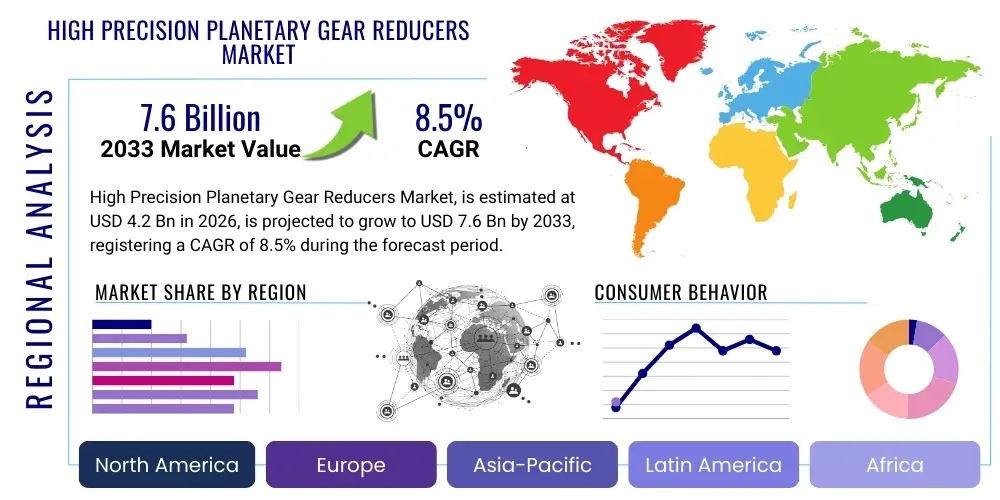

High Precision Planetary Gear Reducers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436149 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Precision Planetary Gear Reducers Market Size

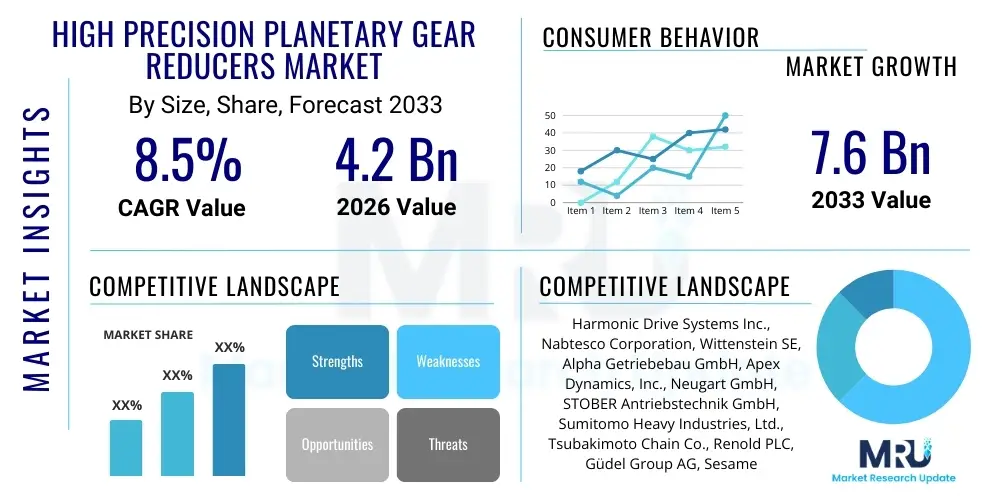

The High Precision Planetary Gear Reducers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

High Precision Planetary Gear Reducers Market introduction

The High Precision Planetary Gear Reducers Market encompasses specialized mechanical components designed to transfer torque and reduce rotational speed with minimal backlash and maximum efficiency. These reducers are critical components in systems requiring accurate positioning, high repeatability, and dynamic stiffness, primarily serving advanced automation and motion control applications. The product description highlights their compact size, high torque density, and ability to handle high radial and axial loads, distinguishing them from standard gearboxes by their superior positional accuracy, typically measured in arcminutes. Major applications span industrial robotics, high-speed automated manufacturing lines, CNC machine tools, and sophisticated medical imaging and surgical equipment.

The core benefits derived from utilizing high precision planetary gear reducers include enhanced machine performance, increased operational lifespan of equipment due to smooth torque transmission, and significantly improved product quality in manufacturing processes that rely on stringent positional tolerances. Their robust design ensures reliable operation even under intermittent high loads, crucial for dynamic industrial environments. Furthermore, the inherent modularity of many planetary designs allows for straightforward integration into diverse motor configurations, supporting the trend towards customized automation solutions across various industry verticals.

Key driving factors propelling market expansion include the accelerating global adoption of Industry 4.0 standards, the rapid proliferation of collaborative and industrial robots demanding precise motion control, and continuous investment in aerospace and defense technologies where reliability is paramount. The shift towards miniaturization in electronics manufacturing and the requirement for increasingly fast and accurate assembly systems are further cementing the indispensable role of these precision components. Economic incentives supporting the modernization of manufacturing infrastructure in emerging economies also contribute significantly to the sustained demand for high precision planetary gear reducers globally.

High Precision Planetary Gear Reducers Market Executive Summary

The High Precision Planetary Gear Reducers Market is characterized by intense technological innovation focused on achieving zero backlash, higher torque-to-volume ratios, and extended maintenance intervals. Business trends show a strong emphasis on strategic acquisitions and partnerships among leading manufacturers to consolidate market share and expand product portfolios, particularly integrating reduction technology with smart sensors for predictive maintenance capabilities. Furthermore, there is a discernible trend toward developing specialized reducers tailored for harsh environments, such as those found in food processing (stainless steel and hygiene standards) and extreme temperature applications, diversifying revenue streams beyond traditional industrial automation.

Regional trends indicate that Asia Pacific (APAC), particularly China, Japan, and South Korea, dominates consumption and production, driven by massive investments in automotive electrification, advanced semiconductor manufacturing, and robotics integration in mass production facilities. North America and Europe maintain strong market shares, focusing on high-end specialized applications like aerospace, high-speed machining, and advanced medical robotics, valuing customization and long-term reliability over sheer volume. The competitive landscape in these mature markets is often centered on proprietary design patents and superior customer support services.

Segment trends reveal that the robotics segment remains the highest growth area, demanding ultra-low backlash and compact designs to enhance robot dexterity and payload capacity. By type, inline planetary reducers hold a larger volume share due to their versatility and ease of integration, while right-angle reducers are growing rapidly, driven by spatial constraints in highly compact automation cells. Material science trends favor lighter, yet stiffer alloys and enhanced bearing technologies, improving overall system efficiency and reducing inertia, vital for high-speed cyclical operations in packaging and printing machinery.

AI Impact Analysis on High Precision Planetary Gear Reducers Market

Users frequently inquire about how Artificial Intelligence and Machine Learning (ML) can enhance the operational lifespan and precision of High Precision Planetary Gear Reducers, specifically focusing on predictive maintenance, optimization of manufacturing tolerances, and real-time performance adjustments. Key themes center around minimizing unexpected failures in critical applications like robotics and CNC machinery, improving energy efficiency by optimizing gear mesh patterns under varying loads, and using AI-driven feedback loops to refine the design of future generations of reducers. Concerns often involve the cost and complexity of integrating smart sensors and AI processors into existing motion control systems and ensuring data security for proprietary operational parameters. Expectations are high regarding AI’s potential to facilitate true "zero-downtime" manufacturing by anticipating wear patterns and scheduling maintenance proactively, thereby maximizing overall equipment effectiveness (OEE).

- AI enables highly accurate predictive maintenance models by analyzing vibration, temperature, and torque data, significantly extending MTBF (Mean Time Between Failures).

- Machine Learning algorithms optimize the complex CNC grinding process, achieving tighter manufacturing tolerances (e.g., backlash below 1 arcminute consistently).

- AI-driven control systems dynamically adjust motor current and speed to compensate for slight manufacturing imperfections or thermal expansion, maintaining constant positional accuracy.

- Integration of smart sensors (IoT) into reducers allows for real-time performance monitoring and anomaly detection, crucial for critical automation processes.

- AI contributes to supply chain optimization by predicting demand fluctuations for specific reducer models based on macroeconomic indicators and industrial sector performance.

- Simulation models, powered by AI, reduce the time needed for R&D by rapidly testing new materials and gear tooth geometries under simulated stress conditions.

- Advanced robotics utilize AI feedback to perform trajectory planning that minimizes sudden load shocks on the gearbox, enhancing system longevity.

- AI supports customized manufacturing processes, allowing manufacturers to rapidly scale production of highly specialized, application-specific gear reducer designs.

- Optimization of energy consumption through ML algorithms that determine the most efficient operating window (speed/torque combination) for the reducer.

- AI facilitates automated quality control checks post-assembly, analyzing acoustic and visual signatures to ensure compliance with ultra-high precision standards.

- Development of digital twins for high precision gear reducers, allowing operators to test operational scenarios virtually before deploying changes physically.

- AI assists in failure root cause analysis by correlating operational data logs with known failure modes, speeding up troubleshooting and repair processes.

- Improved gear lubrication management using AI to monitor oil quality and particulates, ensuring optimal performance across varying temperature and load profiles.

- AI is essential for optimizing the calibration and tuning of complex multi-axis robotic systems that rely on multiple high precision reducers working synchronously.

- Market forecasting for specific application verticals (e.g., aerospace vs. medical) becomes more accurate using AI-driven econometric models, guiding production planning.

DRO & Impact Forces Of High Precision Planetary Gear Reducers Market

The High Precision Planetary Gear Reducers Market is powerfully driven by the global imperative for automation and the increasing complexity of industrial processes demanding tighter positional control and faster cycle times. Key restraints include the high initial cost associated with manufacturing and acquiring these specialized components, the technical complexity of achieving sub-arcminute backlash consistently, and the intense competitive pressure from alternative precision transmission technologies like cycloidal drives in certain applications. Opportunities are vast, primarily centered on the booming collaborative robotics sector (cobots), the expansion of precision automation into new sectors like personalized medicine and decentralized logistics, and the development of lightweight reducers essential for drone technology and mobile robotics. These forces collectively propel market expansion while requiring manufacturers to continually innovate on cost, precision, and integration capabilities to maintain viability.

Drivers include accelerating demand from the automotive industry, particularly for electric vehicle (EV) battery manufacturing and assembly, which requires ultra-precise, high-throughput automation systems. Furthermore, the semiconductor industry's need for micron-level positioning accuracy in wafer handling and inspection equipment mandates the use of the highest quality planetary reducers. The continuous evolution of CNC machine tools towards 5-axis and 6-axis capabilities necessitates corresponding improvements in the precision and stiffness of the drive mechanisms to fully realize the potential of advanced machining strategies. Additionally, government initiatives globally supporting industrial digitization and smart factories provide a regulatory and financial impetus for market growth.

Restraints include the stringent quality control necessary, which translates into higher manufacturing overheads and longer lead times compared to standard gearboxes. The skilled labor required for both manufacturing and maintenance poses a challenge in some regions. Moreover, economic cycles and geopolitical instabilities can affect capital expenditure in the manufacturing sector, impacting large-scale automation projects. The market faces pressure to increase power density without compromising thermal management, as operational heat can degrade performance and reduce positional accuracy over time, posing a significant engineering challenge.

Opportunities are largely tied to emerging technology adoption. The growth of additive manufacturing (3D printing) systems requires precise linear and rotational motion control for optimal layer deposition. The proliferation of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) in logistics and warehousing represents a massive untapped application base requiring durable, compact, and high-efficiency planetary drives. Furthermore, customizing gear reducer designs specifically for direct drive motor integration to reduce mechanical complexity and system footprint offers substantial growth potential, especially in space-constrained robotic arms and medical devices.

Segmentation Analysis

The High Precision Planetary Gear Reducers Market is primarily segmented based on the critical attributes of the product, including Type, Application, and Torque Capacity, allowing users and manufacturers to match the specific operational requirements of automated machinery with the most appropriate reduction technology. Segmentation by Type, typically Inline or Right-Angle, addresses installation constraints and torque path geometry, which are crucial design considerations for system integrators. Application-based segmentation highlights the distinct performance requirements across sectors, recognizing the differing needs of a high-speed packaging machine versus an aerospace testing rig in terms of rigidity, speed, and environmental tolerance. This structural analysis is vital for understanding competitive dynamics and targeting specific high-growth niches within the broader automation landscape.

Torque Capacity segmentation defines the primary functionality and target market of the reducer, ranging from low-torque versions used in miniature medical devices and laboratory automation to high-torque models indispensable for heavy-duty machine tools and large industrial robots. The diversity in required capacities necessitates a wide array of precision manufacturing capabilities and material choices among vendors. Furthermore, the segmentation by design features, such as single-stage versus multi-stage reduction, helps in meeting varying demands for high reduction ratios while managing heat generation and overall efficiency. The ability of manufacturers to offer comprehensive product lines spanning all these segmentations is a major determinant of market leadership and strategic resilience.

The application segmentation is particularly dynamic, with robotics and factory automation accounting for the largest revenue share, though emerging applications in renewable energy systems (e.g., precise tracking mechanisms in solar farms) and sophisticated defense systems are demonstrating above-average growth rates. Manufacturers increasingly focus R&D efforts on segments requiring ultra-high cleanliness (medical, semiconductor) or extreme ruggedness (off-highway, mining equipment), driving innovation in sealing technologies, bearing materials, and corrosion resistance. Understanding these nuanced segments is paramount for strategic market entry and accurate sales forecasting, ensuring that product development aligns with future industrial demand patterns.

- By Type:

- Inline Planetary Gear Reducers

- Right-Angle Planetary Gear Reducers (Bevel Gear Input, Worm Gear Input)

- Customized Integrated Gearhead Modules

- By Torque Capacity:

- Low Torque (< 100 Nm)

- Medium Torque (100 Nm – 500 Nm)

- High Torque (> 500 Nm)

- By Application:

- Industrial Robotics (Articulated, SCARA, Delta, Collaborative)

- CNC Machine Tools (Turning, Milling, Grinding Centers)

- Packaging and Printing Machinery (High-speed Indexing)

- Semiconductor Manufacturing Equipment (Wafer Handling, Inspection Systems)

- Medical and Healthcare Devices (Surgical Robotics, MRI Tables, Diagnostics)

- Aerospace and Defense (Actuators, Antenna Positioning Systems)

- Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs)

- Material Handling and Assembly Automation

- Textile Machinery and Woodworking Equipment

- Food & Beverage Processing Equipment

- By Industry Vertical:

- Automotive and Transportation

- Electronics and Semiconductors

- General Manufacturing and Factory Automation

- Healthcare and Pharmaceutical

- Aerospace, Military, and Defense

- Energy and Power Generation

Value Chain Analysis For High Precision Planetary Gear Reducers Market

The value chain for High Precision Planetary Gear Reducers begins with upstream analysis, focusing on the sourcing of specialized raw materials, including high-grade steel alloys (such as hardened chrome-molybdenum steels), advanced ceramics for specific bearings, and specialized lubricants designed for high-speed, high-pressure operation. Upstream suppliers must adhere to extremely tight quality tolerances, as material inconsistencies directly translate into performance degradation, backlash issues, and reduced component lifespan. Manufacturing complexity involves precision machining, specialized gear cutting (hobbing and shaping), heat treatment processes to ensure surface hardness, and highly sophisticated grinding and finishing techniques, often performed in climate-controlled environments to minimize thermal expansion effects on accuracy.

The midstream involves assembly, rigorous quality control testing (including backlash and runout measurements using advanced metrology equipment), and final integration into motor systems. The distribution channel is crucial; due to the technical nature of the product, both direct and indirect channels are heavily utilized. Direct sales often cater to large OEMs (Original Equipment Manufacturers) in the robotics and machine tool sectors, where customized solutions and direct technical support are required. Indirect channels, consisting of specialized industrial distributors, automation solution providers, and system integrators, handle smaller volume orders, provide local inventory, and offer first-line maintenance support to a broader customer base.

Downstream analysis focuses on the end-user adoption and integration phase. High precision reducers are integrated into complex automation systems, where their performance directly affects the quality and efficiency of the final product or service. Post-sale support, including maintenance contracts, spare parts supply, and technical training, forms a critical part of the downstream value. The transition toward smart reducers, incorporating sensors and IoT connectivity, is redefining the downstream relationship, enabling manufacturers to offer condition monitoring and predictive maintenance services, effectively moving up the value chain toward comprehensive motion solutions rather than just component supply.

High Precision Planetary Gear Reducers Market Potential Customers

Potential customers for High Precision Planetary Gear Reducers are overwhelmingly organizations engaged in advanced manufacturing, process automation, or specialized high-accuracy equipment production. The primary end-users/buyers include major industrial robotics manufacturers (e.g., Fanuc, ABB, KUKA, Yaskawa), who integrate these components directly into their articulated joints to ensure the requisite speed and accuracy for complex tasks. Secondly, leading global manufacturers of CNC machining centers and advanced machine tools rely heavily on these reducers for axis drive systems, rotary tables, and tool changers where minute precision is non-negotiable for high-tolerance metalworking operations. These customers prioritize positional accuracy, rigidity, and long-term durability under continuous heavy loads.

Another significant customer segment includes companies specializing in high-speed and intermittent motion automation, such as those in packaging, bottling, and printing industries. These users require dynamic stiffness and zero backlash to handle rapid acceleration and deceleration cycles efficiently without compromising alignment or registration accuracy. Furthermore, highly specialized sectors like aerospace and defense contractors and medical device manufacturers (e.g., producers of surgical robots and sophisticated diagnostic imaging systems) constitute an extremely high-value customer base, characterized by stringent qualification requirements, low volume, but demanding the absolute highest performance standards, often customized for specific mission-critical applications.

Finally, the rapidly expanding sectors of intra-logistics (AGVs/AMRs) and new energy vehicle production represent growing pools of potential customers. The transition to electric vehicles necessitates massive, precise automation lines for battery assembly and inspection, driving demand for robust, high-precision components that can sustain continuous operation. Logistics firms investing in automated warehousing solutions seek reducers that offer high efficiency and reliability in compact designs, minimizing energy consumption and maximizing the operational uptime of their mobile assets across large distribution centers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Harmonic Drive Systems Inc., Nabtesco Corporation, Wittenstein SE, Alpha Getriebebau GmbH, Apex Dynamics, Inc., Neugart GmbH, STOBER Antriebstechnik GmbH, Sumitomo Heavy Industries, Ltd., Tsubakimoto Chain Co., Renold PLC, Güdel Group AG, Sesame Motor Corp., DANA Inc. (Fairfield), Shenzhen Dingcheng High-Precision Gear Reducer Co., Ltd., Zhejiang Hengyi Planetary Gearbox Co., Ltd., Shimpo Industrial (Nidec Group), KHK Gear, Sanyou Dentsu Co., Ltd., Cone Drive, Rexroth (Bosch Group) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Precision Planetary Gear Reducers Market Key Technology Landscape

The technological landscape of the High Precision Planetary Gear Reducers Market is defined by continuous advancements aimed at increasing power density, reducing backlash, and enhancing integration capabilities with modern motor and control systems. A key focus is on precision manufacturing techniques, notably advanced gear tooth geometry optimization using Finite Element Analysis (FEA) to minimize deflection and improve load distribution across the planet gears. This computational approach, combined with ultra-precision CNC grinding and honing processes, allows manufacturers to consistently achieve backlash tolerances of less than three arcminutes, often pushing toward the sub-one arcminute range necessary for mission-critical robotic applications.

Material science innovation is equally vital, focusing on developing proprietary alloys for gears and housings that offer higher strength-to-weight ratios and improved thermal stability. Lightweight materials, such as specific aluminum alloys or composite structures, are increasingly employed in the housing to reduce system inertia, crucial for dynamic operations like pick-and-place robotics and aerial drones. Simultaneously, improvements in bearing technology, including preloaded angular contact bearings, are essential for managing high radial and axial forces while maintaining system rigidity, directly contributing to overall positional accuracy and lifespan of the reducer unit. Specialized lubrication, often synthetic grease designed for lifetime use, eliminates maintenance requirements and enhances thermal dissipation.

Furthermore, the integration of smart technology represents a major technological thrust. Modern high precision reducers are increasingly equipped with integrated sensors for temperature, vibration, and sometimes torque measurement. This enables condition monitoring and facilitates connectivity to industrial IoT platforms (Industry 4.0), allowing for remote diagnostics and predictive maintenance scheduling. This digital transformation not only improves reliability but also positions the gear reducer as an intelligent component within the overall automated system, contributing valuable data feedback to the control loop for optimized performance and energy management. This convergence of mechanical precision with digital intelligence is setting the new benchmark for high-performance motion control solutions.

Regional Highlights

The High Precision Planetary Gear Reducers Market exhibits distinct regional dynamics reflecting global manufacturing investment and automation maturity levels.

- Asia Pacific (APAC): APAC is the global powerhouse for both production and consumption. Driven primarily by China's aggressive investment in domestic industrial automation and robotics (Made in China 2025 initiative), and the highly advanced manufacturing sectors in Japan (semiconductors, high-end machine tools) and South Korea (electronics, automotive). The region benefits from lower manufacturing costs for mass-produced automation components and rapid adoption of AGVs and logistics automation.

- North America: Characterized by high demand for specialized, ultra-high-precision reducers, particularly in the aerospace, defense, and medical robotics sectors. The US market emphasizes quality, reliability, and local technical support. Growth is driven by reshoring manufacturing initiatives requiring modernized automation infrastructure and significant investment in next-generation autonomous systems.

- Europe: A mature market led by Germany, Italy, and Switzerland, strong in high-end machine tools, automotive manufacturing (especially EV production lines), and complex industrial machinery. European manufacturers focus heavily on energy efficiency, precision engineering, and adherence to rigorous safety and quality standards (e.g., ISO certifications). Innovation is frequently centered around zero-backlash mechanisms and compact, integrated drive packages.

- Latin America (LATAM): Growth is primarily concentrated in Brazil and Mexico, fueled by automotive manufacturing and mining automation projects. The market is highly price-sensitive and relies on imported technology, but increasing local assembly and integration capabilities are beginning to drive demand for quality precision components.

- Middle East and Africa (MEA): Currently a smaller market, but experiencing rapid growth due to large-scale infrastructure projects, expansion of logistics hubs (ports and warehousing), and diversification efforts away from oil economies, leading to investments in light manufacturing and assembly plants requiring entry-level automation systems.

- Japan: Maintains a leadership position in precision component manufacturing, particularly for robotics and machine tools, driven by high domestic technological capability and export orientation. Japanese companies set global standards for zero-backlash technology and longevity.

- China: Represents the largest volume market, characterized by intense domestic competition and growing technological capabilities, moving from lower-cost standard reducers to domestically produced high-precision alternatives to support local robotics firms.

- Germany: A core hub for high-end industrial automation and mechatronics, demanding gear reducers integrated with advanced servo drives for demanding applications in automotive and aerospace parts production.

- South Korea: Strong demand driven by the semiconductor fabrication and electronics assembly industries, necessitating reducers capable of extreme precision and high cycle rates in cleanroom environments.

- Canada: Key demand sectors include specialized resource extraction equipment and advanced manufacturing for aerospace components, requiring robust and highly reliable precision gearboxes.

- Taiwan: A major producer and consumer, specializing in machine tools and components, contributing significantly to the global supply chain of mid-to-high-precision reducers.

- India: An emerging market with rapidly expanding manufacturing base under the 'Make in India' initiative, driving incremental but significant demand for automation solutions across diverse industries including consumer goods and automotive components.

- United Kingdom: Focus on specialized R&D and manufacturing, particularly in defense, medical technology, and niche high-tech sectors requiring bespoke precision motion solutions.

- Italy: High consumption in packaging, printing, and textile machinery sectors, demanding dynamic, precise, and reliable reduction units optimized for continuous operation.

- Southeast Asia (ASEAN): Growing regional importance due to the relocation of manufacturing bases, increasing the need for standardized industrial automation equipment and associated precision drives in countries like Vietnam, Thailand, and Malaysia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Precision Planetary Gear Reducers Market.- Harmonic Drive Systems Inc.

- Nabtesco Corporation

- Wittenstein SE

- Alpha Getriebebau GmbH (Wittenstein Group)

- Apex Dynamics, Inc.

- Neugart GmbH

- STOBER Antriebstechnik GmbH

- Sumitomo Heavy Industries, Ltd. (Hansen Industrial Transmissions)

- Tsubakimoto Chain Co.

- Renold PLC

- Güdel Group AG

- Sesame Motor Corp.

- DANA Inc. (Fairfield)

- Shenzhen Dingcheng High-Precision Gear Reducer Co., Ltd.

- Zhejiang Hengyi Planetary Gearbox Co., Ltd.

- Shimpo Industrial (Nidec Group)

- KHK Gear

- Sanyou Dentsu Co., Ltd.

- Cone Drive

- Rexroth (Bosch Group)

- ZF Friedrichshafen AG (Industrial Drives Technology)

- Bonfiglioli Riduttori S.p.A.

- Flender GmbH (Siemens AG)

- GAM Gear, LLC

- TwinDisc, Inc.

Frequently Asked Questions

Analyze common user questions about the High Precision Planetary Gear Reducers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard and high precision planetary gear reducers?

The critical distinction is backlash. High precision reducers minimize backlash, often below 3 arcminutes, ensuring accurate positional control, which is essential for robotics and CNC machines, whereas standard reducers prioritize torque transmission over positional accuracy.

Which application sector drives the highest demand for these precision reducers?

The industrial robotics segment, including collaborative robots (cobots), represents the most significant growth and volume driver due to the absolute requirement for minimal backlash, high torsional rigidity, and compact designs to achieve precise motion and high repeatability in manufacturing tasks.

How does the integration of Industry 4.0 affect the gear reducer market?

Industry 4.0 integration mandates smart components. This drives demand for reducers equipped with sensors and IoT connectivity for real-time condition monitoring, predictive maintenance, and optimized performance feedback, moving the focus beyond mechanical components to intelligent motion solutions.

What technological advancements are key to achieving ultra-low backlash?

Key technologies include advanced gear tooth profile optimization (using FEA), ultra-precision CNC grinding, specialized surface treatments (hardening), and the use of preloaded bearing systems and proprietary gear geometry to eliminate free play and ensure constant contact under load.

Which geographical region leads the market in terms of production and consumption?

Asia Pacific (APAC), particularly driven by major manufacturing centers like China and Japan, leads both production and consumption due to massive investments in factory automation, semiconductor fabrication, and the rapid expansion of robotic integration across diverse industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager