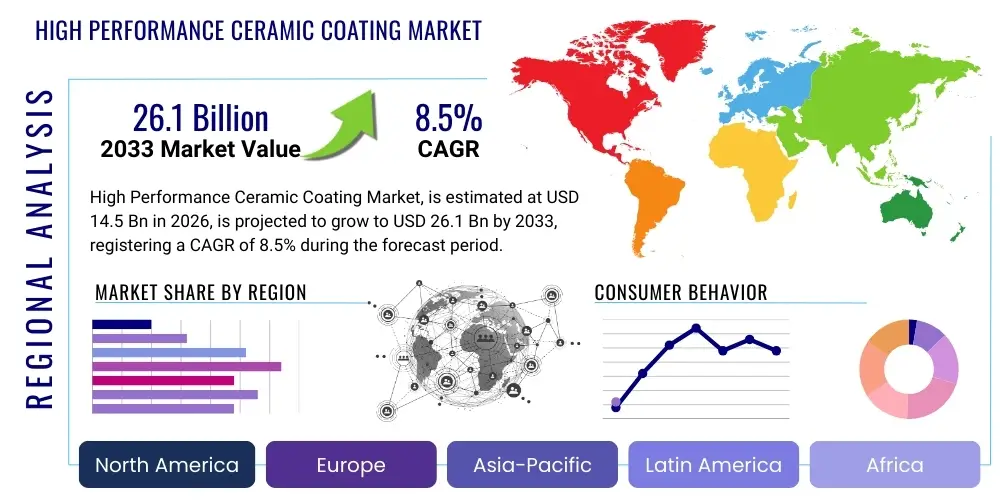

High Performance Ceramic Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435458 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Performance Ceramic Coating Market Size

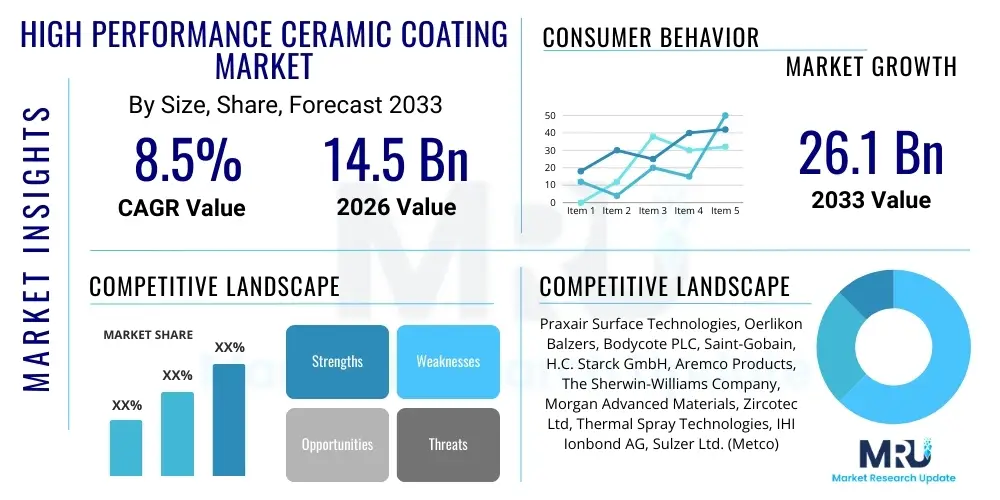

The High Performance Ceramic Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $26.1 Billion by the end of the forecast period in 2033.

High Performance Ceramic Coating Market introduction

The High Performance Ceramic Coating Market encompasses advanced materials utilized to protect substrates from extreme operational conditions, including high temperature, corrosion, abrasion, and thermal cycling. These coatings typically utilize inorganic compounds such as oxides (e.g., Alumina, Zirconia), carbides (e.g., Silicon Carbide), and nitrides, applied through sophisticated techniques like Thermal Spray (Plasma Spray, HVOF), Physical Vapor Deposition (PVD), and Chemical Vapor Deposition (CVD). The primary objective is to enhance the functional lifespan, efficiency, and structural integrity of critical components used across highly demanding industries such as aerospace, automotive, energy, and industrial machinery. These advanced materials are essential for enabling next-generation performance in engines, turbines, and chemical processing equipment where traditional metallic coatings fail under severe stress environments. The inherent resistance of ceramic structures to chemical attack and high thermal loads positions them as indispensable solutions for performance optimization and reliability in modern engineering.

High performance ceramic coatings are distinguished from conventional coatings by their superior hardness, low coefficient of friction, exceptional wear resistance, and ability to serve as effective thermal barriers (TBCs). Product descriptions often emphasize tailored microstructures and layered systems designed for specific applications, such as erosion shielding in gas turbine blades or dielectric insulation in electronics. Major applications span structural components in jet engines where they mitigate heat transfer, automotive components like brake rotors and exhaust systems to manage thermal stress, and oil and gas infrastructure requiring extreme corrosion and abrasion resistance in harsh drilling environments. Furthermore, the burgeoning demand for lightweight materials and improved fuel efficiency necessitates the use of these coatings to protect lighter alloys that inherently lack the durability of heavier counterparts, driving innovation in material synthesis and application methodologies.

The core benefits derived from implementing these coatings include substantial improvements in component durability, reduction in maintenance downtime, enhanced energy efficiency through reduced frictional losses, and superior protection against chemical degradation. Driving factors for market expansion include stringent environmental regulations necessitating higher efficiency engines (especially in aerospace), the rapid expansion of renewable energy infrastructure (wind turbines, concentrated solar power), and the continuous innovation in material science leading to coatings with multi-functionality, such as self-healing or smart characteristics. The shift towards electrification in the automotive sector also drives demand for specialized ceramic coatings for battery components and power electronics requiring thermal management and electrical insulation, further solidifying the market’s robust growth trajectory over the forecast period.

High Performance Ceramic Coating Market Executive Summary

The High Performance Ceramic Coating Market is currently defined by significant technological maturation and robust cross-sectoral adoption, led predominantly by the aerospace and industrial gas turbine (IGT) sectors. Key business trends indicate a strong focus on developing thinner, multi-layered coating systems that offer superior adhesion and lower application costs, addressing historical challenges related to thermal mismatch and spallation. Strategic alliances between raw material suppliers, coating service providers, and Original Equipment Manufacturers (OEMs) are crucial for accelerating time-to-market for novel coating formulations, particularly those utilizing nanotechnology to enhance density and performance characteristics. Furthermore, sustainability is becoming a pivotal business driver, with increasing emphasis on coating processes that reduce volatile organic compound (VOC) emissions and minimize energy consumption during application, aligning with global green manufacturing mandates.

Regionally, the market exhibits dynamic growth, with Asia Pacific (APAC) emerging as the fastest-growing region, fueled by massive infrastructure investments, rapid industrialization, and the establishment of sophisticated aerospace and defense manufacturing hubs, notably in China and India. North America and Europe maintain dominance in terms of technological innovation and consumption value, primarily due to the established presence of major aerospace and power generation firms committed to long-term efficiency upgrades and component life extension programs. Regulatory frameworks, such as REACH in Europe, significantly influence the material selection process, pushing manufacturers toward advanced, compliant ceramic precursors. Geopolitical stability and defense spending variations also exert direct influence on regional demand, particularly for high-end thermal barrier coatings (TBCs) used in military aircraft and naval vessel components.

In terms of segmentation, the Thermal Barrier Coatings (TBCs) segment maintains the largest market share by value, indispensable in high-temperature environments. However, the Corrosion and Wear Resistant Coatings segment is projected to witness the highest compound annual growth rate, driven by expanding applications in chemical processing, marine environments, and general heavy machinery requiring prolonged operational periods. The application method segment is seeing a shift towards highly automated and precise deposition technologies like Plasma Spray and High-Velocity Oxy-Fuel (HVOF) coating, enhancing coating quality consistency and scalability. End-user segmentation remains heavily skewed towards aerospace and automotive, though the penetration into emerging sectors like medical devices (bioceramic coatings) and consumer electronics offers significant future growth potential.

AI Impact Analysis on High Performance Ceramic Coating Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the High Performance Ceramic Coating Market frequently revolve around optimizing coating formulation, predicting component life under stress, and automating complex application processes. Users are concerned about how AI can accelerate R&D cycles, moving from months of experimental validation to predictive modeling of coating performance (e.g., creep, oxidation resistance) under specific operational profiles. Key themes include the implementation of Machine Learning (ML) for quality control during the thermal spraying process, determining optimal spray parameters in real-time based on sensor data, and leveraging Big Data analytics to correlate coating defects with precursor batch variations. The expectations center on AI driving significant cost reductions, improving first-pass yield rates, and enabling the customization of coating microstructures at scale, effectively moving the industry toward 'Coating 4.0'—a highly automated, data-driven manufacturing paradigm.

AI is poised to revolutionize the design phase by utilizing generative design algorithms to engineer novel ceramic material compositions and microstructures that meet predefined performance criteria, a process far exceeding human capabilities in combinatorial analysis. This includes predicting the complex phase stability of multi-component ceramic systems under extreme temperature and pressure environments, minimizing the need for extensive physical testing. Furthermore, AI-driven digital twins of coated components allow manufacturers to simulate wear and failure mechanisms with high fidelity, enabling proactive maintenance scheduling and extending the lifespan of critical assets in sectors like power generation and aviation. This predictive capability transforms the value proposition of ceramic coatings from merely protective layers to critical, data-informed structural elements.

In the manufacturing and application segment, AI algorithms analyze massive datasets generated by sensors integrated into thermal spray booths, controlling factors such as plasma power, powder feed rate, and torch distance with sub-millimeter precision. This level of autonomous process control dramatically reduces variability, ensuring coating uniformity and structural integrity across large batches. The integration of computer vision and deep learning techniques allows for automated, non-destructive inspection (NDI) of coated surfaces, identifying microscopic pores, cracks, or inhomogeneities that are difficult for human inspectors to detect, thereby guaranteeing compliance with stringent quality standards required by aerospace OEMs. This operational efficiency is fundamental to scaling the production of complex, high-reliability ceramic coatings.

- AI-driven optimization of coating parameters (e.g., plasma jet velocity, powder size distribution) for enhanced uniformity and adhesion.

- Machine Learning models predict component failure and wear rates of coated parts, enabling predictive maintenance schedules.

- Generative AI accelerates the discovery of new ceramic compositions (e.g., novel TBC chemistries) with superior thermal stability.

- Automated visual inspection using Computer Vision systems ensures real-time quality control and defect detection during application.

- Digital twin technology simulates coating performance under variable operational loads, reducing the reliance on physical prototypes.

- AI supports supply chain optimization by predicting demand fluctuations for specific ceramic precursors and managing inventory.

- Enhanced material traceability and quality ledger creation using blockchain integrated with AI monitoring systems.

DRO & Impact Forces Of High Performance Ceramic Coating Market

The High Performance Ceramic Coating Market is propelled by compelling Drivers (D), constrained by significant Restraints (R), and offers substantial Opportunities (O), which collectively shape the competitive landscape through various Impact Forces. A primary driver is the relentless pursuit of increased efficiency and performance in end-use industries, particularly in aerospace and power generation, where ceramic coatings enable higher operating temperatures, directly correlating with improved fuel economy and power output. Regulatory pressures, such as emissions reduction mandates, necessitate lighter, more durable components, further reinforcing the demand for protective ceramic layers. Additionally, the increasing complexity of materials engineering and the introduction of advanced alloys that require protection against high-temperature oxidation act as fundamental market accelerants. These drivers create a consistently positive demand curve for innovative coating solutions capable of meeting evolving industry standards.

Restraints primarily center around the high capital expenditure required for sophisticated application equipment (such as plasma spray systems and PVD/CVD reactors) and the inherent complexity associated with processing and applying ceramic materials, which often require specialized environments and highly skilled labor. Thermal mismatch between the ceramic coating and the metallic substrate remains a persistent technical challenge, leading to potential spallation or cracking under severe thermal cycling, necessitating complex bond coat layers and pre-treatment procedures. Furthermore, the standardization and certification process, particularly within regulated sectors like aviation, are long and costly, posing significant entry barriers for smaller innovative players. Material volatility and supply chain concentration for specialized precursors (e.g., Yttria-Stabilized Zirconia powder) can also introduce price instability and production risks.

Opportunities are abundant, particularly in emerging markets such as electric vehicle battery thermal management, advanced electronics, and the medical device sector (biocompatible ceramic implants). The development of novel processing technologies, including cold spray and suspension plasma spraying (SPS), allows for finer microstructure control and application on temperature-sensitive substrates, opening new application windows. Moreover, substantial opportunities exist in the development of multi-functional coatings that combine thermal, electrical, and wear-resistant properties into a single system, simplifying component design and manufacturing. The continuous investment in additive manufacturing (3D printing) requires compatible ceramic coating solutions for printed metallic parts, presenting a specialized, high-growth niche. These market dynamics ensure sustained technological innovation and market expansion beyond traditional heavy industrial applications.

Segmentation Analysis

The High Performance Ceramic Coating Market is comprehensively segmented based on material type, technology, application method, and end-user industry, providing a granular view of market dynamics and adoption patterns. Material segmentation, covering oxides, carbides, and nitrides, reflects the diverse functional requirements across industries, with oxides dominating due to their excellent thermal properties (TBCs). Technology segmentation distinguishes between conventional methods like sol-gel and electroplating and advanced methods like thermal spray and CVD, highlighting the shift toward highly precise, high-density deposition techniques. Application method further refines the market by differentiating between atmospheric plasma spray (APS), vacuum plasma spray (VPS), and High-Velocity Oxy-Fuel (HVOF), each optimized for specific component geometries and required coating thicknesses. The end-user analysis provides the most critical perspective on consumption, revealing the cyclical stability and growth drivers emanating from sectors like aerospace, energy, and automotive, which heavily rely on ceramic protection for operational longevity.

- By Material Type:

- Oxide Coatings (Alumina, Zirconia, Chromia)

- Carbide Coatings (Tungsten Carbide, Silicon Carbide)

- Nitride Coatings (Titanium Nitride, Chromium Nitride)

- Others (Borides, Silicides)

- By Technology:

- Thermal Spray (Plasma Spray, HVOF, Wire Arc, Flame Spray)

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Sol-Gel Process

- Others (Electrophoretic Deposition, Laser Cladding)

- By Application:

- Thermal Barrier Coatings (TBCs)

- Wear and Corrosion Resistant Coatings

- Electrical Insulation/Dielectric Coatings

- Bioceramic Coatings

- Aesthetic Coatings

- By End-User Industry:

- Aerospace & Defense

- Automotive & Transportation

- Energy & Power (Gas Turbines, Oil & Gas)

- Industrial Equipment (Pumps, Valves, Machinery)

- Healthcare (Medical Implants)

- Electronics & Semiconductors

Value Chain Analysis For High Performance Ceramic Coating Market

The value chain for the High Performance Ceramic Coating Market is complex and highly specialized, beginning with upstream raw material suppliers who provide high-purity ceramic powders, precursors, and specialized metallic bond coat materials. Upstream analysis focuses on securing stable supply chains for materials like Yttria-Stabilized Zirconia (YSZ), high-grade aluminum oxide, and specialized carbide powders, where purity and particle size distribution are critical determinants of the final coating performance. Consolidation among primary raw material producers often impacts pricing and availability. Research and development institutions and material technology firms play a crucial role upstream by continually innovating in powder synthesis and optimizing precursor materials for new application technologies, ensuring that the foundational elements meet rigorous aerospace and energy sector specifications. Stability in this phase is paramount as material quality directly dictates coating reliability and regulatory compliance.

The midstream segment involves coating service providers and equipment manufacturers. Equipment manufacturing is dominated by specialized firms providing highly complex thermal spray systems (e.g., Plasma torches, HVOF guns), PVD/CVD chambers, and automated handling systems. Coating service providers apply the materials onto the components, often requiring proprietary processes, specialized surface preparation (blasting, cleaning), and rigorous post-coating testing. These providers can operate either independently or as captive units within large OEMs. The selection of the distribution channel is highly specific; high-value, critical components (like gas turbine blades) typically follow a direct model, where OEMs contract specialized service providers directly for precise application and quality assurance, minimizing risk associated with intermediaries.

Downstream analysis focuses on the end-user industries—Aerospace, Energy, and Automotive—which are the primary consumers. Direct distribution channels involve the coating manufacturer applying the product directly to OEM components or replacement parts. Indirect distribution, though less common for critical high-performance coatings, involves distributors or agents handling lower-volume, standard applications or maintenance, repair, and overhaul (MRO) services. The proximity of coating service centers to major MRO hubs and manufacturing facilities is a key competitive differentiator downstream. The downstream relationship is characterized by long-term contracts and strategic partnerships, driven by the need for continuous engineering support and customization based on the evolving operational requirements of complex machinery.

High Performance Ceramic Coating Market Potential Customers

The potential customers for the High Performance Ceramic Coating Market are predominantly large industrial entities and manufacturers requiring enhanced material protection and functional performance in extreme operating environments. These include global aerospace engine manufacturers (e.g., Pratt & Whitney, GE Aviation, Rolls-Royce) who mandate TBCs for turbine components to maximize engine efficiency and longevity under ultra-high temperatures, viewing ceramic coatings as enabling technology rather than mere protection. Similarly, independent Maintenance, Repair, and Overhaul (MRO) facilities represent a significant customer base, requiring specialized coating services for component refurbishment and lifecycle extension of aging fleets.

In the energy sector, potential customers encompass manufacturers of industrial gas turbines (IGTs) used in power generation, as well as oil and gas exploration companies. IGT manufacturers rely on coatings to manage intense thermal loads and oxidation, while oil and gas firms require extreme wear and corrosion resistance for drilling tools, downhole equipment, and critical piping exposed to abrasive slurries and corrosive chemicals. The shift toward higher efficiency combined cycle power plants intensifies the need for more robust, high-performance TBCs capable of enduring continuous exposure to elevated temperatures and pressure.

The automotive industry represents a massive potential customer base, extending beyond high-performance vehicles to mainstream transportation, especially concerning engine components (pistons, valves, exhaust manifolds) that benefit from thermal management and reduced friction. Furthermore, the rapidly expanding electric vehicle (EV) segment presents unique customer needs for specialized dielectric ceramic coatings and thermal interface materials (TIMs) to ensure the safety and optimal thermal management of high-density battery packs and power electronics, establishing a new, high-volume customer segment focused on electrical and thermal control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $26.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Praxair Surface Technologies, Oerlikon Balzers, Bodycote PLC, Saint-Gobain, H.C. Starck GmbH, Aremco Products, The Sherwin-Williams Company, Morgan Advanced Materials, Zircotec Ltd, Thermal Spray Technologies, IHI Ionbond AG, Sulzer Ltd. (Metco), APS Materials Inc., General Magnaplate Corporation, C. Starck Ceramics, Advanced Ceramic Coating, Kurt J. Lesker Company, TST Coatings GmbH, Keronite International Ltd, Ceramic Coating Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Performance Ceramic Coating Market Key Technology Landscape

The technology landscape for the High Performance Ceramic Coating Market is defined by the ongoing advancements in deposition methods aimed at improving coating density, reducing porosity, and enhancing adhesion strength, particularly under extreme thermal and mechanical stresses. Thermal Spray technologies, specifically Plasma Spray (both Atmospheric and Vacuum) and High-Velocity Oxy-Fuel (HVOF), remain the foundational methods for depositing thick ceramic layers like Thermal Barrier Coatings (TBCs) and wear-resistant carbide coatings. Recent innovation focuses on Suspension Plasma Spray (SPS) and Solution Precursor Plasma Spray (SPPS), which utilize liquid feedstocks instead of traditional powders, allowing for the creation of unique, columnar microstructures with superior strain tolerance and lower thermal conductivity, directly boosting the efficiency of modern gas turbines. The precise control over microstructure afforded by these liquid-feed technologies is crucial for achieving next-generation performance requirements.

Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) technologies are critical for thin-film applications requiring exceptional hardness, chemical purity, and intricate coating architecture, primarily utilized for cutting tools, medical implants, and certain semiconductor components. PVD methods, such as sputtering and arc deposition, allow for the precise creation of highly crystalline, dense nitride and carbide layers (e.g., TiN, CrN). CVD is favored when complex component geometries require conformal coverage, enabling highly uniform deposition on internal surfaces. The convergence of these technologies, often resulting in hybrid coating systems combining PVD/CVD layers with underlying thermal spray layers, allows for the realization of multi-functional protection tailored to highly specific operational demands, maximizing the protective envelope of the finished component.

A significant emerging technological frontier involves nanotechnology and additive manufacturing compatibility. Nanostructured ceramic coatings, achieved through novel powder synthesis or advanced deposition control, exhibit dramatically enhanced hardness, lower friction, and improved fracture toughness compared to traditional microcrystalline materials. Furthermore, the increasing adoption of Additive Manufacturing (AM) for fabricating complex metal components necessitates the development of specialized coating processes capable of handling the unique surface roughness and material composition variances inherent to AM parts. Research in laser cladding and cold spray techniques is specifically targeting AM component protection, offering methods to deposit high-density ceramic layers with minimal thermal distortion to the underlying printed substrate, thereby accelerating the commercial viability of 3D-printed components in critical applications.

Regional Highlights

- North America: This region holds a dominant position in terms of market value, driven by the colossal presence of the aerospace and defense sector, particularly in the United States. Stringent FAA regulations and consistent investment in military aircraft and commercial jet engine programs necessitate the use of cutting-edge TBCs and wear-resistant ceramics. The region also features significant research and development activity, particularly in Silicon Valley and across major universities, focusing on advanced materials for electronics, semiconductors, and specialized military applications. The mature power generation market, with its focus on modernizing aging gas turbine fleets, provides a steady demand for high-reliability coating services.

- Europe: Europe represents a highly mature and technologically advanced market, characterized by stringent environmental regulations (e.g., EU Emissions Trading System, REACH) which favor high-efficiency technologies enabled by ceramic coatings. Germany, France, and the UK are central hubs, driven by the automotive sector (high-performance and electric vehicle components), aerospace (Airbus and engine manufacturers), and general industrial machinery. The focus here is on precision engineering and highly customized coating solutions, often supported by public-private research consortia aiming to improve coating sustainability and application processes.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, propelled by rapid industrialization, massive infrastructure development, and escalating energy demand, particularly in China, India, and South Korea. The expansion of domestic civil aviation, coupled with significant investments in new power plants (including conventional and concentrated solar power), drives high-volume consumption. China leads in establishing coating service capacity, aiming for self-sufficiency in high-performance materials. Lower manufacturing costs and governmental support for domestic aerospace and automotive industries make APAC a critical growth engine.

- Latin America (LATAM): The market growth in LATAM is primarily driven by the oil and gas sector (especially in Brazil and Mexico) requiring robust corrosion and abrasion resistance for drilling and processing equipment, often operating in challenging deep-water environments. The aerospace MRO market is also emerging, though the overall adoption rate for high-end thermal ceramics remains lower compared to North America, often relying on imported technology and services.

- Middle East and Africa (MEA): MEA market expansion is intrinsically linked to substantial investments in the petrochemical and power generation sectors, driven by resource extraction and energy infrastructure upgrades, particularly in the GCC countries. The harsh, high-temperature desert environments necessitate superior anti-corrosion and thermal management coatings for pipelines, turbines, and desalination plants. Significant defense spending also contributes to demand for specialized ceramic materials for military platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Performance Ceramic Coating Market.- Praxair Surface Technologies (A Linde Company)

- Oerlikon Balzers (Surface Solutions Division of OC Oerlikon Management AG)

- Bodycote PLC

- Saint-Gobain

- H.C. Starck GmbH

- Aremco Products, Inc.

- The Sherwin-Williams Company

- Morgan Advanced Materials

- Zircotec Ltd

- Thermal Spray Technologies (TST)

- IHI Ionbond AG

- Sulzer Ltd. (Metco)

- APS Materials Inc.

- General Magnaplate Corporation

- C. Starck Ceramics

- Advanced Ceramic Coating (ACC)

- Kurt J. Lesker Company

- TST Coatings GmbH

- Keronite International Ltd

- Ceramic Coating Co.

Frequently Asked Questions

Analyze common user questions about the High Performance Ceramic Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of High Performance Ceramic Coatings in the aerospace industry?

The primary function is the application of Thermal Barrier Coatings (TBCs), typically Yttria-Stabilized Zirconia, on gas turbine hot section components (blades, vanes). TBCs reduce the operating temperature of the underlying metallic superalloy, enabling higher engine firing temperatures for improved fuel efficiency and power output, while extending component service life dramatically.

How do High Performance Ceramic Coatings enhance the efficiency of industrial gas turbines?

Ceramic coatings allow industrial gas turbines to operate at significantly higher combustion temperatures without melting the turbine blades. This elevated operational temperature directly translates into increased thermodynamic efficiency (higher Carnot efficiency), reduced fuel consumption per kilowatt-hour generated, and minimized NOₓ emissions, crucial for modern power generation requirements.

What are the key technical challenges facing the adoption of ceramic coatings?

The main technical challenge is managing the thermal expansion mismatch between the ceramic coating (low thermal expansion) and the metallic substrate (high thermal expansion). This mismatch can lead to high residual stresses, causing coating cracking, delamination, or spallation, especially during severe thermal cycling. Researchers address this using graded coatings and specialized metallic bond layers.

Which application technology dominates the high-performance ceramic coating market?

Thermal Spray technology, particularly Plasma Spray (APS and VPS) and High-Velocity Oxy-Fuel (HVOF), dominates the market by volume and value. These methods efficiently deposit thick, dense ceramic layers required for high-stress applications like TBCs and heavy wear protection, offering the necessary deposition rates and flexibility for large industrial components.

How is the High Performance Ceramic Coating Market being impacted by the rise of electric vehicles (EVs)?

The EV sector drives demand for ceramic coatings used for thermal management and electrical insulation of battery components and power electronics. Specialized dielectric ceramic coatings prevent thermal runaway in lithium-ion battery modules and provide high-performance electrical insulation for critical high-voltage components, ensuring safety and thermal stability in advanced EV systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager