI, will be crucial for sustained growth and broader market penetration of these premium materials across all prescription strengths globally.

Segmentation Analysis

The High Index Lens Monomer Market is systematically segmented primarily by the type of monomer material, the specific application of the resulting lens, and the distribution channel used to reach the end-user. This layered segmentation allows manufacturers and strategists to precisely target specific technological niches and demographic demands. Segmentation by material type is critical as it directly correlates with the achievable refractive index, density, and optical clarity (Abbe number), differentiating performance characteristics that define the final product's utility and price point. Thiourethane monomers, offering superior indices (1.67, 1.74), currently dominate the value share due to their widespread acceptance for thinning highly powerful lenses, while polyurethane monomers (1.60, 1.61) maintain significant volume share as the entry point into high index materials, providing a necessary balance between cost and performance for moderate prescriptions. The trend is moving towards higher index materials as R&D breakthroughs mitigate associated challenges like higher specific gravity and reduced Abbe numbers.

Application segmentation reveals the overwhelming dominance of spectacle lenses, reflecting the sheer volume of global vision correction requirements. Within this segment, single vision, bifocal, and especially progressive addition lenses (PALs) utilize high index monomers to manage edge thickness, reduce visual distortion, and enhance comfort, particularly in complex prescriptions. The utilization in safety and sports eyewear is also growing, where the lightweight nature of high index polymers, combined with their inherent impact resistance (especially polycarbonates or specific polyurethane formulations), offers a superior protective solution compared to traditional materials. This dual benefit of aesthetic appeal and functional performance across various lens types underscores the versatility and indispensable nature of these specialized monomers in modern optical manufacturing processes, allowing lens designers greater freedom in curvature and thickness optimization.

Geographic segmentation is crucial, with the Asia Pacific region being the largest and fastest-growing segment driven by massive demographic shifts related to myopia and expanding domestic lens manufacturing capabilities. Distribution segmentation differentiates between direct sales to large, vertically integrated ophthalmic laboratories and indirect sales through specialized chemical distributors catering to smaller, regional casting houses. This intricate segmentation structure dictates pricing strategies, required material specifications, and regulatory compliance standards across different regions and end-use environments. A thorough understanding of these segments is vital for monomer suppliers aiming to optimize their global supply chain and product portfolio to meet highly localized and specialized demands for high-performance ophthalmic materials.

- By Material Type:

- Polyurethane Monomers (e.g., MR-6, MR-8, primarily 1.60 index)

- Thiourethane Monomers (e.g., MR-7, MR-10, MR-17, 1.67 and 1.74 index)

- Polycarbonate Monomers (Used for specific impact resistance and 1.59 index)

- Epoxy Resin Monomers

- By Refractive Index:

- 1.60 Index

- 1.67 Index

- 1.74 Index and Above

- By Application:

- Spectacle Lenses (Single Vision, Bifocal, Progressive)

- Contact Lenses (Specialty and Extended Wear)

- Safety and Protective Eyewear

- By End-Use Industry:

- Ophthalmic Laboratories

- Integrated Eyewear Retailers

- Safety Equipment Manufacturers

Value Chain Analysis For High Index Lens Monomer Market

The value chain of the High Index Lens Monomer Market is highly specialized and begins with the upstream procurement of essential raw chemical feedstocks, notably sulfur compounds (isocyanates and polythiols), which are crucial for synthesizing high refractive index thiourethane monomers. Upstream analysis involves highly complex organic chemistry processes that require stringent purity control, as minor impurities can significantly compromise the optical integrity (Abbe number and haze) of the final lens. Key suppliers in the upstream segment are typically large, specialized chemical companies with proprietary synthesis patents. The cost and volatility of these specialty raw materials directly impact the final monomer price, making strategic long-term sourcing contracts critical for maintaining competitive pricing and stable supply flow across the entire value chain.

The midstream stage is dominated by the core monomer manufacturers who specialize in the sophisticated polymerization and purification processes, primarily utilizing casting polymerization where the monomer liquid is poured into glass molds and cured under controlled thermal conditions. This stage is capital-intensive and requires high technological expertise. Efficient distribution channels then move the finished monomer (in liquid form, often stored under specific temperature controls) to downstream players. Distribution often relies on both direct sales, particularly to large, multinational ophthalmic corporations that require bulk, custom formulations, and indirect channels via regional chemical distributors who service smaller or specialized regional laboratories and lens casting facilities. The choice of distribution method often reflects the complexity of the monomer and the geographic concentration of the lens manufacturing ecosystem.

Downstream analysis focuses on the ophthalmic lens manufacturers and integrated optical retailers. These entities convert the liquid monomer into finished lenses, applying complex surface treatments (hard coatings, anti-reflective coatings, hydrophobic layers) before distribution to optometrists, ophthalmologists, and retail outlets. Vertical integration, where major lens manufacturers acquire or form deep partnerships with monomer suppliers, is a noticeable trend aimed at securing specialized supply, controlling proprietary formulations, and maintaining quality from chemical synthesis to the final lens product. The performance of the high index monomer directly influences the final lens quality, making the relationship between the monomer producer and the lens finisher paramount in ensuring market acceptance and brand reputation in the highly competitive vision care industry.

High Index Lens Monomer Market Potential Customers

The primary customers for high index lens monomers are businesses engaged in the mass production and finishing of ophthalmic lenses. This segment includes large-scale, international ophthalmic laboratories (e.g., those operated by EssilorLuxottica, Carl Zeiss Vision, and HOYA), which process millions of prescriptions annually and require reliable, bulk supplies of consistent quality monomers across various refractive indices (1.60 to 1.74). These integrated laboratories are typically characterized by high volume, automated production lines that demand monomers optimized for fast, reproducible casting and high compatibility with automated surfacing and coating equipment. Their purchasing decisions are heavily influenced by monomer cost, stability of supply, and technical support regarding process compatibility and achieving desired optical specifications, particularly concerning the Abbe number and UV absorption properties.

Another crucial customer segment involves independent, regional lens casting facilities and smaller, specialized laboratories. These customers often procure monomers through indirect distribution channels (chemical distributors) and focus on niche markets, such as custom-tinted lenses, high-performance sports eyewear, or specialized industrial protective lenses. While their individual volume requirements are lower than global players, they represent a significant aggregate market share and often require greater flexibility in ordering smaller batch sizes and specialized, non-standard monomer formulations. This segment values personalized technical service, rapid response times, and the ability of the monomer to support complex, often hand-finished, lens designs, particularly those involving customized progressive surfaces.

Finally, emerging market manufacturers and government procurement entities represent a growing base of potential customers. As healthcare infrastructure expands in Asia, Latin America, and Africa, local manufacturers are scaling up production to meet domestic demand for affordable yet quality vision correction. These customers seek high index monomers that balance premium performance with cost-effectiveness, favoring widely available and reliable formulations (like 1.60 and 1.67) that offer a good return on investment. The long-term customer base is expanding globally, driven by the need for better visual acuity solutions for an aging and increasingly myopic population, ensuring that the demand for high index monomers, which deliver aesthetic comfort and technical superiority, remains robust across all customer tiers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsui Chemicals, PPG Industries, SDC Technologies (Makers of MR series monomers), Wanhua Chemical Group Co. Ltd., Mitsubishi Gas Chemical Company Inc., Kowa Company Ltd., Tokuyama Corporation, Chemix Global Co., Ltd., Seiko PMC Corporation, Ajinomoto Fine-Techno Co., Inc., Evonik Industries AG, The Dow Chemical Company, Huntsman Corporation, Covestro AG, Jiangsu Liansheng Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Index Lens Monomer Market Key Technology Landscape

The technology landscape for the High Index Lens Monomer Market is characterized by continuous refinement of polymer synthesis and casting techniques, aiming primarily to enhance the refractive index while mitigating the inverse relationship with the Abbe number (optical clarity). The proprietary technology centers around the synthesis of polythiourethane and polyurethane derivatives that incorporate high concentrations of sulfur, a heavy element that increases the refractive capability of the final polymer. Manufacturers focus heavily on optimizing the molecular weight distribution and cross-linking density of these polymers. Advanced monomer synthesis involves highly controlled multi-step reactions utilizing specialty raw materials such as proprietary isocyanates and polythiol compounds. These patented formulations are the core intellectual property that differentiates key market players, enabling them to offer monomers like the MR series (MR-8, MR-10, MR-17) which are industry benchmarks for performance and consistency.

The lens manufacturing process itself relies critically on precision casting polymerization. This technology involves pouring the liquid monomer into specialized glass molds and subjecting it to meticulously controlled thermal cycles (curing). Technological advancements here focus on optimizing the initiator systems and curing profiles to ensure uniform polymerization, minimize shrinkage, and eliminate internal stress that could lead to birefringence or defects, especially in ultra-high index (1.74) materials which are more susceptible to these issues. Furthermore, the integration technology of performance coatings represents another vital segment. Monomer suppliers must ensure their materials are chemically compatible with subsequent hard coatings (anti-scratch) and anti-reflective layers. Recent innovations involve developing monomers that intrinsically absorb harmful UV and blue light, reducing reliance on surface-applied filters and simplifying the downstream lens finishing process for ophthalmic laboratories, thereby improving overall product quality and durability.

Emerging technology trends include the investigation into high-throughput screening and combinatorial chemistry, often facilitated by AI, to rapidly test thousands of potential high index monomer formulations. Furthermore, novel polymerization techniques, such as UV curing or injection molding adaptation for specific high index materials (though casting remains dominant), are being explored to improve production throughput and reduce energy consumption. The push for bio-based monomers derived from sustainable sources, while still nascent due to performance constraints, represents a significant area of future technological focus driven by increasing regulatory and consumer pressure for greener chemical solutions in the optical industry. Ultimately, the successful development and commercialization of new high index monomers rely on overcoming the complex technical challenge of simultaneously optimizing the refractive index, specific gravity, Abbe number, and compatibility with advanced lens surface treatments.

Regional Highlights

The global demand for High Index Lens Monomers is highly concentrated across three major regions: Asia Pacific (APAC), North America, and Europe, with each region presenting unique drivers and consumer preferences.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally for high index monomers, primarily driven by the region's demographic crisis related to myopia. Countries like China, India, and South Korea exhibit high rates of myopia prevalence, necessitating high-power correction lenses, thereby creating immense volume demand for 1.67 and 1.74 index monomers. Furthermore, APAC is the world's major manufacturing hub for ophthalmic lenses, housing numerous large-scale casting facilities and finished lens suppliers, which translates directly into high consumption of raw chemical monomers. Economic expansion and rising middle-class disposable income also contribute to the shift towards premium, aesthetically pleasing, thin lenses.

- North America: North America represents a mature and technologically advanced market characterized by high consumer awareness and a willingness to pay a premium for technologically superior products. Demand here is strongly focused on high-quality, specialty applications, including integrated features such as anti-blue light filtering, photochromic capabilities, and superior hard coatings incorporated into high index lenses. The strong presence of leading optical chains and independent optometrists who actively promote premium lens options ensures stable, high-value demand for MR-8 and MR-17 type monomers. Adoption is also bolstered by robust healthcare infrastructure and high standards for occupational safety eyewear.

- Europe: The European market is highly regulated and emphasizes quality and environmental sustainability. Demand for high index monomers is substantial, driven by an aging population increasing the need for sophisticated progressive addition lenses (PALs). European consumers often prioritize optical clarity (high Abbe number) and durability, leading to a strong preference for balanced monomers (like 1.60 and 1.67 index materials). The region is also at the forefront of adopting bio-based or greener polymer alternatives, positioning it as a key area for R&D related to sustainable high index materials.

- Latin America and Middle East & Africa (LAMEA): These regions are emerging markets with significant untapped potential. Growth is accelerating due to improving economic conditions, expanding access to basic eye care, and increasing penetration of large international optical retailers. While currently dominated by entry-level high index materials (1.60 index) and standard CR-39, the increasing urbanization and adoption of modern eyewear trends suggest a rapid future transition towards ultra-thin 1.67 and 1.74 monomers, making them critical targets for future market expansion strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Index Lens Monomer Market.- Mitsui Chemicals, Inc.

- PPG Industries, Inc.

- SDC Technologies, Inc. (Makers of MR series monomers)

- Wanhua Chemical Group Co. Ltd.

- Mitsubishi Gas Chemical Company Inc.

- Kowa Company Ltd.

- Tokuyama Corporation

- Chemix Global Co., Ltd.

- Seiko PMC Corporation

- Ajinomoto Fine-Techno Co., Inc.

- Evonik Industries AG

- The Dow Chemical Company

- Huntsman Corporation

- Covestro AG

- Jiangsu Liansheng Chemical Co., Ltd.

- Shanghai Sino-Pharm Science and Technology Development Co., Ltd.

- Guangzhou Kaida Chemical Co., Ltd.

- TOSOH CORPORATION

- BASF SE

Frequently Asked Questions

Analyze common user questions about the High Index Lens Monomer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of high index lens monomers over traditional materials?

The primary technical advantage is the high refractive index (typically 1.60 up to 1.74+), which significantly reduces the center thickness of positive lenses and the edge thickness of negative lenses, resulting in substantially thinner, lighter, and more aesthetically appealing eyewear, particularly for strong prescriptions. This reduction in material volume enhances wearer comfort.

Which monomer type dominates the market for ultra-high refractive indices (1.74 and above)?

Thiourethane monomers, often sulfur-containing polyurethane derivatives such as the MR-17 series, dominate the ultra-high index segment (1.74 and above). Their chemical structure allows for maximized light bending capability, although manufacturers must employ advanced synthesis techniques to minimize the corresponding reduction in the Abbe number.

How does the Abbe number impact the performance of high index lenses?

The Abbe number is critical as it measures the material's ability to disperse light (chromatic aberration). Higher Abbe numbers are desirable for superior optical clarity. High index monomers inherently have lower Abbe numbers, making material selection and lens design crucial to minimize visible color fringing, especially towards the lens periphery.

What role do Asia Pacific countries play in the High Index Lens Monomer market growth?

Asia Pacific is the largest consumption and production region, driven by the epidemic prevalence of myopia requiring high-power lens prescriptions. The region also hosts major global lens manufacturing facilities, creating massive bulk demand for high index monomers to serve both regional and global optical supply chains.

What are the key restraints affecting the market profitability of high index lens monomers?

The primary restraints include the high production cost stemming from expensive, specialty sulfur-containing raw chemical feedstocks, and the inherently complex, capital-intensive casting polymerization process required to achieve consistent, high optical quality with these advanced materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager