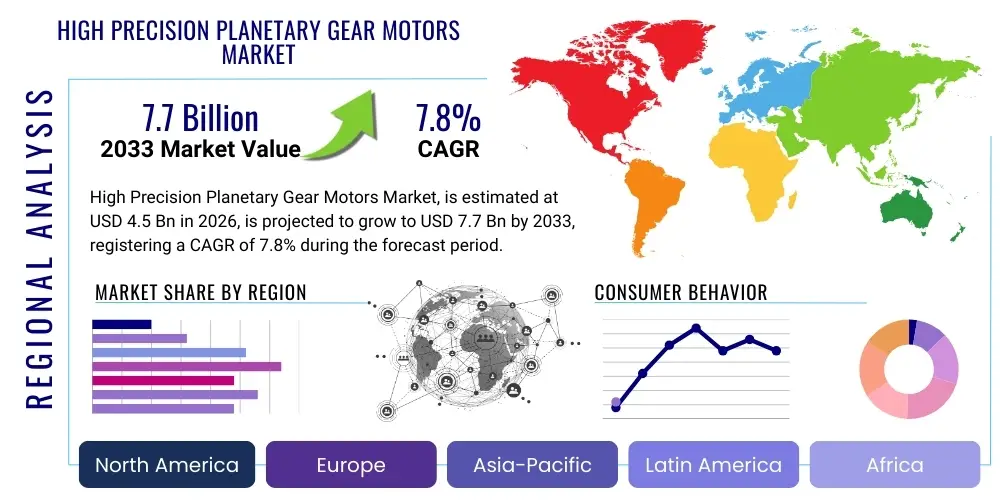

High Precision Planetary Gear Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431532 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

High Precision Planetary Gear Motors Market Size

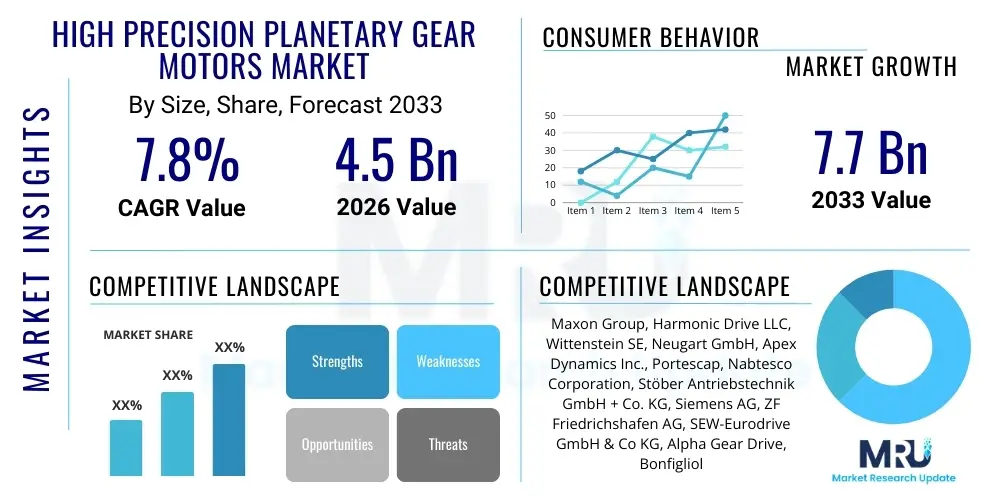

The High Precision Planetary Gear Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the escalating demand for highly accurate motion control solutions across sophisticated industrial applications, including surgical robotics, semiconductor manufacturing equipment, and advanced aerospace systems, where reliability and minimal backlash are paramount performance indicators.

High Precision Planetary Gear Motors Market introduction

The High Precision Planetary Gear Motors Market encompasses integrated motor and gearbox units specifically designed to offer exceptional torque density, high efficiency, and minimal backlash, typically measured in arcminutes. These motors utilize planetary gear trains, where several outer gears (planets) revolve around a central gear (sun), enclosed within an internal ring gear. The high precision designation differentiates these products from standard industrial gearboxes, emphasizing tight tolerances, optimized material selection, and rigorous assembly processes to ensure accuracy and repeatability in critical applications. The core function is to reduce speed and multiply torque from a primary motor source, maintaining angular accuracy essential for tasks requiring highly controlled movement.

High precision planetary gear motors are indispensable components in modern automation infrastructure, finding extensive use across sectors demanding high dynamic performance and positional accuracy. Major applications include industrial robots, particularly six-axis articulated arms and SCARA robots; medical equipment such as diagnostic imaging systems and surgical robots; and specialized machine tools for micro-machining. The inherent benefits, such as high torque transmission in a compact radial design, robust durability, and superior shock absorption, make them the preferred choice over standard spur or worm gear systems in highly demanding environments. Furthermore, their modular design allows for easy integration with various motor types, including servo motors and stepper motors, enhancing system flexibility.

The market is predominantly driven by the global transition toward Industry 4.0, which necessitates the integration of smarter, more autonomous machinery. Increasing adoption of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) in logistics and manufacturing is creating significant traction. Key driving factors include the rapid expansion of the semiconductor industry, which requires ultra-precise motion for wafer handling and lithography processes, and the growth of electric vehicle (EV) production, where highly accurate assembly systems are critical. Additionally, advancements in materials science, leading to lighter and stronger gear components, further enhance the performance and lifespan of these high precision solutions.

High Precision Planetary Gear Motors Market Executive Summary

The global High Precision Planetary Gear Motors Market is characterized by intense technological competition and strong demand driven by secular trends in automation and digitalization. Business trends indicate a pronounced shift towards customized solutions, particularly in robotics and medical devices, where standardized units often fail to meet stringent performance requirements for low noise and specific environmental resistance (e.g., vacuum compatibility). Leading manufacturers are focusing heavily on integrating advanced sensing capabilities, such as encoders and temperature sensors, directly into the motor units, offering smarter, predictive maintenance-enabled drives. Furthermore, miniaturization without sacrificing torque density is a major focus area, facilitating their use in compact collaborative robots (cobots).

Regionally, the Asia Pacific (APAC) region dominates the market, primarily fueled by massive investments in factory automation, particularly in China, Japan, and South Korea, which are global hubs for electronics and automotive manufacturing. Europe maintains a strong foothold, driven by sophisticated demand from the aerospace and high-end machine tool industries, demanding adherence to rigorous quality standards and extended service life. North America exhibits robust growth, significantly influenced by high expenditure in defense, specialized robotics, and the burgeoning medical robotics sector. These regions continue to drive innovation in gearing materials and manufacturing processes, such as improved gear teeth profiling and surface treatments to minimize friction and backlash.

Segmentation trends highlight the dominance of the less than 5 arcmin backlash category, catering to ultra-precision applications where movement accuracy is critical for performance, such as surgical instruments and sophisticated laboratory automation. By application, the robotics segment remains the largest and fastest-growing segment, owing to the increasing deployment of automated solutions to mitigate labor shortages and improve production efficiency globally. The technological landscape is evolving towards hermetically sealed units and maintenance-free designs, reducing total cost of ownership (TCO) for end-users. The competitive environment is fragmented, featuring a mix of large multinational conglomerates offering full motion control suites and specialized niche players focusing exclusively on ultra-high precision gearing systems.

AI Impact Analysis on High Precision Planetary Gear Motors Market

Common user questions regarding AI's impact on the High Precision Planetary Gear Motors Market typically revolve around operational efficiency, predictive failure, and optimization of manufacturing processes. Users frequently ask how AI can improve the long-term reliability of high precision components, whether AI algorithms can enhance real-time motion control beyond traditional PID loops, and how manufacturing yield rates can be maximized using intelligent monitoring systems. Key concerns center on integrating AI-driven monitoring with existing factory infrastructure and the feasibility of developing self-optimizing gear motors that adjust parameters dynamically to external loads or wear. Based on this analysis, the primary themes are centered on leveraging AI and machine learning (ML) for enhanced product lifecycle management, smart manufacturing, and dynamic performance tuning.

The adoption of Artificial Intelligence significantly enhances the lifecycle and performance management of high precision planetary gear motors, moving beyond standard condition monitoring to genuine predictive intelligence. AI algorithms process vast amounts of data collected via integrated sensors (vibration, temperature, current draw) to develop highly accurate wear and degradation models specific to the gearing mechanism. This allows end-users to predict component failure with significantly greater lead time than traditional monitoring methods, enabling scheduled, non-disruptive maintenance. This optimization is crucial in high-stakes environments like semiconductor fabrication or robotic surgery, where unexpected downtime results in substantial financial and operational losses. Furthermore, AI facilitates real-time compensation for phenomena like thermal expansion or minor manufacturing tolerances, ensuring that the motor consistently performs within its specified arcminute precision limits throughout its operational life.

In the manufacturing phase, AI-driven quality control and process optimization are transforming how high precision gear components are produced. AI vision systems combined with ML models are used for ultra-fine defect detection on gear teeth and bearing surfaces, far exceeding human inspection capabilities. This dramatically reduces the rejection rate of critical components. Moreover, AI is employed to optimize the CNC machining and heat treatment parameters during production. By analyzing material properties and machine behavior in real-time, ML models can fine-tune feed rates, cutting depths, and temperature cycles to achieve optimal material hardness and surface finish, directly translating to higher precision (lower backlash) and extended motor lifespan. This digital optimization loop ensures better yield, reduces resource waste, and lowers the overall manufacturing cost for these complex components.

- AI-driven Predictive Maintenance: Enables precise forecasting of bearing and gear wear using vibration and thermal data, minimizing unscheduled downtime.

- Manufacturing Process Optimization: Utilizes Machine Learning (ML) for real-time adjustments of grinding and surface finishing operations to maximize precision and reduce defects.

- Dynamic Backlash Compensation: AI algorithms analyze motor load and position feedback to compensate dynamically for minimal residual backlash, improving real-time positioning accuracy.

- Digital Twin Simulation: AI enhances the fidelity of digital twins, simulating various operational loads and environmental conditions to refine gear motor design before physical prototyping.

- Energy Efficiency Optimization: ML models analyze duty cycles and operational patterns, allowing the motor control system to optimize power consumption while maintaining specified motion performance.

DRO & Impact Forces Of High Precision Planetary Gear Motors Market

The High Precision Planetary Gear Motors Market is fundamentally shaped by powerful drivers, strict restraints, and promising opportunities, collectively defining the impact forces influencing its trajectory. Key drivers include the accelerated adoption of industrial and collaborative robotics across all manufacturing sectors, driven by the need for enhanced productivity and quality control in complex assembly tasks. Restraints primarily involve the high initial cost associated with ultra-low backlash gear mechanisms and the technical complexity involved in their maintenance and integration into existing systems. Opportunities are centered on emerging applications such as surgical robotics, specialized defense equipment, and the massive scale-up of automation in emerging economies, offering new frontiers for market expansion and specialized product development.

Drivers: The primary driver remains the indispensable requirement for high positional accuracy in automated processes, especially in industries like electronics, medical devices, and aerospace where micron-level precision is non-negotiable. Furthermore, the global shortage of skilled labor is compelling companies to invest heavily in automated systems, increasing the demand for highly reliable and precise actuators. The push for modular and compact machine designs also favors planetary systems due to their superior torque-to-volume ratio compared to other gear configurations. Regulatory standards requiring higher safety and reliability in advanced machinery also indirectly drive the demand for certified, high-quality precision gear motors that ensure repeatable and safe operations.

Restraints: The most significant restraint is the high manufacturing complexity and resulting premium price of high precision gear motors compared to standard gearing options. Achieving sub-5 arcminute backlash requires specialized manufacturing equipment, stringent material selection (e.g., hardened steels, specialized coatings), and lengthy quality control processes, which limits mass adoption in cost-sensitive applications. Furthermore, the specialized nature often translates to higher maintenance expertise required for servicing, and potential supply chain bottlenecks for niche components can impact production stability. Additionally, competition from alternative high-precision drive technologies, such as direct-drive motors, while having higher efficiency, sometimes limits market share in specific ultra-high-speed applications.

Opportunities: Significant market opportunities lie in the continuous evolution of surgical and medical robotics, which are increasingly relying on miniature, high-torque precision motors for sophisticated instruments used inside the human body. The emerging field of specialized agricultural robotics (Agri-tech) and autonomous construction equipment also presents a growing application area. Geographically, untapped potential exists in secondary and tertiary automation markets in Southeast Asia and Latin America, where industrial modernization efforts are gaining momentum. Product innovation focused on integrating smart diagnostics and wireless communication capabilities into the gear motors represents a key area for value-added offerings and market differentiation, especially targeting preventative maintenance contracts.

Segmentation Analysis

The High Precision Planetary Gear Motors Market is comprehensively segmented based on the critical technical parameter of Backlash, the specific Motor Type used, and the diverse Application spectrum they serve. Understanding these segments is vital for strategic market positioning, as performance requirements vary dramatically across end-user industries. For instance, the demand profile for a surgical robot actuator (ultra-low backlash, high cleanliness) is vastly different from that of a heavy-duty packaging machine (high torque, robust durability). The analysis of these segmentations reveals dynamic shifts driven by technological convergence and industry-specific automation goals, with motor efficiency and backlash tolerance being the defining performance metrics.

By Backlash, the market differentiates between standard precision (often >10 arcmin), high precision (5 to 10 arcmin), and ultra-high precision (less than 5 arcmin). The ultra-high precision segment is seeing the fastest growth, directly correlating with the increasing sophistication of tasks performed by industrial and medical robotics, requiring virtually zero positional error. The motor type segmentation, particularly between Servo Motors and Stepper Motors integrated with planetary gearing, highlights the trade-offs between dynamic response and cost. Servo motor integration dominates in high-throughput, high-dynamic applications like CNC machining and robotics due to precise feedback control, while stepper motor solutions often serve positioning tasks requiring high holding torque at standstill.

The Application segmentation underscores the market's reliance on industrial automation, encompassing robotics, machine tools, and packaging, alongside rapid expansion in specialized sectors. The medical and healthcare sector is demonstrating exceptional growth due to the complexity and sensitivity of new robotic-assisted surgeries and laboratory automation equipment. Geographic segmentation remains crucial, showing how market maturity and industrial focus (e.g., Germany's focus on high-end machine tools versus China's focus on mass robotics production) influence regional demand for specific precision levels and torque capacities. This detailed segmentation aids manufacturers in tailoring product portfolios to meet these exacting specifications.

- By Backlash (Arcminutes)

- Less than 5 arcmin (Ultra-High Precision)

- 5 to 10 arcmin (High Precision)

- More than 10 arcmin (Standard Precision)

- By Motor Type

- Servo Motor Integrated

- Stepper Motor Integrated

- DC Brushless Motor Integrated

- By Torque Capacity (Nm)

- Up to 50 Nm

- 50 Nm to 150 Nm

- Above 150 Nm

- By Application

- Industrial Robotics (Assembly, Welding, Painting)

- Machine Tools (CNC, Lasers)

- Packaging and Material Handling

- Medical and Healthcare (Surgical Robotics, Scanners)

- Aerospace and Defense

- Semiconductor Equipment

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For High Precision Planetary Gear Motors Market

The value chain for High Precision Planetary Gear Motors is characterized by highly specialized expertise required across all stages, starting from raw material sourcing through to final integration. Upstream analysis focuses heavily on material procurement, particularly specialized high-grade steel alloys (such as chromium molybdenum steel) and advanced ceramics used for bearings and gear teeth, which ensure minimal wear and thermal stability. Suppliers of specialized components, including high-resolution encoders and custom magnetic materials for motor windings, occupy a critical position, as the quality of these inputs directly dictates the final product's precision level and lifespan. Strict quality control at the raw material stage is non-negotiable for achieving sub-arcminute performance specifications.

The core manufacturing and assembly stage involves high-precision machining (e.g., gear grinding and honing), heat treatment processes to ensure optimal hardness, and, crucially, the clean-room assembly of the gear sets and motor components. Manufacturers often differentiate themselves through proprietary gear tooth profiling and unique lubrication techniques designed for lifetime, maintenance-free operation. The complexity of minimizing backlash means that assembly is often performed manually or using highly automated, precise machinery. Following manufacturing, products move through stringent testing and certification processes, verifying parameters like torsional stiffness, noise level, and actual backlash under varying loads before distribution.

Downstream analysis highlights complex distribution channels utilizing both direct sales and specialized indirect channels. Direct sales are preferred for large volume customers (like major robotics manufacturers) and for highly customized, complex applications (aerospace, defense), allowing manufacturers to provide immediate technical support and tailored engineering services. Indirect distribution, leveraging specialized industrial distributors and system integrators (SIs), is vital for reaching smaller enterprises and managing regional market penetration. These partners often possess the technical expertise to integrate the gear motors into diverse motion control systems, adding value through localized technical support, inventory management, and post-sales servicing, ensuring smooth adoption by end-users.

High Precision Planetary Gear Motors Market Potential Customers

The primary end-users and buyers of High Precision Planetary Gear Motors span various advanced manufacturing and technological sectors that demand absolute reliability and exceptional positional accuracy in their operational mechanisms. These customers are typically characterized by high capital expenditure on automated systems and an intolerance for performance degradation or unscheduled downtime. Key potential customers include global industrial robot manufacturers (e.g., FANUC, KUKA, ABB) who use these motors as joint actuators in sophisticated robotic arms, machine tool builders requiring precise axis movement for milling and grinding, and semiconductor original equipment manufacturers (OEMs) utilizing ultra-clean, high-precision drives for wafer handling and lithography systems.

Beyond traditional manufacturing, the medical and healthcare sector is a rapidly growing customer base, specifically surgical robotics companies (e.g., Intuitive Surgical) that necessitate compact, highly reliable actuators for patient safety and manipulation fidelity. These applications require gear motors that meet extremely strict standards regarding cleanliness, sterilization capabilities, and quiet operation. Furthermore, the burgeoning aerospace and defense industries are significant buyers, deploying these high-reliability motors in critical systems such as missile guidance platforms, radar positioning systems, and flight control actuation mechanisms, where failure is not permissible.

Emerging buyers include specialized logistics and warehousing companies investing in highly complex Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) that need precise navigation and payload positioning, especially within automated vertical storage systems. Research institutions and advanced laboratories, particularly those involved in particle physics or micro-manipulation, also form a niche but highly demanding customer segment. The common thread among all these potential customers is the prioritization of precision, longevity, and low maintenance over initial purchasing cost, making them ideal targets for premium high precision planetary gear motor suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maxon Group, Harmonic Drive LLC, Wittenstein SE, Neugart GmbH, Apex Dynamics Inc., Portescap, Nabtesco Corporation, Stöber Antriebstechnik GmbH + Co. KG, Siemens AG, ZF Friedrichshafen AG, SEW-Eurodrive GmbH & Co KG, Alpha Gear Drive, Bonfiglioli S.p.A., Lafert S.p.A., Delta Electronics, Inc., Lenze SE, Kollmorgen, Anaheim Automation, Inc., Tsubaki Nakashima Co., Ltd., Sumitomo Drive Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Precision Planetary Gear Motors Market Key Technology Landscape

The technology landscape of the High Precision Planetary Gear Motors Market is defined by continuous innovation aimed at reducing backlash, increasing power density, and enhancing reliability under extreme conditions. A key technological focus is on advanced gear geometry and surface treatments. Manufacturers are increasingly utilizing computer-aided design (CAD) optimization and specialized machining techniques, such as skiving and grinding, to achieve highly accurate involute tooth profiles. Furthermore, thin-film coatings, including various grades of PVD (Physical Vapor Deposition) and DLC (Diamond-Like Carbon), are applied to gear teeth surfaces to minimize friction, reduce wear, and significantly extend the operating life, particularly in applications requiring high dynamic cycling.

Integration of smart features represents another major technological shift. Modern high precision gear motors often incorporate high-resolution absolute encoders directly into the motor assembly, providing real-time positional feedback essential for closed-loop servo control and meeting the demanding accuracy requirements of modern CNC and robotic systems. Additionally, the development of integrated diagnostic electronics capable of monitoring vibration, temperature, and current consumption facilitates predictive maintenance protocols. This move toward smart components minimizes the need for external sensors and simplifies integration for the end-user, aligning the product offering with the principles of the Industrial Internet of Things (IIoT).

Material science advancements play a crucial role, particularly the use of specialized, lightweight, and thermally stable materials. For casings, lightweight aluminum alloys are frequently employed to reduce inertia, while high-performance composite materials are sometimes utilized in non-load-bearing components to enhance shock absorption and further reduce system weight, vital for mobile robotics. Furthermore, the evolution of lubrication technology—shifting towards synthetic, lifetime greases optimized for specific operating temperatures and pressures—ensures consistent performance across the motor's lifespan, eliminating the need for periodic re-lubrication in many high precision designs and contributing significantly to the overall reliability proposition.

Regional Highlights

The regional distribution of the High Precision Planetary Gear Motors Market reflects the global landscape of advanced manufacturing, automation intensity, and technological adoption rates. Asia Pacific (APAC) stands out as the primary market driver, characterized by unprecedented industrialization and government-backed initiatives focused on automating production lines, particularly in robotics and consumer electronics manufacturing. China, Japan, and South Korea lead the regional demand, with Japan maintaining global leadership in high-end robotics and machine tool technology, necessitating the highest quality precision drives. The substantial, ongoing expansion of EV battery manufacturing and semiconductor fabrication in this region creates sustained, exponential demand for reliable, high-torque, low-backlash motors for assembly and handling equipment.

Europe represents a mature yet highly quality-conscious market, driven primarily by Germany, Italy, and Switzerland, which possess world-renowned machine tool, automotive (non-EV focus), and aerospace industries. European manufacturers demand adherence to rigorous technical standards and longevity, preferring specialized solutions that offer superior torsional stiffness and minimal noise. The regional demand is concentrated in high-value, bespoke applications where customization and technical support are paramount. Furthermore, Europe’s strong emphasis on sustainable manufacturing and energy efficiency is driving the adoption of highly efficient servo-motor integrated planetary systems, often featuring advanced regenerative braking capabilities.

North America is characterized by robust demand from high-tech sectors, notably aerospace, defense, and medical robotics. The market growth here is strongly correlated with capital expenditure in sophisticated military and commercial aircraft programs, which require motors capable of enduring extreme environmental conditions while maintaining strict precision standards. The rapid scaling of medical robotics, particularly surgical systems, is a unique growth catalyst, demanding miniature, high-torque, ceramic-bearing gear motors that ensure patient safety and operational integrity. While overall manufacturing volume may be lower than in APAC, the value of the units sold in specialized North American applications is often significantly higher, reflecting the bespoke nature and stringent regulatory requirements of these industries.

- Asia Pacific (APAC): Dominant region due to large-scale investment in industrial robotics, semiconductor manufacturing expansion (e.g., Taiwan, South Korea), and rapid deployment of automated logistics systems in China.

- Europe: Market maturity focused on quality, serving high-end machine tool industry, precision automotive assembly, and aerospace components. Germany is the regional technology leader.

- North America: High growth driven by specialized applications in defense, commercial aerospace (actuation systems), and the exponential expansion of the surgical and medical robotics sector.

- Latin America (LATAM): Emerging market potential, primarily in automotive assembly and mining automation, showing gradual adoption of standard precision planetary drives, with growing interest in high precision as modernization accelerates.

- Middle East and Africa (MEA): Growth concentrated in oil and gas automation, specialized infrastructure projects, and defense expenditures, generally focused on robust, durable, high-torque units rather than ultra-low backlash medical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Precision Planetary Gear Motors Market.- Maxon Group

- Harmonic Drive LLC

- Wittenstein SE

- Neugart GmbH

- Apex Dynamics Inc.

- Portescap

- Nabtesco Corporation

- Stöber Antriebstechnik GmbH + Co. KG

- Siemens AG

- ZF Friedrichshafen AG

- SEW-Eurodrive GmbH & Co KG

- Alpha Gear Drive

- Bonfiglioli S.p.A.

- Lafert S.p.A.

- Delta Electronics, Inc.

- Lenze SE

- Kollmorgen

- Anaheim Automation, Inc.

- Tsubaki Nakashima Co., Ltd.

- Sumitomo Drive Technologies

Frequently Asked Questions

Analyze common user questions about the High Precision Planetary Gear Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a high precision planetary gear motor and why is backlash reduction crucial?

High precision motors are defined by their extremely low backlash, typically below 10 arcminutes, often reaching less than 5 arcminutes, alongside high torsional stiffness and optimized bearing systems. Backlash reduction is critical because it minimizes the dead band in motion reversal, ensuring superior positional accuracy, repeatability, and dynamic response necessary for precision tasks like robotic surgery, high-speed pick-and-place, and CNC machine tool operation.

How do High Precision Planetary Gear Motors compare in efficiency and lifespan to traditional gearboxes?

Planetary gear designs inherently offer higher efficiency (typically 95-97% per stage) compared to systems like worm gears, due to rolling contact instead of sliding contact. When manufactured to high precision standards, their lifespan is significantly extended due to specialized surface treatments, precise lubrication, and robust housing materials that minimize wear and heat generation, resulting in a lower total cost of ownership (TCO).

Which industries are the major consumers driving the demand for ultra-low backlash gear motors?

The primary consumption drivers are the industrial robotics sector (especially collaborative and six-axis articulated robots), the medical device industry (specifically surgical and hospital automation), and the semiconductor fabrication equipment sector. These industries require guaranteed micron-level precision and high reliability in demanding, continuous operation cycles, making ultra-low backlash an essential specification.

What technological advancements are currently enhancing the performance and compactness of these motors?

Key advancements include the integration of high-resolution absolute encoders for superior closed-loop control, the use of advanced materials (e.g., ceramic bearings, hardened gear steel alloys) to improve thermal stability and longevity, and the development of proprietary gear tooth geometries that optimize contact ratios, further reducing backlash and enabling higher torque density within a smaller, more compact frame suitable for modern cobots.

What is the impact of the Industry 4.0 shift on the design requirements for High Precision Planetary Gear Motors?

Industry 4.0 demands motors equipped with enhanced connectivity and intelligence, requiring integrated sensors for predictive maintenance, digital twin compatibility for simulation, and standardized communication protocols (like EtherCAT or PROFINET). Motors must be robustly designed for continuous connectivity and dynamic self-adjustment, allowing them to communicate their status and optimize performance parameters within a centralized, smart factory ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager