High Net Worth Household Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433564 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

High Net Worth Household Insurance Market Size

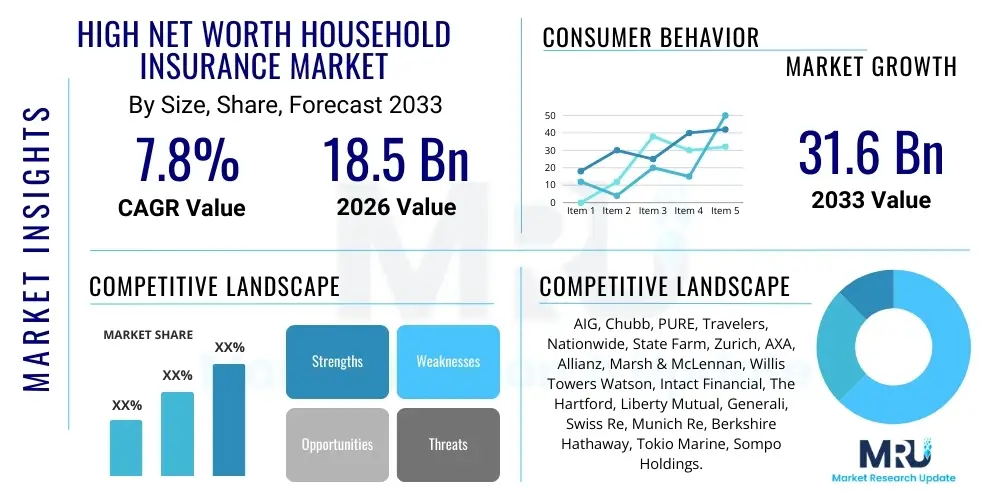

The High Net Worth Household Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $31.6 Billion by the end of the forecast period in 2033.

High Net Worth Household Insurance Market introduction

The High Net Worth (HNW) Household Insurance market caters specifically to individuals and families possessing substantial assets, often defined by insurable assets exceeding predetermined thresholds or requiring bespoke underwriting solutions due to complexity and value. This specialized insurance product extends far beyond standard homeowner policies, encompassing extensive coverage for high-value properties, secondary residences, rare and valuable collections (such as fine art, jewelry, wine, and classic automobiles), and comprehensive liability protection, including umbrella policies designed to shield significant wealth from complex litigation. Major applications revolve around comprehensive asset protection, sophisticated risk mitigation consulting, and tailored personal catastrophe liability coverage. The primary benefits include personalized concierge services, guaranteed replacement cost valuation regardless of depreciation, global coverage flexibility, and discreet claims management. Driving factors include the sustained global growth in the HNW population, increasing volatility in weather-related events necessitating robust physical asset protection, and the rising threat of cyber risks targeting wealthy individuals, demanding specialized digital liability policies.

High Net Worth Household Insurance Market Executive Summary

The global High Net Worth Household Insurance market demonstrates resilience and growth, driven by an expanding affluent demographic and a heightened awareness regarding complex, modern risks, including climate change impacts and sophisticated cyber threats. Business trends indicate a strong move toward digitalization of client interfaces, leveraging sophisticated data analytics for hyper-personalized risk assessment and pricing, rather than reliance on traditional actuarial tables. Insurers are transitioning from simple risk coverage providers to comprehensive risk mitigation partners, offering advisory services on property maintenance, security upgrades, and cyber resilience, thus enhancing client retention and policy value. Regionally, North America remains the largest and most mature market due to high concentrations of generational wealth and established regulatory frameworks, while the Asia Pacific region, particularly emerging economies with rapidly growing HNW populations, is poised for the fastest expansion. Segment trends highlight a significant demand surge in liability coverage and specialty coverage for intangible or highly portable assets, underscoring the dynamic nature of HNW wealth management and the necessity for global policy portability.

AI Impact Analysis on High Net Worth Household Insurance Market

User inquiries regarding AI's influence in the HNW insurance domain center primarily on its ability to enhance personalization, streamline complex claims processes, and mitigate unique high-value risks. Key concerns focus on data privacy when utilizing predictive modeling for affluent clients and ensuring that automated systems retain the required white-glove service expected by this demanding demographic. Users anticipate AI will revolutionize underwriting by enabling instant, granular analysis of property and asset risks using satellite imagery, IoT data, and public records, leading to fairer and highly customized premiums. There is also a strong expectation that AI will automate routine administrative tasks, freeing up HNW dedicated agents to focus exclusively on complex risk consultation and relationship management, thereby enhancing the overall client experience while maintaining the necessary level of discretion and sophistication.

- Enhanced predictive modeling for catastrophic risk assessment, leveraging vast climate and geospatial datasets.

- Personalized pricing algorithms based on real-time behavior, security system data, and asset portfolio complexity.

- Automated underwriting processes for quick issuance of standard, albeit high-value, policies.

- Accelerated and discreet claims processing through AI-driven fraud detection and damage assessment utilizing remote sensing technology.

- Development of sophisticated cyber risk policies managed by AI monitoring systems that provide proactive threat intelligence.

- Implementation of virtual risk advisors offering 24/7 concierge service and immediate policy adjustments.

DRO & Impact Forces Of High Net Worth Household Insurance Market

The High Net Worth Household Insurance market is fundamentally shaped by compelling drivers, structural restraints, and significant opportunities, which collectively define its impact forces. Primary drivers include the global expansion of disposable income among the wealthy, leading to increased investment in high-value, insurable assets such as luxury real estate and valuable collectibles. Furthermore, the rising severity and frequency of natural catastrophes necessitate more robust and comprehensive coverage solutions that only specialty HNW policies can provide. Restraints primarily involve the regulatory complexity across different jurisdictions, making global policy synchronization challenging, and the difficulty in accurately valuing highly bespoke or unique assets, which requires specialized appraiser networks. Opportunities are vast in leveraging digital platforms to offer integrated wealth and risk management solutions and expanding into rapidly wealth-generating regions like APAC and the Middle East, focusing specifically on novel risks such as cyber extortion and reputational damage. The impact forces show that macroeconomic stability and regulatory modernization act as accelerants, while systemic economic downturns or poorly adapted catastrophic models pose severe headwinds to market expansion.

Segmentation Analysis

The High Net Worth Household Insurance Market is segmented across various dimensions, reflecting the diverse needs and asset profiles of affluent clientele. Segmentation based on coverage type reveals distinct product categories addressing specific risk areas, ranging from standard dwelling and contents to specialized high-limit liability and dedicated art and collectibles insurance. Segmentation by distribution channel is critical, showing the reliance on independent brokers and private wealth management advisory firms, which typically offer the bespoke advice HNW clients demand, contrasting with the limited use of direct channels. Furthermore, geographic segmentation highlights concentrated wealth pockets and corresponding market maturity levels across North America, Europe, and Asia, necessitating localized product customization and regulatory compliance strategies. The complexity of HNW needs dictates that personalized bundling of diverse coverage types is often the standard practice rather than single-product sales.

- Coverage Type

- Dwelling and Contents Coverage

- Collections Insurance (Art, Jewelry, Wine, etc.)

- High-Limit Personal Liability (Umbrella Coverage)

- Travel and Kidnap & Ransom (K&R) Coverage

- Cyber and Digital Asset Protection

- Property Type

- Primary Residences (Estates)

- Secondary/Vacation Homes

- Investment Properties

- International Properties

- Distribution Channel

- Independent Agents and Brokers

- Private Wealth Management Firms (Bank Channels)

- Direct Writers

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For High Net Worth Household Insurance Market

The value chain for HNW household insurance begins with upstream activities focused on sophisticated risk data acquisition and product development. This includes specialized actuarial science dedicated to low-frequency, high-severity events and partnerships with specialized appraisers and security consultants who assess unique assets like multi-million dollar art collections or complex residential security systems. Midstream activities are dominated by underwriting and policy issuance, requiring highly skilled underwriters who can deviate from standard algorithms to structure bespoke policies for unique global asset portfolios. The distribution channel, which is the primary value point for HNW clients, heavily favors independent brokers and private client groups due to their ability to provide discreet, complex advisory services and manage integrated risk portfolios alongside wealth managers. Downstream activities involve claims management, which must be executed with white-glove service, speed, and discretion, often utilizing specialized adjusters for high-value losses, ensuring replacement cost valuation and minimal client disruption. Direct and indirect channels are both utilized, though indirect distribution via trusted advisors remains paramount for capturing and retaining the most valuable clientele, leveraging existing trust frameworks within wealth management.

High Net Worth Household Insurance Market Potential Customers

The potential customers for High Net Worth Household Insurance are defined as individuals and families with significant liquid and illiquid assets that exceed the capacity or scope of standard personal lines insurance carriers. This demographic typically includes entrepreneurs, successful business owners, corporate executives, professional athletes, celebrities, and families benefiting from generational wealth transfer. These customers frequently own multiple properties, often across international borders, and possess collections of valuable assets requiring specialized, scheduled coverage and global policy portability. Their buying decision is heavily influenced not just by premium cost but primarily by the insurer's reputation for financial stability, discretion, and the quality of claims service, viewing insurance as a critical component of holistic wealth protection and legacy planning. The ultimate buyers are highly advised consumers, often purchasing policies through recommendations from their trust and estate attorneys, family offices, or dedicated private bankers who prioritize seamless integration of insurance solutions with overall financial strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $31.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIG, Chubb, PURE, Travelers, Nationwide, State Farm, Zurich, AXA, Allianz, Marsh & McLennan, Willis Towers Watson, Intact Financial, The Hartford, Liberty Mutual, Generali, Swiss Re, Munich Re, Berkshire Hathaway, Tokio Marine, Sompo Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Net Worth Household Insurance Market Key Technology Landscape

The technological landscape supporting the High Net Worth Household Insurance market is rapidly evolving, moving beyond basic digital policy administration toward advanced risk mitigation and client relationship tools. Key technologies deployed include sophisticated Geospatial Information Systems (GIS) and satellite imagery analysis, which enable insurers to assess granular environmental risks (flood, fire proximity) specific to high-value properties globally, significantly enhancing the accuracy of underwriting large estates. Furthermore, the integration of Internet of Things (IoT) devices, such as smart home security systems and water leak detection sensors, provides real-time data for proactive risk management, allowing carriers to offer premium discounts or even intervene before a loss occurs. These systems are crucial for minimizing both frequency and severity of claims related to physical damage in luxury homes.

In addition to physical risk technologies, advanced data analytics and Artificial Intelligence (AI) platforms are pivotal in managing the complex liability side of HNW insurance. Machine learning models are utilized to analyze litigation trends, wealth profiles, and behavioral data to accurately price high-limit umbrella policies and specialized cyber risks, moving away from generalized industry benchmarks. Blockchain technology is also being explored, albeit slowly, for its potential in creating immutable records for high-value asset ownership (e.g., art provenance) and automating complex, multi-jurisdictional reinsurance agreements. This technological adoption is not merely about efficiency; it is about delivering the level of bespoke risk intelligence and speed that sophisticated HNW clients require.

The primary focus of technology implementation remains on enhancing the customer experience while ensuring data security and privacy, which are paramount concerns for affluent individuals. Digital engagement platforms now offer secure portals for policy management, claims submission, and access to curated risk management advice. These platforms must integrate seamlessly with the advisory ecosystem, allowing brokers and family offices to manage policy details efficiently, further cementing the role of technology as a critical enabler of white-glove service in this exclusive market segment. The effective deployment of these technologies allows insurers to move up the value chain from indemnification providers to integrated risk consultants.

Regional Highlights

- North America: This region dominates the global HNW Household Insurance market, characterized by mature regulatory environments, high asset concentration, and a culture of extensive insurance coverage. The U.S. market, particularly states like California, New York, and Florida, drives demand due to high real estate values, significant art collection ownership, and the necessity for robust liability protection against increasing litigation exposure.

- Europe: Europe is a highly segmented but significant market, with strong demand emanating from Western European countries (UK, Germany, Switzerland). The market is driven by generational wealth and historical collections. Insurers here must navigate diverse national regulations and offer policies that seamlessly cover assets across multiple EU jurisdictions, focusing heavily on art and property preservation risk management.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid wealth creation in countries like China, India, Singapore, and Australia. Demand is high for liability coverage and policies covering new luxury residential developments and newly acquired global assets. The market requires localized expertise due to vast cultural and regulatory differences, with a growing focus on integrating property and private asset security services.

- Latin America (LATAM): This region presents specific challenges related to political instability and higher security risks, leading to strong demand for specialized coverage such as Kidnap & Ransom (K&R) and sophisticated security advisory services. Key markets include Brazil and Mexico, where HNW individuals prioritize protective coverage over standard property indemnification.

- Middle East and Africa (MEA): The MEA market, driven by oil wealth and regional financial hubs like the UAE and Saudi Arabia, exhibits robust growth. Demand centers on large, bespoke residential compounds and high-value, portable luxury items, often necessitating international coverage that accommodates frequent global travel and significant geopolitical volatility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Net Worth Household Insurance Market.- AIG (American International Group)

- Chubb Limited

- PURE Insurance (Privilege Underwriters Reciprocal Exchange)

- Travelers Companies Inc.

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Zurich Insurance Group

- AXA S.A.

- Allianz SE

- Marsh & McLennan Companies

- Willis Towers Watson

- Intact Financial Corporation

- The Hartford Financial Services Group

- Liberty Mutual Insurance

- Generali Group

- Swiss Re

- Munich Re

- Berkshire Hathaway (via various subsidiaries)

- Tokio Marine Holdings

- Sompo Holdings

Frequently Asked Questions

Analyze common user questions about the High Net Worth Household Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific coverages distinguish High Net Worth policies from standard homeowner insurance?

HNW policies offer specialized features such as guaranteed replacement cost, cash settlement options for collections, blanket coverage for undisclosed new acquisitions, much higher liability limits (often $100M+ umbrella coverage), and global protection that automatically extends coverage to secondary and international residences.

How is technology currently influencing the pricing and risk assessment process for luxury properties?

Insurers are utilizing advanced technologies like AI, machine learning, and geospatial data to analyze specific property risks (e.g., proximity to fire zones, flood plains) and personalize premiums based on real-time data from integrated smart home security and environmental monitoring devices, leading to more accurate and granular risk segmentation.

Which geographic region is exhibiting the highest growth potential for High Net Worth Insurance?

The Asia Pacific (APAC) region, driven by rapid wealth accumulation in economies such as China, India, and Southeast Asia, currently demonstrates the highest growth potential, necessitating tailored products that address complex international asset structures and evolving local regulatory demands.

What role do independent brokers and wealth advisors play in the distribution of HNW policies?

Independent brokers and private wealth management firms are the dominant distribution channel, crucial for providing the specialized advisory services, discretion, and integrated risk management necessary to serve complex HNW client portfolios, often acting as trusted intermediaries between the client and the carrier.

What are the primary emerging risks demanding new insurance products in the HNW sector?

The most significant emerging risks are sophisticated cyber threats targeting digital assets and personal information, increasingly severe climate-related events requiring complex catastrophic coverage, and risks associated with global mobility, such as specialized Kidnap & Ransom (K&R) coverage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Net Worth Household Insurance Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Buildings insurance, Contents insurance, Valuables cover, Others), By Application (Celebrity, Company Leader, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- High Net Worth Household Insurance Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Luxury Cars, Property and Villa, Antiques and Artwork, Yacht and Speedboat, Others), By Application (Long Term Insurance, Medium Term Insurance, Short Term Insurance), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager