High Intensity Discharge (HID) Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433424 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

High Intensity Discharge (HID) Lighting Market Size

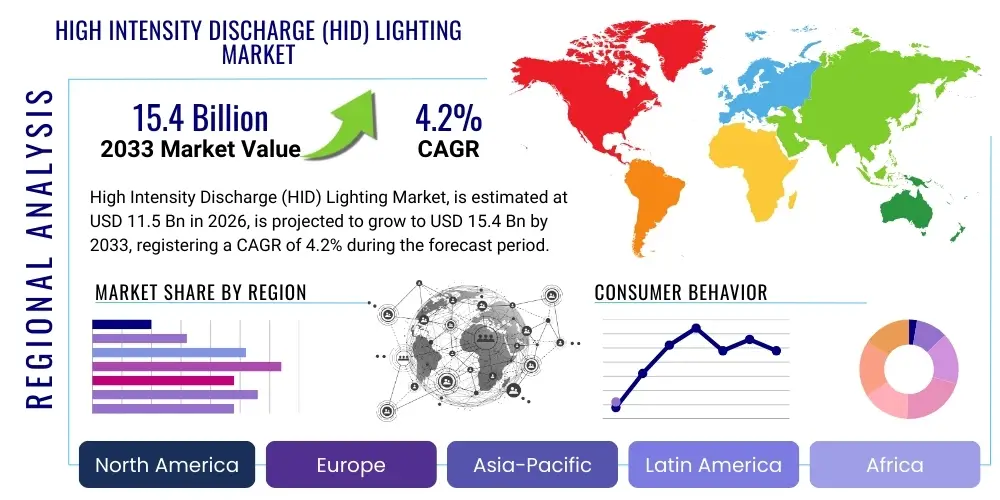

The High Intensity Discharge (HID) Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 15.4 Billion by the end of the forecast period in 2033.

High Intensity Discharge (HID) Lighting Market introduction

The High Intensity Discharge (HID) lighting market encompasses a variety of lamp types, including Metal Halide, High-Pressure Sodium (HPS), and Mercury Vapor lamps, which produce light through an electric arc between tungsten electrodes housed within a translucent or transparent fused quartz or fused alumina arc tube. These systems require a ballast to regulate the power supply and initiate the high-voltage arc necessary for operation. HID technology is distinguished by its high luminous efficacy—providing substantially more light per watt of electricity consumed compared to traditional incandescent or even early fluorescent sources—making it suitable for applications demanding high light output over large areas.

Major applications of HID lighting traditionally span outdoor and industrial environments, such as street lighting, parking lots, warehouses, large retail facilities, sports arenas, and automotive headlamps. The inherent strength of HID technology lies in its long lifespan and robust performance under challenging conditions. While the market faces significant competitive pressure from advanced LED solutions, HID lighting maintains niche dominance due to specific spectral requirements (especially in horticulture with HPS) and in legacy infrastructure where replacement costs favor continued HID usage. The benefits include superior light penetration, relatively low maintenance costs once installed, and excellent energy conversion efficiency compared to older lighting standards.

Key driving factors supporting the market, despite the LED transition, include the continuing demand for HPS lamps in the agricultural sector for optimal plant growth spectrums, the established installed base requiring replacement parts (aftermarket demand), and cost-effectiveness in certain high-wattage industrial applications where initial investment in high-power LED systems remains prohibitively high. Furthermore, specialized applications such as explosion-proof lighting and high-mast illumination still frequently utilize robust HID systems due to their proven reliability in harsh environments.

High Intensity Discharge (HID) Lighting Market Executive Summary

The global High Intensity Discharge (HID) Lighting Market is characterized by strategic deceleration in new installations in favor of LED, yet it maintains a robust aftermarket and specialty segment growth driven by infrastructure replacement cycles and high-intensity niche applications. Business trends indicate a shift in manufacturing focus toward optimizing existing HID product lines for longevity and spectral accuracy, rather than radical innovation, concurrently with increased investment in smart ballasts and control systems to improve HID energy efficiency and extend operational lifespan, mitigating immediate replacement pressure from solid-state lighting (SSL). Manufacturers are strategically focusing on providing comprehensive service and maintenance contracts for existing large-scale HID installations, securing consistent revenue streams from parts and labor.

Regionally, the market dynamics vary significantly; developed regions like North America and Europe are rapidly migrating toward LED, positioning the HID market predominantly as an aftermarket parts supply business, particularly strong in municipal lighting and large industrial complexes built prior to 2015. Conversely, emerging markets in Asia Pacific (APAC) and parts of Latin America still see moderate adoption of new HID installations in infrastructure and burgeoning industrial zones due to lower initial capital expenditure requirements compared to advanced LED infrastructure. APAC is particularly critical due to its vast installed base of HPS street lighting and significant demand for Metal Halide lamps in fast-growing industrial sectors.

Segment trends reveal that Metal Halide lamps hold a significant share due to their use in architectural, retail, and sports lighting where high Color Rendering Index (CRI) is essential, although this segment faces the most direct competition from LED. High-Pressure Sodium (HPS) lamps, known for their efficiency and orange-yellow light spectrum, dominate the agricultural and greenhouse lighting segment, an area experiencing stable growth driven by global food demand and controlled environment agriculture (CEA). The aftermarket segment, which includes replacement lamps and electronic ballasts, is crucial for market resilience, cushioning the impact of declining new installation sales by ensuring long-term operational support for existing infrastructure.

AI Impact Analysis on High Intensity Discharge (HID) Lighting Market

User queries regarding AI's impact on the HID lighting market frequently revolve around its potential to optimize energy usage in large-scale legacy HID systems and to predict maintenance failures, extending the operational life of installed infrastructure. Users are concerned about whether AI-driven predictive maintenance could make existing HID assets viable for longer periods, delaying the necessary transition to LED. Key themes center on optimizing ballast performance, dynamically adjusting light output based on real-time environmental data (e.g., fog, traffic density), and integrating legacy HID systems into broader smart city networks through AI-enabled control modules, thereby justifying the continued use of high-lumen HID sources in specific applications where LED conversion is structurally or economically difficult. The expectations are primarily centered on extending efficiency and lifetime, rather than leveraging AI for core HID product innovation.

The integration of AI and machine learning (ML) primarily targets the control and management layer of HID systems, rather than the light source itself. AI algorithms are being deployed in sophisticated electronic ballasts to monitor lamp degradation, analyze power consumption patterns, and autonomously adjust voltage and frequency to maximize efficacy and minimize premature failure. This analytical capability allows facility managers to shift from scheduled maintenance to predictive maintenance, dramatically reducing operational expenditure (OpEx) and extending the useful life of costly infrastructure, which is a major factor in determining the return on investment (ROI) for delayed LED conversion. AI-driven systems also facilitate dynamic lighting schedules based on occupancy or environmental monitoring, ensuring that HID systems are only operating at peak intensity when necessary, thus significantly enhancing energy conservation in large installations like ports, rail yards, and specialized industrial facilities.

- AI-powered predictive maintenance: Utilizes sensor data to forecast ballast and lamp failure, minimizing unexpected downtime and optimizing replacement cycles.

- Dynamic energy optimization: ML algorithms analyze environmental conditions and historical usage to adjust HID light intensity dynamically, reducing unnecessary power consumption.

- Smart infrastructure integration: Enables legacy HID systems to communicate within broader IoT and Smart City frameworks via specialized AI-enabled control modules.

- Automated spectral calibration: AI assists in monitoring and maintaining specific spectral outputs required for niche applications, particularly in horticulture (HPS) and specialized industrial imaging.

- Inventory management efficiency: Predicts demand for specific HID replacement parts based on geographical distribution and system aging data, streamlining the aftermarket supply chain.

DRO & Impact Forces Of High Intensity Discharge (HID) Lighting Market

The High Intensity Discharge (HID) Lighting Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively define the Impact Forces on its structure and trajectory. The primary driver is the necessity of maintaining the vast existing global installed base, which ensures steady demand for replacement lamps and advanced ballasts, particularly in developing economies where the upfront cost of full LED conversion remains prohibitive for municipal budgets. Opportunities arise from specialized applications such as controlled environment agriculture (CEA), where High-Pressure Sodium (HPS) lamps offer optimal spectral output for specific crops, creating stable niche market growth insulated from general lighting conversion trends. Additionally, the development of sophisticated electronic ballasts that enhance the energy efficiency and dimming capabilities of HID lamps provides a temporary bridge solution, prolonging their relevance in industrial settings.

Conversely, the most significant restraint is the aggressive global transition toward highly energy-efficient and long-lasting Light Emitting Diode (LED) technology, strongly supported by government regulations promoting energy conservation and phase-outs of older, less efficient lighting sources (e.g., Mercury Vapor restrictions). LED technology offers superior lifespan, instant on/off capability, precise dimming control, and better environmental performance (no mercury), directly challenging HID's competitive advantages. The impact forces show a market structure moving toward a dual state: consolidation and decline in general illumination, offset by strategic persistence and innovation within highly specialized segments such as high-mast, horticultural, and specialized automotive aftermarket lighting.

The overarching impact forces indicate that the market is undergoing a managed decline in volume but is experiencing growth in value within high-margin specialty components and integrated control solutions. The market structure is shifting from a mass-market commodity orientation to a specialized, service-oriented aftermarket that focuses on optimizing legacy assets. Environmental regulations and technological obsolescence exert strong downward pressure, while the established asset base and unique spectral requirements provide stabilizing upward forces in specific vertical markets.

Segmentation Analysis

The High Intensity Discharge (HID) Lighting Market is extensively segmented based on Lamp Type, Component, Application, and Geographic region, reflecting the diverse end-user requirements and the ongoing technological shifts within the industry. Understanding these segments is crucial for manufacturers focusing on specific revenue streams—for instance, targeting the growing agricultural sector with High-Pressure Sodium lamps or catering to the industrial aftermarket with robust Metal Halide replacement components. The segmentation highlights the market's transition from a volume-driven business in general lighting to a value-driven focus on specialized and maintenance components.

Segmentation by Lamp Type provides insight into where HID technology maintains its competitive edge; while Metal Halide (MH) offers high quality white light for commercial interiors and sports venues, HPS is indispensable for high luminous efficacy in street lighting and horticulture, where spectral quality is more critical than color rendering. Component segmentation underscores the importance of the peripheral electronics; the ballast segment, particularly electronic ballasts capable of smarter control, represents a significant growth area as infrastructure owners seek to modernize existing HID fixtures without full lamp replacement. This detailed breakdown ensures targeted marketing and R&D efforts in areas where HID technology remains technically superior or economically feasible compared to competing light sources.

- Lamp Type:

- Metal Halide (MH) Lamps

- High-Pressure Sodium (HPS) Lamps

- Mercury Vapor Lamps (Declining)

- Xenon Lamps (Primarily Automotive and Specialty)

- Component:

- Lamps/Bulbs (Replacement and New)

- Ballasts (Magnetic and Electronic)

- Ignitors

- Capacitors

- Fixtures/Luminaires

- Application:

- Automotive Lighting (Headlamps, Aftermarket Kits)

- Industrial Lighting (Warehouses, Factories, Ports)

- Street and Roadway Lighting

- Horticultural Lighting (Greenhouses, Controlled Environment Agriculture - CEA)

- Sports & Stadium Lighting

- Architectural and Commercial Lighting

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For High Intensity Discharge (HID) Lighting Market

The value chain for the HID lighting market begins with the upstream raw material suppliers, including highly specialized manufacturers of fused quartz, fused alumina ceramics, tungsten electrodes, and various metal halide salts (e.g., sodium iodide, thallium iodide, scandium iodide) that form the core components of the arc tube. Given the precision required for lamp manufacturing, upstream operations are highly capital-intensive and concentrated among a few specialized chemical and material processing firms. Quality control at this stage is paramount, as the purity of the materials directly impacts the light output, efficacy, and lifespan of the final HID product. Ballast manufacturing represents a parallel upstream segment, requiring sophisticated electronic components, magnetics, and heat dissipation materials, increasingly focusing on smart, electronic ballast technology to enhance lamp performance.

The midstream involves manufacturing, assembly, and testing of the final HID lamps and fixtures. Manufacturers consolidate materials and components, applying advanced sealing, vacuum, and gas-filling processes. Downstream activities are dominated by distribution channels, which are bifurcated into direct sales and indirect sales structures. Direct channels are typically utilized for large infrastructure projects (e.g., municipal street lighting contracts, new stadium construction) where volume discounts and technical consultation are required. Indirect distribution relies heavily on electrical wholesalers, specialized lighting distributors, and, critically, the automotive aftermarket supply chain, which distributes replacement lamps and conversion kits to retail outlets and independent garages globally.

The aftermarket focus defines the current distribution landscape; as new HID installation projects decline, the efficiency of the indirect replacement parts network becomes the primary determinant of market success. Specialized distributors who maintain comprehensive inventories of older, less common lamp types and legacy ballasts are essential. E-commerce platforms are also gaining traction, particularly in the automotive HID replacement segment, offering consumers direct access to high-performance Xenon and Metal Halide bulbs. This dual structure ensures that both large-scale industrial consumers and individual end-users can access necessary components for maintenance.

High Intensity Discharge (HID) Lighting Market Potential Customers

Potential customers for the High Intensity Discharge (HID) Lighting Market primarily fall into four distinct categories: infrastructure owners requiring robust outdoor lighting, specialized agricultural operations, industrial facilities with high-bay needs, and the pervasive automotive aftermarket. Municipal governments and state transportation departments remain major buyers, not necessarily for new installations, but crucially for maintaining and upgrading existing street lighting networks and tunnel illumination systems built over the last four decades. These entities prioritize component reliability and standardization, favoring suppliers who can commit to long-term supply agreements for HPS and MH replacement lamps and compatible electronic control gear.

The industrial sector, including logistics centers, manufacturing plants, port authorities, and utility providers, forms a significant end-user base. These buyers often utilize high-wattage Metal Halide systems in high-bay applications where the initial cost of equivalent high-power LED fixtures is still disproportionately high, or where specific color temperature requirements for tasks like quality inspection must be met. Furthermore, specialized end-users like professional sports venue operators continue to employ HID for floodlighting due to its mature technology base, uniform light distribution over extreme distances, and proven performance in broadcasting environments, though migration to high-power LED is accelerating in this segment.

Crucially, the agricultural sector, specifically commercial greenhouse and Controlled Environment Agriculture (CEA) operators, relies heavily on High-Pressure Sodium (HPS) lamps. HPS lamps provide a highly specific light spectrum (red and far-red) proven to maximize vegetative and flowering growth in many crop types. These buyers are focused entirely on spectral efficiency and crop yield optimization, viewing HPS as a critical tool that is currently difficult and expensive to replicate perfectly with solid-state lighting, thus securing a highly loyal and growing customer segment for the HID industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 15.4 Billion |

| Growth Rate | 4.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OSRAM, Philips Lighting (Signify), General Electric (GE Lighting), Acuity Brands, Eaton, Ushio Inc., Advanced Lighting Technologies (ADLT), Larson Electronics, Hubbell, Sylvania (LEDVANCE), Iwasaki Electric, Eye Lighting International, Venture Lighting, NVC Lighting, Shanghai Yaming Lighting, TCP International Holdings, Wipro Lighting, Hella KGaA Hueck & Co., Koito Manufacturing Co., Ltd., Zizala Lichtsysteme GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Intensity Discharge (HID) Lighting Market Key Technology Landscape

The technological landscape of the HID lighting market, while mature, is not static; innovation is primarily focused on enhancing the performance and longevity of peripheral components, specifically the ballast technology, and improving the spectral consistency of the lamps. Current developments prioritize the shift from traditional magnetic ballasts, which are heavy and inefficient, to compact, high-frequency electronic ballasts. These electronic ballasts offer superior regulation of lamp power, allowing for better efficiency, extended lamp life by minimizing electrode wear, and crucial features like dimming and hot-restrike capabilities. The ability to dim HID lamps, previously a significant disadvantage compared to LEDs, allows facility managers to comply with energy conservation mandates while maintaining the installed infrastructure.

In terms of lamp technology, advancements include Pulse Start Metal Halide lamps, which offer faster warm-up times, improved color stability, and significantly extended service life compared to older probe-start designs. Ceramic Metal Halide (CMH) technology represents a premium segment, utilizing ceramic arc tubes instead of traditional quartz glass. CMH lamps provide excellent color rendering (CRI above 80) and superior color uniformity throughout their operational life, making them highly desirable for high-end retail and specialized horticultural applications where precise spectral output is necessary. These incremental improvements in CMH and pulse-start technology are crucial for defending market share against high-quality LED alternatives.

Furthermore, technology integration involves incorporating microprocessors and IoT connectivity into HID systems. This enables remote monitoring of ballast performance, energy consumption tracking, and automated fault reporting, effectively integrating legacy HID infrastructure into modern smart lighting grids. These smart controls, often powered by AI algorithms for predictive maintenance, represent the future of HID asset management, focusing on maximizing the utility and lifespan of existing, costly infrastructure. The technological focus is therefore centered on control systems that mitigate the inherent energy inefficiency of the light source itself.

Regional Highlights

Regional dynamics within the High Intensity Discharge (HID) Lighting Market are highly divergent, primarily driven by the pace of governmental regulation and the maturity of existing infrastructure. North America and Europe are leading the transition to LED, catalyzed by strict energy efficiency standards and mandates (such as the EU's Ecodesign Directive). Consequently, the HID market in these regions is heavily focused on aftermarket sales—replacement lamps, high-performance ballasts, and niche applications like specialized horticulture and automotive parts. While new installations are minimal, the sheer scale of the historical installed base ensures a profitable, albeit shrinking, market for maintenance components, positioning regional suppliers as expertise centers for legacy system support and optimization.

Asia Pacific (APAC) stands out as the largest and most dynamic region for the HID market. While major economies like China and Japan are accelerating LED adoption in urban centers, vast areas of India, Southeast Asia, and remote industrial zones still rely on HID lighting, particularly HPS for street lighting and Metal Halide for high-mast industrial illumination, driven by budget constraints and the need for rapid infrastructure deployment. Furthermore, APAC is a massive manufacturing hub for both HID lamps and components, supplying the global aftermarket. The region exhibits a slower, more phased transition compared to the West, offering continued moderate growth opportunities for specialized HID products, especially within the rapidly expanding agricultural technology sector which heavily utilizes HPS lighting.

Latin America and the Middle East & Africa (MEA) represent opportunity zones where cost-effectiveness remains a powerful driver. Many municipalities in these regions prioritize low initial capital expenditure, making HID systems an attractive, reliable option for street and public area lighting. The lack of stringent immediate regulatory pressure, combined with ongoing infrastructure development, supports sustained, moderate adoption of HID technology. Suppliers focusing on robust, standard HPS and MH systems, coupled with basic magnetic ballast technology for simplicity and repairability, find significant traction in these markets, creating localized pockets of demand that offset global trends toward solid-state lighting.

- North America: Focuses heavily on aftermarket maintenance, specialized automotive HID (Xenon), and high-efficiency horticultural lighting systems (HPS for controlled growing operations).

- Europe: Driven by strong regulatory phase-outs, the market is characterized by high demand for smart electronic ballasts to improve energy efficiency of existing MH installations prior to full LED conversion.

- Asia Pacific (APAC): The largest consumer market, fueled by ongoing infrastructure projects in developing economies and dominant manufacturing capacity; exhibits high demand for replacement parts across all sectors.

- Latin America: Characterized by sustained demand for cost-effective HPS and MH solutions in municipal and industrial lighting, favoring low initial investment costs over long-term energy savings.

- Middle East & Africa (MEA): Growth driven by large-scale infrastructure and industrial projects (ports, oil fields) requiring robust, high-lumen lighting solutions, where HID reliability is highly valued.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Intensity Discharge (HID) Lighting Market.- Signify N.V. (formerly Philips Lighting)

- OSRAM GmbH

- Acuity Brands, Inc.

- General Electric Company (GE Lighting)

- Eaton Corporation plc

- Ushio Inc.

- Advanced Lighting Technologies (ADLT)

- Hubbell Incorporated

- LEDVANCE GmbH (Sylvania)

- Iwasaki Electric Co., Ltd.

- Eye Lighting International of North America

- Venture Lighting International

- NVC Lighting Technology Corporation

- Luminator Technology Group

- Hella KGaA Hueck & Co.

- Koito Manufacturing Co., Ltd.

- TCP International Holdings Ltd.

- Zizala Lichtsysteme GmbH

- Wipro Lighting

- Shanghai Yaming Lighting Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the High Intensity Discharge (HID) Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining the growth of the HID Lighting Market?

The rapid technological maturation and adoption of Light Emitting Diode (LED) technology is the chief restraint. LEDs offer significantly superior energy efficiency, extended operational lifespan, minimal maintenance costs, and better environmental performance compared to traditional HID lamps, leading to aggressive replacement programs globally.

In which application sector does HID lighting maintain a competitive advantage over LED?

The horticultural lighting segment, particularly Controlled Environment Agriculture (CEA), remains a strong area for High-Pressure Sodium (HPS) HID lamps. HPS lamps deliver a highly specific spectrum (rich in yellow/red light) that is proven optimal for plant growth and flowering, often making them more cost-effective and spectrally accurate for growers than current high-power LED alternatives.

How are manufacturers extending the relevance of existing HID infrastructure?

Manufacturers are innovating primarily in the control components, transitioning from older magnetic ballasts to sophisticated electronic ballasts. These new ballasts enable features like precise dimming, remote monitoring, integration with IoT systems, and predictive maintenance algorithms, enhancing the energy efficiency and prolonging the useful life of existing HID fixtures.

What is the role of the aftermarket in the current HID market structure?

The aftermarket—comprising replacement lamps, ballasts, and ignitors—is critical and accounts for the majority of current market revenue. Due to the massive installed base of HID lighting globally, especially in municipal and industrial infrastructure, there is a consistent and non-negotiable demand for replacement components to keep existing systems operational before full-scale LED conversion occurs.

What are the key types of HID lamps and their common uses?

The primary types are Metal Halide (MH), valued for high Color Rendering Index (CRI) in sports and commercial lighting; High-Pressure Sodium (HPS), used extensively for high luminous efficacy in street lighting and horticulture; and Xenon, which is predominantly used in the high-performance automotive headlamp sector due to its instant-on capability and bright light output.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager