High Performance Brake System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435112 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

High Performance Brake System Market Size

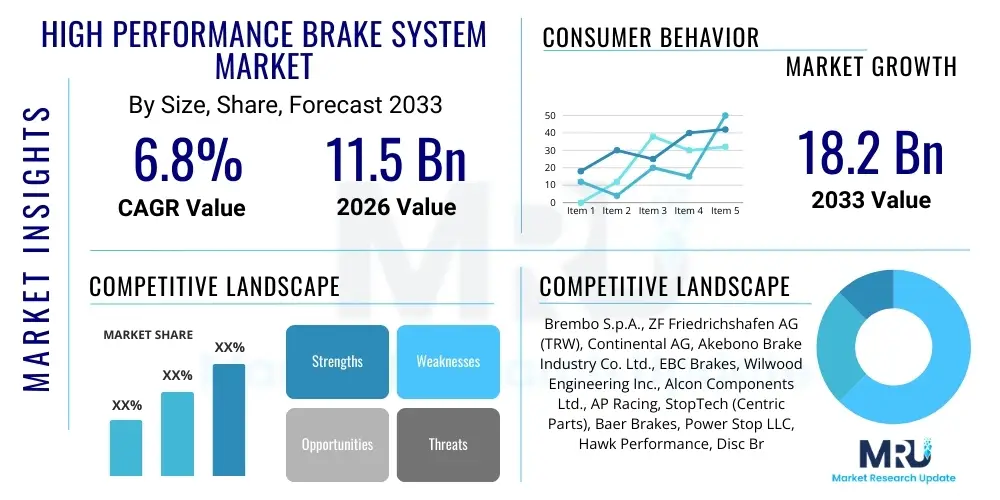

The High Performance Brake System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.2 Billion by the end of the forecast period in 2033.

High Performance Brake System Market introduction

The High Performance Brake System Market encompasses advanced braking technologies designed to deliver superior stopping power, thermal resistance, and durability compared to standard original equipment manufacturer (OEM) brakes. These systems are predominantly utilized in high-end vehicles, including luxury cars, sports cars, racing automobiles, and heavy-duty trucks that require consistent, reliable braking under extreme conditions, such as high speeds or frequent hard braking. Key components typically include multi-piston calipers, large ventilated rotors (often made of composite materials like carbon ceramics), and specialized high-friction brake pads.

The growing consumer demand for enhanced vehicle safety, coupled with the increasing production and sales of high-performance and luxury vehicles globally, serves as a primary driver for this market. Furthermore, advancements in material science, particularly the utilization of lightweight and heat-resistant composites, allow these systems to dissipate heat more effectively, preventing brake fade and maintaining performance consistency. The adoption of stringent regulatory standards regarding vehicle safety and the competitive landscape in professional motorsports further solidify the necessity and adoption of sophisticated braking solutions.

Major applications of high performance brake systems are concentrated within the automotive aftermarket, where enthusiasts seek upgrades, and the OEM segment for premium and performance trims. Benefits derived from these systems include shorter stopping distances, improved pedal feel, significant reduction in brake fade during continuous use, and extended component lifespan. The market structure is heavily influenced by technological innovation, focusing on reducing unsprung weight and improving system response time.

High Performance Brake System Market Executive Summary

The High Performance Brake System Market is exhibiting robust growth, primarily driven by evolving consumer preferences towards vehicle customization and safety enhancements, alongside the exponential expansion of the luxury and electric sports vehicle sectors. Business trends indicate a strong move toward lightweight materials, with carbon-ceramic brake systems gaining prominence due to their superior performance characteristics and weight reduction benefits. Key industry players are focusing on strategic partnerships with major vehicle manufacturers (OEMs) to ensure their advanced braking solutions are integrated into new generation performance models, particularly those featuring electric drivetrains which necessitate robust braking for regenerative efficiency and high-speed safety.

Regionally, North America and Europe remain the dominant markets, owing to the high concentration of luxury vehicle ownership, active motorsports communities, and well-established aftermarket networks that facilitate upgrades. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market due to rising disposable incomes, rapid urbanization, and the subsequent increase in demand for premium automobiles. Regional trends also show varying levels of adoption based on vehicle usage; for instance, European demand is often centered around track performance, while North American demand balances between heavy-duty towing applications and luxury performance vehicles.

Segment trends reveal that the aftermarket segment, although slightly less profitable on a per-unit basis than OEM supply, is critical for market penetration and brand awareness among enthusiasts. In terms of components, the brake disc segment, specifically the rotor materials like carbon ceramic and high-carbon cast iron, is expected to witness the highest technological innovation and market valuation growth. Furthermore, the increasing electrification of performance cars is pushing manufacturers to adapt existing hydraulic systems with advanced electronic controls and ensure compatibility with regenerative braking mechanisms.

AI Impact Analysis on High Performance Brake System Market

Common user questions regarding AI's impact on high performance braking center on several themes: how AI can enhance braking safety beyond traditional ABS, the role of machine learning in predicting brake wear and optimizing maintenance schedules, and whether AI-driven vehicle dynamics control (VDC) systems will render high-cost mechanical upgrades obsolete. Users are keen to understand if AI can personalize braking performance based on driver style and road conditions in real-time. The core concern revolves around the integration complexity between highly sophisticated mechanical components and advanced algorithms, ensuring fault tolerance and system reliability, especially under extreme performance scenarios where reaction time is critical.

The convergence of Artificial Intelligence and high performance braking systems is primarily manifesting through predictive maintenance and advanced vehicle control systems. AI algorithms are being used to process vast amounts of telemetry data collected from sensors—including temperature, pressure, rotational speed, and vibration—to accurately model brake component degradation and optimize heat management strategies. This predictive capability allows drivers and fleet managers to replace components precisely when necessary, maximizing both safety and component lifespan, which is crucial given the high cost of components like carbon-ceramic rotors.

Furthermore, AI plays a pivotal role in optimizing Active Braking Systems (ABS) and Electronic Stability Control (ESC) within high-performance vehicles. Machine learning models analyze real-time driving inputs (steering angle, throttle position, G-forces) and contextual data (weather, road friction) to modulate braking force distribution with unprecedented precision, often exceeding the capabilities of pre-programmed logic. This AI-enhanced dynamic control ensures maximum grip utilization during high-speed cornering or emergency maneuvers, directly translating to superior performance and safety, thereby increasing the value proposition of integrated high-performance mechanical systems.

- AI enhances predictive maintenance by analyzing brake usage patterns, reducing unexpected component failure.

- Machine learning algorithms optimize electronic brake force distribution (EBD) for improved track performance and street safety.

- AI-driven thermal modeling ensures consistent braking performance by managing heat dissipation in real-time.

- Integration of AI with Advanced Driver Assistance Systems (ADAS) necessitates high-reliability, performance-grade braking components.

- Optimization of regenerative braking in high-performance EVs through AI requires seamless integration with friction brake systems.

DRO & Impact Forces Of High Performance Brake System Market

The High Performance Brake System Market is strongly influenced by the simultaneous pressure of accelerating consumer demand for performance vehicles and the technological hurdle of integrating lightweight, exotic materials. Key drivers include the surge in global motorsports activities and the increasing regulatory emphasis on enhanced vehicle safety standards, particularly concerning high-speed capability. However, the market faces significant restraints, primarily stemming from the extremely high cost of advanced materials such as carbon ceramics, making these systems prohibitive for mass-market adoption, coupled with the complex supply chain logistics for specialized components. Opportunities lie in the rapidly expanding electric vehicle (EV) performance segment, where braking systems must manage high vehicle weight and seamlessly integrate with regenerative technologies, offering a new avenue for innovation and market penetration. The major impact forces driving the market include technological substitution pressure from electric vehicle braking concepts and the continuous refinement of material science to lower production costs while maintaining thermal efficiency.

Segmentation Analysis

The High Performance Brake System Market is comprehensively segmented based on product type, component, vehicle type, and sales channel, reflecting the diverse application landscape and varying demands across end-user groups. Analysis of these segments is crucial for understanding specific market dynamics, technological uptake rates, and key purchasing behaviors. The component segmentation offers insights into where investment and innovation are concentrated, with the brake caliper and rotor segments typically dominating revenue due to the high material and manufacturing complexity involved. Vehicle type segmentation helps identify the core consumer base, overwhelmingly focused on specialized performance categories where braking efficiency is non-negotiable.

The product type segmentation differentiates the market based on the material technology utilized, distinguishing between traditional metallic systems, advanced ceramic composite offerings, and the elite carbon ceramic solutions, each serving distinct price points and performance expectations. Furthermore, the sales channel delineation between Original Equipment Manufacturer (OEM) and Aftermarket sales highlights the two primary distribution routes. While OEM provides volume and stability through direct integration into production lines, the Aftermarket segment drives growth through customization, high margin specialized products, and immediate adoption of the latest technological innovations desired by vehicle enthusiasts.

- Product Type: Metallic Brakes, Ceramic Composite Brakes, Carbon Ceramic Brakes

- Component: Brake Caliper, Brake Disc/Rotor, Brake Pad, Brake Fluid, Master Cylinder, Others

- Vehicle Type: Sports Cars, Premium Sedans, Heavy-Duty Vehicles, Racing Vehicles, High-Performance Electric Vehicles

- Sales Channel: OEM (Original Equipment Manufacturer), Aftermarket

Value Chain Analysis For High Performance Brake System Market

The value chain for the High Performance Brake System Market is characterized by a high degree of specialization and stringent quality requirements, initiating from the upstream material suppliers. Upstream activities involve the extraction and processing of specialized raw materials, such as high-grade carbon fiber, specialized alloys (e.g., titanium, aluminum), and unique friction materials required for pads and rotors. Suppliers in this segment are typically highly specialized chemical or metallurgy firms that provide inputs crucial for achieving the lightweight and thermal endurance characteristics required of high performance systems. The proprietary nature of these materials often creates high barriers to entry and significant cost pressures further down the chain.

Midstream activities focus on precision manufacturing and assembly, where components like multi-piston calipers, complex rotors, and bespoke brake pads are engineered and produced. Key manufacturers invest heavily in R&D to optimize designs for heat dissipation, aerodynamic efficiency, and weight reduction. This manufacturing stage involves rigorous testing and certification processes, especially for components destined for racing applications or high-end OEM integration. Direct sales often occur from these manufacturers to OEM assembly lines for new vehicle integration, representing a substantial volume channel characterized by long-term contracts and strict specifications.

Downstream distribution channels are segmented into direct and indirect routes. The direct channel serves OEMs exclusively. Indirect channels primarily target the aftermarket, utilizing highly specialized distributors, authorized dealers, high-performance tuning shops, and increasingly, specialized e-commerce platforms. These distributors often provide installation services and technical support, leveraging product knowledge for high-value sales. The complexity and high cost of installation typically necessitate professional involvement, minimizing the role of purely consumer-focused retail outlets and reinforcing the importance of skilled installation centers.

High Performance Brake System Market Potential Customers

The primary customers for high performance brake systems are categorized into two major groups: vehicle manufacturers seeking superior component integration for their high-end models, and individual vehicle owners or tuning shops focused on enhancing the performance and safety of existing vehicles. Original Equipment Manufacturers (OEMs) of premium, luxury, and sports vehicles constitute a fundamental and high-volume customer base. These OEMs, including brands like Porsche, Ferrari, BMW M, and Mercedes-AMG, mandate the highest standards of performance and reliability, integrating these systems directly into their production lines to meet brand positioning and technical specifications.

The aftermarket segment, representing individual high-performance vehicle owners, racing teams, and independent tuning establishments, forms the second major customer cohort. These customers are motivated by a desire for enhanced safety, improved track performance, or vehicle customization. Racing teams, ranging from amateur circuits to professional series like Formula 1 or endurance racing, are highly demanding customers, requiring bespoke, extremely durable, and lightweight braking solutions that offer a competitive edge. Their purchasing decisions are driven purely by performance metrics and continuous product iteration.

Furthermore, a growing segment comprises fleet operators and owners of heavy-duty commercial vehicles (HDVs) that operate under severe load and gradient conditions. While not traditionally associated with 'high performance' in the speed sense, these vehicles require high-thermal capacity and durable braking systems to ensure safety and longevity, often utilizing specialized metallic or composite brakes designed for sustained, high-energy stopping events, particularly in mountainous or demanding terrains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brembo S.p.A., ZF Friedrichshafen AG (TRW), Continental AG, Akebono Brake Industry Co. Ltd., EBC Brakes, Wilwood Engineering Inc., Alcon Components Ltd., AP Racing, StopTech (Centric Parts), Baer Brakes, Power Stop LLC, Hawk Performance, Disc Brakes Australia (DBA), Racing Brake, Tarox S.p.A., Performance Friction Brakes (PFC), SSBC Brakes, Mando Corporation, Bosch (through subsidiary operations), Endless Brake Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Performance Brake System Market Key Technology Landscape

The technology landscape of the High Performance Brake System Market is dominated by material innovation and precision engineering focused on maximizing thermal capacity and minimizing unsprung mass. A critical technology is the development and commercialization of Carbon Ceramic Matrix (CCM) rotors. These rotors utilize a mix of carbon fiber and silicon carbide, offering exceptional heat resistance and significantly reducing weight compared to traditional cast iron rotors. This weight reduction directly contributes to improved handling, acceleration, and fuel efficiency, making it the preferred choice for elite sports and luxury vehicles. Ongoing research focuses on improving the cost-effectiveness and durability of these composite materials for broader application.

Another major technological area is the advancement in brake caliper design, shifting towards monobloc construction and lightweight alloy materials (primarily forged aluminum or specialized titanium alloys). Monobloc calipers, machined from a single block of material, offer enhanced rigidity and reduced flex under extreme hydraulic pressure, providing a more consistent and firm pedal feel. Furthermore, the integration of advanced thermal coatings and optimized fluid dynamics within the caliper structure ensures superior cooling and prevents premature component failure, which is crucial for track-day reliability and high-speed endurance applications.

Electronic integration represents a burgeoning technological field, especially with the proliferation of performance EVs. This involves integrating traditional hydraulic braking components with sophisticated mechatronic systems. Technologies such as high-response electro-hydraulic boosters and Brake-by-Wire (BBW) systems allow for highly precise brake force modulation, rapid reaction times, and seamless blending of friction braking with regenerative charging. This electronic overlay is essential for managing the high-torque characteristics and heavy mass of electric performance vehicles, requiring the underlying mechanical system to be impeccably engineered to handle the maximum kinetic energy dissipation.

Regional Highlights

Regional dynamics play a crucial role in shaping the High Performance Brake System Market, driven by differential automotive production capabilities, consumer wealth, and the prevalence of motorsports activities.

- North America (United States, Canada, Mexico): North America is characterized by robust demand for large, high-performance vehicles, including muscle cars, luxury SUVs, and heavy-duty trucks requiring specialized braking. The region boasts a highly active aftermarket segment fueled by car modification culture and accessible track-day events. The presence of major performance vehicle manufacturers and a high average disposable income supports premium pricing for advanced systems.

- Europe (Germany, UK, Italy, France): Europe holds a dominant position, especially due to its concentration of leading luxury and performance car manufacturers (Germany and Italy) and a strong historical foundation in competitive motorsports (Formula 1, Le Mans). Stringent European vehicle safety regulations mandate high-quality braking systems, ensuring high OEM penetration. Technological innovation, particularly in carbon-ceramic technology, often originates in this region.

- Asia Pacific (China, Japan, South Korea, India): APAC is projected to be the fastest-growing market. This growth is underpinned by rising affluence, rapid expansion of the luxury vehicle segment, and increasing domestic performance car production in countries like China and South Korea. While historically focused on value, the Japanese market maintains strong demand for high-end tuning and domestic OEM performance vehicles, driven by brands like Toyota (Lexus) and Nissan (Infiniti).

- Latin America (Brazil, Argentina): Growth in this region is moderate, primarily constrained by economic volatility and higher import duties. Demand is concentrated in major urban centers and among professional racing teams. The aftermarket segment is resilient but often favors more cost-effective upgrades rather than ultra-high-end composites.

- Middle East and Africa (MEA): The MEA region, particularly the GCC countries (UAE, Saudi Arabia), shows significant demand for high-performance and luxury vehicles, driven by extreme climate conditions (requiring superior thermal management) and high per capita wealth. This region serves as a strong market for premium aftermarket upgrades and high-end OEM sales.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Performance Brake System Market.- Brembo S.p.A.

- ZF Friedrichshafen AG (TRW)

- Continental AG

- Akebono Brake Industry Co. Ltd.

- EBC Brakes

- Wilwood Engineering Inc.

- Alcon Components Ltd.

- AP Racing

- StopTech (Centric Parts)

- Baer Brakes

- Power Stop LLC

- Hawk Performance

- Disc Brakes Australia (DBA)

- Racing Brake

- Tarox S.p.A.

- Performance Friction Brakes (PFC)

- SSBC Brakes

- Mando Corporation

- Bosch (through subsidiary operations)

- Endless Brake Technology

Frequently Asked Questions

Analyze common user questions about the High Performance Brake System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard brakes and high performance brake systems?

The primary difference lies in material composition and thermal capacity. High performance systems utilize multi-piston calipers, larger ventilated or cross-drilled rotors (often carbon ceramic), and high-friction pads engineered to dissipate far greater heat and energy. This results in significantly shorter stopping distances, vastly reduced brake fade under repeated use, and improved longevity under extreme driving conditions compared to standard OEM metallic systems.

How is the rise of Electric Vehicles (EVs) impacting the demand for high performance brake components?

EVs are positively impacting the demand, particularly in the high-performance segment. While EVs use regenerative braking for deceleration, they require exceptionally robust friction brakes for emergency stops and high-speed track use due to their increased curb weight and instant torque delivery. Manufacturers are focusing on lighter, more durable calipers and rotors that seamlessly integrate with complex electro-hydraulic systems to maximize safety and thermal management.

Which segment of the High Performance Brake System Market is expected to grow the fastest?

The Carbon Ceramic Brake segment, under Product Type, is projected to exhibit the highest CAGR. Although highly expensive, their unparalleled lightweight properties and thermal endurance make them essential for elite sports cars and increasingly for high-end performance EVs. Geographically, the Asia Pacific region is anticipated to see the fastest expansion due to rising luxury vehicle sales and increasing consumer focus on vehicle customization and safety upgrades.

Are carbon ceramic brake systems worth the substantial increase in cost for standard street driving?

For standard street driving, the cost-benefit ratio of carbon ceramic systems is often low, as their primary advantages (fade resistance at extreme temperatures) are rarely realized. While they offer superior longevity and low dust production, their high replacement cost and susceptibility to low-temperature noise generally make high-quality metallic or composite systems a more practical and cost-effective choice for everyday, non-racing performance driving.

What role does the aftermarket play in the High Performance Brake System Market?

The aftermarket is crucial, serving as the primary channel for enthusiasts and motorsports teams seeking upgrades, customization, and the latest technological iterations not available on their vehicle’s original specification. The aftermarket drives innovation acceptance, offering a diverse array of performance pads, rotors, and caliper kits from specialized manufacturers, providing significant revenue streams outside of direct OEM contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager