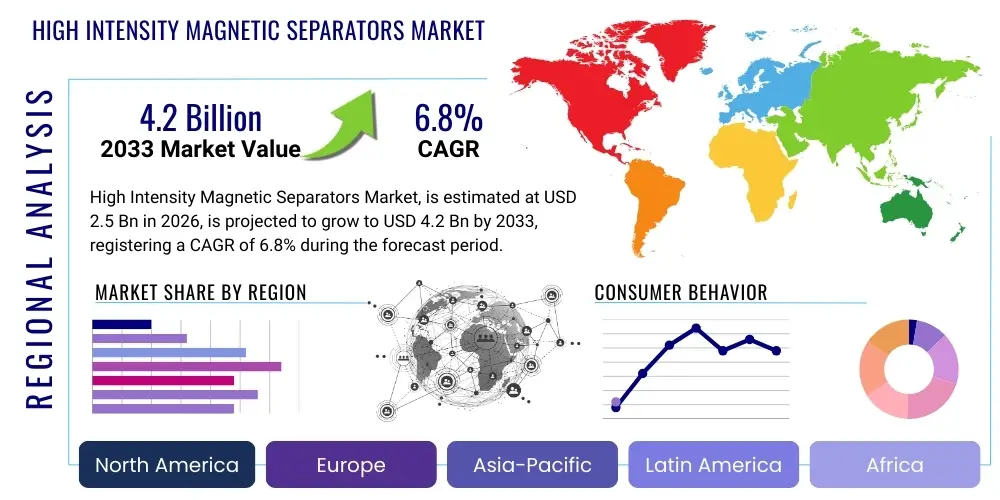

High Intensity Magnetic Separators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439083 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

High Intensity Magnetic Separators Market Size

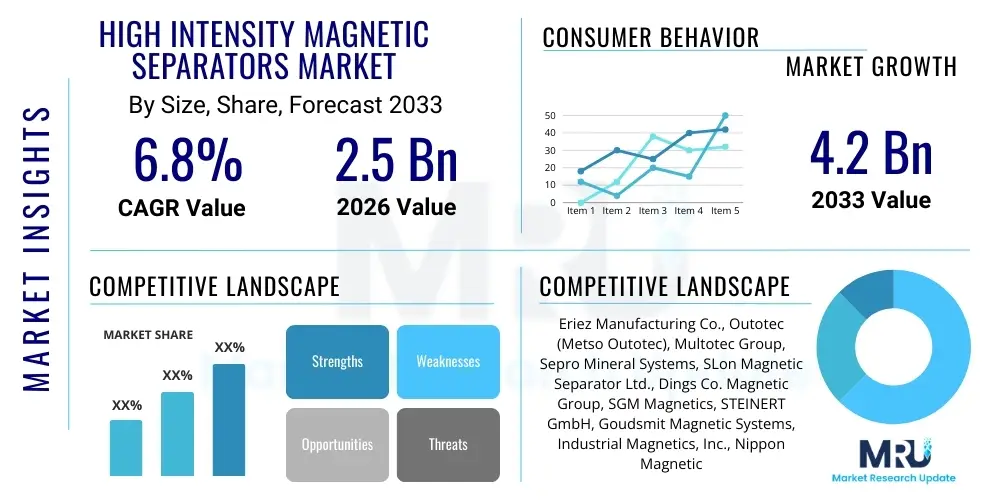

The High Intensity Magnetic Separators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033.

High Intensity Magnetic Separators Market introduction

High Intensity Magnetic Separators (HIMS) are specialized industrial equipment designed to remove weakly magnetic, fine particulate contaminants from bulk materials. These separators utilize powerful magnetic fields, often exceeding 1 Tesla, generated by permanent magnets or electromagnets, including superconducting variants, to purify non-magnetic substances. The operational principle relies on inducing a magnetic moment in weakly paramagnetic particles, enabling their deflection and separation from the bulk flow. This technology is critical across several heavy industries where product purity and resource recovery are paramount.

The primary applications of HIMS span mineral processing, particularly the beneficiation of iron ore, tantalite, and rare earth minerals; recycling operations for recovering valuable metals; and rigorous quality control in food, chemical, and pharmaceutical manufacturing. High efficiency in separating extremely fine materials, which conventional low-intensity separators cannot handle, defines the product's unique value proposition. HIMS units are integral in achieving stringent quality specifications for end products, improving efficiency in downstream processing, and minimizing waste.

Market growth is substantially driven by the global surge in demand for high-purity minerals, especially those crucial for renewable energy technologies and electronics, such as lithium, cobalt, and various rare earth elements. Furthermore, tightening environmental regulations mandate superior quality control and increased recycling rates, necessitating advanced separation technologies like HIMS. Technological advancements leading to more energy-efficient and powerful separator designs also contribute to broader adoption across previously challenging applications, cementing HIMS's role as a cornerstone technology in modern material processing.

High Intensity Magnetic Separators Market Executive Summary

The global High Intensity Magnetic Separators market is characterized by robust expansion, primarily fueled by unprecedented demand from the mining sector, which seeks enhanced efficiency in processing lower-grade ore bodies. Key business trends include a significant shift towards dry separation technologies to reduce water consumption and operating costs, alongside the proliferation of automated and sensor-based HIMS systems for real-time optimization. Leading manufacturers are focusing heavily on developing superconducting magnetic separators, offering superior field gradients and energy efficiency, particularly for high-throughput operations in rare earth element extraction and iron ore beneficiation, establishing a premium segment within the market.

Regionally, the Asia Pacific (APAC) area dominates the market both in consumption and production capacity, driven by rapid industrialization, massive infrastructure projects, and the presence of abundant mineral reserves in countries like China, India, and Australia. North America and Europe, while representing mature markets, exhibit strong growth in the recycling and advanced materials sectors, focusing on incorporating high-tech separation for electronic waste (e-waste) and specialized chemical processing. Regulatory harmonization regarding mineral quality and environmental impact globally further accelerates the adoption of high-efficiency HIMS units across all major geographical regions.

In terms of segmentation, the Wet High Intensity Magnetic Separators (WHIMS) segment currently holds the largest market share due to its established efficacy in slurry processing and mineral sand treatment. However, the Dry High Intensity Magnetic Separators (DHIMS) segment is projected to exhibit the fastest growth, benefiting from lower energy requirements and suitability for arid mining environments. Application-wise, the mining and mineral processing category remains the dominant revenue generator, but the recycling and non-metallic mineral industries are experiencing accelerated growth rates, indicating diversification in HIMS utilization beyond traditional mining contexts.

AI Impact Analysis on High Intensity Magnetic Separators Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the performance and operational efficiency of HIMS technology, specifically focusing on predictive maintenance, optimizing separation parameters, and integrating sensor data for quality control. Concerns often center on the complexity of implementing AI models in harsh industrial environments and the requisite data infrastructure investment. The consensus expectation is that AI will move HIMS from standardized, fixed-parameter operation to adaptive, real-time optimized systems, capable of adjusting magnetic field strength and throughput based on immediate changes in feed material characteristics. This transition promises to significantly boost recovery rates, reduce energy consumption, and minimize unexpected equipment downtime across mineral and materials processing facilities globally.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms on sensor data (vibration, temperature, current) to anticipate component failures (e.g., matrix blockage, coil degradation), drastically reducing unplanned outages.

- Real-time Process Optimization: Implementation of AI models to continuously adjust slurry density, feed rate, and magnetic field intensity based on inline analysis of material composition, maximizing yield and purity instantly.

- Enhanced Quality Control: Integration of computer vision and spectroscopic sensors with AI to precisely monitor the purity of separated fractions, ensuring compliance with strict industrial specifications without manual intervention.

- Automated Fault Diagnosis: Deploying expert systems to rapidly identify operational anomalies and recommend corrective actions, improving throughput stability and decreasing reliance on highly specialized operators.

- Energy Efficiency Management: AI optimizing the duty cycle and power consumption of electromagnets based on variable load and desired separation efficiency, leading to substantial reductions in overall energy use.

DRO & Impact Forces Of High Intensity Magnetic Separators Market

The High Intensity Magnetic Separators market is strongly influenced by increasing global demand for high-purity industrial materials, particularly rare earth elements (REEs) and battery minerals, serving as the primary driver. Simultaneously, strict environmental regulations concerning waste reduction and efficient resource utilization compel industries to adopt superior separation technologies, further boosting HIMS demand. However, the high initial capital expenditure associated with installing HIMS units, especially superconducting variants, and the technical complexities involved in maintaining the magnetic systems act as significant restraints, potentially limiting adoption among smaller mining operations. Opportunities are abundant in developing markets, where urbanization drives infrastructure development, necessitating advanced mineral processing equipment, and within the expanding field of e-waste recycling, where efficient metal recovery is critical. The market is also heavily impacted by the cyclical nature of commodity prices, which directly affects mining investment, and by technological advancements in magnetic materials leading to lighter, more powerful permanent magnet designs.

Segmentation Analysis

The High Intensity Magnetic Separators market is intricately segmented based on technology type, material characteristics, operational mechanism, and primary application areas. This segmentation allows for a nuanced understanding of market dynamics, revealing specific growth pockets driven by distinct industrial requirements. The technological division primarily differentiates between Wet High Intensity Magnetic Separators (WHIMS) and Dry High Intensity Magnetic Separators (DHIMS), reflecting the industry's need for solutions tailored to either slurry-based or powder/granular material processing. The efficiency, cost of operation, and required purity level dictate the selection between these primary types, with DHIMS gaining momentum due to water scarcity concerns and energy-saving capabilities. Further segmentation based on magnet type—Permanent Magnet, Electromagnet, and Superconducting Magnet—highlights the differing levels of magnetic field strength and capital investment associated with each technology.

The application segmentation is crucial, demonstrating the broad utility of HIMS beyond traditional metal mining. While iron ore and non-ferrous metal beneficiation remain significant revenue streams, the rapid expansion of applications in specialized sectors, such as ceramics, glass purification (removing iron contamination), chemical manufacturing, and pharmaceutical ingredient preparation, necessitates bespoke separation solutions. The demand for ultra-pure feedstocks in high-tech manufacturing, particularly semiconductors and advanced batteries, mandates increasingly precise separation, driving demand for the highest intensity units. This diversification across high-value, non-traditional sectors ensures market resilience against fluctuations in commodity markets.

Geographic segmentation underscores the disparity in adoption rates and technological maturity globally. APAC leads owing to its extensive mining activities and manufacturing base, while North America and Europe prioritize technological refinement and applications in complex recycling scenarios (e-waste). Understanding these segments is vital for manufacturers to align their product development strategies—for instance, focusing on robust, high-throughput WHIMS for iron ore in Brazil and Australia, while emphasizing compact, high-precision DHIMS for advanced materials processing in Germany or Japan.

- By Type:

- Wet High Intensity Magnetic Separators (WHIMS)

- Dry High Intensity Magnetic Separators (DHIMS)

- Superconducting Magnetic Separators (SCMS)

- By Magnet Technology:

- Permanent Magnetic Separators

- Electromagnetic Separators

- Superconducting Magnetic Separators

- By Application:

- Mining and Mineral Processing

- Iron Ore Beneficiation

- Rare Earth Elements (REE) Extraction

- Non-Ferrous Metals (Tantalum, Tungsten)

- Mineral Sands

- Industrial Minerals and Ceramics

- Recycling (E-waste, Scrap Metal)

- Chemical and Pharmaceutical Industry

- Food Processing and Purification

- Mining and Mineral Processing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, India, Japan, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (South Africa, Saudi Arabia)

Value Chain Analysis For High Intensity Magnetic Separators Market

The value chain for the High Intensity Magnetic Separators market begins with upstream material procurement, heavily reliant on suppliers of high-grade magnetic materials (neodymium-iron-boron, samarium-cobalt) for permanent magnets and specialized superconducting wires (e.g., Niobium-Titanium) for SCMS. The design and manufacturing stage, characterized by high engineering complexity, involves precise fabrication of the magnetic circuits, mechanical handling systems, and integration of advanced control electronics. Critical considerations at this stage include minimizing eddy current losses, ensuring robust material handling capabilities, and optimizing the magnetic field uniformity and gradient. Successful manufacturers typically possess proprietary intellectual property regarding magnetic circuit design and material matrix technology.

The downstream segment involves direct sales and distribution channels, dominated by large, specialized original equipment manufacturers (OEMs) who often engage directly with major mining corporations and EPC (Engineering, Procurement, and Construction) firms. Due to the high capital cost and customization requirements of HIMS units, the sales process is highly consultative, often requiring extensive pre-installation testing and pilot studies. Indirect distribution, involving agents and local distributors, is more prevalent for standard or smaller-capacity magnetic separators used in industrial mineral applications. Post-sales services, including installation, commissioning, preventative maintenance, and provision of specialized replacement parts (like magnetic matrix elements), represent a significant and growing revenue stream within the downstream value chain.

Service and maintenance are crucial because the longevity and efficiency of HIMS depend on regular calibration and the replacement of consumable parts susceptible to abrasion in high-wear mining environments. OEMs leverage digitalization and IoT integration to offer remote diagnostics and monitoring services, creating strong customer lock-in. The end of the value chain sees the equipment deployed across mining sites, industrial processing plants, and recycling facilities, where the efficiency of the HIMS unit directly impacts the profitability and purity standards of the end product. Collaboration between manufacturers and technology providers specializing in AI and automation is increasingly influencing the downstream operation and service delivery models.

High Intensity Magnetic Separators Market Potential Customers

The primary consumers of High Intensity Magnetic Separators are large-scale corporations and entities engaged in primary resource extraction and high-purity material manufacturing. These customers require separation efficiency far exceeding standard magnetic systems, driven by the need to process low-grade ores or meet stringent contamination limits. The largest customer segment remains the mineral processing and mining industry, particularly companies involved in the beneficiation of weakly magnetic iron ores (taconite), titanium dioxide (rutile, ilmenite), manganese, and critical minerals such as rare earth elements (REEs) and battery precursors (e.g., nickel, cobalt). These buyers prioritize throughput capacity, operational uptime, and high recovery rates when making purchasing decisions.

A rapidly expanding customer base includes industrial mineral producers specializing in non-metallic substances like kaolin, feldspar, quartz, and industrial sands. In these applications, HIMS is used to remove minuscule ferrous contaminants that severely degrade the quality of products used in ceramics, glassmaking, and fillers. For example, high-grade glass requires iron concentrations often below 100 parts per million (ppm), achievable only through high-intensity separation. Furthermore, the recycling sector, encompassing e-waste processing and ferrous scrap metal recovery, represents a high-growth segment, utilizing HIMS to isolate valuable paramagnetic metals from mixed material streams, boosting circular economy initiatives.

Lastly, high-specification manufacturing sectors, including the chemical, pharmaceutical, and food industries, purchase HIMS units for final-stage product purification. In pharmaceuticals, for instance, HIMS ensures the removal of catalyst residues or equipment wear debris, maintaining strict safety and quality standards mandated by regulatory bodies like the FDA or EMA. These customers typically demand compact, sanitary-design separators with precise control mechanisms, prioritizing product safety and compliance over sheer tonnage throughput, highlighting the diverse needs across the HIMS customer spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eriez Manufacturing Co., Outotec (Metso Outotec), Multotec Group, Sepro Mineral Systems, SLon Magnetic Separator Ltd., Dings Co. Magnetic Group, SGM Magnetics, STEINERT GmbH, Goudsmit Magnetic Systems, Industrial Magnetics, Inc., Nippon Magnetics, Bunting Magnetics, Jiangsu Dingsheng Industry, Star Trace Pvt. Ltd., Tecnoidea Impianti S.r.l., Master Magnets, Shaker Grate Separators, Magnetic Products Inc. (MPI), Velec Systems, Magnetics International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Intensity Magnetic Separators Market Key Technology Landscape

The technological landscape of the High Intensity Magnetic Separators market is defined by continuous innovation focused on increasing magnetic field strength, improving efficiency, and reducing operational expenditure, particularly energy consumption. The predominant technologies currently employed are the Wet High Intensity Magnetic Separator (WHIMS), which uses a cyclic or continuous matrix rotating through a high-field zone for slurry processing, and the Dry High Intensity Magnetic Separator (DHIMS), which uses vibrating feeders and specialized pole geometries for fine dry powders. Recent advancements in material science, particularly in rare earth permanent magnets, allow for the construction of exceptionally powerful permanent magnetic circuits that approach the intensity levels previously achievable only with electromagnets, providing energy savings and reducing heat management complexity.

The frontier of HIMS technology is dominated by Superconducting Magnetic Separators (SCMS). SCMS utilizes superconducting coils, cooled to cryogenic temperatures, to generate extremely high and stable magnetic fields (often >5 Tesla). This technology is specifically valuable for materials with ultra-low magnetic susceptibility, such as highly disseminated clay minerals or specific chemical purification tasks where maximal field gradient is essential. Although the initial capital investment and operational complexity (cryogenics) are substantial, the enhanced separation performance and efficiency offered by SCMS are making them indispensable in specialized, high-value applications like kaolin clay bleaching and the extraction of fine REEs, thereby driving technological investment.

Further innovation is concentrated on the integration of smart controls and material sensing technologies. This includes integrating eddy current sensors, pH meters, and X-ray fluorescence (XRF) analyzers directly into the HIMS feed and discharge lines. These sensors provide real-time data on material composition, enabling the sophisticated control systems to dynamically adjust separation parameters—such as rotation speed, rinse water flow (for WHIMS), or magnetic field strength—to maintain optimal performance despite variations in feed quality. This level of automation, facilitated by robust PLCs and often augmented by AI algorithms, is crucial for maximizing recovery rates and ensuring product consistency in modern, high-throughput processing plants.

Regional Highlights

-

Asia Pacific (APAC): Dominance in Production and Consumption

The APAC region holds the largest market share for High Intensity Magnetic Separators, primarily fueled by extensive mining operations in China, Australia, and India, particularly involving iron ore, mineral sands, and the global dominance in rare earth element (REE) processing. China, as the world’s largest producer of many raw materials and a critical hub for high-tech manufacturing, drives massive demand for HIMS to ensure high purity in feedstocks for electronics, ceramics, and advanced battery materials. Government policies supporting domestic material processing and infrastructure expansion further accelerate adoption. This region is also a key manufacturing base for HIMS equipment, leading to competitive pricing and rapid technological deployment suited to high-volume operations.

Australia, rich in iron ore and mineral sands, represents a mature but technologically demanding market, prioritizing robust, high-throughput WHIMS and DHIMS units capable of operating reliably in harsh, remote environments. The ongoing pressure on miners to increase efficiency and recover valuable components from lower-grade or complex ores ensures continuous investment in advanced separation technologies. The environmental mandate to conserve water is rapidly accelerating the adoption of Dry High Intensity Magnetic Separators (DHIMS) throughout the arid regions of Australia and Inner China, shifting technology preference within the region.

-

North America: Focus on Recycling and High-Tech Purity

North America is characterized by high technological maturity and strong investment in circular economy initiatives, particularly e-waste recycling and scrap metal processing. While traditional mining remains important, especially in iron ore (US) and specialized minerals (Canada), the growth driver here is the application of HIMS in sophisticated separation tasks to recover high-value metals (e.g., platinum group metals, critical battery components) from complex waste streams. The stringent environmental standards necessitate the use of highly efficient, energy-saving HIMS units, with particular interest in superconducting technology for cutting-edge materials purification.

The market in the U.S. and Canada places a strong emphasis on automation and digital integration. Customers in the chemical and pharmaceutical sectors demand customized, compact HIMS solutions tailored for highly regulated clean environments. This region is a leader in implementing AI for process control and predictive maintenance of separation systems. Furthermore, renewed interest in domestic critical mineral supply chains, prompted by geopolitical concerns, is stimulating investment in new mining and processing infrastructure, ensuring stable, measured growth for high-intensity separation equipment manufacturers.

-

Europe: Advanced Industrial Minerals and Sustainable Separation

Europe’s HIMS market is driven by demand from the high-quality industrial minerals sector (kaolin, quartz, ceramics) and the continent's commitment to sustainability and resource efficiency. European companies prioritize the removal of contaminants to achieve ultra-high purity levels required for applications like high-grade glass manufacturing and technical ceramics. Germany, Italy, and the UK are key markets, with manufacturers often specializing in highly customizable, precise WHIMS and DHIMS systems designed for medium-scale, high-value operations.

Sustainability regulations, particularly those promoting water conservation and low energy consumption, strongly influence purchasing decisions. This preference is driving increased adoption of DHIMS systems across Southern and Eastern Europe. Europe is also a center for advanced research in magnetic technologies, contributing significantly to the refinement of superconducting separators and the development of specialized matrix materials, reinforcing its position as a hub for high-end, niche HIMS applications. The market often favors technology refresh cycles aimed at improving energy metrics and operational precision.

-

Latin America and MEA: Resource Extraction and Infrastructure Growth

Latin America, dominated by Brazil, Chile, and Peru, represents a large volume market tied closely to the global price of iron ore, copper, and specialized industrial minerals. HIMS adoption here is primarily focused on massive, high-throughput beneficiation plants, where WHIMS units are essential for processing the region’s extensive mineral reserves. Growth is directly correlated with mining investment and the expansion of operations targeting increasingly lower-grade ores, requiring more effective separation techniques to maintain profitability.

The Middle East and Africa (MEA), especially South Africa and Saudi Arabia, are focused on leveraging HIMS for mineral sands processing, phosphate beneficiation, and infrastructure development materials. South Africa is a crucial market for heavy mineral sands and iron ore. The MEA region faces significant challenges related to water scarcity, which is beginning to spur interest in DHIMS technology, though large-scale mining operations still rely heavily on conventional WHIMS. Investment tends to be large-scale but intermittent, dependent on major resource project approvals and foreign direct investment into the mining sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Intensity Magnetic Separators Market.- Eriez Manufacturing Co.

- Outotec (Metso Outotec)

- Multotec Group

- Sepro Mineral Systems

- SLon Magnetic Separator Ltd.

- Dings Co. Magnetic Group

- SGM Magnetics

- STEINERT GmbH

- Goudsmit Magnetic Systems

- Industrial Magnetics, Inc.

- Nippon Magnetics

- Bunting Magnetics

- Jiangsu Dingsheng Industry

- Star Trace Pvt. Ltd.

- Tecnoidea Impianti S.r.l.

- Master Magnets

- Shaker Grate Separators

- Magnetic Products Inc. (MPI)

- Velec Systems

- Magnetics International

Frequently Asked Questions

Analyze common user questions about the High Intensity Magnetic Separators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Wet and Dry High Intensity Magnetic Separators (HIMS)?

The core difference lies in the material handling medium. Wet HIMS (WHIMS) are designed to process materials suspended in a liquid slurry, making them ideal for mineral sands and fine particle beneficiation, offering high efficiency but requiring significant water consumption. Dry HIMS (DHIMS) process dry, granular, or powdered materials, eliminating water usage and minimizing energy required for drying, which is crucial for operations in arid environments or for materials sensitive to moisture.

Why are High Intensity Magnetic Separators (HIMS) crucial for the Rare Earth Elements (REE) industry?

HIMS are essential for REE extraction because many rare earth minerals are only weakly magnetic (paramagnetic). Conventional low-intensity separation is ineffective. HIMS, especially advanced models like Superconducting Magnetic Separators (SCMS), generate the extremely high magnetic field gradients necessary to efficiently separate these weakly magnetic REE components from associated gangue minerals, ensuring the high purity required for downstream refining processes.

What major factors restrain the growth of the High Intensity Magnetic Separators market?

The primary restraints include the high initial capital investment required for HIMS equipment, particularly for advanced superconducting or large-scale electromagnetic units. Furthermore, the operational complexity and specialized maintenance required for maintaining high-field magnetic circuits and cryogenic systems can be challenging and costly, limiting adoption primarily to large-scale operations with dedicated technical expertise.

How does technological innovation, such as Superconducting Magnetic Separators (SCMS), impact market dynamics?

SCMS technology significantly raises the barrier to entry while opening up new high-value applications. By generating magnetic fields several times stronger than conventional separators, SCMS enables the economic processing of ultra-fine or very low-grade ores previously deemed uneconomical. This innovation drives segmentation, creating a premium market niche focused on maximizing product purity and processing extremely challenging materials, often impacting the competitive landscape through superior performance metrics.

In which application segment is the highest growth anticipated for HIMS over the forecast period?

The highest growth is anticipated in the Recycling sector, specifically within e-waste and specialized material recovery. As global volumes of electronic waste increase and regulations tighten, HIMS provides the necessary efficiency to recover valuable, weakly magnetic metals and critical elements from complex, mixed-material streams, driving strong demand for high-precision, customized separation solutions in circular economy initiatives worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager