High Power CW DUV Lasers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435323 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

High Power CW DUV Lasers Market Size

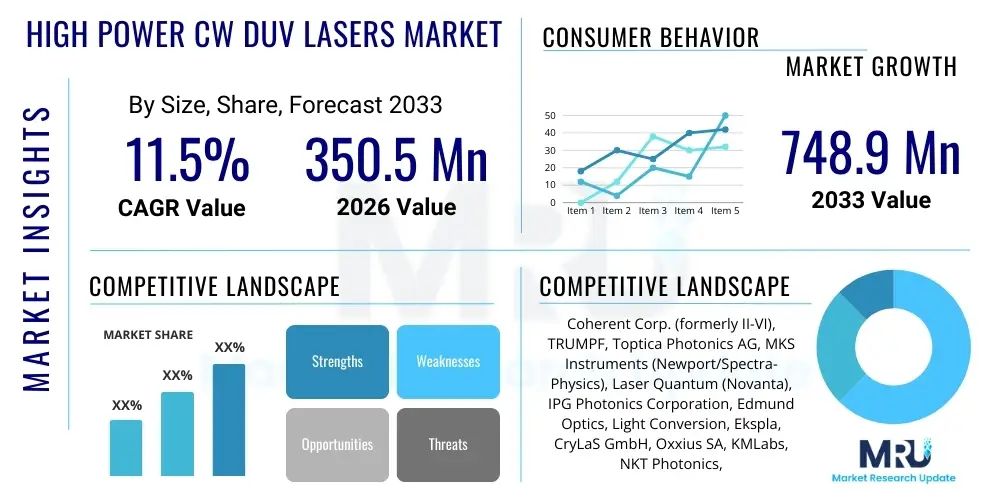

The High Power CW DUV Lasers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $350.5 million in 2026 and is projected to reach $748.9 million by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the relentless demand for miniaturization in semiconductor manufacturing, particularly in advanced lithography and high-precision metrology applications. Continuous wave (CW) Deep Ultraviolet (DUV) lasers, characterized by their stable output power and narrow linewidth, are becoming indispensable tools for high-yield production processes.

High Power CW DUV Lasers Market introduction

The High Power CW DUV Lasers Market encompasses specialized laser systems that emit continuous wave radiation in the deep ultraviolet spectrum, typically below 300 nm, often achieved through frequency conversion techniques such as second harmonic generation (SHG) or fourth harmonic generation (FHG) from established infrared or visible laser platforms. These lasers deliver superior beam quality and power stability, which are critical for applications demanding extremely high spatial resolution and repeatable processing. The necessity for these high-specification characteristics positions DUV lasers as foundational components in several high-tech sectors, ensuring optimal performance where standard UV or visible lasers cannot meet the technical requirements. The technology leverages complex nonlinear optics and thermal management systems to sustain high output power in the challenging DUV range.

The product description centers on highly stable, solid-state or diode-pumped solid-state (DPSS) laser architectures utilizing sophisticated optics to generate coherent light in the 266 nm or 248 nm range. Major applications include advanced semiconductor wafer inspection, mask repair, photomask manufacturing, and high-resolution optical metrology. Furthermore, they are increasingly utilized in specialized materials processing, such as precise etching and patterning of transparent materials, and in the nascent fields of quantum technology and specialized bio-imaging where high photon energy and low noise are paramount. The reliability and long operational lifespan of modern CW DUV systems, coupled with decreasing cost of ownership, are significantly expanding their adoption footprint across diverse industrial environments.

Key benefits of High Power CW DUV Lasers include exceptionally fine feature size realization due to the shorter wavelength, enhanced measurement accuracy in metrology tasks due to superior stability, and reduced thermal impact on sensitive materials due to continuous rather than pulsed operation, allowing for smoother, higher-quality processing surfaces. Driving factors propelling this market include the global transition to sub-10 nm semiconductor manufacturing nodes, the expansion of high-definition display technology (OLED and MicroLED), and increased investment in advanced quality control and non-destructive testing methodologies. Regulatory pressures emphasizing zero-defect manufacturing in critical industries like aerospace and medical devices also contribute to the demand for these high-precision tools, making DUV lasers a strategic investment for technology leaders globally.

High Power CW DUV Lasers Market Executive Summary

The global High Power CW DUV Lasers market is characterized by robust business trends driven primarily by capital expenditure increases in the semiconductor fabrication sector (Fabs) globally. Market dynamics show a distinct focus on improving system efficiency, enhancing power output while maintaining ultra-low noise, and extending the operational lifespan of frequency conversion crystals, which remains a key technical challenge. Strategic collaborations between laser manufacturers and major equipment integrators (OEMs) are crucial for developing customized solutions that meet the exacting specifications of leading-edge lithography and inspection tools. Furthermore, the trend toward vertical integration, where component suppliers are acquired by larger laser system providers, is observed, aimed at securing critical supply chains for specialized optics and gain media, thereby optimizing production scale and cost effectiveness in a highly competitive technical niche.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing segment, primarily fueled by massive government and private investments in establishing and expanding semiconductor fabrication facilities in countries such as South Korea, Taiwan, China, and Japan. These countries represent the core global manufacturing hub for advanced microelectronics, necessitating continuous upgrades to inspection and quality assurance infrastructure utilizing DUV lasers. North America and Europe maintain significant market shares, predominantly driven by intense research and development (R&D) activities, adoption in niche scientific instrumentation, and application in high-value, low-volume manufacturing sectors, including specialized aerospace components and complex medical diagnostics equipment, ensuring technological leadership and demanding sophisticated customization capabilities from suppliers.

Segment-wise, the Application segment focusing on Semiconductor Inspection and Metrology holds the largest market share due to the critical role DUV systems play in ensuring defect-free output at nanoscale dimensions, a requirement that scales directly with chip complexity. Within the Power Output segment, the sub-segment comprising systems capable of delivering high power (e.g., above 5W in DUV) is expected to exhibit the highest CAGR, reflecting the industry need for faster throughput in demanding processes like advanced mask writing and laser trimming. Technological trends indicate a shift towards more compact, air-cooled, and higher efficiency solid-state laser systems, minimizing facility requirements and operational complexity for end-users while maximizing beam stability over extended operational cycles in high-volume production environments.

AI Impact Analysis on High Power CW DUV Lasers Market

Users frequently inquire how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the notoriously complex and sensitive operations of High Power CW DUV Laser systems. Common questions revolve around predictive maintenance schedules for critical components like frequency conversion crystals, dynamic optimization of beam parameters (power, alignment, stability) in real-time to counter environmental fluctuations, and the application of AI in analyzing the voluminous data generated during semiconductor inspection processes. The key themes summarized from user concerns are focused on reducing unscheduled downtime—a major cost factor in semiconductor fabs—and enhancing process control precision beyond traditional feedback loop limitations. Users expect AI integration to lower the total cost of ownership (TCO) by maximizing component lifespan and ensuring consistent, defect-free material processing and metrology outcomes.

AI's primary influence is moving DUV laser operation from reactive maintenance to predictive and prescriptive control. Traditional systems rely on manual calibration and periodic overhauls; however, implementing ML algorithms allows the system to continuously monitor internal parameters—temperature, current draw, voltage fluctuations, crystal conversion efficiency decay—and correlate these data points with historical performance trends. This enables the prediction of potential component failure hours or even days in advance, allowing for scheduled maintenance during non-production windows. Such predictive capabilities dramatically increase the uptime and reliability of multi-million dollar capital equipment, which is critical in competitive fabrication environments where every hour of downtime translates to significant revenue loss. Furthermore, AI models can be trained on vast datasets of processed materials to identify subtle shifts in processing quality that might not be visible to human operators or traditional statistical process control (SPC) methods.

Beyond maintenance, AI algorithms are being deployed for real-time beam shaping and stability enhancement. DUV beams are highly sensitive to thermal gradients and vibrations; AI can rapidly analyze sensor input from beam profilers and wavefront sensors and implement micro-adjustments to the laser optics or thermal management systems faster and more accurately than conventional PID (Proportional-Integral-Derivative) controllers. This dynamic optimization is crucial for maintaining the stringent linewidth and spatial intensity requirements needed for sub-micron processing. In metrology applications, AI accelerates defect classification and root cause analysis by processing high-resolution DUV inspection images, drastically reducing the time required for decision-making and allowing for immediate process correction feedback, thereby integrating the laser system more tightly into the overall smart manufacturing ecosystem.

- AI-driven Predictive Maintenance: Forecasts crystal degradation and component failure, maximizing laser uptime.

- Real-time Parameter Optimization: Utilizes ML to dynamically adjust beam stability and power output, compensating for environmental noise.

- Enhanced Defect Classification: Accelerates the analysis of metrology data from DUV inspection tools, improving yield management.

- Optimized Laser Alignment: Facilitates automated, precise alignment routines, reducing human intervention and calibration time.

- Reduced Total Cost of Ownership (TCO): By extending component lifespan and preventing catastrophic failures.

- Improved Process Recipe Development: AI assists in iterating optimal laser settings for new materials processing tasks.

DRO & Impact Forces Of High Power CW DUV Lasers Market

The High Power CW DUV Lasers Market is shaped by a complex interplay of drivers, restraints, and opportunities that dictate its growth trajectory and technological evolution. Key drivers center on the global acceleration of digital transformation, which mandates higher density computing and storage, directly increasing demand for advanced semiconductors requiring DUV inspection and lithography. Restraints primarily involve the high initial capital investment and the technical fragility associated with DUV components, such as the limited lifespan and sensitivity of nonlinear frequency conversion crystals and specialized optical coatings, which necessitate stringent operating environments and complex maintenance protocols. Opportunities arise from expanding applications beyond traditional semiconductor manufacturing, notably in specialized micro-machining of brittle materials like sapphire and glass for consumer electronics, as well as emerging high-growth areas like quantum computing component fabrication and advanced medical diagnostics, offering avenues for diversification and sustained revenue streams. These forces collectively propel market players toward innovation in system reliability and efficiency, balancing performance gains with operational expenses.

Drivers: The fundamental driver is the ongoing scaling of Moore's Law, pushing semiconductor feature sizes below 10 nm, where only DUV wavelengths provide the requisite resolution for inspection and pattern verification. The explosive growth in data centers, 5G infrastructure, electric vehicles (EVs), and advanced connectivity devices necessitates massive production of complex integrated circuits (ICs), directly correlating to the demand for high-throughput DUV metrology systems to ensure quality. Furthermore, the increasing complexity of 3D IC architectures (e.g., FinFET, GAA) and stacked memory requires non-destructive, high-resolution subsurface inspection capabilities, which CW DUV lasers are uniquely positioned to provide due to their penetration depth and low noise characteristics compared to pulsed systems.

Restraints: The most significant restraint remains the high acquisition cost of high power CW DUV systems, which places a substantial burden on smaller fabrication facilities and R&D labs. Technically, the inherent challenge of generating and maintaining stable DUV output involves significant complexity. The components, particularly the nonlinear crystals used for frequency conversion, are highly susceptible to thermal degradation and "solarization," leading to decreased efficiency and requiring frequent, costly replacement or servicing. Moreover, the stringent environmental control (temperature and humidity) required for optimal laser operation adds to the operational expense (OpEx), acting as a barrier to entry for widespread industrial application outside of controlled cleanroom environments.

Opportunities: Strategic opportunities lie in the adoption of DUV lasers for applications in next-generation displays, specifically microLED manufacturing, where high-precision laser lift-off and repair processes are essential. The burgeoning field of quantum technology, which requires fabrication of ultra-precise optical components and defect engineering in diamond (NV centers), presents a niche but highly lucrative application area for stable CW DUV sources. Furthermore, advancements in specialized materials processing, such as surface activation and high-precision ablation of bio-compatible polymers for medical devices, open new revenue channels. Innovations in crystal technology and the development of more robust, environmentally tolerant laser architectures are key to unlocking these opportunities, potentially mitigating the current restraints related to cost and complexity.

Segmentation Analysis

The High Power CW DUV Lasers market is meticulously segmented to provide clarity on market structure, end-user adoption patterns, and technological trends. Segmentation primarily occurs across three critical axes: Output Power, Wavelength, and Application. Understanding these segments is vital for stakeholders to tailor product development and market strategies effectively. The Output Power segment differentiates between low, medium, and high power systems, reflecting the required throughput and complexity of the processing or inspection tasks. For instance, high-power systems are essential for high-speed wafer scanning in volume production environments, whereas lower power systems might suffice for specialized research or low-volume mask repair. Wavelength segmentation is typically divided based on the dominant industry standards, predominantly 266 nm and 248 nm, each optimized for specific material interactions and regulatory standards within the semiconductor industry.

The most defining segmentation factor is Application, which clearly delineates the market utility. This segment includes Semiconductor Inspection (further broken down into front-end and back-end inspection), Metrology, Photomask Repair, and Advanced Materials Processing. Semiconductor applications dominate due to the non-negotiable requirement for DUV metrology in quality control. The specific use case dictates the necessary laser specifications; for instance, high-resolution CD (Critical Dimension) metrology requires maximum beam stability and narrow linewidth, while mask repair prioritizes fast, localized power modulation. The diversity in required laser characteristics across these applications underscores the need for suppliers to offer highly specialized and customized product lines.

Growth analysis suggests that while Semiconductor Inspection remains the largest volume segment, the emerging application area of Advanced Materials Processing—including micro-scale patterning and specialized surface modification for aerospace and medical components—is poised for accelerated growth, reflecting the expanding versatility of DUV laser technology outside its traditional semiconductor stronghold. This diversification is crucial for market stability, mitigating dependence on the cyclical nature of the microchip industry. Manufacturers are consequently focusing R&D efforts on enhancing wavelength flexibility and integrating intelligent control systems compatible with diverse industrial automation platforms.

- By Output Power

- Low Power (Below 1 W)

- Medium Power (1 W to 5 W)

- High Power (Above 5 W)

- By Wavelength

- 266 nm Lasers

- 248 nm Lasers

- Other Wavelengths (e.g., 213 nm, utilizing higher harmonic generation)

- By Application

- Semiconductor Inspection and Metrology

- Wafer Inspection

- Critical Dimension (CD) Metrology

- Photomask Manufacturing and Repair

- Advanced Materials Processing (Etching, Ablation)

- Scientific Research and Instrumentation

- Display Manufacturing (MicroLED, OLED)

- Semiconductor Inspection and Metrology

Value Chain Analysis For High Power CW DUV Lasers Market

The value chain for High Power CW DUV Lasers is complex and characterized by high technical expertise at every stage, commencing with highly specialized upstream component manufacturing. Upstream activities involve the production of critical components necessary for laser operation, primarily the fundamental infrared (IR) pump source lasers (often high-power DPSS or Fiber lasers), highly pure and defect-free nonlinear optical crystals (e.g., LBO, BBO, CLBO) required for frequency conversion to DUV, and specialized optical elements like highly reflective mirrors, beam splitters, and high-damage-threshold coatings designed specifically for the DUV wavelength. Suppliers in this phase are often niche, globally distributed experts whose product quality directly impacts the final laser system's performance and longevity. Securing stable, high-quality sourcing for these components, particularly the conversion crystals, remains a significant competitive differentiator and supply chain challenge due to the demanding technical specifications and relatively low yield rates in manufacturing. The cost structure of the final DUV system is heavily weighted towards these upstream specialized components.

Midstream activities encompass the core manufacturing, integration, and testing of the complete CW DUV laser system. This phase involves meticulous assembly of the laser cavity, precise alignment of the frequency conversion stage (often requiring intricate thermal stabilization systems), integration of sophisticated power supply and control electronics, and comprehensive quality assurance testing. The manufacturing process demands ultra-clean environments (typically Class 100 or better) and highly skilled technicians to ensure the laser system meets stringent specifications for power stability (often measured in parts per million), beam pointing stability, and noise suppression. Original Equipment Manufacturers (OEMs) who integrate these systems into larger tools (e.g., semiconductor inspection equipment) require close collaboration during this stage to ensure compatibility and seamless interface with robotic handling and software control systems. The complexity of integration often limits the number of viable system integrators, contributing to the concentrated nature of the market.

Downstream activities include distribution, installation, service, and end-user adoption. Distribution channels are typically direct for large-scale industrial customers (Tier 1 semiconductor fabs) due to the high value and customization required, necessitating dedicated sales engineers and support teams. Indirect channels, involving specialized distributors or system integrators, are more common for R&D laboratories or smaller industrial users. Post-sale service and maintenance are crucial revenue streams, given the sensitivity of DUV components. Service agreements often include rapid response for realignment, component replacement (especially crystals), and predictive maintenance routines. Effective distribution and robust, highly technical after-sales support are paramount for customer satisfaction and retention, particularly in high-volume production environments where minimal downtime is acceptable. The reputation of the system supplier for reliability and rapid service significantly influences customer purchasing decisions.

High Power CW DUV Lasers Market Potential Customers

The primary customers and end-users of High Power CW DUV Lasers are entities operating at the forefront of microfabrication and advanced material analysis, requiring resolution and precision unattainable with longer wavelength sources. Predominantly, these customers fall within the semiconductor manufacturing ecosystem, encompassing major Integrated Device Manufacturers (IDMs), pure-play foundries, and specialized equipment OEMs. These players utilize DUV lasers for critical front-end processes such as wafer inspection for pattern defects, overlay measurement, and Critical Dimension (CD) metrology during the lithography process, ensuring compliance with extremely tight tolerance limits required for current and next-generation chip designs. The decision-makers are typically process engineers, quality control managers, and procurement officers responsible for selecting and validating high-capital equipment that directly impacts yield and throughput in multi-billion-dollar fabrication plants, prioritizing reliability, stability, and guaranteed specifications above initial cost.

Beyond semiconductors, a growing segment of potential customers includes manufacturers in the advanced display industry, particularly those focused on developing and mass-producing high-resolution MicroLED and OLED panels. In this context, DUV lasers are leveraged for high-precision processes like laser lift-off (LLO), which separates the fragile display layer from the growth substrate, and specialized repair processes for defective pixels or circuits. These customers seek high throughput and exceptional uniformity across large substrate areas. Furthermore, research institutions and universities involved in fundamental physics, material science, and quantum technology R&D represent a consistent, albeit smaller, market segment. They utilize DUV lasers for spectroscopic analysis, manipulating cold atoms, and fabricating novel materials and components for next-generation computing architectures, where spectral purity and long-term stability are crucial experimental parameters.

Other vital customer groups encompass specialized industrial manufacturers involved in high-precision micro-machining. This includes companies creating highly complex medical devices (e.g., stents, micro-fluidic channels), aerospace components requiring ultra-clean surface ablation, and specialized defense contractors working with sensitive materials. These end-users demand customized laser specifications, often focusing on reliability under non-ideal industrial conditions and integration into existing robotic and automated production lines. The trend towards industrial automation and the increasing complexity of manufactured components across all sectors ensures a continually expanding base of potential customers requiring the unique capabilities provided by high-power, stable CW DUV laser systems for non-destructive testing, precise material removal, and surface analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350.5 million |

| Market Forecast in 2033 | $748.9 million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coherent Corp. (formerly II-VI), TRUMPF, Toptica Photonics AG, MKS Instruments (Newport/Spectra-Physics), Laser Quantum (Novanta), IPG Photonics Corporation, Edmund Optics, Light Conversion, Ekspla, CryLaS GmbH, Oxxius SA, KMLabs, NKT Photonics, Quantronix, Radiant Dyes Laser Accessories GmbH, JDS Uniphase (Lumentum), Lambda Physik (Coherent), Sumitomo Heavy Industries, FST Inc., Photonics Industries International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Power CW DUV Lasers Market Key Technology Landscape

The core technology underpinning the High Power CW DUV Lasers market revolves around advanced frequency conversion techniques, primarily utilizing highly efficient non-linear optical processes to generate deep ultraviolet light from readily available, stable infrared or visible sources. The most common methods employed include Fourth Harmonic Generation (FHG) or Second Harmonic Generation (SHG) cascaded processes from DPSS lasers, typically Nd:YAG or Nd:YVO4, operating in the IR range (1064 nm or 1319 nm). For 266 nm output, two sequential SHG stages are often employed: the first converts the IR fundamental to the visible green (532 nm or 659.5 nm), and the second stage converts the green light into the DUV range. The crucial technical challenge lies in selecting and maintaining the non-linear crystal (such as LBO, BBO, or CLBO) to sustain high conversion efficiency without thermal degradation (solarization) or optical damage under high continuous wave power loading, necessitating sophisticated thermal management and active phase matching control to ensure output stability over time.

A second critical element in the technology landscape is the development and integration of advanced resonator designs and beam conditioning optics specifically optimized for DUV light. Due to the high photon energy and potential for material interaction, DUV optics require specialized, high-damage-threshold coatings and ultra-low-scatter substrates (typically fused silica). Manufacturers employ active feedback loops utilizing fast actuators and high-sensitivity photodiodes to maintain precise cavity alignment and counteract environmental disturbances, ensuring the beam quality (M2 value) and pointing stability meet the extremely rigorous standards required for metrology systems. Furthermore, techniques such as external resonant cavities are often implemented to significantly enhance the intensity of the fundamental or harmonic beam interacting with the conversion crystal, boosting the overall DUV output power efficiency without overloading the internal laser components, although this adds complexity to the system architecture.

Emerging technological innovations focus on increasing system robustness and compactness. This includes exploring novel non-linear materials that offer higher resistance to solarization and lower maintenance requirements, such as periodically poled stoichiometric lithium tantalate (PPSLT), though their implementation in high-power DUV CW systems is still maturing. There is also a significant drive towards fiber-laser-pumped systems due to the inherent stability and compact form factor of fiber lasers compared to traditional bulk DPSS architectures. Integrating AI-powered control systems is becoming standard practice; these systems monitor the laser's operational parameters in real-time and automatically perform micro-adjustments to optimize power, stability, and crystal phase matching, drastically reducing the reliance on manual calibration and scheduled maintenance, thereby improving the overall operational efficiency and reducing the TCO for industrial end-users globally, solidifying the market’s technological trajectory towards increased automation and reliability in demanding applications.

Regional Highlights

The regional analysis of the High Power CW DUV Lasers Market clearly defines Asia Pacific (APAC) as the epicenter of demand, driven by massive investments in semiconductor fabrication and advanced display manufacturing. Countries like Taiwan, South Korea, China, and Japan house the world's largest semiconductor foundries and advanced packaging facilities, which rely heavily on DUV metrology and inspection for quality control at leading-edge nodes (7 nm and below). Government initiatives and national strategies promoting self-sufficiency in high-tech manufacturing, particularly in China and South Korea, continue to fuel the expansion of new wafer fabs, guaranteeing sustained, high-volume demand for DUV laser systems necessary for capital equipment procurement. The market in APAC is characterized by high volume, price sensitivity, and a strong preference for localized technical support and rapid response times for minimizing production losses. This region dictates global pricing and technological adoption trends due to its sheer manufacturing scale.

North America represents a mature, high-value market segment, distinguished by strong leadership in R&D, advanced scientific instrumentation, and specialized industrial manufacturing. The demand here is less volume-driven and more focused on cutting-edge performance, customization, and integration into proprietary high-technology systems, particularly in defense, aerospace, and advanced materials research laboratories. Key demand drivers include next-generation lithography research, photonics development for quantum computing, and specialized academic research requiring ultra-stable, narrow-linewidth DUV sources. The presence of major laser component manufacturers and system integrators in the U.S. ensures robust supply chain capabilities and continuous innovation, allowing North America to retain a dominant position in technological advancement and setting global standards for system reliability and specification requirements.

Europe constitutes a significant market, primarily centered around industrial automation, high-precision manufacturing, and stringent quality control standards in key industries like automotive, medical devices, and high-end consumer electronics. Western European countries, particularly Germany, France, and the UK, exhibit strong demand for DUV lasers utilized in micro-machining brittle materials and advanced non-destructive testing (NDT) methodologies for quality assurance in complex component manufacturing. The European market emphasizes energy efficiency, modularity, and integration into existing highly automated production lines, often favoring specialized, low-maintenance systems. While not matching APAC's volume, the European market commands premium pricing for systems that demonstrate superior engineering, long-term reliability, and compliance with strict environmental and safety regulations, fostering a culture of technical excellence among local suppliers.

- Asia Pacific (APAC): Dominant market share; fueled by semiconductor fabrication expansion (Taiwan, South Korea, China); fastest growth rate; key applications in wafer inspection and display manufacturing.

- North America: High-value market; focus on R&D, quantum technology, and advanced scientific instrumentation; major technological innovation hub; demand for customized, ultra-high-specification systems.

- Europe: Strong presence in industrial micromachining, medical device manufacturing, and high-precision quality control; emphasis on system reliability, automation integration, and adherence to strict EU standards.

- Latin America & MEA (Middle East & Africa): Emerging markets; smaller current share; growth driven by localized electronics manufacturing investment and academic research expansion, although adoption rates lag due to infrastructural and capital constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Power CW DUV Lasers Market.- Coherent Corp. (formerly II-VI Incorporated)

- TRUMPF

- Toptica Photonics AG

- MKS Instruments (Spectra-Physics/Newport)

- Laser Quantum (Novanta)

- IPG Photonics Corporation

- Edmund Optics (Focused on components)

- Light Conversion

- Ekspla

- CryLaS GmbH

- Oxxius SA

- KMLabs

- NKT Photonics

- Quantronix

- Radiant Dyes Laser Accessories GmbH

- Lumentum Operations LLC

- Sumitomo Heavy Industries, Ltd.

- FST Inc.

- Photonics Industries International, Inc.

- ASML Holding N.V. (indirect involvement through integration)

Frequently Asked Questions

Analyze common user questions about the High Power CW DUV Lasers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are High Power CW DUV Lasers primarily used for in the semiconductor industry?

High Power Continuous Wave Deep Ultraviolet (CW DUV) lasers are primarily used for high-resolution metrology, wafer inspection, and Critical Dimension (CD) measurement in advanced semiconductor fabrication. Their short wavelength (typically 266 nm) and superior beam stability are essential for detecting nanoscale defects and verifying pattern integrity on sub-10 nm nodes, directly impacting chip yield and quality.

What major technical challenges restrict the widespread adoption of CW DUV lasers?

The primary technical challenges include the high initial capital cost of the laser systems and the operational complexity associated with maintaining the sensitive nonlinear optical crystals used for frequency conversion. These crystals are prone to thermal degradation (solarization), requiring stringent temperature control and periodic, costly replacement, which increases the Total Cost of Ownership (TCO).

How is AI impacting the performance and maintenance of DUV laser systems?

AI significantly impacts DUV laser systems by enabling predictive maintenance, utilizing machine learning algorithms to forecast component failure (like crystal degradation) based on real-time operational data. AI also facilitates dynamic, real-time beam parameter optimization, enhancing power stability and precision far beyond traditional feedback control methods.

Which geographic region dominates the demand for High Power CW DUV Lasers?

The Asia Pacific (APAC) region dominates the demand for High Power CW DUV Lasers. This dominance is driven by the massive concentration of leading-edge semiconductor foundries and advanced microelectronics manufacturing hubs in countries such as Taiwan, South Korea, and China, necessitating continuous investment in advanced metrology equipment.

What differentiates Continuous Wave (CW) DUV lasers from Pulsed DUV lasers in industrial applications?

CW DUV lasers deliver a continuous, stable beam with extremely low noise and high spectral purity, making them ideal for high-precision metrology, inspection, and non-destructive surface analysis where measurement accuracy is paramount. In contrast, pulsed DUV lasers, offering high peak power, are typically preferred for high-energy material modification tasks like ablation or drilling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager