High Power Green Laser Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432643 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Power Green Laser Market Size

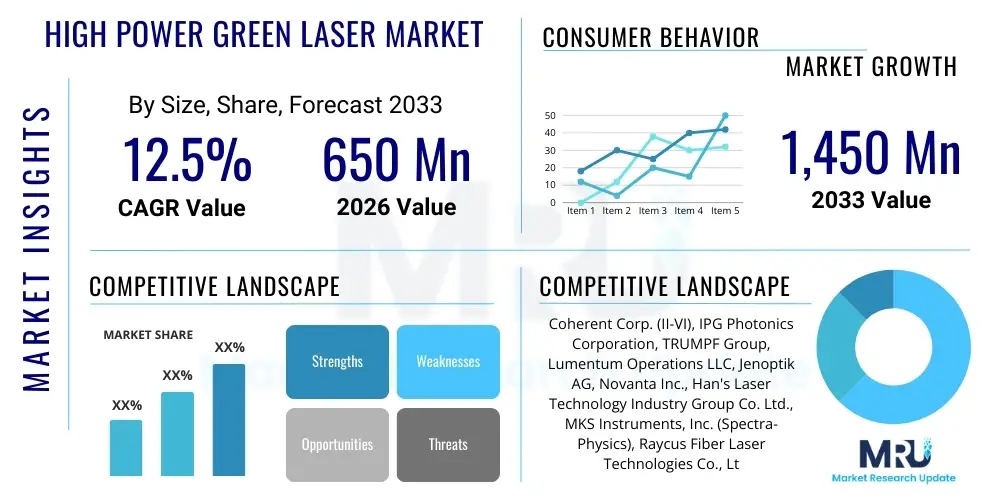

The High Power Green Laser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [insert 12.5%] between 2026 and 2033. The market is estimated at [insert USD 650 Million] in 2026 and is projected to reach [insert USD 1,450 Million] by the end of the forecast period in 2033.

High Power Green Laser Market introduction

The High Power Green Laser Market encompasses advanced laser systems emitting coherent light in the green spectrum (typically 532 nm), characterized by high energy output essential for demanding industrial, medical, and scientific applications. These lasers typically utilize frequency doubling techniques, often based on Neodymium-doped Yttrium Vanadate (Nd:YVO4) or Neodymium-doped Yttrium Aluminum Garnet (Nd:YAG) crystals, pumped by high-efficiency diodes. The distinct advantage of green lasers lies in their shorter wavelength compared to infrared lasers, which translates to better absorption characteristics across various materials, particularly high-reflectivity metals like copper and gold, and biological tissues, enabling superior precision and material processing efficiency.

Key applications driving market adoption include micro-machining, photovoltaic manufacturing (solar cell scribing and edge deletion), precision marking, and advanced medical procedures such as ophthalmology and dermatology. The green laser's high beam quality, coupled with its ability to deliver precise energy pulses, makes it indispensable for tasks requiring minimal thermal damage and high throughput. Furthermore, the rising demand for sophisticated consumer electronics, where micromachining of fragile components is crucial, is accelerating the integration of these laser systems into high-volume manufacturing lines globally.

The primary benefit of utilizing high power green lasers is the significant improvement in process yield and speed, particularly in applications dealing with thin films and temperature-sensitive substrates. Driving factors for this market include rapid industrial automation, substantial investments in renewable energy infrastructure, and the continuous miniaturization trend in semiconductor and electronics fabrication. These technological demands necessitate laser sources capable of finer spot sizes and higher peak power stability, positioning high power green lasers as critical enabling technology across several high-growth sectors.

High Power Green Laser Market Executive Summary

The High Power Green Laser Market is poised for robust expansion, primarily fueled by escalating industrial adoption within Asia Pacific, particularly in electronics and solar energy sectors. Business trends indicate a strong focus on developing cost-effective, high-efficiency Diode-Pumped Solid-State (DPSS) lasers and specialized fiber laser systems operating in the green spectrum, aiming to reduce the total cost of ownership and improve industrial scalability. Strategic mergers, acquisitions, and collaborations focusing on integrating beam shaping technologies and advanced laser control software are central to competitive strategies, ensuring manufacturers maintain technological superiority and address the complex demands of micromachining applications.

Regional trends highlight the dominance of the Asia Pacific market due to its overwhelming concentration of semiconductor, display panel, and electric vehicle battery manufacturing facilities, which are heavy users of precision green laser systems for cutting and bonding. North America and Europe demonstrate steady growth, driven by advanced medical device manufacturing, scientific research endeavors, and sophisticated defense applications requiring specialized ruggedized laser sources. Regulatory support for renewable energy technologies further stimulates demand in these regions, specifically for solar cell production equipment utilizing green laser scribing.

Segment trends reveal that the Material Processing segment, encompassing micro-cutting, drilling, and annealing, retains the largest market share, driven by the persistent need for ultra-precision manufacturing in consumer electronics. Concurrently, the 50W to 100W power output range is expected to exhibit the fastest growth, offering an optimal balance between high processing speed and stable beam characteristics essential for demanding industrial environments. The continuous technological advancements in frequency conversion efficiency and diode reliability are enabling the commercial viability of even higher power green lasers for emerging applications like laser cleaning and large-area material modification.

AI Impact Analysis on High Power Green Laser Market

Analysis of common user questions regarding AI's impact on the High Power Green Laser Market reveals key thematic areas focusing on process optimization, predictive maintenance, and autonomous manufacturing integration. Users frequently inquire about how AI can enhance the precision of laser micro-machining (e.g., dynamic parameter adjustment based on real-time material feedback), the ability of machine learning algorithms to predict and compensate for thermal drift or beam quality degradation, and the development of fully automated, 'lights-out' laser processing cells managed by AI. The core expectations center around leveraging AI to push the boundaries of achievable precision, significantly reduce downtime through predictive failure analysis, and decrease reliance on highly skilled human operators for complex laser setup and calibration procedures.

The integration of artificial intelligence with high power green laser systems is revolutionizing material processing by enabling real-time adaptive control. AI algorithms utilize sensor data—such as high-speed camera feedback, thermal imaging, and acoustic monitoring—to instantly adjust laser parameters (power, pulse duration, repetition rate) to maintain optimal processing quality despite material variations or environmental fluctuations. This level of dynamic control is crucial in high-value, high-precision manufacturing sectors like semiconductor packaging and complex medical device fabrication, where marginal errors are unacceptable, ensuring process repeatability and minimizing scrap rates significantly.

Furthermore, AI is instrumental in transforming the operational efficiency of laser systems through advanced diagnostics and predictive maintenance (PdM). Machine learning models analyze historical operational data (e.g., diode current, chiller temperature, crystal efficiency) to forecast component degradation, such as the aging of pump diodes or contamination of optical components, long before failure occurs. This capability shifts maintenance strategies from reactive or scheduled interventions to condition-based proactive repairs, maximizing laser uptime and significantly improving overall equipment effectiveness (OEE), thus providing a substantial competitive advantage to manufacturers adopting smart factory solutions.

- Real-Time Process Optimization: AI algorithms enable dynamic adjustment of laser parameters (power, focus, speed) based on in-situ monitoring, maximizing quality and minimizing heat-affected zones (HAZ).

- Predictive Maintenance (PdM): Machine learning models analyze operational data to forecast component failure (e.g., diode degradation, optical misalignment), drastically reducing unplanned downtime and maintenance costs.

- Automated Quality Control: AI-driven vision systems inspect processed materials at high speed, identifying micro-defects invisible to human operators, leading to enhanced quality assurance.

- Autonomous Calibration and Alignment: AI is used to automatically align optical paths and calibrate pulse characteristics, reducing setup time and operator dependence.

- Enhanced Beam Shaping: AI optimizes spatial light modulator (SLM) patterns and beam delivery systems to achieve complex processing geometries with superior efficiency.

- Material Database Optimization: AI creates self-learning material processing databases, quickly determining the optimal laser recipe for new materials or thicknesses.

DRO & Impact Forces Of High Power Green Laser Market

The High Power Green Laser Market dynamics are profoundly shaped by a robust interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the exponential growth in demand for micro-electromechanical systems (MEMS), the expansion of the Electric Vehicle (EV) market requiring precision battery welding and cutting, and accelerating automation trends in solar cell manufacturing, all of which benefit from the high precision and material compatibility of green lasers. Restraints primarily involve the high initial capital investment required for these sophisticated systems, coupled with the complexity of integrating and maintaining high power solid-state and fiber-based green laser sources, particularly concerning thermal management and frequency conversion efficiency.

Opportunities are substantial, revolving around the emergence of new materials processing techniques, such as laser-induced forward transfer (LIFT) and advanced selective laser melting in additive manufacturing, where green lasers offer unique advantages. Furthermore, the push towards developing more compact and energy-efficient green laser modules, leveraging direct diode technology or novel non-linear crystals, presents avenues for market expansion into portable or smaller-scale industrial environments. The successful navigation of these forces determines competitive positioning, with companies focusing on developing lower-cost, maintenance-free systems capable of integrating seamlessly into Industry 4.0 frameworks.

Impact forces illustrate how these DRO elements influence market growth trajectories. The increasing stringency of quality requirements in electronics manufacturing (an external force) amplifies the need for green lasers (a driver), whereas the challenge of securing qualified technical personnel (an internal restraint) slows adoption in some developing regions. The collective impact suggests a market experiencing rapid technological evolution spurred by high-demand applications, yet constrained by technological complexity and investment hurdles, making strategic partnerships and IP control critical elements for sustaining long-term market influence.

Segmentation Analysis

The High Power Green Laser Market is comprehensively segmented based on Laser Type, Power Output, Application, and End-Use Industry, allowing for granular analysis of market demand drivers and technological adoption patterns. This segmentation helps stakeholders understand which specific laser configurations are gaining traction in diverse sectors, from high-throughput industrial processing to sensitive medical diagnostics. The interplay between laser type (e.g., DPSS vs. Fiber) and application (e.g., marking vs. micromachining) often dictates pricing strategies and competitive differentiation within the global marketplace, reflecting the varied requirements for pulse energy, beam quality, and repetition rate.

The segmentation by Power Output is crucial, as it directly correlates with processing speed and application feasibility. Lower power lasers (up to 50W) generally serve precision marking and light medical procedures, whereas higher power configurations (above 100W) are essential for high-speed cutting, drilling of thick materials, and demanding scientific experiments. Understanding this power distribution is vital for manufacturers planning product development roadmaps and for end-users selecting appropriate equipment for their specific operational needs.

Furthermore, segmentation by End-Use Industry—including Electronics & Semiconductor, Automotive, Aerospace & Defense, and Medical—provides insights into the regulatory landscapes and long-term procurement cycles influencing market stability and growth projections. The electronics sector remains the largest consumer, driven by continuous innovation in display technology (OLED/MicroLED) and semiconductor fabrication processes that necessitate ultra-fine, non-thermal processing capabilities best delivered by high-power green laser systems.

- By Laser Type:

- Diode-Pumped Solid-State (DPSS) Lasers

- Fiber Lasers (Frequency Doubled)

- Semiconductor Lasers (Direct Green Diode - Emerging)

- By Power Output:

- Up to 50W

- 50W to 100W

- Above 100W

- By Application:

- Material Processing (Cutting, Scribing, Drilling, Annealing)

- Precision Marking and Engraving

- Scientific Research and Instrumentation

- Medical and Aesthetic Procedures

- Defense and Aerospace

- By End-Use Industry:

- Electronics and Semiconductor Manufacturing

- Automotive and Electric Vehicles

- Aerospace and Defense

- Medical and Healthcare

- Solar/Photovoltaic Industry

Value Chain Analysis For High Power Green Laser Market

The value chain for the High Power Green Laser Market commences with upstream component suppliers providing critical foundational materials such as high-brightness pump diodes, specialized non-linear crystals (e.g., KTP, LBO) for frequency conversion, and high-purity rare-earth-doped gain media (e.g., Nd:YAG, Nd:YVO4). The quality and reliability of these upstream components directly dictate the final performance and lifespan of the laser system. Strong relationships with reliable diode manufacturers, particularly those focusing on power stability and thermal management, are essential for maintaining competitive advantage, as diode cost and longevity are major factors influencing the overall system cost.

Midstream activities involve the complex integration and manufacturing processes undertaken by laser system producers, including optical design, beam delivery system construction, integration of control electronics, and rigorous testing for beam quality and power stability. This stage is characterized by high intellectual property barriers, revolving around proprietary cavity designs, thermal management solutions, and harmonic generation techniques. Distribution channels are varied, incorporating both direct sales models for large, specialized industrial integrators (e.g., OEM customers in the solar industry) and indirect sales through regional distributors and value-added resellers (VARs) who provide localized installation, maintenance, and application support to smaller end-users.

Downstream activities focus on the end-user deployment across diverse industries. For industrial applications, the laser system is often integrated into larger processing machines (e.g., CNC platforms or automated assembly lines), where technical support and application specific training are crucial services provided by the channel partners. The market relies heavily on a skilled network of indirect distributors who can offer tailored solutions and rapid localized service response, particularly in geographically dispersed manufacturing centers. Direct sales are usually reserved for high-volume, global accounts or highly customized scientific research apparatus, ensuring direct manufacturer control over complex specifications and deployment protocols.

High Power Green Laser Market Potential Customers

The primary end-users and buyers of High Power Green Laser systems span a highly specialized range of manufacturing, research, and healthcare entities that require high precision and interaction with materials that exhibit poor infrared absorption. In the industrial sector, the major customer base includes manufacturers of advanced displays (e.g., flexible OLED, MicroLED), where green lasers perform critical processes like laser lift-off (LLO) and precise annealing. Semiconductor foundries utilize these lasers extensively for wafer dicing, memory repair, and trimming thin-film resistors, capitalizing on the short wavelength for superior spot size resolution and minimal substrate damage.

Another significant customer segment resides within the Electric Vehicle (EV) and battery manufacturing industries, where green lasers are increasingly adopted for the precision cutting of highly reflective copper foils used in battery electrodes, a process where traditional infrared lasers struggle due to copper’s high reflectivity at longer wavelengths. Furthermore, the solar industry relies heavily on green lasers for selective emitter scribing and edge deletion processes to enhance photovoltaic cell efficiency, positioning solar panel producers as major long-term procurement entities within this market segment.

Beyond manufacturing, the scientific community, including university research laboratories and national physics facilities, represents a crucial, albeit smaller, customer segment, using high power green lasers for advanced spectroscopy, pumping dye lasers, and generating high harmonics. In the medical domain, specialized dermatology clinics and ophthalmology centers purchase these systems for targeted treatments, such as vascular lesion removal and retinal photocoagulation, benefiting from the specific absorption characteristics of green light in biological tissues.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,450 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coherent Corp. (II-VI), IPG Photonics Corporation, TRUMPF Group, Lumentum Operations LLC, Jenoptik AG, Novanta Inc., Han's Laser Technology Industry Group Co. Ltd., MKS Instruments, Inc. (Spectra-Physics), Raycus Fiber Laser Technologies Co., Ltd., nLIGHT, Inc., EKSPLA UAB, Clark MXR, Inc., Amplitude Laser Group, Toptica Photonics AG, Fuzhou Furi Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Power Green Laser Market Key Technology Landscape

The technological landscape of the High Power Green Laser Market is dominated by two mature approaches and one emerging solution. The predominant technology is the Diode-Pumped Solid-State (DPSS) Laser, which utilizes high-power semiconductor diodes to pump a solid-state gain medium, typically Nd:YVO4 or Nd:YAG. The infrared light generated (around 1064 nm) is then passed through a non-linear optical crystal (NLOC), such as KTP or LBO, to achieve Second Harmonic Generation (SHG), effectively frequency doubling the output to the desired 532 nm green wavelength. Advances here focus heavily on improving the efficiency and stability of the NLOCs and enhancing the thermal management systems necessary to maintain optimal operating temperatures under high power loads.

The second key technology involves Frequency-Doubled Fiber Lasers. While fiber lasers inherently operate in the infrared region, specialized high-power fiber amplifier stages followed by external frequency conversion modules are utilized to achieve green output. This approach benefits from the inherent advantages of fiber architecture, including high beam quality, excellent thermal robustness, and a compact footprint. Current technological refinement in this area centers on optimizing the coupling efficiency between the fiber output and the frequency doubling stage and mitigating the risk of parasitic nonlinear effects that can limit peak power scalability and pulse duration control in high repetition rate systems.

An emerging, though still lower-power, trend is the development of Direct Diode Green Lasers. This technology eliminates the complex and costly frequency conversion stage entirely by using specialized Gallium Nitride (GaN) based semiconductor materials capable of emitting green light directly. While direct green diodes offer superior efficiency and compactness, current limitations lie in scaling these sources to the high kilowatt peak power levels required for heavy industrial applications. However, continuous research efforts are rapidly closing this power gap, potentially revolutionizing the cost and footprint of mid-power green laser systems, particularly for portable instrumentation and less demanding marking tasks.

Regional Highlights

The global distribution of the High Power Green Laser Market exhibits significant concentration in regions characterized by dense high-tech manufacturing ecosystems. Asia Pacific (APAC) stands as the undeniable leader, driven by the massive presence of Original Equipment Manufacturers (OEMs) specializing in consumer electronics, solar photovoltaics, and electric vehicle components. Countries like China, South Korea, Taiwan, and Japan are pivotal, hosting the majority of the world's flat panel display and semiconductor fabrication plants, which are the heaviest consumers of green lasers for micro-processing tasks like laser repair and cutting flexible substrates. The intense competition and rapid scaling of manufacturing capacities in APAC necessitates constant investment in high-throughput, high-precision laser tools.

North America and Europe represent mature markets characterized by high value-add applications, strong regulatory environments, and significant expenditure on research and defense. In North America, the market is sustained by the aerospace industry, advanced scientific research institutions, and the medical device sector, where stringent quality control demands the utmost precision provided by green laser systems. European growth is stimulated by the robust German automotive sector, which utilizes green lasers for precision welding and marking, alongside strong medical technology and advanced material science research centers across countries like Germany, France, and Switzerland.

The Middle East and Africa (MEA) and Latin America currently hold smaller market shares, but are projected to exhibit accelerating growth, largely spurred by increasing efforts towards industrial diversification and investments in localized manufacturing hubs, particularly related to renewable energy and basic electronics assembly. Growth in these regions is largely tied to infrastructure development and technology transfer initiatives, though adoption complexity remains higher due to logistical challenges and the reliance on imported technical expertise for system integration and maintenance.

- Asia Pacific (APAC): Dominant market share due to large-scale electronics, semiconductor, and solar PV manufacturing base. Key growth areas include laser lift-off for OLED displays and precision scribing for next-generation solar cells.

- North America: Strong market segment driven by high-specification applications in defense, aerospace component manufacturing, and advanced medical diagnostics and therapeutic systems. Emphasis on highly stable, ruggedized systems.

- Europe: Steady growth propelled by high-precision micromachining in the automotive sector (especially EV component production) and robust scientific research applications; stringent quality standards drive adoption of high-quality systems.

- Latin America: Emerging market with increasing industrialization, focused initially on basic material processing and marking; growth trajectory linked to foreign direct investment in manufacturing infrastructure.

- Middle East and Africa (MEA): Smallest current share, but potential growth in renewable energy projects (solar) and increasing government focus on developing local technology manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Power Green Laser Market.- Coherent Corp. (II-VI)

- IPG Photonics Corporation

- TRUMPF Group

- Lumentum Operations LLC

- Jenoptik AG

- Novanta Inc. (Includes Synrad, Cambridge Technology)

- Han's Laser Technology Industry Group Co. Ltd.

- MKS Instruments, Inc. (Spectra-Physics)

- Raycus Fiber Laser Technologies Co., Ltd.

- nLIGHT, Inc.

- EKSPLA UAB

- Clark MXR, Inc.

- Amplitude Laser Group

- Toptica Photonics AG

- Fuzhou Furi Electronics Co., Ltd.

- Delphi Laser Co., Ltd.

- Laser Quantum (A Novanta Company)

- NKT Photonics A/S

- JPT Opto-electronics Co., Ltd.

- Quantum Light Instruments (QLI)

Frequently Asked Questions

Analyze common user questions about the High Power Green Laser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of using a high power green laser (532 nm) over an infrared laser (1064 nm) for industrial processes?

The primary advantage lies in the shorter wavelength (532 nm), which results in significantly higher absorption efficiency for highly reflective materials, such as copper and gold. This superior absorption minimizes wasted energy and thermal diffusion, allowing for finer feature sizes, cleaner cuts, and reduced heat-affected zones (HAZ) in micromachining and battery electrode processing.

Which end-use industry is the largest consumer of high power green laser systems globally?

The Electronics and Semiconductor industry is the largest consumer, primarily due to the intense demand for high-precision processes like laser lift-off (LLO) for flexible displays (OLED/MicroLED), semiconductor wafer scribing, and memory repair, where the green laser's fine spot size and low thermal impact are critical for component integrity.

What are the key technological restraints currently limiting the scalability of direct diode green lasers?

The main constraint is the difficulty in scaling current Gallium Nitride (GaN) based semiconductor diode technology to achieve the very high kilowatt peak powers and stable beam quality required for heavy-duty industrial cutting and drilling applications, forcing reliance on more complex Diode-Pumped Solid-State (DPSS) solutions.

How is the growth of the Electric Vehicle (EV) sector influencing the demand for green lasers?

The EV sector is driving significant demand as green lasers are uniquely suited for precision cutting and welding of highly conductive and reflective materials, specifically copper foil electrodes used in lithium-ion battery production, offering superior throughput and quality compared to traditional methods.

What role does Artificial Intelligence (AI) play in improving the performance of high power green laser systems?

AI integration is crucial for enhancing operational efficiency through real-time adaptive process control, where algorithms dynamically adjust laser parameters based on in-situ feedback, and for enabling predictive maintenance (PdM) to forecast component degradation and maximize system uptime in critical manufacturing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager